The 3 best TradingView demo accounts in comparison + tutorial

Table of Contents

If you are a technology lover, you cannot stay away from creative carting tools for trading, which is why Tradingview is becoming popular. With its variety of charting and trading tools, it is becoming a go-to trading platform for novice and advanced traders. You can access many charting and trading tools in TradingView for free if you sign up for their free membership plan.

Besides, if you think practically, you only need a paid trading account once you have some trading experience. Moreover, it is a useless idea to buy a plan without even trying the demo account. You never know what the reality of the platform is.

If you have got some experience in trading and have used binance, you must have been familiar with the TradingView’s tools available on the exchange and found them intimidating. This is where the need for a demo account lies. If you try demo accounts of tradingview, you will get an idea and review of the tools and can trade seamlessly in TradingView.

See the list of the three best TradingView demo accounts here:

Tradingview Broker: | Review: | Regulation: | Demo account: | Advantages: | Free account: |

|---|---|---|---|---|---|

1. BlackBull Markets  | Regulated by the FSPR, FSCL | $ 10,000+ Free & unlimited | # 24-hour support # No hidden fees # Free demo account # 100+ different markets # Excellent liquidity | TradingView demo account: (Risk warning: Your capital can be at risk) | |

2. Vantage Markets | Regulated by the CIMA & ASIC | $ 10,000+ Free & unlimited | # Regulated and safe # Real ECN trading # Fast order execution # No hidden fees # Free bonus available | TradingView demo account: (Risk warning: Your capital can be at risk) | |

3. Pepperstone | Regulated by the FCA, ASIC, DSFA & SCB | $ 10,000+ Free & unlimited | # Award-winning broker # Excellent client support # Competitive spreads # Advanced tools # Free demo account for 30 days | TradingView demo account: (Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

The list of the best three TradingView demo accounts includes:

- BlackBull Markets – 26000+ assets available for trading

- Vantage Markets – Three TradingView plans

- Pepperstone – Great for forex trading

Best three TradingView demo accounts in comparison:

If you have some knowledge about the trading view, you must know that there are many broker accounts available on the trading view. Even though they are good, only some accounts can stand out. This article will discuss the top three trading view demo accounts in terms of comparison and tutorial.

