AvaTrade Social Trading: How to copy other traders – review & tutorial

Table of Contents

Based in Dublin, Ireland, AvaTrade has been pioneering in the online trading domain since 2006. It offers trading in various financial instruments that range from commodities, stocks, currencies, etc. It also offers stock indices as assets. But what makes it a cut above the rest is its expertise in Forex and CFD trading.

Contrary to CFD, when it comes to Forex Trading, we know it is concerned with trading and exchanging national currencies. Moreover, exchanging a currency demands an exchange rate that justifies the particular currency’s value. Hence, a foreign exchange plays the role of a marketplace that does the exchange while giving an exchange rate.

So, be it Forex trading or CFD trading, a new trader must always look for ways to enhance the experience. So, the methods like Social Trading or copy trading may become the need of the hour for beginner traders. It is, however, essential to understanding the basics before opting for any method. Therefore, let us first understand what social and copy trading signify and then implement them.

(Risk warning: 71% of retail CFD accounts lose money)

Copy-trading with AvaTrade

AvaTrade Rating | 4.5 |

Copy Trading Availability | Yes |

Regulators | ASIC, FSA |

Trading Desk | MetaTrader 4, MT5 |

Copy Trade Commission | No |

Total Currency Pairs | 60 |

Islamic Account | Yes |

Account Activation Time | 24 Hours |

To successfully copy trade with AvaTrade, a trader needs to follow the basic steps, which are as follows:

- First, you need to select a regulated broker like AvaTrade to partner up with. AvaTrade offers security and proper customer support, so selecting a broker like AvaTrade is foremost.

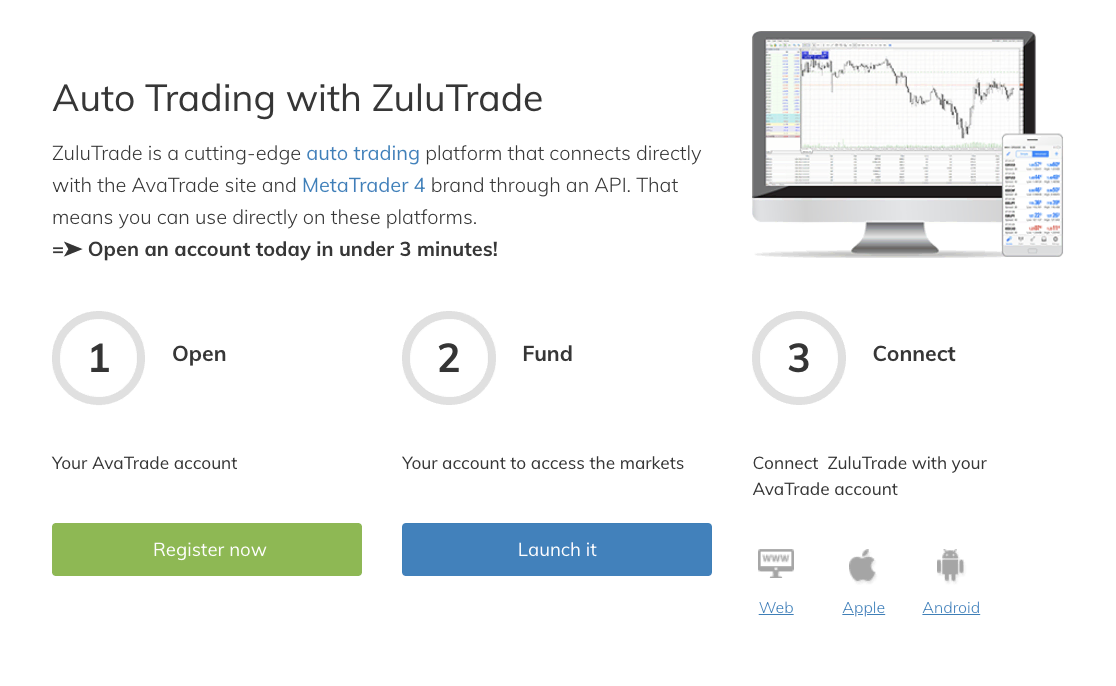

- Now you need to progress to open an account on an automated platform. At AvaTrade, you can get well-known options like ZuluTrade and DupliTrade for a better copy trading experience.

