Does an online broker charge deposit fees?

Traders need a reliable broker on their side to enter the market. That’s because brokers make trading easier and offer a safe platform to enter the market.

But the question is, how do trading brokers make money? It’s simple; they charge brokerage fees from their registered traders. The brokerage fee includes deposit, transaction, currency conversion, and more.

When it comes to deposit fees, a broker can either have a flat fee or charge a small percentage of the deposit.

Keep reading to know more about deposit fees.

What is the deposit fee?

A deposit fee is a small amount you need to pay as part of the trading cost. Most brokers charge it as a part of industry practice and to continue offering the best trading services. Unlike deposit fees, withdrawal fees are charged by payment method.

That means deposit and withdrawal fees are never the same. The deposit fee is relatively small, so traders don’t mind paying it. In fact, most traders don’t even pay attention to the deposit fee.

But avoiding the deposit fee can help you get extra money, which can further add to your trading account as a deposit. That’s why you must do detailed research to choose trading brokers with less deposit fees.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

How to find a broker with fewer deposit fees?

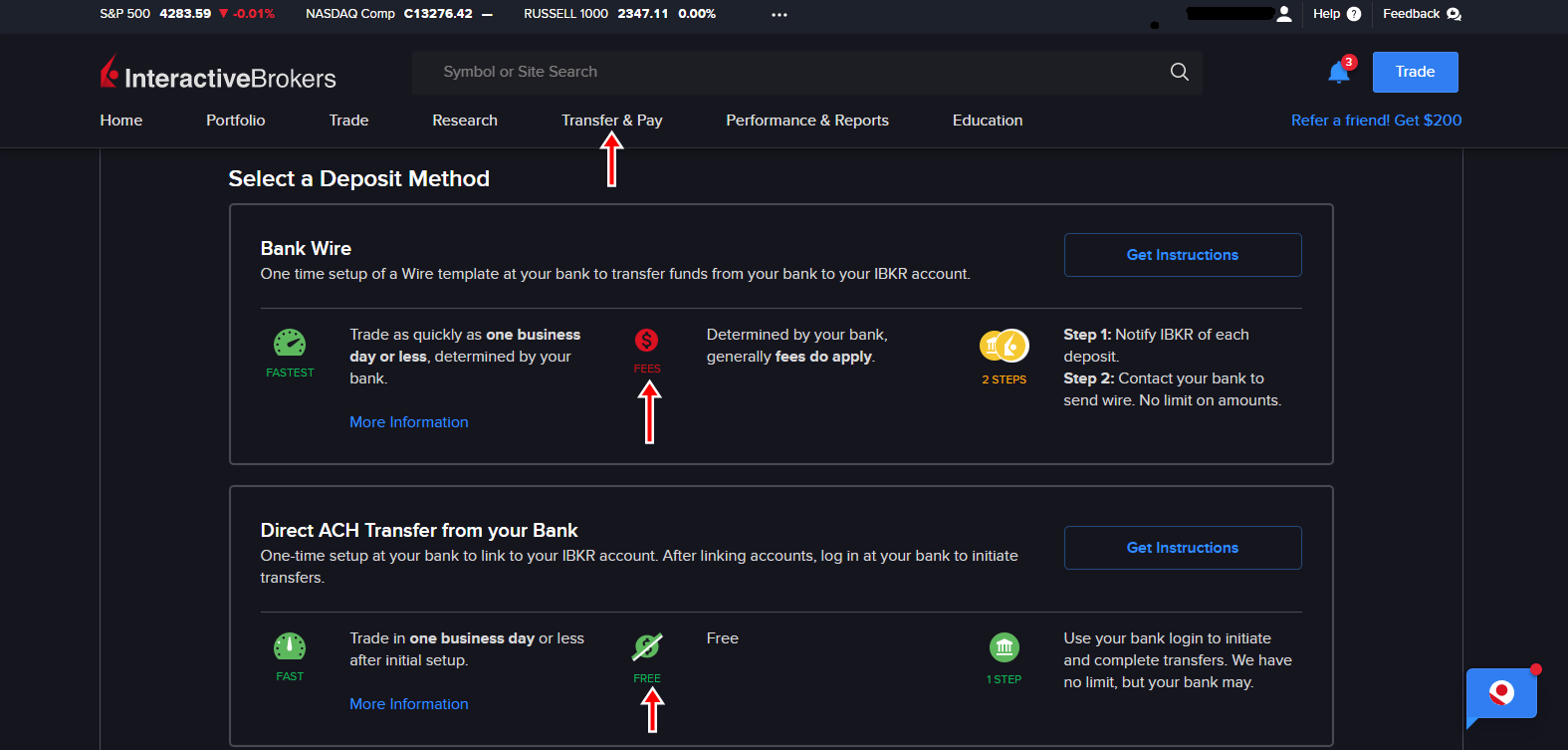

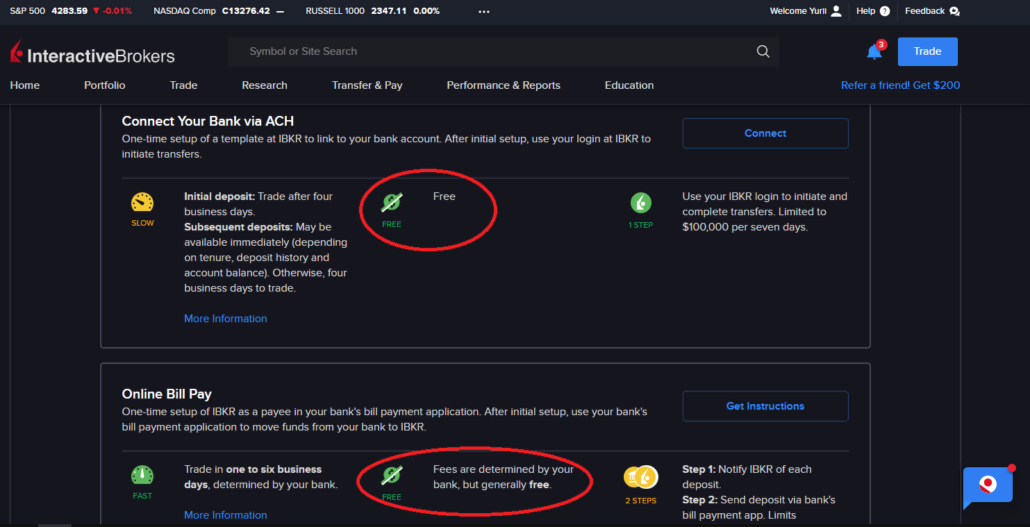

Brokers using third-party transfer methods do not charge deposits because they transfer funds from one account to another.

But finding the best broker that charges less deposit fee is difficult because every now and then a new broker pops up. You can, however, make the process simple by considering these three aspects:

- The concept of service

- Transaction limit

- Transaction type and trading method

1. The concept of service

You first need to figure out whether a zero deposit fee is a part of the broker’s payment policy. If it’s a temporary arrangement, it can be taken down anytime.

Don’t worry; you can easily find a broker permanent no-deposit fee policy because many brokers have started implementing it to offer better service.

