The 5 best Forex Brokers and platforms in Albania – Comparison and reviews

Table of Contents

Forex trade is one of the biggest financial markets in the world today. People trade forex for various reasons. Part of this is that it is a convenient way to make money, and there is high liquidity. It is no wonder why it keeps growing, even today.

See the list of the best Forex Brokers in Albania:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 75% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

People trade forex with the use of Forex broker platforms. This article has the best five broker platforms to trade within Albania for you. You will also get to know how to start trading forex by the time you finish reading.

The list of the 5 best Forex brokers in Albania includes the following:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

Capital.com is a forex broker that is headquartered in London. It has branches in other countries like Australia, Cyprus, Belarus, Bulgaria, Poland, Ukraine, Lithuania, and Gibraltar. The broker is appropriately under the regulation of some international financial institutions. These institutions include the CySEC, ASIC, FCA, and BaFin.

The broker provides its traders with a variety of assets to trade with. These include assets like cryptocurrencies, commodities, stocks, and CFDs. All of these are tradable on the platform. The tradable fees of these assets are low on Capital.com.

Traders have access to three account types. These account types include a demo account, a standard account, and a plus account. The demo account is simple there for learning how the interface of the broker works. It is an excellent way to know how forex works if you are new to forex trading.

Capital.com is commission-free, so whether you trade with the standard account or the plus account, there is no commission on any of these accounts. The standard account’s minimum deposit is $20, while the plus account users’ minimum deposit starts at $3000. The platform provides different payment methods through which traders can fund their accounts.

Capital.com is a MetaTrader platform that is only on MT4. MT4 is a good platform because it can be used to perform multiple functions at once. The platform is available on phones and desktops with the same user experience. Trading is even more flexible and enjoyable for traders.

Advantages of Capital.com

- The minimum deposit available for a standard account is $30

- Opening and setting up an account is straightforward.

- Equal market and trading as it is commission-free

- The platform offers free educational resources and quizzes that traders can use to improve and access themselves.

Disadvantages of Capital.com

- The plus account minimum deposit is relatively high

- It does not offer the MT5 platform

(Risk warning: 75% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a brokers’ platform that started in 2014, and it has its headquarters in Auckland, New Zealand. The broker offers forex services to countries across the globe. BlackBull Markets is an award-winning financial technology company, and the broker provides assets for traders around the world. These assets include Forex pairs, CFDs, indices, and commodities.

The traders enjoy reliable and resourceful market tips from the brokers’ platforms. These resources are helpful because they help traders to know what the market competition is like. The resources help traders understand how to strategize themselves against the coming market days.

BlackBull Markets has three account types that traders can use. They include the demo account, a standard account, and an ECN prime account. The demo account is available for both the standard account owners and the ECN prime account owners. The demo account is used to know how to trade forex and how exactly the interface works.

The broker is not commissioned, and those with the ECN prime account must pay a commission after every trade. ECN Prime account owners must also make an initial deposit of $2000 before the account can be used to trade. Standard account owners do not get any commission, but their deposit is $200.

The broker platform is a MetaTrader platform, and they have both the MT4 and MT5 platforms available. There is also the WebTrader for desktop users. The good thing is that the MetaTrader is available on both mobile applications and desktops. So, traders enjoy the same trading experience.

Advantages of BlackBull Markets

- The platform is MetaTrader-based

- Traders get access to meaningful, reliable market resources

- The broker is regulated and so offers security for traders

- ECN Prime account owners receive a commission after the trade

Disadvantages of BlackBull Markets

- Traders from the US are not allowed on the platform

- Educational resources and quizzes are not accessible on Blackbull Markets

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is under the regulation of the FSC (Forest Stewardship Council). The company started in 2009 to offer services to the world. It initially had two groups: the RoboForex group and the RoboMarkets group. The two groups perform different functions but primarily offer forex services.

The broker is well set up in countries around the world. It has customer service that can efficiently respond to the traders. The customer service offers well over 17 languages. This makes communicating with clients easy, fast, and responsive. Traders are accessible to assets like Forex pairs, Commodities, and gold.

