Admirals review and test – How good is the broker?

Table of Contents

REVIEW: | REGULATION: | ASSETS: | MIN. SPREAD: |

|---|---|---|---|

(5 / 5) (5 / 5) | ASIC, CySEC, EFSA, FCA | 4,000+ | Variable 0.0 Pips + $ 1.8 – $ 3.0 commission per 1 lot trade |

Are you looking for a trusted online trading service provider? – Then, this is exactly what you need to read about. In this review, we will discuss one of the leading online trading service providers, which offers investment services for trading with forex and CFDs – Admirals (before Admiral Markets). In this article, you will find out more about the company and learn better about investing in this type of platform. Let’s start our journey to a worthwhile investment.

What is Admirals? – The company presented

Admirals are investment firms that operate under the Admiral Markets trademark. It offers investment services for trading with Forex and CFDs on indices, metals, energies, stocks, bonds, and cryptocurrencies. The company was founded in the year 2001 and has never stopped expanding up to today. Now it offers its services worldwide through its regulated trading companies. The aim of the Admiral Markets Group is to provide traders access to highly-functional software that assures a qualitative and transparent trading experience.

The investment firms of this company have an outstanding reputation, provide high security of investments, offer quality services, and present financial stability. In 2021 the company made a re-brand from “Admiral Markets” to “Admirals”. Since the company is growing very fast it has branches all over Europe, Asia, and South America.

Facts about Admirals:

⭐ Rating: | 5 / 5 |

🏛 Founded: | 2001 |

💻 Trading platforms: | MetaTrader 4, MetaTrader 5 |

💰 Minimum deposit: | $25 |

💱 Account Currencies: | EUR, GBP, USD, CHF, BGN, CZK, HRK, HUF, PLN, RON |

💸 Withdrawal limit: | No |

📉 Minimum trade amount: | $1,000 trading volume / 0.01 lot |

⌨️ Demo account: | Yes |

🕌 Islamic account: | Yes |

🎁 Bonus: | Up to $5,000 |

📊 Assets: | Forex, Commodities, Indices, Stocks, ETFs, Bonds |

💳 Payment methods: | Bank transfer, credit- or debit card (Visa, Mastercard), Perfect Money |

🧮 Fees: | From 0.5 pip spread, variable overnight fees |

📞 Support: | Different support hours depend on the country of residence |

🌎 Languages: | 28 languages |

What are the pros and cons of Admirals?

Admiral Markets is a trusted and regulated company with outstanding customer service, you definitely won’t regret if you sign-up for an account with the company. We tested the broker extensively and give you the main advantages and disadvantages below.

Pros of Admirals | Cons of Admirals |

✔ Competitive spreads and fast execution | ✘ Relatively high swap fees for overnight positions |

✔ Outstanding customer support | ✘Some clients report problems with unreliable stop-loss feature |

✔ Additional fund insurance for up to $100,000 | ✘ Limited funding and withdrawal methods |

✔ Advanced trading tools for customers available | ✘ Not available for US traders |

✔ Company is rated as “excellent” on Trustpilot | |

✔ Wide range of trading assets available | |

✔ All fees are communicated transparently, no hidden fees |

Is Admirals easy to use?

Admirals are one of the best options on the market, in my opinion, and user experience plays a big role here. Not only is the customer support exceptionally good, and there are dedicated support employees in many countries Admirals is operating. Apart from that, we are taking a closer look at the usability of the broker in this section.

Criteria | Rating |

General Website Design and Setup | ★★★★★ Setup and design are perfectly structured and easy to navigate. We particularly like the well-structured help center |

Sign-up Process | ★★★★★ It took us less than two minutes to set up a demo account |

Usability of trading area | ★★★★★ IG online trading platform is very easy to understand |

Usability of mobile app | ★★★★ The Admirals app makes trading on the smartphone safe, easy, and fun |

Is Admirals regulated? – Regulation and safety for customers

Before making an investment, you have to make sure that the company that you are investing with is regulated. There are a lot of scam companies that are circling on the internet these days. These companies are unregulated, and you must be vigilant about them. Regulation by an official authority is very important. It protects you from online trading scams. Also, you need to make sure that the company has a license because it is proof that the broker is examined and has reached certain criteria and regulations required.

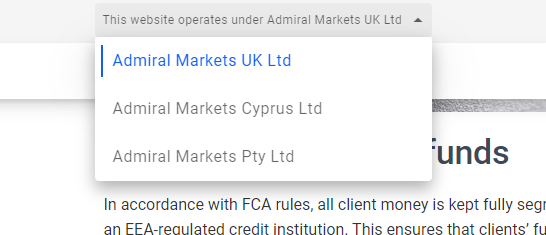

Admiral Markets is authorized and regulated in Europe and Australia. It has an outstanding reputation that proves its investment firms possess trusted platforms, gives quality services, and embody high security of investments.

Admirals is regulated by the following:

- FCA (UK – registered in England and Wales)

- ASIC (Australia)

- CySEC (EU – registered in Cyprus)

- EFSA (Estonia)

- JSC (Jordania)

- CIPC (South Africa)

You can find this information by going to the website (https://admiralmarkets.com) and by clicking on the question mark icon (please see the image below):

You will see this section afterward (please see the image below):

Financial Security

Admiral Markets manages the customer funds in segregated bank accounts. The company does not use customer funds for its own investments or for any other purpose. In addition, the broker is checked and verified by well-known auditors.

