IQCent broker review and test – Is it a scam or not?

Table of Contents

Review: | Regulation: | Minimum deposit: | Markets: | Functions: |

|---|---|---|---|---|

(3.8 / 5) (3.8 / 5) | No | $250 | 100+ currencies, crypto, indices, stocks, commodities | Forex and CFD Trading, Options trading |

Introduction to the review:

Trading seems to be gaining so much popularity nowadays because you can do it anywhere as long as you have a decent internet connection. This is why so many people have decided to pick up trading either as a side job or a full-time job.

When choosing the right broker, you have to ask yourself questions like “Is this broker legit?”, “Are my funds safe with this broker?”, “Can I actually make a profit with them?”, and many more.

This review will be focusing on IQCent and will help you answer all those important questions. You will also get to know the company as a whole and the different features and services they provide.

(Risk warning: Your capital can be at risk)

What is IQCent? – The broker presented:

IQCent was founded by a team of trading professionals in 2017. This broker provides both binary options and CFD assets for its clients to trade and has a main office located in Majuro, Marshall Islands. IQCent is also known for being the first broker to accept cents when trading.

Regulation and safety for users

Most reputable and legit brokers are regulated by well-known regulatory bodies like the VFSC or Vanuatu Financial Services, or the ASIC or Australian Securities and Investments Commission.

IQCent, however, does not fall into this category. This broker is not regulated or registered by any of these reputable regulatory bodies. Thus, clients who choose to partner with IQCent must be careful when trading with this particular broker.

Regulatory notice:

IQcent is not a regulated broker and platform.

If you do decide to do business with this broker, you can rest assured that all the information you give them, like your personal data and bank details, is completely safe and can not be accessed by hackers. This is because IQCent’s website and web-based platform are SSL Certified.

For more information, you can check out IQ Cent’s privacy policy. You can access this from the website’s home page.

Trading conditions for users

IQCent offers over 100 assets for their clients to trade. Among these assets are:

- Stocks

- Crypto

- Commodities

- Indices

- Forex

You can find a couple of the most tradeable assets like the major currency pairs, gold, silver, oil, US100, and many more. You can see the full list on the web-based platform. Keep in mind that assets offered as options differ from the assets offered as CFDs.

The products offered on IQCent’s platform can be traded with a leverage of 1:100 and can reach up to 1:500. The maximum and minimum leverage depend on the asset that is being traded. By default, all of your trades will have leverage applied. To change this, clients must contact IQCent’s customer support representatives.

IQCent operates on a 24/7 basis, but the availability of trading the assets depends on official market schedules. This broker does not charge any fees, but when withdrawing funds, a small amount may be charged depending on your method of withdrawal. There is more information on this in the withdrawal section below.

Overall trading conditions:

- Minimum deposit of $250

- Multiple payment methods

- Return of 90%+ for options trading

- Leverage up to 1:500 in CFD Trading

- Fixed CFD Trading fees up to 5%

- 24/7 support

- Unique web-platform

(Risk warning: Your capital can be at risk)

Test of the IQcent trading platform

IQCent features a web-based platform that doesn’t require any kind of download nor installation. With IQCent, you only need to login on to their website to enjoy all of their services. This can be accessed on any web browser such as Opera, Microsoft Edge, and Mozilla Firefox.

Since all your data is stored on the website, and account rather than on your computer, you can be sure that upon accessing your account through another device, all of your settings will be reloaded immediately. With clients not being required to download or install anything, they are also able to avoid any kind of viruses that come from installing new software.

Upon logging in through the website, you will be immediately redirected to the platform offered by IQCent. If you’re a seasoned trader, you will notice that their platform is easy to use as everything you need is on one screen and this includes the charting application, portfolio, trade execution, and a list of all the assets you can trade.

Generally, the platform is straightforward and provides lots of information. At the top-most part of the platform, financial tools that can help you on your trading journey are available for you to access as well as tabs to manage your account. Beneath this is a ticker that showcases all the recent trades that other clients of IQCent have made.

The charting software is located in the middle of the screen and is hard to miss. All tradable assets are found on its left and the right, clients will be able to test out and use an order terminal for both CFD trades and options trading.

For easy access, a table that will act as your portfolio will constantly update clients with all of their open, closed, and pending positions to easily monitor their trading performance. Aside from this, this table can be used for backtesting and trade review, both of which are important to know your profitability and win rate.

Since the table below can filter out data, you can easily scan all your profitable trades to know where you shine best. Also, keep in mind that the platform changes a bit when trading options or CFDs and we’ll be talking about their differences below.