RoboForex is a MetaTrader platform. The MetaTrader consists of both the MT4 and MT5 platforms. This means that traders can perform multiple functions thanks to the MetaTrader available. The cTrader on RoboForex is even more efficient than the MT4 and MT5 platforms.

Traders get access to both educational resources and market resources. The educational resources help improve one’s knowledge about forex trade. The educational resources could even have strategies that traders can apply when they want to trade or before they trade.

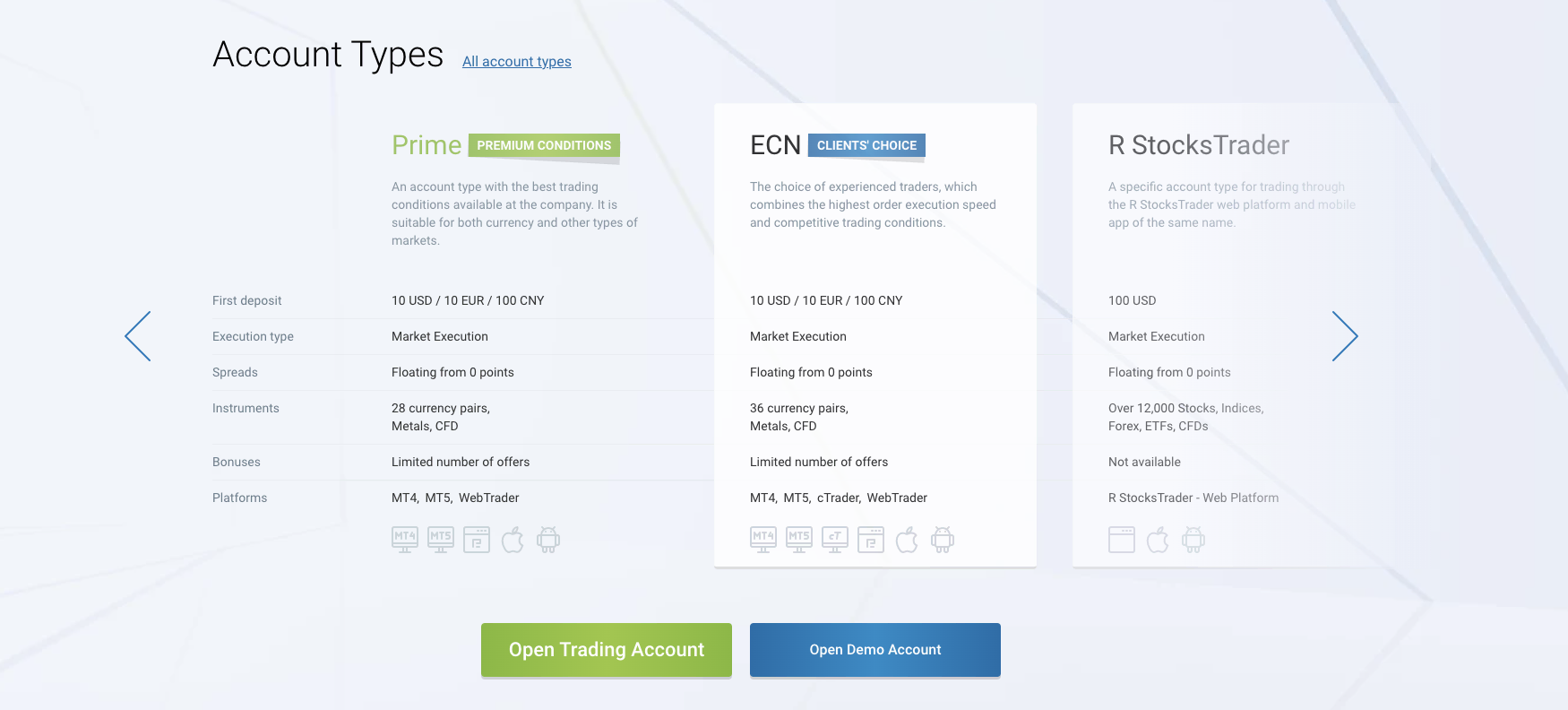

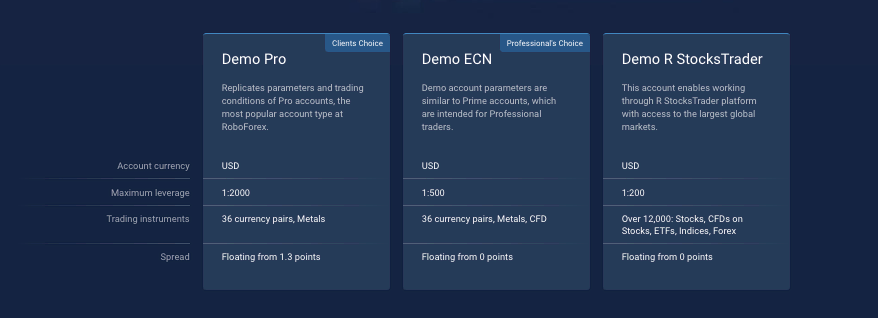

RoboForex is available with a demo account and five other account types that traders can choose from. The other five account types include – Prime account, ECN account, R StocksTrader, Pro-Cent account, and Pro-Standard account. All the account types have a minimum deposit of $10 except the R StocksTrader, whose minimum deposit is $100.

