4 best Forex Brokers & platforms in Austria – Comparisons and reviews

Table of Contents

If you are in Austria and looking to start trading forex, choosing one from the countless European online brokers may not be easy.

See the list of the best Forex Brokers in Austria:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC, SCB | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Userfriendly platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

This article will simplify your choice by limiting your options to five of Austrians’ best and most proven forex brokers.

List of the 4 best forex brokers in Austria:

- Capital.com

- Blackbull Markets

- Pepperstone

- IQ Option

Below, we give a brief introduction to each of their offerings:

1. Capital.com

Capital.com is a Britain-based CFD and forex trading brokerage firm founded in 2016. Two well-respected financial entities in Europe authorize the company. These are the Cyprus Securities and Exchange Commission CySEC, ASIC, SCB of Bahamas and the Financial Conduct Authority FCA.

The broker is one of the best for Austrians since it is among the most reputable broker offering top-rate services at competitive costs.

At a glance:

- Minimum deposit – $20 by card

- License – CySEC, FCA. SCB, ASIC

- Platform – MT4, Capital.com app.

- Spreads – low: 0.7 pips on major pairs

- Support – 24 – 5

- Free demo – Yes

- Leverage – 1:30

Austrians can access more than 125 forex pairs and thousands of CFDs in stocks, cryptocurrencies, indices, commodities, and futures. The platforms for trading are MT4 and Capital.com app. Mobile trading is available, and the platforms are packed with indicators and tools that can help you succeed.

Its account offerings are all zero commission, and spreads start at 0.7 pips. The broker charges zero for withdrawals, dormant accounts, or deposits. Overnight fees only apply to the leverage, and according to Austrian regulations, the broker provides up to 1:30 leverage.

Drawbacks of trading with Capital.com

- No MetaTrader 5

The broker only provides MetaTrader 4 and its app for trading. Many traders that are conversant with the MetaTrader platforms may prefer the tools that come with the MT5.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is an online forex broker based in New Zealand and founded in 2014. The company operates with a license from its home, Financial Markets Authority FMA. They are also authorized by the Financial Service Authority of Seychelles FSA.

BlackBull Markets is an authentic ECN broker and boasts of the fastest order executions in the market. The broker has built a good reputation on this and is now among the most trusted for non-dealing desks execution structure.

Summary:

- Minimum deposit – $200

- License – FMA, FSA.

- Platform – MT4, BlackBull Markets app.

- Spreads – low: 0.1pips on the raw ECN account

- Support – 24 – 5

- Free demo – Yes

- Leverage – 1:30

Traders can access various instruments, such as 35+ forex pairs, 100+ CFDs, energies, metals, and indices. The services are provided on the Mt4 and the BlackBull app. The broker also supports social and copy trading through Zulutrade and MyFxbook.

Austrian traders can choose a commission-based account that uses ECN execution methods. Or they can choose a commission-free STP account type. Spreads start from 0.8 pips on the latter. BlackBull Markets is among the low-trading-fees broker that guarantees superfast execution at 2.5 milliseconds. Traders can carry out numerous transactions and earn more based on this.

The disadvantage of trading with BlackBull Markets

- No EU license

Though the broker is licensed and has a good reputation, they are not regulated by an EU body. Therefore, they are not bound by MiFiD and may not offer the complete customer protection that other EU brokers provide.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone is an award-winning online broker headquartered in Australia. The brokerage was created in 2010 and now operates with several licenses from top-tier bodies in Europe.

Pepperstone is among the safest brokers for Austrians, offering world-class service at low fees.

Overview:

- Minimum deposit – $200 (recommended)

- License – CySEC, BaFiN, FCA, ASIC, FSA.

- Platform – MT4, MT5, cTrader

- Spreads – low: 0.1 pips on the razor account

- Support – 24 – 5

- Free demo – Yes

- Leverage – 1:30

With Pepperstone, you can choose a standard or razor account to trade on zero commission or the tightest spreads. The razor account is an ECN model account where traders sometimes enjoy zero markups on forex pairs. Although, a commission of $3 per lot size accrues.

