5 best Forex Brokers & platforms for small accounts in comparison

Table of Contents

See the list of the 5 best Forex Brokers for small accounts:

Broker: | Review: | Minimum deposit: | Regulation: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | $10 | IFSC | 9000+ (36+ currency pairs) | + Many awards + Huge diversity + Many account types + Leverage up to 1:2000 + Bonus program + Low spreads + Low commissions + 9,000+ assets | Live account from $10(Risk warning: Your capital can be at risk) | |

2. Capital.com  | $20 | FCA (UK), CySEC (CY), ASIC (AU), SCB (BH), SCA (UAE) | 3,000+ (125+ currency pairs) | + Competitive spreads + No commissions (*other fees can apply) + High security + Multi-Regulated + 3,000 markets + Personal support + Education center | Live account from $20 by card(Risk warning: 75% of retail CFD accounts lose money) | |

3. FBS  | $1 | IFSC, CySEC | 500+ (40+ currency pairs) | + MT4 & MT5 + 24/7 support + Bonus program + Low spreads + Low commissions + Leverage up to 1:3000 + International trading | Live account from $1(Risk warning: Your capital can be at risk) | |

4. XTB  | $0 | More than 10 | 3000+ (48+ currency pairs) | + Low spreads + Leverage up to 1:500 + No minimum deposit + No hidden fees + Fully regulated | Live account from $0(Risk warning: 72% of retail CFD accounts lose money) | |

5. XM Forex  | $5 | IFSC, CySEC, ASIC | 1,000+ (55+ currency pairs) | + Cheap trading fees + No hidden costs + Regulated and safe + International trading + 1000+ assets | Live account from $5(Risk warning: 75.59% of retail CFD accounts lose) |

When you want to start forex trading, you have to register a trading account. The trading account has the trader’s details and is what the trader will use to deposit and access the forex market. There are various types of traders in the forex market.

Beginner, expert, and professional traders have different requirements, which is why forex brokers offer various account types to their brokers. There is a professional/premium/ prime account that has all the trading tools traders require.

There is a standard account designed for expert and/or advanced traders. There is also a mini/micro account that is often the smallest account for beginner traders. We will focus on the smallest trading accounts and the forex brokers that top the industry in offering the best small accounts.

What are forex small accounts?

These are accounts that forex traders can use to trade small positions in forex. It was originally designed for beginner forex traders who might not have the funds to open big positions. Most of the trading conditions, like the asset market and trading tools, are the same as those of the standard accounts.

The small accounts often have the name micro or mini trading accounts. They are the smallest account types that forex brokers offer. Most of its users are new traders, but expert and professional forex traders are also.

Properties of small accounts:

1. It has minimum deposits

Most mini and micro-accounts charge a small deposit to open a trading account. Some forex brokers don’t charge anything for a mini or micro-trading account. The average fee forex brokers charge is $10 to $50 for a small trading account.

2. It has small position sizes

The contract size makes the small trading accounts, such as the mini and micro-accounts. The Standard trading account usually has one lot for 100,000 units of currency. The mini trading account has a mini lot for 10,000 units, and the micro lot has 1000 units.

3. Limited account features

The small account types have trading tools that forex traders can perform technical and fundamental analysis. But, when you compare the small accounts to Standard and Premium accounts, it lacks some features.

Forex traders access more features when they advance to use the standard or premium accounts.

Advantages of having a small trading account:

- Low minimum deposits

- It has high liquidity since it’s easy to open and close small trading sizes.

- It can get used to practicing new trading strategies with low risks.

- It is available for new and experienced forex traders

- It is the best account to transition from the demo account.

- Traders use them to test the features of a forex broker when they are choosing a broker.

Disadvantages of a small trading account:

- Low profits per trade

- Limited financial markets

- Limited trading features

- Low leverage

- High forex spreads from some forex brokers

5 best forex brokers for small trading accounts in comparison:

1. RoboForex

It has had over 3.5 million clients in 170 countries since its launch in 2009. It is headquartered in Belize and has operated for more than a decade. Its users access 12000 financial instruments such as forex, indices, ETFs, commodities, stocks, and metals.

It has regulated by International Financial Services Commission in Belize.

Account types at Roboforex

It offers five types of trading accounts, and a Prime account has a minimum deposit of $10 deposits. The ECN account for experienced traders has a minimum deposit of $10.

R stocks trader has its trading platform with an initial deposit of $100. There is also the Pro and the Pro-cent account as the smallest accounts

Small trading accounts at RoboForex

Pro account

This account is one of the small accounts which beginning forex traders can open at RoboForex. It has a minimum deposit of $10 and a leverage of up to 1:2000. Forex traders can access metals, cryptocurrencies, CFDs on indices, US stocks, over 36 forex pairs, and oil.

