The 5 Best Forex Brokers & platforms in Asia – Comparisons and reviews

Table of Contents

The Asian market is a huge one for forex and CFD trading. Numerous online brokers use attractive campaigns to lure customers into dealing with them, making it difficult to decide whom to deal with.

See the list of the best Forex Brokers in Asia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 69% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 69% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 69% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

We have reviewed and tested several platforms. We now bring you the 5 best forex brokers to narrow the options and make it easier to choose.

The 5 best forex brokers in Malaysia:

We give you an overview of each of them below:

1. Capital.com

Capital.com is a globally recognized forex and CFD broker with headquarters in the United Kingdom. The brokerage came into existence in 2016 and has quickly expanded with offices in Cyprus, Belarus, Gibraltar, Poland, Ukraine, Seychelles, and Australia.

Capital.com currently accepts customers from more than 180 countries. These include the parts of Asia where forex and CFD trading is legal. Capital.com is not available in China, Japan, Syria, and Pakistan.

The broker is registered with the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA), the Australia Securities and Investments Commission (ASIC), and the National Bank of the Republic of Belarus.

These licenses and their world-class service are why the broker is among the most trusted.

Asians can choose from many market instruments, including more than 130 forex pairs, hundreds of stocks, CFDs, indices, and cryptocurrencies. But cryptocurrency trading is not allowed in some parts of the world, such as the United Kingdom.

Asians can choose any of its four account types, including:

- Standard

- Plus

- Premier

- Invest account.

Trading services are provided on Capital.com’s proprietary platform and the MT4. These platforms are accessible on IOS, Android, and Windows. It means mobile trading is available with complete indicators, news updates, and other tools for trading.

The fees on these accounts are truly competitive, with spreads from 0.6 pips on major pairs. The account types are all zero commission accounts. The recently introduced Invest account allows you to trade stocks at extremely low fees. With a minimum deposit of $20, you can begin forex trading with Capital.com.

Its educational and research materials are specifically prepared for beginners and skilled traders to find valuable information. The broker provides extremely useful content for beginners to find their way quickly and for experienced traders to improve their know-how.

Capital.com pros

1. Regulated broker with low trading fees.

2. Trading platforms that novice and skilled traders can comfortably use.

3. Excellent support service, available 24 hours during trading days.

Capital.com cons

1. Capital.com does not offer Islamic interest-free accounts.

(Risk warning: 69% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is an international forex broker offering authentic ECN trading services at competitive fees.

The broker was founded in 2014 in New Zealand and has gone global with offices in various parts of the world, including Malaysia, Indonesia, and the United Arab Emirates.

BlackBull Markets has won several awards for its first-rate trading services. The company is regulated by the Financial Markets Authority of New Zealand (FCA) and Seychelles’ Financial Service Authority (FSA).

The broker offers genuine ECN trading at competitive fees. Asians can trade on spreads as low as 0.0 pip in their raw account.

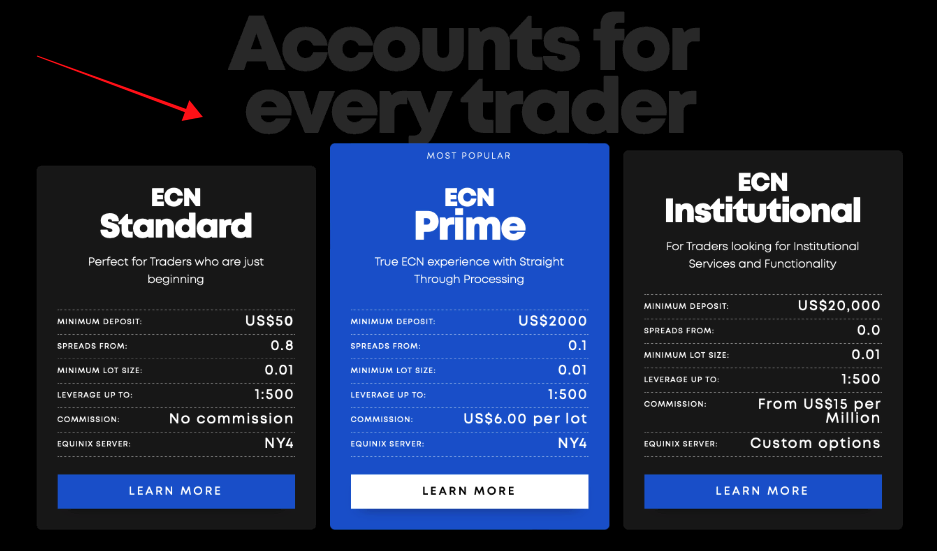

BlackBull Markets require a minimum of $200 to start trading on its Standard account. Although this is higher than the average required deposit by other reputable brokers, fees remain highly competitive. 0.8 pips is the starting spread on major, and this account is commission-free.

