Capital.com review: Is it a scam or not? – Real broker test for traders

Table of Contents

Review: | Regulation: | Markets: | Min. deposit: | Spreads from: |

|---|---|---|---|---|

(5 / 5) (5 / 5) | FCA (UK), CySEC (CY), ASIC (AU), SCB, SCA (UAE) | 3,000+ | $ 20 by credit card | 0.3 pips without commission (other fees can apply) |

Capital.com is a unique CFD broker trading and investment platform that provides a series of services to its users. The headquarters are in Cyprus, and the company also manages branches in other countries. The global CFD broker has a rising customer base and becomes more and more popular. We have tested the provider Capital.com in detail and will tell you about the results in the following article. Learn about the trading conditions, platform, and assets to trade. Is it really worth investing your money there? – Find out in the following sections.

What is Capital.com? – Introduction

Capital.com is a Forex and CFD Broker platform where users can trade CFDs on the basis of cryptocurrencies, foreign exchange, forex, where you can trade real stocks and stock CFDs, and also different kinds of markets. Capital.com was founded in 2016 and is authorized and regulated by the CySEC, FCA, ASIC, and FSA. Its users can trade on more than 3,000+ different financial CFD instruments. It provides its users and traders to learn at the same time by providing technical analysis and AI-based reviews on their trades.

It has got an immense amount of users within no time due to its simple interface and the dedicated team. It also makes its users aware of the current market potential through its qualified team of economic, political, and psychological experts. This feature of capital.com makes it unique from competitors and helps its users to flourish their growth exponentially.

Apart from providing multiple markets of the world, it also educates its users by giving them video lecture series and providing feedback through the use of artificial intelligence (AI) on their trades. The platform offers a demo account for practice and has a crystal clear deposit and withdrawal process. It has about 285,000 active users. This platform lays great stress on the future bullish markets of electric vehicles and robotics due to the challenges posed by global warming.

Facts about the company:

⭐ Rating: | 5 / 5 |

🏛 Founded: | 2016 |

💻 Trading platforms: | Desktop Trader, MetaTrader 4, TradingView, Capital App |

💰 Minimum deposit: | $20 (by Card) |

💱 Account currencies: | USD, EUR, GBP, JPY |

💸 Withdrawal limit: | No |

📉 Minimum trade amount: | $1,000 trading volume / 0.01 lot |

⌨️ Demo account: | Yes |

🕌 Islamic account: | Yes |

🎁 Bonus: | No |

📊 Assets: | Forex, Indices, Commodities, Shares, Cryptocurrencies via CFDs |

💳 Payment methods: | Bank transfer, Credit- debit card, ApplePay, GooglePay, local payment methods |

🧮 Fees: | Starting at 0.3 pip spread, variable overnight fees (other fees can apply) |

📞 Support: | 24 / 7 support via chat, e-mail, and phone |

🌎 Languages: | 29 languages |

(Risk warning: 67% of retail CFD accounts lose money)

Regulation of Capital.com

Financial regulation is a form of regulation or supervision which subjects financial institutions to certain requirements, restrictions, and guidelines, aiming to maintain the stability and integrity of the financial system. Capital.com is an award-winning platform that keeps regulations of paramount importance for any trading and broker platform.

- FSCS (Financial Services Compensation Scheme) up to 85,000 pounds for FCA regulation (available for retail clients only)

- ICF (Investor Compensation Fund) for CySEC regulation up to 20,000 EUR available for retail clients

Capital.com (UK) Limited is registered in England and Wales with company registration number 10506220, authorized and regulated by the Financial Conduct Authority (FCA) under register number 793714. Capital.com SV Investments Limited is a regulated Cyprus Investment Firm, registration number HE 354252.

The Capital.com group is regulated by the following:

- Regulated by CySEC (Cyprus)

- Regulated by FCA (UK)

- Regulated by ASIC (Australia)

- SCB

- SCA in the UAE

What are the pros and cons of Capital.com?

Capital.com is on of the biggest players in the markets with millions of loyal users around the world, but that doesn’t necessarily need it is also the best fit for you. To help you make an informed decision, you will find some of our favorite pros and cons below.

