5 Forex brokers & platforms with low spreads in comparison

Table of Contents

See the list of the best 5 Forex brokers with low spreads:

Broker: | Review: | Spreads from: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | 0.0 pips | IFSC (Belize) | 9000+ (36+ currency pairs) | + Many awards + Huge diversity + Account types + 1:2000 leverage + Attractive bonus program + Low spreads + Low commissions + 9,000+ assets available | Live account from $1(Risk warning: Your capital can be at risk) | |

2. Capital.com  | 0.3 pips | FCA, CySEC, ASIC, SCB, SCA | 3,000+ (70+ currency pairs) | + Competitive spreads + No commissions (*other fees can apply) + High security + Multi-Regulated + 3,000+ markets + Personal support + Education center | Live account from $20 by card(Risk warning: 75% of retail CFD accounts lose money) | |

3. Vantage Markets  | 0.5 pips | CIMA, ASIC | 300+ (40+ currency pairs) | + Fast execution + MT4 & MT5 + Low trading fees + No hidden costs + Free bonus + Multi-regulated | Live account from $200(Risk warning: Your capital can be at risk) | |

4. XTB  | 0.5 pips | More than 10 | 3000+ (48+ currency pairs) | + Spreads from 0.1 pips + Leverage up to 1:500 + No minimum deposit + No hidden fees + Fully regulated | Live account from $1(Risk warning: Your capital can be at risk) | |

5. FBS  | 0.5 pips | CySEC (Cyprus) for EEA countries | 500+ (40+ currency pairs) | + MT4 & MT5 + 24/7 support + Bonus program + Low spreads + Low commissions + 1:3000 leverage + International trading | Live account from $5(Risk warning: 75.59% of retail CFD accounts lose) |

All forex traders would like a forex broker with low forex spreads. It is because forex trading requires capital and well-planned strategies. But the most important is that it requires a broker that understands the needs of forex traders, one of them being low forex spreads.

Forex spreads get charged on the buying and asking prices and can pile up to become high when you are trading volumes. It is crucial to choose a forex broker with low forex spreads.

What are low Forex spreads in forex trading?

Low forex spreads mean that the forex broker with low forex spreads has forex spreads at the market price. The forex spreads are close to the forex spreads that liquidity providers have.

Advantages of low Forex spreads:

1. Low trading costs

The most obvious benefit of a forex broker with low spreads is you spend less on trading costs. Forex spreads displayed may be little, but they are significant when you use leverage or open bigger positions.

At some point, a forex trader uses leverage or takes advantage of market volatility to open large positions. Forex traders must choose a forex broker with low spreads to mitigate the trading costs when they are trading.

2. Assist in planning

Forex traders have to plan before they enter the market. You have to account for the cost of forex spreads when budgeting for the entire trade. It helps when you have a forex broker with low forex spreads since you can factor in the probable losses and profits.

It also helps traders choose a suitable trading strategy for trading. Forex traders make proper decisions on the strategy to use when they have lower trading costs.

The disadvantages of Forex brokers with low spreads:

1. High commissions and other trading fees

Forex brokers generate their income from forex spreads. Forex brokers that offer low forex spreads have to find a way to supplement their income through commissions and other trading fees. Although it is not the case for most forex brokers with low spreads, most charge high commissions.

That is why other than low forex spreads, forex traders have to also check the other trading fees and commissions before choosing a forex broker.

2. Forex scams

The forex industry has attracted many unregulated forex brokers. These forex brokers have the characteristic of luring unknowing forex traders with low forex spreads. If the naive forex broker falls into their trap and invests on their platform, the trader cannot withdraw the profits or deposit.

It is why forex traders must look at the licensing and registration of forex brokers with low forex spreads. It helps to avoid losing money from forex scams.

However, not all forex brokers with low forex spreads are out to steal from you. There are regulated forex brokers that have been in the market for a long time. These forex brokers have a record from forex traders and are reliable.

