XTB broker review and real test – Is it a scam or not?

Table of Contents

REVIEW: | REGULATION: | ASSETS: | MIN. DEPOSIT: |

|---|---|---|---|

(4.8 / 5) (4.8 / 5) | More than 10 | 5,800 – 6,200+ Markets (Depending on the regulator) | 0$ |

The choice of a trusted broker is very difficult nowadays. XTB is currently one of the best-known internationally. Are you looking for experience with the online broker XTB? – Then you are exactly right on this page. With more than nine years of experience in the financial markets, we tested the broker for real money. You will get an overview and an introduction to trading with X-Trade Brokers. Is it really safe to invest your money there? – Inform yourself in detail.

(Risk warning: 76% of retail CFD accounts lose money)

What is XTB? – The broker presented

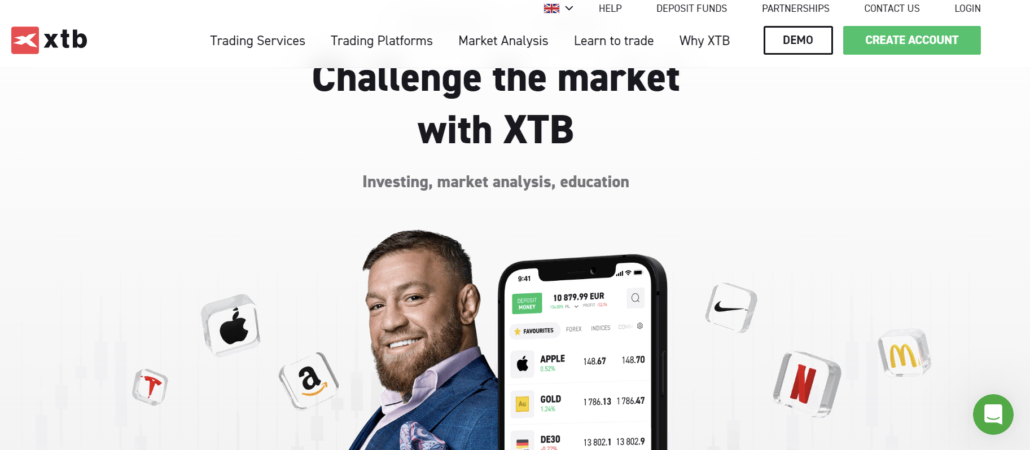

The company was founded in 2002 in Poland and is still a good address for online trading. The company quickly grew in demand, and offices were opened throughout Europe. Currently, the broker is represented in over 12 countries. Maybe a branch is also located in your country. XTB is a public company that is traded on the Polish stock exchange. In 2016, the company dared to take that step and posted a 4% gain on the first day.

With this Forex Broker, you can trade over 5,800 different assets (6,300 for Europe and 5,800 internationally) and six asset classes on a universal trading platform. In addition, XTB connects its customers with very good customer support through support, webinars, and training long term. Extensive training also helps beginners to find their way around the markets.

Personal care and a high deposit guarantee are the broker’s heart. Overall, the company has won many awards, which makes an additional good impression on me. From my experience, the company is one of the top providers.

Also, watch our review video about XTB:

Facts about the company:

⭐ Rating: | 4.8 / 5 |

🏛 Founded: | 2002 |

💻 Trading platforms: | xStation 5 |

💰 Minimum deposit: | Depending on country registration |

💱 Account Currencies: | USD, EUR |

💸 Withdrawal limit: | No |

📉 Minimum trade amount: | No |

⌨️ Demo account: | Yes |

🕌 Islamic account: | Yes |

🎁 Bonus: | Yes, available to residents outside the EU |

📊 Assets: | Forex, Indices, Commodities, Stocks, ETFs, Crypto CFDs |

💳 Payment methods: | Credit- or Debit card, bank transfer, Paypal (depending on your country) |

🧮 Fees: | from 0.2 pip / variable overnight fees |

📞 Support: | 24 / 5 live support via chat, phone, and e-mail |

🌎 Languages: | 17 languages |

(Risk warning: 76% of retail CFD accounts lose money)

What are the pros and cons of XTB?

XTB is one of the largest and most reputable trading companies, but it doesn’t automatically mean it is the best option for your personal situation. To help you make an informed decision, we listed the main pros and cons in the table below.

