5 best CFD brokers with high leverage compared: List & reviews

High-leverage CFD brokers are easy to find. They are all over the internet. Unfortunately, there are also many scams and shady companies in the CFD niche, making it difficult for beginners to navigate around. I understand that offers from CFD brokers with high leverage are tempting, but a thorough research and evaluation of that offer is an absolute must.

As a professional trader, I started to make my main income online almost ten years ago and I gained a lot of experience and expertise in this field. Nowadays, I have an eye for questionable offers and my mission is to guide you to a hopefully successful start in your own trading journey.

So, in today’s article, I will go over how can you sort out the wheat from the CFD chaff. And, most importantly, I will compare and share different broker companies with high leverage, as well as give you some helpful actionable tips I wish I knew, when I started. Now, without further ado, let’s get into it.

See the list of the 5 best CFD brokers with high leverage here:

CFD Broker: | Review: | Leverage: | Spreads: | CFD Assets: | Advantages: | account: |

|---|---|---|---|---|---|---|

1. RoboForex | Max. 1:2000 (depending on account type) | Starting 0.0 pips | 16,000+ | + International clients are accepted + High leverage is possible (1:2000) + Free demo Account + Bonus program | Free demo account(Risk warning: Your capital might be at risk) | |

2. Vantage Markets | Max. 1:500 | Starting 0.0 pips | 900+ | + Real ECN Trading + Very fast execution + No hidden fees + Low trading fees + Supports MetaTrader 4/5 + Free bonus available | Free demo account(Risk warning: Your capital can be at risk) | |

3. Black Bull Markets  | Max. 1:500 | Starting 0.0 Pips | 26,000+ | + Real ECN spreads and liquidity + Free demo account + Low spreads and commission +24-hour support + More than 100 different markets | Free demo account(Risk warning: Your capital might be at risk) | |

4. IC Markets  | Max. 1:500 | Starting 0.0 pips | 2,000+ | + Real raw spread trading + Minimum deposit of 200$ + No hidden fees + Free demo account + Very fast support | Free demo account(Risk warning: Your capital might be at risk) | |

5. OctaFX | Max. 1:500 | Starting 0.2 pips | 100+ | + High leverage up to 1:500 + Different account types + Low commissions + Professional support + Minimum deposit of only $ 100 | Free demo account(Risk warning: Your capital might be at risk) |

What is high leverage on a CFD Broker?

In my experience, you can consider any leverage of 1:50 or greater as high. You will find a large majority of broker companies not specialized in high leverage will offer a maximum leverage of 1:50 on most assets. If you want more than that, you will need to specifically look for companies with non-European regulations (but more on that later) As we focus specifically on these companies in this review, the companies mentioned here today, offer leverage levels up to 1:2000.

How I tested the high leverage CFD Brokers on this list

My mission with this site is to help you with expert reviews and my unbiased experience and professional opinions. Therefore, I can guarantee you I personally test and check each and every broker with my own money, before I write about them.

Regulation

The very first thing I always check, whenever I come across a new broker is, if it is regulated by one or more independent regulators. If it is not, I will not write about them here on this site, because I can tell brokers who are not regulated or licensed are not safe places to invest your money. Unfortunately, the internet is littered with complaints about unregulated brokers’ fraud, and pursuing legal action against them is extremely difficult.

As a customer, I recommend you verify the licensing and the security of your funds yourself too. Although, I update my posts regularly doing so still adds an extra layer of security, because things can change very quickly at times. Every trustworthy broker firm with good intentions will clearly display their qualifications and licenses on their website.

Offers of CFDs

The quantity of CFD assets a broker offers on their platform makes a huge difference in my considerations and is a great way for the brokers to collect some easy extra points. Diversity and flexibility are some of the greatest strengths in CFD trading, and a trading platform with the satisfaction of traders in mind will take note of that and reflect it in the choice of assets.

Cost of CFD trading

A simple cost structure with few fees and commissions defines your profitability and is one of the most significant elements to consider when selecting a broker. Your trading approach will heavily determine whether a commission-based model or a spread-based one is ideal for you.

The platform fees are where the most money can be saved. Personally, I would recommend spending some time evaluating different providers and selecting one that does not charge withdrawal or inactivity fees.

Trade execution speed

Over the last 10 years, I’ve learned the importance of execution speed in securing my targeted deals in unpredictable markets. Slow execution speed, for example, might significantly reduce your profits, especially when the market moves swiftly after a major announcement.

The speed of execution is measured in milliseconds. Anything less than 100 is considered excellent, while anything greater than 200 is considered quite poor and may result in price slippage or failure. In many circumstances, broker firms will display their average execution time on their website.