List of 5 Forex brokers with low spreads in comparison:

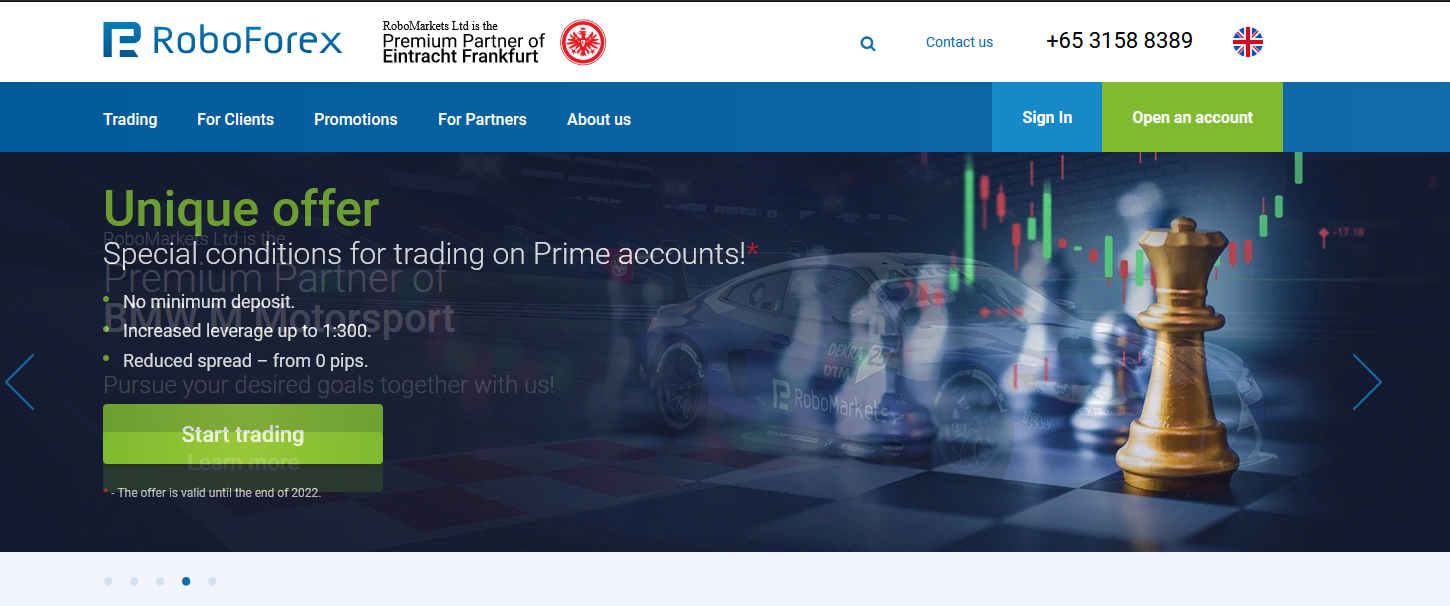

1. RoboForex

It is a forex broker with low forex spreads founded in 2009, which means it has operated in the market for more than a decade. It has more than 3.5 million investors from 170 countries investing in Roboforex.

They offer access to more than 12000 markets such as forex, stocks, indices, ETFs, metals, and commodities. It is regulated in Belize by the International Financial Services Commission (IFSC).

Pros and cons of RoboForex

Pros

- It has quality trading resources and research materials

- Many forex trading platforms

- Fast transactional methods

- Access to a wide variety of trading instruments

- Has low minimum deposits

Cons

- It is not available in many forex trading countries.

(Risk Warning: Your capital can be at risk)

