3 best offshore Forex Brokers & platforms for traders in comparison

Table of Contents

See the list of the 3 best offshore Forex Brokers:

Broker: | Review: | Offshore broker: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Thunder Forex  | Yes | FSA (Seychelles) | 200+ (64+ currency pairs) | + Raw spreads + MT4-support + Multi-regulated + Low min. deposit + Low commissions + Excellent support | Live account from $100(Risk warning: Your capital can be at risk) | |

2. RoboForex  | Yes | IFSC (Belize) | 9000+ (36+ currency pairs) | + Many awards + Huge diversity + Many account types + 1:2000 Leverage + Bonus program + Low spreads + Low commissions + 9,000+ assets | Live account from $10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | Yes | CIMA, ASIC | 300+ (40+ currency pairs) | + Fast execution + MT4 & MT5 + Low trading fees + No hidden costs + Free bonus + Multi-regulated | Live account from $200(Risk warning: Your capital can be at risk) |

Forex trading has grown in recent years as more people are looking for ways to invest in financial markets. Technology has also propelled its growth as people share more ways to trade and offer lessons on how to make money trading.

This has led to an increase in the volume of traders and the volume traded in forex. More forex brokers have come up and also fraudulent schemes causing countries to set up strict regulations to limit forex operations.

Countries in the EU and US have strict laws that limit trading activities and forex brokers. These regulations have caused forex brokers from these regions to opt for alternative offshore trading with less stringent rules.

What is offshore trading?

Offshore trading is when forex traders within countries from level A to C go to forex brokers from outside their regulatory jurisdictions. Onshore forex brokers are mostly from regulatory institutions within the countries in the EU and the US.

The forex regulatory bodies from levels A to C are from countries within the US and the UK. Some of them include;

- Financial Conduct Authority

- Commodities Futures Trading Commission

- National Features Association

- Australian Securities and Investment Commissions

- Cyprus Securities and Exchange Commission

Onshore regulatory bodies usually have strict guidelines that limit forex brokers from offering certain trading instruments such as CFDs and cryptocurrency. New policies are enforced that have more stringent laws.

Some of the laws limit using a high leverage rate when trading, while others have high requirements to get a license in the US and the EU. They also need a high capital of up to $20million to get a license in the US.

These are some factors that have led to a lower number of forex brokers in these regions. Forex traders who want to trade some restricted instruments in these regions look for offshore forex brokers with less stringent rules.

Which are the best offshore regulators?

The best offshore regulators are from institutions termed as levels D and E when it comes to categories of regulatory bodies. These regulatory institutions have less stern rules and low requirements to acquire a forex broker trading license.

Some of them include:

- Vanuatu Financial Services Commission

- Financial Services Authority in Seychelles

- Financial Services Regulatory Commission in St Christopher and Nevis

- International Financial Services Commission

- BVI Financial Services Commission

The forex brokers within these regions offer more trading instruments and higher leverage. They have easy account opening procedures and low initial deposits. They require less documentation to open a trading account and have low taxes on the income made through forex trading.

It is fairly easy to get a trading license from these regulatory institutions since they have lower charges, often less than $200,000. It is the reason they are known as offshore forex brokers and have clients from many regions globally.

Advantages of offshore trading:

1. Less trading restrictions

Traders can access a wide variety of trading instruments including CFDs, ETFs, indices, and cryptocurrencies. In The US, they have restrictions on trading CFDs and some cryptocurrencies which is available on offshore forex brokers.

2. High leverage

The EU and the US have restrictions on the highest leverage that traders can get. ESMA is a regulatory body of forex brokers operating in the EU. It has restrictions of up to 1:30 leverage, while in the US traders cannot access more than 1:50.

Offshore forex brokers offer access to up to 1:3000 which is an attractive offer for forex traders who like to trade high volumes with leverage.

3. Low taxes

Forex brokers within level A to C jurisdictions have KYC registration procedures for collecting enough personal information about their traders. This information is not only used for protection against money laundering but also useful for collecting taxes.

Forex traders have to pay taxes when they reach a certain volume as the regulatory bodies state. Volume traders usually have to pay higher taxes which is not the case for offshore forex brokers. Their taxes are low and some do not charge any taxes on profits made.