Pros of Capital.com | Cons of Capital.com |

✔ Awarded platform with artificial intelligence | ✘ Account deposit with cryptocurrencies not possible |

✔ Huge variety of 3,000+ markets | |

✔ Compliant with the PCI standards security council | |

✔ Regulated in the UK, Cyprus, Seychelles, and Australia | |

✔ Low spreads and no commissions | |

✔ Low minimum deposit of 20 EUR/USD/GBP (by Card) | |

✔ Excellent ratings on Trustpilot |

Does Capital.com offer a user-friendly platform?

Next, we will take a closer look at the usability of the platform, which is one of the key factors for new beginners, in our opinion. One of the broker’s strengths is undoubtfully their vast variety of educational material, but there are more questions to it, such as how easy it is to open a demo account, the design and structure of the site, page loading speed, security aspects, and much more. In the table below, we take a look at the usability of Capital.com

Criteria | Rating |

General Website Design and Setup | ★★★★★ Locigal structure of the site and the app and Webtrader also have a very intuitive structure |

Sign-up Process | ★★★★★ The easy sign-up process for a demo account and very fast approval for a live account (less than 1 hour in our test) |

Usability of trading area | ★★★★★ Trading area is very easy to use and has plenty of options when it comes to trading platforms |

Usability of mobile app | ★★★★★ The capital.com app for Android and IOS devices is one of the best on the market and enables you to trade from anywhere without sacrificing anything. |

Capital.com trading conditions and offers for traders

Trading conditions are the principal trading terms in CFDs. They may include Margin, Spread, offers, Swaps, Initial Margin, Necessary Margin, Normal Market Size, the minimum level for placing Stop Loss, Take Profit, and Limit Order. Capital.com has clearly mentioned the trading conditions for its users.

(Risk warning: 67% of retail CFD accounts lose money)

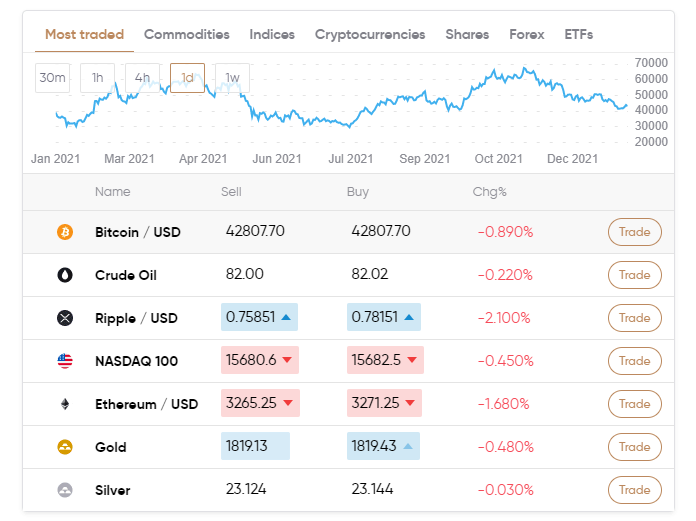

Spreads and markets

In trading, it is the difference between the buy (offer) and sells (bid) prices quoted for an asset.capital.com has a policy of charging users on the basis of spread. Spread betting (only for traders from the UK) is also used to speculate on upward and downward market moves. Appreciate the opportunity to go long or short on a wide range of markets, including forex, shares, commodities, and indices, with leverage and tight spreads. People that are new are correctly trained by the great platform. Minimum spreads for various markets start from 0.004 in stocks, 0.07 in indices, commodities 0.018, and currencies 0.7 pips. (Tested on 13.01.2022)

- Spread depends on the market you trade

- No commissions

The following markets are available with Capital.com:

- Forex (currencies) CFDs

- Commodities CFDs

- Metals CFDs

- Stocks CFDs and real Stocks for the UK and some EU countries

- Indices CFDs

- Cryptocurrencies CFDs

- Bonds CFDs

In order to provide quality services to its users, capital.com has applied certain conditions:

- The minimum deposit amount has been fixed by the broker

- The user has to verify their address and personal identification in compliance with the rules of its regulators.