Its users can open positions from 0.01 to 500 lots and floating spreads starting from 1.3 pips. Forex traders can access a swap-free trading account and free deposits and withdrawals. They also get trading bonuses and an account history of 1 year.

Pro-Cent account

It is a trading account that beginner traders start with as they move from the virtual currency to the live trading account. You can open it with a minimum deposit of $10, and you can open positions starting from 0.1 to 10,000 lots.

It has floating spreads from 1.3 pips, and a leverage of up to 1:2000. Bonus on this account goes up to 1.5% for cashback and free deposits and withdrawals. Its users can get swap-free trading accounts and trading history for a month.

(Risk Warning: Your capital can be at risk)

Trading fees

Trading costs vary with the account types the Prime and ECN accounts have low forex spreads starting from 0.0 pips. R stocks trader has forex spreads from 0.1 pips, the Pro and Pro-cent with 1.3 pips.

The Pro and Pro-cent have no commission, whereas the ECN and Prime account commissions differ with the assets traded. Dormant accounts for more than a year have an inactivity fee of $10, and there is also an overnight fee charged according to the Position size using leverage.

Deposits and withdrawals are free, and traders can fund their accounts by bank transfer, credit/debit cards, and e-wallets.

Features of Roboforex:

- New traders can start from its variety of demo accounts, demo Pro, demo Rstocks Trader, and demo ECN

- It has four types of trading platforms; MT4, MT5, c Trader, and R stocks trader.

- Traders can access MQL4 and MQL5 algorithmic trading from MT4 and 5.

- These trading platforms offer advanced trading charts, more than 50 technical indicators, fast execution rates, and hedging options for the MT5.

- There is the copy FX for social/ copy trading, which is among the best copy trading features in the industry.

- Its users can get the Expert Adviser features to work during automated trading for the best trading experience.

- Its trading features are available via mobile, desktop, and website versions.

- The Virtual private surfer runs 24 hours that are available for qualifying clients

- Educational resources are in videos covering various trading strategies and topics about financial markets.

- Research offered ranges from the strategy builder, news feeds, and over one-year trading history.

- Customer support is available 24/7 in 10 languages and more via phone calls, emails, live chat, and social media platforms.

Pros of Roboforex:

- Low trading fees

- Fast execution rates

- Several trading platforms

- Negative balance protection

Cons:

- It is unavailable in many countries

(Risk Warning: Your capital can be at risk)

2. Capital.com

It is a forex broker founded in 2016 with six global offices and serves over 500,000 traders. Its traders access over 3,000 trading instruments, cryptocurrencies, commodities, forex, shares, and indices via CFDs.

(Risk warning: 75% of retail CFD accounts lose money)

Registration

- Financial Conduct Authority – FCA in the UK

- Cyprus Securities and Exchange Commission- CySEC

- Australian Securities and Investment Commission – ASIC

- SCB – Bahamas

- SCA UAE

Trading fees

Trading accounts at Capital.com have forex spreads starting from 0.6 pips and a leverage of 1:30. It has an overnight fee charged according to the size of the trading position.

Deposits and withdrawals are free through bank transfers, credit/debit cards, and e-wallets. It is a no-commission forex broker and has no trading commissions.

(Risk warning: 75% of retail CFD accounts lose money)

Features of Capital.com:

