ThinkMarkets review and test – Is it a scam or a reliable broker?

Table of Contents

All traders ask the same questions when choosing the right broker for them. “Is this company trying to scam me?” and “What do I stand to gain if I choose this broker?”. Naturally, traders would want a broker who’s trustworthy and straight to the point. Time is money, after all.

ThinkMarkets isn’t all that popular. This is probably the first time you heard about this broker. In this review, you will read about what ThinkMarkets offers. We’ll also talk about its pros and cons to help you decide whether this broker is the right one for you.

(Risk warning: Your capital can be at risk)

What is ThinkMarkets? – The company presented

ThinkMarkets is an online multi-asset broker that was established on the year 2010. This company has collected numerous awards throughout its years of operation. Some of these awards are the Global Forex Best Value Broker in Asia of 2020 award, the UK Forex Best Forex Trading Innovation of 2017 award, and the UK Forex Best Forex Trading Experience of 2017 award.

ThinkMarkets has three main offices. TF Global Markets Limited can be found in Hana, 70 St Mary Axe, London. TF Global Markets Pty. Ltd is found on Level 18, 357 Collins St, Melbourne, Australia. TF Global Markets (South Africa) Ltd is located at 61 Katherine Street, Dennehof, Sandton, South Africa.

Here is a quick overview of ThinkMarkets:

⭐ Rating: | (4.8 / 5) |

⚖️ Regulation: | Regulated by multiple authorities |

🏛 Founded: | 2010 |

💻 Trading platforms: | Web platform, mobile applications |

💰 Minimum deposit: | No minimum deposit requirement for a Standard account and just $500 for a ThinkZero account |

💸 Withdrawal limit: | No limit |

📈 Minimum trade amount: | From 0.01 lots only |

⌨️ Demo account: | Free and unlimited |

🕌 Islamic account: | Available |

📊 Assets: | Forex, shares, indices, commodities, crypto |

💳 Payment methods: | Bank wire, Visa, Mastercard, Neteller, Skrill and many others |

🧮 Fees: | Low spreads from 0.0 pips |

📞 Support: | 24/7 by phone, chat and email |

🌎 Languages: | More than 12 |

(Risk warning: Your capital can be at risk)

Is ThinkMarkets regulated and safe?

ThinkMarkets is regulated by the FCA or Financial Conduct Authority with an FCA number of 629628. They are also regulated by the Australian Securities and Investment Commission or ASIC with a service license of 424700.

Lastly, ThinkMarkets’ sister South African company (TF Global Markets Pty Ltd) holds an FSP or Financial Service Provider license. Their registration number is 2017/098181/07.

Clients don’t need to worry about the safety of their money because ThinkMarkets segregates your funds from theirs and keeps them in secure, top-tier banks like the National Australia Bank, Commonwealth Bank of Australia, and Barclays Bank.

They also have an existing AML policy. AML stands for Anti-Money Laundering. The Financial Action Task Force or FATF created this extra security line to prevent money laundering.

Here are some facts about the security of ThinkMarkets:

SSL: | Yes |

Data protection: | Yes |

2-factor authentication: | Yes |

Regulated payment methods: | Yes, available |

Negative balance protection: | Yes |

Trading conditions and products offered

ThinkMarkets has a Margin Call Policy that is being implemented on forex, indices, and energy assets. When your margin call level reaches 50%, ThinkMarkets automatically liquidates your open trades.

They also have a trading condition for the unlikely event that an asset’s value becomes negative. In this case, the reflected price on ThinkMarkets’ platform will be set to 0.01. All open positions trading this asset are automatically closed-out at 0.01, and no new positions may be opened.

Here is an overview of their trading conditions and offers:

Leverage: | Up to 1:500 |

Execution time | 1 ms (no delays) |

Forex: | Yes |

Commodities: | Yes |

Cryptocurrencies: | Yes |

Binary options: | No |

Event contracts: | No |

Indices: | Yes |

Futures: | No |

Bonds: | No |

Mutual funds: | No |

Stocks: | Yes |

Hedge funds: | No |

Lets have a closer look at each of their assets.