Furthermore, there is a Financial Service Compensation Scheme (FSCS). That means the security for customer funds is up to £85,000 if a bank goes bankrupt where the money is stored. Another important point to look at is the negative balance protection. With Admiral Markets, you are completely safe on this point because the broker is covering up to £85,000 per client.

Margin call – Negative Balance Protection Policy

At Admirals, there is no margin call for retail clients (private traders). This is protected by regulation. For professional clients, there can be a margin call, but Admirals protects the client with a buzzer of 50,000 GBP. So as a normal trader, you do not have to worry about margin calls.

Summary of the regulation and financial security:

- Multi-regulated online broker

- Segregated customer funds

- Financial Service Compensation Scheme £85,000

- Deposit guarantee schemes € 100,000

Review of the trading conditions for traders

The investment services of Admiral Markets offer to trade with Forex and CFDs on indices, energies, or crude oil futures, stocks, bonds, cryptocurrencies, and traders can also choose from almost seventy foreign pairs, which are as precious as metals. It is a global online broker that aims to focus on making online Forex trading accessible for the trader as well as transparent for individual currency traders worldwide. It is proven and tested that it’s a trading platform that is efficient and very useful. The tools provide a cautious and well-informed interpretation of the markets that greatly contribute to the trader.

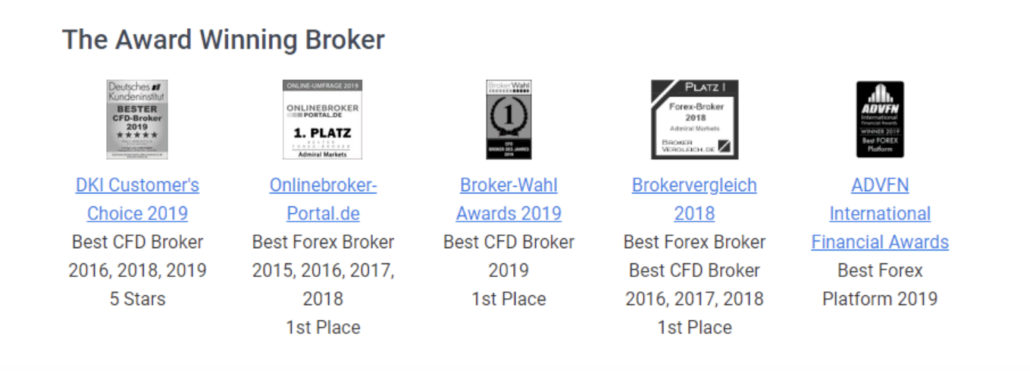

Admiral Markets has shown its execution and has been voted as the number one Forex broker by the users of online broker-portal.de (readers’ choice). In the year 2015, the company has been awarded second place by Broker Wahl (Germany Brokerwahl) in the category of FX broker of the year.

There are three types of accounts that Admirals offers: “Trade.MT5”, “Invest.MT5”, and “Zero.MT5” (also offered for MT4). Each of the accounts has different requirements, and each has different assets to choose from. Each account varies as well in leverages, and some do charge a fee for a commission. The maximum leverage can be 1:500, and the spreads are variable and start from 0.0 pips, depending on the market conditions and account type.

Admiral Markets also offers support to clients through numerous educational and training programs. This helps the clients to have more reflective and well-thought decisions when it comes to trading. The company offers free seminars, online webinars, and regular seminars that tackle important trading skills, giving awareness about the risks and as well as educating clients in the Forex market.

The good thing about Admiral Markets is that it publishes not only fundamental analysis but also technical analysis on a regular basis, which is an advantage for traders. On their official website, Admiral Markets also presents an economic calendar together with the rates of worldwide currencies. Plus, it has 24/7 access to Partner Portals, which gives traders access to their page with progress, commissions, and as well as profit updates. The brokers are reputable, regulated, and trusted.

The company and its brokers have been operating for 18 years of reliability and have proven their worth to the clients.

The following markets are tradable at Admirals:

- Forex

- CFDs

- Commodities (Spot Energies CFDs)

- Metals (Spot Metals CFDs)

- Indices (Index CFDs)

- Shares

- ETFs

- Bonds

- Cryptocurrencies

A Forex and CFD account can be opened for as little as $ 100, and for a stock account, you only need a minimum deposit of $ 1. For traders who want to test the service first without risk, a free demo account is available. We will discuss the different account models in more detail in the next sections.

Forex (Currency Trading)

At Admiral Markets, you can trade over 45 currency pairs. These include the most popular currencies, such as Euro, Dollar, and Yen, but also exotic currencies, such as Norwegian Krone or Hong Kong Dollar. The leverage is as high as 1:30 for private traders. Professional traders benefit from higher leverage of 1:500. To be classified as a professional trader, you need to contact the broker and meet certain criteria.

Spreads start as low as 0.0 pips. You can choose the fee structure depending on the account type. Either you choose the “Trade” account with no commissions and an added spread, or you choose the “Zero” account and pay an additional commission instead of an additional spread. In my experience, the trading fees for Forex trading are very low. Also, liquidity is high, and execution is very fast, thanks to European servers.