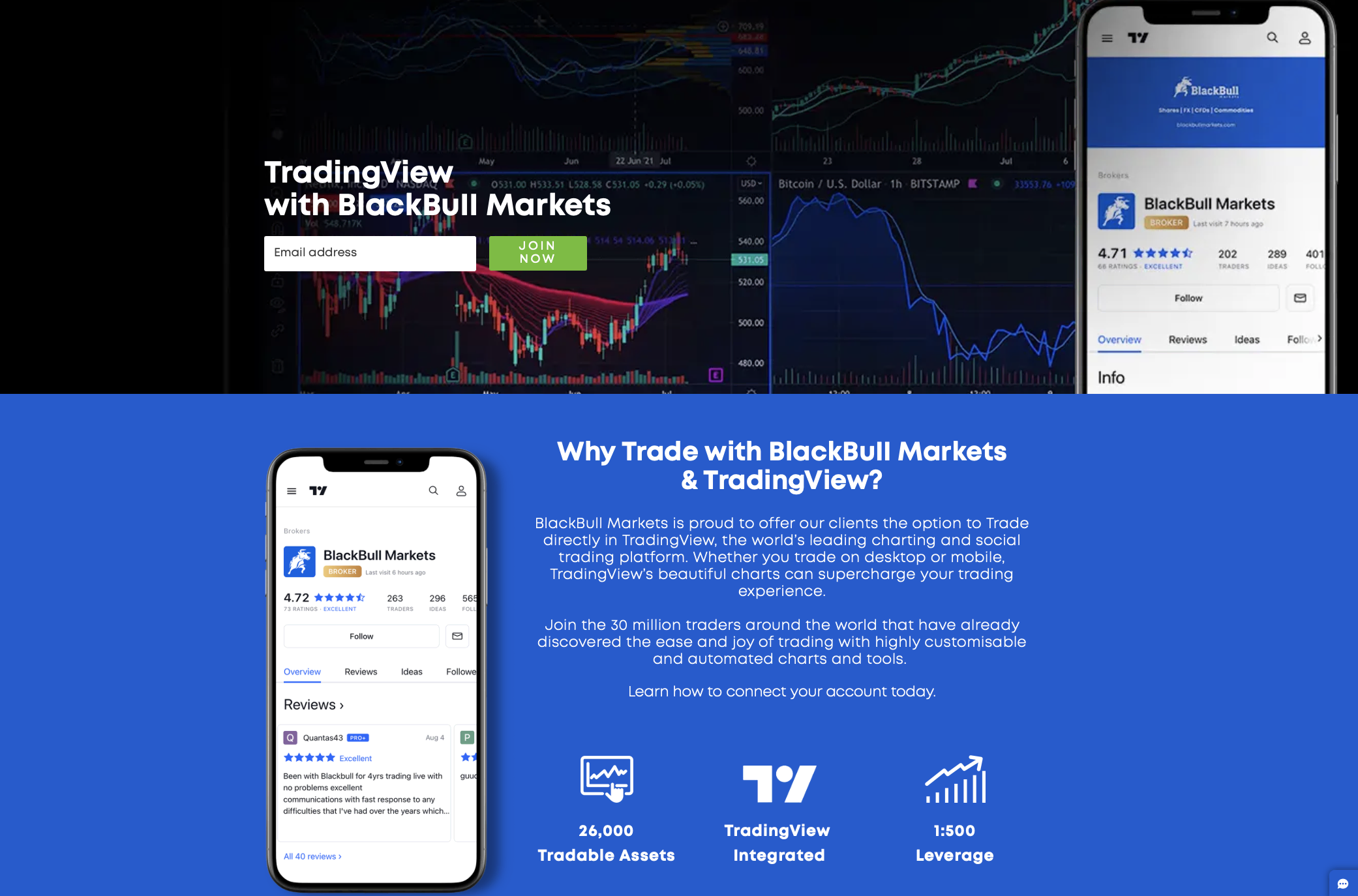

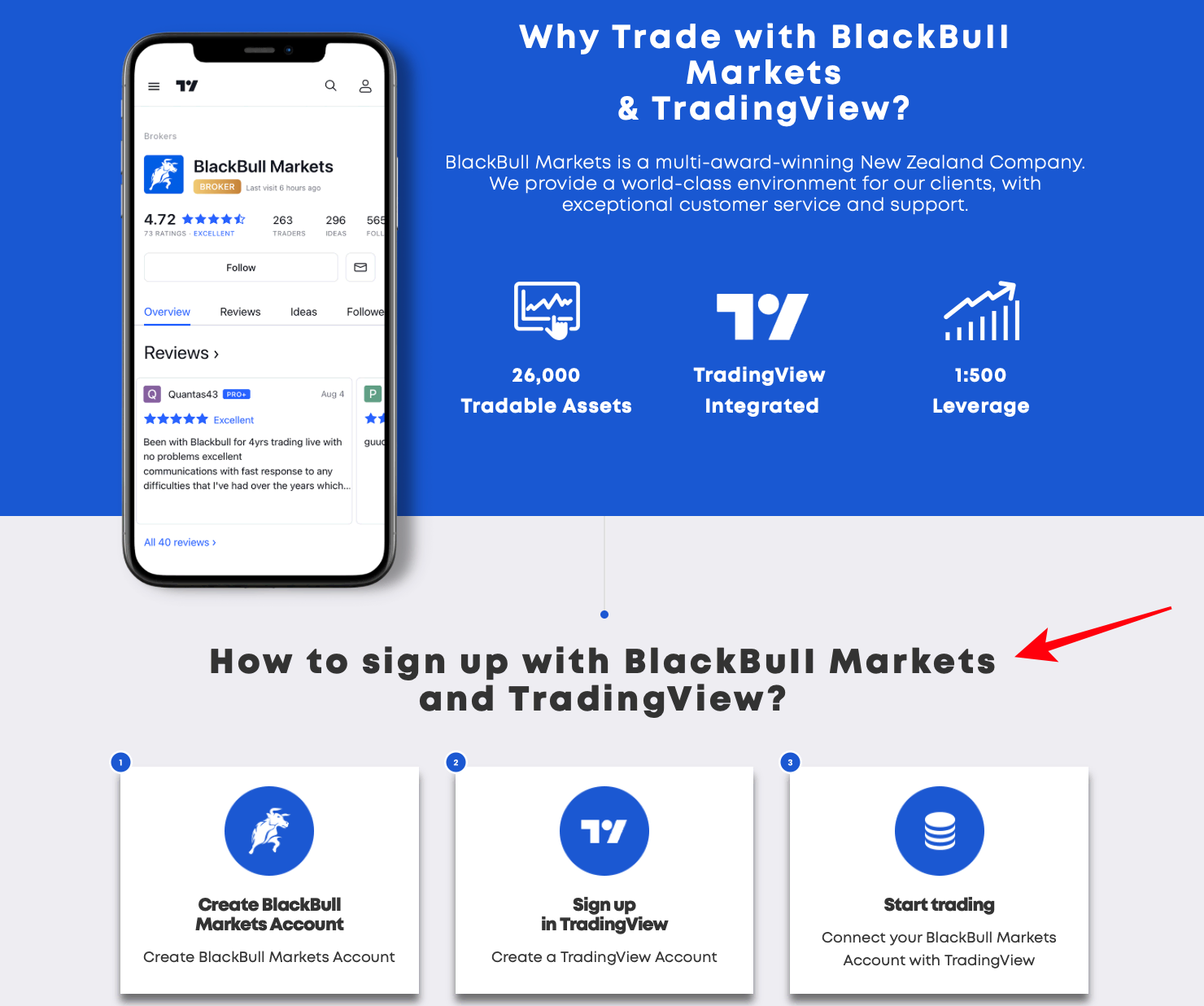

1. BlackBull Markets – 26000+ assets available for trading

BlackBull Markets has evolved into one of the most competitive brokers in the business, providing demanding traders with cutting-edge infrastructure built on technology.

High leverage, API trading, VPS hosting, STP, ECN, deep liquidity pools, NDD order processing, and low-latency trading are all key tools for algorithmic traders and scalpers. Automatic MT4/MT5 solutions, Myfxbook Autotrade, and ZuluTrade aid copy traders. A demo account is required for algorithmic and copy trading to test solutions and assess strategies.

To receive their BlackBull Markets trial account without creating an actual one, traders must complete a simple online registration form, and the default demo balance is $100,000. Demo account trading replicates live trading but does not expose consumers to trade psychology.

No matter if you are a novice trader who wants to learn the basics of trading or if you are an algorithmic trader who bug fix solutions and test strategies, or a seasoned trader who compare metrics, copies traders evaluating signal providers, and adjust your trading strategies, you will get to learn a lot with this platform.

The BlackBull Markets trial account has a 30-day time limit by default, which is likely sufficient for most potential clients but may need longer for others. Anyone who wants to utilize a demo account for more than 30 days may contact BlackBull Market’s customer service and request an extension or just try to establish a new one once the previous one expires.

If you use BlackBull Markets, you can get a wide range of advantages like:

- Traders may utilize, test, and bug-fix algorithmic trading systems,

- There are demo accounts for MT4/MT5 trading platforms

- There is no restriction on the number of demo accounts per user at BlackBull Markets

- Online registration can be done without even opening a live account.

(Risk warning: Your capital can be at risk)