Pros of XTB | Cons of XTB |

✔ Designated support for every new client | ✘ No two-factor identification on the website |

✔ Competitive spread fees | |

✔ One of the best trading platforms on the market | |

✔ Competent and helpful customer support | |

✔ Direct market access | |

✔ No hidden fees or commissions | |

✔ XTB is a highly regulated and trusted company |

How good is the user experience on XTB?

In this section, we will take a look at user-friendliness and support of the website. Is the website mobile optimized, how easy is the app to use, and the general website design and setup?

Criteria | Rating |

General Website Design and Setup | ★★★★★ XTB is among the largest and most reputable brokers in the world, and the website is clean, fast loading speed, and easy to navigate |

Sign-up Process | ★★★★★ Sign-up process for the demo account is quick and easy we had no negative aspects observed during the sign-up process |

Usability of trading area | ★★★★ Xstation5 is one of the best trading platforms in the world |

Usability of mobile app | ★★★★★ Website is optimized for mobile users, leaves no wishes open |

XTB regulation and safety of customer funds

The regulation of an official financial regulator is essential for serious online trading. The broker thus gains trust between him and the customer. Among other things, European brokers must have official regulations to offer certain financial products. If such a license is missing, one can start with possible fraud. Before investing, the provider should be checked for regulation.

For your own safety, it is recommended to trade only with regulated companies and brokers.

XTB has several internationally regulated regimes as the company has a large number of branches in different countries. Important and well-known regulations of the broker are, for example, the FCA (UK), IFSC (Belize), CySEC (Cyprus), DFSA (Dubai), and the KNF (PL). Thus, the company radiates a very high level of security.

Certain criteria and requirements must be met for such a license to be awarded. A breach or fraud would mean the immediate loss of this license. Another point for a good provider is the security of customer funds. XTB keeps client money separate from corporate funds in Europe. Speculation with client funds is completely excluded here. There is also a deposit guarantee of up to 20,000€ (under CySEC), 20,100€ (under KNF). In summary, XTB makes a very serious and trusting impression on us. Fraud on the customer can be excluded.

Facts about the regulation and safety of customer funds:

- International branches with regulations

- Separated customer funds from the broker’s money

- Regulated payment methods

- High deposit guarantee

(Risk warning: 76% of retail CFD accounts lose money)

Review the trading conditions for customers

Before opening an account with an online broker, you should be clear about which trading instruments you would like to trade and which offer or terms the broker will give me. From our experience, XTB is a truly broad-based provider of many financial products and asset classes. More than 3,000 markets are currently available, and the company is steadily expanding its offering.

Trade Forex, Equities, Commodities (CFDs), ETFs, and Cryptocurrencies (CFDs) from a trading platform. As a beginner, you can quickly find your way around the platform because the menu navigation is very clearly arranged.

You can trade a huge range of markets:

- Forex

- Index and Stocks

- Commodities

- ETFs (Exchange Traded Funds)

- Cryptocurrencies

Trade currencies (Forex), stocks (and stocks CFDs), commodities (CFDs), ETFs (and ETF CFDs), and cryptocurrencies (CFDs) from one trading platform. On the platform, you can quickly find your way around as a beginner because the menu navigation is very clearly designed. In addition, there is maximum leverage when trading at 1:30 (European regulation) and 1:500 (international regulation), which can be used to make faster and more profit. Furthermore, the trading fees are very low compared to other providers and quite strongly competitive (more on this in the further course of this website). Variable spreads are always offered for the accounts. These start as low as 0.1 or 0.0 pips.

Variable spreads on the XTB trading platform:

- Asset:

- EUR/USD

- USD/JPY

- Gold

- Oil

- DAX

- S&P500

- Spread from:

- 0.1 pips

- 0.4 pips

- 0.35 points

- 0.04 points

- 1.0 points

- 0.5 points

Depending on the regulation authority you choose. XTB can offer different account types. There are account types with an additional spread or account types with fixed commissions.

(Risk warning: 76% of retail CFD accounts lose money)

The leverage for private traders is 1:30 high, and professional traders can upgrade to high leverage of up to 1:500 (only for European clients). There is also a free demo account available, and the minimum deposit for a live account is €0 (may depending on your country of registration).

