4 best Forex Brokers & platforms with no commission in comparison

Table of Contents

See the list of the best 4 Forex brokers with no commission:

Broker: | Review: | Commission: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | 0 | IFSC | 9000+ (36+ currency pairs) | + Many awards + Huge diversity + Many account types + 1:2000 Leverage + Bonus program + Low spreads + Low commissions + 9,000+ assets | Live account from $10(Risk warning: Your capital can be at risk) | |

2. Capital.com  | 0 (*other fees can apply) | FCA, CySEC, ASIC, SCB, SCA | 3,000+ (70+ currency pairs) | + Competitive spreads + No commissions (*other fees can apply) + High security + Multi-Regulated + 3,000+ markets + Personal support + Education center | Live account from $20 by card(Risk warning: 75% of retail CFD accounts lose money) | |

3. Vantage Markets  | 0 | CIMA, ASIC | 300+ (40+ currency pairs) | + Fast execution + MT4 & MT5 + Low trading fees + No hidden costs + Free bonus + Multi-regulated | Live account from $200(Risk warning: Your capital can be at risk) | |

4. Pepperstone  | 0 | FCA, ASIC, CySEC, BaFin, DFSA, SCB, CMA | 180+ (60+ currency pairs) | + Authorized broker + Multi-regulated + 24/5 support + Low spreads + Leverage up to 1:500 | Live account from $200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

Forex brokers have different ways they earn from offering services to forex traders. The known method is through using forex spreads and commissions. The forex spreads are costs charged within the buy and sell prices.

Brokers also earn their income through conversion fees, rollover fees, inactivity fees, and many other ways. Forex commissions usually get charged when forex brokers facilitate forex trades. Trading accounts with commissions are the raw spread accounts that use ECN or DMA.

Most of the time, these trading accounts have low to no forex spreads, which means that the primary mode of income for forex brokers is through forex spreads.

What is a commission in forex?

A commission is a fixed fee that forex brokers charge when facilitating trades for forex traders. Forex brokers match buy and sell orders for forex traders in the forex market. When forex brokers offer very tight spreads, they charge commissions.

Forex brokers can charge fixed or variable commissions. Fixed commissions are constant for trades placed. Variable commissions depend on the volume of the trade, and more volume attracts more commissions.

How do you trade forex without commission?

There are trading accounts that have low to zero commissions. One method to trade without paying commissions is through a zero commissions forex broker. Look for forex brokers that have competitive forex spreads and no commissions.

Ensure that the forex broker is regulated and safe to trust with your funds. Forex brokers offer low forex spreads and no commissions that lure naive forex traders. Most forex scams have this promise, and traders lose their investments.

List of the 4 best forex brokers with no commission:

1. RoboForex

It is a forex broker launched in 2009 and has grown for the last decade to offer its services to three million users globally. It offers trading instruments such as stocks, ETFs, energies, commodities, metals, and forex.

Regulation

The International Financial Service Commission in Belize

Account types at Roboforex

Roboforex offers five trading accounts, starting with the Pro Cent and the Pro accounts that most new traders use. They have a minimum deposit of $10 and forex leverage as high as 1:2000. The prime account for advanced traders has a minimum deposit of $10, and its users access high forex leverage of 1:300.

The ECN account for experienced volume traders has a minimum deposit of $10 and high leverage of 1:500. Finally, the R stocks trader account is for forex traders that prefer stock trading. it has a higher minimum deposit of $100 and a leverage of 1:300.

(Risk Warning: Your capital can be at risk)

Forex spreads

RoboForex has low trading costs, indicated by their forex spreads. The Prime and ECN accounts have forex spreads starting at 0.0 pips, while the R stocks trader is from 0.1 pips. The Pro and Pro-Cent accounts have forex spreads from 1.3 pips.

A $10 inactivity fee for accounts inactive for more than a year and an overnight fee for open trades through the night using leverage. Its rate depends on the size of the open positions.