(Risk warning: Your capital can be at risk)

Options charting

As mentioned, clients will easily notice the chart that occupies a big section. When trading options, the default chart is a tick chart that is beneficial for short-term trading. This tick chart updates itself and changes every second for the benefit of options that expire in the next minute.

This style of charting and trading is widely used by scalpers for a quick buck and having more than one asset class gives more options when trading. For IQCent, you can switch between 4 different options asset classes that include currencies, commodities, stocks, and cryptocurrencies with crypto pairs.

In addition to the tick chart’s by-the-second movement, it also features a bar that gauges the number of current puts and calls that could help you decide on the direction of your trade. Though, it must be noted that even though an asset has more calls than puts, it’s not guaranteed that a stock will go up in the near future.

There is also a feature on the tick chart that acts as a timer for easier monitoring of options trades. Depending on your chosen time of expiration, this timer will act as a reminder that you have trades that are either in-the-money or out-of-the-money.

Aside from the tick chart, clients of IQCent will be able to use candlestick charting for both options trading and CFD trading. Candlestick charting will be discussed below together with CFD charting.

CFD/Forex charting

Generally, traders use candlestick charting more often than other types of charting software variations. This is because of the amount of customization and personalization this kind of chart offers to clients. Together with Tradingview, the top-charting software of the world, IQCent gives users the advantage to trade like a professional fund manager.

With candlestick charting available for both CFD and options trading, it’s a given that TradingView allows users to also customize their time intervals. Choices for these include 1m, 5m,15m, 1h, and 1d but clients could opt to have more if they are premium members of TradingView.

As for the candlestick customization, traders have the option of six types. These are

- Bars

- Candles

- Hollow Candles

- Heikin Ashi

- Line

- Area charts

Each of these charts can be used and it is up to the user’s preference as to which one they want to select.

TradingView allows expert-level charting and usage of hundreds of indicators and systems that range from simple moving averages to the more complex Ichimoku Cloud Trading system. Clients are also able to customize the chart’s background, bar color, and scales for clients to be most comfortable when charting.

As the leader in charting, TradingView’s software gives clients access to powerful drawing tools that exponentially assist in charting. Being able to spot and pinpoint price points for you to use now or in the future will help you in deciding what to do.

Measuring tools are also available and give clients the power to estimate their probable gains and losses once a trade is exited. Users will also be able to add text tools that add annotations and comments to help you remember important notes.

Some of these drawing tools include the Fibonacci tools such as the Fibonacci fan or the Fibonacci retracement tool. With the Fibonacci theories, price points can be anticipated even before they happen.

Although IQCent clients are not able to save charts directly on the platform, upon accessing TradingView directly from their website or from IQCent’s technical analysis tab, clients are able to access more assets and will be able to save charts.

To take your trading to the next level, you could switch to a log scale chart from the default linear price scale chart. This is used for parabolic price changes and would allow you to draw a clearer long-term trend line. A percentage scale setting is also available for clients and could be changed at the bottom-right side of the trading platform.

Usually, the price shown is historical. This means that you can look back at the prices since the asset was first traded. This is particularly useful when mapping price points and gauging the demand and supply at a certain price.

Although clients can opt to manually save a copy of their screen by pressing the Print Screen button, they may also use TradingView’s camera feature that instantly saves your chart on your device. All indicators and annotations will be saved on the image as well.

(Risk warning: Your capital can be at risk)

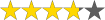

How to trade Options with IQcent

One of the first things you should do is to check whether you’re on a real or demo account and check if you have enough balance to trade the assets you want. To trade options, you also need to select an asset from the list of currency pairs, commodities, stocks, and cryptocurrencies.

Clients should note that, more often than not, binary options trading entails more risk compared to regular investments as it’s possible to lose all your invested amount as fast as one minute. Even with IQCent reporting profits of up to 90% within a minute. That said, we want to suggest that clients would properly learn everything about options trading first because it’s different from regular trading.

After selecting an asset, one should decide the range of the time frame of the trade. IQCent offers options with expiry times ranging from 1 minute up to 1 month and is classified between Turbo, Intraday, and Long Term. Turbo time frames range from 1 minute up to 30 minutes and Intraday orders last between 31 minutes up until the trading day ends.

Long-term positions, on the other hand, can reach up to 30 days. To have better control, you can turn on IQCent’s Fix Time mode that controls the entry time of trades as well as its expiry time. Subsequently, you should know if your trade is more valuable as a put or as a call. Since all orders on IQCent are all buys, you cannot sell puts or sell calls.

Whenever a trade is executed, it will be listed down on your portfolio below. Here, you can track not only the opened trades but your closed and pending trades as well. You could manually close your positions here as well.

Details for your positions listed down on your portfolio are the asset traded, expiry price, start time, strike price, expiry time, order size, order type, and payout.