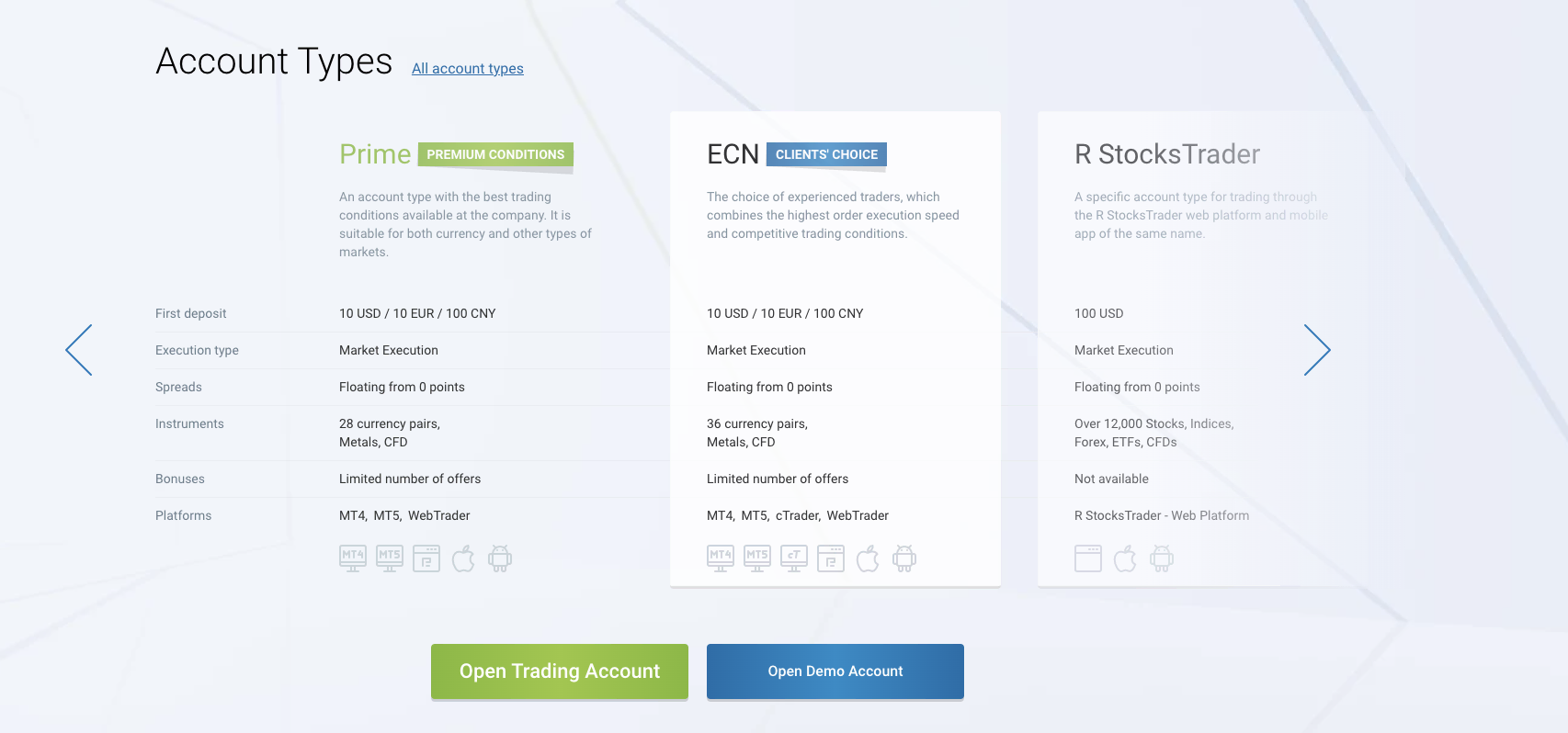

Accounts at Roboforex

Roboforex has five types of trading accounts; Prime account, with a minimum deposit of $10, has a forex leverage of 1:300. ECN accounts that expert traders use to have a minimum deposit of $10 and a forex leverage of 1:500.

The R- stocks Trader has an initial deposit of $100 and a leverage of 1:300. The Pro and the Pro-Cent created for new traders have a minimum deposit of $10 and a forex leverage of 1:2000.

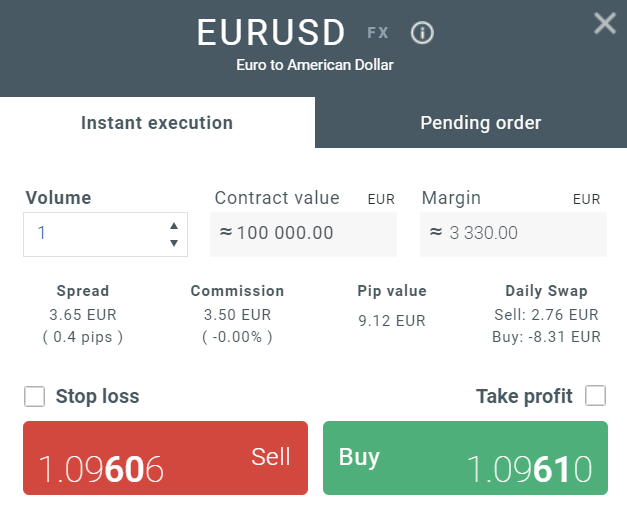

Forex spreads

Roboforex is a forex broker with low forex spreads, which you can see from their average forex spreads on the accounts. The prime and ECN have spread starting from as low as 0.0 pips. The R stocks trader account has forex spreads starting from 0.01 pips.