The broker provides valuable tools and support on its MT4, MT5, and cTrader platforms. Free VPS is available for volume traders, and an active trader’s program allows traders to enjoy rebates and other benefits. Pepperstone provides exclusive add-ons on its platforms to support automated trading. Social and copy trading is also offered using Zulutrade.

Cons of Pepperstone

- 30-day demo access

Customers can access this broker’s demo only for 30 days. This isn’t enough time for some people since other brokers offer much longer time than this.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option is a European binary option and forex trading company. They hold a license from CySEC and have been operating since 2013.

Many in Europe consider the IQ Option app the best for trading binary and forex options (for professional traders and those outside of EAA countries only). The company has won several awards for its intuitive trading app and outstanding services.

Overview:

- Minimum deposit – $10

- License – CySEC

- Platform – IQ Option app

- Spreads – From 0.8 pips for majors. Zero commission.

- Support – 24 – 5

- Free demo – Yes

- Leverage – 1:30

Through IQ Option, Austrians can access a wide selection of instruments, including forex pairs, CFDs, and binary and digital options (for professional traders and those outside of EAA countries only). The trading cost is relatively low, and beginners get adequate support as they learn to trade options. A deposit of $1900 raises the trader’s status to VIP, where they enjoy several benefits, including a dedicated account manager and rebates.

IQ Option recently introduced a unique market instrument called FX options. Unlike the binary (for professional traders and those outside of EAA countries only) and digital options, non-professional traders can invest in this asset. And the broker allows the closing of the trade before its specified maturity time.

The disadvantage of IQ Option

- No MetaTrader platforms

Trading services for all its products are provided on the IQ Option app. Many traders who prefer the MetaTrader above all else might not stir clear of this broker.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Austria?

Austria joined the European Union in the mid-90s. This development opened doors for many economic benefits for the country.

Among these benefits are an increase in investors and, soon after, the adoption of the euro as its national currency.

Many Austrians are involved in financial market investments. The list of forex traders in the country, too, keeps growing.

Austria’s financial body in charge of market activities is the Financial Markets Authority of Austria FMA. However, the country also has other international regulators that oversee its financial sector.

All the bodies follow the Markets in Financial Instruments Directive (MiFID) framework. All licensed financial companies in Europe, including brokerages, operate under MiFID. The implication is that competition in this market is high, and so is customer protection.

These regulatory bodies all operate in Austria:

- The Cyrus Securities and Exchange Commission, CySEC.

- The Financial Conduct Authority, FCA.

- The Financial Markets Authority of Austria.

Brokers who wish to operate within Austria must hold a license from these bodies. Austrians can deal with brokers licensed by any financial body in Europe as long as their regulations do not contradict Austrian financial laws.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for Austrian traders – What you need to know

Austrian traders enjoy full-quality customer protection, including insurance, when they trade with any EU-regulated broker.

Brokerage companies operating within Europe with a valid license are a good option for any Austrian trader. But they must also check out the broker’s offering and ensure it matches their trading objectives.

Austrian traders must understand the key points of trading the foreign exchange market before going into it. For this, there are various sources where the individual must educate themself.

The trader must study the relationships between the pairs they choose to trade before investing. Analyses are a great way to do this, and we will explain more about this further down.

Austrians must also trade within EU laws to remain protected. These laws include leverage limits, trading amounts, regulations, etc.

Is it legal to trade Forex in Austria?

Yes, forex trading is allowed in Austria. But traders must strictly adhere to their country’s financial markets regulations. They must conduct business within the laid down regulations, such as trading and leverage limit. And they must trade with a confirmed regulated broker in the EU region.

How to trade Forex in Austria – Quick tutorial

The basic first step to forex trading in Austria is finding a broker.