Advantages of RoboForex

- Minimum deposit of $10 for most of the account types

- A demo account is accessible to traders

- The platforms available are MetaTrader and cTrader platforms

- The broker is commission-free

Disadvantages of RoboForex

- US clients cannot trade on the platform

- A small number of currency pairs

(Risk Warning: Your capital can be at risk)

4. Pepperstone

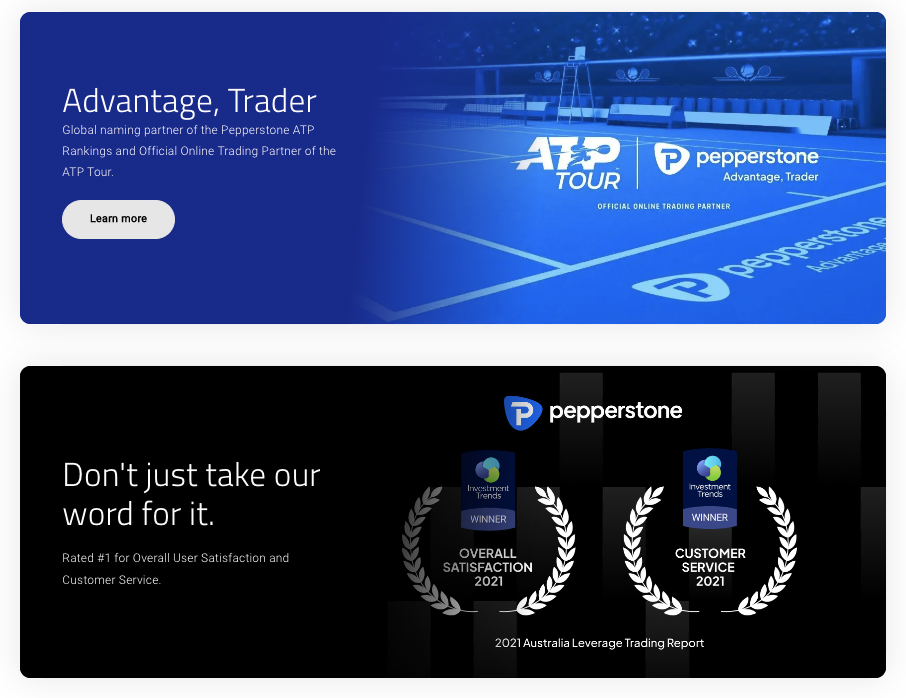

Pepperstone has its company headquarters in Australia. The office was built in 2010 to offer financial services to forex traders worldwide. The company is under the regulation of the ASIC, FCA, BaFin, SCB, CySEC, and DFSA. Pepperstone has many licenses that offer security to the traders on its platform.