Pro and Pro- Cent forex spreads start from 1.3 pips, which are competitive forex spreads in the forex industry.

Features of RoboForex

Roboforex has a demo account where traders can access financial markets using the trading platforms that Roboforex offers. It has risk-free trading for practicing strategies before moving to the live account.

It uses the Meta Trader 4 and 5, R stocks trader, and the c Trader trading platforms. The Meta Trader 4 and 5 come with the MQL4 trading robots for algorithmic trading, over 50 technical indicators, and the Expert Advisors feature.

It also has trading signals and insights that help traders in fundamental analysis. Its users can use the social/ copy trading available on all trading platforms. Roboforex has a mobile application, a desktop, and a web-based version that traders can access.

It has educational materials such as beginner-friendly videos since it covers topics on the content needed to start forex trading. Roboforex also has trading analyses of financial markets, the economic center, the economic calendar, and informational blogs.

Their customer support is available through live chat, emails, and phone calls. It supports 11 languages and works 24/7, responds to queries fast, and engages with its clients.

Other trading fees

Roboforex has fixed commissions which depend on the type of account you have opened. The Pro and Pro-Cent accounts have no commission, while the ECN accounts have a fixed commission. It has an inactivity fee of $10 and overnight fees charged according to the position size opened with leverage.

It has no deposit or withdrawal fees, and users transfer funds using bank transfers, credit/ debit cards, and electronic wallets.

(Risk Warning: Your capital can be at risk)

2. Capital.com

It is a forex broker with competitive spreads founded in 2016 and serves over 580,000 clients. Capuital.com provides access to over 3,000 financial markets, such as Indices, cryptocurrencies, commodities, shares, and forex via CFDs.

Regulation

Capital.com has regulations from:

- Financial Conduct Authority in the United Kingdom

- Australian Securities and Exchange Commission

- Cyprus Securities and Exchange Commission

- SCB (Bahamas)

- SCA in the UAE

Pros and cons of Capital.com:

Pros

- Low forex spreads and zero commissions

- Industry-leading forex trading tools and resources.

- Regulation from top tier 1 regulating bodies.

- It has integrated Artificial Intelligence into its platform.

- Low initial deposit to open a trading account.

- Reliable customer care team present 24/7.

Cons

- Limited amount of trading instruments.

(Risk warning: 75% of retail CFD accounts lose money)

Forex spreads

Capital.com is among the forex brokers with low forex spreads, with an average of 0.6 pips in most major financial markets. The spreads change with the volatility of the forex asset and the account you open.

It has no commissions (other fees can apply) on any trades, making it one of the forex brokers that have the lowest trading fees.

Features of Capital.com

It has a demo account that forex traders can use for a long time and has no expiry time like other forex brokers. It is always available for forex traders to practice their strategies before using them in the live trading account.

It integrated the web-based platform with over 75 technical indicators and multiple charts. It also provides negative balance protection and risk management tools such as stop-loss orders. It also has the Meta Trader 4 trading platform with fast execution rates and algorithmic trading.

Traders can get expert advice from the Meta Trader 4 trading platform and access it via the mobile application, desktop, and web platform. Capital.com has research and analysis on its websites, including insights, data presentations, webinars, economic calendars, and Capital.com TV.

It also provides educational materials like webinars, video courses, and articles about different markets. It has an Investment Application, a mobile app with forex courses, and content levels for all traders.

Its customer support allows traders to ask for assistance 24/7 in eight languages. They are responsive within minutes and can get contacted through email, phone calls, and live chat. They are available through several social media like Telegram, WhatsApp, Facebook, and Viber.

Other fees

It only charges additional spreads and an overnight fee that varies according to the size of the trade. Capital.com offers a leverage of 1:30.

Deposits and withdrawals work with bank transfers, credit/debit cards, and electronic wallets.

(Risk warning: 75% of retail CFD accounts lose money)

3. Vantage Markets

It is a forex broker with low forex spreads founded in 2009 and is now operating in over 172 countries and 30 offices. It has over 300 trading instruments that range from Shares, forex, indices, commodities, CFDs, and cryptocurrencies.