Its deposits and withdrawals are free, and traders can use bank transfers, credit/debit cards, and electronic wallets such as Skrill, Neteller, Union pay, Pay pal and others.

Commissions

Roboforex is a forex broker offering Pro and Pro Cent accounts that are commission-free. Other trading accounts have low fixed commissions due to the raw spreads offered from ECN and shares. Most forex traders who use the Pro and Pro Cent accounts don’t pay commissions.

Features of Roboforex

- It has a demo account compatible with all trading accounts for testing various features offered by the trading accounts.

- It has four types of trading platforms, MT4, MT5, R stocks trader, and the cTrader, offering various trading tools.

- The MT4 has more than 50 inbuilt technical indicators, numerous charts, three types of order execution, drawing tools, 9-time frames, Expert Advisor, and many more tools.

- MT5 trading tools include four order executions, increased technical indicators and drawing tools than MT4, market depth quotes, hedging and netting options, etc.

- C trader is not behind with 54 technical indicators, multiple charts with 14 timeframes, level two pricing, customized trading robots, and more.

- The R stocks trader is a trading platform for trading stocks. It has market depth quotes, automated trading tools, and a wide range of trading instruments.

- It offers a Virtual Private Server for traders who register a trading account and have account balances of more than $300.

- It also has a swap-free or Muslim account meant for overnight trading without rollover fees.

- The Copy FX platform is a copy trading platform for traders to share trading methods and strategies.

- It offers research tools for traders through the free analytics center; it contains views and ideas from trading experts.

- Traders can apply filters to get information about various markets on the analytics center, research tools, and the economic calendar.

- Roboforex has beginner-friendly educational resources. It consists of trading knowledge from basic to advanced levels through videos.

- Customer support is available 24/7 in 11 languages through live chat, emails, and phone calls.

Pros

- Low initial deposit

- Fast withdrawals and deposits

- Quality trading and research materials

- Zero commissions

- Swap-free accounts

- MT4 and MT5 are available

- Negative balance protection

Cons

- It is unavailable in many countries

(Risk Warning: Your capital can be at risk)

2. Capital.com

It is a forex broker launched in 2016, and it serves over a million forex traders. It offers access to indices, stocks, leverage forex markets to forex traders, and commodities via CFDs.

Regulation

It is a secure trading platform with regulations from:

- Cyprus Securities Exchange Commission (CySEC)

- Financial Conduct Authority in the United Kingdom

- AISC (Australia

- SCB (The Bahmas)

- SCA (in the UAE)

Trading account features:

- One live account for all traders with minimal deposit of $20 by credit card

- Free demo account with virtual money

Forex spreads

Trading fees for capital.com are low. On average forex, the spread is 0.6 pips (starting from 0.0 pips). It has no deposit, withdrawal and it has an overnight fee for positions open overnight using leverage which depends on the size of the trading position.

Users in Capital.com can deposit and withdraw using bank transfers, credit and debit cards, and electronic wallets such as Pay Pal, Sofort, Web money, and Trustly.

(Risk warning: 75% of retail CFD accounts lose money)

Commissions

Capital.com is known as a no-commission forex broker (*other fees can apply). Most of the income it makes is from the forex spreads. It has no commission charges on stocks and other trading instruments it offers across the three trading accounts offered.

Features of Capital.com

- Demo account for Forex traders to trade virtual money worth $1,000 and access 3,000 trading instruments.

- It has 3 trading platforms, a web platform, TradingView and Meta Trader 4 trading platforms offering various trading tools.

- MT4 offers various features, including 30+ technical indicators, multi-charging, Expert advisors, 9-time frames, and one-click access.

- Traders can access automated trading using Expert Advisor and MQL4 programming to customize the trading robot.

- Automated trading is available 24/7. Traders can use long-term trading strategies that can last more than a day.