Thanks to the multiple languages-speaking branches, the broker can also score with competent support for traders! The support is active 24/5 on weekdays and professionally handles your personal requests. In addition, there is a very large range of training opportunities. Webinars, e-books, and 1 to 1 coaching sessions are offered by the broker. From our experience, very helpful knowledge is passed on here for the first time, which is directly applied to the markets.

From our XTB experience, many new customers also ask if XTB is a market maker. The provider is not a market maker and gives customers Direct Market Access (DMA). The platform is directly connected to well-known exchanges and liquidity providers. In summary, the conditions make a very good impression on me. XTB can clearly stand out from other providers due to its experience and expertise. Further down on this website, I will go into more detail on the individual topics.

Now also buy shares for free without fees at XTB:

In 2020, the broker took a new step towards opening up the market! You can now also trade stocks and ETFs without fees at XTB. You buy the right underlying asset in the trading platform. Dividends are also distributed in real-time. However, this offer is only valid for a monthly trade of up to 100,000€, which should apply to most investors. A total of 16 global exchanges are offered!

Summary of the trading conditions:

- More than 5,800 – 6,200 (depending on the regulator you choose) markets to trade

- Free demo account

- No minimum deposit (depending on your country)

- Own platform xStation 5

- High leverage up to 1:500 (only for professional clients)

- Low spreads from 0.1 pips

- Trade stocks and ETFs without commission

(Risk warning: 76% of retail CFD accounts lose money)

Review and test of the XTB trading platform

The trading platform is the most important tool for every trader. It is all the more important that it works correctly and is reliable. Of course, XTB’s trading platform was scrutinized in this review. XTB offers its own developed xStation 5 as software for investing and trading. From our experience, xStation 5 has a few more advantages in contrast to the popular trading platform Metatrader 4, which is why we would like to elaborate on this platform in the following lines.

The platform xStation is available for any device:

- Web Trader

- Desktop

- Mobile Trade

- Smartwatch

- Table

The platform makes a very professional impression on us. It is very easy to use for beginners. A clear structure helps the trader not to get confused. Prices and charts are clearly visible. There are many options here. In addition, the trading platform displays possible fees openly and transparently.

Compared to other platforms, the xStation 5 is really worth mentioning because not every Forex Broker offers a good and reliable trading platform. Through various tests and ideas from traders, it has turned out that the xStation is very powerful, and you have real-time access to the markets.

(Risk warning: 76% of retail CFD accounts lose money)

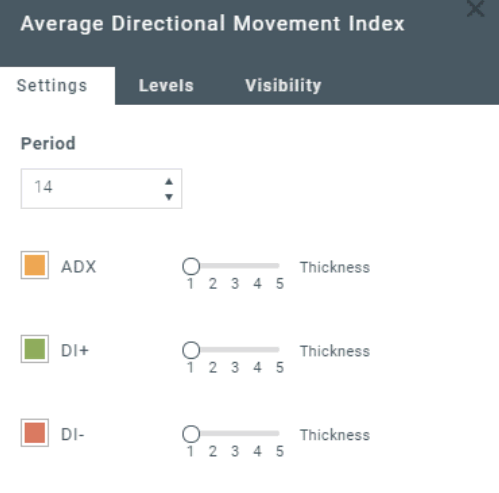

Professional Charting for Beginners and advanced traders

Technical analysis is a tool for long-term market success for most traders. That’s why it’s important to check if an offered trading platform provides the right tools. My first impression of xStation 5 is sensational because the charts are personally customizable.

Use several chart representations:

- Candlestick Chart

- Line Chart

- Heikin-Ashi Chart

- OHLC/HLC

For personal analysis, drawing tools and indicators are provided. More than six different drawing tools can be actively used on every chart. So the analysis should not be a problem for a trader. For example, use horizontal, vertical, or trend lines. Even the familiar Fibonacci levels can be inserted with just a few clicks.

The drawing tools are also independently adjustable in the presentation. Also, indicators make up a significant proportion of the tool in xStation 5. More than 20 different indicators can be inserted in a few clicks.

