The four best Forex Brokers and trading platforms in Afghanistan-Comparison and reviews

Table of Contents

The residents of Afghanistan have embraced forex trading as another form of income. At present, Afghanistan forex traders can choose from a variety of forex brokers that are now accessible in Iraq. Here are some international forex brokers offering investment opportunities in Afghanistan.

See the list of the best Forex Brokers in Afghanistan:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

List of the four best forex brokers and platforms in Afghanistan

- RoboForex

- BlackBull Markets

- Pepperstone

1. RoboForex

RoboForex has been in the forex market since 2009 and has registered over 1 million forex traders in 169 countries.

Trading instruments – Investors can trade stocks, ETFs, Forex, Commodities, CFDs, energies, and metals.

Regulation – it has a trading license from International Financial Service Commission.

Account types – traders have an option of five, the Prime, ECN, Pro, and Pro-Cent, all with an initial deposit of $10, and the R-stocks trader with $100.

Fees – the Pro and Pro-cent have forex spreads from 1.3 pips, the Prime and ECN accounts start at 0.0 pips, and the R-stocks traders trade stocks, indices, and CFDs from $0.01.

Trading costs – it has an inactivity cost of $10; rollover costs apply for overnight trading, and deposits and withdrawals are free. It also has low commissions.

Leverage – the Pro and Pro-Cent account have the highest with 1:2000, the Prime and R-stocks trader have 1:300, while the ECN has 1:500.

Demo account – its demo account is unlimited and available in all account types.

Trading platforms – it offers four types, MT5, MT4, R-stocks trader, and the c Trader.

Payment methods – traders can use bank transfer, credit/debit cards such as Maestro, Visa, and digital wallets such as AdvCash, Ngan Luong, Neteller, Skrill, AstroPay and Perfect Money.

Customer Support – its customer support works 24/7 through live chat, emails, and phone calls and supports 11 languages.

Pros

- A Fast account registration process

- Responsive Customer Support

- Low trading costs

- Low initial deposits

- Negative Balance Protection

Cons

- Does not offer fixed Spreads

- Limited trading assets

(Risk Warning: Your capital can be at risk)

2. BlackBull Markets

BlackBull Markets started its operations in 2014, and since then, it has registered thousands of traders from five continents.

Trading instruments – it has indexes, metals, shares, energies, CFDs, commodities, and forex.

Regulation – has regulation from Financial Services Authority in Seychelles.

Account types – traders can access ECN Standard with an initial deposit of $200, ECN prime with $2000, and ECN Institutional has $10,000.

Fees – the ECN Standard has forex spreads starting at 0.8 pips, the ECN Prime from 0.1 pips, and the ECN Institutional from 0.0 pips.

Trading costs – The ECN Standard has no commission, ECN Prime has commissions of $6 for every $100,000 traded, and the ECN Institutional has no commissions. It has no inactivity costs; deposits and withdrawals are free.

Leverage – it has a maximum of 1:500.

The demo account – it has a free demo account for registered traders.

Trading platform – it has two, MT4 and MT5.

Payment methods – traders can deposit using Bank transfers, credit/debit cards, and electronic wallets such as Fasa pay, Neteller, Skrill, and Union Pay.

Customer Support – Customer care works 24/6 through live chat, email, and phone calls.

Pros

- Low trading costs

- Quality trading tools

- Fast account registration

- Fast order processing speeds

Cons

- Limited learning resources

- Customer Support is only available 24/6

(Risk Warning: Your capital can be at risk)