Regulation

Vantage markets are regulated by

- Cayman Islands Monetary Authority

- Australian Securities and Investment Commission

- Financial Conduct Authority

Pros and cons of Vantage Markets

Pros

- It is a secure trading platform and has regulation by tier 1 and 3 regulatory institutions

- It has reliable research and technical analysis tools.

- It has an excellent copy-trading tool.

- Low forex-trading fees.

- Accepts several payment methods

Cons

- Has limited trading instruments

Accounts on Vantage Markets

Vantage markets have a Standard STP account for beginner traders with a minimum deposit of $200, and a Raw ECN account is for active traders with an initial deposit of $500. The Pro ECN account for professional traders has an initial deposit of $20,000.

(Risk warning: Your capital can be at risk)

For all these accounts, forex traders can open positions as low as 0.01 lots and access leverage ratios up to 1:500.

Forex spreads

Vantage markets have low forex spreads starting from 1.0 pips for Standard and 0.0 pips for the Raw ECN and Pro ECN accounts. These are low forex spreads day-traders or scalpers can use the Raw ECN and the Pro ECN account.

Features of Vantage Markets

It has a demo account that traders can use for practice trading. It is the first step new traders have to understand how trading works. Vantage markets have the Meta Trader 4 and 5 trading platforms for trading.

Meta trader 4 and 5 offer advanced trading tools such as charts, technical indicators, notifications, and expert advisers. It also gives free VPS access with fast execution when trading CFDs, forex, and other markets.

Traders can access social trading using Zulutrade, MAM, PAAM, and MyFXBook Auto-trade. It can also opt for the auto-trade option available on the mobile app, desktop, and website platforms. It has some articles posted on the website which has fundamental knowledge on trading.

It covers topics such as forex trading, technical analysis, and fundamental analysis. It also has the psychology of trading, which most new traders need to know. Forex traders can get more trading resources from Trading Central, with more than 130 videos.

They have a customer support team present 24/7 to answer any questions. Vantage users reach them through email, live chats, and phone numbers.

Other trading fees

Vantage markets is a forex broker with low spreads and no commission. It also has no account, inactivity, deposit, or withdrawal fees. It also has conversion, and overnight fees for positions opened overnight using leverage.

Forex traders can fund and withdraw from their accounts through bank transfers, credit, and debit cards. They also accept digital wallets such as Neteller, Skrill, Union Pay, and Fasa Pay.

(Risk warning: Your capital can be at risk)

4. XTB

It is a low spreads forex broker founded in 2002 and has given services to forex traders for over twenty years. It has 30 offices and offers 1500 trading instruments. They are like forex, Indices, Stocks, CFDs, ETFs, and commodities.

Regulation

XTB is a secure forex broker with low spreads and has regulators such as

- Financial Conduct Authority in the United Kingdom

- Cyprus Securities and Exchange Commission

- International Financial Services Commission in Belize

- Polish Securities and Exchange Commission

Pros and cons of XTB

Pros

- It has credibility and reliability in the market due to its trading record.

- Low trading costs

- A secure platform regulated in many countries

- Quality trading tools and research materials

- Excellent customer support team

Cons

- Has no Meta Trader 4 and 5 trading platforms

Account types at XTB

XTB has two account types, the Standard account and the Pro account. Standard is for new and regular forex traders and has no minimum deposit required. It also has a leverage of 1:30. XTB users can trade positions as low as 0.01 lots.

(Risk warning: 72% of retail CFD accounts lose money)

The Pro account is only for professional forex traders who meet their criteria of experience and are allowed to open it.

Forex spreads

XTB is among the forex brokers having competitive forex spreads starting from 0.5pips for the standard account. The Pro account has lower forex spreads starting from 0.1 pips, although it has a commission charge of $3.50 per lot.

Features of XTB

XTB has a demo account where traders practice their trading strategies, new forex traders also use it before moving to the live trading account. XTB has its proprietary trading platform X Station 5, also available with the demo account.

It is simple to use with over 2100 financial markets, an advanced trading calculator, and more. It has a portable trading platform, X Station, for mobile trading. Likewise, it has a stock screener, copy trading, technical indicators, and great charting software with fast execution rates.

It has arranged its educational resources such that forex traders can work on the areas they need to improve. It has the basic, intermediate, expert, and premium levels of content. They are available as videos, articles, and live webinars.

XTB also has a trading academy in levels where they get broken down into lessons for traders. It assists traders to improve their trading skills and teach beginner traders from the basic levels to the expert level.