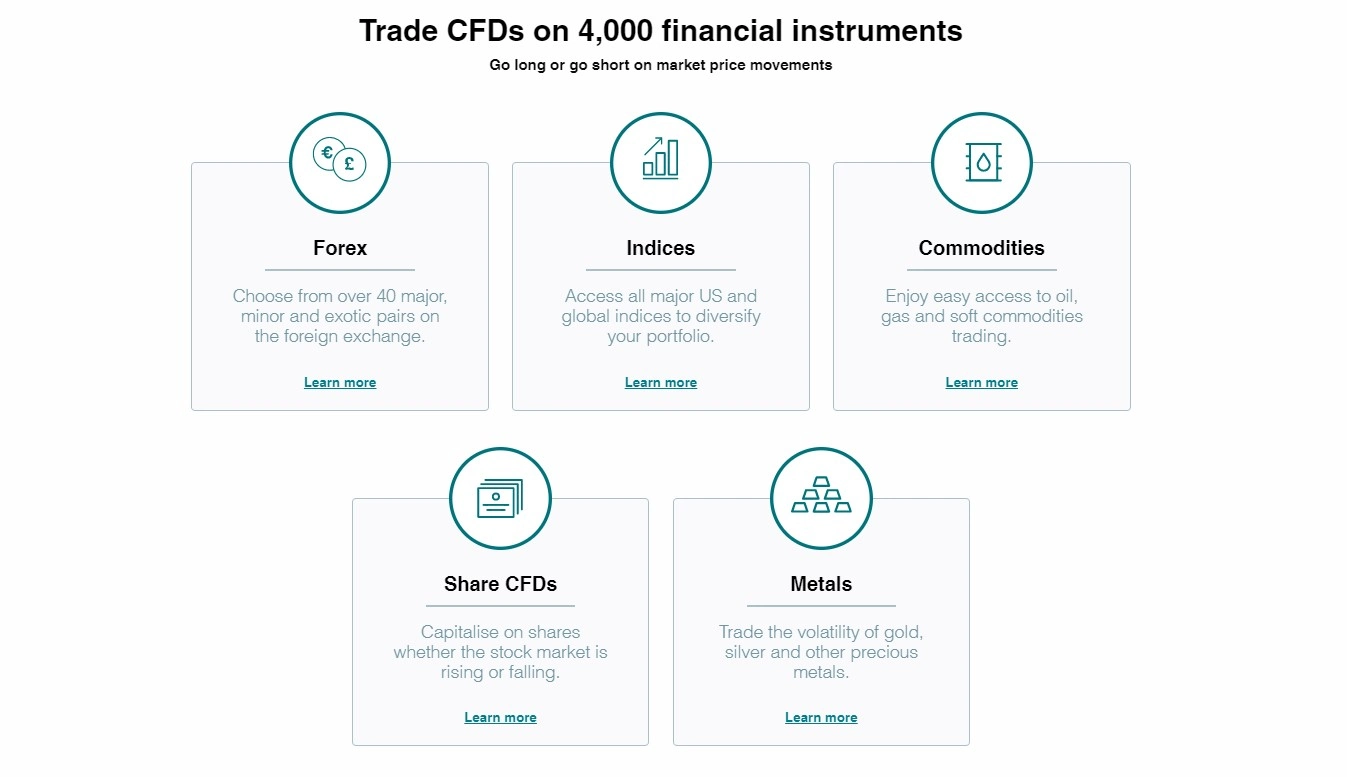

Forex

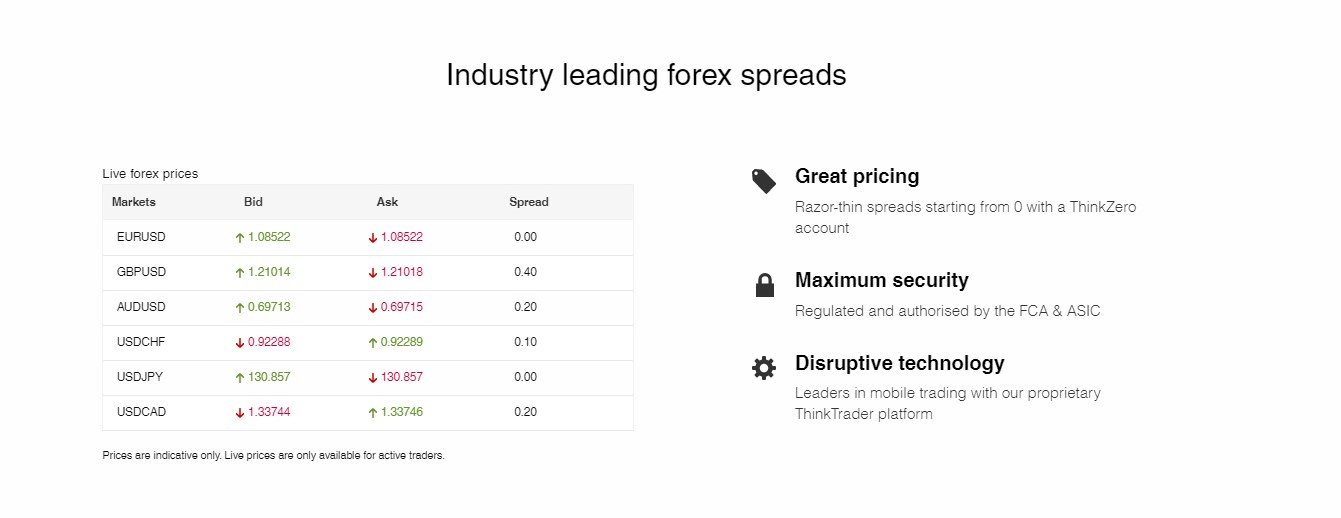

With ThinkMarkets, you can trade more than 30 currency pairs. This includes seven major currency pairs: EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD, AUD/USD, and NZD/USD.

Spreads start at 0.0 pips for major pairs and can reach up to 40 pips when trading exotic pairs with a ThinkZero account. On standard accounts, however, spreads start at 0.4 pips and can reach up to 70 pips, depending on the currency pair you’re trading.

Each lot size for this asset class is 100,000, and the minimum trade size is 0.01. You can trade up to 50 lots with the standard account and up to 100 lots with the ThinkZero account. The maximum leverage, regardless of your account type and traded currency pair, is 500:1.

Forex trading hours start on Monday at 12:03 AM and end on Friday at 11:55 PM GMT +3.

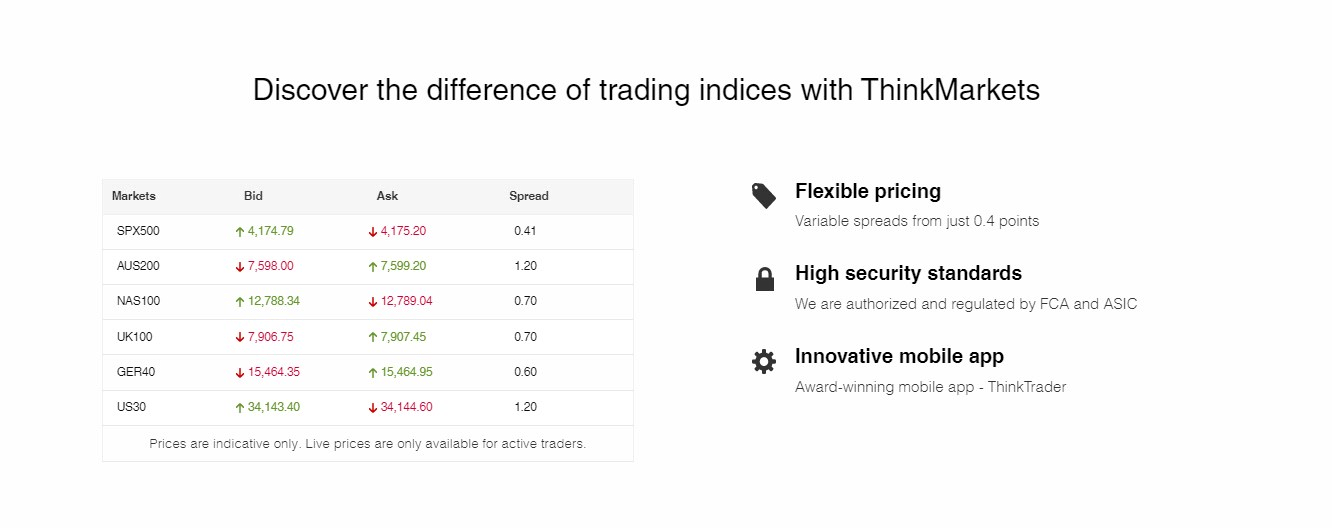

Indices

ThinkMarkets offers 15 global indices and a financial index. You can trade some of the popular indices on the market, like the Dow Jones Industrial Average (US30), Nikkei 225 (JPN225), Nasdaq Composite Index (NAS100), the Hang Seng Index (HK50), and many more. The financial index that ThinkMarkets offers is the US Dollar Index or USD INDEX.

The currency denominations for these indices are USD, AUD, EUR, ZAR, HKD, JPN, and GBP. The maximum leverage for this asset is 200:1 for most indices. However, maximum trading with leverage could go as low as 25:1 for some of the available indices on ThinkMarkets’ platform.

Contract size, minimum, and maximum trade size also vary. The possible contract sizes are 1, 10, and 100 for the minimum and maximum trade sizes. It starts at 0.1 and can reach up to 100.

Refer to their website for the complete schedule for each of the indices offered by ThinkMarkets.

(Risk warning: Your capital can be at risk)

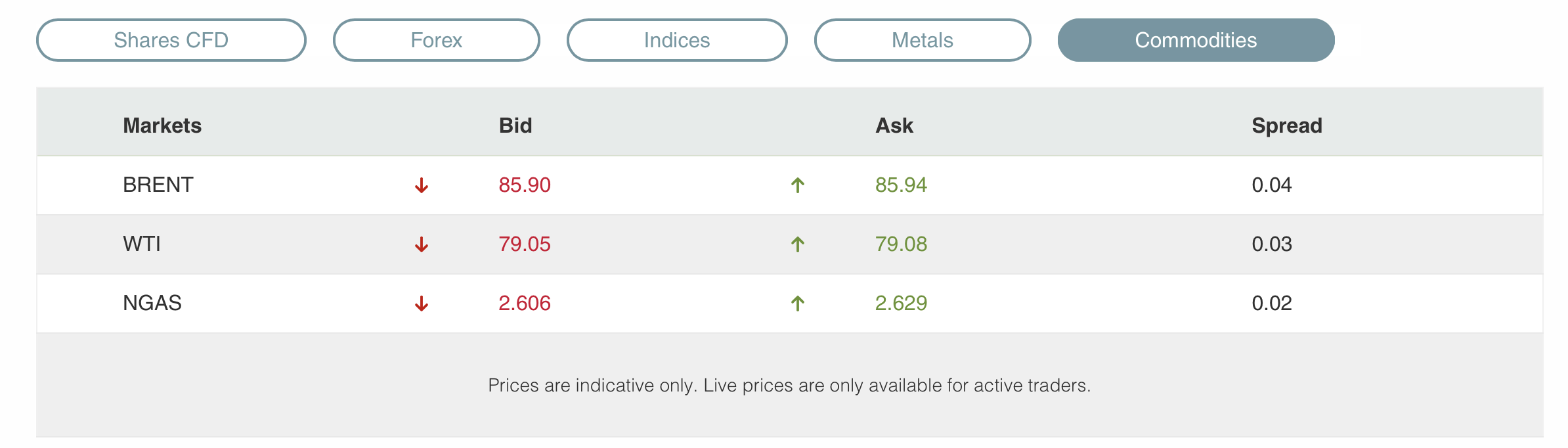

Energy

These prices are against the US dollar, and the maximum leverage is 200:1 except for Natural Gas. The maximum leverage for this is 25:1. The minimum spread for both oil assets is two, while for Natural Gas, it is 0.02.