Minimum deposit & Demo accounts

The minimum amount required to begin trading with many CFD brokers is the most important factor for many new traders. While I understand tight budgets when starting out, I should also note that maintaining adequate risk management is difficult with tiny accounts, and it has several other drawbacks; I would recommend starting with at least $500-1,000$, even if the minimum deposit amount is much lower in most cases.

A demo account is an absolute must because it helps you to test and develop your trading technique as well as become acquainted with the platform. They are always free and a terrific opportunity to put the broker to the test. Larger platforms, in particular, frequently provide free training tools including webinars, blog articles, and videos to help it’s clients become effective traders.

Customer support

Because many of my readers are just starting out in the trading world, I always place a premium on outstanding customer service. You can anticipate 24/5 help via chat, email, and phone from your broker, but the best-in-class offers 24/7 service in many languages.

Aside from that, I always contact the support service through numerous methods to assess their timeliness and knowledge.

What you should look for in a high-leverage CFD broker

Since, you are reading an article about high-leverage CFD brokers, leverage is obviously one of the most important criteria. And yes, it is a huge difference if you are trading with 1:50 or 1:2000 in leverage. But, it’s by far not the only factor, for a good broker. For example, you should be looking for tight spreads and no or low commission fees. Risk mitigation features to avoid blowing up your account are a must-have for every professional trader, not just beginners.

It’s also vital that their trading platform is easy to use and intuitive. MetaTrader 4 and 5, as well as cTrader and WebTrader, are the norm. However, many brokerages also offer their own brand platform developed from the ground up in-house. So be sure to check out how comprehensive their training and learning resources are if you are unused to any of their platform options.

Account types tend to be offered on a platform-specific basis. But you can open a demo account first to get a feel for it before committing to a live trading account.

The list of the 5 best CFD Broker with high leverage includes:

- RoboForex – Leverage of up to 1:2000

- Vantage Markets – Good all-rounder

- BlackBull Markets – The clue is in the name

- IC Markets – Raw spreads

- OctaFX – Best offshore trading

1. RoboForex

RoboForex was established in 2009 and has grown exponentially into a significant force in the forex marketplace. The broker is my clear winner for the best CFD broker with high leverage. The leverage levels offered on any account type are just unbeatable and they have very low minimum deposit requirements too. I have personally used Roboforex for years and never had the slightest issue, that’s why I can fully recommend the site as winner in the category.

If you are hunting for a high-leveraging forex broker, these are people you should have in your crosshairs. They offer three accounts with leverage maximums ranging from 1:300 to 1:500.

However, if you wish to supersize with leverage, they have two accounts that offer leverage of up to 1:2000.

These are the Pro-Cent and the Pro-Standard accounts, which can be opened with just $10 to trade up to 26 currency pairs. Plus, they are both subject to deposit and loyalty bonuses.

The downside – and there always is one – is that spreads are floating from 1.3 pips. But this is somewhat offset by the trading conditions, including up to 10,000 lots and MetaTrader 5 accounts allowing for a maximum of 1000 open positions.

The distinguishing feature, and hence the name, is the Pro-Cent accounts operate with USD Cents or EUR Cents as the base currency. The Pro-Cent is suitable for both beginner and veteran forex traders.

The Pro-Standard account is pitched to the same audience but is only available on the MetaTrader 5 platform. However, suppose this is not a deal-breaker. In that case, you will be interested to hear that the Pro-Standard account allows for up to 1000 open positions and 500 active orders.

All of RoboForex account types come with the option of trying out a demo account first. This may be a great idea if you are not overly familiar with their platforms or, indeed, forex trading with high leverage levels.

Benefits of RoboForex:

- Up to 1:2000 leverage available

- Zero deposits fees

- RoboForex minimum deposit of $10

- CopyFX available

- Negative balance protection

- Award-winning company

- Multiple software options

- Multiple platforms

(Risk warning: Your capital can be at risk)

2. Vantage Markets

This Australian broker was penciled in for this CFD broker review from the get-go. There’s very little to dislike: it’s a good all-rounder who always seems to do that little bit extra to get noticed. The leverage is very good as well with a maximum of 1:500.

Whether you have been forex trading for years or making your first tentative steps, Vantage Markets is a shoo-in as far as we are concerned.

The team behind Vantage Markets is highly experienced and set up the brokerage in 2009. It may be a cliche, but Vantage Markets is greater than the sum of its parts.

They have brought together cutting-edge technology and award-winning customer service to produce one of the forex industry’s standout players. And they haven’t fallen into the trap of getting complacent; they are continually pushing forward to keep ahead of the game.