The broker platform offers three account types to its traders: the demo account, the standard version, and the razor account. The demo account is available for standard and razor account users. Pepperstone’s demo account is not everlasting. It expires after a month.

Pepperstone’s standard account and razor account operate on different spreads. The accounts work on other spreads and commission rates. A standard account user has a minimum deposit of $200 with a spread that operates at 1.1pip with zero commission for the trader.

On the other hand, the Razor account is more competitive, having a spread that operates at 0 pips. Trading with the razor account allows you to make a minimum deposit of $2000. You will get a commission at the end of every trade. Professionals usually start with the razor account because of its spread.

Pepperstone is a MetaTrader platform, having both the MT4 and MT5 for traders to use. cTrader platform is available on the platform. One good thing about trading on the MetaTrader platform is that it has plugins that help traders strategize themselves on the forex chart. The plugin makes trading a lot easier thanks to its functions by creating good strategic positions on the chart.

Advantages of Pepperstone

- There is a bot within the plugin that helps traders’ trading strategy

- MetaTrader and cTrader platforms are available

- Excellent and responsive customer service

- Offers multiple social copy space

Disadvantages of Pepperstone

- The demo account will expire after a month

- It has limited trading assets

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option started as a broker company in 2013. The only thing they offered then was a binary option. But in later years and with the improvement of their technology, they now offer more than binary options. The broker platform provides traders with worldwide assets such as – commodities, forex pairs, cryptocurrencies, groceries, and stocks.

IQ Option has its main office in Cyprus. The company is under the Cyprus Securities and Exchange Commission (CySEC) regulation. The CySEC is an international regulatory body that offers security for traders. The rules laid by the CySEC make IQ Option trading conditions favorable to the traders.

The broker platform offers three account types. These account types include the demo account, the standard account, and the VIP account. The demo account is loaded with $10000 that the traders can use to trade. The demo account does not expire, so traders can keep using it to practice new strategies that they might have in their minds continuously.

The standard account users make a minimum deposit of $10 into their accounts. The spread is different from that of the VIP account. There is no commission for users with this account type, the VIP account offers a tighter spread, and the initial deposit starts from $1000. Traders with VIP accounts enjoy a commission amount at the end of every trade.

The company offers educational resources to traders in articles, courses, and videos. There is also the occasional webinar that is organized. The platform has a forum that provides educational and market resources to traders.

IQ Option is available for both mobile users and web users. The platform is flexible and easily accessible, designed with a manipulative chart type. This means traders can switch the chart type from default to customize.

Advantages of IQ Option

- The platform offers good customer support.

- There is a minimum deposit of $10 for standard account owners

- A demo account is available

- There is an interactive forum and organized webinars for traders

Disadvantages of IQ Option

- US clients cannot trade on IQ Option

- There is a withdrawal fee when you want to withdraw funds.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Albania?

According to the law, the institution responsible for Albania’s financial regulation is the Bank of Albania. The law stipulates that the Bank of Albania may carry out the following duties in the country – regulate, give guidelines, make decisions and order any other financial institution that operates in the country. These financial institutions include commercial banks, mortgage banks, moneylenders, etc.

The regulations set by the Bank of Albania are meant to supervise the other financial institutions. The regulations limit the banks and other financial institutions’ risk. The Basel Committee documents and EU directives serve as the foremost guidelines by which the Bank of Albania regulations are followed.

(Risk warning: 75% of retail CFD accounts lose money)

Security for traders from Albania

Forex trading is an online financial transaction with individual phones and computers. There are many misconceptions about forex being a lie, and a means to steal money from those who trade forex. Though this is liable, it is only familiar with not licensed brokers.

Trading forex in Albania does not have any framework that guides it, so it may seem like a fraud. The best form of security traders can give to themselves is trading on regulated broker platforms. Such platforms usually have favorable trading conditions for traders.

The regulations set by the international financial institutions that oversee such brokers make sure that they comply with rules that put traders first. Such rules set include protection from fraud, prevention of financial abuse, and prevention of price manipulations of such brokers.

