Best Forex Brokers in Belgium – Comparison & reviews

Table of Contents

Forex trading in Belgium is easier and more profitable if you are trading with the best online brokers in the industry. Interestingly, the presence of many brokerage firms makes it difficult to find a platform committed to both expert and novice traders.

See the list of the 2 best Forex Brokers in Belgium:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: |

|---|---|---|---|---|---|

1. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | |

2. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts |

In this article, we have streamlined your research by providing the best four forex brokers in Belgium. The page also reveals some common concerns and queries new Belgian investors face.

2 best Forex Brokers & platforms in Belgium

- BlackBull Markets

- Pepperstone

1. BlackBull Markets

BlackBull Markets is an Auckland-based forex broker renowned for being one of the most trustworthy brokers. The company has operating licenses from international regulators like the Financial Markets Authority and the Seychelles Financial Services Authority (FSA).

Up to 350 financial instruments are available on BlackBull Markets’ MetaTrader trading platforms. These tradable assets include all major FX pairs, commodities, major US stocks, and indices.

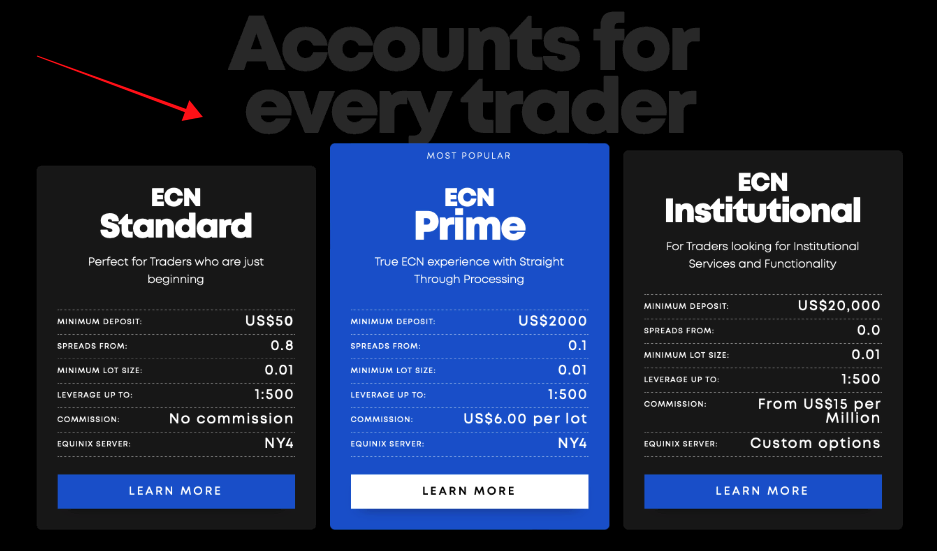

The broker offers three main ECN-based account types:

- ECN Standard

- ECN Institutional

- ECN Prime

Investors can also use the demo account (which is simple and quick to sign up for) or the Islamic Account, depending on their unique needs.

The ECN Standard Account is best suited for new traders or new users on the platform. However, traders must deposit a minimum deposit of $200 to start trading.

BlackBull Markets welcomes usual account-funding options such as credit cards (MasterCard and VISA) and bank wires. However, you can fund using third-party providers like UnionPay, FasaPay, and Neteller.

Belgian traders are offered high leverage and a few exceptionally liquid trading instruments with low rates. Moreover, deposits are free, while the processing time for withdrawals is two days.

The easiest approach to contact BlackBull Market’s customer service is to use the online chat service on the official web page. If you can’t reach a representative via live chat, send an email to [email protected].

Pros

- There are more than 64 currency pairings among the instruments offered.

- Customers of BlackBull Markets can participate in a benefits package with a maximum reward of $250.

Cons

- Expensive withdrawals

- Limited trading instruments and market analysis

2. Pepperstone

Pepperstone, an Australian brokerage founded in 2010, is regulated by two tier-1 regulatory agencies. This is why it has swiftly risen to become one of the world’s largest FX and CFD providers.