- It offers trading signals from leading industry experts offering analysis, insights, informative blogs, and videos.

- Traders can also get financial market news fast using capital.com TV, a comprehensive economic calendar useful when conducting fundamental analysis.

- The web platform offers CFDs and advanced trading tools such as drawing tools, 75+ technical indicators, multiple charts, and risk management strategies.

- It has a vast library of educational materials, starting with its news, analysis, and explainers section, which has numerous blogs about various financial markets.

- Investors can get the latest information affecting different markets and how the financial market might react to them.

- Learning materials range from guides covering the trading instruments offered, the basics of forex trading, how to apply trading tools, and trading psychology.

- An educational app, Investmate is available on the app store and offers live webinars and online courses.

- The customer care team is available 24/7 to answer any queries and assist traders. They support 13 languages, and clients can contact them via emails, live chat, and phone calls.

Pros

- Low trading fees and zero commissions

- Advanced trading tools

- It accepts many payment methods

- Fast registration process

- Low initial deposit

Cons

- MT5 is unsupported

(Risk warning: 75% of retail CFD accounts lose money)

3. Vantage Markets

Vantage markets is a forex broker launched in 2009 and has grown to serve more than 500,000 forex traders. It offers an array of trading instruments ranging from metals, forex, CFDs, indices, shares, and commodities.

Regulation

- Australian Securities and Investments Commission

- Cayman Islands Monetary Authority

- Vanuatu Financial Services Commission

Account types

Vantage Markets offers three types of trading accounts, a Standard STP account, which most new traders begin with, and a minimum deposit of $200. The Raw ECN for expert or experienced traders has a minimum deposit of $500.

The Pro ECN account for volume traders has a minimum deposit of $20,000. Traders using any of these accounts can open trading positions from 0.01 lots and access leverage of up to 1:500.

(Risk warning: Your capital can be at risk)

Fees

Vantage Markets offers competitive forex spreads for their traders. The Standard STP account has forex spreads from 1.4 pips, while the Pro ECN and Raw ECN start with 0.0 pips.

It has no inactivity or conversion fees deposits and withdrawals are free. It has overnight fees charged when you open a position overnight using forex leverage. The overnight fees depend on the type of asset and the size of the position.

It accepts various payment methods like transfers, credit/ debit cards, and digital wallets like Neteller, Skrill.

Commissions

Most of the traders on vantage FX open the Standard STP account since it has lower trading costs and a lower initial deposit. It has tight forex spreads and is a commission-free account which means that no commissions get charged on any trades.

Features of Vantage Markets

- Vantage markets have a free virtual account for practice trading or testing out the platform.

- Vantage markets have integrated the MT4 and MT5 trading platforms for accessing the financial markets.

- They are available on mobiles, desktops, and the website, allowing vantage market clients to access their trades.

- MT4 and MT5 allow traders to hedge positions and practice scalping trading strategies due to their fast execution speeds.

- It offers various trading tools such as 80+ technical indicators, graphical drawing tools, and numerous time frames on charts.

- Vantage markets have trading bonuses and promotions, such as the 50% welcome bonus for new investors.

- Its clients can get research tools and trading signals from its research experts, who publish this data through news, articles, and weekly blogs.

- It also offers Trading Central, which has an advanced filter system. It scans the markets for relevant news or information about an asset.

- Its educational materials are available on its platform through detailed articles covering basic details on forex trading, trading strategies, and psychology.

- Their customer service is available 24/7 to solve any issues traders face. They can get contacted through email, live chat section, or phone calls.