BlackBull Markets account types are:

- Standard ECN

- Prime ECN

- Institutional account

The standard account is great for beginners as it allows them to start trading smaller contract sizes. However, the prime account sees lower spreads, averaging 0.3 pips on peak times.

BlackBull Markets offers Islamic accounts, so Muslim traders can trade interest-free as Sharia law requires.

The market instruments to trade with this broker include 70 forex pairs and other instruments, such as index CFDs. The broker provides the trading services on MetaTrader 4, MetaTrader 5, and its mobile app.

A free demo is available to test the platforms before trading. The basic functionalities are included to check different trading styles and strategies before going live.

Asian traders who do high-volume transactions can enjoy a free VPS service that supports auto-trading and keep their data safe and private.

Traders can access full features on their accounts conveniently on their mobile phones. It only requires downloading the app.

Pros of BlackBull Markets

1. The broker provides social and copies trading services on three platforms: MyFxbook, Zulutrade, and Tradingview. Customers have various options for this.

2. MetaTrader platforms with complete features are available for mobile trading.

Cons of BlackBull Markets

1. $200 minimum deposit is relatively high. Many credible brokers offer the same service with a much lower required trading amount.

(Risk Warning: Your capital can be at risk)

3. RoboForex

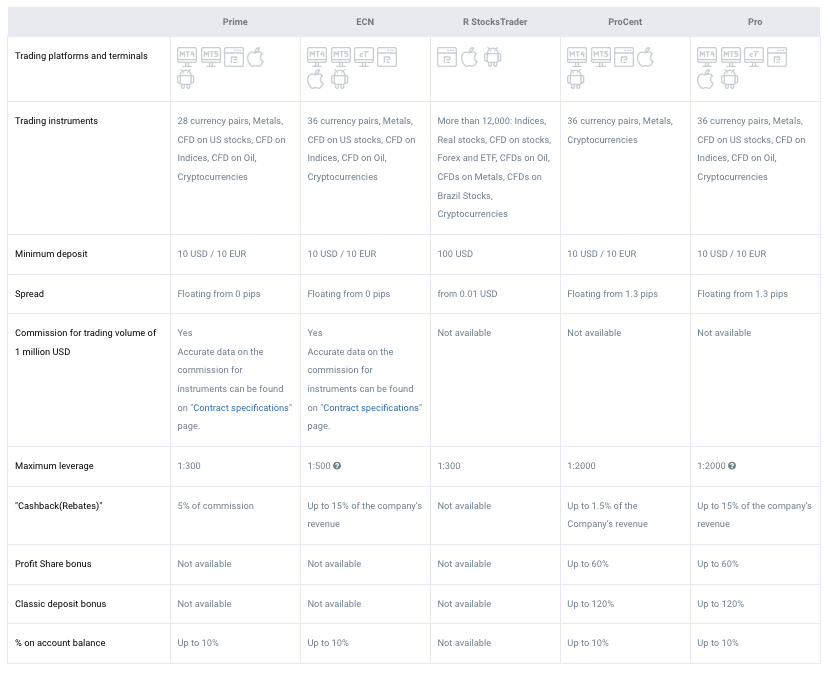

On RoboForex, traders can choose from several account types that cater to traders of all levels. Multiple trading platforms are provided to match these accounts, giving the trader many choices.

These account types are:

- Pro standard

- Pro cent

- ECN

- Prime

- RStocksTrader

Trading platforms include:

- MetaTrader 4

- MetaTrader 5

- CTrader

- RTrader.

With a minimum deposit of $10, customers trade with this broker. The small amount and easy registration allow you to test the broker on a live account. Although, a free demo is available for testing.

Asians can trade on a commission-based or commission-free account. The spreads on these vary. Spreads on a zero commission account start from 0.6 pips but are much lower on the commission-based account.

Asian customers can trade on zero spreads on the ECN and the prime account, but these attract commission fees that range from $2 – $4.

RoboForex is licensed by the IFSC (International Financial Service Commission) Belize.

These regulators are tier-1 and tier-2 financial bodies. Some traders might feel that the regulation is not enough. But the broker has built a great reputation since it was founded. RoboForex is now among the well-known and well-liked brokers in this industry.