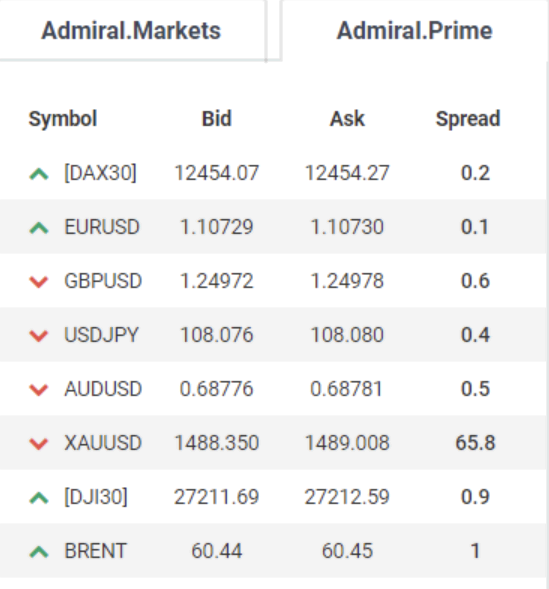

Commodities

Trade a total of over 20 different commodities. As an asset, the spot market or the future is available. For example, it is possible to bet on rising or falling prices of gold. A leverage of up to 1:20 is possible for private traders. The fees are also very low here. The website of Admiral Markets is also a comparison to current competitors (image below).

The spreads vary depending on the market. In the “Zero” account, you will pay a commission of about 1.80 – 3.00 USD per 1 lot trade for metals and energies. For this, you will get raw spreads. In the “Trade” account, an additional spread is added. Again, Admiral Markets can score with low fees.

Real shares and shares CFDs

To trade real stocks, you only need to deposit €1 at Admiral Markets. In total, over 4,000 real stocks are offered, which can also be traded as CFDs. The advantage of a CFD (contract for difference) is that you can use a leverage of 1:5 and also short sell. The offer is also rounded off by about 300 ETFs.

For real shares, you pay a commission of 0.02 USD per share. For stock CFDs, there is a fee of 0.01 USD per CFD. When trading, also pay attention to overnight funding fees. Depending on the interest rate and currency, there is a holding fee because leverage is used.

Cryptocurrencies

Cryptocurrencies are currently very trendy and popular among private investors. Admiral Markets also has them on offer via CFD. You buy or sell as not the real coin but the contract on it. It is possible to trade ten different cryptocurrencies. Among them are also 22 different fiat currencies. The spread is variable for cryptocurrencies and is between 1 – 3%. The leverage is 1:2, and you can also go short.

Traders benefit from multi-language support from the different customer centers around the world. From our experience, the service is professionally structured, and there is also training, webinars, and direct analysis. The trading platform offered is the globally popular MetaTrader versions 4 and 5.

The spreads at Admirals:

The spreads at Admiral Markets can vary depending on the market. As a well-known DAX broker, the spread in the Dax is only 0.8 pips. The spreads in the Forex market start from 0.0 pips. Depending on the account model, your spreads can be different. Admiral Markets offers an account with spread markup and an ECN account with an additional commission ($3 per $100,000 traded).

So the trader has to decide which fee model he prefers. From my experience, the ECN account is cheaper than the spread account. For stocks and ETFs, the 0.0 pips spread applies. There you get a direct exchange execution. In general, the spreads and trading fees are very low.

Get an overview of this in the table below:

TRADE.MT5 | INVEST.MT5 | ZERO.MT5 | |

|---|---|---|---|

Spreads and commission: | Spreads from 0.5 pips (no commission) | Spreads from 0.0 (only stocks and ETFs available) + 0.02 USD commission per share | Spreads from 0.0 pips + $ 1-8 – $ 3.0 commission per one lot traded |

The provider specializes in forex trading and CFD trading. Especially the spreads in stock indices (index CFDs) are really very low. The Dax is already tradable from 0.8 points spread and thus perfect for scalping. But also, for trading with currencies, the forex broker is really well-positioned. High liquidity and fast execution, we could determine from our Admiral Markets experience.

Summary of conditions for traders:

- Free demo account

- Minimum deposit 100€ for Forex and CFDs

- Minimum deposit 1€ for stocks

- MetaTrader 4 / 5 trading platform

- Maximum leverage 1:30 (retail clients)

- Spreads from 0 pips to 0.1 pips

- Different account models

- Fast execution with high liquidity

- Direct market access

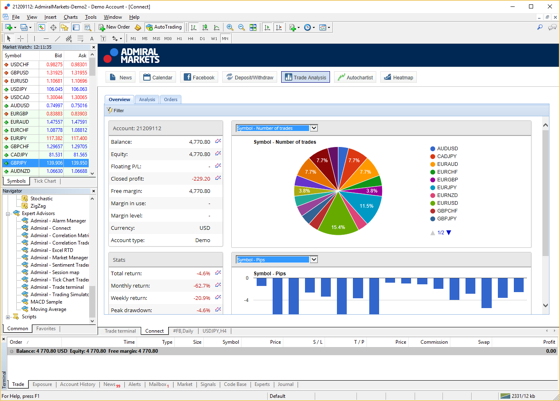

Test and review of the Admirals trading platforms

For professional forex trading, it is important to have a reliable trading platform. Most traders are using some sort of analysis where tools or indicators are necessary. In the next section, we will give you an introduction to the different platforms which are available to Admirals.

Admirals offer the following platforms:

- MetaTrader 5

- MetaTrader 4

- WebTrader

- App for mobile devices

MetaTrader 5

MT5 is the most famous platform and is the number one multi-asset platform traders and investors choose to use from around the world in trading Forex, CFDs, futures, and exchange-traded instruments. It has thousands of markets, is very easy to use, has level 2 pricing, trading robots, VPS Support, superior charting, education market and provides free market data and news. The platform not only offers advanced charting and trading tools but also options for automated trading.