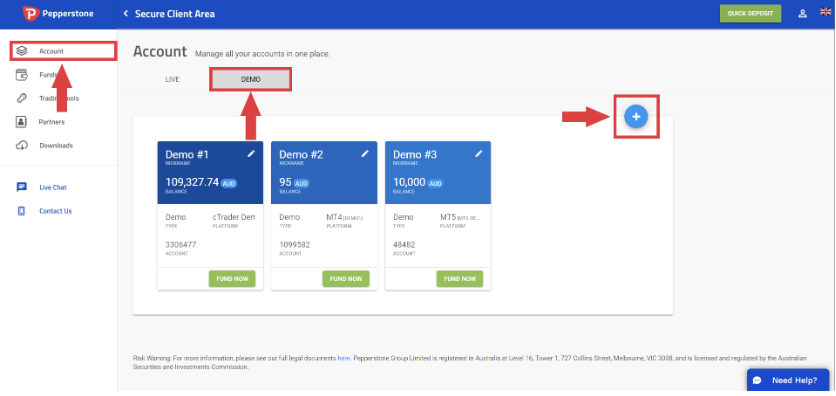

3. Pepperstone

Pepperstone launched in 2010 and has grown to serve more than 50,000 traders worldwide.

Trading instruments – it has indices, ETFs, commodities, Shares, and forex.

Regulation – it is licensed by the FCA and ASIC.

Account types – Pepperstone has two of them, the Standard account, which has a minimum deposit of $200, and the Razor account, also with $200.

Fees – the Standard account has forex spreads starting at 1.0 pips while the Razor account starts at 0.0 pips.

Trading costs – the Standard account has no commissions; the Razor account has commissions starting from $7 for a volume of $100,000. It also has no deposit or withdrawal fees and no inactivity fees.

Leverage – the highest leverage is 1:400.

The demo account – has $50,000 in virtual funds and is unrestricted.

The trading platforms – it has three, cTrader, MT5, and MT4.

Payment methods – traders can deposit or withdraw using bank transfers, credit/debit cards, and e-wallets such as Bpay, UnionPay, Neteller, Skrill, POLi, and PayPal.

Customer care – customer support works 24/5 via live chat, telephone, and email.

Pros

- Low trading costs

- Fast account opening process

- Fast order execution

- Numerous trading instruments

- Wide range of risk management tools

Cons

- Limited learning materials

- The customer care team is only present 24/5

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Is it legal to trade Forex in Afghanistan?

Yes, it is legal to trade forex if you are a resident of Afghanistan. There are forex brokers that have expanded their operations to Afghanistan, allowing more forex traders to access the securities and exchange markets.

The government of Afghanistan has recognized that forex trading is a way of generating income. It has given the Da Afghanistan Bank DAB the mandate to regulate the financial sector, including the securities and exchange industry, which is gradually growing.

What are the financial regulations in Afghanistan?

The backbone of the economy of Afghanistan depends on Agricultural produce. Some produce includes Saffron, cannabis, nuts, opium, and pomegranates. It also depends on foreign aid to support its economy.

The economy of Afghanistan was affected by the internal strife that took place since the invasion of 1979 by the Soviet Union, which affected its economic activities. The international community intervened with foreign aid, and although it helped rejuvenate its economy, GDP growth has been slow.

The Da Afghanistan Bank DAB is the central institution given the mandate to regulate the financial sector in Afghanistan. Since 2001 its inception, it has been responsible for ensuring the Afghan Afghani, which is the currency of Afghanistan.

The Responsibility of the DAB to regulate forex gives them the right to establish and execute laws that ensure that the securities and exchange markets are secure and transparent for all forex traders, dealers, forex brokers, and other market participants.

Some functions of the DAB are:

- It is responsible for establishing and executing guidelines or policies of foreign exchange markets within the boundaries of Afghanistan.

- It offers trading licenses to foreign exchange dealers such as brokers, banks, and financial institutions that operate in Afghanistan.

- Setting the scope of the position’s forex dealers and banks have to operate within.

- Creating the conditions to which forex exchange dealers and banks must adhere to have a license for operations.

- Revoking the licenses of forex dealers, banks, or financial agencies found to breach the guidelines set to control the financial industry.

- Supervising and regulating market participants registered under it.

- Regulations for forex dealers to comply with include;

- The forex brokers or financial providers within the securities and exchange market are responsible for collecting and recording relevant information about clients.

