How much does it cost to trade with Binomo? – All fees explained

Table of Contents

Binomo is one of the trending brokerage platforms that offer a diverse range of asset trading services in over 100 countries across the globe. It has the regulation of the International Finance Commission, which is a dispute resolution firm. The major popularity of this platform is from countries such as Indonesia, Turkey, Brazil, and India.

Binomo was established in 2014 and is under the ownership of a company called Dolphin Corporation. This company is located in St. Vincent and Grenadines. As per the statistics and records are concerned, this platform currently has 887,470 active daily traders and is conducting over 30,000,000 trades on a weekly basis.

With these figures, Binomo is undoubtedly one of the best and largest brokers of all time. It makes use of a proprietary trading platform for all of the users. It makes use of the SSL protocol for ensuring that all of the user data is under encryption and security. Therefore, you can be sure of the fact that your funds are safe during any kind of trading conditions.

Binomo thrives to offer security for customer data and is successfully implementing the practices for that as well. Binomo has the right ideologies to protect financial information. Without giving up some of that information, the traders cannot possibly deposit the funds to their trading account. Therefore, this security aspect is what boosts the prime demand for Binomo.

Even with all of the features and efficacies, it becomes really important for the newcomers of Binomo to understand the fees. It will give them an idea of what they have to pay for getting started with their trading journey over the platform. Therefore, this review article is dedicated to giving you complete explanations of Binomo costs, fees, and charges.

The efficacy of Binomo trading platform

Indeed, this review article is for educating you about the fees, charges, spreads, and costs! But if you are a beginner to Binomo, you should primarily have an idea of what this platform is. Without understanding the efficacy of this platform, it is worthless to get into it and invest your money in the platform. Therefore, this section will give you a basic idea of Binomo to better understand the further review.