Individuals can not trade the market directly. The broker provides access by when you register with them.

Brokers provide access to the foreign exchange market for a fee, which is the spreads, in most cases. Some include a commission, and others charge both, depending on the account type.

The fee gets deducted from each transaction the trader makes. If it is too high, the transaction may be worthless for the trader, even if it was a profitable trade.

That is why traders look for low-spread brokers. Trading costs are not all you should consider before choosing a broker.

Make sure the broker meets the requirements below:

- Well-regulated in European Union jurisdiction.

- Competitive commission and tight spreads.

- 24-hour customer support.

- Free demo account.

- Common payment methods for easy funding and transfers.

All of these mean the broker is worth considering.

Steps to trading forex:

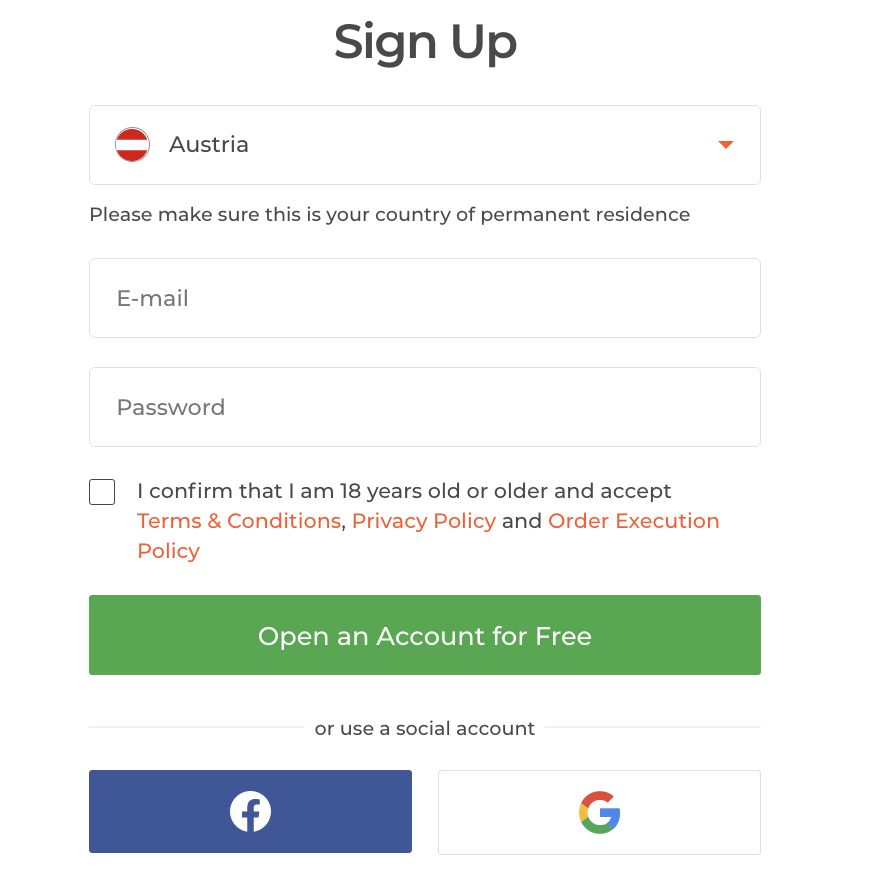

1. Open an account for Austrian traders

Go to the broker’s website to signup for an account. The register tab should be on the homepage and easy to spot. Click on that and enter the requested information.

Check your email for an authentication link and click on that to verify the information you gave. Complete the signup process by filling out the rest of the required details.

You may need to upload some documents for KYC. That’s a national ID and proof of address. In some cases, the broker may only request your social security number.

2. Start with a demo or real account

The broker will provide a free demo account with enough virtual cash for testing. The demo is a chance for you to test the broker’s platform and see if it is right.

New traders use it to learn to trade the market. It helps you familiarize yourself with forex trading before starting live trades.