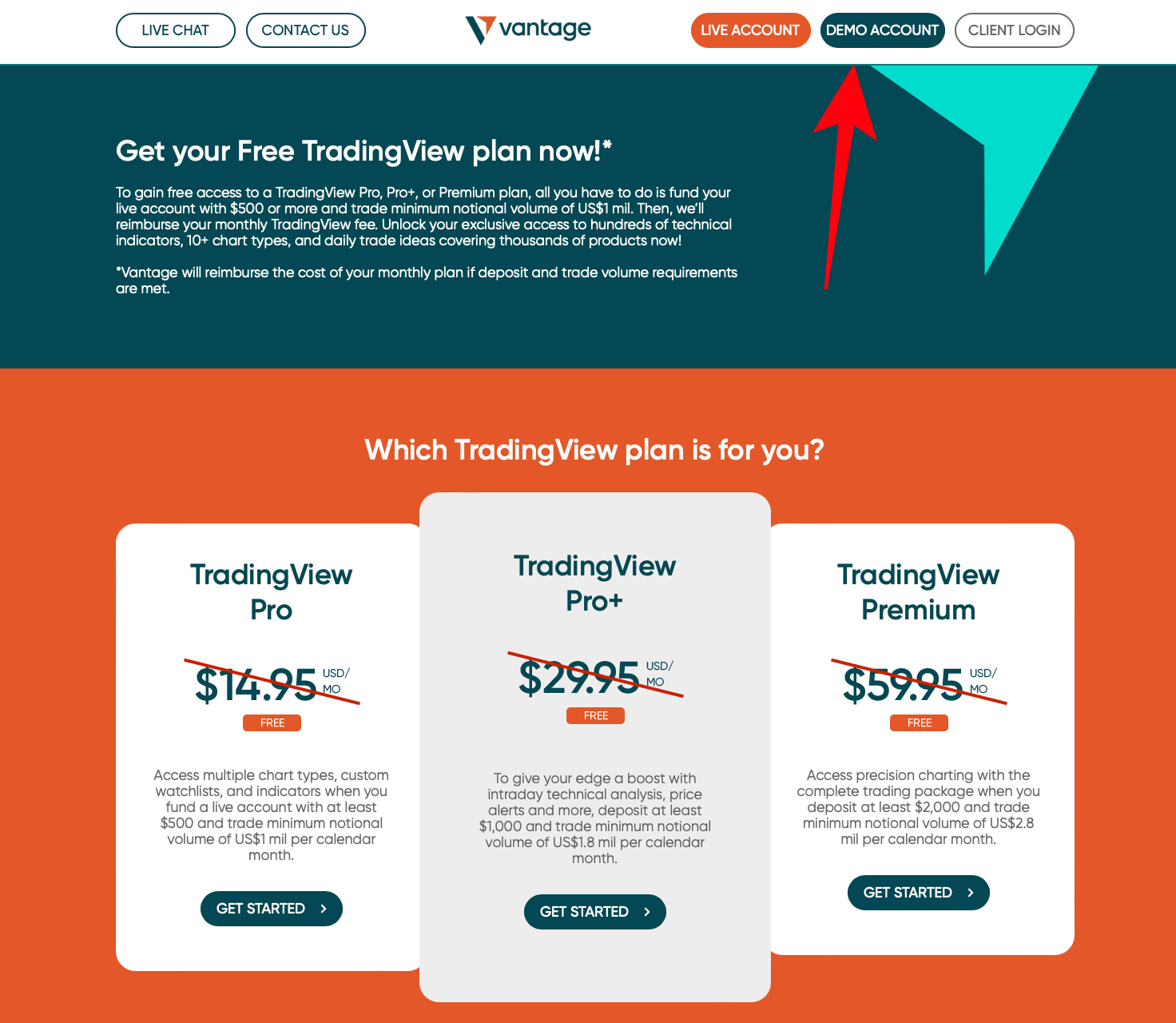

2. Vantage Markets – Three TradingView plans

The Vantage Markets Demo account has a wealth of tools that allow users to practice trading in the forex market with virtual money. The bill allows traders to test their trading techniques and see if they are profitable. Traders may learn how to trade for real money by utilizing the numerous tools offered.

Following are some of the features available in Vantage Markets:

- Traders may find practically all key parts of trading, such as currency market monitoring. They may also follow the status of their order.

- In addition, Vantage virtual trading offers market analysis tools and research goods. Traders can become acquainted with these tools and then engage in trading.

- The demo account of Vantage Markets also includes MT4 and MT5, two currency trading terminals.

- The finest thing is that Vantage Markets virtual trading is dependable and simple to utilize.

- They can also look at the many order kinds that are offered.

Above all, traders may use the platform to access the many features. The sections are also likely determined by the available assets, Vantage Markets spreads, financial instruments, etc.

(Risk warning: Your capital can be at risk)