Benefits of trading with RoboForex

1. A genuine and regulated broker, providing quality services at low trading costs.

2. Various market instruments to choose from and widen your portfolio.

3. Superb trading environment with its powerful proprietary platform, the MetaTrader, and cTrader.

4. Swap-free Islamic account type available

Drawbacks

1. Only one top-tier license.

2. Withdrawal charges may apply most days.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone was created in 2010 to raise the quality standards offered by online forex dealers.

The company was set up by a group of finance professionals who were not content with the industry’s poor forex and CFD trading services.

Pepperstone aims to boost trading services in all areas for customers continuously. The broker tries to improve on areas where other brokers fail to deliver. These include pricing, execution speed, customer services, trust, etc.

The company is among the most trustworthy and well-regulated brokers, offering quality trading conditions at low trading fees.

Pepperstone started operations in Melbourne, Australia. But they are now present in many parts of the world, including China. Asian forex traders are welcome to trade according to the country’s regulations.

Pepperstone renders fantastic trading services with powerful, effective trading tools that increase the trader’s skills and help them thoroughly understand forex trading.

The broker operates with licenses from several globally known financial bodies, including:

It is part of the reasons traders worldwide trust and feel comfortable dealing with Pepperstone. The customer can trade at competitive fees and enjoy peace of mind dealing with a regulated broker.

Pepperstone does not impose a fixed minimum deposit for trading. They recommend you start with $200. But if this is too much, the trader can invest much less.

The two types of account options are Standard and Razor accounts. The MetaTrader 4, 5, and cTrader are offered here, and mobile trading is available.

But the fees for the different accounts and platforms vary. The standard account has its commission built into the spreads. Trading fees on this account start from 0.7 pips, which is still extremely competitive.

Asians can trade over 60 forex pairs and cryptocurrency CFDs. If cryptocurrency trading is banned in your country, you cannot access this instrument on the broker’s platform.

Pepperstone advantages

1. Regulated by multiple acclaimed bodies. Offers excellent trading conditions at low fees.

2. Special add-ons on the MetaTrader and cTrader to improve algorithm trading and social trading.

3. Pepperstone is flexible and allows hedging and scalping. You can trade with any amount.

Pepperstone disadvantage

1. The broker’s educational content does not include quizzes to test progress.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a globally recognized forex and binary options online dealer. The company started in 2013 in Cyprus and attracted many traders worldwide, including in Asia.

Beginners find it a uniquely easy-to-use trading app appealing. The $10 minimum deposit makes it easy to start forex and binary options trading with this broker. (Important: Binary Options are only for professional traders and for those that are located outside of EAA countries.)

IQ Option trading platform comes with many useful indicators and tools to elevate the traders’ experience. A ‘community live deal’ feature allows social trading, which is helpful for sharing, learning, and increasing trading knowledge.

One standard account type is offered, but the trader can attain a VIP account if they deposit at least $1900. These accounts grant access to trade many instruments, including CFDs, binary options, digital options, forex pairs, and ETFs.

The accounts are zero commission types and the spreads start from 0.7 pips on major forex pairs. Note that withdrawal charges apply with this broker.

IQ Option is licensed by the International acclaimed body based in Europe, CySEC. The company is also registered with St. Vincent and the Grenadines’ Financial Service Authority, SVG FSA. IQ Option is, therefore, a genuine broker and safe for Asians to partner with.

Pros of IQ Option

1. IQ Option has won several awards for its uniquely designed and beginner-friendly platform.

2. Forex pairs spreads are highly competitive.

3. Many traders consider the IQ Option the best for binary options trading (only for professional traders and outside EAA countries).

Cons of IQ Option

1. A dormant account attracts inactivity charges after three months of no activity in the account.

2. Withdrawal fees for the bank transfer payment method are quite high.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Asia?

Forex trading records huge market activities daily in Asia. Many people engage in forex trading on this continent.

That is why the market attracts many online brokers, both genuine and fraudsters.

Fortunately, regulations exist, and there are several regulators on the continent that protects traders.

The popular financial markets regulatory bodies in Asia are:

These financial bodies provide the standards and framework that all forex brokers should adhere to while operating in Asia.

The regulations require periodic audits of the forex brokers and ensure that Asian traders’ funds are put in a separate account from the brokers in case of insolvency.

Some of these bodies also impose limits on the amount of leverage offered.

These bodies also make sure anti-money laundering rules are strictly adhered to by brokers.

The regulations vary from region to region, and these bodies ensure that brokers are compliant where they are situated. For example, SEBI allows Indians to trade forex. But they can only trade the rupee with a major currency, such as the dollar, pound, euro, or yen.

Security for traders in Asia

Asian forex traders can safely deal with any licensed broker. However, they must find out their country’s regulations on forex trading and ensure they abide by them to trade legally.