Skilled traders sometimes use demo accounts to see what the broker has to offer in the trading environment. They can also use it to test trading strategies.

A few people prefer to test a broker with a real account, though a micro one. They invest the minimum required trading amount to run FULL tests. If satisfied, they raise their capital.

3. Deposit money

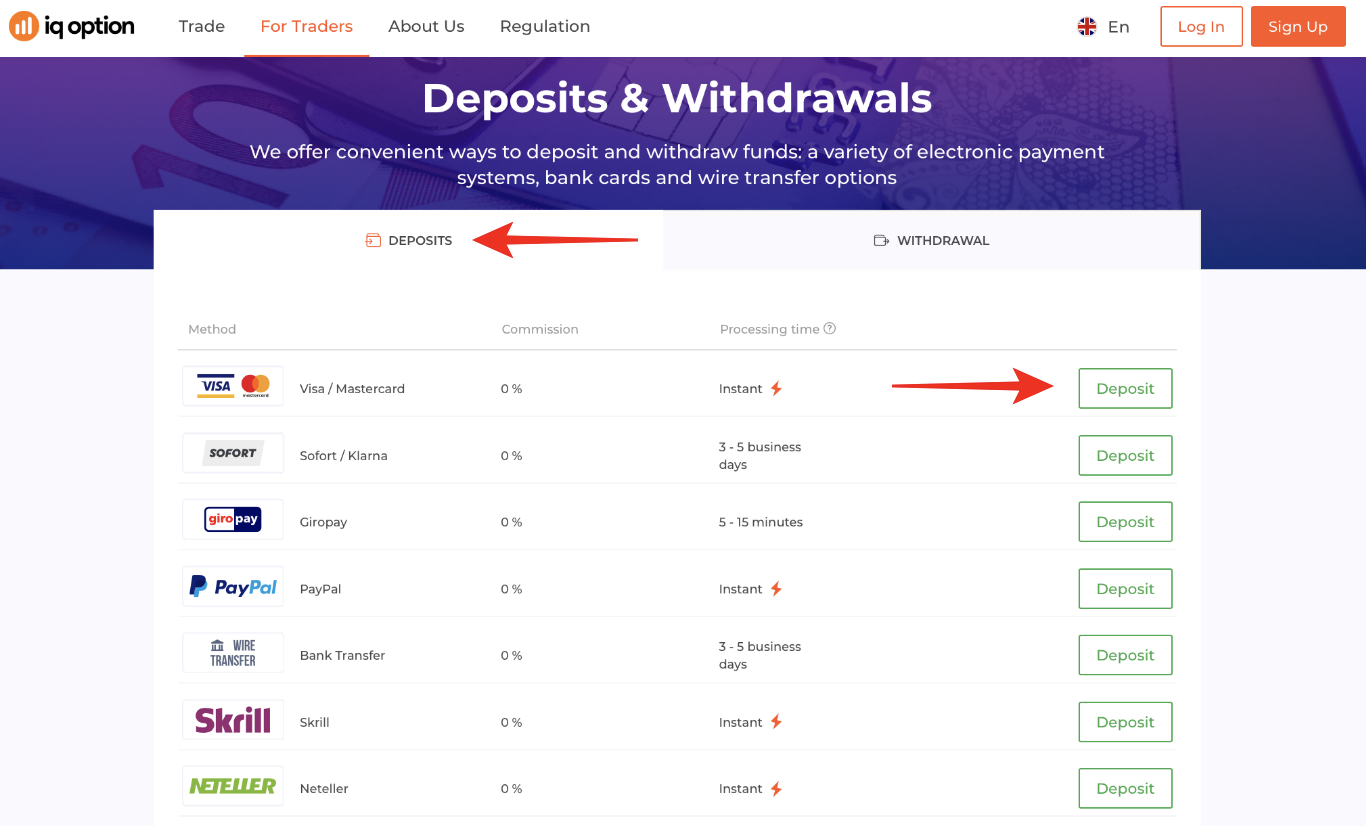

Once you test the demo and are satisfied, it is time to use the real account and trade live. You’ll need to deposit money for this.