- User’s funds will be returned if they do not provide verifications within 15 days of creating an account

- The size of the potential loss is limited to the size of the deposit made by the user.

Conditions overview:

Capital.com provides a free demo account or a live trading account with a minimum deposit of $20 by credit card and $250 by wire transfer. Trades are executed by their own developed trading platform. The software is available for browsers, desktops, and mobile devices. More than 3,000+ markets are available to trade with variable spreads and no commissions. Traders are supported in more than 24 languages. Overall, capital.com has a very good offer for new and advanced traders.

- Minimum deposit is $ 20 by credit card and $ 250 by wire transfer

- Free demo account

- Maximum leverage 1:30 for retail clients

- Personal support in more than 25 languages

- Professional trading platform for desktop, browser, and app

- A lot of different payment methods

- No hidden fees

- More than 3,000+ markets are available via CFD

(Risk warning: 67% of retail CFD accounts lose money)

Test of the trading platform Capital.com

Capital.com has a very unique and easy interface, which makes its users trade and explore all the options and platforms available on this platform. Capital.com has a number of trading platforms.

- Web platform

- MetaTrader 4

- TradingView platform

- Mobile app

Web platform

Capital.com has designed a very simple and unique layout for its users. It has a live view of stocks and currencies prices along with charts at the bottom to analyze the specific coin or trade. There are five options on the top left corner of the web platform for the users.

- Trade: About a particular pair

- Discover: Series of coins and pairs

- Charts: To analyze the technical analysis

- Portfolio: To view the trade pairs and overall balance

- Reports: Reports about the recent market’s potential.

It also has an implied view to look at the top gainers and top losers coins to get an idea of the current situation of the market, which helps its users to critically analyze the market. On the bottom left corner of the web platform, there are settings where one can see its verification status, password, and other personal details that need to be kept secret. One can also set platform settings by changing layout, languages, and time zone along with chart types.

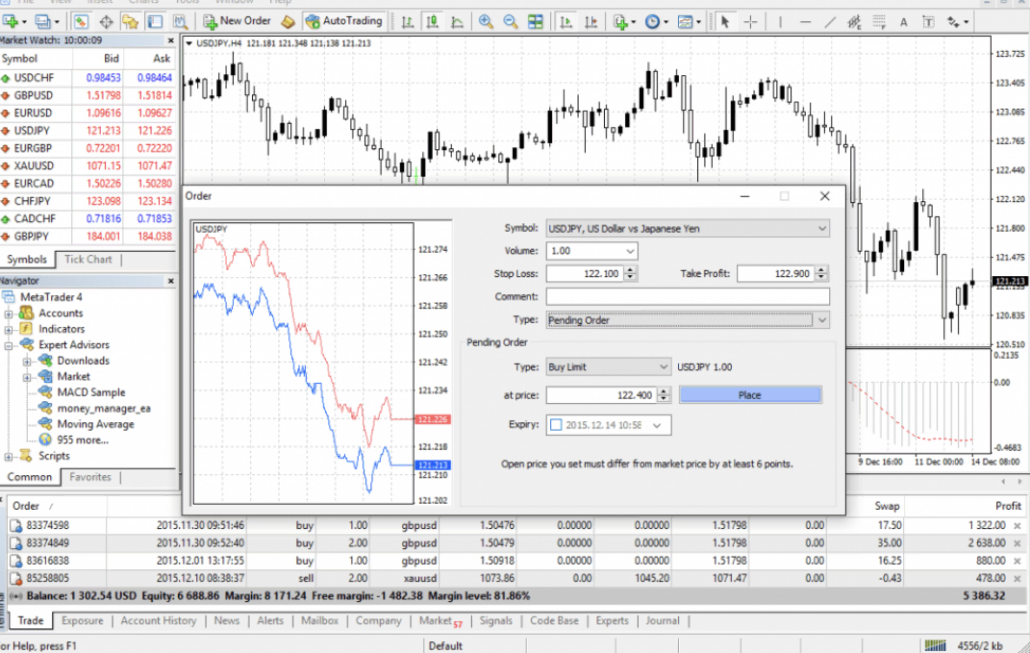

MetaTrader 4

Captial.com has also partnered with MetaTrader 4, which is probably the best fit if you are looking for a highly customizable trading platform. The platform is equipped with many professional-grade features. Some of the key features of MetaTrader 4 are:

