How to fund a forex trading account – Tutorial for beginners

Table of Contents

Foreign currency online trading accounts are often used for trading and storing foreign currencies online. Using these accounts has never been easier. In general, you can open a new account, deposit an amount of your choice in your country’s currency, and then buy or sell any currency pair you want.

Traders often complain when brokers refuse to honor their withdrawal requests. If you are a victim of such scams or don’t know how to go about with forex account funding, this article will help you to avoid costly mistakes.

Forex account funding methods used by brokers

Forex traders usually have many options when deciding how to deposit money into their trading account. To attract all types of traders, brokers currently offer various payment methods, including deposits and withdrawals. Forex account funding methods are mainly divided into the following:

Offline funding methods

Offline funding methods include standard forex account funding procedures such as:

- Bank transfer

- Bank Cheque

- Western Union

- Local Deposits

Offline funding methods are best used when you want to transfer large amounts of funds into your trading account. However, before transferring large amounts of trading capital, make sure that you know and trust the broker well enough.

Investors can also transfer money from their existing bank account to their trading account via bank wire or online check. When using bank transfer, most banks charge about $30 per transfer, and the first transfer may take 2-3 days for the money to appear in the recipient’s account.

Forex account funding through WIRE Bank is more expensive and takes a minimum of 5 days. Additional forex fees, such as bank transaction fees and online currency exchange services, may apply to the payment.

Traders can equally write personal or bank checks directly to the currency broker. The only problem with using these other methods is the time it takes to process the payment. For example, a paper check may be held for up to 10 business days (depending on your bank and government) before it is added to your trading account.

Another downside of using the above method is that it is difficult to get your money back if you find a scam. At best, the bank only provides proof of payment, which is the only proof of payment.

Trade forex with the best conditions and a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 75% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

