The five best Forex Brokers and platforms in Angola – Comparison and reviews

Table of Contents

Many people assume that forex trading in Africa is non-existent, but the forex trading community in Angola is thriving and growing by the day. It is why we have created a list of five forex brokers traders in Angola should consider that have low trading costs and are regulated by the leading regulatory institutions in the industry.

See the list of the best Forex Brokers in Angola:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 75% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

List of the five best forex brokers and platforms in Angola:

1. Capital.com

Capital.com is a forex broker with 5 million registered trading accounts since 2016, when it was established.

Trading instruments – its user’s trade indices, commodities, shares, cryptocurrencies, stocks, and forex.

Regulation – it has regulations from the NBRB, CySEC, FCA, and the ASIC.

Account types – it offers three types of trading accounts Standard with an initial deposit of $20, Plus account with $2000, and Premium with an initial deposit of $10,000.

Fees – forex spreads start at 0.8 pips.

Trading costs – it has no inactivity costs and is a zero commission forex broker. The deposits and withdrawals are also free.

Leverage – the maximum leverage is 1:500.

Demo account – it has an unlimited account with $10,000 virtual funds.

The trading platforms – it uses web trader and MT4.

Payment methods – They support credit/debit cards, bank transfers, and e-wallets such as iDeal, Multibanko, Trustly, 2c2p, and Apple Pay.

Customer support – Their support team is available 24/7 via SMS, emails, live chat, and they offer support in 13 languages.

Pros

- It offers negative balance protection

- Fast deposits and withdrawals

- Low trading costs

- Low initial deposit

- Fast order Processing speeds

Cons

- High initial deposit for the premier account

- Limited research tools

(Risk warning: 75% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets started its operations in 2014 and has since registered thousands of clients.

Trading instruments – it has shares, energies, indexes, CFDs, forex, commodities, metals, and forex.

Regulation – it has a trading license from Financial Services Authority

Account types – the ECN standard with a $200 initial deposit, the ECN Prime has $2000, and ECN Institutional has $20,000.

Fees – the ECN Standard has forex spreads from 0.8 pips, Prime from 0.1 pips, and the Institutional from 0.0 pips.

Trading costs – Institutional account has a variable commission, the Prime starts at $6 for a volume of $100,000, and the Standard is commission-free. It has no inactivity fee, and deposits/ withdrawals are free.

Leverage – the highest leverage is 1:500.

Demo account – its demo account is unrestricted.

The trading platforms – it offers MT5 and MT4.

Payment methods – traders, can deposit via credit/debit cards, bank transfers, UnionPay, Neteller, Fasa Pay, and Skrill.

Customer support – Their support team is present 24/6 through emails, live chat, and phone calls.

Pros

- High leverage

- Low trading costs

- Fats account registration

- Low trading costs.

Cons

- Limited learning and research materials

- Customer support is only present 24/6

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex has over one million registered brokers since 2009 when it got launched.

Trading instruments – stocks, cryptocurrencies, CFDs, forex, commodities, metals, ETFs, and energies.

Regulation – from the international Financial Service Commission

Account types – it has five, ECN, Prime, Pro, and Pro-Cent, all with an initial deposit of $10, while the R- stocks trader has $100.

Forex spreads – the Pro and Pro cent have forex spreads starting at 1.3 pips, ECN from 0.0 pips, Prime at 0.0 pips, and R-stocks trader from 0.01 USD.

Trading costs – an inactivity cost of $10; the commissions vary with the account types, and overnight costs depend on the leverage. Deposit and withdrawal costs are negligible.

Leverage – the Pro and Pro –cent has 1:2000, the Prime and R-stocks trader have 1:300, and the ECN has 1:500.