The broker will offer several common payment methods to make this easy to do. The popular payment methods in Europe are Visa, MasterCard, local bank deposit, Wire transfer, Neteller, Skrill, and Paypal.

Other local PSPs may be provided too. The broker may also offer one-on-one assistance in the initial stage of signing up with them. Depositing funds should be pretty straightforward, and the money should reflect in the account within a few minutes to 1 hour.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

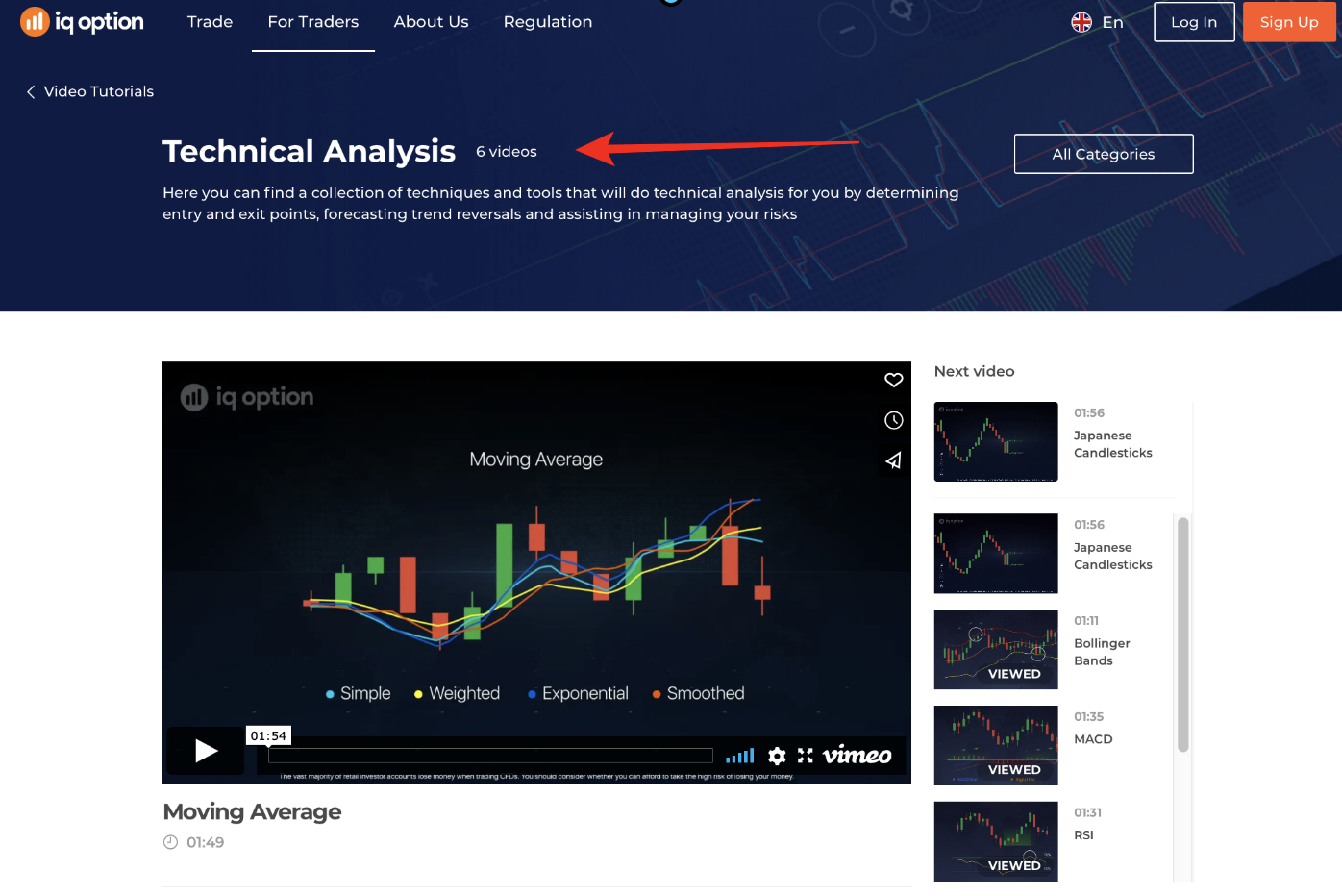

4. Use analysis and strategies

Signing up with a good broker is half the work. The other important part of trading is market analysis and strategizing.

Before trading for real, you need to conduct a market analysis and devise a good strategy to trade your chosen asset.

The analysis will give you insight into the asset’s price direction and its influences. At the same time, strategies help you make winning trades by opening and closing trades at the best times.

The two paramount forex analyses to conduct are:

- Technical

- Fundamental analysis