- Once you activate your account, you can view a list of signal providers along with their stats. It can include P&L, and risk profile, so you can select the person/people that best suit your objectives of copy trading.

(Risk warning: 71% of retail CFD accounts lose money)

AvaTrade copy trading tutorial – Ava Social

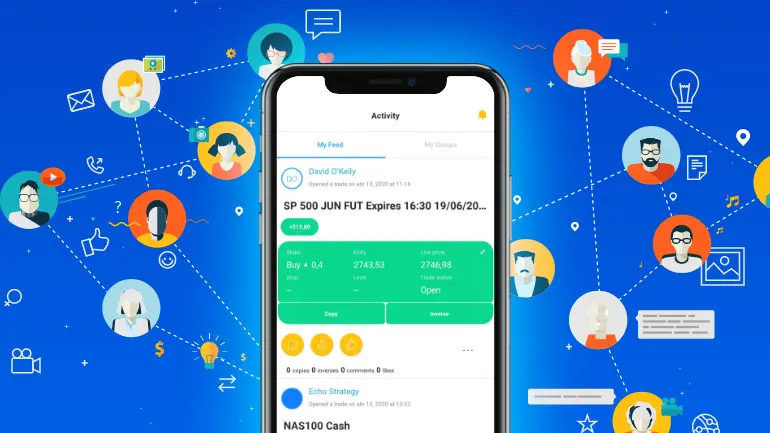

Ava Social is among the latest social trading products at AvaTrade. It was introduced in 2020, yet it is actively gaining popularity and developing faster than anticipated. Moreover, it is available as a mobile application with more than 1000+ downloads. Therefore, a trader looking to enter social trading can easily register on Ava Social to begin social trading.

Now, let’s understand the simple steps involved in the process.

Registration

The registration process requires the user to have a demo account, if not a live trading account. After opening the Ava Social app, the first step is to give your details while registering. You need to provide your name, email address, and phone number and click next.

Preferences

In this step, after clicking the next button, the app will direct you to the page where preferences are asked. Here, you have to mention the professional level you are trading at. Next, the markets you prefer to work on shall be filled, and finally, your investment amount and long-term goals as well.

Open app

After completing the previous steps, you can move to the opening of the app. However, it requires the trader to fill in the AvaTrade account number and the password. So, if a trader enters the app without the AvaTrade account, she will have to register there first.

(Risk warning: 71% of retail CFD accounts lose money)

Advantages and disadvantages

A copy trading strategy is beneficial for the new traders immensely. First, it makes them familiar with the markets and gives them confidence. Since they don’t have prior experience, new traders can learn by watching the moves made by expert traders.

Copy trading is not limited to any one kind of financial instrument. The traders can benefit through various instruments like currencies, stocks, commodities, etc. Last but not the least, it creates a community of global traders that include beginners, experienced ones, and intermediates. They all can exchange their ideas and strategies to improve further.

Although it sounds like the simplest way to earn profits, you cannot ignore that even professional traders can commit mistakes. Since a trader follows them blindly, there is a chance of losing funds.

Moreover, manual copy trading requires 24/7 access to the exchange, while the automatic programs require a constant presence on the network, either of which can burden a new trader. Finally, professional traders may even charge a commission for their services, so a trader must assess all such possibilities beforehand.

What does social trading signify?

Understanding the term social trading is not a daunting task. As the name suggests, it is a method that allows users to share information with other members of a community in real-time. Therefore, we can say that social trading is the next step in the social media revolution. It is a new way of trading that allows the trader to have instant access to various market information through internet connectivity.

The social trading method differs from the other trading parameters, such as fundamental and technical analysis. That is primarily because, in social trading, the information is generated by other users only. Therefore, it allows the new traders to trade without performing the analyses themselves.