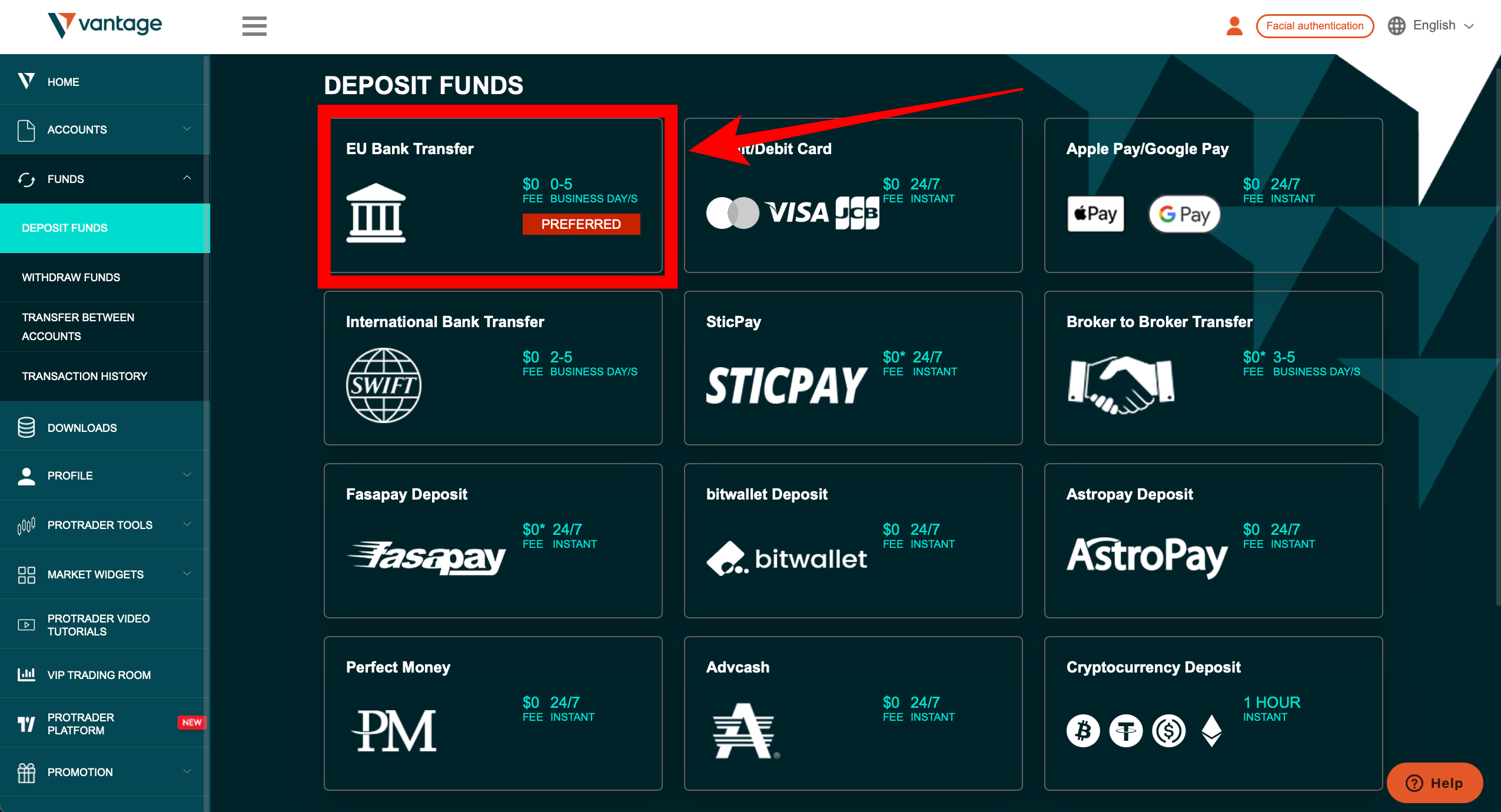

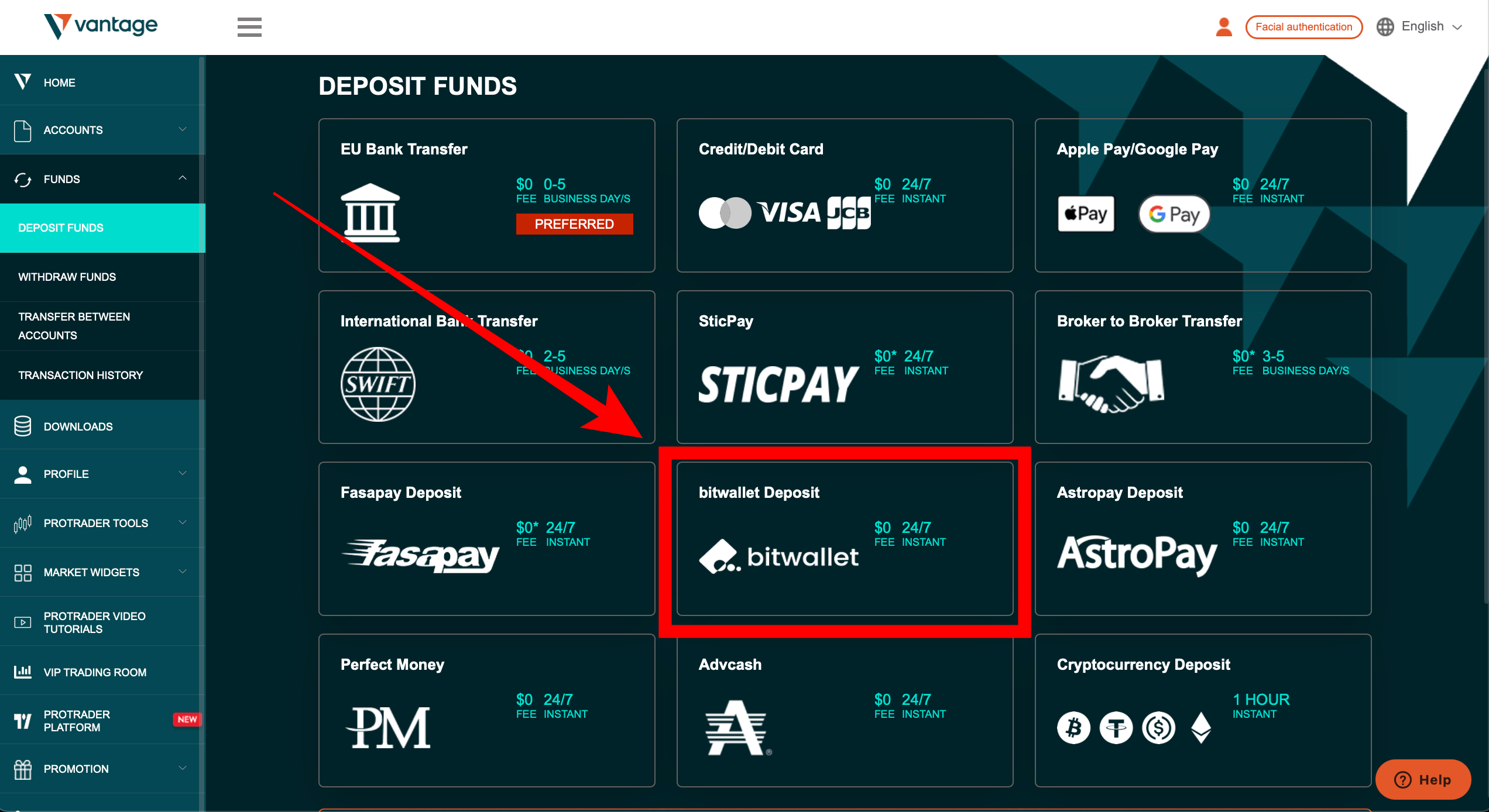

Payment via e-wallet

E-wallet payments are becoming more popular these days due to their relative ease of use, low transaction costs, and fast processing times. Most forex brokers offer deposits and withdrawals via e-wallets. The most common e-wallet forex account funding methods are:

Forex account funding with an e-wallet is often better than other funding methods. Reputable e-wallet service providers like Paypal and Skrill offer “protection.” In other words, if the currency broker does not pay and you want to get your deposit back, the e-wallet can mediate between the currency broker and the trader. E-wallets are also popular because most forex brokers offer special bonuses when depositing with one of the above e-wallet methods.