2. Transaction limit

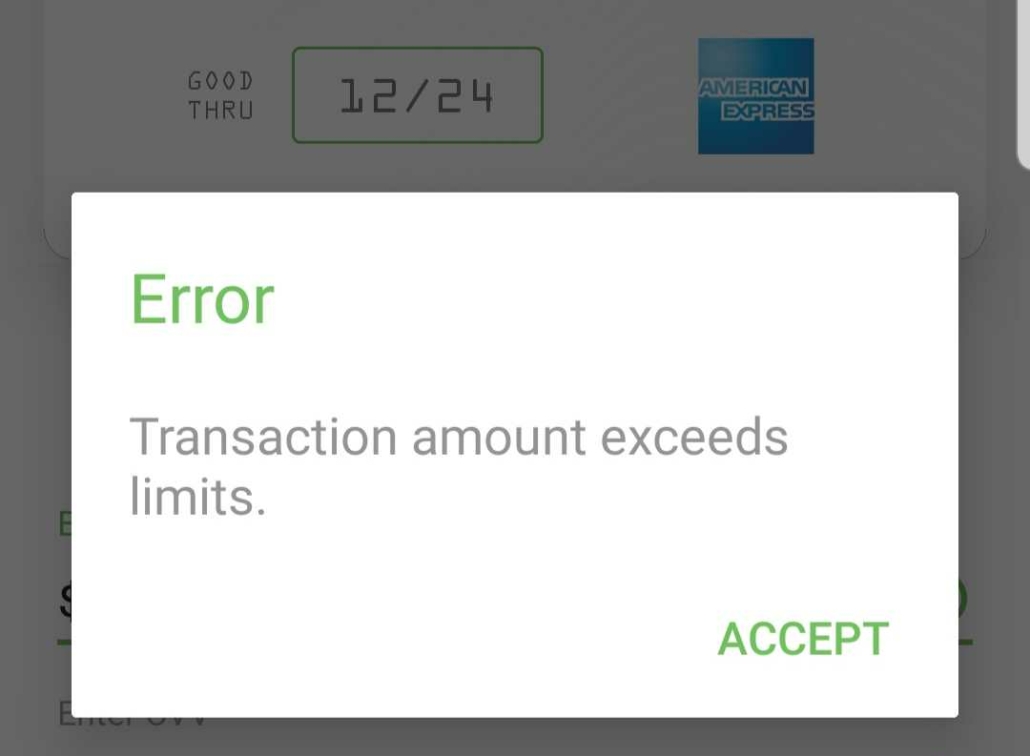

Brokers tend to impose transaction limits, which need to be fulfilled by traders. You can’t enjoy a free deposit if you fail to meet the transaction limit requirement. Thus, you would have to pay a small fee for the deposits.

So, you must know about such conditions before registering with a broker. It can save you from unnecessary surprises, which can arise further during trading.

3. Transaction type and payment method

At last, check the transaction type and payment methods. Why? Because a trading broker might not apply this feature for all its services. When you look for these features, you can rest assured about the deposit fee.

Zero deposit fee is a beneficial program run by many brokers because it helps traders reduce trading costs. Many brokers offer this service under their permanent policy to attract more traders.

But as a good trader, you must not entirely base your decision on this feature. Each broker has their pros and cons, which you need to consider. Why? Because a broker might have a zero deposit fee policy but lack quality and customer service. Or the broker might not support the trading strategy you want to use.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Why do brokers charge deposit fees?

Brokers charge deposit fees to make money and to continue offering the best trading services. By charging a deposit fee, they keep the firm profitable.

But if a broker does not charge a deposit fee, it charges other sorts of fees, including inactivity fees, maintenance fees, trading fees, and more. In simple words, traders need to pay money to use the platform and its services to make a trade.

How to avoid a deposit fee?

A deposit fee is a type of brokerage fee that cannot be avoided. By regularly logging into your account, you can avoid other brokerage fees like inactivity fees. Or by making regular trades.

But to avoid the deposit fee, you need a broker with a zero deposit fee policy. Carefully check the deposit fee conditions because certain brokers use it as a temporary arrangement.

Conclusion about the charging of your online broker deposit fees

Having a reliable trading broker lets you enter the market safely. You also get to use many wonderful trading features, which help you earn high profitability. But you cannot make a random broker selection, especially when most of them charge high deposit fees.

Instead, you can conduct detailed research to find brokers with a permanent no-deposit fee policy. Register yourself with such a broker and start trading.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Last Updated on June 17, 2023 by Andre Witzel