MetaTrader 4

MT4 is a user-friendly platform that is flexible, secure, fast, and responsive. This platform is used as well for trading Forex and CFDs. It analyses the financial markets and offers traders advance access to trading operations in a secure, fast, and reliable environment. It offers multi-language support as well as automated trading. Its advanced charting capabilities are a big plus, and it is totally customizable.

MetaTrader WebTrader

MetaTrader WebTrader is a very convenient trading platform. You can trade in a browser from anywhere, and every moment is safe to trade. It requires no downloading, has no OS preference, and is very fast to start.

Facts about Admirals platforms:

- User-Friendly (easy to use)

- Advanced tools

- Reliable

- Fast

- Secure

Which market instruments are available at Admirals?

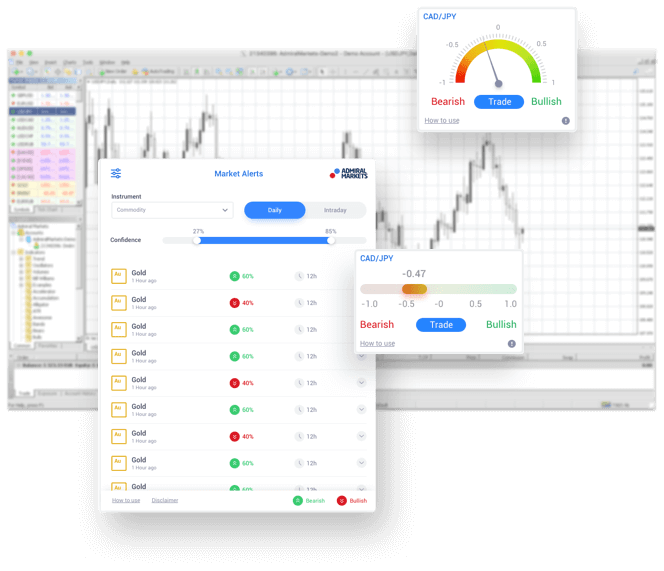

MetaTrader Supreme Edition

The MetaTrader Supreme Edition platform possesses the most advanced tools and will definitely improve your trading experience. You can get this platform for free to live and demo accounts. It has powerful Global Opinion widgets for MT4/MT5 that improve your Forex trading performance. Promotes fast order reversal and hedging with order templates for OCO and OCA order types. Very reliable and very efficient order opening with preset stop-loss, take-profit, and trailing stop. It has a handy and latest indicator that can let you see multiple time frames and chart types in one chart! You can easily track your chart movement, stay connected and definitely manage your whole account and all your orders efficiently.

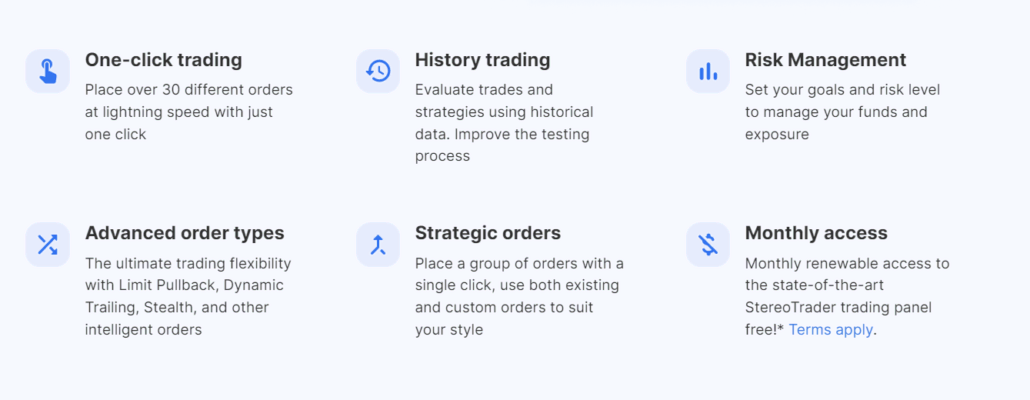

StereoTrader

If you sign up, you will get monthly and renewable access to StereoTrader. StereoTrader is a MetaTrader trading panel with special features that make trades easier and more regulated. It will automate quickly and intelligently to optimize your entrances and exits.

Use increased one-click and historical trading, place strategic, stealth, or other advanced order types, and make use of a wide range of other choices to increase your trading productivity.StereoTrader has multiple uses. Whatever your preferred method of trading, StereoTrader gives you the resources you need to carry out your plan with the utmost accuracy.

Professional charting and analysis are possible

Technical analysis of the markets is very essential, and charting is one of the most significant things that you need to know about. The essence of this is to help you understand the trend and volatility of the markets. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the most recommended software by brokers. It is known to be a very flexible and reliable platform in trading.

Admirals encourage traders to give attention to fundamental analysis as much as they give to technical analysis. Both have their advantages and disadvantages when it comes to trading. It is important to know both analyses because fundamental analysis helps you understand the market’s movement (upward or downward), and when combined with technical analysis, this can lead you to long-term trends, which is a good edge on the trader’s part.

There are several kinds of forex charts. Candlestick charting is the most famous and common charting that most traders use around the world due to the fact that it is easy to use and very useful. It is a comfortable structure to work with and isn’t difficult to use every day.