- More than 20 different indicators

- Technical drawing tools

- Customizable and user-friendly tools

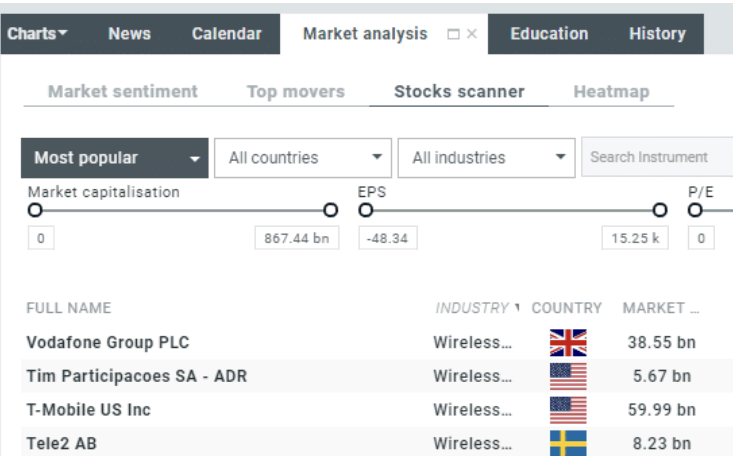

XTB analysis, news, and stock screener

In addition, xStation 5 delivers current market news and a professional stock screener. Get the latest business news and results displayed directly on the trading platform. Market News is provided by XTB every day on current events and can generate additional trading ideas. In any case, the market news should always be checked before a trader in order to increase the probability of winning.

Stock traders beware. XTB offers a professional stock screener in its trading platform. This allows you to select the best values for investment. More than 20 different filter settings are possible with the stock screener. This makes it easier for you to find profitable companies from more than 3,000 markets. There is also help under the point “training” to the large offer. Video tutorials are provided to show trading on the platform.

Get more success through:

- Market News

- Market Analysis

- Stock Screener to find the best companies

- Educations center

(Risk warning: 76% of retail CFD accounts lose money)

Mobile trading via the XTB app

Of course, trading at XTB can also be done via a mobile app. Forex and CFD trading, as well as stock trading, is possible via the xStation5 app. Use your Android or iOS device for this purpose. The appropriate software is also offered for the Apple Watch.

The xStation5 app does not differ in functions from the desktop version. You can also use the regular stop-loss analysis tools and indicators or simply trade the CFDs. All functions are also possible via a mobile device.

We have tested the app several times and are surprised about the user-friendliness. The xStation5 app is clearly one of the best trading apps.

(Risk warning: 76% of retail CFD accounts lose money)

How to trade with XTB? – Step-by-step guide

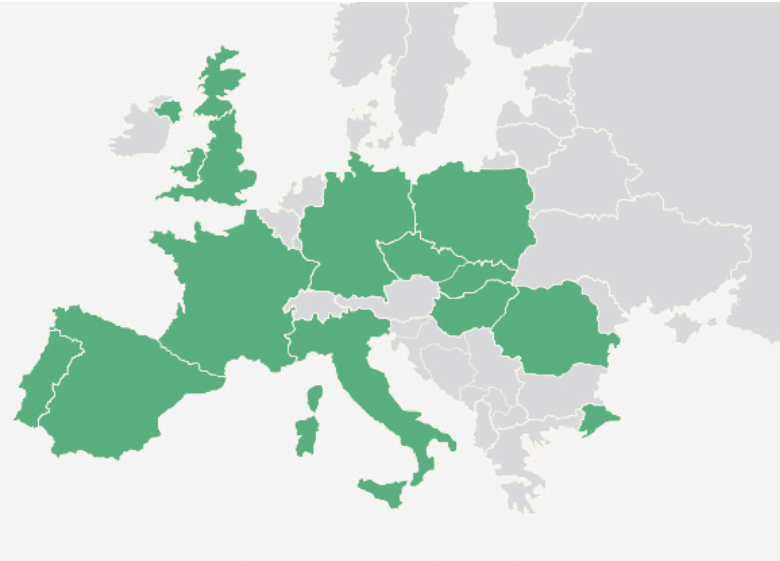

XTB’s trading platform comes with all the tools you need for a professional trading experience, but how does the Forex Broker Order actually work? We would like to talk about this in this section. Below this text, you will see the live order mask of XTB. There you can see different settings.

In general, the online broker offers you the opportunity to invest in rising or falling markets. Short sales (short) are easily possible by the forex market or if you own the stock and want to hedge. Minimum amounts of a few dollars can already be invested. The biggest advantage of the platform is that all sizes and transaction properties are displayed transparently. So it is easy, with a bit of practice, to plan an exact risk and start the investment.