With its help, the traders can interact with others, watch others take trades, then duplicate their trades. By doing so, they can learn what prompted the top performer to take a trade in the first place. Hence, providing a better insight into the whole process. Furthermore, by using social trading, the investors and traders could incorporate social indicators from the trading data feeds of other traders. Many brokers offer this process through their social trading platforms, which form the core of the social networking services.

So, in other words, while social trading, a trader bases the investment decisions on the analyses coming from other traders. Therefore, we can view it as a way of sharing trading experiences. With the help of social trading, a trader can seek or help others in the same field. So, it is beneficial for the new traders, but that does not mean the experienced traders cannot benefit from it. They can also reap the benefits equally by improving their strategies and methods. However, the new traders get the benefit of shortening their learning curve.

We can get more clarity in social trading with a simple example. For instance, you receive information about a company going to introduce a new product in the market through the social media platform. However, your friend is the one who conducted the research and shared the information. Now, such a move by the company will shoot up the stock value of the same company. So, now you can decide that if you are interested in buying the stocks of that company, it is the best time.

Similarly, it applies to assets like currencies as well. Let us take another instance, say there is a political controversy regarding a certain company’s product, and you own shares of it. Such a scenario suggests that there will be a decrease in the stock’s value.

Furthermore, someone from the trading community shares this information through social media feeds. So now you get to know that it is the best time to sell the same shares. When expanded to a global scale, the same process gives us an idea of how social trading works.

However, we know that the information shared through social media platforms such as Facebook, Twitter, etc., cannot be relied upon completely. So, to resolve that, many brokers such as Ava Trade offers social trading platforms that are specialized for this purpose. You can register in them and receive updates on your feed in real-time.

Moreover, another advantage the trader can expect is that they can even check the source’s credibility in it. They can go to the profile of the source and scrutinize their profile to be sure. By visiting their profile, we can see which stocks they have invested in. So, if they claim that a company’s stock value will shoot up, but they don’t own any shares of it, then we can assume it’s a bluff.

(Risk warning: 71% of retail CFD accounts lose money)

Copy Trading

Copy trading is often confused with Social trading; however, it differs from what like mentioned before. We can understand copy trading as a form of portfolio management. It aims at finding other investors who have a track record that a trader can imitate. As the name hints out, it focuses on copying the trading methods, which are proven to be beneficial.

With the help of copy trading, the traders can monitor strategies from other successful traders, which they can use for winning trades. It can be immensely useful for those who don’t have time to analyze the market themselves. Copy-trading usually focuses on short-term trading, particularly on day-trading and swing trading strategies. However, the traders can use several other strategies to generate profits.

Copy trading is not a method limited to only the assets in Forex, and it focuses on assets within other volatile markets as well. So, it can be effectively implemented while trading in crypto, commodities, stocks, etc.

While copy trading can be lucrative without any doubt as it provides an easier way to implement strategies, there are also risks involved in it. A new trader should always remember that past results are not an assurance of future returns. So, it does not always mean that copying the same trading strategy by a past user will always result in the same result.

We understand that a trader can copy or emulate the trades executed by other investors with copy trading. So, the aim of copy trading is for the trader to have the same positions as the investor they wish to copy. However, a trader should also note that when copying the trade of another, she does not receive the layout of that strategy. Instead, in this method, blind copying is what takes place.

Copy-trading owes its origin to another method called mirror trading. It was introduced in the open market in 2005, and the traders focussed on copying the algorithms developed through automated trading. In the beginning, the developers shared their trading history which allowed others to copy their strategies. However, it resulted in the formation of a social trading network. Consequently, the traders also copied trades in their personal trading accounts. Afterward, it evolved into copying another trader blindly rather than the strategy alone.

(Risk warning: 71% of retail CFD accounts lose money)

Social Trading and Copy Trading

Various online sources use them as synonyms; however, as we mentioned before, they are distinguishable. To simplify it, we can say that social trading is the broader term, and copy trading is a part of it. So, copy trading can be viewed as social trading per se.

