The 5 best Forex Brokers and platforms in Armenia – Comparison and reviews

Table of Contents

Brokers provide their clients with assets to trade with on their platform. Clients that use broker platforms enjoy forex trading in this digital age because transactions are now carried out smoothly and in the comfort of the client’s homes.

See the list of the best Forex Brokers in Armenia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 75% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

This article will learn how to begin trading in forex, ensure security for yourself as a forex trader, and show you the list of the five best forex broker platforms that you can use.

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

It is no news that Capital.com is a user-friendly broker platform. The broker allows their traders access to various assets to trade with. The company started in 2016 and, over the years, has built a substantial user range from across the world. Today, Capital.com has traders that are up to 500,000 on its trading platform.

Capital.com offers its traders security. This is thanks to the fact that financial bodies regulate the company. These financial bodies that provide the broker’s regulations are international-based and have themselves set up in the UK, Cyprus, Australia, and Seychelles.

Trading on Capital.com offers traders access to forex-based educational materials and resources. Capital.com even give reliable market resources to traders on their platform.

Traders can choose from the different accounts the platform provides. When you register, you can use the standard account, which traders can start with a deposit of $20. If they prefer, they can use the plus account, but trading with the account needs an initial deposit of $3000. There is even a demo account that traders can use to practice their different trading techniques.

The platform is technologically improved because it offers clients the possibility to trade with their mobile phones through the app and on their desktops with the web version. This makes trading forex not as restricted as it used to be.

Benefits of Capital.com

- A demo account is available for traders to use.

- Capital.com offers both educational materials and market resources to traders.

- An initial $20 deposit for traders with the standard account

- Capital.com does have a good customer service

Drawbacks of Capital.com

- Trading with a plus account requires an initial deposit fund of $3000

- Capital.com those not offer an MT5 platform, making it limited to some features

(Risk warning: 75% of retail CFD accounts lose money)

2. BlackBull Markets

The brokerage firm started in 2014 with many assets for traders to trade with. BlackBull Markets’ main office is within New Zealand, and the company was started by some forex traders and financial tech gurus. The company has an office in New Zealand, but they also have offices in other countries across Europe.

The broker platform offers more than two assets that traders can choose from. CFDs, Gold, and commodities are some of the assets that traders can trade with. The FSA regulates BlackBull Market in Seychelles. The FSA ensures that traders on the platform enjoy favorable trading conditions.

The platform is a MetaTrader type with both MT4 and MT5 available. Trading on the broker platform allows traders to carry out fast transactions because the MetaTrader platforms are connected to Wall Street servers. The MetaTrader platform also gives a unique experience to the traders and security.

BlackBull Market’s traders can register by opening a standard or ECN prime account. The standard account traders make an initial deposit of $200 before they can trade with the account. ECN Prime accounts must deposit $2000 before they can begin trading on the platform.

Traders on the platform have access to market resources provided by the company. This helps traders to have proper strategies and steps to take when they want to trade. The market tips offered by the company are reliable and can be trusted.

The Forex trading platform is available on both mobile applications and web versions. This is good since now most people like to do things with their phones. The interfaces are the same.

Benefits of BlackBull Markets

- ECN account owners get a commission at the end of every trade

- The broker platform is a MetaTrader one

- The company provides forex market resources

- Trader’s transactions are done thanks to its server connection quickly

Drawbacks of BlackBull Markets

- No forex educational material

- $2000 is the least deposit for the Prime account

(Risk Warning: Your capital can be at risk)

3. RoboForex

The broker company was built in 2009 in Belize. It has two offices created to serve different purposes. The RoboForex provides services to countries across the globe, while the RoboMarket group provides services to countries in the EU and EEA. RoboForex has customer support that offers 11 languages for traders to communicate with the company in case of any complaint or question.

RoboForex’s traders are provided with security. It follows the regulation of the IFSC to make trading transparent to its clients. RoboForex offers assets like Metals, Groceries, and Stocks.

Traders can choose from the five accounts that are available on the platform. A trader has the possibility of selecting the account that offers them the best trading experience. Every account type has what they provide to the traders. Anyway, the standard account traders make an initial deposit of $10 before they can trade on the platform.

RoboForex is technologically improved. The broker is a MetaTrader platform with both MT4 and MT5. Traders also have access to the cTrader platform.

Traders can trade either on the phone application or the web version on the desktop. The trading experience is now flexible for the traders that use this broker platform.

Benefits of RoboForex

- The broker offers MT4, MT5, and cTrader platforms.

- The standard account traders can deposit as low as $10 to their account

- There is a demo account that traders can use

- Withdrawing your funds will not attract any fee

Drawbacks of RoboForex

- There is not a fixed spread on the platform

- Clients from the US are not allowed to trade on the platform

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone was formed in Australia in 2010 to offer assets like stocks, cryptocurrencies, metals, and others to their clients worldwide. The company provides security for traders because it is under the regulation of the ASIC. The ASIC makes sure Pepperstone trading policies are transparent.