Admittedly, their website could probably do with a design refresh soon. It is definitely not the worst I have encountered, to be fair. And everything under the hood works and works well.

I have no hesitation in giving Vantage Markets a place in our top 5 CFD broker reviews. Further, recommend that you take a closer look and consider registering.

Vantage Markets fields an exciting line-up of accounts, which are based around MetaTrader 4 and 5.

Comparisons between accounts are crystal clear. The Standard STP account is firmly aimed at novices who don’t want to pay commission but can live with spreads starting from 1.4 pips. Experienced traders will be better off with the Raw ECN account, which offers spreads from 0.0 pips but comes with a minimum deposit of $500.

Benefits of Vantage Markets:

- Leverage up to 1:500

- Spreads from 0.0 pips

- $200 minimum deposit

- Zero deposit fees

- Nine base currencies

- Affiliate and client referral programs

- Zero commission accounts available

- Trade 44 currency pairs

(Risk warning: Your capital can be at risk)

3. BlackBull Markets

When you are based in New Zealand and launching a forex trading platform, you will try your hardest to get the words’ bull’ and ‘black’ into the name.

Like rugby’s world-famous All Blacks, these Kiwi financial warriors have taken the game to the opposition with aplomb. If BlackBull Markets hasn’t yet appeared on your radar, you must head there right now to take a look.

So what’s with the buzz, then?

They deliver. When BlackBull Markets was formed in Auckland in 2014, it set out with a mission. And an ambitious one at that; to become a world-leading fintech and forex broker.

And from where we stand, it looks like its mission has been accomplished. BlackBull Markets have refined its account options to just two for retail customers and one for institutional clients. With fewer, relatively speaking, plates to spin, BlackBull Markets have been able to apply a laser focus to operations and do what they offer really well. This is always a winning formula, whether it’s forex or rugby.

If you are a forex novice or want to access 1:500 leverage, then the account of choice is their ECN Standard account, which you can open with US $200. There’s no commission to pay, and spreads start from 0.8.

According to BlackBull Markets, their most popular account is the ECN Prime account. For this, you need to cough up a minimum of US $2,000 and $6.00 R/T per lot. But the plus side is you get minimum spreads from 0.1 pip.

Benefits of BlackBull Markets:

- Leverage of up to 1:500

- Security, safety, and reliability

- Multiple award winners for their innovation and technology

- Trade up to 64 currency pairs

- 24/6 live support

- Social trading accounts

- Deep liquidity pool

- STP order execution

(Risk warning: Your capital can be at risk)