If you want your portfolio to have exposure to energy-related assets, ThinkMarkets offers three different investments to choose from. These include US Crude Oil (WTI), Brent Crude Oil (BRENT), and Natural Gas (NGAS).

You can trade as small as 0.1 lots up to 100 lots for this asset. Trading hours for US Crude Oil and Natural Gas are from Monday 1:00 AM to Friday 12:00 midnight. For Brent Crude Oil, the market is open from Monday 3:00 AM to Friday 12:00 midnight. The server time is GMT +3.

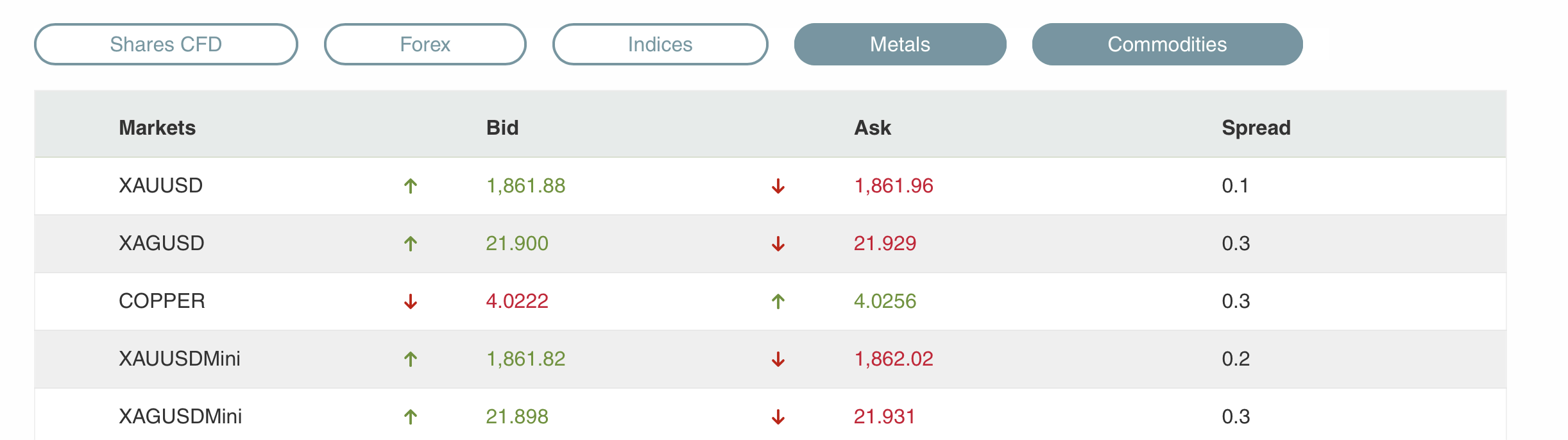

Precious Metals

ThinkMarkets offers three metals divided into seven different tradeable assets. Here is a table of all the metals offered as well as their trading conditions.

Metal | Contract Size | Min. Trade Size | Max Trade Size | Spread | Max Leverage |

High-Grade Copper (COPPER) | 10000 | 0.1 | 25 | 54 USD | 200:1 |

Silver (XAG/USD) | 5000 | 0.1 | 10 | 40 cents | 125:1 |

Mini Silver | 500 | 0.01 | 10 | 40 cents | 125:1 |

Gold (XAU/USD) | 100 | 0.01 | 10 | 30 cents | 400:1 |

Mini Gold | 10 | 0.01 | 10 | 30 cents | 400:1 |

Silver Zero (XAG/USDx) | 5000 | 0.01 | 10 | 25 cents | 125:1 |

Gold Zero (XAU/USDx) | 100 | 0.01 | 10 | 6 cents | 400:1 |

This asset is tradeable from Monday 1:03 AM to Friday 11:59 PM GMT +3.

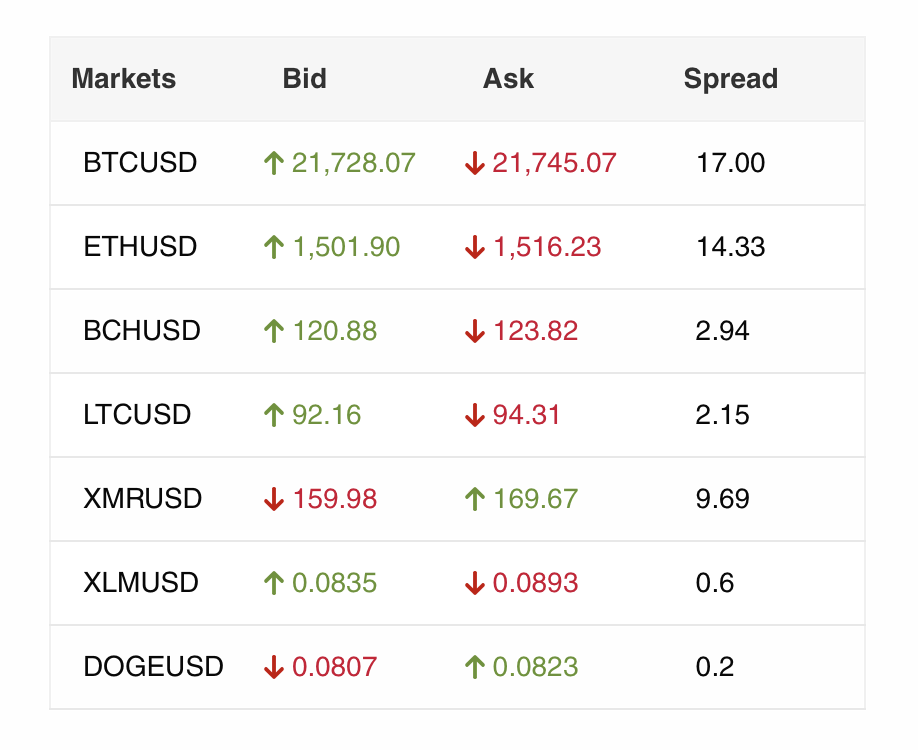

Crypto

ThinkMarkets’ clients have 15 tradeable cryptocurrencies to choose from. These include some of the popular cryptos like Bitcoin, Litecoin, Ethereum, Ripple trading, and Cardano. The maximum leverage is usually 2:1, but it could reach 5:1 for Bitcoin Cash and Litecoin and 10:1 for Ethereum and Bitcoin.

The maximum position size depends on the asset and on which day you traded it. To view the current spreads of each of their cryptocurrencies, refer to their website.

The great thing about trading cryptocurrency is that its market is available 24/7, with two breaks on Saturdays. The first break is from 12:00 midnight to 1:00 AM (GMT +3), and the second break starts at 12:00 noon and ends at 3:00 PM (GMT +3).

ETFs

To trade a particular subsector in the market, you can choose to invest in ETFs instead of individual stocks. There are over 50 ETFs to trade on ThinkMarkets’ platform. The funds are managed by some of the most important financial institutions, such as Vanguard, BlackRock, and Invesco. Margin rates vary depending on the ETF, and this ranges from 5% to 25%.

Equities

Equities, also known as stocks, allow you to acquire shares as CFD products. ThinkMarkets offers a wide variety of assets from different stock markets all over the world. Zoom, Visa, Amazon, Intel, Tesla, Walmart, and Coca-Cola are just a few of the equities you can trade with ThinkMarkets.

Good to know!

The asset has the same marginal rate as ETFs, which is at 5% to 25%. Market hours would depend on the stock exchange the equity is listed on.

Futures

Futures contracts are also offered ThinkMarkets. These contracts include cocoa, cotton, coffee robusta, platinum, WTI, and BRENT. Trading futures with ThinkMarkets entitles you to a margin of 0.5% up to 3% with a minimum spread of 0.05 to 15 points.