Regulated brokerage companies are the best form of security a trader can give themselves.

Is it legal to trade Forex in Albania?

Yes, trading forex in Albania is legal. No law limits forex trading in the country. Albania might not have a framework that guides forex brokers in Albania, so it is advised that traders in the country trade with international brokerage companies such as the ones mentioned earlier.

International brokerage companies have different regulatory bodies that guide their existence. There is no limitation to the amount that a trader can deposit into their account too. The international forex brokers are licensed and therefore offer proper security to the traders.

International regulatory bodies guide the functioning of the brokers. They ensure that brokers do not act opposite to the rule that guides them.

How to trade Forex in Albania – Tutorial

Open account for Albanian trader

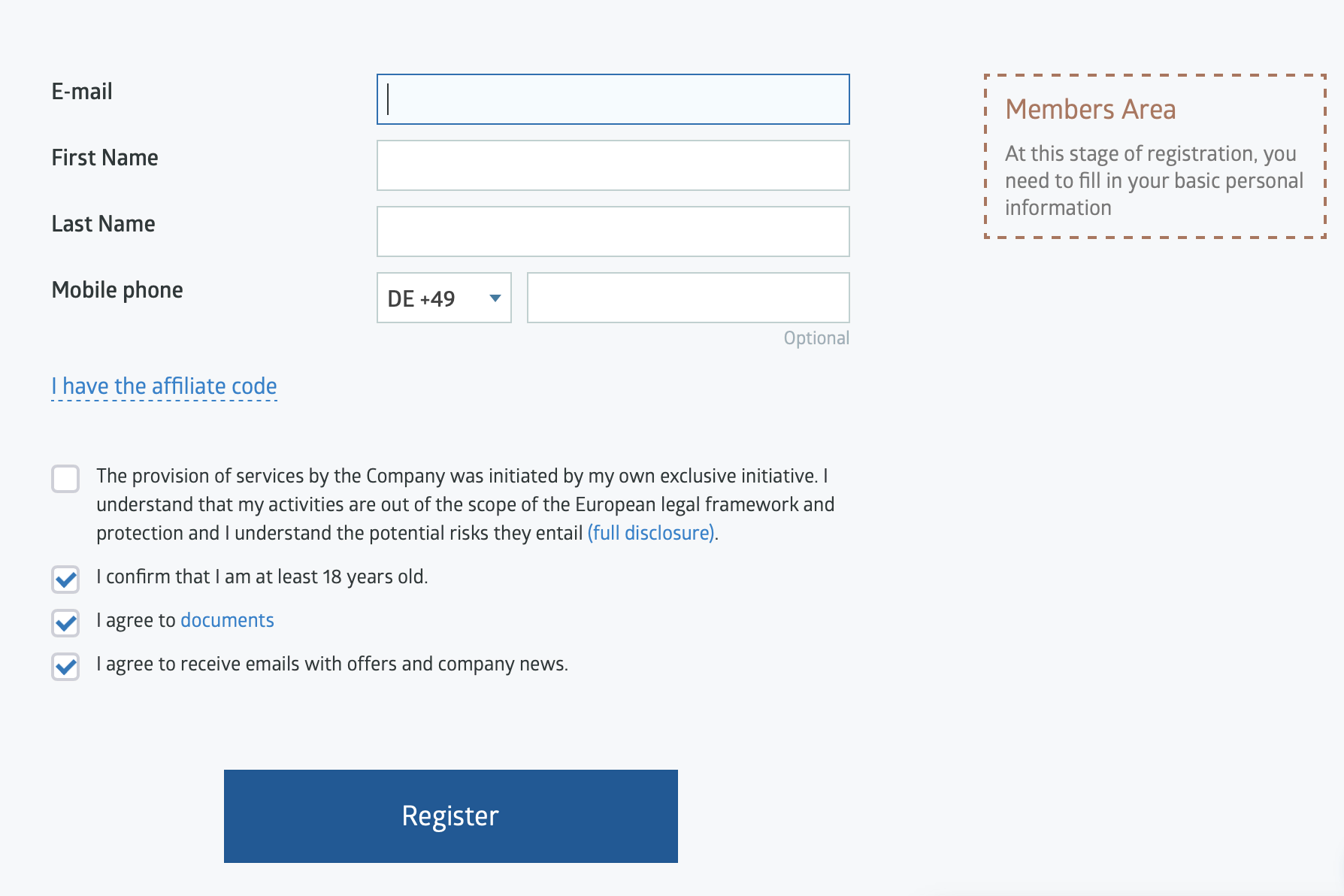

Forex trading on a broker platform will require you to open an account with them. You cannot trade forex on any broker platform without first registering with them. It is straightforward to open an account with the brokers listed above. But they will require documents to verify your account.

The documents for verification include identification documents like – a national passport, a national identity card, or a driver’s license. Then they will require a document of residency, too, like a utility bill.

Start with a demo account or real account

After registration, you will then be able to use the demo account provided by the broker and your real account. If you are a new forex trader or new to forex trading, it is advised that you start with the demo account first. Use it to get familiar with the platform’s chart, spread, and environment. Trading with your real account will require you to deposit money into it.