(Risk warning: Your capital can be at risk)

CFD and Forex trading

Trading these assets is straightforward and might seem familiar if you’ve already started on your trading journey. As usual, the first thing you should do is select the asset you want from the list of CFDs or forex pairs. For CFDs, choices are limited to cryptocurrencies, commodities, indices, and stocks.

We recommend checking the chart of the asset you want to purchase to assess its performance and outlook using technical analysis methods. With fundamental analysis, you could also read news reports and company disclosures which are very important for the company and its value.

Next, you should take a look at your total portfolio value and assess how much you’re willing to risk on this one particular trade. Usually, experts would suggest not going all-in and instead just invest a fraction of your total portfolio value. 10% of your capital is good enough to start with and won’t damage you too much should the trade go wrong.

Once you’ve made a decision, input the investment amount in the section to the right to begin setting up your trade. You should also decide whether it would be a limit order or a market order. For limit orders, it is required to input a price in which you want your trade to be executed.

Then, you should fill out the empty spaces to stop loss and take profits. These are important and protect you from unforeseen market events. These also help the client by practicing good trading of cutting losses early or taking profits responsibly.

Clients should keep in mind that each asset has default leverage in place and varies depending on the asset. To change this, we recommend contacting IQCent’s customer service representative.

Copy Trading

With IQCent, clients are also able to copy trade the ten most profitable traders on their platform. Being able to only copy the best of the best saves time for users that would scan hundreds, if not thousands, of traders just to find the perfect one for them.

This isn’t just for beginners that would want to skip the learning part of trading but it’s also for veterans that are looking for another source of passive income for diversification purposes. With this, clients are also able to allocate a set amount of funds to be invested in a certain portfolio to better manage all their assets.

Since profits earned are taken note of by the system on the left-hand side of the platform, you can easily determine if you want to take your profits for these.

Mobile app

Unfortunately, IQCent does not have a mobile application for android or iOS devices but to compensate for that, their web-based platform can be accessed through mobile web browsers and could also be used easily.

Since all your settings are saved on your account, once you reload your account, the only thing you need to do is to trade and earn profits.

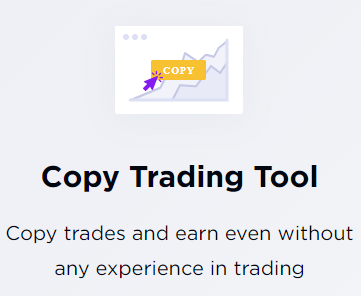

How to open an account with IQcent

IQCent understands that users would want to start trading as soon as possible. This is why they made the signup process quick and easy. It won’t take more than a minute.

Click on the “Sign Up” button found on the upper right portion of the website. This will redirect you to the signup form that will only ask for your complete name, phone number, email address, password, and account currency. Your choices for your account currency are USD, GBP, RUB, and EUR.

Skim through the Terms ad Risk Statement before you hit the “Next” button. Also, keep in mind that IQCent does not provide its services to traders from the USA.

After sending in your form, you will instantly be redirected to IQCent’s trading platform. You’re not required to send in any form of identification when you create an account.

You can choose from any of the three account types that IQCent has to offer. These are Bronze, Silver, and Gold accounts. Each of these has different features, minimum deposits, and bonuses. The minimum deposits and bonuses will be discussed in a different section below.

These three accounts give clients access to their 24/7 live video chat support system, a demo account, and their copy trading tool. Silver and Gold account holders, however, are assigned a personal success manager and gain access to a web class.

Clients with Silver or Gold accounts are also given three risk-free trades. This basically means that if you lose cash in your first three trades, the amount you lost will be credited back to your account as trading funds.

(Risk warning: Your capital can be at risk)

Demo account

As previously mentioned, clients who sign up for an IQCent account have access to a demo account. Demo accounts function as free trials so you can test the platform with zero risks. Also, it can be used as training grounds for beginners since the charts reflect live prices.

You instantly get access to this feature. However, you will need to contact a customer support representative to add virtual funds to your account so you can start trading virtually.

Payment methods

Various payment methods are supported by IQCent. These methods include Visa, MasterCard, Bitcoin, and Altcoins. The available altcoins are Tether, Bitcoin Cash, LINK, HT, PAX, USDC, TUSD, Zcash, Litecoin, Ethereum, and Dash.

Payment method: | Transfer fee: | Funding Time: | Withdrawal time: |

|---|---|---|---|

Credit Cards, Debit Cards | 5% | Instant | Up to 1 hour |

Bitcoin | No fee | Instant | Up to 1 hour |

Ethereum | No fee | Instant | Up to 1 hour |

Other cryptocurrencies (altcoins) | No fee | Instant | Up to 1 hour |

Deposit and minimum deposit

To deposit funds to your account, simply click on the account funding tab. This will take you to the deposit page where all the payment methods are found. You will also see the different account types as well as a computation of your bonus depending on the account you choose.