- Reporting any transactions beyond the limited amount as stipulated to the relevant department in the DAB.

- Offering required information and records about clients, management, financial institution operations, or the company to the DAB for audit.

Security for Forex traders from Afghanistan

The DAB has set regulations to ensure that the forex industry is safe. Some of them have included the Know your Customer law which forex dealers follow when registering forex traders to ensure that the transactions are transparent.

Apart from these, forex traders can ensure their safety by registering with internationally credited forex brokers to access the securities market in forex. These forex brokers have regulations from tier one and two jurisdictions, which means that they comply with laws that protect investors’ rights.

These policies include negative balance protection, monitoring, and preventing forex brokers from fraudulent activities such as manipulating spreads. International regulations also ensure that investor funds are secure by using segregated accounts for investors and company funds.

Trading strategies and analysis

Before you start trading, you have to understand the basics of forex trading. Some critical basics include using analysis to evaluate the underlying market. You can use two types of analysis, technical and fundamental analysis.

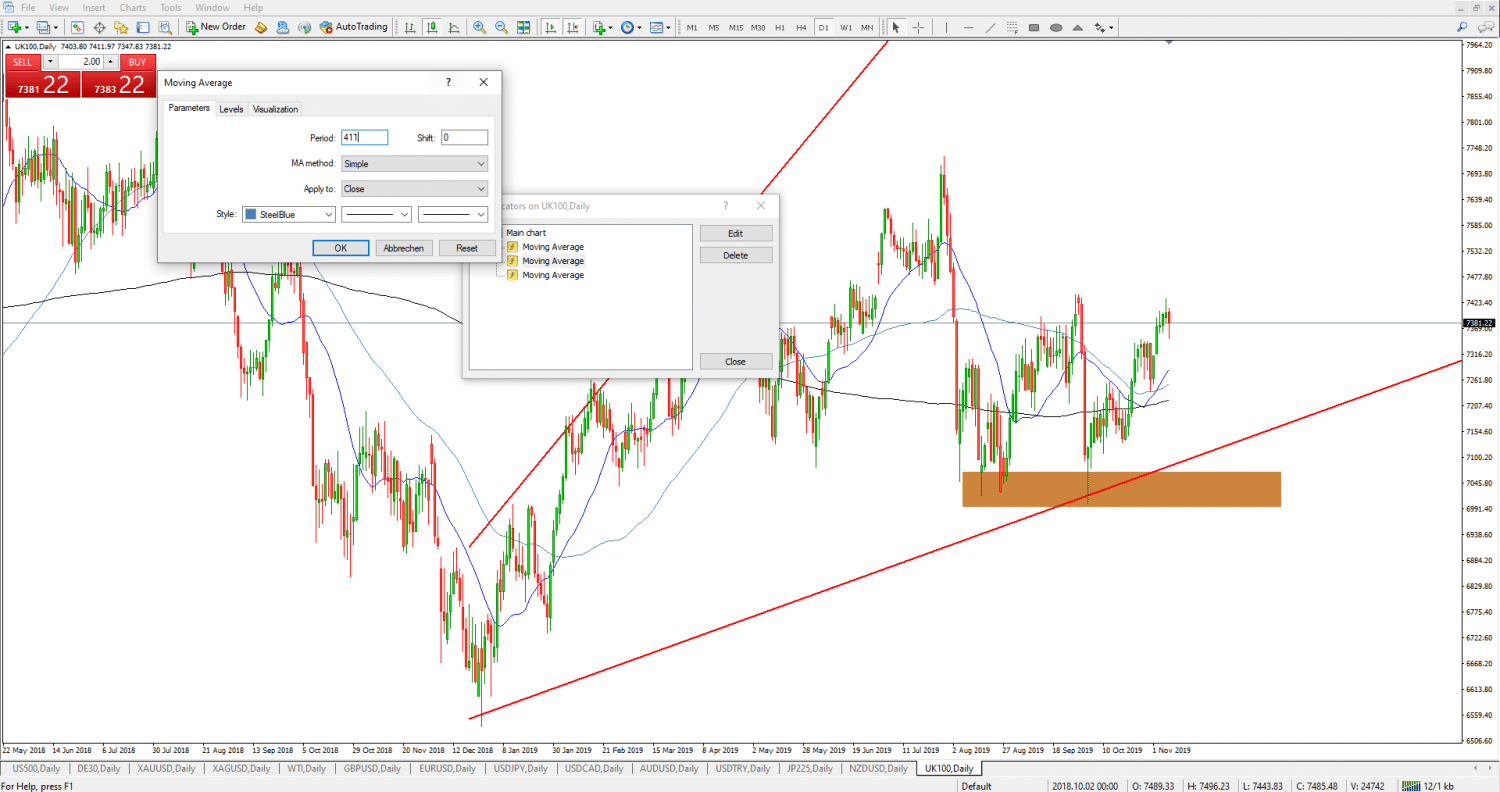

Technical analysis requires you to know how to read and evaluate trading signals you get from the price action. Technical analysis involves using technical tools such as indicators to know the volatility, momentum, and trend direction. You can also use the price patterns and the price history to know how the market behaves.