Pros of Vantage Markets

- Low trading fees

- Zero commissions

- Fast order processing speeds

- MT4 and MT5 are available

- Fast account registration

- Fast withdrawals and deposits

- Customer support is available 24/7

Cons

- Limited trading instruments

- Limited educational resources

(Risk warning: Your capital can be at risk)

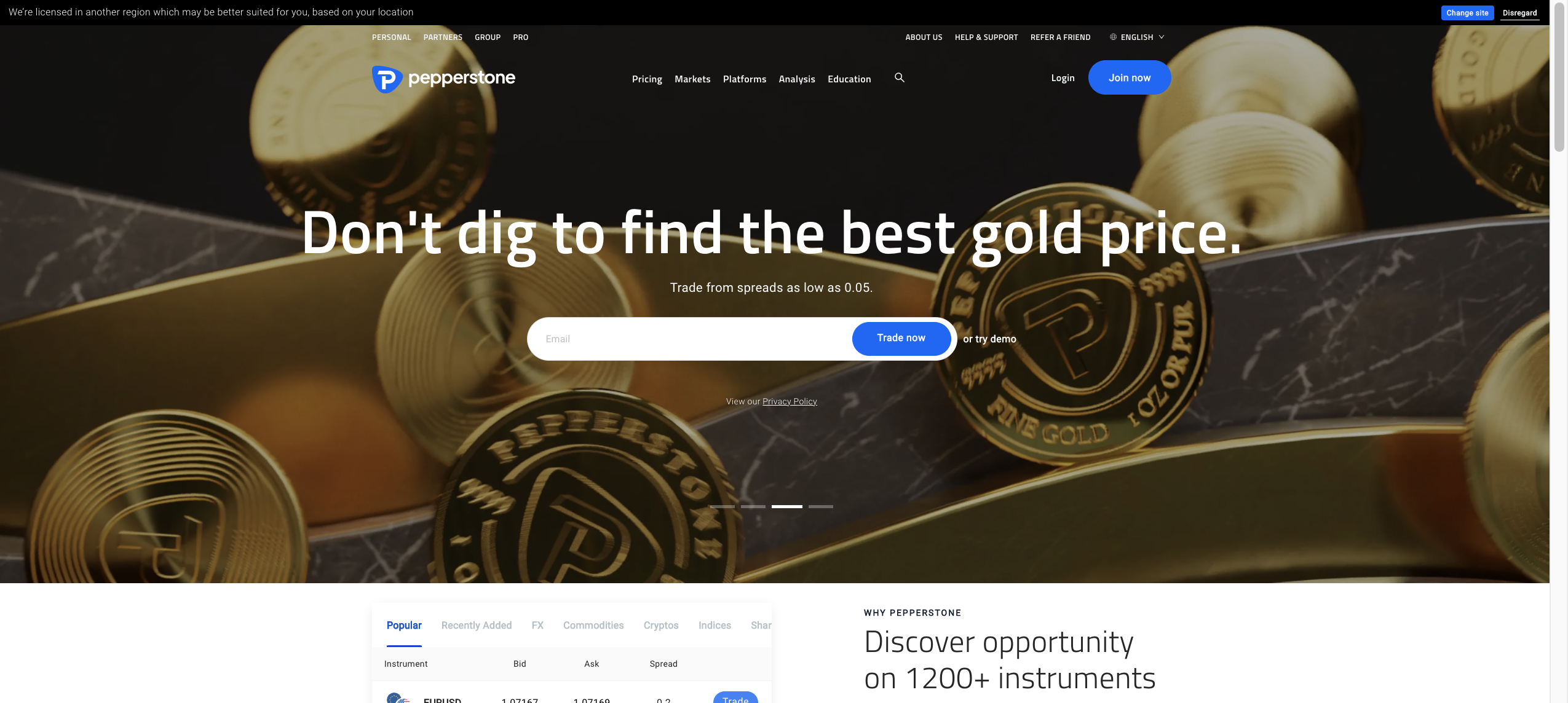

4. Pepperstone

It started its operations in 2010, and over the past 10+ years, it has grown to serve more than 300,000. It has access to over 2000 trading instruments such as forex, commodities, shares, ETFs, and indices.

