The 5 best Forex Brokers and platforms in Bangladesh – Comparison and reviews

Table of Contents

Forex trading is fast-growing in Bangladesh. This makes it a bit difficult for intending forex traders to conclude on the platform to work with. However, this article gives an in-depth view of all you need to know about trading in the foreign exchange market in Bangladesh.

See the list of the best Forex Brokers in Bangladesh:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 67% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 67% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 67% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Top 5 Forex Brokers and platforms in Bangladesh

Using valid bases of comparison, below are the best 5 forex brokers in Bangladesh:

1. Capital.com

Capital.com has emerged as one of the best forex brokers in Bangladesh. It was established in 2016. In compliance with forex regulations in Bangladesh, it applies the rule of segregation of accounts.

Capital.com is regulated by three bodies:

- UK’s Financial Conduct Authority;

- Cyprus Securities and Exchange Commission; and

- Australian Securities and Investments Commission.

Capital.com has an edge over other brokers in the forex market. These benefits include:

- Instructive training content and educational materials;

- Excellent quality-service delivery;

- They have gained ground in over 6,100 Forex markets; and

- Provision tight spreads and low deposits;

- Stress-free account opening process;

- No withdrawal cost, which takes only 1 day; and

- Sound technology in its financial system.

The pitfall of Capital.com include:

- It is not publicly traded; and

- No license in tier 1 jurisdictions.

(Risk warning: 67% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is another highly-rated broker in Bangladesh, known for its excellent quality offerings. It has its origin in Auckland, New Zealand, in 2014.

The currencies accepted for deposits include:

- UR;

- USD; and

- GBP.

Virtual funds of $100,000 are used for a 30 days demo account simulator. In 2021, the standard accounts recorded 1.25 pips.

BlackBull Markets account registration involves filling out an application form, verifying ID and email address, then awaiting access.

Benefits of BlackBull Markets

- Running a free trading commission with the standard account. At the same time, the prime account runs $3.0 per lot.

- Offers a YouTube training site named the Whiteboard Wizards Playlist.

- User-friendly training materials; and

- SSL encrypted data to protect clients’ information and funds.

Drawbacks of BlackBull Markets

- Investors from Bangladesh, the UK, South Africa, UAE, and some other countries are permitted; and

- At the same time, US clients are not granted access to its forex market.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex was recognized in 2021 by The International Business Magazine Awards as the Most Trusted Broker of the year. It has been in existence since 2009.

To open a RoboForex account, sign up, fill out the registration form, and make an initial deposit. A RoboForex demo account can be used to verify the conditions offered before creating a real account.

There are different deposit methods and withdrawal options to select. RoboForex has eight classes of assets. Five currencies are approved. These include USD, EUR, RUB, GOLD, and CNY.

Pros of RoboForex

- $30 bonus in initial funds given to all newly-registered traders that sign up;

- The minimum deposit is $10 with a spread starting from 0 pips;

- Recognized trading experience;

- Quality customer support and analytical research;

- Immediate fund withdrawal;

- Favorable trading terms with a low minimum deposit; and

- Application of the negative balance protection, which protects clients’ deposits from losses.

Cons of RoboForex

- Clients from Australia, the US, Japan, and Canada are not permitted to trade; and

- It is not regulated and controlled by the FCA.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is known for its quality research and multiple platforms for copy trading. It was founded in the year 2010. It has low risk with a total Trust score of 93 over 99.

Pepperstone provides two types of accounts:

- Standard account; and

- Razor account. The razor account is recommended for traders who want lower fees.

It has over 72 currencies to trade with. Pepperstone is ideal for traders that desire low-cost offerings, account types, and quality customer support.

The four platforms for trade offered by Pepperstone include:

- MT4;

- MT5;

- TradingView; and

- cTrader.

Pepperstone is featured on daily market commentary and on an economic calendar. Pepperstone started operating in Italy after getting its license from CONSOB.

Benefits of Pepperstone

- Excellent customer support;

- Low cost of commission and low spreads;

- Provision of security to its clients by segregating the clients’ funds from their funds;

- Withdrawal of funds in pepper stones takes up to 1-3 business days, with various withdrawal options; and

- Easy access to the markets.