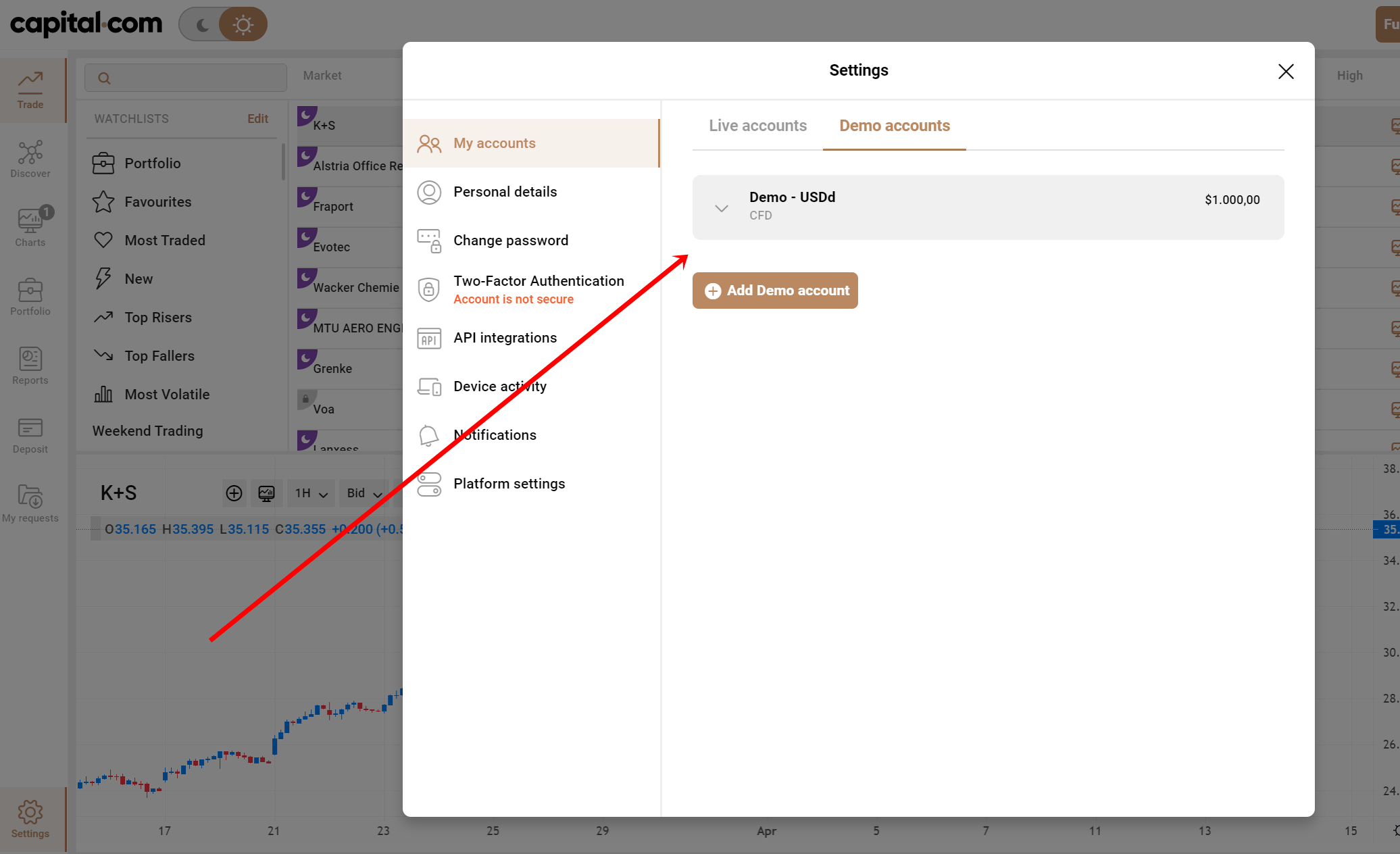

- The demo account is free to use for any trading account type.

- It has integrated MT4, its proprietary platform, and web trader trading platforms

- It has access to several charting software and zooms in and out of different time zones.

- Over 75 technical indicators and drawing tools for market analysis

- It offers risk management tools such as take-profits and stop-loss

- Research tools include Trading Central, which has trading ideas and signal analysis from an expert.

- An educational library has videos, articles, courses, webinars, charts, and analyses of various markets.

- The investment app has educational materials and videos.

- Customer support is present in eight languages 24/7 via live chat, phone calls, and email.

Pros of Capital.com:

- Zero commissions (other fees can apply) and competitive forex spreads

- Numerous trading tools

- Industry-leading educational materials

- Low initial deposit

- Regulation from tier 1 institutions

- Responsive customer support is available 24/7

- Negative account protection

Cons:

- Limited access to financial markets

(Risk warning: 75% of retail CFD accounts lose money)

3. FBS

This forex broker has had over 17 million forex traders since it got launched in 2009. It is available in 150 countries and over 170 trading assets, including metals, energies, stock indices, cryptocurrency, and forex.

Regulation

- Cyprus Securities and Exchange Commission

- International Financial Services Commission in Belize

- Australian Securities and Investment Commission

- Financial Sector Conduct Authority of South Africa

Account types in FBS:

FBS has a wide variety of trading accounts custom-made for various levels of forex traders. Zero Spread account for volume traders has an initial deposit of $500. The Standard trading account has a minimum deposit of $500 for average traders.

ECN account with a deposit of $1000 and forex leverage of 1:500. The Cent and Micro accounts are the smallest accounts designed for new traders or any other trader wishing to trade small volumes.

Small trading accounts:

Cent account

It is a trading account that forex traders can start trading using cents. Its minimum deposit is $1, and you can open trading positions starting from 0.01 to 1000 cent lots. It has maximum forex leverage of 1:1000, and you can open up to 200 trading positions.