Regulation

- Australian Securities and Investment Commission

- Financial Conduct Authority

Types of trading accounts

Pepperstone has two types of trading accounts, Razor and standard. The Standard account, which most forex traders start from and has an initial deposit of $200. Razor’s account has tight forex spreads and an initial deposit of $200.

They have forex leverage of 1:400, and fees defer on these trading accounts.

Trading fees

The standard account has forex spreads from 1.0-1.3 pips. The Razor account has tight forex spreads from 0.0 to 1.3 pips; It has no inactivity, account maintenance, or hidden fees.

Overnight fees or rollover rates depend on the size of the account, the number of nights the position was open, and the forex leverage. Deposits and withdrawals are free. It accepts bank transfers, credit/debit cards, and digital wallets like Skrill, Pay Pal, and Neteller.

Commissions

Pepperstone offers commission-free trades on its Standard account, which is a trading account that most forex traders have. It also has competitive trading fees suitable for new traders transitioning from the demo to the live trading account.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Features

- It has a limited virtual account with $50,000 in virtual funds.

- It has integrated MT5, MT4, and cTrader trading platforms such that traders can identify which they want to use.

- They offer various trading tools such as technical indicators, drawing tools, multiple charting tools, Expert Trader, and a one-click option.

- Automated trading on MT4/MT5 with help from the MQL4/MQL5 tools for customizing the trading robot.

- Fast order processing speeds through the numerous types of order executions offered.

- In-depth market quotes and risk management tools such as stop loss and take profits.

- The Pepperstone app is available in app stores, and there is also a desktop and a website version.

- Traders can access analysis done by expert financial analysts, the economic calendar on the website platforms, and market analysis.

- Educational content is also available through articles, video courses, and webinars on their trading platforms.

- Customer support is available 24/5 through live chat, emails, and phone calls.

Pros

- Low forex spreads

- Zero commissions

- Quality research materials

- Fast order execution speed

- Fast deposits and withdrawals

Cons

- Limited educational resources

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Conclusion – There are a few brokers that allow trading without a commission

Forex traders look for some quality factors when choosing a forex broker. One of them is low trading fees, which consist of forex spreads and commissions. Forex brokers usually charge no commissions, but they charge forex spreads.

The best forex brokers offer zero commissions and tight spreads on the trades. Forex traders should consider these factors because they contribute to how much you will spend. Zero-commission forex brokers are one-way traders can use to cut down trading costs.

FAQs – The most asked questions about Forex Brokers with no commission :

Is there a forex broker with no commissions and zero forex spreads?

No, it is unlikely that you will find a forex broker offering zero commissions or spreads. Forex brokers have to make their income in one way. Such offers are often qualities of forex scams.

How do forex brokers with no commission forex brokers earn?

They earn through the forex spreads, it is a small cost between the buy and sells price. Forex brokers with zero commissions usually have average spreads. When compiled from many forex or volume traders, it makes a quantitative income for forex brokers.

How do I calculate forex trading costs?

When we consider calculating the exact cost of trading forex, certain expenses must be taken into account. Some of them are the spreads, turn-around commissions, and overnight and rollover fees. There are also ample scopes for you to lower your trading costs. This can be done by trading liquid currency pairs; a few examples of such are EUR/USD. You can easily jot them down on a piece of paper and place them anywhere near your trading terminal. Whenever you are thinking of choosing a broker, or selecting a particular account, have a quick glance at the formula to remind yourself of the trading conditions.

How much money do I need to start trading forex?

If you are new to trading and are bothered as to how much you need to invest to start trading forex, then you need to know that trading forex can be easily initiated even with low capital; there is no requirement for humongous investment. Even with a minimum investment of 5$, you can start trading. But according to most brokers, it is advised that you should initiate trading with a minimum deposit of $100 (1,500 ZAR), or even more than that can also be invested. The rest is totally up to you as to how much you intend to invest.

Last Updated on July 25, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.8 / 5)

(4.8 / 5)