Disadvantages of Pepperstone

- High minimum deposit of $200; and

- US clients are not permitted to trade.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option was established in 2013, with a minimum deposit of $10. Recently, IQ Option has 25 Forex pairs on its platform. The IQ Option is available in 13 languages.

Forex trading tools include:

- Multi-chart layouts

- Technical analysis

- Economic calendars

- Volatility alerts

- Market updates

Spreads in the IQ Option depend on volatility, time, and liquidity.

IQ Option provides competitive spreads and currency pairs, including:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CAD

- AUD/USD

- NZD/USD

- USD/CHF

IQ Option provides a free demo account with virtual money of $10,000. Demo accounts can be used as long as possible to assess trading strategies and become familiarized with the platform before depositing real money.

An IQ Option client doesn’t have to fill in any information to use the demo account. Nevertheless, some other brokers require you to fill in certain information to access their demo account.

Pros of IQ Options

- No processing fees are charged for funds deposits;

- Withdrawal on IQ Option takes up to 3 days to verify the client’s identity. The option of withdrawal must correspond with the deposit or payment option;

- Countries such as Italy, Qatar, Kuwait, Italy, Thailand, UAE, and Luxembourg, are accepted; and

- IQ Option has a user-friendly platform.

Cons of IQ Option

- A withdrawal fee of 31 USD; and

- Few assets.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Bangladesh?

Workforce modifications were introduced through Bangladesh’s Foreign Exchange Regulation Act 1947 (FERA). FERA provides legal guidelines for Forex. The main regulatory body is the Bangladesh Bank (BB). It has strict and patterned forex regulations.

Bangladeshi Taka can be easily converted. International funds’ transfer is only allowed under special conditions and proper documentation.

Occasionally, the BB publishes a manual that guides and regulates Forex activities in the country.

Any trader who fails to adhere to the guidelines provided by FERA is considered illegal and faces the necessary sanctions.

Money changers are registered people permitted to buy international currencies and sell them to the citizens of Bangladesh traveling abroad.

Hotels, Malls, and other service rendering organizations have limited licenses to change currencies. They instead buy from guests and sell to ADs. Banks with competent teams can apply for this license issued by the Bangladesh Bank, providing they adhere to the stipulated guidelines.

Authorized Dealers Licenses are issued based on applications. These applications must be submitted to the General Manager of the Forex department in Dhaka.

The application’s components include the scope of the business, the business location, names of trained staff, and addresses.

The on-spot basis is employed in the Bangladesh Bank transaction when buying and selling to the ADs. ADs are free to give their rates.

Remittance of funds outside the country is permitted only under certain circumstances. Proper documentation has to be made and presented.

When a person with foreign currency enters Bangladesh, no declaration has to be made for amounts ranging from $5000 and below. However, if it exceeds $5000, the amount must be declared to the Bangladeshi Customs Authority.

Security for traders – What you need to know as a Bangladeshi trader

Below are some steps to proceed as a trader in the Bangladeshi forex market. Start with a solid internet connection. To connect with a broker and facilitate trading, you need an internet connection free of latency and downtime.

To excel in forex trading, you have to be time conscious. This is because some windows are not always open. It would be best if you were very sensitive to this factor.

Connect your accounts to the selected platform to ensure you have been verified. Your forex broker also has to link your bank accounts.

The selected broker determines the deposit’s option, either through debit cards or going directly to your bank. The next step is to download your trading user interface (UI). A good UI minimizes the rate of input error and enables you to analyze situations.

To be prepared to trade, you need to get your UI ready. Always proceed with a virtual funds account before upgrading to a real account.

The BB carries out close monitoring to prevent the volatility of its forex reserves. The currency reserves may experience pressure when payment obligations for higher imports in Bangladesh.

The BB requested the submission of reports on all casual and corporate deals to the department of the Central Bank that is in charge. This submission is made daily by 4.00 pm.

All the commercial banks were mandated to submit daily records of all their inter-bank forex market dealings; the BB was charged with that responsibility.

