What is online trading with leverage?

Table of Contents

How does trading with leverage work? – On this page, you are exactly right about this topic. Leverage is offered on almost all assets for private traders. This makes it all the more important to find out exactly what leverage is. Trading with leverage can have advantages and disadvantages. On this page, you will be shown which leverage you should use and how to handle the risk correctly.

Definition: What is leverage?

A lever multiplies the amount used (margin) on the financial markets. Leverage is usually used when trading in derivatives. It is based on any market on which various trading contracts are issued. Trading with leverage works for stocks, currencies (Forex), cryptocurrencies, commodities, and many other markets.

In this case, the broker lends you money to trade. The margin is multiplied and you trade a larger contract size. This is possible due to the skill of the broker. He borrows the money from other banks or uses equity to lend it to traders. This allows them to trade larger contract sizes. Through an interest rate difference, the online broker makes additional profit every day.

Average leverage for CFDs and Forex:

Currency Pairs: | Indices: | Stocks: | Cryptocurrencies: |

|---|---|---|---|

1:500 | 1:200 | 1:50 | 1:100 |

Note:

Through new regulations, European retail traders have to trade with a maximum leverage of 1:30.

If you want to trade with higher leverage as a European trader, you have to choose a broker outside the EU and with no European regulatory authority. In our experience, however, maximum leverage of 1:30 is sufficient for speculation in the financial market

How to calculate the leverage by yourself

In our opinion, it is not always necessary to calculate leverage before trading. With an online broker, you can normally see which leverage is offered. In the following calculation, you will learn how you can easily determine the margin and the leverage:

Leverage example:

- Account size 10.000€

- Leverage in Forex 1:30

- We want to risk 1% of my account per trade (100€) with Stop Loss

- Trade is executed with SL 1.15000 (Buy)

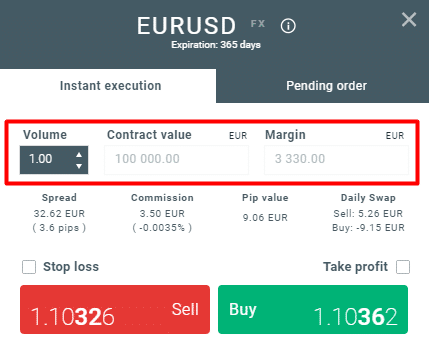

- Contract size of 1.00 is used for this purpose.

- 1 lot corresponds to a 100.000€ contract size

- 100.000€ : 30 = 3333.33€

- A security deposit of 3333.33€ is required.

Here you can see that trading is always at your own risk. The leverage increases the maximum position size (depending on the account balance).

A trader should consciously use the stop loss to control his risk. It is an automatic limit that is executed at a certain price in the event of a loss.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 67% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Which lever should be used?

Many beginners ask themselves: “Which lever can we use for trading?” When trading with leverage, the amount used (margin) is multiplied. The higher the leverage, the higher the tradable position size.

Here, it always depends on the trading style of the trader. Long-term investors, for example, do not need high leverage. Short-term traders, on the other hand, who only trade small movements with high positions, need high leverage. There the position size must be higher.

In summary, the leverage should fit your trading style. Ultimately, however, the trader still determines his own risk per position size. The lever can’t change that much. The lever does not change the risk or dangerousness in trading. It is up to the trader himself.

Conclusion:

- For long-term investments, high leverage is not needed

- For short-term trades, high leverage can be used

Obligation to make additional payments – Can debts be incurred?

In fact, it is possible to incur debt through a leveraged position with an online broker. This has happened in the past due to extreme market situations. Due to a lack of liquidity, the positions could not be closed or executed.

The new regulation, however, now imposes a restriction. A margin call obligation is no longer possible and has been banned for forex and CFDs on most online brokers (Negative Balance Protection). In addition, there are new safety precautions from the providers so that such a scenario is no longer possible.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

Advantages and disadvantages of trading leverage

Trading leveraged products with low-cost providers

By using a lever, the trading fees are also automatically higher. Therefore, you should definitely choose a low-priced provider. Calculated on the year the saving of trade fees is extremely worthwhile and the saving can be even several thousand dollars.

In the following table, you will find our top 3 providers for trading derivatives. RoboForex offers the best total package and allows a leverage of 1:400.

Facts about good online brokers:

- Regulated and secure providers

- Low fees when trading with leverage

- Comprehensive service for international customers

- Fast execution of trades

The trading leverage explains – All facts to risk

- The broker lends money to the trader via the trading leverage. This allows you to move more capital into the financial markets. The position is multiplied by the leverage.

- Due to the leverage effect, fees can occur. These fees are called financing fees (swap). The position is financed, so to speak. A fee is only charged overnight. If you hold a position with a lever for several days, this fee may be charged several times.

- In forex trading, for example, the fees due to the leverage effect can also be positive. It depends on the interest rates of the currencies being traded.

- Leverage can have advantages and disadvantages. However, many traders overestimate the leverage effect and take too much risk.

Conclusion: The advantages of online trading with leverage predominate

Trading with leverage has massive advantages for independent traders. The multiplier allows you to generate higher returns even with a small amount of capital. For some markets, you need a multiplier or massive amounts of money to make a profit. For example, these markets move only a few cents per day (Forex). For example, if you invested €10, it could take years for you to earn a 10% return.

A lever is a tool that can help the trader to make more profit. However, one should use it with caution, because it can increase the risk. The higher the leverage, the higher the contract size can be.

The leverage help traders increase their profit. You can take more risks because of it.

Trusted Broker Reviews

Experienced traders since 2013Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 67% of retail CFD accounts lose money)

FAQs- The most asked questions about Trading with leverage:

What is Net Asset Value?

A trader’s NAV indicates the current value of their trading account, including their unrealized profits or losses. Typically, a trader’s NAV keeps changing throughout the day since several trades are open. An account’s available funds are equal to the part of the NAV that isn’t in use as a margin requirement to keep positions open. These available funds can be used to trade with leverage.

Are overnight fees charged when a trader doesn’t use borrowed funds?

Let’s say a trader has $300 in their account and opens a trade worth $100 with a leverage of 1:10. So, the trader has used $10 to open this position and is technically not borrowing money. Some brokers may charge an overnight fee on this leveraged trade, while others will only charge the fee when the trader exceeds their trading capital for opening positions. For this reason, it’s important to double-check the fine print when choosing a broker.

How to avoid a margin call?

Keeping tabs on your open positions is the best way to avoid a margin call because you will see it coming. It’s important to avoid leveraging your entire account balance. A stop loss will protect you from sudden margin calls when the price movement becomes erratic.

See other articles about online trading:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)