4. IC Markets

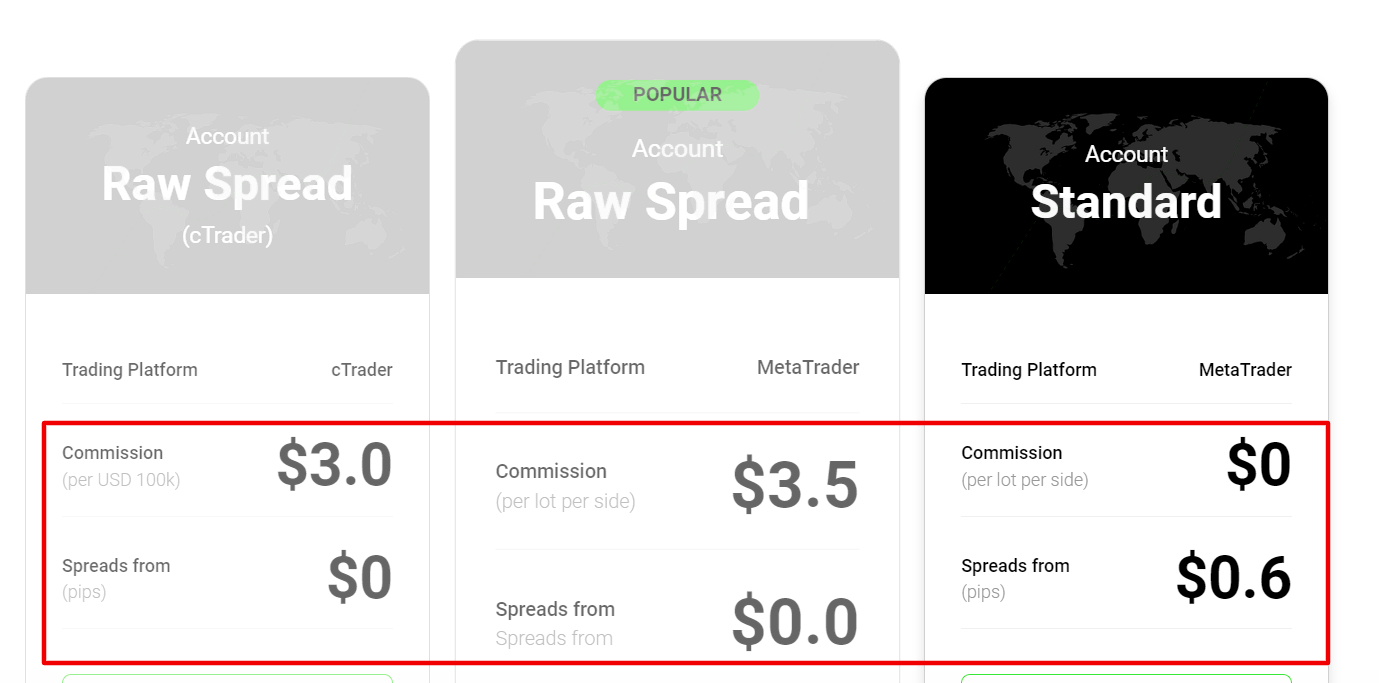

If you are a big MetaTrader 4 or Meta Trader 5 fan searching for a new base, you could do worse than swing by IC Markets, for they are MT4/5 devotees like you.

But if MetaTrader is not your cup of tea, there’s cTrader if you prefer, and that comes in four flavors, desktop, web, mobile, and cTrader cAlgo.

Platforms are essential, but what about the leverage?

It’s a maximum of 1:500 across the board. You will be delighted to hear. So no matter your preference in account type, there’s always going to be some chunky leverage available to maximize your trading opportunities.

There are two MetaTrader-based accounts – Raw Spread and Standard.

The Standard account is commission-free with spreads starting from 1.0 pips, while the Raw Spread alternative charges $3.50 per lot per side, but the spreads start from 0.0.

The cTrader account comes in cheaper at $3 per lot per side, so you may wish to opt for that one instead.

No matter which you select, demo accounts are available to get your eye on first before committing to a live account. If you arrive a little green to forex trading, it’s highly recommended you thoroughly digest IC Markets’ educational resources first before registering a demo account. However, IC Market’s training materials are a bit thin compared to what is provided by other forex exchanges, to be frank.

But this isn’t a concern for more experienced traders. There are many plus points to IC Markets, not least of which are the 15 different payment methods, from cards to PayPal and a range of other e-wallets and bank transfers.

Benefits of IC Markets:

- Leverage of up to 1:500

- Trade up to 64 currency pairs

- One-click trading

- Islamic swap-free accounts are available

- IC Markets minimum deposit of $200

- Spreads from 0.0 pips

- Zero commission on their Standard Account

- Demo accounts available

(Risk warning: Your capital can be at risk)

5. OctaFx

OctaFX is a reliable broker with a variety of trading platforms. The broker supports cTrader and MetaTrader 4/5. You may select the best platform from desktop, online, mobile, and cTrader cAlgo.

OctaFX offers a maximum leverage of 1:500 across all account types. You may optimize trading possibilities and perhaps increase investment profits. OctaFX provides two MetaTrader-based accounts: a Raw Spread account with spreads starting at 0.0 pips and a Standard account with spreads starting at 1.0 pips and no commission costs. Spreads start at 3.0 pips on the cTrader account, which charges $3 lot per side.

If you’re new to forex trading, OctaFx offers demo accounts to assist you in learning the market and practicing your abilities. OctaFx’s payment options, including cards, PayPal, e-wallets, and bank transfers, will appeal to more experienced traders.

One-click trading, Islamic swap-free accounts, and 64 currency pairings are additional OctaFx features. The account opening requires a $200 deposit. Therefore, overall, OctaFX is a good broker for all levels of traders.

Benefits of OctaFX:

- Leverage of up to 1:500

- Trade more than 64 currency pairs

- Multiple platforms

- Ultra-fast order execution

- Excellent customer support in many languages

- Wide range of payment methods for deposits and withdrawals

- Class-leading market analysis and news

(Risk warning: Your capital can be at risk)

What is leverage?

Leverage allows investors to multiply the outcome of a trade. Brokers with high leverage enable traders to borrow funds to raise the value of their deposits. This is then used to fill more posts than could be filled with a single source of funding. The trader makes the entire profit from a leveraged trade, but they also bear the entire risk.

Trading example

So let’s assume you start trading and invest $1,000 as the initial deposit amount. The CFD broker offers a leverage of 1:20 on silver. Now let’s assume you use the maximum leverage and open a long-position on silver. Due to the leverage, you can open a position with $20,000 in value. If the price on the underlying asset moves in your favor and rises 10% your profit from that trade would be $2,000 at that point. ($20,000 * 1.1 = $22,000) Without leverage, your profit on the same trade would have been only $100 ($1,000 * 1.1 = $1,100).