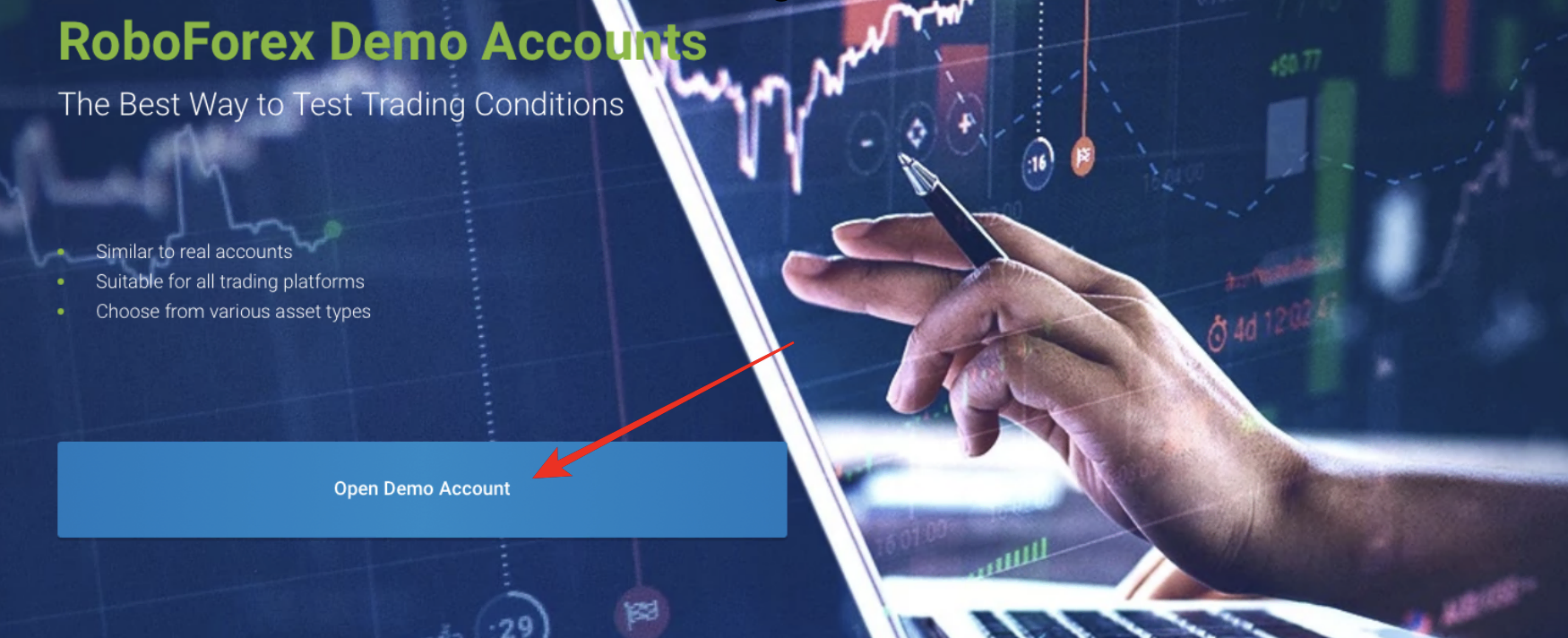

Demo account – its demo account is unlimited.