The brokerage firm offers low spreads and interbank executions. It is famous for being an execution-only broker without a transaction desk, offering low-cost pricing from various direct sources of liquidity to both market makers and retail customers.

Pepperstone customers can choose between its two major trading accounts, known as Razor and Standard accounts. While the Standard account offers zero commission, the Razor account offers zero spreads.

When it comes to trading styles, Pepperstone provides you with many options. Scalping, hedging, and automated trading using EAs (expert advisors) are all authorized, and mini, micro, and normal lots can be traded.

Funding a Pepperstone account is easy thanks to different deposit options like UnionPay, Skrill, BPay, PayPal, MPESA, etc. Belgian traders can deposit money using the local bank deposit or bank wire.

Pros

- Sixty-two currency pairs, virtual currencies, and indices are available for traders.

- Negative balance protection is included

- Access to a compensation program worth £85,000 per customer.

- 24/7 live chat support

Cons

- US traders are not accepted.

- No stop-loss protection.

What are the financial regulations in Belgium?

Located in Western Europe, Belgium is a nation with about 11.5 million citizens. Belgian traders and local brokers make up the country’s forex market which is regulated by the Financial Services and Markets Authority (FSMA). The local regulatory body serves as a conduit between the government and the financial markets, ensuring fair competition and combating financial fraud and terrorism funding.

On the other hand, local forex brokers must follow a regulator’s principles and requirements, which forbid them from participating in unlawful or unethical acts.

The regulatory body also protects customers’ funds by ensuring trading platforms provide security and risk management solutions. It is also important for brokers to keep modifying these protection strategies to keep up with new risks arising in the forex markets.

Another major purpose of the regulatory agency is to ensure that brokers do not combine investors’ funds with the company’s capital. This way, a regulated brokerage firm can process payouts anytime without excuses.

Therefore, Belgian investors should only open an account with regulated companies. Apart from the FSMA in Belgium, other international bodies like the CySEC and the FCA provide similar rules to protect customers.

Security for traders

Even with the level of regulation in the country, it is possible to get scammed while trading forex in Belgium. This is why investors need to carry out their due diligence on forex brokers before registering on any platform.

To help you avoid being defrauded, here are three considerations to note when looking for the right forex broker in Belgium.

- Choose approved brokers: Regulating is, of course, crucial. The good news is that forex trading firms are only permitted to provide products within Europe if they are well-regulated and ESMA-compliant. This can assist you in avoiding unauthorized international providers. However, if you prefer local brokers, ensure they are under the FSMA regulations.

- Choose Forex/Stock Brokers if you are not an experienced trader: If you’re a non-professional investor in Belgium, your trading options can be restricted to stocks. This is why it is necessary to register only on platforms that provide stock and forex trading.

- Choose brokers with reasonable commissions: It’s always crucial to maintain commissions and fees as minimal as possible. This is especially true in Belgium, where you will probably deal with long-term investments such as shares.

Your gains may not be as quick to come in with these types of investments. Finally, while trading forex in Belgium, it may be even more crucial for you to limit charges, commissions, and fees.

Is it legal to trade Forex in Belgium?

In Belgium, forex trading is legal for only professional traders. However, some forex firms can provide trading in stocks and non-leveraged goods while being compliant with that legislation.

If you are a non-Belgian citizen, you would assume this to be a straightforward procedure because you are a part of the European Union. Unfortunately, it is not, but non-Belgian traders living in Belgium can participate in trading forex legally.

While forex trading is permitted in Belgium, you must be a successful trader to participate in the forex market because retail forex trading is prohibited.

You must provide two of the following three pieces of evidence to prove that you are an expert trader:

- At least one year of trading experience.

- A financial investment portfolio of at least €500.000 (excluding properties such as houses, cars, etc.)

- Proof of at least 40 high-leveraged holdings traded in the previous year (at least 10 per quarter)

Your forex broker verification will be completed once you have submitted this documentation, and you will be able to begin trading.

How to trade Forex in Belgium – A quick tutorial

Forex trading is available to expert traders in Belgium, provided they have an internet connection. However, because the currency market in Belgium is a high-risk activity, investors should always conduct their assessment before going ahead.