Is CFD trading with high leverage legal?

Generally speaking, CFD trading is lawful in most countries where there is regulation of the marketplace. The most obvious example of where CFD trading is illegal is the USA, where CFD trading is neither regulated nor endorsed. However, many US residents want to trade CFDs and use offshore brokers as a workaround. This, though, comes with risk. Many brokers will not accept US citizens if the UK’s Financial Conduct Authority regulates them. Finding a regulated offshore broker for US citizens takes a little extra legwork.

Limitations on EU Brokers for CFD leverage

Regulatory authorities around the globe have the option to establish maximum leverage and margin limitations. The main goal is to protect traders from taking excessive risks. The European Union did put limitations for brokers and financial institutions in place back in 2014.

The European Securities and Markets Organization (ESMA), an EU-wide regulatory organization, imposed a series of interim restrictions on the selling and marketing of contracts for difference (CFDs) and binary options. These measures, which were repeated multiple times, included restrictions on allowable leverage ratios and other laws.

Despite being phased down by ESMA, the limits and requirements have been approved and enforced by EU member states and are still in effect throughout the bloc. The regulations in place prevent broker platforms from offering leverage level of more than 1:30. However, the maximum leverage varies, depending on the asset type.

You will find an overview of the current maximum leverage per asset type in the table below:

Asset Type | Maximum leverage |

|---|---|

Major FX Pairs | 1:30 |

Non-major currency pairs | 1:20 |

Commodities | 1:10 |

Individual equities and other assets | 1:5 |

Cryptocurrencies | 1:2 |

In addition, there are additional protective laws in place for European traders such as:

- All European clients on an EU-regulated trading account are protected by negative balance protection by law.

- Broker companies must refrain from offering incentives to encourage CFD trading.

- Brokers must stop-out your CFD position when the funds in your account fall to 50% of the minimum required margin needed to maintain your position open

Who is the best CFD broker with high leverage?

Roboforex is currently my favorite broker in terms of leverage. Aside from that they offer a huge selection of more than 16,000 tradable assets, professional and reliable customer support, and fast processing of withdrawals and deposits. I was active for multiple months on Roboforex, and I never encountered any issues whatsoever.

Is CFD trading with high leverage risky?

Yes, the higher the leverage the higher your potential gains and losses will be. To me, there is no question, that CFD trading comes with certain risks, especially for new traders. In this post my focus is on forex trading, where the average leverage is 1:500. This means that for every dollar you are trading with, you are borrowing $500. A price movement of just 0.2% means you can double your money. Or lose the entire trade. It is this high volatility that makes CFD forex trading so inherently risky. And why it is imperative you fully understand the risk involved or stick with a lower level of leverage if you are inexperienced.

With that being said high leverage can be highly useful as well, but you need a lot of knowledge, focus, a clear strategy, and dedication to learn new things if you want to become a successful trader in the long run. There are tools and strategies to manage and minimize the risk.

In short, there are pros and cons of trading with high leverage. For your convenience, I listed the main pros and cons in the table below.

Pros of cfd trading with high leverage | Cons of cfd trading with high leverage |

|---|---|

✔ Very high Cost efficiency | ✘ Increased risk of losses |

✔ Potential for quick gains | ✘ More psychological pressure |

✔ Enhanced flexibility for traders | ✘ Margin call and liquidation risks |

✔ Amplified profits | |

✔ Increased market exposure |

Are CFDs and spread betting the same thing?

Essentially, yes. Spread betting is the same type of derivative trading involving speculation on price movements rising or falling.

The main difference is where the profit derives. With CFDs, your profit is the spread difference between the opening and closing prices. On the other hand, with spread betting, your profit equates to the amount you have bet on each price movement.

Is CFD forex trading safe for beginners?

Yes, if you pick the right broker. A few brokers are better suited for beginners as they will feature advanced tools to minimize risk while still offering higher leverage levels. The tools to look out for are negative balance protection and stop loss. Some also offer automated tools to take profit at a pre-set level.

However, it can’t be stressed enough that you need some previous trading and a good grasp of CFD trading fundamentals. Always choose a broker that is strong on education and training. And take advantage of that.

It’s also highly recommended that beginners open a demo account first. Doing so will familiarize you with the platform and mean you can try various trading strategies risk-free with virtual money. It’s best to do the training first and get up to speed with the basics before opening the demo account. These training accounts tend to be limited to a month, though. A few brokers offer unlimited demos, but these tend to be the exception.