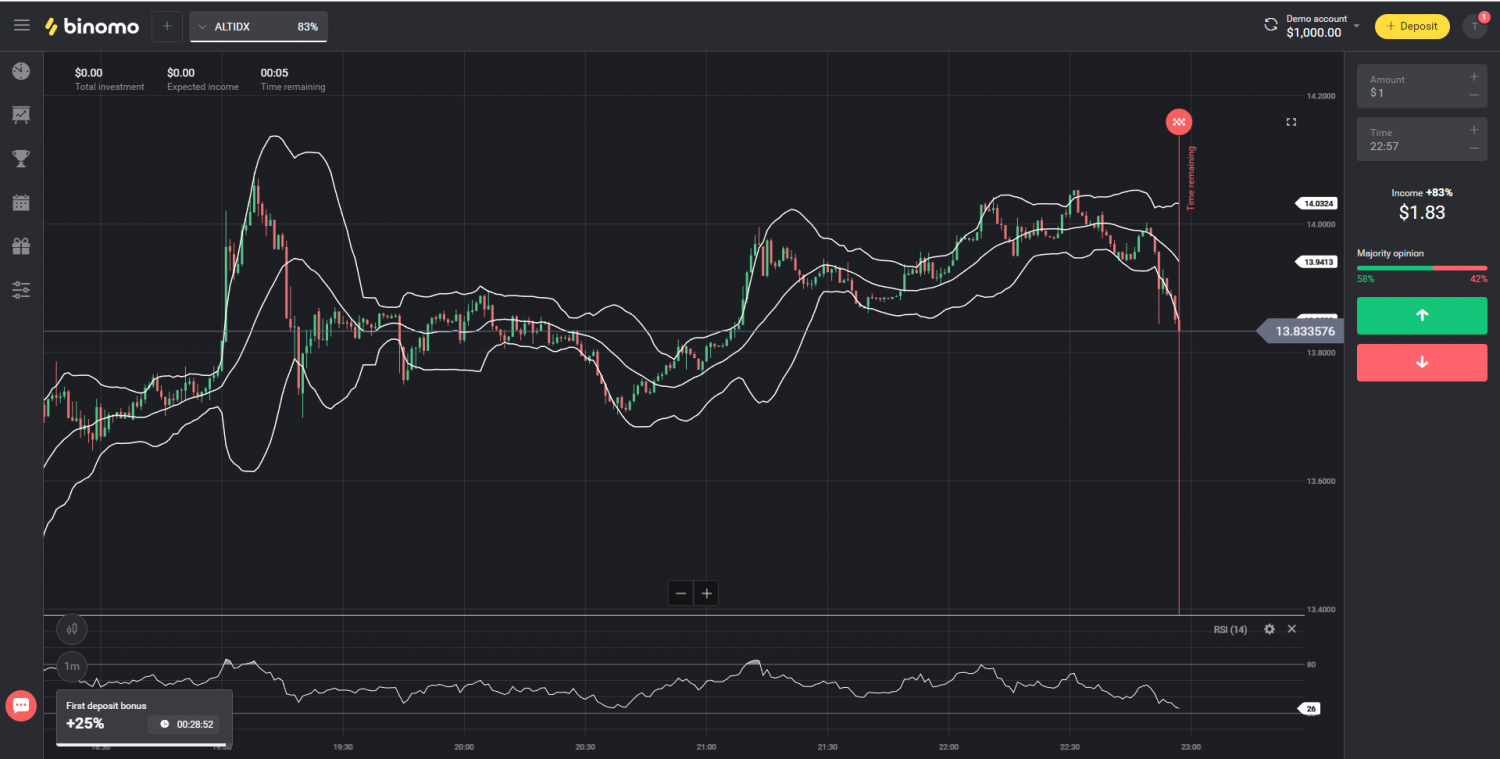

The trading platform of Binomo consists of 20 different graphical tools, which will help you analyze the different trading charts and history. There are hotkeys that will allow you quick access and faster online trading. This aspect is unique to Binomo, and no other broker in the competition has it. The Binomo provides you with the economic calendar integration and also gives you independent tabs for use with different charts.

Apart from that, many other features are scalable, along with the option to commence trading in just one click. You do not need any kind of confirmation for the purpose. This aspect is in combination with that of a quick refresh rate and allows the traders to grab the opportunities right at the moment when they arise. There are various trade types available within the platform as well, such as Turbo trades, Call/Put, and High/Low, which are generally available from all of the online brokers.

Binomo offers a non-stop trading feature that never closes! It means that you have the flexibility to trade whenever you feel like it, even on weekends. Hence, this is another aspect that sets apart Binomo from other brokerage platforms. Binomo comes with four types of accounts, Free, Standard, Gold, and VIP. To decide which can be best for you, you need to check out the benefits, fees, offerings, and other features of these different account types. You will know more about them later in this article.

Apart from seamless trading, Binomo also offers responsive customer support solutions such as Chat and Email. They have the chat option on their website and application. It is the live chat option where you will be interacting with the representative to get a solution for your queries. If not, you can also drop an email for your queries at [email protected]. And they will reply to you as soon as they can!

Binomo is under the regulation of the International Financial Commission, which has been a Category A member since 2018. The IFC is accountable as the independent organization which helps regulate the financial markets. Hence, this is what speaks for the reputation of Binomo amidst the traders. The benefit of having this regulation is that IFC has a sort of compensation fund for all of the members.

It means that if something is about to happen to Binomo that would make it compromise funds, then the traders will have the protection of up to $20,000. This protection assures all of the traders of the safety of their funds and lets them know that Binomo is valuing their hard-earned money. Apart from just being the Category A member of IFC, it is also certified by FMMC. Moreover, the platform also undergoes auditing by the VerifyMyTrade branch of IFC on a regular basis.

These audits and the independent certification is liable to speak for the integrity of Binomo as a brokerage platform. Currently, Binomo is also in the process of getting a CySEC license. For all of the international brokers, they are pretty much confused upon which broker they should count on priority. But keep in mind that multiple licenses, regulations, and audits always indicate the proficiency of a brokerage platform.

List of fees that can occur when you trade with Binomo

So, now is the time to give you complete exposure to the different types of fees that you will come across while you are trading with Binomo. Just like any other broker, Binomo also earns from fees and commissions, but that is not the only mode of earning for them. Binomo earns its profits not just by charging the transfers but also by covering the trading operations of clients.