Their customer support is available 24/5 through phone calls, email, live chats, and support in 16 languages.

Other trading fees

It has an inactivity fee of $10 for dormant accounts for up to a year. It has no withdrawal and deposit charges, and traders can use bank transfers and electronic wallets like Skrill and PayPal. Furthermore, it also accepts credit and debit cards.

(Risk warning: 72% of retail CFD accounts lose money)

5. FBS

It is a low-spread forex broker founded in 2009 with customers reaching up to 17 million. It has forex traders from over 150 countries and has access to Forex, precious metals, energies, stocks, indices, and cryptocurrency.

Regulation

FBS has regulations from:

- Australian Securities and Investment Commission

- Cyprus Securities and Exchange Commission

- International Financial Services Commission in Belize

- Financial Sector Conduct Authority of South Africa

Pros and cons of FBS

Pros

- It is a safe platform since it has regulations from major regulatory bodies.

- It has advanced trading tools and resources

- It has a reputable copy trading platform.

- It provides negative balance protection.

- It has high leverage of up to 1:3000.

- It has low trading fees and tight spreads.

Cons

- It has limited trading instruments

Account types at FBS

FBS has six types of accounts that traders can open according to their forex trading abilities. The Cent account has a minimum deposit of $1 and trades with leverage of up to 1:2000. The Micro account has a minimum deposit of $5 and access leverage of up to 1:3000.

Next is the Standard account with a minimum deposit of $100 and a leverage of 1:3000. The ECN account has an initial deposit of $1000 and a leverage of 1:500. Finally, the Zero spread has a minimum deposit of $500 and a leverage of 1:3000.

(Risk Warning: Your capital can be at risk)

Forex spreads

Forex spreads at FBS are very low, the Cent account has forex spreads starting from 0.1 pips, and the Micro starts at 0.5 pips. Standard has forex spreads starting from 0.5 pips, while the Zero spread and the ECN accounts start from 0.0 pips.

Features at FBS

It has a demo account with the Meta Trader 4 and 5 integrated, and traders can use it to test out the FBS Trading Software. Forex traders using FBS have the Meta Trader 4 and 5, which provides a range of trading features.

Traders can access copy trading, Expert advisors, top-of-the-range trading tools, and fast execution rates using the VPS. FBS also has an increased number of technical indicators and time frames when you switch to the Meta Trader 5 trading platform.

Forex traders can get analysis news, informative trading videos, and the economic calendar in the analysis section. There is an option of using the FBS mobile application, the desktop app, and the web-based platform.

The copy trading feature at FBS allows new forex traders to choose experts to learn from through their trading techniques. The first three trades, while copy trading, is risk-free, which means that if you experience a loss, your balance will remain the same.

Traders can get educational materials such as guidebooks, articles, live events, video courses, interactive webinars, and seminars.

Their customer support team is available in 5 different languages, and they can get contacted via email, live chat, phone calls, and their physical offices.

Other fees

The Zero spread account and the ECN accounts have fixed commissions of $20 and $6. It has an overnight fee that varies with the size of the open position using leverage. It has an inactivity fee of $10 for an account dormant for over a year.

It has no deposit and withdrawal fees, and its users can transfer funds through credit and debit cards, wire transfers, crypto wallets, and digital wallets.

(Risk Warning: Your capital can be at risk)

What are forex spreads?

It is the cost that is charged in the buy and sell prices by the forex broker. You get it by calculating the difference between the bid and ask price. It is one of the main ways that forex brokers earn money for giving their services.

The forex spreads can be wide or narrow depending on the market conditions. They widen when there is low liquidity and in the event of a release of major financial news. Financial announcements make the market volatile.

It causes uncertainty and can lead to low volumes of traders. It makes the spreads widen as it is hard to match traders in the market.

The spreads are narrow when there is liquidity on the forex market. The major forex currencies like the USD, the British pound, and the Euro often have narrow forex spreads because their markets are liquid. The minor and the exotic pairs have wider spreads since they are volatile and have low liquidity.

Types of forex spreads

When trading Forex or any other security, you will get brokers that offer two types of spreads.

The fixed spreads- these are spreads that do not change. They are constant, which means that the forex spreads will remain constant despite the market volatility. They are wide or high because the broker wants to fix the risks encountered when trading.