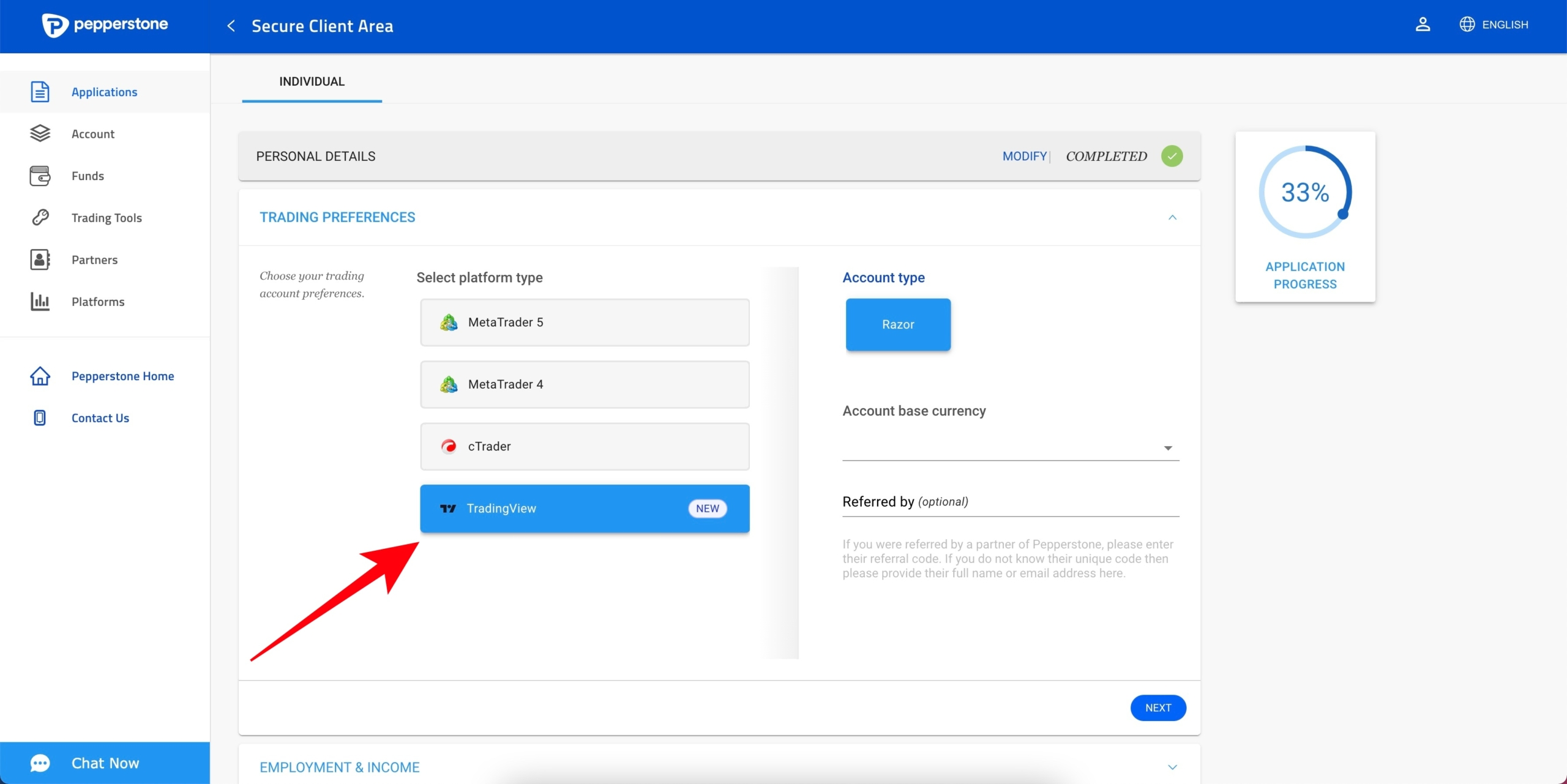

3. Pepperstone – Great for forex trading

Pepperstone offers one of the best demo accounts, allowing you to practice with the MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader forex trading platforms.

MetaTrader 4 is the greatest platform for a sample trading account because it is regarded as the gold standard in trading platforms. This platform provides all the necessary trading tools for getting started, including 30 indicators, 31 graphical tools, 9 timeframes, automatic trading, and social trading.

Pepperstone will help you decrease your trading expenses by offering over 60 currency pairs with ECN-like narrow spreads. Pepperstone is popular for its high-speed execution of 30ms on average, which will help you avoid slippage. It also has an award-winning customer care team built of traders, which means you will get all the support and guidance you will need as a beginner. Traders can pick between a commission-free basic account and a razor account with round-turn fees of $7.00 per lot.

Pepperstone’s demo trading account scored top owing to its simplicity of use, a virtual money balance to imitate actual trading, and access to an environment comparable to ECN trading. You may see a detailed review of Pepperstone. You can open your real money account once you get the features and knowledge of the trading tools of Pepperstone. This way, you can start trading forex and cryptocurrencies for real.

Strengths of a Pepperstone demo account are:

- Outstanding trading conditions and customer service

- Fast execution times (avg 30ms)

- $50,000 in virtual money, with a 30-day trial period (can be reset through Pepperstone support)

- Trading platforms MT4, MT5, or cTrader

- ASIC, FCA, DFSA, CySEC, BaFin, CMA, and SCB regulation

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Does TradingView have a demo account?