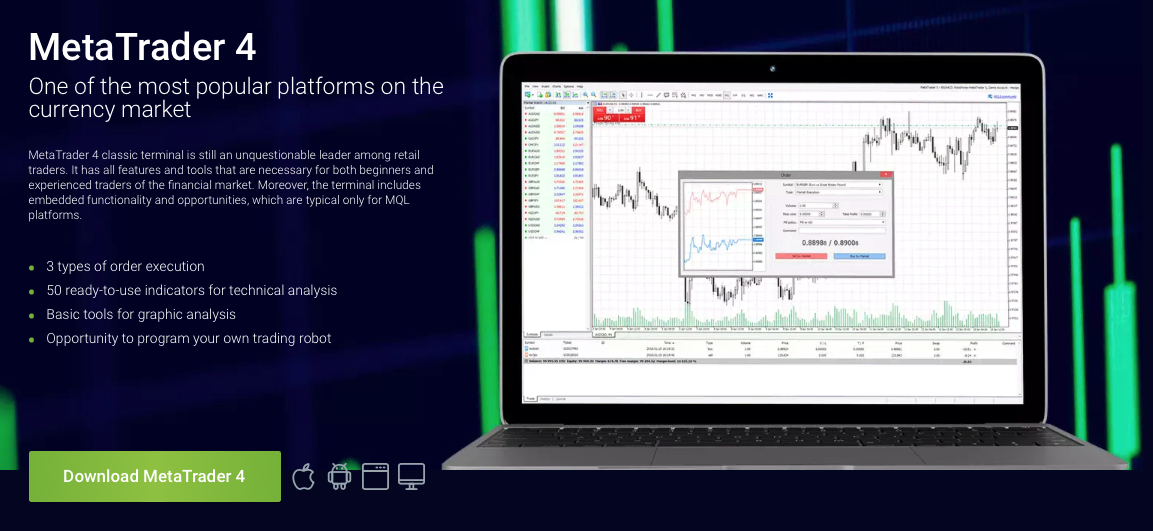

Trading platforms – it uses R-stocks trader, MT4, MT5, and cTrader.

Payment methods – it supports debit/credit cards, bank transfers, Skrill, AdvCash, Perfect Money, Neteller, NganLuong, and AstroPay.

Customer care – is present through emails, live chat, and telephone and supports 11 languages.

Pros

- A fast order execution speed

- Low trading costs

- Numerous trading accounts

- Negative balance protection

- It offers a High leverage

- Low initial deposits

- A wide range of trading resources

Cons

- It has limited trading instruments

- It has no fixed spreads.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is an Australian-based broker that started its operation in 2010 and has registered thousands of forex traders.

Trading instruments – it has indices, ETFs, Indices, CFDs, Commodities, Forex, and shares.

Regulations – it has regulations from the DFSA, FCA, and ASIC.

Account types – it offers two Standard and the Razor account, which have an initial deposit of $200.

Fees – the Razor account has forex spreads from 0.0 pips while the standard account is 1.3 pips.

Trading costs – the Standard account has no commission, but the Razor account charges $7 per round lot for every $100,000. It also has no inactivity cost. Deposits and withdrawals are free.

Leverage – the highest is at 1:400.

The demo account – has a limited account for thirty days from registration.

Trading platforms – it offers the c Trader, MT5 and MT4.

Payment methods – traders can deposit or withdraw using Poli, UnionPay, Skrill, Neteller, PayPal, Bpay, bank transfers, and credit and debit cards.

Customer support – customer care is present 24/5 through live chat, emails, and telephone calls.

Pros

- Fast order processing speeds

- Low trading costs

- High leverage rates

- It has quality risk management tools

- Fats deposits and withdrawals

- Fast execution speeds

Cons

- Limited learning resources

- Customer care is only present 24/5

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option started its operations in 2013 and has thousands of forex brokers registered under it.

Trading instruments – it offers stocks, commodities, cryptocurrencies, CFDs, and forex.

Regulation – it is regulated by the Cyprus Securities and Exchange Commission.

Account types – traders can choose between the Standard account with $10 and the VIP account with varying high initial deposits.

Fees – the forex spreads depend on the account type, liquidity, and volatility.

Trading costs – it has a commission for cryptos of 2.9%, and the rollover costs start from 0.1-0.5%. The deposits and withdrawals are free, although it has an inactivity cost of $10 after three months without any trading activity.

Leverage – the highest is 1:500.

The demo account – has an unlimited demo account with $10,000 virtual funds.

Trading platforms – it has its proprietary trading platform.

Payment methods – traders can deposit or withdraw using WebMoney, MoneyBookers, Cash U, Skrill, Neteller, credit cards, debit cards, and bank transfers.

Customer support – the customer care team is available 24/7 through live chat and emails.

Pros

- Low trading cost

- A wide range of payment methods

- A high leverage

- Fast deposit and withdrawals

- Low initial deposit

- Quality trading tools

Cons

- Limited training and learning resources

- A high initial deposit for the VIP account

(Risk warning: Your capital might be at risk.)

Forex trading in Angola – What you need to know

The economy of Angola depends on the revenue from selling oil and gas since most of its internal income-generating schemes are still growing. It means that the fluctuating oil prices highly the forex reserves.

It means that low oil and gas prices affect the economy of Angolan, in turn, affects the forex market as the investment in Capital markets reduces. The Angolan securities and exchange markets started operating in 2014, and the stock exchange in 2016.

The Committee of Capital markets CMC in Angola started operating in 2005. Initially, it had limited authority over the securities market since the capital markets were slowly developing. It consists of a chairperson and four directors of the commission.