- 85 pre-installed and customizable indicators

- Professional analysis tools and additional Smart Trader tools

- Lightning-fast order execution

TradingView

Tradingview is one of the world’s most popular charting and trading platforms and offers everything a professional trading platform needs. Personally, we like the advanced technical analysis tools and easy-to-use interface.

(Risk warning: 67% of retail CFD accounts lose money)

Mobile app

Compared with traditional websites, companies having mobile apps are more likely to increase their business sales and provide ease to their users. Capital.com has made a step in the right direction by making a unique and easy app compared to its competitors. It is easily available on Android and ios to Play stores. The size of the app is merely 19 MB and has about 1 million or more downloads. This app is specially designed for users that do a lot of traveling so that they can do trading with it. The app is very easy to use and has all the latest features and news in it.

- The app has live price action for every commodity

- Users can see the portfolio of their account instantly

- Users can search any Paris of trading in the search bar

- Recent news and updates can also be accessed from the app

- A watch list for the portfolio can also be created to remain vigilant

- Different markets can be accessed from the top of the app

Charting and analysis

To trade in Stocks, Forex CFDs, or even Crypto CFDs, it is imperative to know and understand price and market movements that can only be learned from Technical Analysis. Charting and analysis is the first and foremost thing to becoming a balanced trader. People having no sense of charting and analysis are likely to lose earned money due to inexperience and lack of technical knowledge. Capital.com has come up with an ambitious plan to give them proper guidance and a video lecture series. Technical analysts claim that markets do trend and that by charting market prices, you can control commodity price risk management.

They further claim that combining the use of price charts with appropriate marketing tools and pricing strategies could have a major positive impact on your potential profitability and, therefore, the long-term survival of your business. Charting can be used by itself with no fundamental input or in conjunction with fundamental information. You will find that as you become more skilled in charting and technical analysis. This will lead to more confidence in making those very crucial marketing decisions. Capital.com has launched an app that helps its users to get enough knowledge and technical skills to become good traders.

(Risk warning: 67% of retail CFD accounts lose money)

Account opening at capital.com

Account opening is not an arduous task. It takes hardly 30 seconds to make an account. All you need is a working email, and you have to provide personal information to complete the registration process. The registration process can be completed after clicking the verification email sent to the user, and the user can trade and enjoy the easiest platform to trade with. The application for a live account is very straightforward as well, and it took the support team less than one hour to approve the live account. Unlike other brokers, capital.com offers only one type of account and no multiple options with different minimum deposits, which makes to process very simple but also less flexible.

(Risk warning: 67% of retail CFD accounts lose money)

Note: You can only open one account per person.

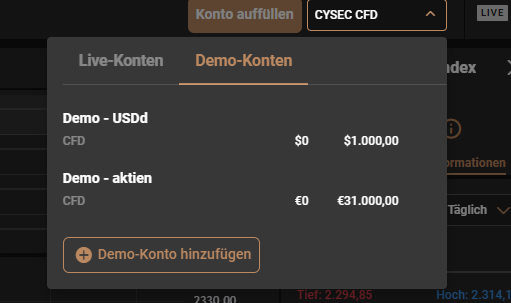

Capital.com demo account review

A demo account is an account that is offered by capital.com to help its users to practice and then trade after having practical experience in the demo account. While switching to a demo account from the website, users instantly get $10.000 for trading. You can top up with another $10.000 if you want.

