The five best Forex Brokers and platforms in Argentina – Comparison and reviews

Table of Contents

Forex trading in Argentina has gained popularity in recent years, so we will give you a list of five forex brokers you should consider if you want to start trading forex in Argentina. This list will contain some of the features that make these forex brokers stand out in the trading industry.

See the list of the best Forex Brokers in Argentina:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 75% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

List of the five best Forex Brokers and platforms in Argentina:

1. Capital.com

Capital.com started its operations in 2016 and has grown to serve over 4 million clients from 180+countries globally, one of them being Argentina.

Trading instruments – traders can access Shares, Indices, Cryptocurrencies, forex, indices, and commodities.

Regulation – It has regulations from the Australian Securities and Investments Commission (ASIC), National Bank of The Republic of Belarus (NBRB),Cyprus Securities and Exchange Commission (CySEC), and Financial Conduct Authority (FCA.).

Account types – the Standard account with a minimum deposit of $20, the Plus account with a minimum deposit of $2000, and the Premier account with an initial $10,000.

Fees – forex spreads start from 0.8 pips, and it has no commissions.

Trading costs – It has an overnight fee varying with the size of the trade; it has no inactivity fee.

Leverage – For EU clients, leverage is limited to 1:30, but clients can apply for up to 1:500.

The demo account – it has a free demo account as long as you register a trading account with virtual funds of up to $10,000.

Trading platforms – Traders can choose between the web trader and MT4 trading platforms.

Payment methods – deposits and withdrawals are free. Transfers can be done through bank wire, credit/debit cards, and electronic wallets, as well as PayPal, Sorfort, Multiblanko, Apple Pay, iDeal, Trustly, and Giropay.

Customer care – The customer support team is present 24/7 in 13 languages via email, live chat, and phone calls.

Pros

- It has a negative balance of protection

- The fast account registration process

- Low trading costs

- Fast deposits and withdrawals

Cons

- The Premier account has a high minimum deposit

- Limited research tools

(Risk warning: 75% of retail CFD accounts lose money)

2. RoboForex

It is a forex broker with over 800K registered accounts from over 169 countries, such as Argentina, since its launch in 2009.

Trading instruments – Its users can access metals, indices, stocks, forex, cryptocurrencies, CFDs, and ETFs.

Regulation – it has regulation by International Financial Services Commission (FSC) in Belize.

Account types – traders can choose from the five account types, Pro, Pro-Cent, Prime, ECN, and the R stocks Trader. R-stocks trader has an initial deposit of $100, and the rest four accounts have a minimum deposit of $10.

Fees – the Prime and ECN accounts have forex spreads from 0.0 pips, R- stocks trader has from 0.01 dollars, while the Pro-cent and the pro account start at 1.3 pips.

Trading costs – RoboForex has an inactivity fee of $10 after ten months of inactivity; there are also overnight charges for the rates ranging with the asset traded.

Leverage – the highest leverage users can access is 1:2000 from the pro and Pro-Cent accounts. The R stocks trader and the Prime accounts have leverage of 1:300, while the ECN account has a maximum of 1:500.

The demo account – it has an unlimited demo account. You don’t have to deposit anything to access it.

Trading platforms – R- stocks trader, MT4, MT5, and c Trader.

Payment methods – deposits and withdrawals are free through bank transfers, credit/ debit cards, and electronic wallets such as Skrill, Astropay, Neteller, PerfectMoney, AdvCash, and NganLuong wallet.

Customer care – their customer support is available 24/7 in 10 languages, through phone calls, email, and live chat.

Pros

- Numerous trading accounts suitable for diverse traders

- Advanced trading tools

- Negative balance protection

- Fast transactional processes, low trading costs

- Low initial deposits

Cons

- Limited educational materials

(Risk Warning: Your capital can be at risk)

3. BlackBull Markets

BlackBull Markets is a forex broker established in 2014 with thousands of trading accounts registered under it.

Financial instruments – They include shares, energies, commodities, indexes, forex, metals, and CFDs.

Regulation – it has regulation by Financial Services Authority (FSA) in Seychelles.

Account types – It has three types of trading accounts: ECN standard has an initial deposit of $200, ECN Prime with $2000, and ECN Institutional with $20,000.

Fees – forex spreads vary with the account type; the ECN standard has forex spreads from 0.8 pips, ECN Prime with 0.1 pips, and ECN Institutional from 0.0 pips.