Different online tools are available to assist you in getting started. However, to get started, you’ll need Belgian forex brokers.

The following are basic steps to take when starting out in forex trading.

1. Open an account for Belgium traders

After deciding on the forex broker you want to trade with, the next step is registering online via the broker’s website. To complete your online registration, you must provide basic details such as:

- Your full name, email address, mailing address, and mobile number.

- Login Password

- Date of birth

- Belgian ID card

Being a forex trader in Belgium, you must provide key financial details that prove you are an established forex trader.

2. Start with an actual or demo account

Generally, demo accounts are advisable for new investors to a trading platform. With such virtual accounts, novice traders can take positions and make profits like a real account, but withdrawal is impossible.

Demo accounts provide market patterns, indicators, and other trading tools like a real account. Belgian forex traders can use demo accounts to understand the fundamentals of trading CFDs, commodities, and other tradable financial assets.

3. Deposit money

Belgian forex traders have different deposit methods for funding their forex accounts. For instance, traders can use bank transfers, credit or debit cards, and private merchants like Skrill and Neteller.

It is important to carefully choose the deposit method to avoid additional private companies’ fees.

Before choosing a deposit option, you should consider the following:

- The amount you want to deposit

- Third-party or bank fees

- Speed and ease of making deposits.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

4. Use analysis and strategies

If you’re starting in trading forex, you’ll need to learn how the industry operates. Basic knowledge necessary for a novice trader includes identifying currency pairings, developing a strategy, and assessing risks.

Some key forex strategies you should learn are listed below:

- Day Trading: This trading involves making profits by concentrating entirely on intraday price swings and generating income from the volatility. Traders using this technique base their decisions based on current market forces (i.e., demand and supply).

- Swing Trading: This technique seeks to profit from short-term market momentum spikes. Swing trading reveals minor booms and drops that may counter the current trend, necessitating a more constrained market analysis.

- Scalping: This is an intraday trading method in which investors purchase and sell currencies to squeeze modest profits from each transaction. Scalping tactics in forex are generally based on a continuous examination of price fluctuations and an understanding of the spread.

5. Make profits

Making money from forex involves cutting losses and knowing when to take profits. You can master this by learning how to set up Stop Loss (SL) and Take Profit (TP) orders.

An SL or TP order is initiated with a forex broker to purchase or sell a currency pair (i.e. EUR/USD) once it arrives at a certain price. They both work in the same fashion, but their purpose is different. While a stop-loss order helps you cut back losses when the price limit is reached, taking profit allows you to lock in profits once a price limit is reached.

Traders use both techniques to tell their forex brokers to close their traders when a particular value is achieved. This way, profits are maximized even when the trader is sleeping or busy somewhere else.

Conclusion: The best Forex Brokers are available in Belgium

Belgian professional forex traders have the opportunity of choosing among several trading platforms. Thanks to national and regional regulations, they can also fund and trade without losing their money to online fraudsters.

However, it is important to research the best brokerage firm that offers multiple financial assets and interactive trading platforms. This way, your trading experience will be smooth and profitable.

- BlackBull Markets

- Pepperstone

FAQ – The most asked questions about Forex Broker Belgium:

Are there any forex trading benefits for traders in Belgium?

Traders in Belgium can experience a lot of benefits while trading forex. For instance, they can make massive profits while trading forex. In addition, traders in Belgium can make money with the fluctuations in currency. Thus, there are higher chances of earning more profits with forex trading than with any other trading form. Besides, several brokers offer traders the best trading services.

Which forex broker should a trader in Belgium choose?

There are numerous forex brokers in Belgium. These forex brokers make trading the best experience for any trader. If you wish to trade without hindrance, you can choose one broker among BlackBull Markets, Pepperstone, and RoboForex. The user interface of these brokers is the best and allows traders to trade easily.

Which forex brokers in Belgium allow traders to trade with a low minimum deposit?

The services offered by Roboforex are the best when considering a low minimum deposit amount. Therefore, traders in Belgium who trade with Roboforex can start trading by funding their accounts with only $10. Apart from this, they can make the lowest trade amounting to $1.

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)