Technical analysis is the most widely used by traders and investors. The user studies the price chart, looking for patterns that help them predict the next price movement. Learning to interpret these patterns to help identify the best trading opportunities. All trading platforms come with tools for this analysis. Some platforms have more tools than others. Most brokers include special add-ons to help the users make a better analysis.

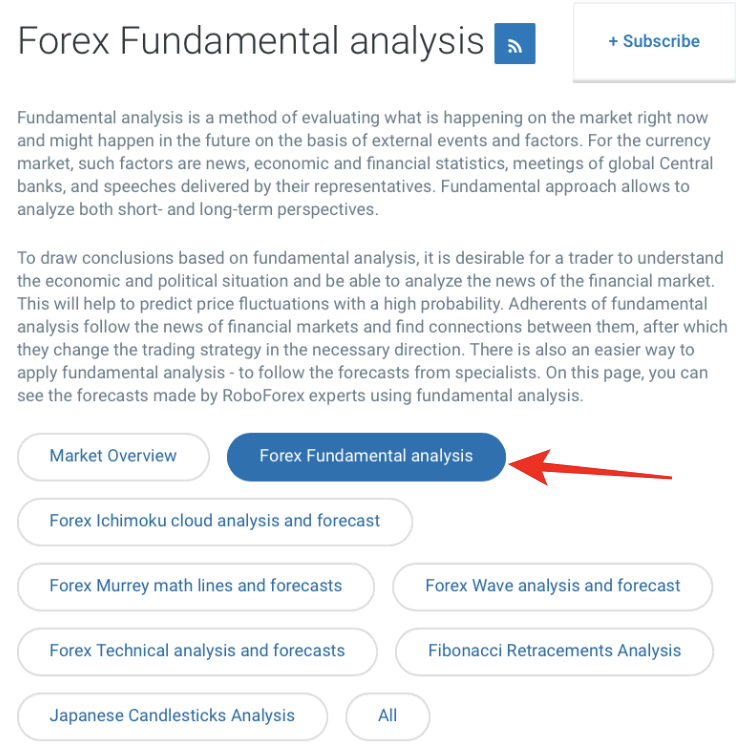

Fundamental analysis is equally essential to successful forex trading. Forex fundamental elements are the things that cause the exchange rates to move in certain directions, up or down. These are economic factors that directly affect a country’s national currency. They include the interest rate, inflation, export and import, gross domestic product (GDP), etc. The trader must analyze these to see how they affect the exchange rate. It allows them can make the right trade decisions.

Successful traders are always analyzing the fundamentals and asset prices before transacting. The more you conduct these analyses, the more your trading skills improve. These two crucial analyses help traders determine the correct strategy for the asset they wish to trade.