The Managing Directors and the Chief Executive Officers of the banks involved were asked to submit all their forex dealings records. This order was issued by the Central Bank of Bangladesh (BB).

To protect your forex trading account, always employ the stop loss technique. This technique was created to prevent losses through a limit order. Here, forex traders use a maximum loss amount which closes all windows until the next trading period.

Another fund management strategy is the trailing stops. Here, profits are preserved while still building a trading platform.

Is it legal to trade Forex in Bangladesh?

Yes, it is. The Bangladesh forex market is a highly potential platform. The Bangladesh Bank (BB) directs Forex transactions in Bangladesh. The legal provision states that authorized brokers can buy and sell currencies under the Foreign Exchange Regulation Act of 1947.

Foreigners and citizens of Bangladesh living outside the country are not licensed to trade forex.

Even though retail traders are not permitted to trade in the forex market, millions of traders engage by adhering to specific rules and exceptions.

How to trade Forex in Bangladesh – A quick tutorial

To trade forex in Bangladesh, the following steps are recommended:

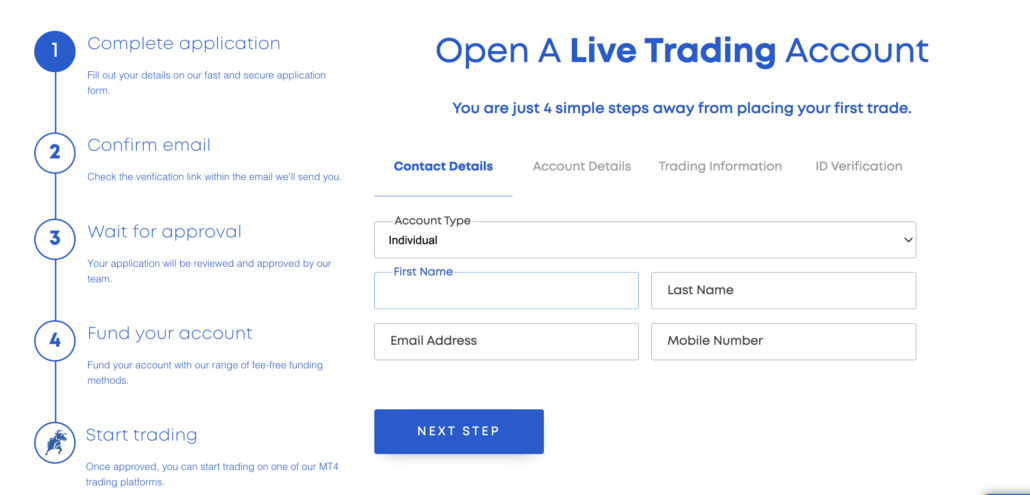

Open a forex trading account

Before opening an account, you need to:

- Verify the forex broker you intend to deal with;

- Ensure that the broker adheres to the stipulated forex regulations of the country;

- Consider the minimum deposit, commission fee (if any), spreads, and other factors;

- Open the website of the broker you’ve settled with;

- Find the suitable account types. If you have a real account, you may give your personal information;

- Fill in the registration form online;

- Go on to validate your account information by providing the required means of identification. This may take more than a day; and

- Once you’ve been verified, download the broker’s platform. You may fund your account after using the demo account. However, this is not compulsory, in any case.

(Risk warning: 67% of retail CFD accounts lose money)

Start with a demo account or real account.

A demo account is always recommended for forex clients who wish to trade in Bangladesh using virtual funds. To access this account, you don’t need to fill in any of your personal information. Beginners using this account in Forex trading should use this to spot the best broker.

A real account is created with proper application and minimum deposits. Real money, not virtual funds, is earned and can be withdrawn. In this type of account, you will be required to fill in your personal information.

Examples of real accounts include:

- Standard or classic;

- Cent; and

- Premium or professional accounts.

Deposit money

Forex platforms have their unique requirements. The forex broker you have agreed to settle with determines many things. For example, the minimum deposit, commission fee, spreads, account types, and more.

Some brokers have high initial deposits, while some have low initial deposits. The selected forex broker determines the variety of deposit methods at your disposal.