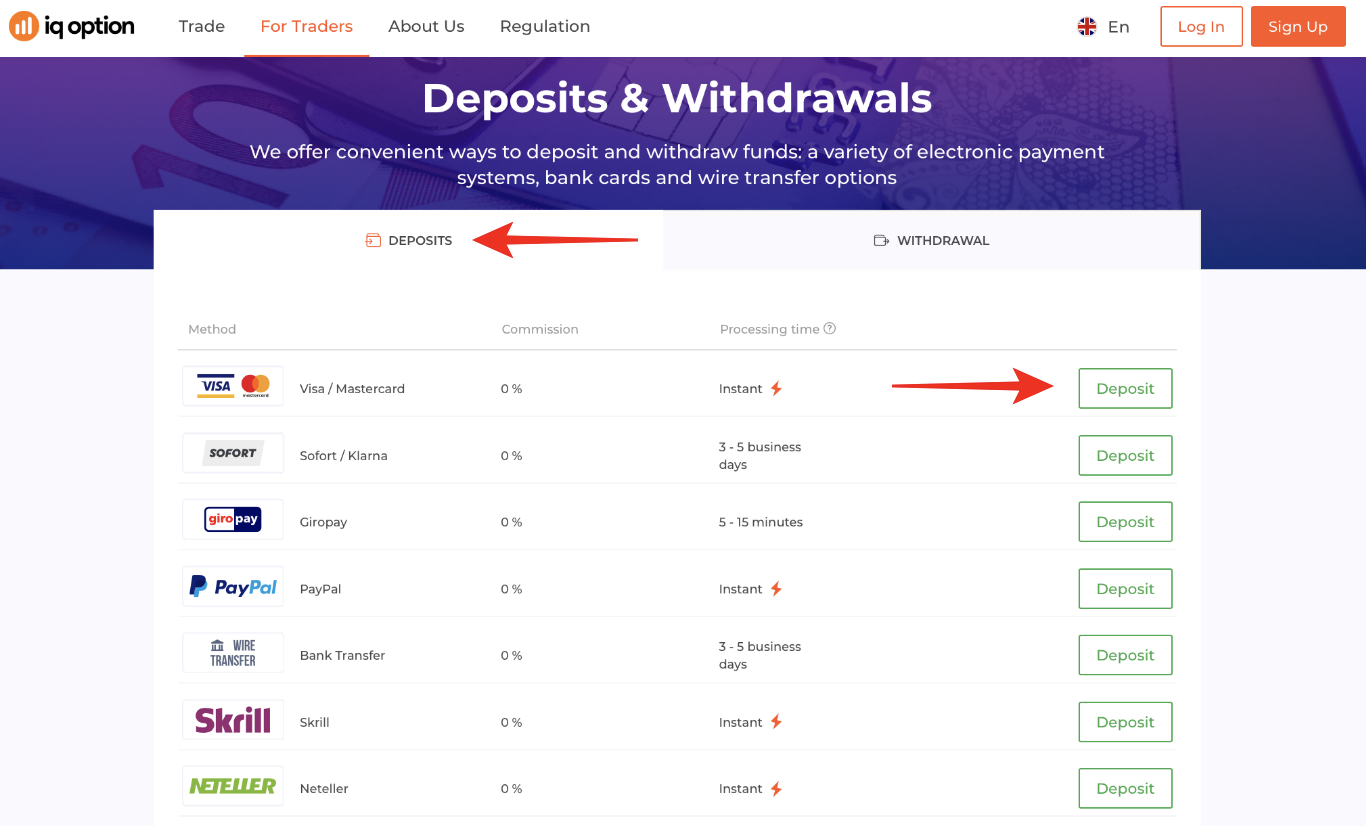

Deposit money

Deposit money into your real account if you want to start actual or live trading. There is a minimum amount that you can deposit into the real account. To deposit money, you will need to select a payment method that you will use to make your deposit. Different payment methods include direct bank transfer, debit card, and credit card.

Notice:

The payment methods depend on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use of analysis and strategies

After you make your deposit, you must have a particular approach or pattern to open and close trades to begin trading. Having a strategy as a trader is handy because it makes your trading more careful and accessible.

Some strategies used in forex include the following.

Scalping

Scalping is a forex strategy that most new traders use. It involves opening multiple trades for a short while or a single day and then closing them soon. The aim is to profit from all the trades opened through the profit may not be much.

Day trading

Day trading is a forex strategy that involves staying in one position for a whole day. The trader closes trading when the primary market ends. This trading style is used in forex and is most common in forex.

Position trading

The position trader is the opposite of the day trader in forex. The position trader can stay in a particular position on the chart for more than one week and even years. This technique is quite similar to investing because it is dependent on long-term market changes.

Make profit

Profit-making is every trader’s end goal. If you are a careful trader, it will be easier to make a profit. Making a profit is all about strategizing and making good positions while trading.

(Risk warning: 75% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Albania

Forex traders must remember that forex involves high risks end this essay. Traders must not just make ignorant decisions because it can lead to immediate loss. Forex trading makes it easy to gain wealth. But note that just as easy as it is to acquire wealth through forex trading, it is also easy to be at a loss. Strategies, tutorials, and forums are beneficial.