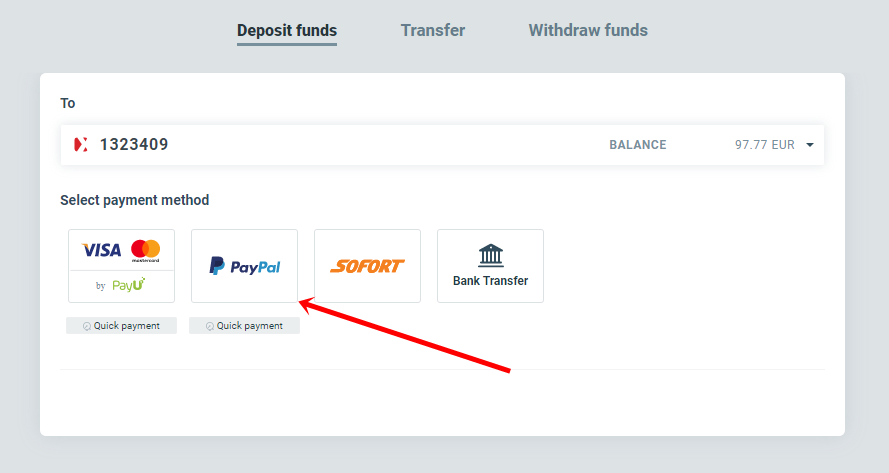

PayPal account

PayPal is probably the fastest way to pay and receive money online. PayPal operates in more than 150 countries around the world, so you won’t have any problems getting and using a PayPal account in those countries. Your PayPal account is complete.

All you have to do is log into your Forex account, select PayPal as your deposit method and click the button. You will be redirected to a PayPal page where you will need to log into your PayPal account. After logging in, click “Payment” and “Add Account,” and everything is ready in seconds.

Forex accounting through wire transfer is a bit cumbersome but still useful. You can find out from your bank how to send money to a foreign exchange broker.