Trading costs – the ECN Standard account has no commissions, the ECN Prime has commissions of $6 per $100,000 traded, and the ECN Institutional account has varying commissions depending on the asset. It also has no account maintenance or inactivity fees.

Leverage – the maximum leverage rate is 1:500 on the three accounts.

The demo account – it is free for all traders with a registered account.

Trading platforms – it has two, the MT4 and MetaTrader 5.

Payment methods – deposits and withdrawals are free on BlackBull Markets. Traders’ transfer methods include bank wires, credit/ debit cards, and electronic wallets such as Skrill, Neteller, QIWI, WebMoney, and Fasapay.

The customer care – support team is present 24/6 through email, live chat, or phone calls.

Pros

- High leverage rates

- Low trading costs

- Tight spreads

- Advanced trading tools

- Fast order processing speeds

Cons

- Limited educational resources

- Customer support is only available 24/6

(Risk Warning: Your capital can be at risk)

4. IQ Option

Since it was established in 2013, it has registered over 49 million trading accounts globally.

Financial instruments – it offers Digital options, forex, ETFs, Commodities, CFDs, Stocks, and Cryptocurrencies.

Regulation – it has regulation by Cyprus Securities and Exchange Commission (CySEC).

Account types – it offers two types, a Standard account with an initial deposit of $10 and a VIP account that requires traders to deposit a minimum of $1900.

Fees – forex spreads vary with the asset and the type of trading account.

Trading costs – it has commissions of 2.9% for cryptocurrencies, overnight fees range from 0.1-0.5% but increase during the weekend, and accounts inactive for more than 90 days have an inactivity cost of $10.

Leverage – Forex traders within the European region have limited leverage of 1:30, but in other regions, traders can access up to 1:500.

The demo account – is unlimited and has $10,000 worth of virtual funds for practice trading.

Trading Platforms – IQ Option has its Proprietary trading platform with Industry-standard trading resources.

Payment methods – traders can transfer funds to and from their accounts through credit/ debit cards, bank transfers, and digital wallets such as LineNaira, Perfect Money, Neteller, Skrill, and Web Money.

Customer care – The support team is present 24/7 through phone calls and email.

Pros

- A fast account registration process

- Low trading costs

- Fast order processing speed

- Wide selection of payment methods

Cons

- It does not support MT4 and MT5

- Limited educational resources

(Risk warning: Your capital might be at risk.)

5. Pepperstone

Pepperstone is a forex broker that has registered thousands of clients in over 60 countries globally since its establishment in 2010.

Financial instruments – traders can access over 2000 assets ranging from commodities, ETFs, shares, and indices.

Regulation – it has regulations from Financial Conduct Authority in the UK and the Australian Securities and Investment Commission.

Account types – It offers the Standard account with an initial deposit of $200 and the Razor account with a $200 initial deposit.

Fees – forex spreads vary with the account type; the Standard account starts from 1.0 to 1.3 pips while the Razor account from 0.0 – 0.3 pips.

The trading costs – The standard account has no commissions, but the Razor account has a commission of $7 per every $100,000 traded. It does not charge any maintenance costs for inactive accounts.

Leverage – the highest leverage traders, can access is 1:400.

The demo account – it is free for registered users and has $50,000 virtual funds.

Trading Platforms – it uses the MetaTrader 4, cTrader, and MT5, trading platforms.

Payment methods – Traders can deposit or withdraw free using Bank Transfer, credit/debit cards, and electronic wallets such as Union pay, PayPal, Neteller, Skrill, and POLi.

Customer care – the customer care team is available 24/5 through phone calls, live chat, and email.

Pros

- Low trading costs

- Advanced trading tools

- Low trading costs

- Low minimum deposit

Cons

- Customer care is only available 24/5

- Limited educational material

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Is it legal to trade Forex in Argentina?

Yes, there are thousands of forex traders that trade forex in Argentina. The central bank of Argentina has the mandate of regulating the forex industry in Argentina. There are limited forex brokers from Argentina, which means that most traders work with offshore forex brokers.

What are the financial regulations in Argentina?

Forex regulation in Argentina stopped when the president imposed strict regulations regarding buying and selling of foreign currencies in 2011. For the next five years, the trading of currencies was limited until 2015, when another government took over the country and removed those restrictions.

