How do you change the password of your broker trading account?

A trading broker can either be a person or a firm that sells and buys stocks on behalf of investors. That means anyone willing to enter the trading market must have a reliable broker on their side.

As many brokers are popping up in the market, it’s important to conduct thorough research before choosing one. Doing a detailed analysis allows you to come across the best brokers with the best trading services.

But how will you keep your trading account safe? As the number of trading scams has increased, safety has become a major concern. An easy way is to regularly change your online broker account’s password.

Keep reading to learn how to change the password of the online broker account.

Why do you need to change the password of a trading account?

A trading market is a profitable place, which makes it so much popular among traders. But it also makes the platform susceptible to scams and fraud.

No matter whether you invest in assets, indices, forex, or cryptocurrencies, you can fall prey to trading scams. Thus, it is important to stay as informed about the market as possible. But that’s not enjoyable.

In addition, you should regularly change your trading account password, so hackers don’t steal your money.

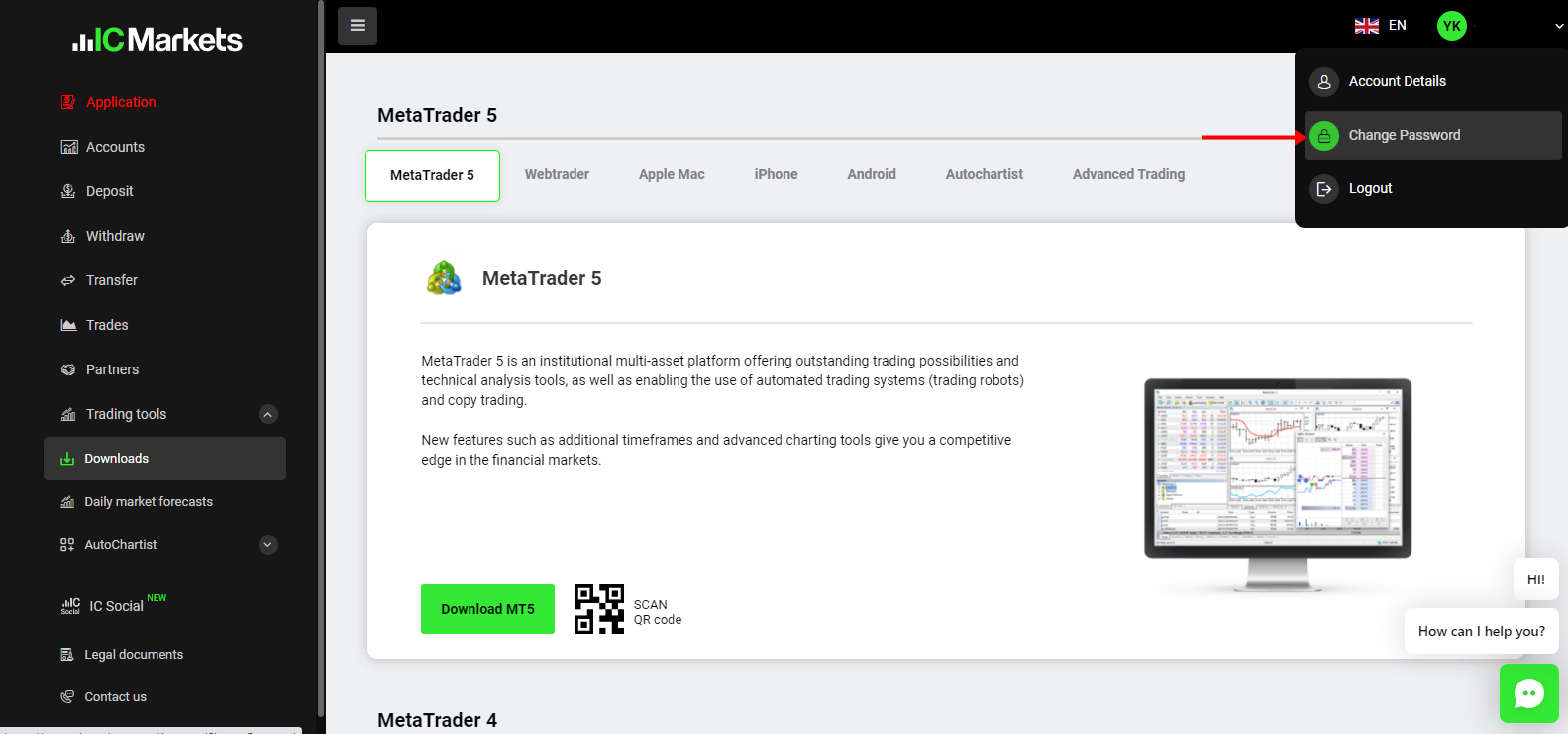

Changing the password of the online broker account is simple:

- All you need to do is log in to your trading account

- Then visit the Settings section and then click on Change Password

- Following this, enter your old password and new password

- Lastly, confirm the password and click change

Just like that, your online trading account password will be changed.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Other ways to keep the trading account safe

Besides regularly changing the password of your trading account, here are some more ways you can keep your account safe:

- Check for trustworthiness

- Profits and rewards for account opening

- Cash bonus for opening an account

1. Check for trustworthiness

Before registering with the trading account, check whether it is trustworthy. That’s because scam brokers have taken over the market, claiming to be regulated and registered by the governing body.