Chart types:

- Candlestick

- Line Chart

- Bar Chart

- Tick Chart

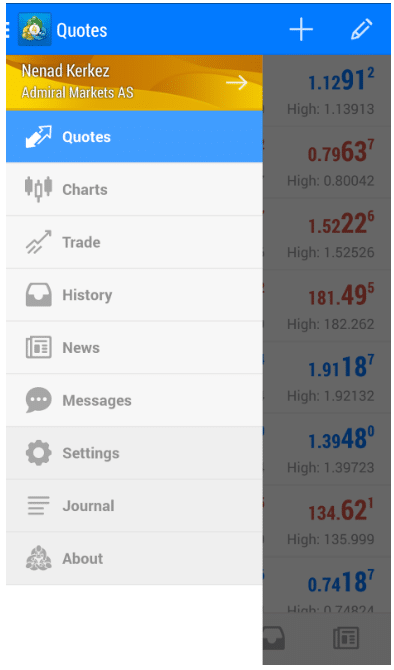

Mobile Trading (App) is possible with Admirals

MetaTrader 4 and 5 (MT4/5) mobile Android platform is a top-notch software that is designed for traders by Admirals. This feature allows clients to access mobile trading from any Android device. It lets clients or traders not only be able to place an order using mobile devices but also perform basic technical analysis on a fully-fledged chart.

Features of MT4/5 App:

- View Live FX Quotes

- Customize the Platform

- Display Charts

- Add Indicators

- Get messages from your Broker

- Access Trading History

- Read Market News

- Change Time Frames

- Allows you to use all types of orders

- General Access to all Mobile-Friendly and Useful Features for Online Trading

You do not need to go to Google and search for the current rate for your opened positions because the MT4/5 App (MetaTrader 4/5 Application) also features a quick preview of the current market situation. The App definitely owns some of the strongest chartings of all mobile apps for FX trading.

You can easily get the MT4/5 App. All you need to do is to get a platform, authorize it with your existing trading account and navigate the advantages of Forex trading from anywhere and anytime.

What we recommend for first-time users is that it is best to explore first the platform’s features by getting a demo account to avoid unintentional trade executions.

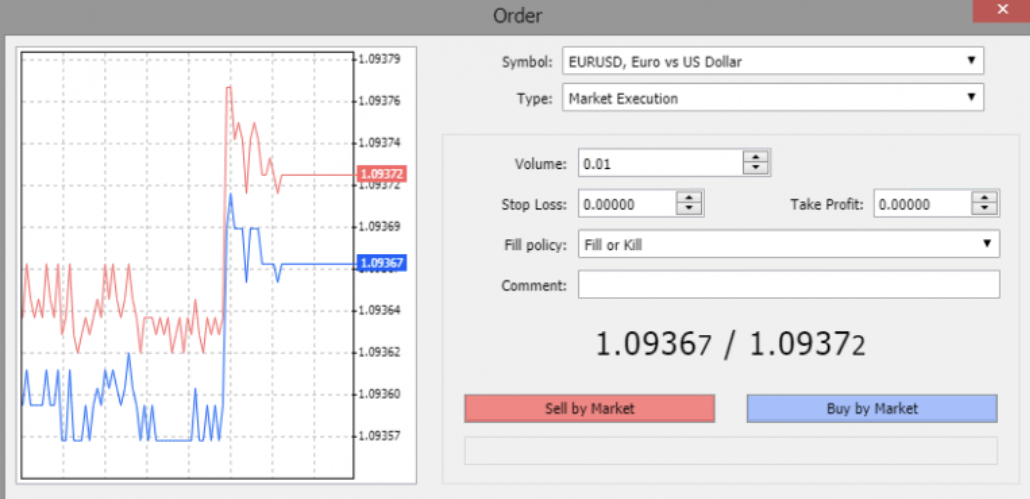

Admirals trading tutorial: How to trade

You need to choose which market you want to trade on.

You need to know the movement of the market, whether it is going upward or downward. You need to decide whether you buy or sell. If you think that the market value will fall, click on ‘sell’, and if you think the price will increase in value, click on ‘buy’.

It is important to add stop-loss because it is an order that secures your position from a certain process when it moves too far against you.

Once you have placed your trade, you can track the market prices and can monitor (or see) your profit or loss in real time.

Step-by-step tutorial:

- Choose an asset you want to analyze

- Analyze the asset and make a forecast of the price movement

- Open the order mask and customize your position

- Choose the order volume

- Limit your loss and profit with the stop-loss and take-profit

- Buy or sell the asset you want

Since Admirals allows you to trade Forex and CFDs, you need to know the difference between them. Generally, Forex is limited to currency markets, while CFDs cover a range of markets. For example, CFDs can be a commodity, indices, or stocks. With Admirals, you can trade CFDs, either precious metals or crude oil.

Trading forex is much more direct than trading CFDs. Basically, the trader trades a currency pair, which means you are buying one currency and then selling the other. Trading CFDs is more on contract specifications.

Market Execution

You buy or sell at the next best price.

Buy Limit (Pending Order)

You buy when the market goes down at a certain price. For example, the Dax is at 13,000 points. The Buy Limit order is at 12,000. If the Dax now falls to 12,000, you automatically buy.

Sell Limit (Pending Order)

The same principle as the Buy Limit Order. In this case, however, the price must rise, and then you sell automatically.

Buy Stop (Pending Order)

The market is at 12,000, and the buy-stop order is at 13,000. Now the market is rising. You automatically buy at 13,000. This order is good for breakout traders.

Sell Stop (Pending Order)

The same principle, but in reverse, and you sell here.