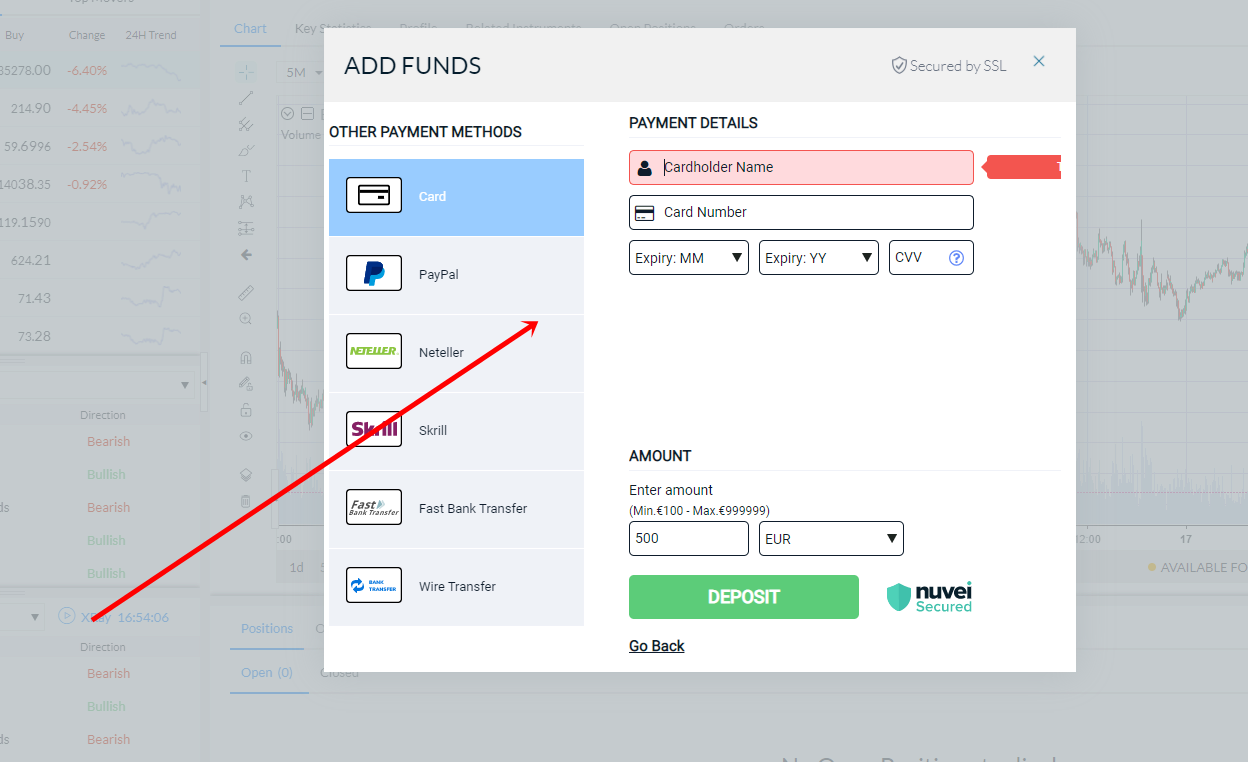

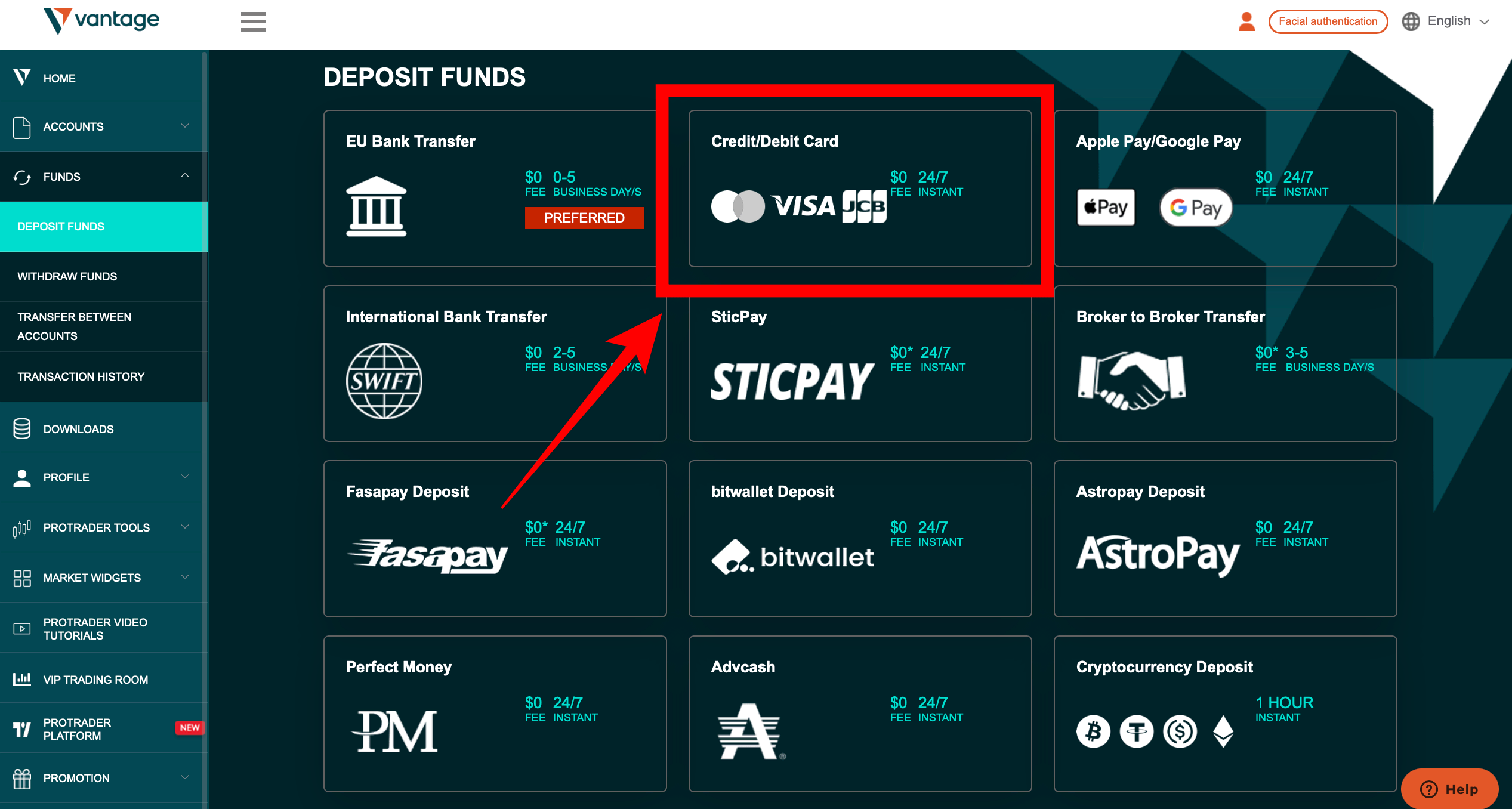

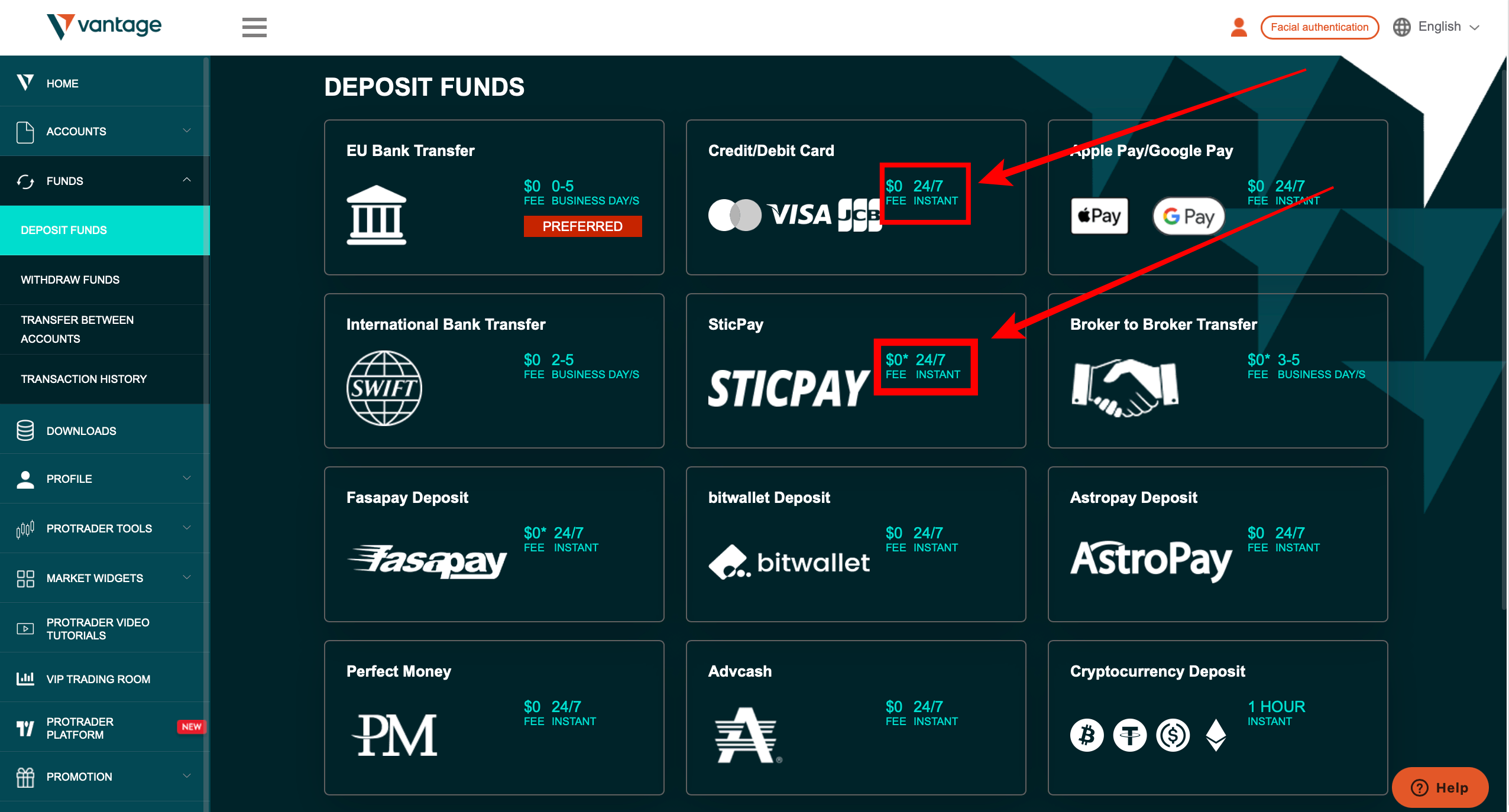

Credit or debit card

Credit card deposits have become the easiest forex account funding method today. With the advent of online payment services, digital credit card payments have become more efficient and secure. Investors can log into their respective currency accounts, enter their credit card information, and send money within about one business day.

Forex account funding with a credit or debit card is also popular for merchants looking for instant deposits. However, the amount that can be deposited depends on the limit set by the bank, so traders should check this first. Besides, if your broker becomes a scammer, you can quickly request a refund through chargeback. However, there are costs involved, including explaining the transaction to the bank manager. As a refund request is not a refund guarantee, traders should exercise extreme caution when financing their credit or debit card accounts.

There is also the risk that the currency broker you use may store information on your credit card, which can cause a lot of trouble if your credit card is in the wrong hands.