The approach of Binomo is to charge a small amount of commission every time the trader makes a profit. Binomo is not the type of platform that benefits from the losses that you make. The major idea of this platform is to make the traders successful. Therefore, it doesn’t charge commissions on lost trades but offers support to them. And the platform offers support with trade training, special offers, and ongoing customer support.

Hence, the aim of this platform is to give a better chance to the traders to succeed in the future. It is a beneficial situation for all of the involved parties in a particular trade. Binomo has no such intentions of taking variable commissions or fixed charges for closing or opening deals. But still, there is some kind of fee or chargeable concept within the platform that has a set of rules for better understanding.

- Account fees

There are three types of live trading accounts with Binomo that includes- Standard, Gold, and VIP. All of the account types have certain minimum deposit requirements, depending upon the features and services that are being offered by Binomo. People misjudge this minimum deposit concept as a fee, which is completely a wrong understanding.

The minimum deposit is not a fee but modest initial funding to the trading account for commencing with the first trade. Binomo doesn’t take even a cent from this deposit. Therefore, you cannot count this minimum deposit aspect as account fees. Instead, it is the charge specified to justify the value of the type of account and the features embedded with it.

- Standard account- The minimum deposit requirement for the Standard account type is $10. In this account type, you get to trade with around 30 assets on the platform. If you are a beginner, then this is the right account type for you to start your trading journey with. When you don’t have to put up a heavy entry cost, you don’t have a fear of risking more of your funds as well.

- Gold account- For the people who hold a substantial amount of experience in trading assets, the Gold account can be the ideal entry point. The minimum deposit requirement for the Gold Account is $500, which is a big jump from the $10 deposit of a Standard account. But, it is because you get around 40+ assets to trade upon. And the withdrawal time is less for the Gold account holders than the Standard ones.

- VIP account- It is the highest tier of accounts within Binomo. If you want to join the VIP account, then you will have to make a minimum deposit of $1000. With it, you will have access to over 50 assets and only a 4-hour wait time for withdrawals. The minimum deposit is double that of the Gold account because you are also getting a trade manager to help you with managing your investments. He/she will also be offering you certain bonuses in the long run.

Some of the other feature-wise description about the account types of Binomo is highlighted in the table below:

Features | Standard | Gold | VIP |

Assets | 41 | 54 | 61 |

Withdrawals | 3 days | 24 hours | 4 hours |

Profitability on Successful Trade | 85% | 90% | 90% |

Deposit Bonus | Up to 100% | Up to 150% | Up to 200% |

Maximum Yield | 84% | 86% | 90% |

- Withdrawal fee

There is no such withdrawal fee that you are bound to pay upon fulfilling the particular set of rules. When you deposit the money over Binomo, you are all set to trade and make your profits. You can put up a request for withdrawal after some time when you have sufficient profits, without any commissions. But the condition is that the profit amount should be twice your deposit amount.

If you are withdrawing any amount lower than that, then you will have to pay a minimum charge. If you are depositing money and are not trading or have earned small profits, then a minimum fee of 10% will be charged during the withdrawal of the funds. Apart from that, you don’t have any other fees or conditions. Wait for the time you make sufficient profits before you raise the withdrawal request. In this way, you can easily avoid the withdrawal fee.

- Subscription fee

The subscription fee is charged upon account inactivity. A fee of $10 is charged from the trader’s account if it has no activity for 30 days in a row. The same amount will be charged further on a monthly basis if the account still remains dormant. This fee is legitimate and common for all account holders and for all trading forms.

- Commission charges

Binomo doesn’t charge any kind of trading fee at all. The commission charges are also called the trading fees, which have always been a prime consideration for traders. There is no Binomo commission for opening a trading account with the platform, which sets it apart from all of the other brokers. Moreover, you do not have to pay any kind of deposit commission as well.

It is upon you to pump as many profits as you want over the trading account without any kind of cutbacks from the platform. It charges a minimal amount of your profit percentage, and that is it!