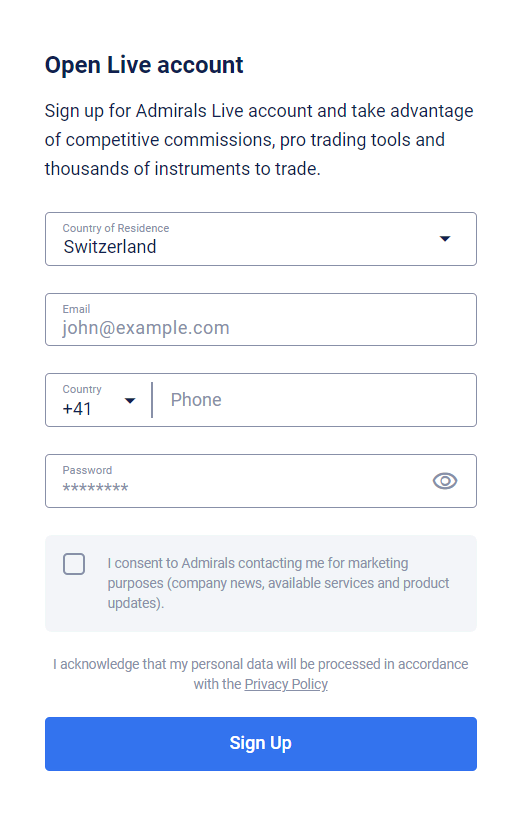

How to open your account

You can definitely open a demo account using any of the three types of trading accounts Admiral Markets offers (“Trade.MT5”, “Invest.MT5” and “Zero.MT5”). It is very easy and quick. All you have to do is to give in your full name and email address.

- First name

- Last name

- Password

- Phone-Number

After you registered, you can use immediately the demo account. For trading with real money, you have to verify your profile. The broker will ask you for additional information about your experience and trading style. Also, it is required to upload documents to verify your identity and home address.

Free Admirals demo account

Anyone who would like to evaluate the platform first before making a deposit can use a demo account for free. The demo account includes $10,000 in virtual funds and is valid for 30 days. The positive thing about using a demo account with Admirals is that it gives the trader all the necessary tools which are available and is used in a real live trading account. It also provides a quick-start guide which is very helpful for first-time traders. We would highly recommend for you get a demo account first so that you can test and practice the platform before making any deposits or investments.

Account types of Admirals

Admiral Markets offers three types of accounts.

Trade.MT4 / Trade.MT5

This account has a minimum deposit of $ 100 and is the most popular trading account of the company. It is a micro account that offers up to 1:500 leverage and spread that begins from 0.5 pips. Traders can select from 59 currencies as well as precious metals, energies / crude oil, futures, stocks, bonds, and indices. The account offers access to the entire list of financial instruments or tools to trade. This account is the most popular and is considered an excellent account for online trading on a large margin due to the high leverage and low spreads, which allow high-risk traders and scalpers to take advantage of the market’s fluctuation or volatility.

ZeroMT4 / Zero MT 5

This account is the second type of account in Admiral Markets. The initial deposit begins with a minimum of $ 100 and has a lowered leverage of 1:500. This account begins from 0 spreads and a commission of $ 1.8 – $ 3.0 per lot. However, there is a downside to this account. It only provides access to precious metal CFDs and FX currencies. This factor prevents traders to be able to invest in other assets that are available in the market’s account.

Invest.MT5

Admiral Invest is for trading more than 4350 stocks and 200 ETFs. You can start investing with a minimum deposit of only $ 1. Admiral Invest gives you access to different stock exchanges. There is a direct exchange execution with a 0.0 pip spread.

In the table below, you will find an overview of the conditions and important information for all account types. One great thing is that you have similar account options for MetaTrader 4 and MetaTrader 5 users, so the decision of which trading platform you prefer is totally up to you.

Trade.MT4 / Trade.MT5 | ZeroMT4 / ZeroMT5 | Invest.MT5 |

Leverage: 1:500-1:10 | Leverage: 1:500-1:10 | No leverage |

Starting at 0.4 pip spread | 0.0 pip spread | 0.0 pip spread |

0.01 lot minimum order size | 0.01 lot minimum order size | No minimum order size |

100 lot maximum order size | 100 lot maximum order size | No maximum order size |

VIP Account Offers

For traders with an account deposit of over € 20,000, Admirals has special offers. You can sign up for VIP conditions via the homepage or support. This is a personal offer from Admirals. Depending on the trading volume, you can get rebates/kickbacks. This means you get money back on every trade.