When the next government lifted the restrictions, it invited forex brokers to access the forex market in Argentina. Later, other regulations got updated in 2019 to regulate the financial industry. Section 29 of the BCRA charter gives the central bank of the argentine Republic, also known as the BCRA, the mandate to enforce the rules as the forex act states.

There is also a wing of the government under the ministry of finance known as the Comision Nacional de Valores (CNV) that works with the BCRA to regulate the securities market. . Some trading regulations in Argentina include:

- Forex brokers and traders need to get the authorization to buy and sell forex currencies from the BCRA before accessing the forex market.

- The BCRA and CNV have the authority to create and implement policies that prevent traders or any market participants from engaging in malicious or illegal activities in the securities market.

- Companies or entities that break any of the laws are liable for punishment, as the policies regarding foreign exchange dictate.

- Traders who access the financial markets for any activities, such as buying and selling derivatives, require paying a monthly cap for the income made through trading.

- Investigating reported cases of market participants engaging in manipulative means, insider trading, and other fraudulent activities.

- Overseeing the supervision and monitoring of the financial markets in Argentina and settling any disputes between market participants.

- Foreign residents in Argentina have to get authorization from the BCRA before accessing the forex market, except for organizations and foreign diplomats, who must report their transactions within 90 days.

- The CNV is responsible for enforcing the rules and regulations to ensure fairness and transparency in the securities market.

- The CNV has to ensure that registered entities offer the required standard when dealing in securities in Argentina.

(Risk warning: 75% of retail CFD accounts lose money)

Security for traders from Argentina – Good to know

Even though Argentina has no official regulatory authority, the forex industry has tight restrictions and limitations from the central bank of Argentina. Argentina has ensured that forex traders have a safe trading condition by ensuring all traders are authorized to access the forex market.

How to trade Forex in Argentina – A tutorial

There are no forex brokers based in Argentina, and Argentinean traders can access forex using international forex brokers, some of which we have mentioned above. If you want to open a forex trading account, here are some steps you can follow:

Find a reliable Forex Broker that works for traders from Argentina

Some features of reliable forex brokers are regulations from credible regulatory institutions.

Some of these institutions include:

You can also test the trading platform using the demo account to see if the forex broker has what you want. Some other features you can check are the order execution speeds, currencies offered, trading platforms, and trading tools.

This first step is crucial because of the forex scams where forex traders have lost their funds. Forex traders have to be cautious when choosing a forex broker to avoid falling victim to these scams. Choosing a reliable forex broker also means looking for a broker compatible with your trading objectives.