- First, select the appropriate contract size for your investment. This starts at 0.01. You will see the current value next to it, and the margin (security deposit) will also be displayed directly to you. For leveraged products, the margin is much smaller than the contract value (maximum leverage 1:400), So you can move 1$ into your account with a maximum of 400$ on the market.

- Another great feature of the order mask is the display of fees. All costs, such as spread, commission, and daily swaps, will be displayed before the position is opened. So you can include the fees in your risk.

- Stop-Loss and Take-Profit are price levels in the market that automatically close your position. So the risk is limited, and the profit is secured.

The execution at XTB is very fast, as the broker sits directly near international trading centers (for example) Frankfurt. In addition, the forex broker brings, thanks to the current low-interest-rate environment in Europe, another advantage of no swap fees in some commodities or indexes.

(Risk warning: 76% of retail CFD accounts lose money)

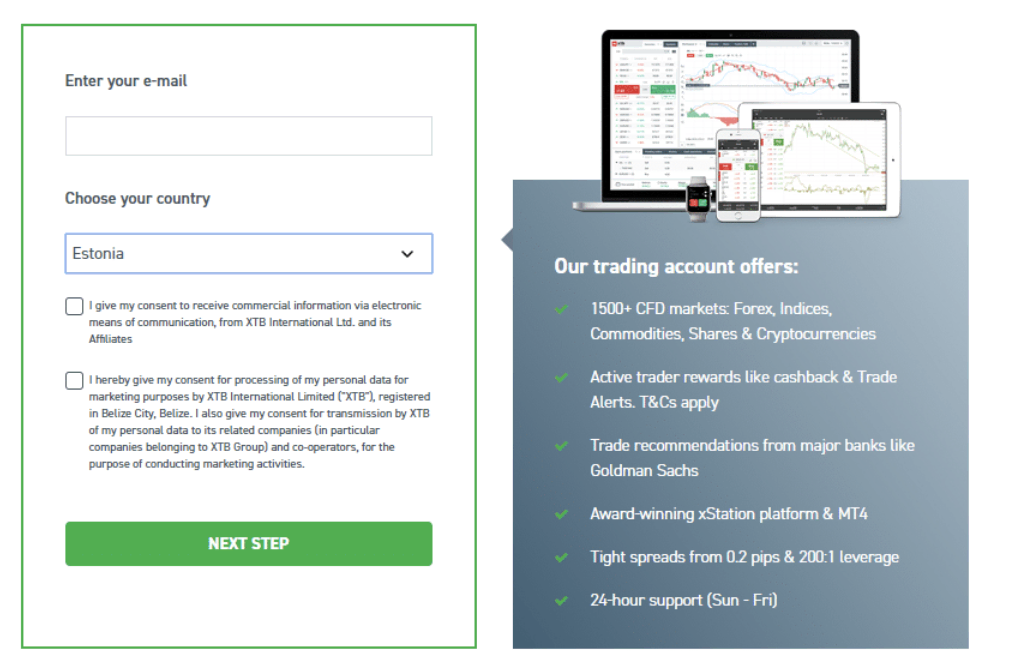

Uncomplicated deposit opening at XTB

How exactly does the opening of the deposit work? – As a trader, we naturally had to do this before trading for real money. A live account or demo account can be opened at XTB in just a few steps. True to the highest security and regulatory standards, the accounts are managed. The account opening took only a few minutes as the broker guides you step by step through the opening. For further questions, the support is always ready to help directly.

Free demo account for beginners and advanced traders

Nowadays, a free demo account is a must for any reputable broker. This is an account with virtual funds and simulates real money trading. So you can test the trading platform at your leisure. In addition, the demo account is perfect for practicing new strategies or backtesting. Traders can try out new markets or financial products without risk. Especially beginners benefit from this and gain their first experience on the markets.

The demo account is the best way for beginners to practice trading.

XTB offers a free demo account for 30 days. However, this only applies to new customers without registering a live account. Should you open a live account, you can benefit from unlimited demo accounts. In the dashboard, you can open as many demo accounts as you want. The demo account is filled with 10,000€ and can be reloaded at will.