Tables of fees and spreads

You definitely need a better understanding of all kinds of fees, spreads, leverages, and other such information about Binomo. The above description was keen upon explaining the fees and their set of conditions over the platform. But this table below is about to give you a clear verdict on all fees, spreads, and other necessary information in a nutshell. The table is as follows:

Features | Binomo Considerations |

Market Instruments | Forex, Stocks, Indices and Commodities |

Minimum Deposit | $10, $500 and $1000 for different account types |

Minimum Trading Amount | $1 |

Leverage | No information on the website |

Spreads | 1.1 pips to 1.5 pips |

Deposit Fees | No Fees |

Withdrawal Fees | 10% charges if the withdrawal amount is less than specified conditions. |

Maximum Pay-out | 90% |

Demo Account | Yes |

Maximum Yield | 90% |

Deposit bonus | Up to 200% |

The Binomo demo account

Binomo also offers you a demo account for free! You do not have to make any deposit for creating your demo account. It is always preferable for you to explore the demo account for trading financial instruments in real-time. It is ideal for beginners and experienced traders too, to learn about the new platform that they are starting their trading journey.

Demo accounts are accountable as the test drive of your car that you check before buying. You need to be familiar with the process, the assets, the market movements, and all of the other aspects before you decide if Binomo trading is for you or not. It is a sign of a good broker to offer the use of free demo opportunities, which Binomo has been offering since the start.

Binomo demo account performs live market movements and allows the traders to implement the trades in real-time. But the only difference is that they will be investing their virtual funds and not the real ones. You will get a $1000 balance in your virtual funds to account for trading over the demo trading interface. You can keep on resetting the funds to practice better and improve your skills before you can enter the live trading account.

Use these risk-free funds to see if the Binomo meets your need as a proficient trader. If it doesn’t go well for you, then it is better to opt-out from the start, as closing an active account requires a more complex procedure. So, utilize the most out of your demo account over Binomo!

Conclusion

So, this is all you need to know about the fees and other such finance-related information about trading over Binomo. Binomo is one of the best trading platforms that charge you nothing as a hidden charge for their services. They profit from your successful trades and do not intend for your losses. Therefore, if you witnessed popularity and positive feedback for Binomo, they are genuine and true as per the technicality of this platform. So, go ahead and commence your trading journey with Binomo today.

FAQ – The most asked questions about cost to trade with Binomo :

How do you successfully trade on Binomo?

You need to first create your account, try your trading skills over the demo account, enter the live trading account upon gaining confidence, make the initial deposit and start investing upon your selected asset. Wait for your trade to hit the expiry duration, and you will get the results upon whether you won the trade or not.

What is the best time to trade in Binomo?

As per the facts are concerned, the night market is observed to be moving sideways, with insignificant amplitude for up to 90% of the time. It means that trading within the price channel is an optimal way to make better trades over the platform.

How much can I withdraw from Binomo?

The maximum withdrawal amount per day is $3000, and per week you can withdraw the maximum of $10,000.

Does Binomo charge a fee for deposits?

Binomo doesn’t charge any fees for making deposits in your trading account.

What are Binomo subscription or inactivity fees?

When an account is inactive, the subscription price is levied. If the trader’s account remains inactive for 30 days in a row, a fee of $10 is deducted. If the account is still inactive after one month, the same sum will be charged again.

What are withdrawal fees in Binomo fees?

A withdrawal fee is an amount levied during the time of withdrawal of the profit. There could be certain terms and conditions when one is subjected to a withdrawal fee. For instance, once you’ve made enough money without incurring any commissions, you can submit a withdrawal request. The profit amount must, however, be two times your deposit amount. If you withdraw any amount lower than that, you will have to pay a minimum charge, also known as a withdrawal. However, Binomo doesn’t charge any fees for withdrawals.

What kinds of commission or fee schemes are offered by Binomo?

As was already indicated, customers are not charged a trading fee by Binomo. As a result, there are zero commission schemes.

Although the commission for withdrawals and subscriptions is the same for everyone, the fee levied from you during withdrawals is dependent on your trading activity, and the various account types do receive special perks and benefits.

Last Updated on January 27, 2023 by Arkady Müller