Although fixed spreads are higher, they help traders plan and calculate how much they can make. They offer stability when it comes to trading.

Variable/ floating spread – these spreads change according to the price movement. It reduces when the market is liquid and increases when there is no liquidity. It is cheaper, more so for trading major currencies which experience higher liquidity.

What is a good spread in forex?

A good spread in forex is when forex brokers offer narrow forex spreads for most of their assets. It makes the costs for trading a currency pair manageable for volume traders. If the value of a currency pair is stable and has liquidity, then a good spread should range from 0.0 to 1.0.

Therefore, a good spread is one that a scalper and a trend trader can use. Most forex brokers have variable spreads, but a forex broker with good spreads has the interests of their traders in mind. However, a good forex spread varies depending on the market.

Forex traders should monitor the market prices to know the brokers with the best forex spreads.

How do you calculate Forex spreads?

To get the forex spread of a currency, you have to get the buying price and subtract it from the selling price. A currency pair has a buying and a selling price. It is crucial to know the spreads because they affect the currency price and the lot size.

It is hard to know which Forex broker provides the best spreads. The methods used to get the best Forex spreads through calculating the Forex spreads. Use the major currencies and compare the brokers.

Calculating the forex spreads places you in a position to understand how much profit you can make.

How do you know if a broker offers a low forex spread?

There are factors to check to identify good forex brokers with fair spreads. A low forex spread stands between 0.1 to 0.9 pips. It shows that you can trade the currency pair at a lower cost.

Another tip is that it should have low or no commissions when trading. Commissions are the charges that brokers set for trading in a particular security. Low commissions will ensure that you get higher profits.

Conclusion: RoboForex is the winner with the lowest spreads!

Forex traders should be careful when choosing a forex broker and pay attention to the trading fees. There are forex brokers who have low forex spreads and high trading fees. It is why traders should consider looking at forex trading fees and forex spreads.

They should also look at the features and test them to avoid falling victim to scams. It is crucial to look at the trading features of a trading broker, like speed and other trading tools.

FAQ – The most asked questions about Forex Brokers with low spreads :

What makes the Zero spread account different from the standard account?

The forex broker with low spreads has a standard account and sometimes a Zero spread account. The Standard account has forex spreads in which a forex broker has added some costs between the bid and ask price for facilitating the trade.

The zero spread account has raw spreads, which means the price is the same as from the liquidity providers. The forex broker earns through commission on the Zero spread account.

Can you trade without a Forex broker?

No, a forex broker’s work is to facilitate the transaction between a forex trader and the market. It is a link between a forex trader and a forex broker.

What is the difference between an ECN account and a standard trading account?

The ECN matches and executes orders at market prices, while a standard account depends on the forex brokers to facilitate the trade. ECN account has low forex spreads and commission, while the standard has average or high forex spreads and no commission.

What are a trader’s options for forex brokers with low spreads?

If you are looking for forex brokers with low spreads, there are many options in the broker market. However, you must choose one that offers you the best of all trading services. In addition to low spreads, the following five brokers offer the best trading services to traders. So you can trust them.

Capital.com

Vantage Markets

RoboForex

XTB

FBS

How can a trader sign up for a trading account with forex brokers with low spreads?

You can visit their website if you are looking forward to opening a trading account with forex brokers with low spreads. Some brokers might also offer you a mobile trading application. Then, you can click on the ‘signup’ option and enter your details to get started. Finally, you can trade with the brokers with the lowest spreads.

What are other things to consider besides forex brokers with low spreads while choosing a broker?

A trader needs to consider other things except for forex brokers with low spreads. Things such as whether the forex broker of regulated or not matters a great deal. So, a trader must choose a broker with the best services. The broker’s trading platform should be full of features ideal for trading forex. Besides, it should offer plenty of underlying assets to traders.

Which forex broker offers the best spreads?

RoboForex is one of the forex brokers with the best spreads. They have access to over 200+ forex markets, and being a multi-asset trader; one can access here 100+ currency pairs. One also gets to trade on shares, indices, commodities, and other trading assets.

What is the best spread available in Forex?

The best spreads are the ones that are as close to 0 as possible. These usually have an average of below 1 pip. One best example of a good spread will be 0.5 pips for the currency pair.

It is quite important to base the calculations on the average price data over an extended period.

Last Updated on July 25, 2024 by Andre Witzel

(5 / 5)

(5 / 5)