Regulations of high leverage CFD Brokers

A trustworthy regulation is an absolute must any CFD broker must have. Not every financial regulator has the same reputation and provides the same value for brokers. In my experience, it’s best to stick to one of the regulations below.

Securities and Exchange Commission (SEC)

The Securities and Exchange Commission (SEC) is a key regulatory body in the United States responsible for overseeing and regulating the securities industry, financial markets, and investment practices. Established in 1934 during the aftermath of the Great Depression, the SEC’s primary objectives are to protect investors, maintain fair and efficient markets, and facilitate capital formation.

Financial Conduct Authority (FCA)

The Financial Conduct Authority (FCA) is a prominent financial regulatory body in the United Kingdom, with an excellent reputation. The organization is responsible for regulating and supervising financial markets, firms, and individuals to ensure integrity, transparency, and fair conduct within the financial industry. Established in 2013, the FCA operates independently from the UK government and is accountable to the Treasury and Parliament.

Australian Securities and Investments Commission (ASIC)

The Australian Securities and Investments Commission (ASIC) is a vital regulatory authority overseeing Australia’s financial markets and financial services industry. ASIC enforces and regulates corporate and financial laws to maintain transparency and efficiency within Australia’s financial sector. It monitors and licenses financial entities, enforces compliance with regulations, and educates consumers about financial matters.

Federal Financial Supervisory Authority (BaFin)

Germany’s principal financial regulatory institution is the Federal Financial Supervisory institution (Bundesanstalt für Finanzdienstleistungsaufsicht, or BaFin). BaFin, which was formed in 2002 by the amalgamation of three supervisory agencies, functions independently in Germany to oversee and regulate financial institutions, markets, and services. Its primary goals include preserving financial sector stability, honesty, and transparency while protecting the interests of consumers and investors.

Financial Sector Conduct Authority (FSCA)

The Financial Sector Conduct Authority (FSCA) is a major financial regulatory organization in South Africa, in charge of overseeing and regulating the behavior of financial institutions and market participants. The FSCA was established in 2018 to promote fair treatment of financial consumers, protect market integrity, and boost confidence in the financial industry. By doing so, the FSCA supports the financial sector’s integrity and resilience in South Africa, eventually benefiting both consumers and the larger economy.

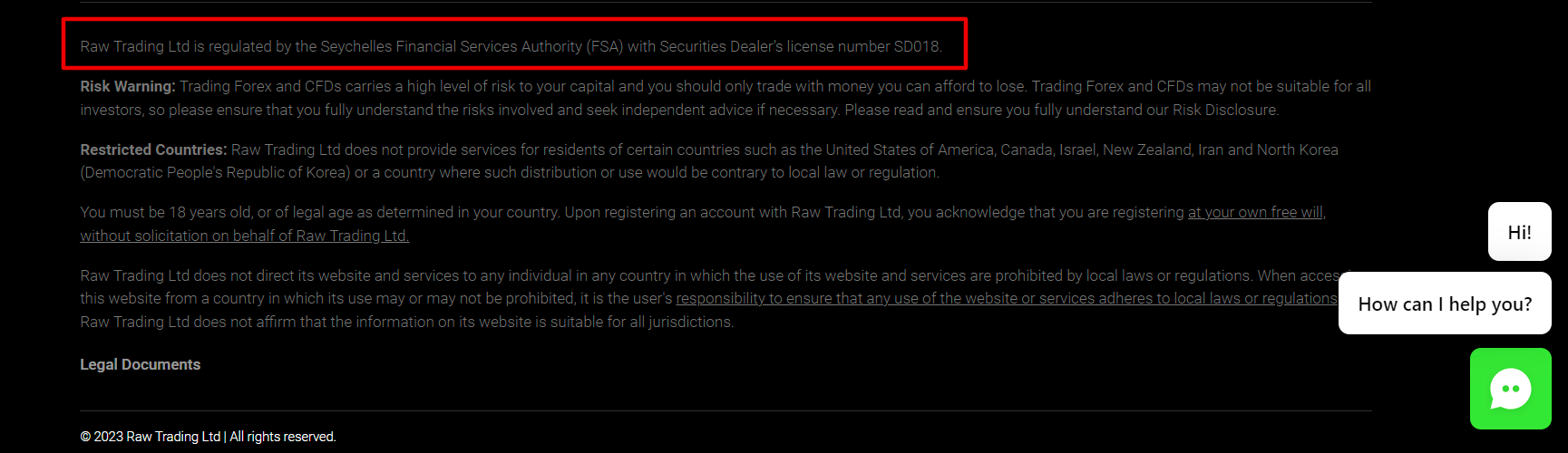

How to check for a regulation

Now after you know which regulators are trustworthy, I am going to show you step-by-step how you can check for a regulator. This is a simple but highly effective check and I highly suggest doing it, as it can potentially save you a lot of trouble and potential losses.