Overall, a credit card forex funding method allows you to deposit directly into your Forex account anytime. All you have to do is log into your Forex account and choose to deposit by credit card. Enter your card information and click on Payroll. If you have enough money in your bank account, money will be withdrawn from your account, and the exact amount will be deposited into your Forex account.

(Risk warning: Your capital can be at risk)

What is the best way to fund a trading account?

From the ongoing, e-wallets are undoubtedly the best forex account funding option for the following reasons:

- Low transaction costs: Most Forex Brokers charge no fees. In other words, the currency broker pays for the transaction to make the deposit. Also, all withdrawal requests have lower transaction fees than other methods.

- Safe use: You can protect your money with the help of an e-wallet. Requesting or negotiating a trade is easy if you discover that the currency broker has cheated you. E-wallets are known to act as arbitrators for traders, and this service is provided at no additional cost.

- Fast processing times: Deposits and withdrawals via e-wallets are generally faster, as they are almost instantaneous in most cases. The best part is that you can use it by linking your credit or debit card or e-wallet bank account.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQ – The most asked questions about Forex account funding:

What is forex account funding?

Forex account funding is financial support that is used for trading global currencies in the Forex market.

How can I fund a forex account?

First, you may need to choose a good forex broker to open a foreign exchange account and deposit your country’s money. You can use the account to trade and hold overseas currencies online. You can then buy and sell currency pairs as you observe fit.

Is it easier to trade global currencies using forex accounts?

Yes, people like you can partake in forex trading easily using forex account funding. It is because of the development of electronic trading and margin trading accounts.

How much should I deposit in my account?

The minimum amount you should deposit varies between brokers. Generally, most brokers need their customers to deposit a minimum sum of $100.

What are the payment modes available to make the deposit?

You can pay your deposit amount for your forex account funding through different payment modes, including credit/debit card, wire transfer, or bank transfer, according to your convenience. Choosing one of these payment modes is the best way to fund your forex account.

Last Updated on February 17, 2023 by Andre Witzel

(5 / 5)

(5 / 5)