Disadvantages of offshore trading:

1. Forex scams

Most offshore forex brokers do not have proper stringent guidelines that they follow. It means that the forex traders who register accounts on these offshore forex brokers are susceptible to forex scams. Other forex brokers are not regulated and could steal from investors.

They could also use fraudulent methods to steal from investors, such as:

- Manipulating spreads-through wide forex spreads or stop loss hunting

- Hidden costs – some forex brokers have unclear trading costs, and forex traders pay for them.

- Fraudulent schemes-they are forex brokers promising to make forex traders millionaires and attract investors. They later realize they are unable to withdraw their investments.

2. Few choices of payment methods

Most banks do not accept transfer funds to forex brokers that are unregulated within a country. It causes a problem for forex traders who want to deposit and start trading. They have a few options when transacting with offshore forex brokers.

For forex traders who opt to use other payment methods, the transaction costs are high, leading to low profits.

Factors to consider when choosing an offshore Forex broker:

1. Credibility

There are offshore forex brokers that have gained the trust of forex brokers and provide quality services. These are forex brokers regulated by some top offshore forex regulatory institutions. Most of them have served traders for a long time and are reliable.

Traders can find these forex brokers by using forex traders’ forums and trustworthy reviews from expert forex traders. Many forex forums share trading information online, where forex traders get any information they need from other traders.

2. Regulation

It is also imperative that you check for regulations before funding a trading account on Offshore forex brokers. It helps to know if the forex broker has a license from the offshore top forex regulatory institutions.

3. Trading costs

It is crucial to know the trading costs of an offshore forex broker, like forex spreads and commissions, including rollover fees.

If the leverage rates are what you prefer, transfer fees or deposits/ withdrawal charges. The base currency forex brokers use and the conversion fees. Trading costs play a crucial role and can affect the profits you want to make.

One way to check the trading costs of a forex broker is using the demo account, which gives an idea of the estimated prices. The Micro accounts are also helpful when checking the legitimacy of an offshore forex broker so you can test without risking too much capital.

4. Trading platforms and resources

It is a crucial component of a forex broker, trading tools such as the charting software, technical indicators, and execution speed. The offshore forex broker supports automated trading, research tools, and educational content for new traders to learn about financial markets.

5. Financial markets

Forex traders prefer to trade various financial instruments such as energies, stocks, foreign currency, commodities, and CFDs. Traders who prefer an asset such as CFDs need to check if the offshore forex broker offers CFDs for trading.

6. Customer support

Customer support helps traders to sort out any problems they face when trading. Traders seeking to register accounts with offshore forex brokers check if the customer care is responsive and offers relevant help. A sign of a scam forex broker is unresponsive customer care.

List of the 3 best offshore Forex brokers for traders in comparison:

1. Thunder Forex

Thunder Forex is an offshore forex broker based in Seychelles that provides forex trading services for thousand of forex traders. It offers a wide variety of over 250+ trading instruments such as forex, indices commodities, shares, and treasuries.

Regulation

- Financial Services Authorities in Seychelles

Security

It has a separate account for holding client funds from Thunder Forex funds. Client information and transactions are confidential unless granted request from the client. It has an external auditor who ensures the services they provide are industrial standards.

Account types

Thunder forex offers one type of trading account that forex traders can access. It has a minimum deposit of 500 Euros and forex spreads from 0.1 pips. It also charges a commission of 3 to 3.5 euros per lot, which is 6 to 7 euros per round turn. Traders can open trading positions from as low as 0.01 micro-lots with no restrictions to the trading strategies. It has a stop-out level of 50% with access to over 64 foreign currencies.

(Risk Warning: Your capital can be at risk)

Trading costs

It offers maximum forex leverage of 1:400 from 1:100 and has rollover fees for open accounts overnight using forex leverage. It has an inactivity fee of $30 charged quarterly when a trading account remains dormant for more than three months or 0.25%of the account balance.

Deposits and withdrawals are free when you use bank transfers but have a fee for electronic wallets such as Skrill. The rates are 3.5% for deposits and 1% for countries outside the European Economic Area, while credit cards are free.