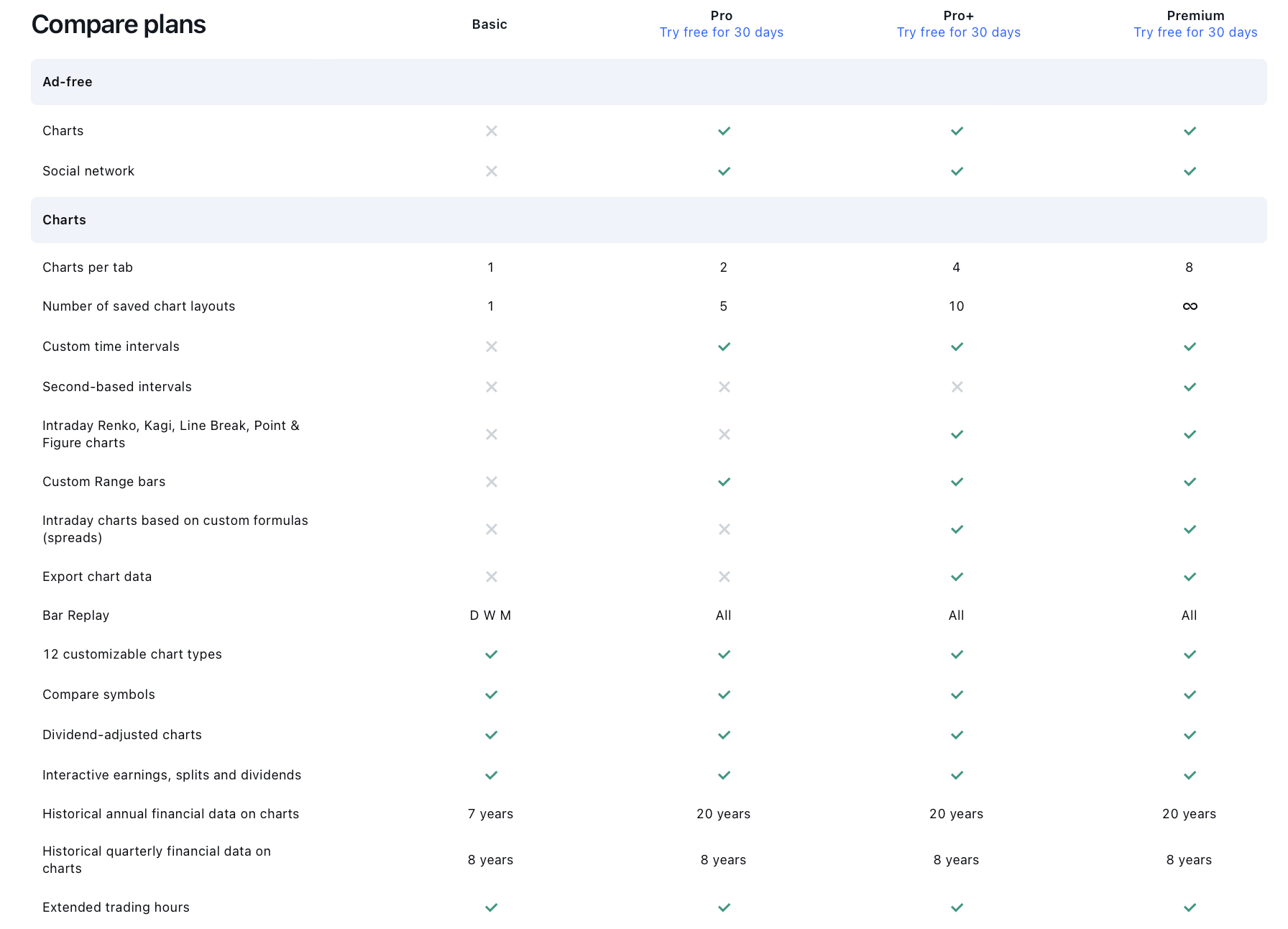

TradingView is one of the best charting applications. The essential software is accessible for free. Users who are creative and wish to use advanced charting tools can buy premium plans that provide a luxurious experience to the trader. There are three types of plans available in tradingview.

The Basic Plan

For novices, a simple plan is sufficient. This approach will provide you with enough tools, data, and information to begin trading.