WTI and BRENT have contracts that expire monthly. For the availability of the other futures contracts on ThinkMarkets’ platform, refer to their website.

Trading platforms of Think Markets

With ThinkMarkets, traders can utilize the MT4, MT5, and ThinkTrader platforms. It’s important to note that some assets are not available on other platforms. Double-check if the platform you prefer has the asset you want to trade.

All their platforms are available on Windows and Mac desktops. They also have downloadable mobile applications from the Google Play Store and Apple Store.

(Risk warning: Your capital can be at risk)

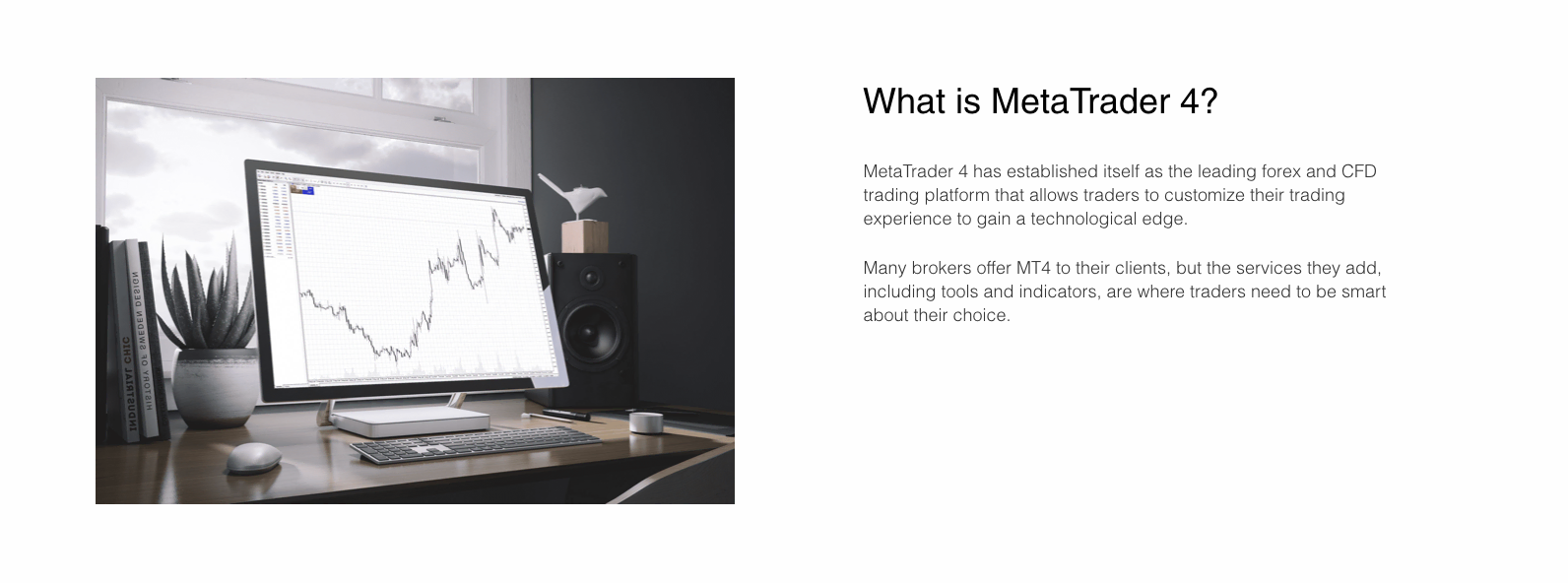

MetaTrader 4

The Meta Trader 4 is the most reliable platform for any trader. Here, you can customize your charts, enter various orders, and even create your own trading bot. You will also receive market updates, and you can access their economic calendar to plan your trades accordingly.

With their integrated Autochartist, you can quickly scan through thousands of assets and choose the product that fits your trading strategy.

MetaTrader 5

This is an upgraded version of the MT4 platform. The Meta Trader 5 has more order types as well as added indicators to help you with your trading. There are more than 20 timeframes that you can use on this platform.

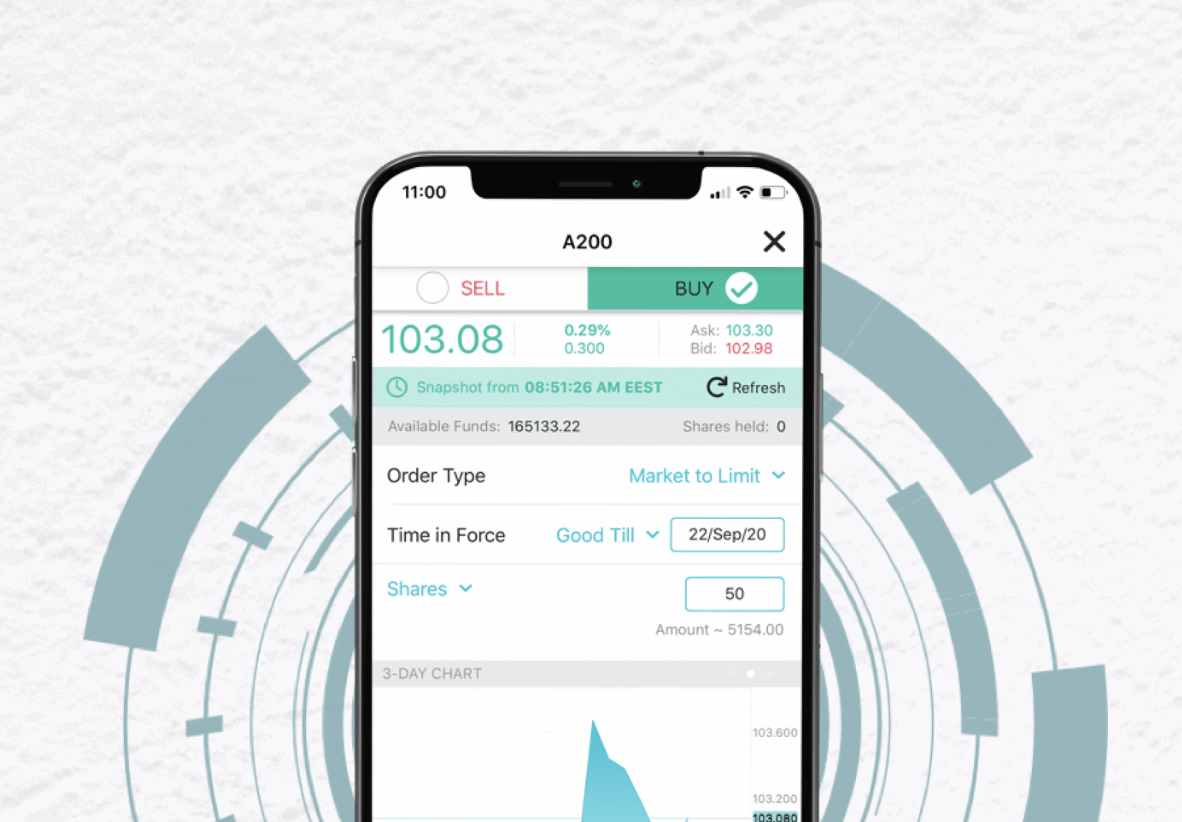

ThinkTrader

Unlike other brokers, ThinkMarkets has its own trading platform. The ThinkTrader platform features a TrendRisk scanner. This helps you find profitable opportunities with minimal risk on multiple timeframes.

Good to know!

This broker is partnered with FX Wire Pro to give clients real-time updates on important economic news. ThinkTrader also makes it easy for clients to add or withdraw funds from their accounts with their mobile applications.