Features of Thunder Forex

- It has a free demo account that traders can test the platform features.

- It has integrated the MT4 trading platform that many forex traders use when trading.

- Forex traders can apply any forex strategy they prefer, such as scalping and hedging.

- Traders can access trading tools such as one-click trading, multiple charts with nine timeframes, fast order processing rates, 50+ technical indicators, and drawing tools.

- It also has Automated trading using Expert Advisors strategy builders and the MQL4 programming language for creating a trading robot.

- It also has a swap-free/ Islamic account that offers trading financial assets without the rollover fees.

- Traders can access their trading accounts on this website via mobile phones with the mobile app, desktop, and website versions for laptops and desktop computers.

- Their customer support team is there 24/5 in English, German and Arabic through email and phone calls.

Pros

- Negative balance protection

- Fast order execution speeds

- Quality trading tools

- Fast account opening process

- Low trading costs

- High leverage

- Transparent costs

Cons

- No educational materials

- Limited research materials

- Customer support is only available 24/5

(Risk Warning: Your capital can be at risk)

2. RoboForex

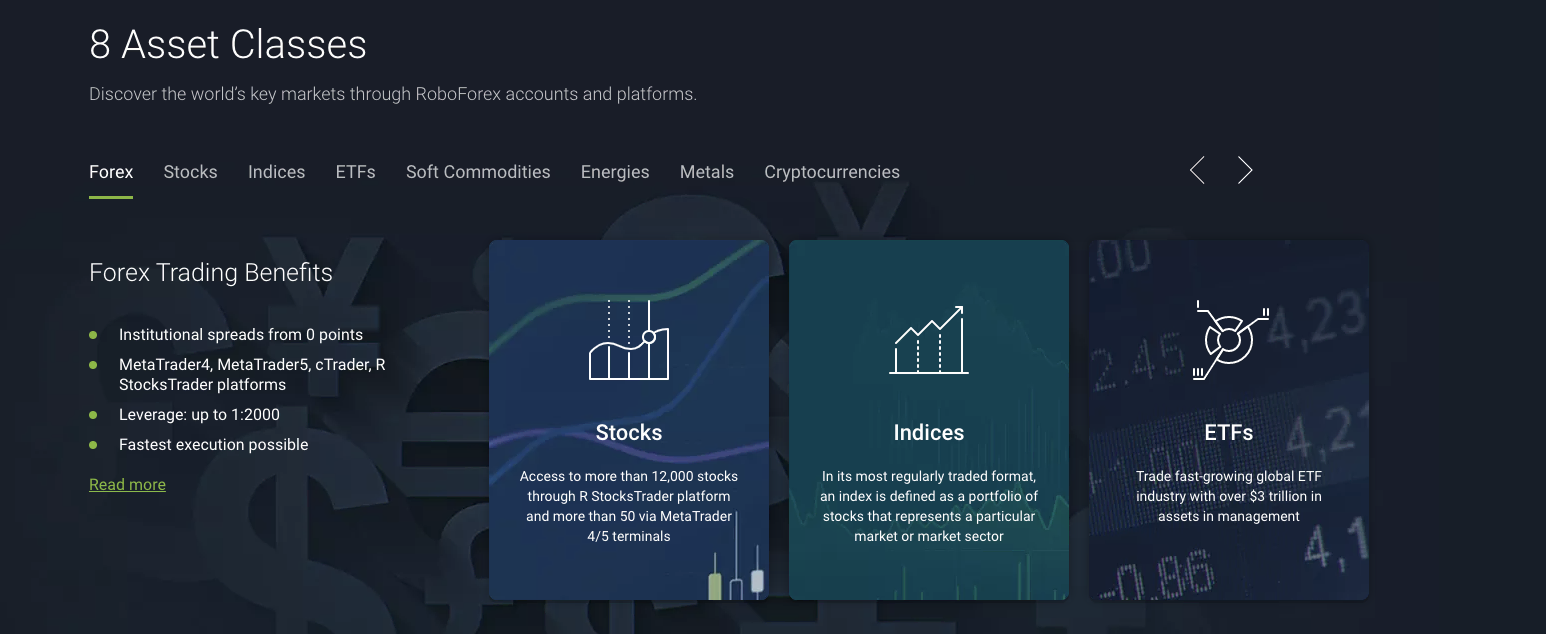

It is a forex broker that has offered forex brokerage services for over a decade to over three million forex traders since its launch in 2009. Forex traders have access to more than 12000 financial markets ranging from stocks, forex, indices, cryptocurrencies, energies, metals, and ETFs.