| TRADE.MT4 / TRADE.MT5 | ZERO.MT4 / ZERO.MT5 | INVEST.MT5 | |

|---|---|---|---|

| MIN. DEPOSIT: | $ 100 | $ 100 | $ 1 |

| ASSETS: | 3,000+ | 60+ | 4,500+ |

| LEVERAGE: | max. 1:500 | max. 1:500 | 1:1 |

| SPREAD: | From 0.5 pips | From 0.0 pips | From 0.0 pips |

| COMMISSION: | / | From $ 1.8 – $ 3.0 | $ 0.02 per share |

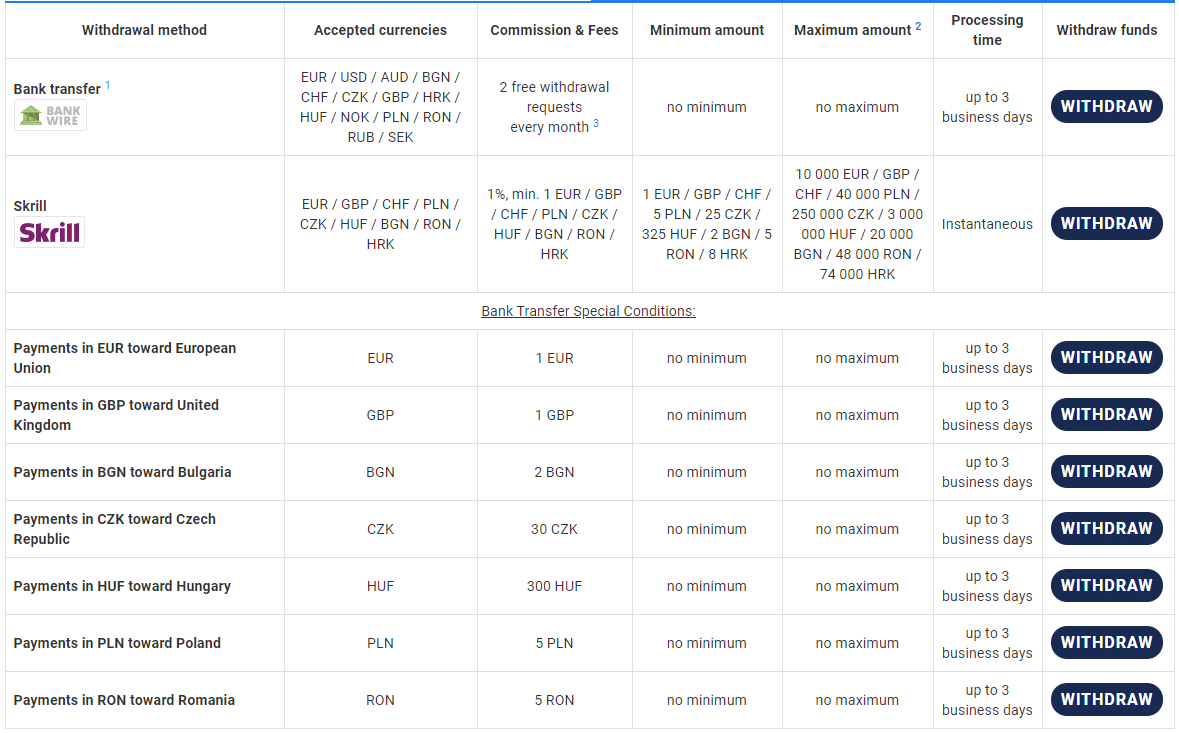

Review of the deposit and withdrawal

Admiral Markets deposit process is very easy, and the majority of the payment methods that are available instantly process the transaction right away. Bank Wire is the only payment platform that may take up to 3 business days to process your funds.

Payment methods that can be used:

- Bank transfer / Bank Wire

- Perfect Money

- Credit Cards (Visa, MasterCard)

Please note that Admirals do not accept cash deposits from banks (only bank wire).

However, for the withdrawal process, it is the other way around. Skrill is the only payment program that processes your funds immediately, and the majority, which is through bank transfer, takes up to 3 business days.

How does Admirals make money from you?

Opening a live or demo trading account is free with Admiral Markets. It is important to know what fees you are paying for or will be charged for by using an online trading platform.

Here is the following information that is relevant when you use Admirals:

Trading fee

- The minimum initial deposit is $ 100 / $ 1

Spread

- Minimum variable 0.0 Pips

Swap fee

- $0.10 (or equivalent in another currency, depending on your asset)

Inactivity fee

- 10 EUR per month

Commissions

- Admirals may charge a commission on CFD shares, shares, and ETFs

Are there any hidden costs at Admirals? – No, all fees and costs are communicated transparently on the broker’s website. We have already mentioned above that Admirals makes its money through the spread or commission.

Other costs may possibly be incurred when withdrawing funds (depending on the method). Not every payment method charges fees. It is quite possible to transfer funds without any withdrawal fees. Additionally, there is still an inactivity fee of 10€ per month for the inactivity of 3 months.

Additional costs and fees:

- A deposit via Skrill or Neteller costs 0,9% (min 1€)

- Inactivity fee 10€

- Withdrawals by bank transfer, Skrill, or Neteller are free two times a month

In addition, of course, there are trading fees for active trading. We have already discussed these above. Spreads can start from 0.0 pips, and there are favorable commissions.

In summary, Admirals is a very cost-effective Forex broker, from my experience. The inactivity fee only comes into question if there are also funds available in the account. Withdrawal or deposit fees can be avoided.

Support and service for traders in different languages

What is amazing about the customer service in Admirals is that they give good quality assistance to the traders. The company has support available in 24 different languages, and clients can reach their customer support through email, chat, and/or phone calls.

Also, Admirals has client remote support, which is very helpful. Whenever the trader has encountered software-related concerns or any technical issues, remote support will swiftly attend to the trader’s questions or needs.

You can find their support details by going to their website and by pointing your mouse cursor on the ‘ABOUT US‘ section, and you will receive a drop-down menu where you will find ‘Contact Us‘.

Facts about the support:

- Supports a wide range of languages (available in 24 different languages)

- Phone support

- Email Support

- Chat Support

- English language support is open 24 hours a day (on a business day)

Admirals also give support by offering clients educational and training programs. These programs are available in regular, free seminars or online webinars. The aim of these programs is to give traders important skills in online trading, awareness of the risks that might take place, and of course, give the clients a view of how the forex market operates.