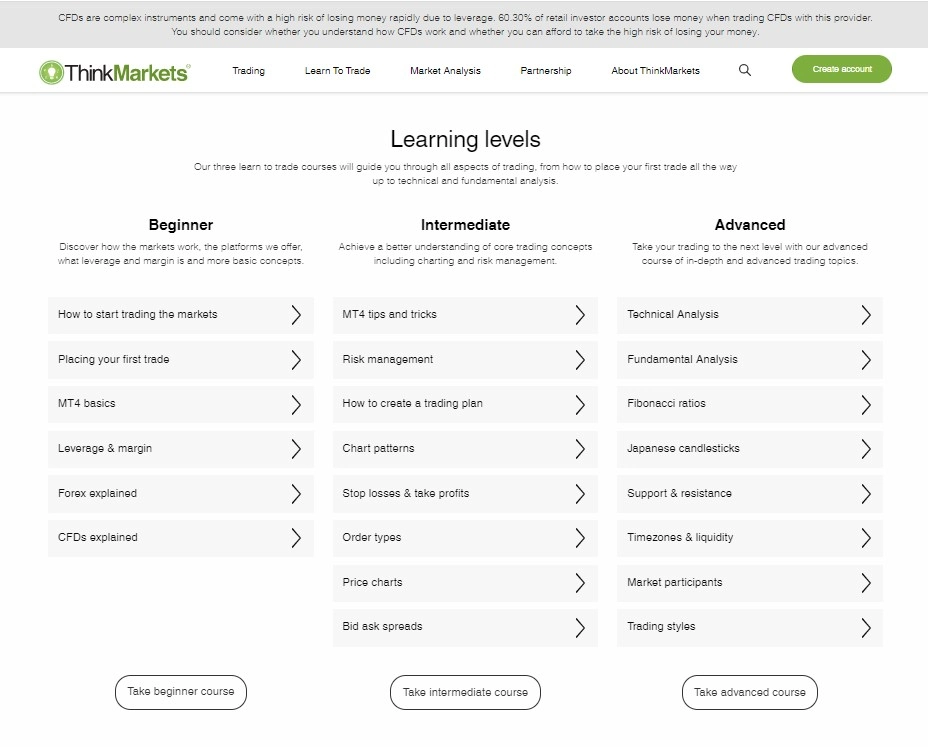

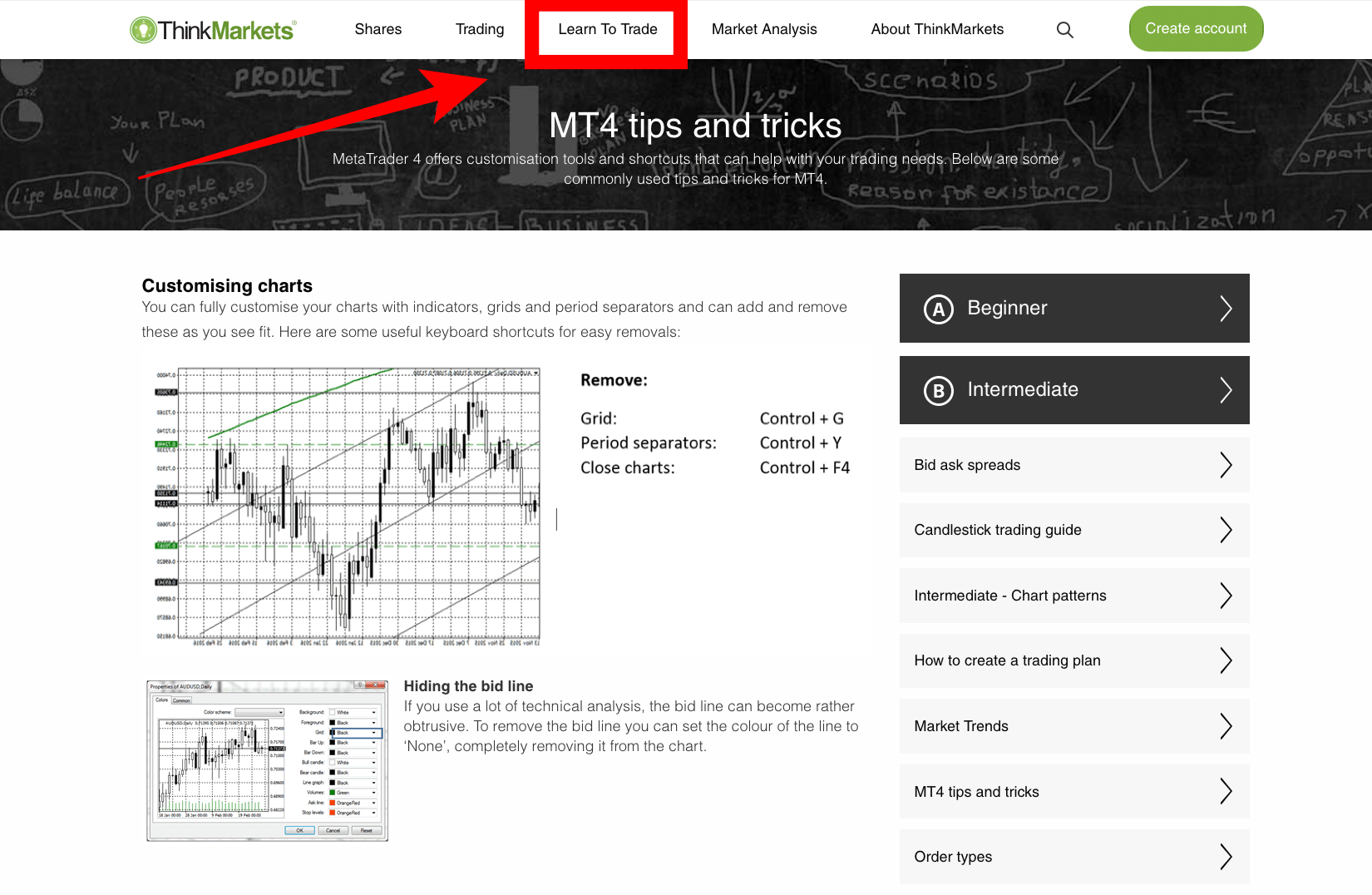

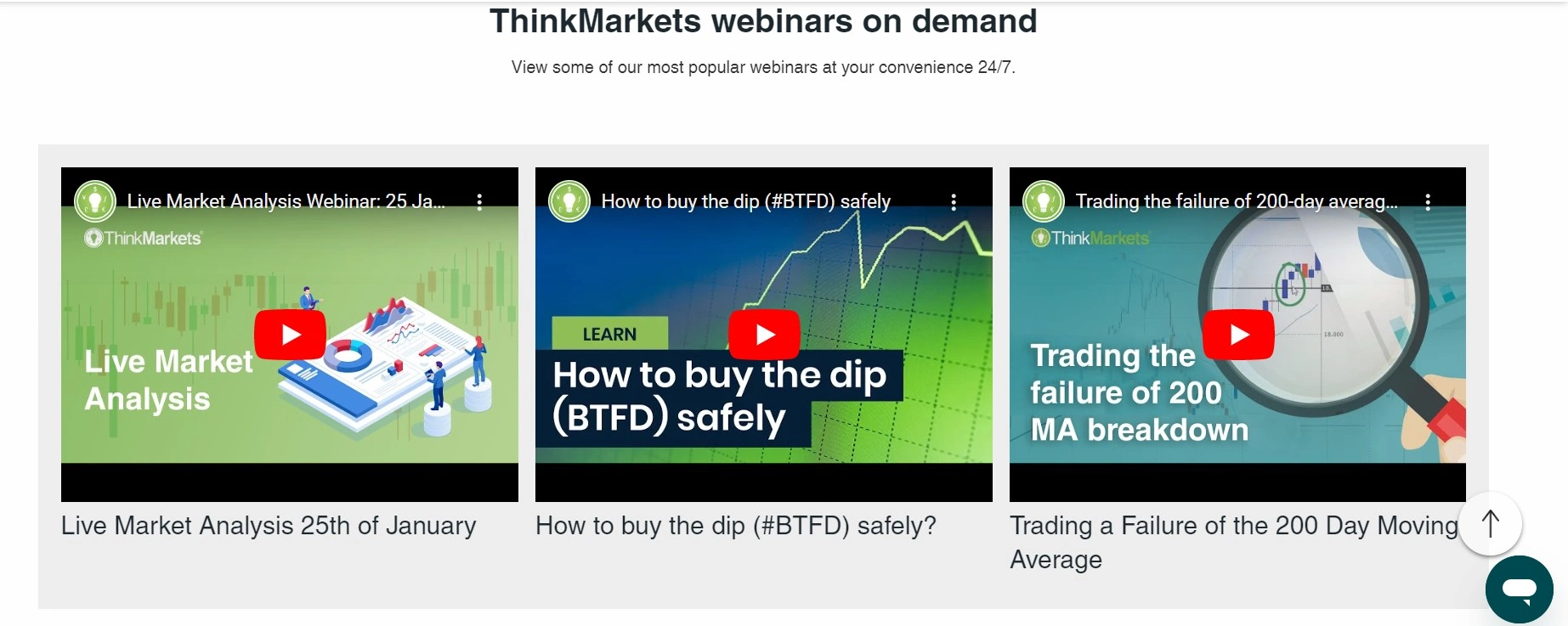

Learn to trade with ThinkMarkets

Traders can learn a lot from ThinkMarkets’ educational materials. They have free and downloadable tutorial guides for beginners, intermediate, and professional traders. You can also access helpful articles that will help you learn more about forex, indicators, and chart patterns. Aside from this, they have a glossary containing all the essential trading terms and their definitions.

Market analysis

ThinkMarkets provides more than a few articles every week. The topics range from forex news to cryptocurrency discussions. They even provide important updates through their Twitter account.

Their website also features an economic calendar to guide you through essential market events. Lastly, they also host live webinars that are held almost weekly. You can register for this on their website. Most of their past webinars can be found on their YouTube channel.

(Risk warning: Your capital can be at risk)

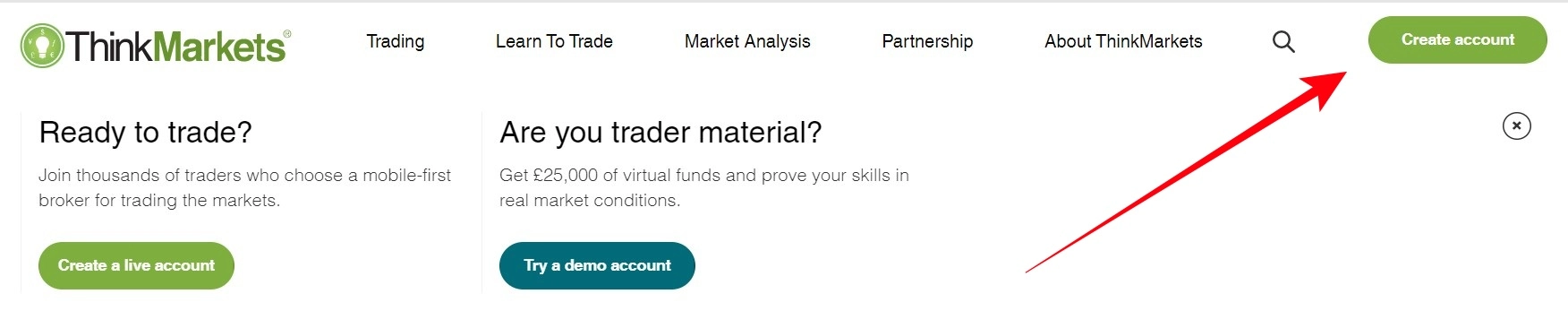

How to open a ThinkMarkets account

Opening a ThinkMarkets account is an easy process. You have two live account types to choose from Standard and ThinkZero. To sign up, you will need to choose whether you want to open an individual or corporate account. Next, fill in the necessary information on the form to complete your application.

Once you’ve finished that, you will need to verify your identity. For individual accounts, you will need to provide a photo ID (passport, driver’s license, or any other government-issued ID is accepted) and proof of residence (phone bill, bank statement, or utility bill). For corporate accounts, you will be asked to provide a valid photo ID, proof of residence of all the shareholders who have 25% of the shares, company information, and the company’s proof of address.

Once the documents you sent have been verified, simply add funds to your account, and you can start trading with ThinkMarkets.

Different types of accounts on ThinkMarkets

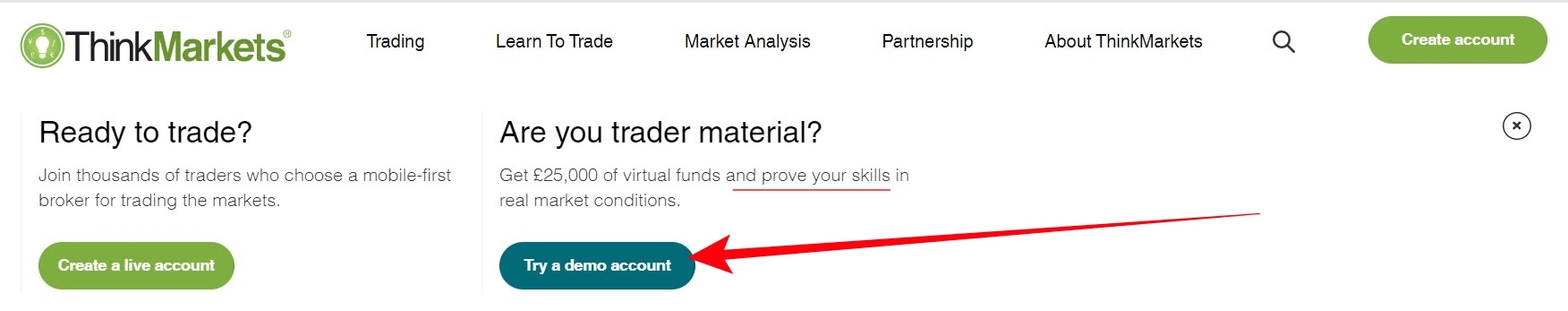