Traders in strictly regulated Asian jurisdictions should visit their regulator’s website to learn more about the investor’s safety and protection policies.

Some Asian countries require brokers to be authorized before operating within their borders. In this case, protection may not cover the trader if they deal with unauthorized brokers in the country.

Many Asians prefer to deal with international brokers holding reputable licenses from bodies such as:

These are also safe for Asian traders.

Is it legal to trade forex in Asia?

Yes and No. It depends on the country. In most places in Asia, forex trading is legal and safe. The trader only has to deal with licensed brokers.

In a few other places, forex trading is restricted by many regulations and sometimes reserved for authorized persons or commercial banks.

The trader has to research regulations in a specific country. Although, we should mention that many still trade forex in places where it is illegal.

(Risk warning: 69% of retail CFD accounts lose money)

How to trade forex in Asia – A quick tutorial

The basic requirements for forex trading are:

- Stable internet connection

- Mobile phone or computer

- A licensed broker.

You probably already have the first two. Next is to find a trusted and regulated broker.

The brokers recommended here all meet the requirements of a good broker. These requirements are:

- License

- Quality support

- Excellent conditions with low fees

- Free demo

- Popular payment methods.

After choosing a broker, follow these steps to trade:

1. Open a forex trading account for your country

Visit the broker’s website to create a forex account. The website for your country should load. Many brokers provide multiple language websites, so you can change languages.

Fill out the create account form and follow all the instructions.

The broker may request a national ID or international passport and proof of residence. You would have to scan and send this to complete the process.

2. Start with a demo or ‘real’ account

After registering, you can test the broker’s demo to understand trading if you’re new.

If not, the demo will allow you to see what the broker offers before fully joining them.

Demos are free and come with enough fake credits to carry out many test trades before starting a live transaction.

We recommend new traders take advantage of this.

3. Deposit money to trade

After testing the broker’s platform, it is time to trade and earn.

You first need real credits, so you must deposit money in the account.

The broker often assists with this at the initial stage. They offer different simple payment methods to make funding and withdrawal uncomplicated.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

Research different trading strategies and conduct important market analyses before you trade.

Market analysis will help you understand the asset’s price movement so that you can make better forecasts.

Trading strategies allow you to place the most profitable trades because you know where and how to enter the market.

Your analyses should include examining economic elements of the currency, including the interest rates, GDP, inflation, etc. This is known as fundamental analysis.

Successful traders also use essential indicators and study price patterns to find opportunities. This is what forex traders refer to as technical analysis.

These analyses help you determine the best and most suitable strategy for your chosen asset.

5. Make a profit

Once you combine an effective strategy with accurate analysis, you start to make a profit soon enough.

You can withdraw or reinvest the funds if you have been trading micro-lots.

The same methods for deposits should work for withdrawing. But the funds may not settle in your account as quickly as the deposits. The processing takes longer, between a few hours to a few days, depending on the broker and payment method.

Ensure you have uploaded all required documents and completed the registration to avoid further unnecessary delays.

(Risk warning: 69% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Asia

The best brokers offer quality service at competitive fees and try to make trading profitable for customers.

The brokers recommended above all fall in this category. Asian traders should choose the best and most suitable and trade according to their countries’ rules.

1. Capital.com

2. BlackBull Markets

3. RoboForex

4. Pepperstone

5. IQ Option

FAQ – The most asked questions about Forex Broker Asia :

Which brokers are available for forex trading in Asia?

Hundreds of forex brokers operate in Asia. However, choosing a random broker for forex trading can prove dangerous for traders in Asia and elsewhere. So, a trader must choose a reliable broker operating in Asia. These 5 brokers – BlackBulls Markets, Pepperstone, IQ Option, RoboForex, and Capital.com are among the leading brokers. You can rely on their trading services as they offer traders the best.

Which brokers in Asia allow traders to begin trading with a low minimum deposit?

As a beginner, a trader would want to signup with such brokers who allow them to initiate trading with a low minimum deposit amount. Brokers operating in Asia might charge a huge minimum deposit to begin forex trading. However, if you trade with one of the following brokers, you can begin with a low amount.

BlackBulls Markets

IQ Option

RoboForex

Capital.com

Pepperstone

Which forex brokers are low-cost forex brokers in Asia?

The five brokers reviewed here are the top low-cost forex brokers in Asia. You can sign up with any of these 5 brokers if you are looking for a broker that charges minimal commissions from traders. Moreover, most of these brokers have no deposit or withdrawal fee. Thus, trading with maximum profit is possible on these forex trading platforms.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)