The following are the various benefits of a demo account:

- It allows you to see how price action develops and understand the risks inherent in leverage

- It allows you to understand how the platform works and get a feel for the broker’s trading conditions

- It allows you to develop trading strategies

“Make better products, seek negative feedback, and ditch those PowerPoint presentations.” Elon Musk

Drawbacks of the demo account:

- Users cannot develop the healthy fear they need while trading

- You won’t see how you will really act when you are risking real money

Review of deposit and withdrawals:

Deposit and withdrawal policies of the different brokers are very important factors, and we will take an in-depth look at capital.com now. Below, you will find an overview of accepted payment methods for deposit and withdrawal. Depending on your location, there might be additional payment methods available, but these are the most important ones.

- Bank transfer

- Credit- debit card (Visa and Mastercard)

- ApplePay

- GooglePay

Is also worth mentioning capital.com will never charge you any deposit or withdrawal fees, however, some additional charges from your financial institution may apply depending on your payment method.

(Risk warning: 67% of retail CFD accounts lose money)

Deposits on Capital.com

The broker community and traders are often blamed for making false claims and mismanagement of the user’s money. However, capital.com comes with an idea to present clear transparency while keeping the user’s money. All the money of users is kept in separate bank accounts, and a compensation policy set by our regulators is also offered by capital.com.

The minimum deposit made by the user account varies depending on their account type. The minimum deposit is 20 EUR, 20 USD, 20 GBP, or 100 PLN for all payment methods except wire transfer to capital.com.

Note for wire transfers:

The minimum deposit is equivalent to or more than €250

Withdrawals on Capital.com

Capital.com has provided a clear and transparent method of taking money out of their accounts. However, capital.com has made a clear policy to ensure transparency, as the withdrawal will be credited into the account by the same method from which the funds were deposited. Capital.com instantly sends the funds after proper verification from the users to ensure the safety of the funds. In compliance with our regulators, the users have to provide their verification and address. If the users fail to provide their verification, all the deposited money will be re-credited to their account from where the users deposited the money in the capital.com account.

Note:

Withdrawals are made in the timeframe of 1 – 3 working days.

Is there a “negative balance protection”?

Yes, negative balance protection is also offered by capital.com to protect its untrained users from losing their investment money due to market volatility as a requirement under the regulations. The plus point is that by using Margin Call or Stop Loss, the negative balance protection can save you from falling into a negative balance. Another good support for this type of protection is that while bearing in mind that it holds a very high risk of failure, you can theoretically opt for high loss if the stop loss is not activated. The fact that captial.com offer negative balance protection shows the credibility and positive approach of capital.com toward its users.

How does this broker make money from you?

The fact that the broker is very open and transparent about the fee structure is a good sign. All the information you need is easily obtainable on the website. There are three main fees on which capital.com will make money from you.

- Spread: The added difference between the ask and the bid price. How high the spread is depends mainly on the instrument you trade.

- Overnight fees: If you hold a position after the market is closed, you will usually pay an interest fee to keep the position open outside the market hours. How the fee is calculated and wheater you pay or receive it depends on a variety of factors. On capital.com, the fee is calculated based on your margin instead of the full value of the position. This results in lower overnight fees.

- Guaranteed stop premiums: You have to option to protect your trades again slippage. This is completely optional but gives you more peace of mind when trading. If you choose to protect your positions with a guaranteed stop, you will pay a small fee every time the stop is triggered. Depending on the instrument, the fee will vary between 0.01%-0.5% of the total value of the position.

(Risk warning: 67% of retail CFD accounts lose money)

Overview of the educational section at Capital.com

Because it is one of their features that makes capital.com so great, we will dedicate this section to the exceptional variety of educational material you will find on their site. From training videos to a range of articles, live webinar, and even their own educational app, Captial.com has everything you, as a new trader, could ask for.