Demo account

New traders are recommended to sign up for a demo account before they jump into a live account. With their free trading demo account, you can start familiarizing yourself with their platforms as well as the tools that can be used. Your demo account will have a virtual balance of $25,000.

To sign up, provide your country of residence, full name, email, and phone number. You can choose to practice on their ThinkTrader platform, MetaTrader 4 platform, or MetaTrader 5 platform. Keep in mind that your demo account will automatically close after 90 days of inactivity.

(Risk warning: Your capital can be at risk)

Standard account

ThinkMarkets’ Standard account is ideal for retail traders with smaller capital. With this account, you will gain access to their free VPS service and all their trading platforms. You will have a maximum trade size of 50 lots and no minimum stop-loss or take-profit levels. No commission fees will be charged for standard account holders.

Good to know!

This account type requires no minimum or maintaining balance.

ThinkZero account

Unlike the Standard Account, the ThinkZero account is recommended for traders with higher capital. Holders of ThinkZero accounts will be able to trade up to 100 lots with a commission of $3.5 per lot. You will also have access to all of MarketTraders’ trading platforms, including an account manager.

To avail of and continue using the ThinkZero account, you will need to deposit a minimum of $500.

Islamic account

This account type is made explicitly for Islamic traders with additional rules to comply with Sharia law. To sign up for this account, you will have to contact ThinkMarkets and submit a formal request. They will guide you through the process of opening an Islamic account.

Negative balance protection

ThinkMarkets features negative balance protection available for all their clients except Pro account holders. This broker has risk management tools that ensure that your account balance will never go below zero. This extra protection feature gives clients peace of mind and is free of charge.