Because of this, we can say that the support and service that the company offers are truly remarkable.

Accepted countries and forbidden countries

The following are the countries accepted by Admirals:

Argentina, Australia, Austria, Bahrain, Belarus, Brazil, Bulgaria, China, Croatia, Cyprus, Czech Republic, Denmark, Estonia, France, Finland, Germany, Greece, Hungary, India, Ireland, Israel, Italy, Kuwait, Malaysia, Malta, Mexico, Monaco, Netherlands, Norway, Latvia, Liechtenstein, Lithuania, Luxembourg, Oman, Poland, Portugal, Russia, Saudi Arabia, Slovakia, Slovenia, South Africa, Spain, Sweden, Switzerland, Thailand, United Arab Emirates, United Kingdom, Qatar

Admiral Markets does not accept US clients.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

What are the best alternatives for Admirals?

If a broker like Admirals manages to survive on the market for more than two decades, they definitely deserved their place, and you can trust them with your funds without concerns. Still, if you decide the broker isn’t the best fit for you, here are our favorite alternatives to Admirals.

Capital.com

Capital.com is the best alternative for new traders with little experience because our test revealed, their platform is easy to use, they offer a ton of educational experience, a free demo account, competitive spread fees, and much more.

RoboForex

RoboForex is a great option for intermediate to advanced traders, mainly due to its high leverage and large number of tradable assets. The broker has more than 900,000 registered customers around the world and scored in terms of leverage and professional customer support. Read our detailed report here.

XTB

XTB is one of the most trusted brokers in history and is great for everyone who wants their funds extremely safe. XTB was originally founded in Poland but has offices in many countries around the world, and they are even traded in the Polish stock market. So you can be sure you won’t go anywhere. As an additional benefit, they are offering access to xStation 5, one of the best and most beginner-friendly trading platforms on the market.

Conclusion of the review: Is Admiral Markets legit? – We think: Yes

Admirals have proven its reliability for over 20 years now and are one of the leading brokers in the industry. The company offers the best support to its clients, offers highly functional software, and aims to provide a transparent trading experience. It offers educational and training programs to offer the clients to have more reflective and well-thought decisions when it comes to trading.

We recommend Admiral Markets as it is legit, reliable, and it is a safe broker for forex and CFD trading. The broker is reputable, authenticated, and highly regulated. As it is one of the first Forex and CFD brokers in the trading industry, the company has the most efficient and developed tools and user-friendly platforms. Plus, it offers mobile trading as well.

Advantages:

- Advanced and highly-functional software

- Transparent trading experience

- User-friendly platforms

- Wide range of markets

- High security of investments

- Quality support and services

- Promotes financial stability

- Offers mobile trading

- Regulated

- Global

- Offers free demo account

- Reliable and competitive spreads

Disadvantage:

- Not available for US traders

If you search for a reliable online broker you should choose Admirals. With more than 20 years of experience, the company knows how to support its clients.

Trusted Broker Reviews

Experienced and professional traders since 2013Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

FAQs- The Most asked questions about Admirals:

Is Admirals a regulated broker?

Yes – Admiral Markets is regulated by the FCA (UK), ASIC (Australia), and CySEC (Cyprus). These are the best regulations in the world for forex and CFD trading. The FCA regulation offers special securities and high deposit protection of 85,000 pounds, for example. Customers can choose the regulator authority they want.

What can I trade at Admirals?

Admiral Markets offers to trade in Forex, CFDs and, real stocks, ETFs. By CFD, the following markets are tradable: Currencies, stocks, ETFs, indices, commodities, or cryptocurrencies. In total, over 4,000 different markets are offered. The offer is constantly being expanded.

What is the minimum deposit at Admirals?

The minimum deposit ranges from $ 1 – $ 100 for a real money account. Admiral Markets offers different account models. The Invest.MT5 account is available with a deposit of 1€. With this, stocks can be traded. The Trade.MT5 and Zero.MT5 for Forex & CFDs is available with a deposit of $ 100.

Which trading platforms do Admirals use?

Admirals have partnered with MetaQuotes, the company behind the MetaTrader 4 & 5 trading platforms. In addition to MT4 and MT5, customers can also use MetaTrader Supreme Edition and MetaTrader WebTrader.

What is Admiral Markets’ Premium program?

The company’s Premium program gives traders access to a personal manager, double the standard cashback, educational material, and a VPS service to facilitate securities trading. Traders also get access to global macro outlook analysis at the beginning of every month and Parallels Desktop software on macOS for free.

How to become a member of Admiral Markets’ Premium program?

To become a Premium member, you must deposit $20,000 across your trading accounts and wallet. Since the company monitors the TR status once a day, you will become a Premium member a day after you make the deposit. You will receive confirmation from your assigned personal manager when you become a member.

How much cashback do Admiral Markets’ Premium members get?

A premium member’s cashback is calculated according to their monthly trading volume, more specifically, based on their closed positions. The cashback rate for Premium members is two US dollars per million USD of notional volume. The nice thing about Admiral Markets is that they don’t need Premium members to do anything to get their cashback. All Premium accounts are credited with cashback in the first five calendar days of a month.

Trade from 0.0 pips over 3,000 markets without commissions and professional platforms:

(Risk warning: 75% of retail CFD accounts lose money)

See other articles about online brokers:

Last Updated on June 8, 2023 by Res Marty