Popular forex trading strategies:

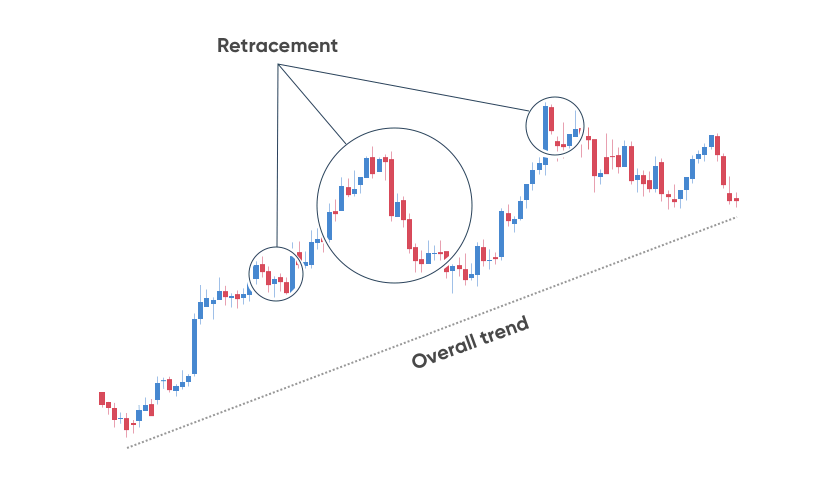

- Trend trading strategy

Many Austrians trade the euro against other currencies. This currency is among the first three major currencies and offers ample opportunities for any trader. If you trade the trend, you place trades in the direction of the current market condition. For example, if EURUSD is on an uptrend, the euro keeps gaining value against the dollar. That is, the asset price is seeing more highs than lows. The trader places more BUY trades to profit from such a market condition.

- New release trading strategy

Many experienced traders use the news to make decisions. They enter trades based on economic releases. These traders can anticipate market sentiments through the information that is released. For instance, a hike in the international oil price may influence the EURUSD price. Skilled news release traders can interpret the influence and anticipate the price movement.

Many more popular strategies exist, including:

- price action

- breakout

- range trading

- scalping

- etc.

Profitable trading results from conducting the needed analyses and mixing them with the correct strategy for your chosen asset.

5. Make a profit

The trader starts to earn profits soon as they use the appropriate strategies. It gives the opportunity to raise the trading amount.

But you can also withdraw the profits. The withdrawal process is usually easy with a good broker. However, the funds may not hit your account right away. Depending on the broker and the payment method, processing withdrawals takes less than 48 hours or more.

The trader can initiate this request by clicking on the FUNDS tab and selecting withdraw from the options. Follow the instructions and wait for the broker to process the request.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Austria

Finding a good forex broker in Austria is the essential first step to trading. All the brokers recommended here are great options for you. We hope this article makes it easier to choose the best one for you.

FAQ – The most asked questions about Forex Broker Austria:

Which regulated brokers in Austria are the best?

A number of regulated brokers in Austria provide traders with the best FX trading platforms. For instance, there are IQ Option, Pepperstone, Capital.com, and BlackBull Markets. In addition to being regulated, these brokerage firms are trustworthy. Moreover, they have a clientele of hundreds of traders. Thus, you can always choose these brokers with closed eyes for forex trading.

Is it possible to register for a free Forex brokerage account in Austria?

Yes, you can open a free forex trading account in Austria. Most brokers will allow you to signup for a free forex trading account in Austria. You can even trade for free without using your money on most platforms. It is possible on the demo trading accounts that IQ Option, BlackBull Markets, Pepperstone, RoboForex, and capital.com offer. The demo account is also ideal for exploring the functionalities of these trading platforms.

Which forex brokers offer the highest number of underlying assets to trade in Austria?

Out of all brokers in Austria, these five brokers offer a high number of underlying assets to traders. Moreover, you can even trade other stocks, commodities, indices, etc., apart from trading forex. So, signing up for one of these trading platforms is always beneficial for traders.

Last Updated on March 31, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)