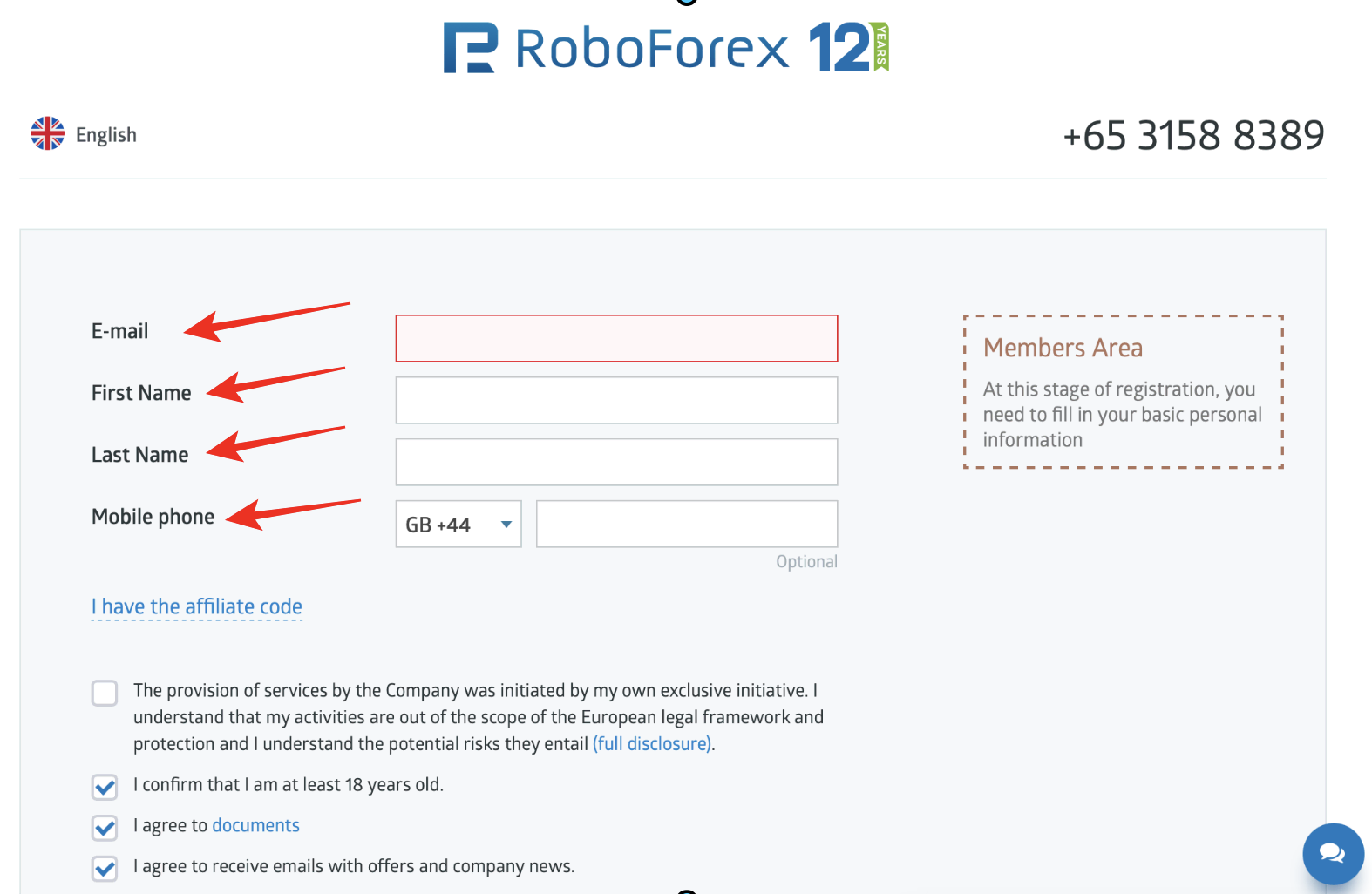

Register a trading account

Once you have chosen a reliable forex broker, you can open a trading account using an online registration form. It is a five-minute process that requires you to fill in some details for the forex broker. Some details include your official name, email, phone number, date of birth, password, and type of account you wish to open.

Forex brokers who comply with to Know Your Customer regulation require that you give your financial details such as employment status and trading background. This information allows the forex broker to access your risk tolerance.

This process also entails verifying the details you have given with your ID and Utility statement. After successfully registering your trading account, you will need to download a trading platform for accessing the financial markets.