It is tasked with ensuring that the market participants in the capital markets comply with Angola’s financial and securities law. The CMC works with the Bank of Angola or the Bank National de Angola (BNA) to establish and implement legislation to regulate the finance sector, including the securities markets.

Is it legal to trade Forex in Angola?

Forex traders can trade securities and stocks in Angola. The CMC and the Bank of Angola regulate the financial markets. The role of the CMC is mainly to ensure the capital markets are secure and transparent.

The Bank of Angola is still reforming and creating more regulatory guidelines for the capital markets. The laws created are also to help stabilize the forex exchange markets. They also help improve the liquidity in Angolan capital markets by reforming and removing strict regulations that restrict investment in forex exchange in Angola.

What are the financial regulations in Angola?

There are functions that the CMA and the MNA have to perform to ensure that investors and other market participants have a fair and transparent capital market when trading forex in Angola. Some Guidelines forex brokers, financial dealers, and other participants have to follow include:

- Any operations that involve foreign exchange require authorization from the Bank of Angola.

- Ensure the efficient functioning of the securities and exchange markets.

- The forex brokers give reliable and sufficient information on the status of an asset without misinformation for investors to make insightful decisions.

- It has established rules forex auditors have to follow when given the takes of financial auditing dealers based in Angola. It also sets the condition that auditors have to meet to be allowed to operate in the financial markets.

- It has established rules and guidelines that prevent money laundering and trading profits o fund terrorist activities. It ensures that the forex dealers and investors have to identify and collect information during account registration.

- It is responsible for ensuring that the Angolan public can access necessary information related to the capital markets.

- The financial dealers have the mandate to monitor and report suspicious activities on trading accounts and give relevant information about the client to the relevant authority to ensure traders comply with the legislation on taxes and reduce tax evasion cases.

- It ensures that financial agencies regulated by CMC have to make sure their clients fill in the Declaration of Origin and destination of Customer Assets.

- It ensures that financial issuers and forex brokers have to fill in forms that make sure they report the transactions made.

- The CMC has the FATCA agreement with the USA, which ensures that forex brokers report US accounts registered with financial institutions in Angola.

(Risk warning: 75% of retail CFD accounts lose money)

Security for traders in Angola

The CMC has ensured that traders have a secure environment through legislative laws that ensure that financial brokers and participants issuing securities are regulated in Angola or other credible regulatory institutions.

It has implemented the laws that ensure that transactions made should be secure and reported to the CMC. It is to improve transparency and fairness; they also have to audit trading brokers and other issuers of securities to ensure industry standards are upheld.

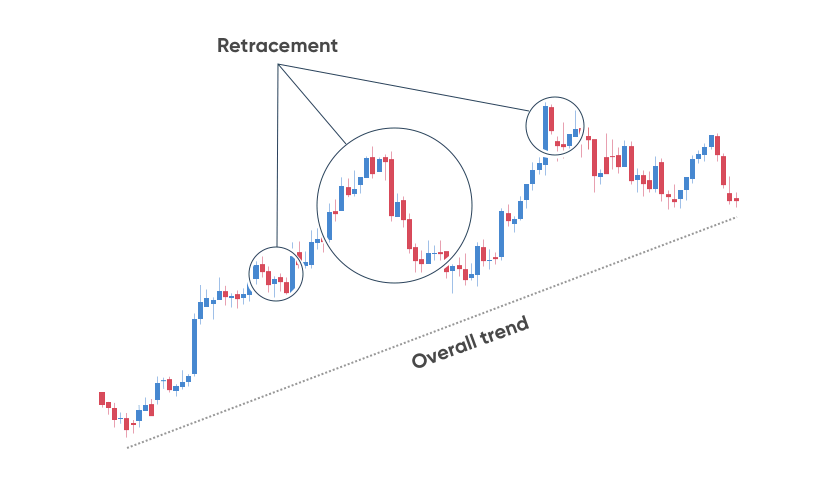

Analysis and trading strategies that Angolan traders can use

Analysis

Forex investors who want to start trading in securities or foreign currency should understand how o apply analysis as it is one of the fundamental knowledge. There are two kinds, technical and fundamental analysis.