Pro Plan

The Pro plan is for traders who want to enjoy the basic privileges with additional features like a powerful watchlist, 5 saved chart templates, customizable time intervals, no ads, etc.

Pro+ Plan

In most ways, Pro+ Plan and Pro plan are identical. However, what distinguishes the Pro + is the less stringent limitations on some functions like the technical indicators have been increased to ten per chart, Priority in support lines for customers, Trading notifications have been increased to 30, The number of charts per layout has been increased to four, and two active devices can run concurrently.

Premium Plan

Premium customers get all the features, like total access to the trading view platform’s capabilities, including 24 indicators and 25 per chart. They also get a maximum of eight charts per layout that you will not get in any other plan and also enhanced to 400 alerts with no lapse, Access to devices, etc.

Free Premium Plan

If you join up for a broker or a site that has linked with TradingView, you can obtain the TradingView Premium edition for free. For example, if you join Fyers broker, you may get TradingView premium services for free. If interested in Forex, you may sign up with FXCM and request premium services. There, you will receive a free one-year premium subscription.

Another way you can get free access to the tradingview premium account is by signing in to Upstox. If you already have an account there, you can get the advantage of a tradingview premium account for free. It is fairly simple to sign up for these networks. Prepare your documents and sign up.

Most brokers offered by TradingView provide demo accounts that may be utilized to trade. Do you also want to try this? You can do it in two simple steps-First open a demo account on your preferred broker’s website, and then, in the bottom trading panel of your chart, select your broker and login to your demo account.

(Risk warning: Your capital can be at risk)

How do I set up a demo account on TradingView?

As discussed earlier, you can set up a demo account on any broker platform associated with tradingview. Now the question is, how to open and use the account? Almost all the platforms follow the same steps to open a demo account.

So, let’s understand the procedure in simple steps:

- Open the application where you want to create the demo account.

- Fill up all the required information and click on the submit button.

- A verification code will be sent to you; enter it in the space given to ensure it’s you.

- Choose the currency you wish to trade in and then your starting balance.

- Your demo account has been created. Check your mail to get the login credentials and use your demo account.

- To start demo trading, you can trade any platform associated with TradingView.

How do I switch to a real account on TradingView?

When you have successfully learned the ABC of trading using the demo account, it’s time to shift to a real trading account on Tradingview. We assume by now you will understand which broker platform of Tradingview is best for you, and you can continue signing up for a real account on that broker platform.

Start by choosing an authentic username for creating a real account. This username can be changed only once when your account is created. So, make sure to choose it wisely.

After successfully creating the account, log in to your account and choose your trading instruments. Many instruments are available, like crypto, stocks, index, and Forex.

Under the chart title, the red and blue buttons display the sale and purchase rates, respectively. Click on one of these buttons to display your panel to your right, and you will see the options before opening your position.

This includes transaction size, if you want to activate take profit and stop loss and the levels at which you want them set, whether you want to open a market or limit order, and tick value and trade value at the bottom. And this is how your trade account is opened. Deposit a minimum value and start trading with your assets.

Conclusion – The TradingView demo account is necessary for beginners!

TradingView, a web-based charting platform, is one area where you may profit from the different offerings the platform delivers to traders through services such as technical analysis.

Besides, it is also widely used as a social network for traders and investors. Traders and investors may quickly connect with other trading competitors using this very effective platform.

An efficient platform like this is always worth trying, and for almost all the broker markets of trading, the view has come up with demo accounts for you to understand trading. Now that you know all the steps from finding a demo account to signing up for one enroll yourself and enjoy the perks of trading with TradingView.

(Risk warning: Your capital can be at risk)

Frequently asked questions about TradingView demo accounts:

Is there anything better than TradingView?

SeekingAlpha is one of the competitor sites of Tradingview. It also provides the same features, charting, and crypto trading tools that help get a greater trade profit. However, the site cannot be tagged as better than tradingview since both are equally popular and have good reviews.

Are trading demo accounts accurate?

No, the demo accounts are not completely accurate. It is difficult to distinguish between the orders that have worked in the live market. This is true for both entries and exits; thus, the results attained are subjective and somewhat inaccurate.

Is it worth paying for TradingView?

Tradingview is an affordable option for both beginners and experienced traders that provide some of the best tools for trading. Thus, it could be said as one of the most worthy trading platforms for both paid and free services.

Last Updated on February 17, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)