(Risk warning: 76% of retail CFD accounts lose money)

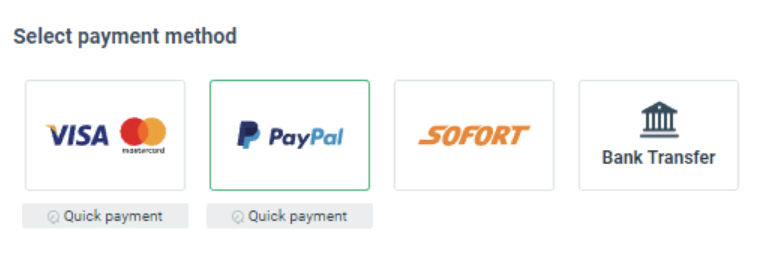

Review of the deposit and withdrawal of money

In this section, we tested the deposit and withdrawal of XTB. For traders, it is important to be able to carry out quick transactions of funds. Deposits should work without errors and in a few minutes. The payouts should be granted without any problems.

Overall, XTB is very well-positioned for client cash transactions. There are several methods available, including PayPal. This is a very big plus for the broker because this method is often in demand by traders, but not every broker can offer it. There are no fees for the deposit. At the payout, but you have to look more closely.

The broker gains further confidence in me through the fast processing of the transactions. Within a maximum of 3 days, payment will be processed. In most cases, it takes less than a day, and the payment is sent. In summary, there is a very good and recommended payment system at XTB.

Payment methods (depending on your country):

- PayPal

- Bankwire

- Credit Cards

- Electronic Payment Systems

- Payment within a maximum of 3 days

Is there negative balance protection on XTB?

The additional funding requirement is feared by every trader. In the past, there were such extreme events in the market that drove some account balances to a negative balance. Forex Brokers worked too badly or slowly. Thanks to tightened regulation, there is currently no additional funding requirement, not even with XTB. (only for EU traders)

How does XTB make money from you?

Fees and commissions are the bread and butter and the main source of income for most reputable trading companies, with added spreads on trades. XTB is no expectation. The most important you should be aware of are the inactivity fees after one year. It is worth noting that the fees at XTB are generally pretty low compared to other brokers.

The fees for trading on the platform

From our experience, the costs and fees are very low. For example, some brokers charge a direct fee of over 50 € for 90 days of inactivity. With XTB, one pays, for example, a maximum inactivity fee of 10 € after 365 days.

The fees for an order in the market are also very low compared to other providers. For example, trade the Dax at 0.7 points spread. For most traders, it pays 100% to switch to XTB.

Fees of XTB:

- 10$ inactivity fee after 365 days

- Markets spread for opening and closing positions

- Commission for CFDs

- Commissions for Stocks

Another important advantage of XTB is swap fees (financing fees). Currently, you are not paying any financing fees on stock indices overnight and on some commodities. Currently, it is the only broker to offer this advantage. If interest rates remain low, you will continue to pay no swaps.

(Risk warning: 76% of retail CFD accounts lose money)

Which type of support and service do they offer?

The last point in this review is the test of support. How good is the service for traders? – Since XTB has international branches worldwide, support is one of the best for each client. Professionally trained staff support you 24/5 during the week. The online broker even suggests that traders can make a visit to the branches. In addition, the company is represented at many trade fairs, for example, at the World of Trading in Frankfurt (Germany).

Compared to other companies, XTB offers the best service for its traders.

Support is available by phone, chat, or email 24/5. From my experiences and tests, you always get a very competent answer. In addition, after the opening of the account, a personal contact person will be in charge, who will introduce you to the world of XTB. The service at this broker is really great in comparison.

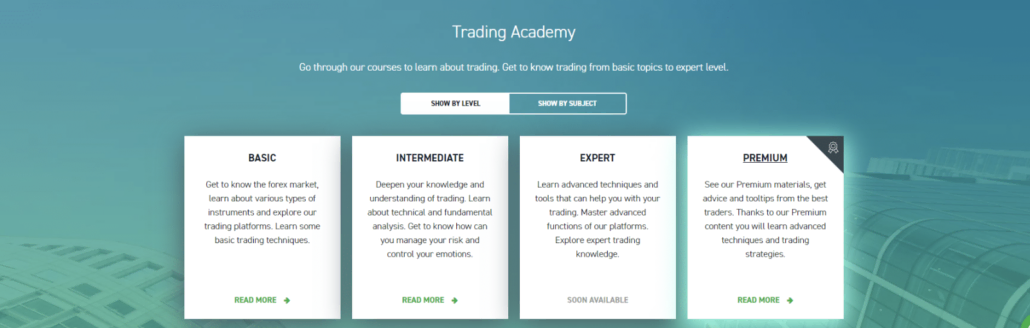

Professional XTB education and analysis

Market analyses are issued daily at XTB and sometimes even sent by email. You can read the market analyses directly on the homepage or on the xStation 5. Interesting trading ideas can be generated in this way or you are informed about important market events. The analyzes of XTB are professionally processed and quite suitable for their own application for trades.