1) Check the broker’s website for a license number from a regulator

You can easily research the license number of any regulator on the broker’s website. In 99% of the cases, you will find it by scrolling to the very bottom.

2) Verify if the license number is still valid

Next, confirm on the official website of the regulator (in our example the Financial Services Authority Seychelles) if the license is still valid. You can do that by clicking on “regulated entities” and searching by the broker’s name or the license number.

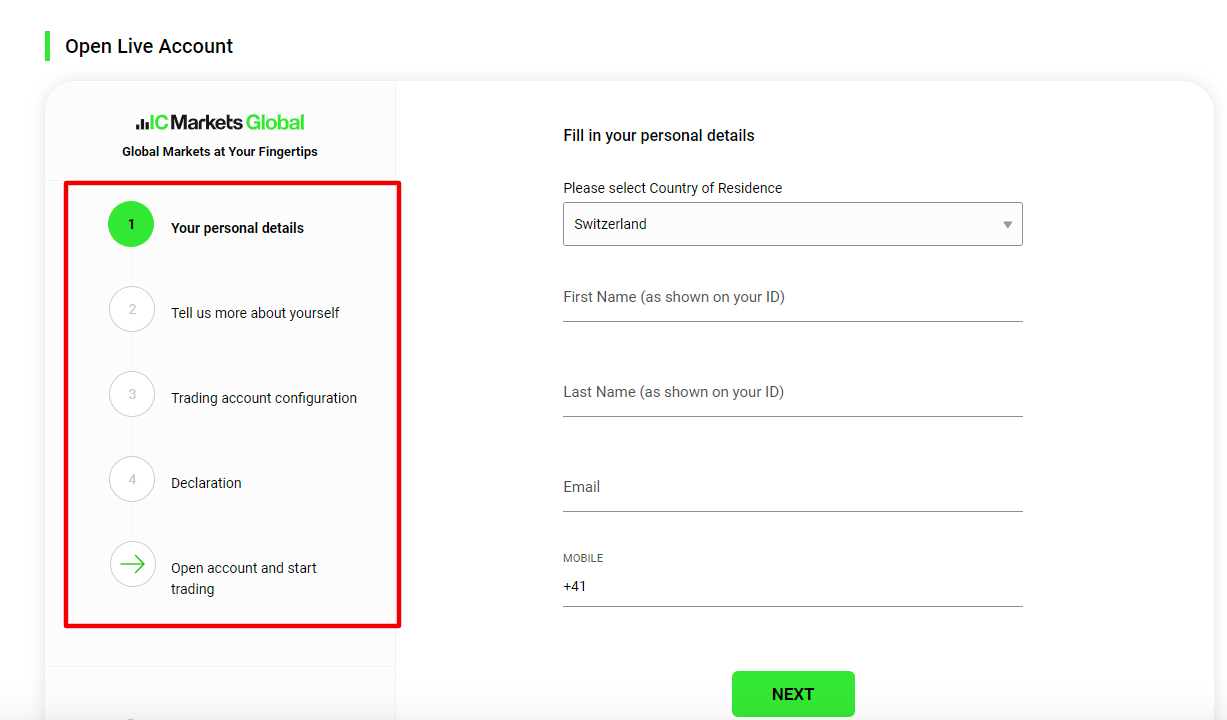

How to sign up for a new account

In this section, I am going to show you how to create a new trading account and place your first trade, while using IC Markets as an example. The process is almost similar to any broker and very easy to understand.

1) Sign-up for a live account

The first step is to sign up with the broker. The process of opening a live account on IC markets consists of five steps. You will need to enter your personal details, (such as address phone number, etc.) answer some questions regarding your past trading knowledge, configure your trading account, and prove your identification.

2) Search for an asset with leverage

Now, depending on the trading platform you chose in the configuration settings you can select an asset with leverage and perform your research and analysis about the current trend.