If you opt for the Bronze account, you will need to add at least $20 to your account. For Silver accounts, the minimum deposit is $250, while Gold accounts require at least $1,000.

How to withdraw money

You can withdraw funds by clicking on the “Withdrawals” button. Here, you will find the total balance of your account and the different withdrawal methods. Simply click on your method of choice, input your Bitcoin wallet address, and the amount you wish to withdraw.

Once you send in your request, IQCent will require you to send in any proof of identification and proof of address to ensure maximum security. Keep in mind that there may be additional withdrawal fees depending on your chosen method. Also, make sure that the account where the funds will be credited belongs to you.

Withdrawals typically take an hour to process. Expect to see your funds credited to your account within that timeframe.

(Risk warning: Your capital can be at risk)

IQcent Bonus

Bronze accounts have a 20% bonus. Silver accounts, on the other hand, have a 50% bonus. Lastly, Gold accounts have a 100% bonus. The amount you get from these bonuses depends on how much you deposit. Keep in mind that the bonus funds are credited to you as trading funds.

Customer support and services

With its 24/7 live video chat support, IQCent prides itself on providing the best customer service to its users. Upon opening the website, you will be greeted by the live chat box where you can chat with a representative. They are both knowledgeable and prompt to answer.

You can access their private chat feature by creating an account. Otherwise, you will be chatting with them as a group. The chat feature supports numerous languages including English, French, German, Thai, Chinese, Yiddish, and many more. The broker also supports per phone via these phone numbers:

- English: +1-8299476383

- Russian: +7-499-3806317

- Chinese: 3-395-0396

- Thai: 02-21345671

- Singapore: 965-65425142

- Australia: 61-8-5550-7288

Conclusion with advantages/disadvantages: IQcent is not a scam but an unregulated broker service!

Usually, trading binary options would require clients to utilize difficult-to-use trading platforms. With IQCent, the trading process becomes simpler. The trading platform is also easy to understand and beginners won’t have a hard time executing their own trades after exploring the platform.

If you still have a hard time understanding how to trade these assets, IQCent offers video tutorials on how to trade both CFDs and binary options. The link to these videos can be accessed from the live video chatbox. Clicking on the link will redirect you to IQCent’s YouTube page.

IQCent is also generous when it comes to bonuses. You can use referral codes to increase your trading funds and you can even join monthly giveaways where you stand to win various gadgets that will help you in your trading career.

Despite having a free demo account, clients still need to deposit actual money first and contact a customer service representative to set up the demo account. IQCent is also not regulated, which raises a couple of red flags to almost every trader out there.

But all in all, IQCent is on par with some regulated brokers out there in terms of their services and assets offered. If you are careful and do your research, IQCent will help you make a profit from the market.

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about IQcent :

Is IQcent legit?

Although IQCent is not regulated, customers vouch for the broker and claim that they have earned a profit with this company. But despite the many positive user reviews, you should still keep your guard up when trading with unregulated brokers.

How long does IQcent take to withdraw?

Withdrawals with this broker typically take an hour. If you experience any delay, you can contact their customer service representatives and they will assist you through the withdrawal process.

How do I get my money from IQcent?

IQCent supports numerous withdrawal methods. These methods include Visa and MasterCard, Bitcoin, and various altcoins. You can withdraw your funds directly from the broker’s web-based platform. But keep in mind that you will need to send in proof of identity as well as proof of address to complete your withdrawal request.

What makes IQ Cent the best trading platform?

IQ Cent is the best of all trading platforms because it offers traders the best features. They can trade well by using its great user interface. Besides, IQ Cent also offers traders a great number of underlying assets. Traders can easily diversify their trades and enjoy minting money on IQ Cent.

What is the IQ Cent minimum deposit amount?

IQ Cent will allow traders to initiate trading with a very low minimum deposit amount. $20 is the minimum amount any trader would need to initiate trading on IQ Cent. They can use the payment methods that IQ Cent makes available for funding their trading accounts. Besides, IQ Option offers great services to traders. Starting with the IQ Cent minimum deposit amount, you can fund your trading account with any amount higher than $20.

Does IQ Cent offer demo testing?

IQ Cent offers demo testing by allowing traders to sign up for a demo account. The demo account will be available with virtual currency that traders can use to learn to trade. Apart from this, traders can also use the IQ Cent demo account to enjoy trading with the best learning experience.

Read our similar broker reviews:

Last Updated on January 27, 2023 by Arkady Müller