Technical analysis ensures that you can utilize the trading tools to predict the price action. If you are trading a currency pair, you have to understand the background of the currency pair by evaluating its previous performance such that you know how it reacts during certain periods.

Fundamental analysis aims at the factors that cause the price action to fluctuate. For example, suppose you are trading a currency pair. In that case, the underlying microeconomic factors that influence the rise and fall of the interest rates include political and economic issues, export and import prices, and the central bank interest rates.

Trading strategies

Before you start trading, you have to develop your unique trading strategy, which you use when entering or exiting the market, and your activities during the trading period. Trading strategies depend on the time you want to commit trading, capital, and trading objectives.

Scalping-this requires you to be available and very keen as you have to open short positions that take 30-second to one-minute trades. You can open numerous of them as long as you ensure you make profits on the majority of the trades.

Trading a trend takes longer, especially if you are trading the big trend and requires you to have a forex broker with low trading costs. It involves identifying a trend and opening a position to profit from the price movement.

Position trading – a position trader looking for a trading instrument like stocks or even a forex pair at low prices, but you speculate that the prices will increase with time. Open a trading position to buy the asset and wait until it appreciates to sell.

How to trade Forex in Angola – A tutorial

Find a regulated Forex Broker

No forex brokers are based in Angola, so Angolan forex traders rely on offshore forex brokers. If you want to open a trading account, you must research the forex broker because many forex scams look like forex brokers.

You can look at the trading license they share on the about us page of their website or the disclaimer at the bottom of the page. Confirm the trading license by visiting the institution’s website it claims to be regulated and searching for its regulation.