Fundamental analysis needs forex traders to follow the financial trends, such as the economic news, events, and announcements that can potentially affect the price movement of the underlying market you are trading. It is imperative to understand how to apply analysis before opening a trading position.

Trading strategies

There are many forex strategies forex traders have developed to increase the chances of profits in the securities market. Since the forex market has gained popularity, millions of traders globally trading different assets.

It makes it a competitive market since forex traders are finding out new trading strategies they can use. You can develop your trading strategy based on the asset you want to trade and the type of trader.

Trading strategies afghan traders can apply are:

Scalping-it works by opening and closing short-term positions through trading the small price movements in the prices.

Day trading – is opening and closing small, numerous positions and ensuring that at the end of the day, you have closed these trading positions. The income you make is the total profit throughout the day.

Trend trading – means opening and closing positions that can last more than a day. It requires a forex trader to be patient and conduct an in-depth analysis of the financial markets before trading.

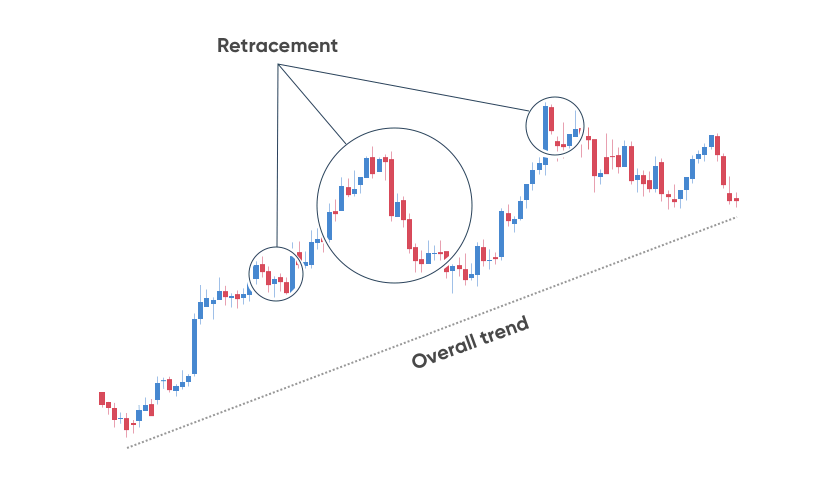

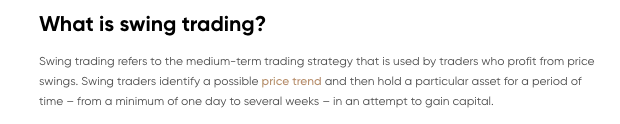

Swing trading – this is trading the upswings and downswings in the market. Depending on the time frame and the asset you want to trade, it can take from one day to several days.