However, a trader must know that not all types of social trading are copy trading because the latter involves a third person managing your trades in an automated fashion. A trader should always focus on using the information from other traders and then base the decisions on it. But, the final decision should always be upon the trader, and that does not happen in copy trading.

So we can view copy trading as a very strict form of social trading. It binds your account with another trader essentially. So, what you see as your trades are a reflection of theirs. In simpler terms, you suffer their losses, and you win their successful trades. Therefore, as an overview, we can say that they both share similarities, but the trader gains ideas in the case of social trading through social platforms. In contrast, copy trading allows them to copy their whole trades blindly.

How to copy trade

Copy-trading another investor can involve various ways to do so. A trader can copy all the transactions, including trade-entry, take-profit, and even stop-loss orders. It is mainly done through spread betting or CFD trading accounts, both of which depend on the broker like Ava Trade.

With the help of copy trading, a trader can easily diversify the portfolio. They can explore multiple ways to make money by putting their capital in multiple assets and markets. In doing so, it is advisable to consider using different traders. Finding copy traders who trade on different assets can diversify the portfolio more effectively. Copying traders from different time frames can be considered for the same.

However, a new trader should know that most copy trading businesses are subscription models. The trader pays a fee to copy other traders every month. So, an alternative model of revenue sharing can also be considered, where one receives a certain percentage of winning trades.

Copy trade vs. mirror trade

Copy-trading differs from mirror trading with slight differences. In mirror trading, the traders mimic the trading style or the strategies. Initially, the traders focussed on finding the algorithms which shared the trading history with them. So, they would eventually copy the results of such algorithms, which showed strong returns.

However, they needed permission first to access their strategies. So in mirror trading, the replicating of trades occurs. At the same time, copy trading was born out of it and involved following the trades blindly without receiving or assessing the layout.

Here is our review of the top 20 forex brokers.

Conclusion

Copy Trading can be viewed as a part of social trading, which can be a useful method to win trades. With the help of a reliable broker like Ava Trade which offers dedicated social and copy-trading products, we can expect a better and safe experience. Copy-trading with Ava Trade is a simple process and can help with trading in multiple assets, including currencies, stocks, commodities, etc.

FAQ – The most asked questions about AvaTrade Social Trading :

Is AvaTrade copy trading good?

Ava Trade is among the top brokers in both Forex and CFD. It is a regulated broker that is governed by strict guidelines. Moreover, it offers dedicated copy trading products like Ava Social, Zulu Trade, DupliTrade, etc., that are fruitful in giving a better experience. So, Ava Trade copy trading can stand apart from the rest and be considered good by a new trader.

Is copy trading too risky?

A chance of losing money is always present, but finding a good trader for copy trading can reduce that. However, the past performance of a trader is no guarantee of their future performance, so even if they’ve been profitable before doesn’t assure safety. So it is always advisable not to invest more than you can lose.

Is Avatrade social trading restricted to only a limited number of financial instruments?

No, there is no one type of financial instrument that can be used for social trading. The traders can profit from a variety of instruments, including currencies, equities, and commodities. Not least of all, it develops a community of international traders composed of novices, seasoned traders, and intermediate traders. To further improve, they can all share their thoughts and techniques.

Is Avatrade social trading a reliable form of trading method?

The answer is quite debatable. If a trader can identify successful traders and imitate their transactions, social trading can be profitable. To replicate another trader’s behavior, however, is exceedingly dangerous because even the best traders make errors. Thus, one should prioritize their inner voice over the trading strategies available on the internet.

How can a copy trader make money using Avatrade social trading?

Some novice investors who need more experience will employ the strategy of copy trading. It only takes a few steps to achieve this: deposit cash, pick a trader, and watch as a website imitates their buying and selling using the money you’ve provided.

Is Avatrade social trading profitable?

By copying other people’s investment techniques, you can invest through social trading. The majority of experts would not advise doing this because what you duplicate might not be suitable for your needs, even though it will save you time from spending too much time looking for good trading opportunities or techniques.

(Risk warning: 71% of retail CFD accounts lose money)

See other broker reviews:

Last Updated on January 27, 2023 by Arkady Müller