The Cent account has no commissions charged, and floating spreads start from 0.01 pips. Its users access forex, energies, stocks, indices, and metals. It uses the MT4 / MT5 trading platform, and traders can exchange for a swap-free trading account.

Micro account

It is another trading account that has an initial deposit of $ 5. It has no commissions on trades and forex spreads starting from 0.3 pips. Its users can use forex leverage of up to 1:3000 and open trading positions from 0.01 to 500 lots.

The maximum number of open positions allowed is 200, using the Meta Trader 4 trading platform. Traders can access a swap-free trading account and trading bonuses like its 100% deposit bonus. It offers access to trading instruments such as forex and metals.

(Risk Warning: Your capital can be at risk)

Trading fees

FBS has low forex spreads for the standard accounts from 0.5 pips, Zero Spread, and ECN from 0.0 pips. The Standard, Micro, and Cent accounts have no commissions, but the Zero spread has commissions of $20 per lot traded.

The ECN account also has commissions starting from $6 per traded lot. There are also overnight fees for positions opened overnight using leverage, charged according to the size of the position. An inactivity fee of $ 10 is charged for dormant accounts for over a year.

Deposits and withdrawals are free through credit and debit cards, bank transfers, and digital wallets.

Features:

- A demo account that forex traders use to test its trading features.

- It has integrated MT4 and MT5 trading platforms, offering industry-leading trading tools.

- Its users can access a wide range of technical indicators, drawing tools, charts, hedging options, MQL4/ MQL5 algorithmic trading features, and more.

- FBs has industry-leading copy trading software which expert traders can use to earn money as they trade.

- Research and analysis from news, daily trading videos, and the economic calendar.

- Traders can access the FBS trading platform has a mobile app, a desktop, and a website version.

- It has extensive educational material through guidebooks, articles, live events, videos, courses, and webinars.

- Customer support is available in 5 languages via email, live chat, and phone calls.

Pros:

- Comprehensive educational resources

- Industry-leading copy trading features

- Low minimum deposits

- Advanced trading tools from MT4 and 5 trading platforms

- Negative balance protection

- High leverage of 1:3000

Cons:

- Limited trading instruments

(Risk Warning: Your capital can be at risk)

4. XTB

It is a publicly-traded forex broker founded in 2002 and has a long track record of serving more than half a million forex traders. It has 30 physical offices and more than 1500 trading instruments such as indices, stocks, CFDs, ETFs, commodities, and forex.

Regulation

- International Financial Services Commission

- Polish Securities and Exchange Commission

- Financial Conduct Authority of the UK

- Cyprus Securities and Exchange Commission

Account types at XTB:

XTB has two types of trading accounts, the Pro and standard accounts. The pro account is for professional traders who qualify for some conditions to register.

Small accounts on XTB:

Most clients at XTB open the Standard account has features to accommodate various levels of traders. It has no minimum deposit, forex traders can access financial markets such as indices, cryptocurrency, commodities, stock CFDs, ETF CFDs, and forex.

Forex spreads start from 0.5 pips, and traders can open trading sizes from 0.01 pips. It also has a leverage of up to 1:500, which varies with the market. Traders can access financial markets using the X station 5 trading platform.

(Risk warning: 72% of retail CFD accounts lose money)

Fees:

Forex spreads start from 0.1 pips, and it has no commissions on Commodities, forex, indices, stock, and ETF CFDs. The pro account has forex spreads starting from 0.1 pips and commissions of $3.50 per traded lot. An inactivity fee of $10 gets charged every month after a year of inactivity.

Withdrawals and deposits are free via bank transfers, digital wallets, and credit/debit cards.

Features:

- The demo account is free for one month and has $100,000 virtual money.

- It uses its X station 5 trading platform that has competitive trading tools.

- Its platform offers technical indicators, risk management tools, a stocks screener, a trading calculator, and several charts.

- Educational content has segments from basic to advanced level content.

- Its users can learn through videos, articles, courses, and live webinars on the platform.

- The market analysis section has the market sentiment, heat maps, and more analysis tools.

- Their customer support is available 24/5 in 16 languages through phone calls, live chat, and emails.

Pros:

- It has a long track record of serving clients

- Low spreads and commissions on traders

- Fast execution rates

- Quality research tools

- It is available in many countries

Cons:

- It does not support MT4 and 5

(Risk warning: 72% of retail CFD accounts lose money)

5. XM

It is a forex broker serving over five million forex traders in 200 countries since its launch in 2009. Its users can access over 1000 trading instruments like stocks, indexes, metals, CFDs, commodities energies, and forex.