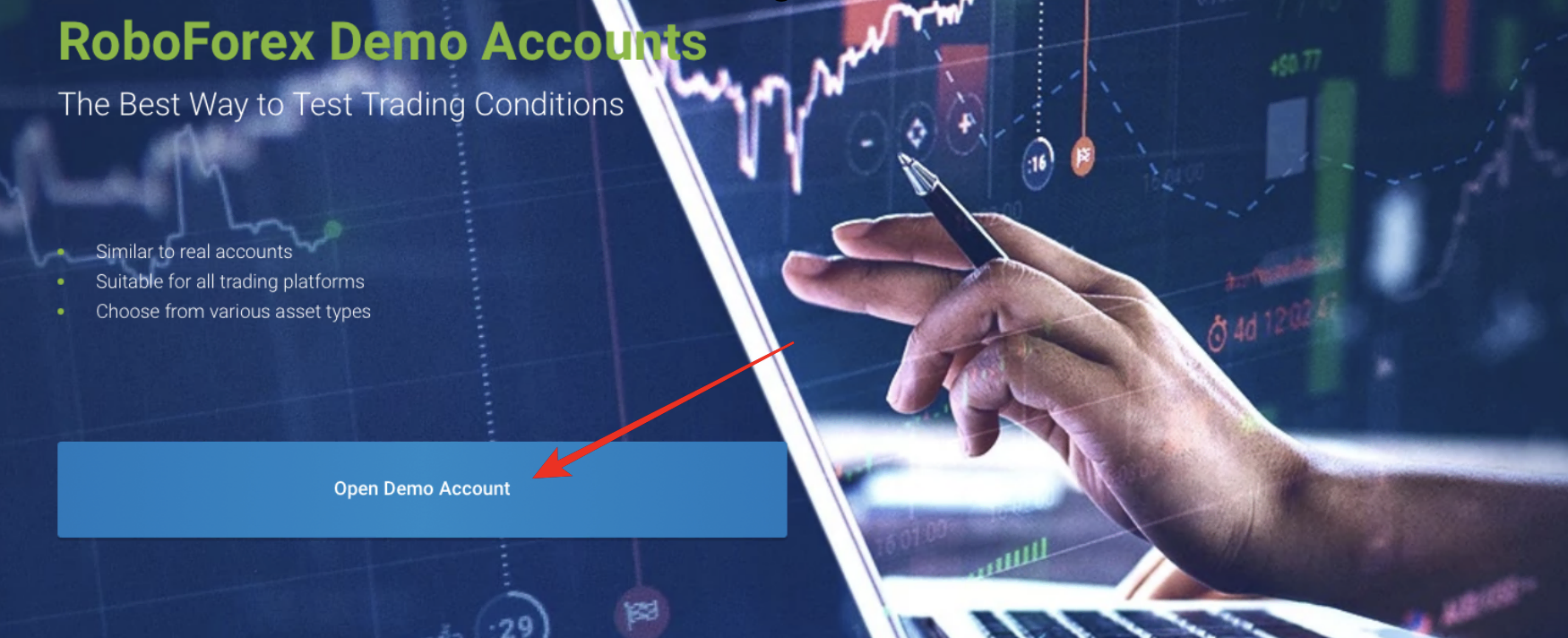

Start with a demo account or real account

The demo account is like a real trading account and offers all the trading conditions like the real account but uses virtual funds. You can trade a currency pair such as the EUR/USD without risking your money.

Traders must start with the demo account to understand how the forex broker and the trading software work. It is also a great tool for practicing trading strategies and how different financial markets can react with different trading tools.

Fund your trading account

Forex brokers offer a variety of payment methods, bank transfers, credit/ debit cards, and electronic wallets. Forex brokers that have clients in Argentina support payment methods favorable in Argentina.

You can find out which payment system you are comfortable with and link with your trading account. It will help you to transfer funds to and from your trading account. Deposit the minimum deposit required or the amount you wish to start trading with.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