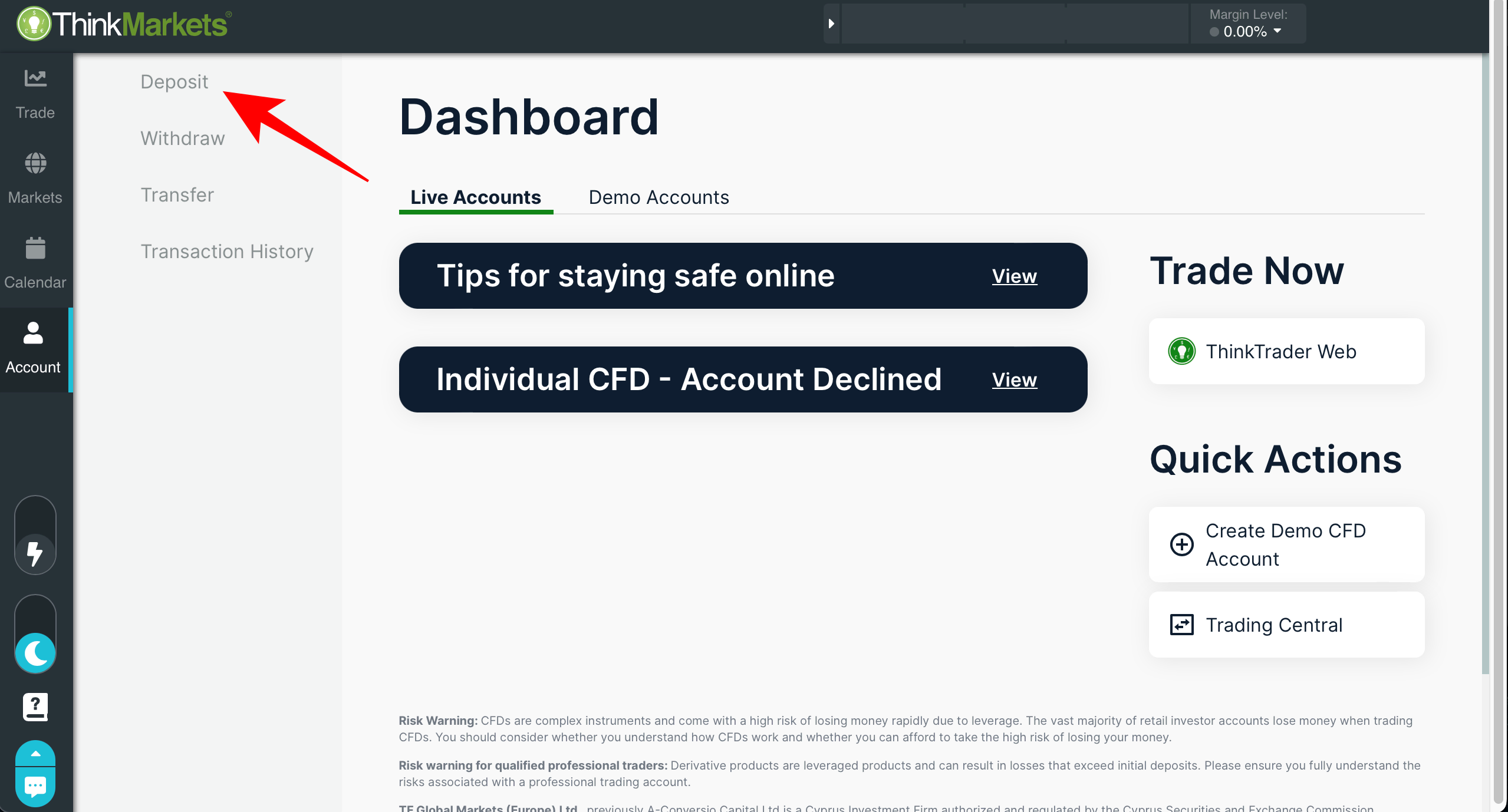

Adding funds to your ThinkMarkets account

Bank Wire

The available currencies for bank wire transfers are USD, GBP, CHF, EUR, and AUD. The amount will reflect in your account after one to three business days.

Visa or MasterCard Credit/Debit card

The currencies available for this method are EUR, AUD, CHF, GBP, and USD. The funds will instantly be credited to your ThinkMarkets account.

Neteller

With Neteller, you can deposit EUR, USD, GBP, JPY, or AUD. Keep in mind that the transaction time can take up to 24 hours.

Skrill

This method allows USD, AUD, CHF, EUR, and GBP currencies. Your funds will be deposited into your account within ten minutes.

BitPay

This is different from all the other deposit methods. Here, you can use cryptocurrencies like Bitcoin, Bitcoin Cash, or Ether to fund your ThinkMarkets account. The amount you deposited will reflect on your ThinkMarkets account within ten minutes.

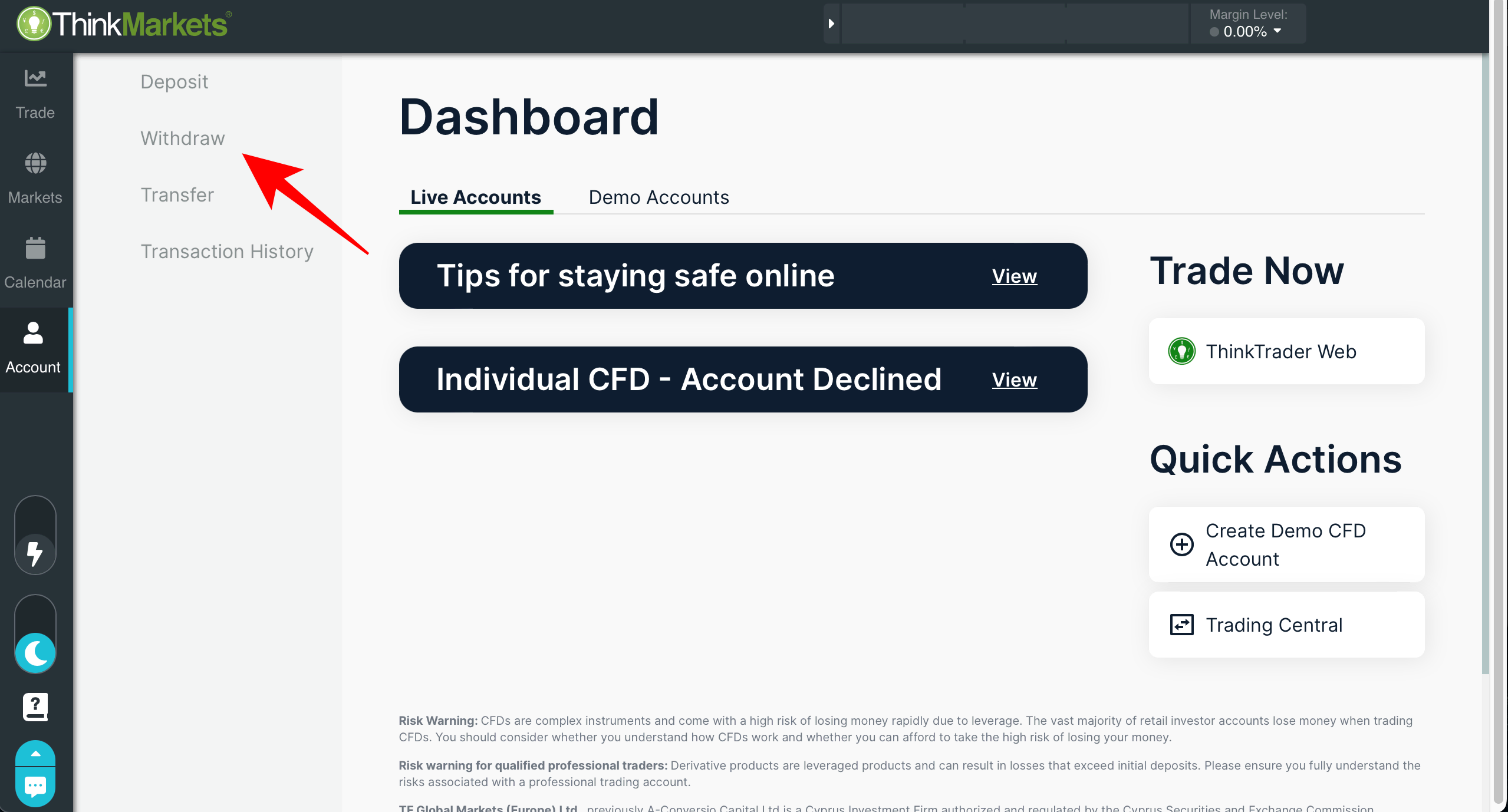

Withdrawing funds from your ThinkMarkets account

It’s important to note that you have to use the same method of funding your account to withdraw your money. You will need to submit a withdrawal request via ThinkMarkets’ ThinkPortal. Your request will be processed within 24 hours, but depending on the withdrawal method, it might take up to seven business days before you receive your funds.