They include:

- Fasapay;

- Bank-wire transfer;

- Qiwi;

- Bank card;

- Bitcoin, and others.

The initial deposit procedure is expected to align with the withdrawal process for most platforms.

Currencies used to make payments include:

- EUR;

- GBP;

- USD;

- JPY;

- RUB; and

- GOLD.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Three trading strategies are used in Bangladesh:

- Day trading strategy;

- Trend trading strategy; and

- Positional trading strategy.

Day traders are the fastest kind of traders. Here, the competition is intense. Day traders have an excellent internet connection and automated software. It is recommended for forex traders who wish to earn immediately when a trade is opened.

A trend trader moves according to price. Trend trading usually puts an investor in a trade for days or weeks at a time. Trends occur in ranges or directional movements that may take some time to pan out.

When a currency is trading within a range, it creates support and resistance levels. When a currency is trending, it moves in a pattern that a trader expects to continue.

If a positional trader is more interested in the economic and political conditions that cause forex prices to rise and fall, you may be a positional trader. Positional investors are not concerned with the daily news items that make a massive difference in the life of a day trader.

Short-term price irregularities are suitable for the positional trader. When a long-term investor knows that a currency is out of place with its rightful position, that becomes a wide-open opportunity for a successful trade.

Make profit

Traders in Bangladesh benefit from a number of privileges, unlike Forex traders in other countries. Bangladesh’s currency (Taka) is a stable and secure currency to trade with.

Bangladesh operates a centralized banking system, making it difficult to secure any loss.

Most people believe that profits can only be realized in forex trade by buying and selling currencies at higher prices. This is a method and not the only means.

Profits can also be boosted through the use of leverage. For instance, if you have 200 Taka to trade with and your broker offers you no leverage. If there is a price movement of 5%, that gives you a profit of 10 Taka.

However, if your forex broker offers you a leverage of 1:50, that will give you 10,000 Taka. If there is a price movement of 5%, that gives you a profit of 500 Taka. Another means of making profits in forex trade is by trading CFDs. CFDs are derivative instruments. Here, speculations are used.

Binary Options (only for professional traders and outside EEA countries) also called fixed-return options are used to speculate the movement of price in forex trading.

Lastly, soaking information from training series and videos and the best brokers, is another means of realizing profits from forex trade.

Conclusion: The best Forex Brokers are available in Bangladesh

Different modes of comparison were used to spot out the top 5 forex brokers and platforms in Bangladesh. The Bangladeshi forex regulations have been explained with clarity.

However, having the right information is not all you need to be a forex trader. You have to trade with caution as internet fraudsters are on the increase.

Forex trading is made easy with the right instructor and instructions. Potential or advanced Forex traders in Bangladesh have low risks as regulatory authorities ensure a secure environment.

Always do a background check on previous and current clients’ reviews of the Forex broker you consider.

FAQ – The most asked questions about Forex Broker Bangladesh :

Does Bangladesh allow forex trading?

In Bangladesh, forex trading is subject to a number of limitations even though it is legal. Directly opening a foreign currency account is not possible for regular users. Only brokers who have received formal approval from the Bangladesh Bank are permitted to act as their brokers.

Which Bangladeshi forex broker is the best for newbies?

Every newbie should choose a broker like RoboForex and XM that offers a demo platform, free training opportunities, and the lowest spreads and deposits. It is challenging to choose which broker is the greatest. However, if the company is willing to provide you with a free trial of their platform, it is worth it.

Can I buy Bitcoin CFDs in Forex trading in Bangladesh?

Bangladesh has access to Bitcoin and a sizable peer-to-peer network. International cryptocurrency exchanges are beginning to come to Bangladesh as a result of cryptocurrencies’ growing popularity. Additionally, traders can benefit from the bitcoin CFDs offered by their Forex brokers.

Is forex trading taxable in Bangladesh?

Yes, Bangladesh taxes foreign exchange transactions. All profits that exceed the taxable income limit are subject to the regular income tax rate. The income tax legislation doesn’t care whether or not the forex profits are the primary source of income.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)