Trading on brokers that are not regulated is another risk that traders must avoid. If the broker you are trading on does not have a regulatory body that oversees it, it is best to withdraw your money and go to a regulated broker. No matter how good that broker’s spread may be or the commission it has for traders, it is not trusted that you trade with them.

FAQ – The most asked questions about Forex Broker Albania:

Which checklist should I prefer while selecting a forex broker in Albania?

The following elements should be taken into consideration by an Albanian trader when selecting a forex broker:

– Check for the brokerage fee, which covers spreads fees and funding/withdrawal costs for trading.

– The availability and widespread use of an FX trading platform (e.g., MetaTrader 4).

– Check for special trading capabilities, including social trading and copy trading capabilities.

– Check for the reputation and regulatory standing of the forex broker.

– Check for the range of financial markets, including currency pairs and CFDs on cryptocurrencies.

– Check for the minimum deposits needed and the funding policies of the broker.

– Check for the availability of both online and offline training platforms with the help of clients.

– Risk-management tools like negative balance protection and guaranteed stop-loss orders.

What are Albania’s top trading and FX broker platforms?

After carefully examining the advantages they provided, the top trading platforms and forex brokers in Albania were determined to be the finest.

Interactive Brokers – It is the best online International broker in Albania, offering low trading fees and many ranges of products with great tools for research.

Roboforex offers low trading fees, excellent opening features, and free deposit and withdrawal terms.

IQ Option is considered a great platform with outstanding research and great product availability.

CMC Market – It offers highly advanced tools for research and strategies in web and mobile apps for low forex fees.

Capital.com – It offers great service and low CFD and commission fees. Offers great customer service.

Last Updated on March 2, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)