Regulation

- International Financial Service Commission in Belize

Security

It complies with regulations from the IFSC in Belize and has insurance against factors that can lead to losses of finances. RoboForex traders also get two-step identification processes when logging in such that the trading accounts are secure.

Accounts at RoboForex:

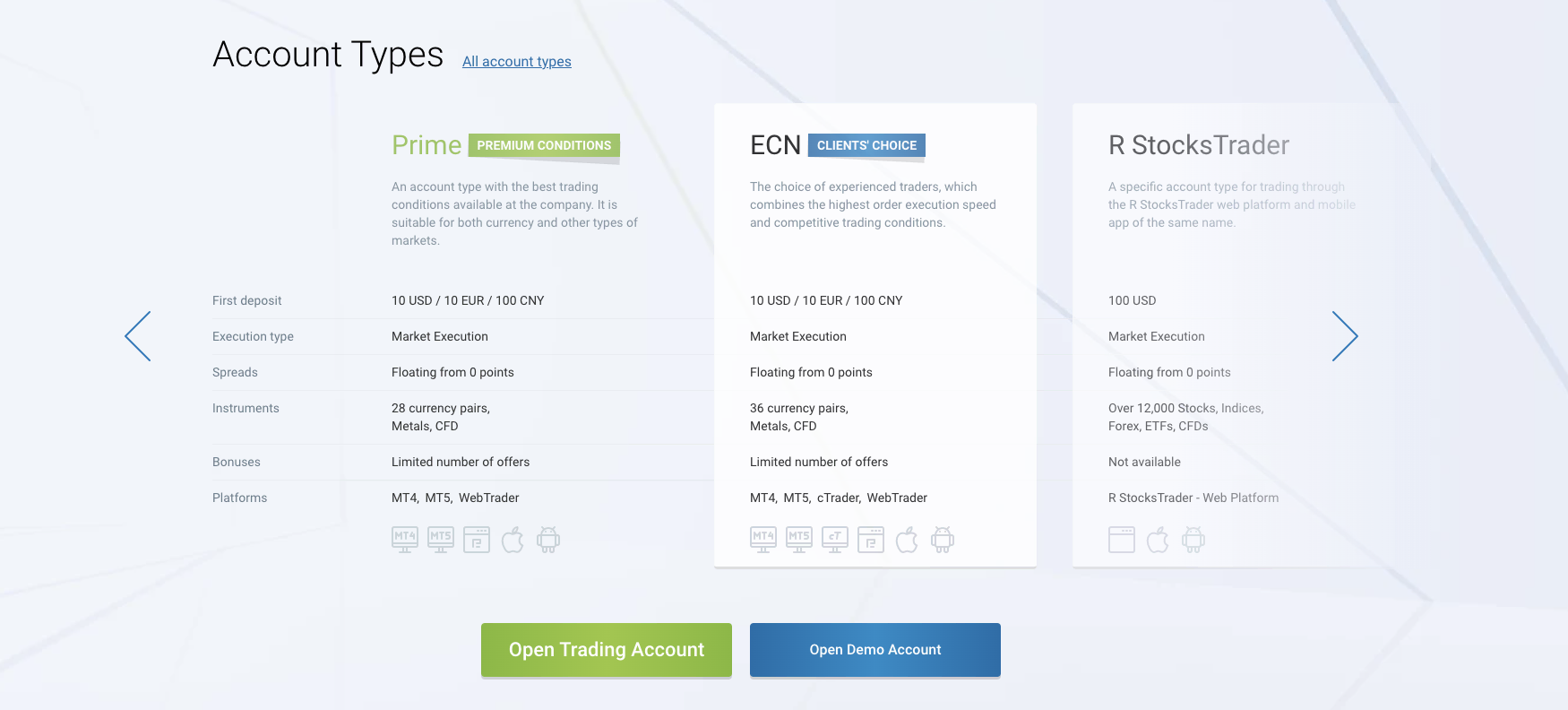

Roboforex has five types of trading accounts;

The Pro Cent for new traders has a minimum deposit of $10. It has forex spreads from as low as 1.3 pips with no commissions. Traders can open positions from 0.1 lots with the maximum open order limit at 500. Stop outs are at 10%, with access to over 36 forex pairs.