Pepperstone provides its clients with reliable educational resources that help traders improve their knowledge about forex and forex trading. Aside from the educational resources, the broker conducts webinars that share helpful information that enlightens the traders.

The broker’s demo account is also a helpful tool that traders can use to plan and know how the FX spread works on the platform. Traders can also use the standard account and a prime account called the “razor account.” Traders should not forget that the demo account does not last more than one month.

The standard account traders can make a minimum deposit of $200 into their accounts. The spread of this account is 1.1 pip. Traders of the account do not get any commission for their trades.

On the other hand, traders of the razor account make an initial deposit of $2000. The spread of the razor account is 0.3 pip, and traders get up to 3% at the end of every trade.

The broker is a MetaTrader platform that supports MT4 and MT5. The MetaTrader platform even has plugins that help traders to strategize their position on the chart during trading. The MetaTrader plugins make trading easier for traders to trade.

Pepperstone’s MetaTrader plugs are also available on the mobile application. So both mobile and web traders get the same trading experience.

Benefits of Pepperstone

- MetaTrader platform is available on the broker.

- There is a plugin that can assist a trader within the platform

- Pepperstone has good customer service

- Commission for razor account owners

Drawbacks of Pepperstone

- The demo account is not everlasting

- Razor account owners’ minimum deposit starts from $2000

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

The firm is a Cyprus-based forex company. The brokerage company started in 2013 with just binary options as its tradable instrument. (Binary options are only for professional traders and for those who are located outside of EAA countries.) Later in 2016, after some improvements to its platform’s technology, the broker company also introduced Gold, cryptocurrencies, CFDs, and commodities as part of its tradable assets.

CySEC is the international regulatory body of the company. IQ Option offers security to traders. The company’s financial activities are under the supervision of CySEC.

IQ Option offers a demo account that traders can always use to trade. The demo account does not extinguish. A trader chooses to use the standard or VIP accounts in a real account.

IQ Option’s standard account traders can make the initial deposit of $10 to trade with the account. Commissions are not offered to traders of the standard account. While the VIP account owners make an initial deposit of $1000 to start trading on the platform. There is a percentage commission for traders trading forex, stocks, or commodities with the VIP account.

The broker provides educational resources that are useful to traders. There are even market resources that the broker offers to its clients. IQ Option has a forum where traders can communicate, and the platform organizes webinars for traders. Through the forum and the webinar, its clients gain helpful information about market competition and strategies.

The broker is available on the phone and desktop. Traders can trade anywhere and anytime. The platform is very interactive, and traders can manipulate the chart’s look to something that helps them trade better on the platform.

Benefits of IQ Option

- An interactive platform that allows traders to change the chart type.

- A demo account that does not finish

- Traders must pay $10 as a minimum deposit into the standard account.

- Interactive forums and webinars that offer helpful information about market

Drawbacks of IQ Option

- Clients from the United States cannot register

- No MT4 or MT5 on IQ Option

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Armenia?

The Central Bank of the Republic of Armenia is responsible for the financial regulation within the country. It is charged by the law to regulate the affairs of other financial institutions within the country. Banks, credit organizations, and other such institutions are subject to licensing by the Central Bank.

The CBA is the sole body responsible for licensing financial organizations. There is no other body besides it.

The law that gives the authority to the CBA also has within it laws that cover foreign policies in-country, Bank to Bank regulations, and other things that deal with finance within the country.

Security for traders from Armenia

Forex trading is a high-risk business. There are no regulations that guide forex brokers in Armenia, and so there is a misconception that forex brokers are frauds within the country. Though this can be the case that some forex brokers are fake and are created to carry out fraudulent activity – like stealing from the traders on their platform. This is not always the case.

Traders who want to start forex can secure themselves by trading with brokers with regulations from international financial bodies like Cyprus Securities and Exchange Commission, Australian Securities and Investments Commission, and Financial Service Authority. These regulatory bodies ensure that broker companies offer transparent services to their clients. The bodies also prevent any form of financial abuse from the brokers.

Is it legal to trade Forex in Armenia?

Forex trading in Armenia is legal. Armenians can free trade forex within the country as long as they trade with a broker under the regulation of international financial organizations. Forex trading in Armenia does not have a regulation that covers it, especially trading with any local forex broker.

It can be dangerous for a trader to trade on a broker without a license to conduct forex. This is because the broker is not covered by any law that backs up its existence, so it can be a fraud and a means of cybercrime. There are a lot of such brokers in existence, so traders must be careful.

Trading with a regulated forex broker in Armenia is legal because a law guides its existence.

(Risk warning: 75% of retail CFD accounts lose money)

How to trade Forex in Armenia – Tutorial

Open account for Armenian trader

Opening an account with a broker is just the first step you need to take to start forex. Once you have selected the broker you want to trade with, you must register with them. The registration process is straightforward and does not take time.

To start trading with any forex broker, you must have certain documents to prove your identity and where you live. The client will be asked to snap and submit a national passport, national identity card, or a driver’s license as proof of identification. Residency proof will be your utility bill.