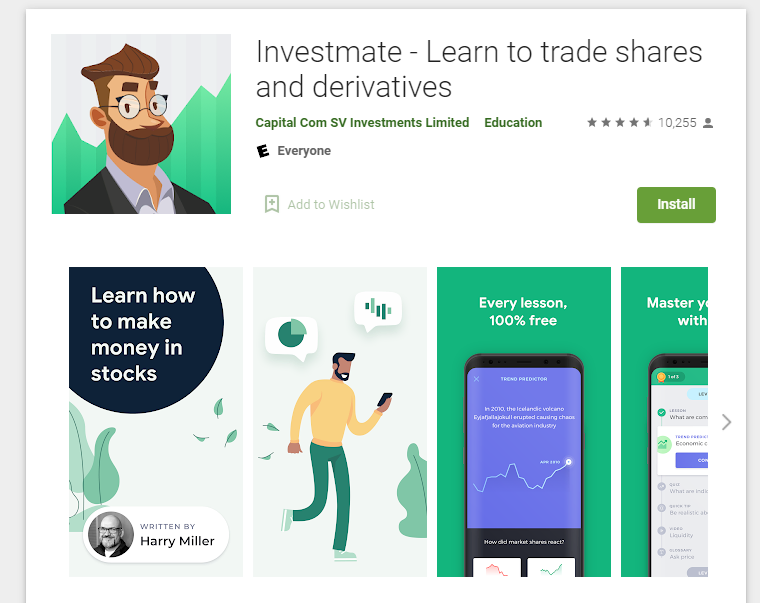

Investmate – Learn to trade shares and derivatives

It is basically an education-based app to help users to become familiar with trading tools and techniques. It is easy to use and install. Upon downloading the app, it asks the user about their currency understanding that helps the users to start from that point:

- Learn the ABCs of finance

- Learn how to predict trends

- Become an expert in CFD trading

No other competitor has been able to carve out such an ambitious plan to help the users. The app is designed in such a way that knowledge is divided into four levels. Upon completion of the lesson, a quiz is conducted to pass on to the next level.

This app also has a live price chart of multiple markets to have a look at the current market scenario. The app also incorporates news, webinars, and list of trading currencies, a trading strategy guide, and an economic colander as well.

Capital.com teaches users how to trade

Trading is a blend of analysis, knowledge, and techniques. Trading has been very lucrative among people due to its volatility. Everyone wants to earn money through trading and loses a lot of money during this process. Hence, capital.com has come up with an idea to teach people trading through their AI techniques and ideas. All other brokers do not have these services that capital.com provides to its users.Capital.com provides step by step guide about trading by using its easy interface. It provides guidance for a series of markets.

- CFD training guide

- Shares training guide

- Commodities training guide

- Forex training guide

- Crypto training guide

- Indices training guide

- Trading psychology guide

Capital.com also provides online finance courses on trading. It includes:

- Introduction to the financial market

- Financial instruments for technical analysis

- The ABCs of CFDs

- Understanding the risks of trading

- Leverage and margin

Capital.com makes use of artificial intelligence to help investors and traders with their strategies, and proper feedback is given to its users to improve their strategies and enhance their knowledge about online trading.

Support and service of Capital.com

Support and service is the paramount factor for any business to grow and flourish. Capital.com has worked day and night to provide ease to its users by providing prompt responses to the users of their relevant queries.

The support team provides a response to users within 24 hours

Support of capital.com has a team of versatile people that can speak 24 languages to assist people from different areas of the world. Capital.com provides services to its users in various forms:

- Teaching how to trade CFDs

- 24/7 trading facility

- Special team for news and updates

- Protection of funds

- Multiple markets under one platform

- Vigilant support team to assist the users

Support: | Live-Chat: | Phone: | E-Mail: | Languages: |

|---|---|---|---|---|

24/7 | Yes | +44 20 8089 7893 | More than 24 |

Accepted countries and un-accepted countries

Capital.com provides services to major trade volume countries. There are almost 50 countries that capital.com is offering its services at the moment, and they are the United Kingdom, Mexico, Monaco, Oman, Netherlands, Norway, Pakistan, Philippines, Portugal, Qatar, Romania, Slovakia, Spain, Sweden, Switzerland, Thailand, United Arab Emirates, Argentina, Austria, Bahrain, Armenia, Bulgaria, Chile, Croatia, Cyprus, Czech Republic, Germany, Estonia, Finland, Georgia, Germany, Gibraltar, Greece, Hungary, Iceland, Indonesia, Ireland, Italy, Kuwait, Latvia, Liechtenstein, Lithuania, and some more

All other countries from all continents are not illegible to trade at capital.com.