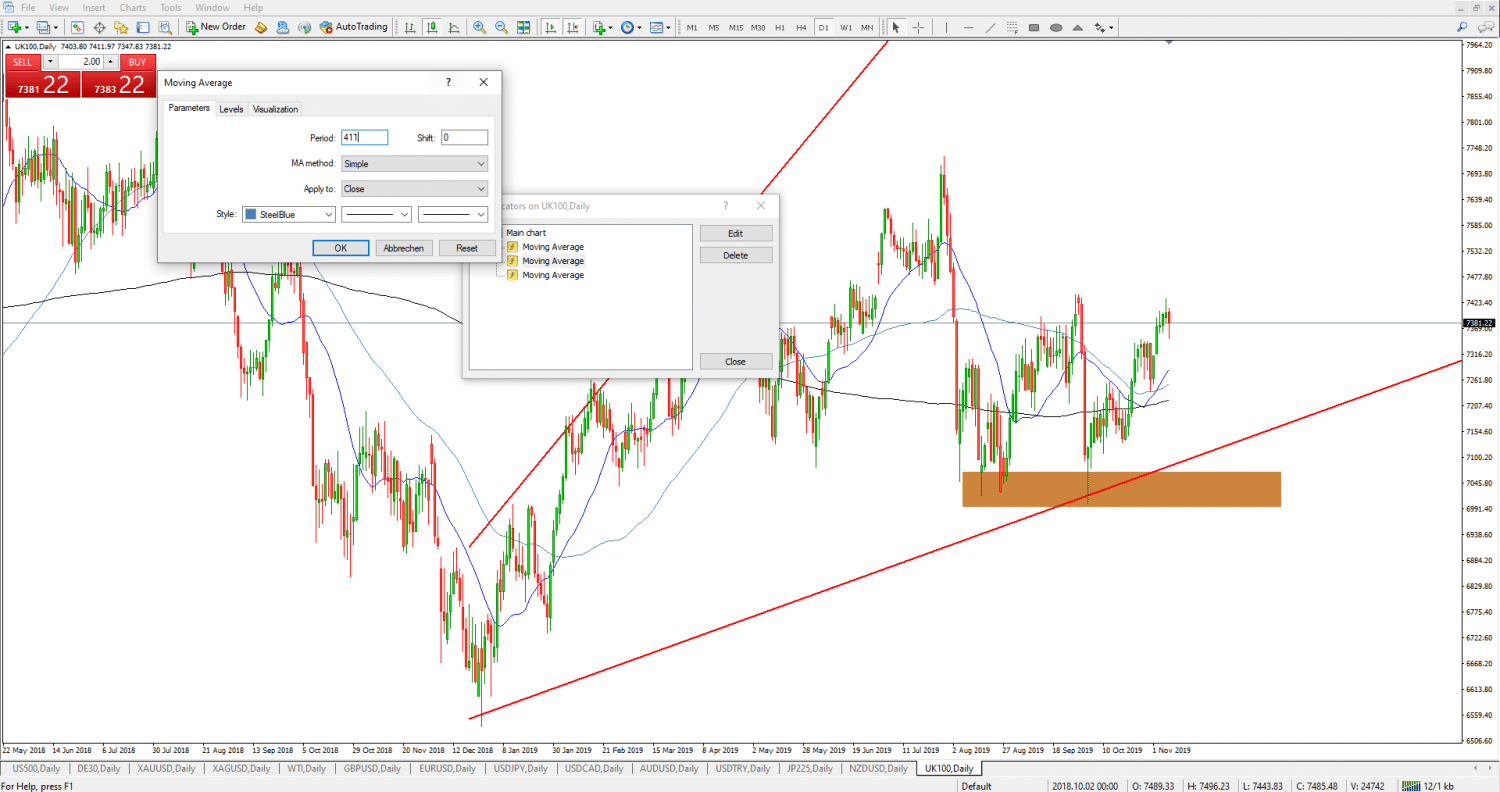

Use analysis and trading strategies

It is another crucial step that forex traders should not miss. The analysis allows you to make informed trading decisions based on the trading signals you find. Analysis methods can be a technical analysis that involves using technical tools, previous price charts of the asset you want to trade, and price patterns to predict the price action.

Fundamental analysis includes following the news and financial announcements and analyzing how the market will react before opening a trading position. Besides analysis, a forex trader needs to have a trading strategy they follow when trading.

Some trading strategies include using the breakout strategy, day trading, scalping, position trading, swing trading, and many more. Forex traders can practice these trading strategies and modify them on the demo account until they get one with consistent results.

Start trading

A forex trader can profit from trading forex by ensuring a consistent trading strategy, proper timing when entering or exiting the market, and trading discipline. Many other factors increase the chances of success, but these are the fundamental principles.

(Risk warning: 75% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Argentina

The Forex Industry in Argentina had started to recover from the years after completely banned forex trading for retail traders. The forex industry has grown, and more people register trading accounts in Argentina.

Apart from that, there are still new regulations imposed on forex traders and brokers. Those who would consider registering a trading account can look at the forex brokers recommended in this article.

FAQ – The most asked questions about Forex Broker Argentina :

Is it possible to trade the Argentine Peso in Forex?

Yes, it is one of the exotic currencies in forex, but some traders trade it against the USD. They can go long or go short, depending on the interest rates. The Argentine Peso has the currency code as ARS in forex; the current exchange rate of the USD/ARS is 114.84 pesos.

Which is the best Forex broker to use in Argentina?

The forex brokers above are among the leading forex brokers in the industry. The best forex broker is relative to the forex trader and depends on what the forex trader wants in a forex broker. If a forex broker has all the qualities you want, that is the best broker for you.

Is forex trading in Argentina permitted?

Yes, traders in Argentina are at par with the world. They can trade all underlying assets that other traders can, including forex. You can trade forex by choosing a forex broker in Argentina.

Traders can trade the local currency. Besides, they can also access the leading forex pairs in the international market. The five brokers mentioned here offer you the best underlying markets in forex trading.

What should a trader keep in mind while choosing a forex broker in Argentina?

A trader must first protect himself from the possibility of any scams. For this, he must choose a well-regulated forex broker in Argentina. Then, the broker’s platform should offer you all the top features. Your trading platform for forex trading should be like a one-stop destination to fulfill all your trading needs.

Which forex brokers in Argentina are the best?

To name only one forex broker in Argentina would not be justified. After all, several brokers operate in Argentina that excel in offering the best services to traders. However, the five brokers that most traders in Argentina prefer include the following. You can pick one after going through these brokers’ pros and cons.

BlackBull Markets

IQ Option

Pepperstone

RoboForex

Pepperstone

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)