Customer support

Good to know!

You can contact ThinkMarkets’ customer support via email or live chat on their website. These are available 24/7. Their website also supports 12 languages. These are Vietnamese, Spanish, Thai, Italian, Polish, Greek, Indonesian, German, English, Chinese, Czech, and Arabic.

Here is an overview of the support provided by Interactive Brokers:

Supported languages: | More than 12 |

Live-Chat | 24/7 |

Email: | |

Phone support: | Spain – +34-911829975 Italy – +39 023 057 9033 Australia Local – +1300-390-515 Australia – +61-3-9093-3400 UK – +44 203 514 2374 |

You can also stay up to date on important news revolving around ThinkMarkets through their LinkedIn, YouTube, Instagram, Facebook, and Twitter accounts.

Accepted and forbidden countries

ThinkMarkets accepts clients from all over the world. Here is a complete list of all the accepted countries.

Antigua Barbuda | Argentina | Aruba | Australia |

Austria | Bahamas | Bahrain | Bangladesh |

Barbados | Belarus | Belize | Benin |

Bermuda | Bhutan | Bolivia | Brazil |

British Indian Territory | British Virgin Islands | Brunei | Bulgaria |

Burkina Faso | Cambodia | Cameroon | Cayman Island |

Chile | China | Christmas Island | Cocos Island |

Colombia | Comoros | Cook Islands | Costa Rica |

Croatia | Cyprus | Czech Republic | Denmark |

Djibouti | Dominica | Dominican Republic | Ecuador |

Egypt | El Salvador | Equatorial Guinea | Estonia |

Ethiopia | Falkland Islands | Faroe Islands | Fiji |

Finland | France | French Polynesia | Gabon |

Georgia | Germany | Ghana | Gibraltar |

Greece | Greenland | Grenada | Guatemala |

Guernsey | Honduras | Hong Kong | Hungary |

Iceland | India | Indonesia | Ireland |

Isle of Man | Israel | Jamaica | Jersey |

Jordan | Kazhakstan | Kenya | Kiribati |

Korea | Kosovo | Kuwait | Latvia |

Lebanon | Lesotho | Liechtenstein | Lituania |

Luxembourg | Macau | Macedonia | Madagascar |

Malawi | Malaysia | Maldives | Malta |

Marshall Islands | Martinique (Fr.) | Mauritania | Mauritius |

Mayotte | Mexico | Micronesia | Republic of Moldova |

Monaco | Mongolia | Montenegro | Montserrat |

Morocco | Nepal | Netherlands Antilles | New Zealand |

Nigeria | Norfolk Island | Norway | Oman |

Pakistan | Palau | Panama | Papua New Guinea |

Paraguay | Peru | Philippines | Poland |

Portugal | Qatar | Reunion | Romania |

Russian Federation | Rwanda | Saint Barthelemy | Saint Martin |

Saint Pierre & Miquelon | Saint Vincent | Samoa | San Marino |

Sao Rome and Principe | Saudi Arabia | Senegal | Serbia |

Seychelles | Singapore | Slovakia | Slovenia |

Solomon Islands | South Africa | Sri Lanka | St. Helena |

St. Kittis Nevis | St. Lucia | Suriname | Svalbard & Jan Mayen |

Swaziland | Sweden | Switzerland | Taiwan |

Thailand | The Gambia | Timor-Leste | Tonga |

Trinidad and Tobago | Tunisia | Turks and Caicos Island | Tuvalu |

Ukraine | United Arab Emirates | United Kingdom | Uruguay |

Uzbekistan | Vatican City | Venezuela | Vietnam |

Wallis and Futuna | Western Sahara |

(Risk warning: Your capital can be at risk)

Other services offered by ThinkMarkets

Social trading

ThinkMarkets is partnered with ZuluTrade to provide their clients access to social trading. With social trading, clients could copy or share their portfolios with other traders. ZuluTrade lets you set up your copying strategy based on trading hours, risk management, number of trades, and lot size.

You can even filter out the available traders for copying based on their performance, drawdowns, profitability, and ranking. If you are unfamiliar with social trading, ThinkMarkets provides a guide that will help you familiarize yourself with how social trading works.

API trading

As a client of ThinkMarkets, you will be given the opportunity to create your own trading platform or trading bot using their cutting-edge API. This makes trading more convenient and could provide additional income if you sell your trading tool or platform.

Good to know!

If you’re unfamiliar with API trading, fill up the form on their website, and a specialist will be assigned to help you.

Advantages and disadvantages of ThinkMarkets

ThinkMarkets does not offer options trading. This can be a deal-breaker to some traders, especially if they prefer to hedge or trade high-risk with options. Some of their products are lacking as well. You won’t find soft commodities traded as CFDs.

But the products offered are enough for most traders. Their website is straightforward to navigate, and they dedicate their time to producing valuable articles. Choosing an account type is also made simple with ThinkMarkets.

Conclusion – ThinkMarkets is an excellent online multi-asset broker!

Regardless of what type of trader you are, beginner or professional, ThinkMarkets can deliver the best service and provide essential tools to help you succeed in the trading scene.

(Risk warning: Your capital can be at risk)

With Think Markets you get a reliable partner for investing and trading in any financial market.

Trusted Broker Reviews

Experienced and professional traders since 2013FAQ – The most asked questions about ThinkMarkets:

Am I permitted to change the leverage on my account?

Yes, but you will have to email their support department to make the necessary changes. Keep in mind that the maximum leverage is 500:1, and the minimum is 30:1 for forex.

Can I change the leverage setting on my demo account?

Like live accounts, you can change the leverage on your demo account. The exact process of emailing the support department applies.

Will my demo account expire?

Currently, demo accounts do not expire. However, ThinkMarkets has the right to close them.

Can I access my account from a different computer?

Your account isn’t locked to one hardware. So yes, you can access it on a different device as long as you input the correct login details. Make sure that your ISP or firewall is not blocking the connection.

What is ThinkMarkets phone number?

You can contact them via their Australian (+61 3 9093 3400 ) or UK number (+44 203 514 2374).

Is ThinkMarkets safe?

ThinkMarkets is a leading trading platform that the FCA (Financial Conduct Authority) regulates. They are also under regulation by the ASIC. ThinkMarkets also has a sister company that is situated in South Africa, and it operates there under the license of a Financial Service Provider (FSP). The clients of ThinkMarkets can rest peacefully without worrying about their funds because the company has the policy to separate the client funds and company funds from each other, keeping your funds secured. They keep their clients’ funds safely in other banks like the Commonwealth Bank of Australia, National Australia Bank, and Barclays Bank. ThinkMarkets also has an anti-money laundering policy to prevent money from being laundered.

How to deposit funds in your ThinkMarkets account?

To deposit money in your ThinkMarkets account, you need to go to the payment method screen first and then select Poli. After that, you need to select the amount you wish to deposit and choose your bank account from the list of banks that dropdown. Then you need to enter your bank credentials and press confirm. In some time, your funds will be allocated to your ThinkMarkets account.

What are the types of accounts in ThinkMarkets?

There are three types of accounts in ThinkMarkets, a Standard account, a ThinkZero account, and an Islamic account.

Last Updated on February 27, 2023 by Arkady Müller