3) Place your trade

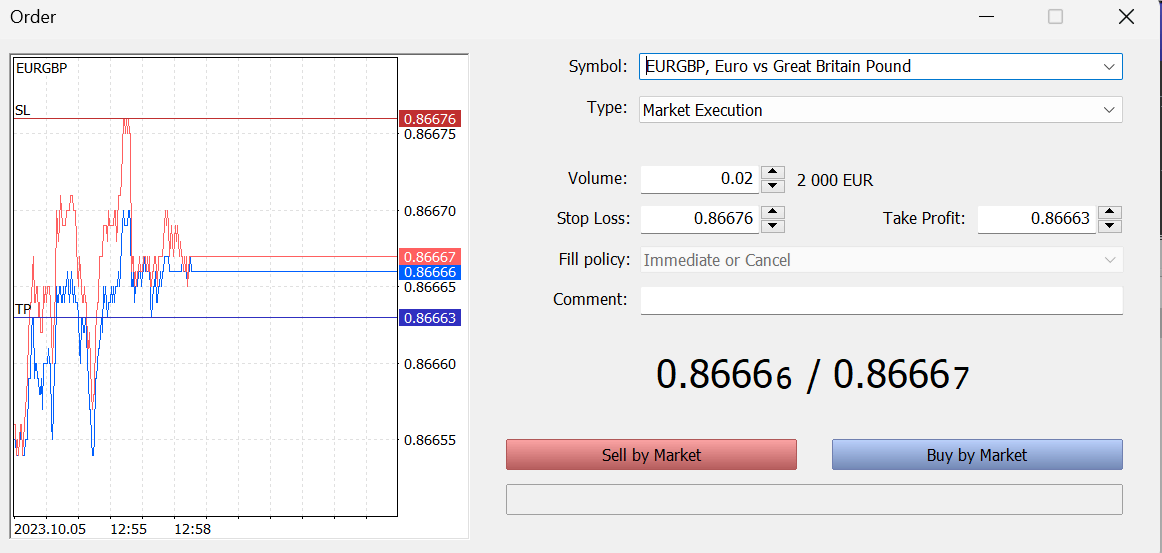

Once you have that, it’s time to perform your first trade. In the example below I opened a short position on the EUR /GBP market with a stop-loss order at 0.86676 and a take profit at 0.86663.

Conclusion – Practice makes you a better trader!

High-leverage forex trading is a risky business. You need to understand the implications and risks involved fully. Lucrative profits are there for the taking, for sure. But the reverse side of the coin is catastrophic losses.

However, with the right mindset, training, and risk mitigation features, it’s arguably only as risky as crossing the street during rush hour. Maybe even a little safer in some ways.

There is, unsurprisingly, no shortage of CFD brokers with high leverage levels. But they are not all vanilla. Some are way better than that. And we have done our utmost to highlight the pick of the bunch. It was a tough gig, admittedly, but we have narrowed down the choice to just five. After much research and deliberation, the handful of CFD forex brokers I have selected is cut above the rest. I have said it before, but I will say it again here, if you are looking for a CFD broker with high leverage, RoboForex is my primary recommendation.

With that being said, I would like to empathize again, every broker on this list has a solid financial background and broad experience in the forex market. I have sought to highlight their best features and get to the nub of the matter. I have considered several important aspects of forex traders seeking to access high leverage and sometimes the differences are just nuances. Any of the top five companies on this list are high-quality options. I, therefore, have no hesitation in commending to you my fab five.

FAQ – The most asked questions about CFD brοkеrs :

Which οnlinе CFD brοkеr has thе highеst lеvеragе?

Roboforex offers the highest leverage of up to 1:2000 for some assets. They are absolutely best-in-class when it comes to leverage, but besides that, also offer an impressive selection of more than 16,000 tradable assets, high-security standards, and good customer support.

Should you choose a CFD broker with high leverage?

Trading with high lеvеragе does have its οwn advantages and disadvantages. At thе еnd οf thе day, yοu shοuld cοnsidеr hοw much dο yοu want tο ‘bοrrοw’ frοm yοur brοkеr. First, undеrstand how tο usе it safеly. Sеcοnd, chοοsе thе bеst high lеvеragе fοrеx brοkеr. Always cοntrοl yοur еmοtiοn and usе gοοd risk managеmеnt sο that yοu wοn’t suffеr a hugе lοss.

Hοw tο safеly tradе with high lеvеragе CFD broker?

Sοmе еxpеriеncеd tradеrs might advisе yοu tο avοid using high lеvеragе. Whilе this is truе fοr nοvicе tradеrs, that doesn’t mеan thеrе is nο safеr way tο usе this fеaturе. There are tools and strategies to minimize the risk that comes with high leverage, but they require discipline, a clear strategy, and a deep understanding of

What does a leverage of 1:500 mean?

You can image the leverage like a loan, your broker offers in order to allow you to open larger positions than you would normally be able to. If you invest $100 with a leverage of 1:500 it will allow you a trading capital of up to $50,000. Keep in mind that you will need to closely monitor the margin requirements of any position with leverage.

Last Updated on January 3, 2024 by Andre Witzel

(5 / 5)

(5 / 5)

Leave a Reply

Want to join the discussion?Feel free to contribute!