The Prime account has an initial deposit of $10 and over 28 forex pairs. Its forex spreads start at 0.0 pips, and commissions depend on the asset traded. Clients open positions from as low as 0.01 lots, with the highest number of open positions at 500.

The ECN account has an initial deposit of $10 with forex spreads from 0.0 pips and commissions depending on the type of trading instrument. Clients can open positions from as low as 0.01 lots, with access to 36 forex pairs and maximum open positions at 1000.

R stocks trader account has a minimum deposit of $100 and offers stocks and CFDs trading. Its spreads are as low as 0.01USD, and commissions depend on the stock or CFD.

The Pro account has forex spreads from 1.3 pips, a minimum deposit of $10 with no commissions, and offers access to 36 currency pairs. Its clients can open positions from as low as 0.0 lots with maximum open positions of 1000.

(Risk Warning: Your capital can be at risk)

Fees

It has an inactivity fee of $10 for accounts dormant for over a year. Open positions using leverage overnight have rollover fees charged depending on the number of nights, and the forex leverage and deposits/withdrawals are free.

It has high leverage of 1:2000 for Pro and Pro Cent accounts. Prime and R stocks trader accounts have a forex leverage of 1:300, and the ECN account has a forex leverage of 1:300. It supports bank wire and credit/ debit cards. It also accepts digital wallets like Skrill, PayPal, Pay Safe, and others.

Features of RoboForex:

- It has a free demo account forex traders can test the Roboforex trading platform.

- It has incorporated four trading platforms the R stocks trader, MT5, MT4, and the cTrader.

- R stocks trader is its proprietary trading platform for trading stocks and CFDs. It offers fast execution speeds of up to 0.01 seconds.

- The MT5 offers four types of executions, click trading, hedging and scalping options, depth of market prices, advanced charts with 21-time frames, and 80+ technical indicators.

- The MT4 offers fast execution speeds, 50+ technical indicators, numerous charts with 9-time frames, and three order execution types.

- cTrader also offers competitive trading tools such as 54+ technical indicators, level two pricing, different market executions, risk management strategies, and charts with over 14-time frames.

- Traders with an account balance of more than $300 can apply to use the virtual private server that Roboforex offers.

- It has a free copy trading platform, Copy FX, where traders share various strategies and copy from expert traders.

- An Islamic account that complies with Sharia laws and has no rollover costs.

- Roboforex research tools are available in the free analytics center, and also have trading analysis and ideas through informative articles and the economic calendar.

- Traders can access free educational content such as guides for different financial markets, video courses, and articles covering basic to advanced trading knowledge.

- Customer support is available 24/7 to assist traders with any issues they face. They can get contacted through live chat, emails, and telephone calls.

Pros

- Fast execution of orders

- A fast account registration process

- Fast withdrawals and deposits

- Negative balance protection

- Low initial deposits

- Low trading costs

- Variety of trading accounts

Cons

- High stock CFDs fees

(Risk Warning: Your capital can be at risk)

3. Vantage Markets

Vantage Markets is a forex broker serving 500,000 forex traders since its inception in 2009. It has access to trading instruments such as forex, CFDs, commodities, shares, and metals.

Regulation

- Australian Securities and Investments Commission

- Cayman Islands Monetary Authority

- Vanuatu Financial Services Commission

Security

It has regulations from tier two and two other regulatory institutions. Regulations ensure client funds are safe through segregated accounts for client funds that separate the fund’s Vantage markets uses for its operations.

Account types at Vantage Markets

It offers three types of trading accounts:

Standard STP account that new forex traders can begin with after the demo account has an initial deposit of $200. It offers access to 44 currency pairs, and traders can open positions from 0.01 lots. It also has forex spreads from 1.0 pips and no commissions.