Regulation:

- Australian Securities and Investment Commission

- International Financial Services Commission in Belize

- Cyprus Securities and Exchange Commission

Account types at XM:

It has four types of trading accounts, Standard accounts with a minimum deposit of $5. The Shares account has a minimum deposit of $10,000. XM Ultra-low and the Micro accounts are the small accounts on XM.

Small accounts:

XM Micro account:

It is a trading account that ushers traders to live trading after practicing on the demo account using virtual money. Forex spreads start from 0.1 pips, and its users can access leverage of up to 1:888 for an account balance between $5 to $20,000.

The minimum position size you can open starts from 0.1 lots, and traders can open up to 300 positions. The initial deposit required to access this account is $5, and it has no commission.

XM Ultra-Low account:

This account has forex spreads starting from 0.6 pips with no commission. Users can open position sizes starting from 0.01 lots and access leverage 1:888 for account balances up to $20,000. It also has an option of exchanging for a swap-free/Islamic account.

Its users can open up to 300 trading positions, and hedging is allowed. Forex traders get negative account protection on their trades using this account.

(Risk warning: 75.59% of retail CFD accounts lose)

Trading fees:

Forex spreads at XM start from 1.0 pips in most trading accounts, and commission is charged only for the Shares account. It has average leverage of 1:888 and an initial deposit of $5, except for the shares account, which has a minimum deposit of $10,000.

Traders have to pay a $15 inactivity fee if their accounts remain dormant for over a year. Deposits and withdrawals are free, and traders can make these transfers via bank wire, electronic wallets, and credit/debit cards.

Features:

- Its demo account has over $100,000 in virtual currency that traders can start trading.

- It uses the Meta Trader 4 and 5 trading platforms to access financial markets.

- The trading platforms have more than 1000 trading instruments, drawing tools, various charts, and more than 80 technical indicators.

- Its users can access research materials such as its comprehensive economic calendar, daily reports, articles, videos, and trading signals.

- It has a mobile app, desktop, and web versions integrated with the MT4 and 5 trading platforms.

- You have educational resources, like articles and videos.

- Their customer support team is available 24/5 in 23 languages through live chat, emails, and phone calls.

Pros of XM:

- Industry-leading research and educational materials

- Quality trading resources

- Fast registration process

- Low trading costs

- The low initial deposit of $5

Cons:

- No negative account protection for non-EU clients

(Risk warning: 75.59% of retail CFD accounts lose)

Conclusion – Small accounts are ideal for getting started

One of the few ways forex traders can survey a trading platform is through micro or mini accounts. These accounts also allow new traders to use a live trading account. It has low risk, so traders can learn to control their emotions from small trading sizes.

The small account types are beneficial to all traders since even experienced traders use them to test out trading strategies. They are also affordable, considering one can trade using $100, which is impossible for some standard accounts.

FAQ – The most asked questions about Forex Brokers for small accounts :

Is trading forex profitable for new traders?

Yes, if the new trader utilizes educational materials and has patience. Forex trading has challenges, and many traders give up after some time. It is also profitable for traders with discipline and analytical skills.

How much do I need to invest in profits using the mini account?

It depends on the type of forex broker and the amount you expect as profits. For the mini accounts, you require a minimum deposit of not less than $800. It is to cater to the trading costs and cover the risk of what you might lose if you want to risk $200 per trade.

How much is one mini lot in forex?

A mini lot is 10,000 units of the base currency you are trading. An example of US dollars for one mini lot is 10,000 units of USD which is $1 per pip.

Can a small account trade forex?

The use of mini lots that are smaller trading sizes is made possible by a mini forex account for newbies. Mini lots are a tenth the capacity of ordinary lots, which means they signify 10,000 currency units rather than 100,000.

What size does a tiny forex account have?

While some forex brokers ask for a $50 first deposit as a minimum to create an account, others let you open an account with no initial investment. You could start trading with a specific quantity of capital.

What are the restrictions on a small Forex account?

Trading with a small account is considerably harder than with a big account. Small accounts lack this buffer, whereas large accounts are protected from errors, sudden losing streaks, and occasionally even poor traders.

How can a small account be grown in forex trading?

Profitable forex trading is one approach to building a small account, although if you’re being cautious and following the 1% risk guideline, the growth may happen more slowly than you’d like. You could engage in higher-risk/higher-reward trading, but doing so would put your account at risk of being completely wiped out.

Last Updated on July 25, 2024 by Andre Witzel

(5 / 5)

(5 / 5)