What are the best capital.com alternatives?

Before we conclude the article, we will take a closer look at the best capital.com alternatives.

RoboForex

RoboForex is next on our list of the best capital.com alternatives. You can trade a wide range of assets with this broker, and their biggest advantage is the low minimum deposit of just $10. Furthermore, your assets are quite secure because the broker is fully licensed by the IFSC Belize. Furthermore, the broker is owned by a large corporation with headquarters in Europe. Finally, Roboforex provides a variety of account kinds, giving you a lot of choices. All of these factors combine to make the broker one of the top capital.com alternatives. Read our detailed RoboForex review here.

XTB

XTB is one of the world’s most well-known broker systems. XTB was created in Poland in 2006 and has enjoyed rapid growth since then. This broker can trade over 3,000 different assets across six asset categories for you. But don’t just take our word for it; customers have given XTB numerous honors, and it is highly known for its excellent customer service. For example, every customer has access to personalized one-on-one support and a learning center with a wealth of resources. Read our full review here.

Conclusion on the Capital.com review: No scam – It is a legit online broker

Capital.com is a versatile platform to trade CFDs and learn at the same time. Through our test, we could not detect any scams or fraud. Capital.com is a regulated company. It is a platform that people have been waiting for for a long time. As it provides a favorable environment to its users and traders. It provides a series of trading opportunities by providing access to trade CFDs on hundreds of markets under one roof. Capital.com also guides its users to learn the art of trading through feedback, video lecture courses, and their AI-based approach.

Capital.com is transparent in a true sense by providing facilities to its users under strict compliance with its regulators. It has a very easy interface, from account opening to deposits and withdrawals. Apart from the easy interface, it has a great team behind the project and highly experienced economists and researchers to guide the users. It has a great friendly support team that assists users in case of facing any difficulties. Hence, capital.com is a unique, reliable, easy, and knowledgeable platform from which users can get a lot of experience and gains through trading.

Advantages of Capital.com:

- Multi-regulated broker

- Compliant with the PCI standards security council

- Trade CFDs on more than 3,000+ markets

- Free demo account

- The minimum deposit is 20 EUR, 20 USD, 20 GBP, or 100 PLN by card

- Contracts for Difference (CFDs) on stocks, also real stocks, commodities, indices, currency pairs, and cryptocurrencies.

- Low spreads and no commissions

- Professional trading platform and mobile app

- Personal support

- Huge variety of educational material

(Risk warning: 67% of retail CFD accounts lose money)

Capital.com is a competitive online broker with a lot of opportunities to trade.

Trusted Broker Reviews

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. (Risk warning: 67% of retail CFD accounts lose money). You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

FAQ – The most asked questions about Capital.com :

Where is the headquarters of Capital.com?

Founded in 2016, Capital.com is regulated by more than one country, including the UK, Australia, Seychelles, and Cyprus. In fact, due to its worldwide popularity, 24 languages are available on capital.com.

Can I safely invest in Capital.com?

Yes, it is absolutely safe to invest and trade in capital.com. For the trader’s ease, some of the retail client funds are secured by the investor compensation fund that sums up to 20,000 euros. These funds are safely kept in the RBS accounts of the app, and Deloitte audits the brokers. PCI data security standards are also available, which is quite satisfactory for brokers.

What are the regulators used by Capital.com?

Regulation is necessary to bind financial platforms by certain guidelines to attain stability and integrity in the system. If you are using Capital.com, you must not worry about security as it has won multiple awards for keeping the trading environment safe from traders. The regulators of capital.com are FSA, CySEC, ASIC, FCA, and NBRB.

Can we use Capital.com from a mobile phone?

Yes, Capital.com has a mobile application designed for their traders so that investments can be made anytime and from anywhere. From surveys, it has been seen that financial platforms with mobile accessibility attract more bonuses as compared to traditional platforms.

See other articles about trading brokers:

Last Updated on July 25, 2024 by Andre Witzel