Raw ECN account is for advanced forex traders and has low forex spreads from 0.0 pips and a commission of $6 per round turn. Its minimum deposit is $500, access to 44 currency pairs, and traders can open positions from as low as 0.01 lots.

Pro ECN account is for volume traders and professional traders. It has an initial deposit of $20,000 and forex spreads from 0.0 pips with commissions of $4 per round turn. Traders can open positions from as low as 0.01 pips with access to 44 forex pairs.

(Risk warning: Your capital can be at risk)

Trading costs

It has no inactivity or account maintenance fees with open trades overnight using leverage attracting rollover fees. IT also has leverage ratios of 1:500, and withdrawals/ deposits are free.

It supports various payment platforms such as credit/debit cards, bank transfers, and digital wallets like Neteller, Skrill, and other methods.

Features of Vantage Markets

- It has an unlimited demo account for practicing trading.

- It has incorporated MT4, MT5 trading platforms for accessing the financial markets.

- MT4 offers one-click trading charting software with nine-time frames, three order types, and scalping and hedging options.

- MT5 offers four order types, market depth, scalping and hedging, advanced charts with 21-time frames, and 80+ technical indicators.

- Traders can access automated trading with the help of MQL4/MQL5 and expert advisors to build a trading robot.

- It also has copy/ social trading platform Autotrade which has over 90,000 members copying and trading strategies.

- It has a swap-free/ Islamic account with similar trading conditions as other trading accounts except for the rollover fees not charged.

- Forex traders using Vantage markets can access their trading accounts via the mobile platform, desktop, and website version.

- Research tools on vantage markets are available through the analysis and news from experts present as blogs, videos, news, and articles. It also has an advanced news scanner from Trading Central.

- Educational content includes basic to advanced level content with topics about trading strategies and fundamental knowledge.

- Their customer service is available 24/7 to solve any issues via email, live chat, and phone calls.

Pros

- Fast execution speeds

- Fast withdrawals and deposits

- Low trading costs

- Quality trading tools

- A fast account registration process

- Customer support is available 24/7

Cons

- Limited trading instruments

- High initial deposit for the Pro ECN account.

(Risk warning: Your capital can be at risk)

Conclusion – Make sure to choose a reliable forex broker

Forex traders should pay extra attention when they decide to trade with an offshore forex broker. It is because some offshore forex brokers can be forex scams. Traders have to check with other forex traders to get reliable forex brokers.

Some traders have good reviews about their experience with offshore forex brokers. It is imperative to stay cautious and avoid losing funds, even with positive reviews from a forex broker.

FAQ – The most asked questions about Offshore Forex brokers:

Why do traders venture offshore Forex trading?

They get attracted to highly leveraged offers and fewer restrictions on risky markets like CFDs.

Are offshore Forex brokers regulated?

Yes, reliable offshore forex brokers often get regulated within their country. Some offshore forex brokers have multiple regulations from various regulatory institutions.

Can a beginner register a trading account with an offshore Forex broker?

Yes, offshore forex brokers have educational resources that new traders can learn about forex trading. Novice traders can start with the micro and mini accounts before going to more advanced trading accounts.

Is it legal to utilize an offshore broker?

It is acceptable to open a brokerage account overseas. However, you wouldn’t have much control if something happened to your assets. You should be aware that using unregulated brokers gives you no legal protections. This is why you must select a reliable company.

Are offshore brokers secure?

Yes, as long as you pick a reliable broker with a solid reputation, opening an offshore account is safe. Although there have been examples of fraud documented, offshore brokers are generally not fundamentally unsafe. Researching your broker in-depth will help you identify any potential concerns.

Why pick an offshore forex broker?

Since offshore brokers are exempt from regulations, they can provide a wider range of tradeable financial instruments. For instance, contracts-for-difference (CFDs) are common everywhere but are prohibited in the United States.

What characteristics should an offshore forex broker have?

A broker’s public image can be ruined in an instant, despite the fact that it takes years to establish. There is a thin line between a reputable and unscrupulous broker, even if it is difficult to locate a well-known broker who has never received a complaint. Referrals can be of great assistance.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)