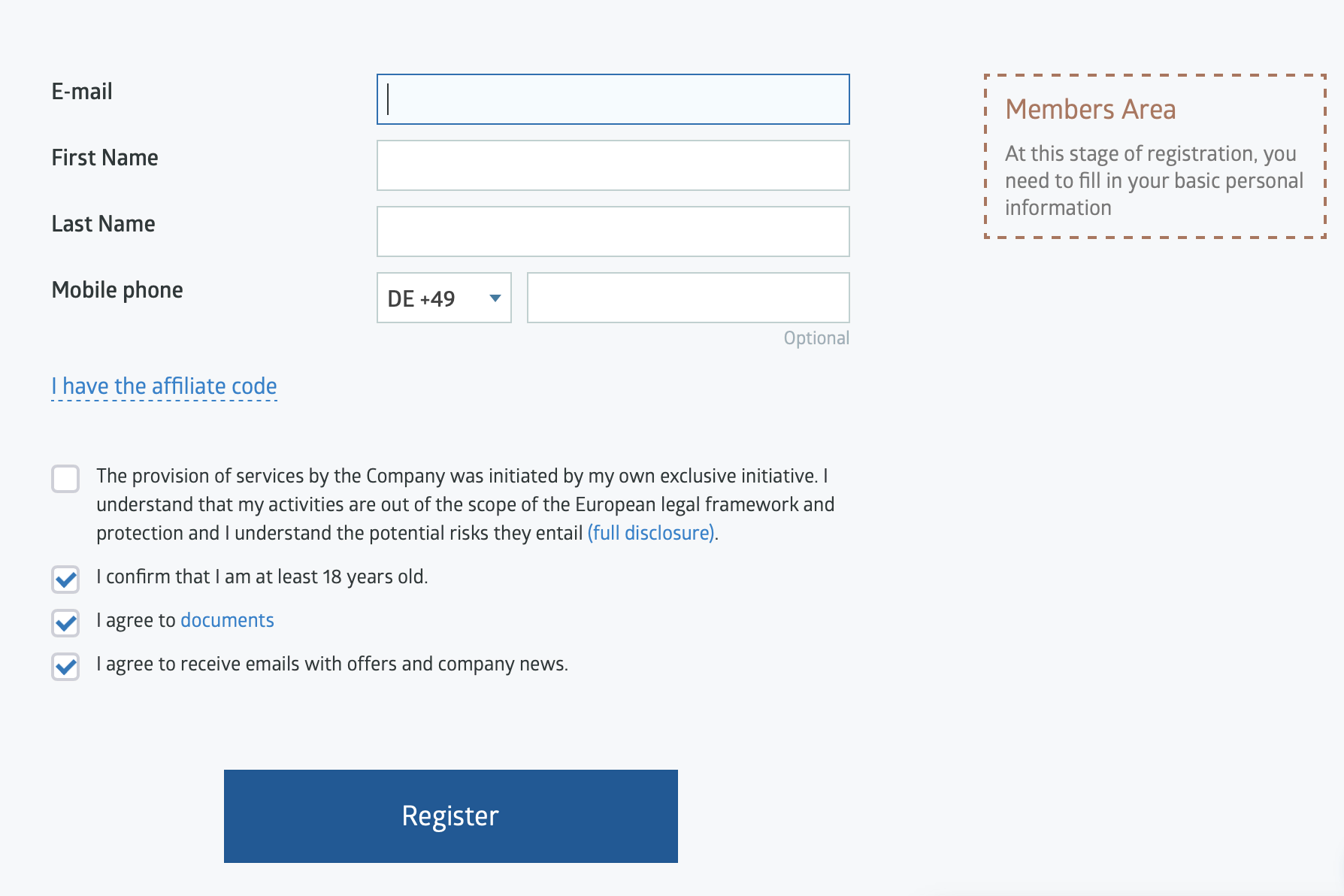

Register a trading account

If you have settled for a forex broker that meets your objectives, you can register a trading account through the online registration form available on the website. The form will require some details to open a trading account and a logging-in password.

They might also need you to confirm your detail by sending a copy of legal documents such as the national ID or a utility statement. According to the Anti-Money Laundering legislation, this process requires the broker to know about their customers.

Download a trading platform

Download a trading platform compatible with your forex broker and offers the trading features you prefer. Some forex brokers offer various trading platforms for different accounts, and others have their proprietary trading platforms.

Start with a demo account

The demo account is important because it allows new traders to learn about trading and apply their new knowledge to practice without any risk. It also helps traders to test different trading features the forex broker or trading platform uses and identifies which ones work with your trading strategies.

Forex traders can trade different assets using different trading strategies to find the best trading strategy. Doing enough practice on the demo account minimizes the mistakes you can make on the live account.

(Risk warning: 75% of retail CFD accounts lose money)

Deposit funds and start trading

Ready forex traders can deposit funds via the payment methods the forex broker supports and start trading. Forex brokers that accept Angolan traders support various payment systems that they can use, such as bank transfers, credit cards, and electronic wallets.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Conclusion: The best Forex Brokers are available in Angola

Forex trading in Angola is still developing, but market experts expect that its potential is high. It is why many forex brokers now accept forex traders from Angola. Forex traders should take caution before opening a trading account and do their research to avoid losing money to scammers.

We recommend regulated forex brokers with regulation from tier one or two jurisdictions. Ensure that you practice before trading because of the risk of trading in securities and exchange. It is also crucial that you apply risk management tools, have patience and maintain a trading discipline during trades.

FAQ – The most asked questions about Forex Broker Angola :

Is the Angolan Kwanza available in Forex?

No, it is not available in forex because of the low interest and low liquidity, which may not bring profit to many forex brokers.

How is Forex taxed in Angola?

The Capital markets are taxed under income tax at 5% for all gains made through trading securities, bonds, or financial instruments issued.

What does a trader in Angola need for forex trading?

A trader wanting to trade forex in Angola needs a forex trading platform that offers him the best trading services. Besides, he would also need a working internet connection that helps him connect with the trading platform. To win forex traders at the platforms that forex brokers in Angola offer, you need to develop perfect trading strategies.

Can traders in Angola use demo trading accounts?

Yes, traders in Angola can use a demo trading account. The brokers operating in Angola offer traders the services of the demo trading account. If you wish to access the best demo trading accounts, you can sign up with IQ Option, RoboForex, Capital.com, or BlackBull Markets. Their demo trading account is similar to the live trading account. Besides, you can also enjoy trading forex with the virtual currency of up to $10,000.

Which forex brokers in Angola offer the best trading services?

The five brokers mentioned are the best forex brokers in Angola. Their trading platforms are full of features that ease forex trading for any trader. In addition, these five brokers also offer excellent customer support. They excel in enhancing any forex trader’s trading experience.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)