A guide on how to trade forex in Afghanistan

Find fast internet and quality hardware trading resources

If you want to access the forex industry in Afghanistan, you have to look for proper resources such as computers and internet connections. Forex trading is possible, and if you want to make a profit, the tools you use, like computers and the internet, have to enable you to remain competitive with other forex traders.

It means that you have to invest in a good computer and fast internet connection to allow you to enter and exit the market without laxity. There are many innovations, such as the VPS, that you can purchase a subscription to, and some forex brokers also offer it at a premium cost.

Look for a reliable Forex trader that accepts Afghanistan traders

The forex market is just like any other online industry, with scams present even in Afghanistan. We recommend you register a trading account after you have done your research on the type of forex broker you want to work with.

When choosing, some of the factors you can check for include regulation, trading instruments, trading platforms, trading costs, and customer support. You can also search for reliable forex brokers by inquiring from other forex traders in Afghanistan.

Register a trading account for Afghan Forex traders

Most forex brokers have a safe online registration system that allows forex traders to open accounts remotely. You can fill in your details and send copies of the relevant documents online for verification.

The registration process takes a short period of between three and five minutes. The forex broker requires you to submit your name, email, citizenship, date of birth, account type you want to open, and password.

Download a trading platform

Forex brokers offer different trading platforms for accessing financial markets. Forex traders have different preferences, so a good forex broker supports several trading platforms that traders can select from.

Check the trading platforms your forex broker supports, select the one you want to use, and download it. Test the trading platform or customize some of the features to get the best experience when trading.

Start trading with a demo or real account.

The demo account allows traders to practice how to trade. It uses virtual funds, which enable forex traders to practice trading without risking their real funds. It is also a crucial tool for new traders to practice when testing out their trading knowledge.

Deposit funds and start trading

If you feel ready, you can deposit funds using one of the various payment methods the forex broker supports. If you use a bank account, you can link it with your trading account to deposit funds and start trading.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

Conclusion: The best Forex Brokers are available in Afghanistan

Like forex markets in other countries, the Afghanistan forex industry has increased the number of traders in the past five years. It has led to the increase of forex brokers and has also encouraged forex scams.

It is why we recommend using international forex brokers that are regulated. It allows you to trade in a secure environment and increases the possibility of making profits.

FAQ – The most asked questions about Forex Broker Afghanistan :

Is the Afghan Afghani available in Forex?

Yes, it is available, but a few forex brokers offer it since it is a low-interest currency. Its currency code is the AFN; forex traders pair it with the USD or the EUR. The USD/ AFN current exchange rate is 86.23, and the EUR/AFN is 90.73.

How is Forex taxed in Afghanistan?

The DAB taxes forex trading according to the generated income and the trading asset traders. If the generated income surpasses the limits set by the DAB, the forex traders are required to follow the policies and pay the taxes as recommended.

Is forex trading possible in Afghanistan?

Yes, Afghanistan traders can trade many underlying assets, including forex. You can begin by choosing a forex broker that operates in Afghanistan. A trader here can choose any desired forex pair to initiate forex trading. The brokers allow you to trade the top international currency pairs. For instance, you can trade USD/EUR, USD/GBP, etc. Forex trading is fun for any trader in Afghanistan.

How can a trader in Afghanistan initiate forex trading?

A trader in Afghanistan hoping to trade forex can initiate by following a few steps.

Choosing a forex broker in Afghanistan is the first step in forex trading.

Then, a trader can sign up for a forex trading account with his chosen broker.

Finally, a trader can fund his live trading account for which he just signed up with the broker.

After careful analysis, he can place his forex trade and earn profits.

Which forex broker in Afghanistan allows traders to begin trading with a low minimum deposit amount?

Among many forex brokers operating in Afghanistan, brokers such as BlackBull Markets, RoboForex, etc., allow traders to sign up with a low minimum deposit amount. Traders in Afghanistan can begin trading with an amount as low as $10. Thus, it is attractive for both beginners and advanced forex traders.

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)