Start with a demo account or a real account

You need to decide if you want to start with the demo account or your real account. As a newbie, it is advised that you start with the demo account provided by your broker. The demo account will help you understand how the forex market works, how to position yourself during trade, and the market competition.

If you want to go ahead with your real account, you will need to deposit some money in it before starting trading with the real account.

Deposit money

If you have decided to trade with your real account, you will be required to deposit an amount of money into your account. To deposit money, you will need to select a payment method. The payment method shows how you wish to transfer the fund into your trading account.

Broker platforms usually have more than one payment method. The amount to be deposited varies because it depends on the broker you are trading on.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

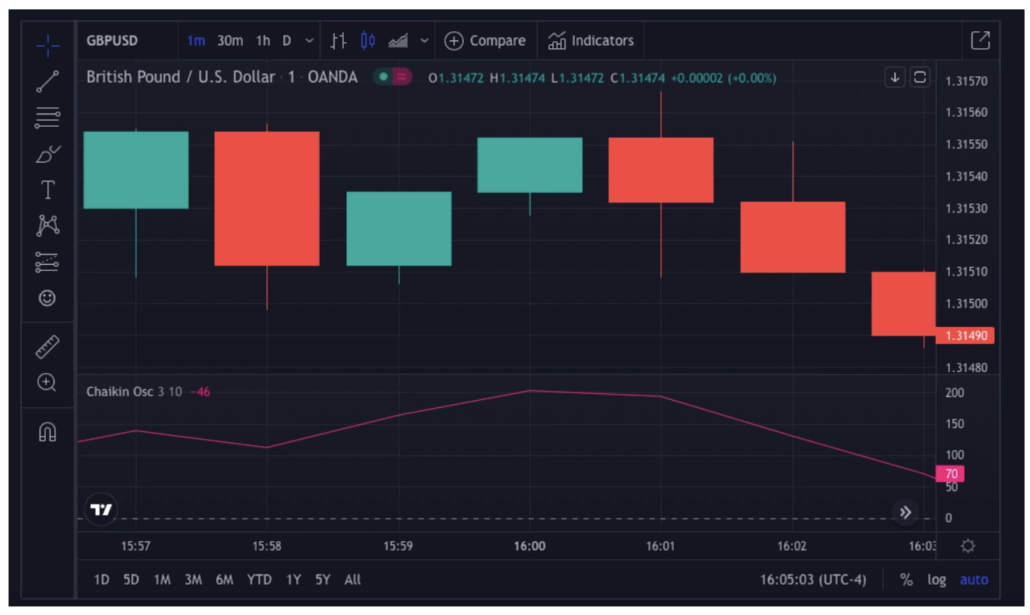

Use of analysis and strategies

Using analysis and strategy is a valuable method through which traders know how the market works. It helps them monitor how the forex spread works and how changes in the market occur. Every good trader has a trading strategy that they use.

Scalping

This strategy involves traders opening more than one trade for a short time. The trader opens multiple trades to gain profits from all of them when the market ends. The payoff might not be so much but is a gradual step to building wealth.

Day trading

The day trader opens a single market in a single day and ends it at the end of the day. The strategy involves staying in the same position for a whole day. The trader can take the same place each day to see how the market spread is.

Position trading

Position trading is somewhat like investing because it involves staying in the same position for an extended period. The trader can be in the same place for months and years. It is an excellent means of analyzing how market competition has been long.

Make profit

Profit in forex trading is determined by your position when the primary market closes. You can even withdraw your profit made into your bank account or any other payment platform that you can withdraw funds into, like PayPal.

(Risk warning: 75% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Armenia

Forex trading is a legal trade, and it continues to grow with the years coming by. More and more people are beginning to go into forex trading. This is so because it is a comfortable way through which many make money. It can be done in the comfort of your home or anywhere you may be because trading is digital.

As easy as it may sound, forex trading involves high risk, so traders must be cautious while trading. As a trader from Armenia, you should first try to make proper findings about the broker you want to deal with. Make sure they are regulated and certified. Do not just open an account with any broker you come across.

FAQ – The most asked questions about Forex Broker Armenia:

How can I start trading as a forex broker in Armenia?

Trading in foreign exchange can be scary to both newbies and professional traders. However, the procedure can be carried out efficiently and without problems, if the right platform is employed.

The main steps you should follow to successfully and profitably trade FX in Armenia are listed here. The procedure can vary slightly depending on the product, but the fundamental procedures will always be the same.

To engage in trading, you ought to open an account.

Begin your trials with a demo or genuine account.

Make a deposit into your account.

Study new tactics and conduct a market analysis.

Earn money.

Take a withdrawal of your earnings.

Start increasing your income as a result of your experience.

How can I safely trade with an Armenia Forex broker?

FX trading is frequently not extremely risky compared to other trading options. The traders can immediately take precise actions to help lower their trading risk. Below is a list of the essential steps to take.

Discover the market regularly.

Gain practice by making little moves in trading.

Make several trades to gain additional experience.

Create a plan on your own.

When trading, try not to get emotional.

Last Updated on March 2, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)