Thoroughly go through the broker’s website and check the bottom of the homepage. If the broker is not reliable, there will be a warning of risks of trading CFDs along with a legal section,

Upon further examination, if you find out that a regulated firm does not regulate the broker, look for other options.

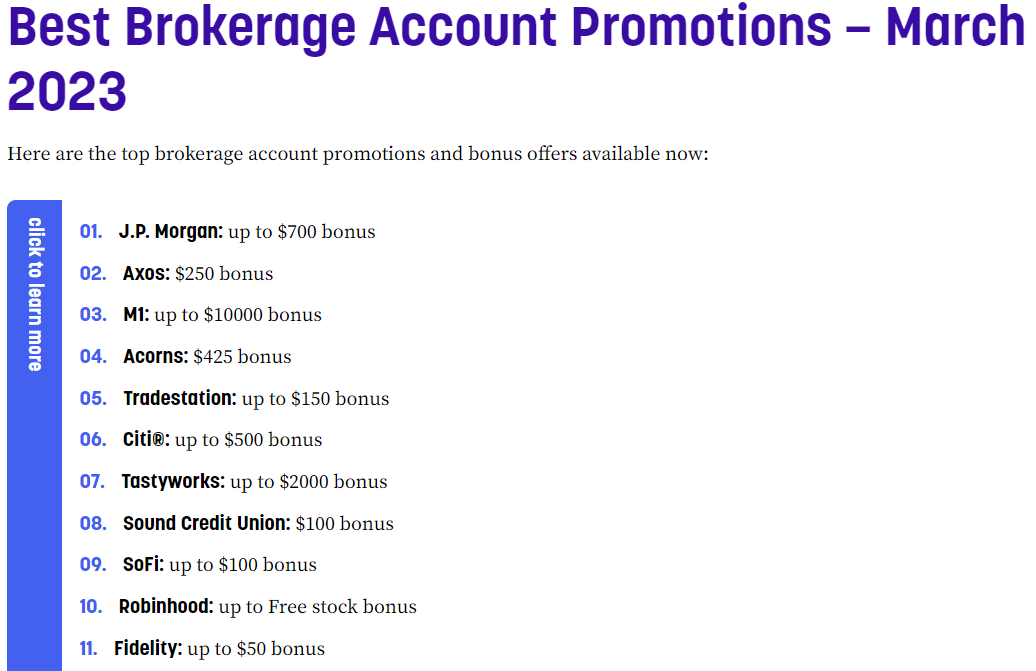

2. Profits and rewards for account opening

Registered and trustworthy brokers offer profits for account opening. Unfortunately, shady brokers have also started doing it to attract traders and to appear appealing in the market.

But there is one way you can differentiate reliable brokers from shady ones. Thoroughly check the profits and rewards that the broker is offering. If it appears too good to be true, it’s a scam.

For instance, the broker might make claims like “earn $50 daily by investing $250”, “100% success rate,” or “make 80% returns on signals.” These claims are nothing but a scam to take your money.

No matter how good a trading broker is, it must never promise returns because the binary market is highly unpredictable. Fraud brokers also advertise pictures of expensive items being given to lucky investors.

3. Cash bonus for opening an account

A trading broker offering a cash bonus for opening a trading account indicates that a reliable authority does not regulate it. Also, if the broker fails to show the bonus details, you should think twice about registering with it.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

How to find an unreliable broker?

With the popularity of the trading market, unregulated brokers have also started popping up in the market.

Here’s how you can find an unreliable broker:

- Churning

- No regulatory background or information

- Unprofessional emails

1. Churning

Unreliable brokers practice an unethical technique called ‘churning’, where they influence the transactions to earn commissions. This practice can bring a great loss even to experienced traders or, if profitable, make traders liable for taxation.

You can protect yourself from churning by having full control of your trading account. But you can only do this if your trading account allows you to take control of your trading activities.

2. No regulatory background or information

Brokers that refuse to provide any background information or tell you about the organization regulating it are unreliable. Such a broker is unregulated and might not provide you with the necessary features to win a trade.

3. Unprofessional emails

Fraud brokers would regularly send you unprofessional emails, asking about your sensitive data like full name, address, or phone number. Avoid replying to such emails with the asked information because it can put you in trouble.

Conclusion about how to change the password of your online broker account

While using a trading account, you need to ensure that it’s safe and away from the reach of scammers. One way to do this is by regularly changing your online broker account password. Follow the steps mentioned in the post to change the password.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Last Updated on June 17, 2023 by Andre Witzel