Another service is the learning materials and training center of the broker. Videos, e-books, or webinars for customers are provided. Especially beginners will help enormously with this knowledge, but even experienced traders can benefit. In summary, XTB offers one of the best services for customers.

Unlike other providers, XTB is committed to providing its clients with sustainable and good knowledge. The more successful a trader is, the more the broker earns from the increased trading volume. It’s a winner for both sides.

The best support and service:

- 1 to 1 support for each client

- Education, coaching sessions, market analysis, and webinars for free

- 24/6 support per phone, email, or chat

- Professionally educated service employees

(Risk warning: 76% of retail CFD accounts lose money)

What are the best alternatives for XTB?

Capital.com

Capital.com can’t miss the list of XTB alternatives, as they are among their main competitors. Compared to other brokers, capital.com is an excellent choice for new traders thanks to an easy-to-use platform, extremely helpful educational resources, and very low spreads. Read our in-depth review of capital.com here.

RoboForex

Roboforex is the best alternative for intermediate to experienced traders, main thanks to the large variety of tradable assets and high leverage. You will find our detailed RoboForex test and review here.

Conclusion of our review: XTB offers a good overall package

Without question, XTB is one of the top online brokers for us. A change of your actual broker will be worthwhile for you because the fees and costs are very low compared to other providers. For example, a special bonus is the abolition of the abolished financing fees overnight.

The variety of over 5,800 – 6,200 (depending on your county) assets and various financial products is huge for the clients, and you will surely find your suitable market. The company is trying to expand its offer and add new markets. Recently, you can trade more than 40 different cryptocurrencies.

It is a regulated and licensed broker from Europe with a high deposit guarantee. In addition, the share of the company is listed on the Poland stock exchange. All this makes a very serious impression on us. Fraud could not be detected here.

Furthermore, every customer gets good service via support. For every trader, there are webinars and even 1 to 1 training. Expand your knowledge as a beginner and advanced. Try the provider in the free demo account now.

The advantages of XTB:

- A fully regulated and safe company

- More than 5,800 – 6,200 different markets (depending on your country)

- Very good trading conditions

- Spreads from 0.1 pips

- Direct market access

- One of the best platforms (xStation 5)

- No hidden fees

- Professional support and customer service

In conclusion, the broker XTB offers its traders a huge range of markets and a good service.

Trusted Broker Reviews

Experienced and professional traders since 2013(Risk warning: 76% of retail CFD accounts lose money)

FAQs – The most asked questions about XTB:

Is XTB a trustworthy brokerage?

XTB is a worldwide FX and Derivatives brokerage that was created in 2002 and has operational facilities in Warsaw and London. Multiple renowned regulatory agencies regulate this organization; therefore, you can be confident that it is fully secure and genuine.

Can you purchase equities or shares on XTB?

Can XTB be used to make investments in stocks? XTB now solely provides equity Derivatives trading. Approximately 1966+ worldwide equity CFDs, like Google, Fb, eBay, and Barclay, are available. Derivatives trading lets you speculate on an asset’s price without purchasing the actual stock.

Is it possible to purchase Cryptocurrency through XTB?

Clients of XTB may trade Derivatives using the most prominent coins, including BTC, ETH, LTC, and XRP. Aside from cryptocurrency trades, XTB also provides CFD trading in equities, currencies, metals, indexes, equities, and ETFs.

What is the least amount that I can withdraw from XTB?

XTB processes transfer using the SHA mechanism and pay the full fee imposed by the transmitting bank. The customer bears all other possible charges (Recipient and Mediator bank) in accordance with their respective fee rates.

See other articles about online brokers:

Last Updated on September 3, 2024 by Andre Witzel