5 best Forex Brokers & platforms in Brazil – Comparisons and reviews

Table of Contents

Like all other places, registering a new forex account in Brazil is free. But trading can attract unreasonable fees if you deal with an overpriced broker.

See the list of the best Forex Brokers in Brazil:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | Not regulated | Starting 0.1 pips variable & low commission | 300+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Low spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

To help you make the best choice and avoid high trading costs, we introduce 5 low-fee brokers in Brazil.

Below, we give an overview of each broker:

1. RoboForex

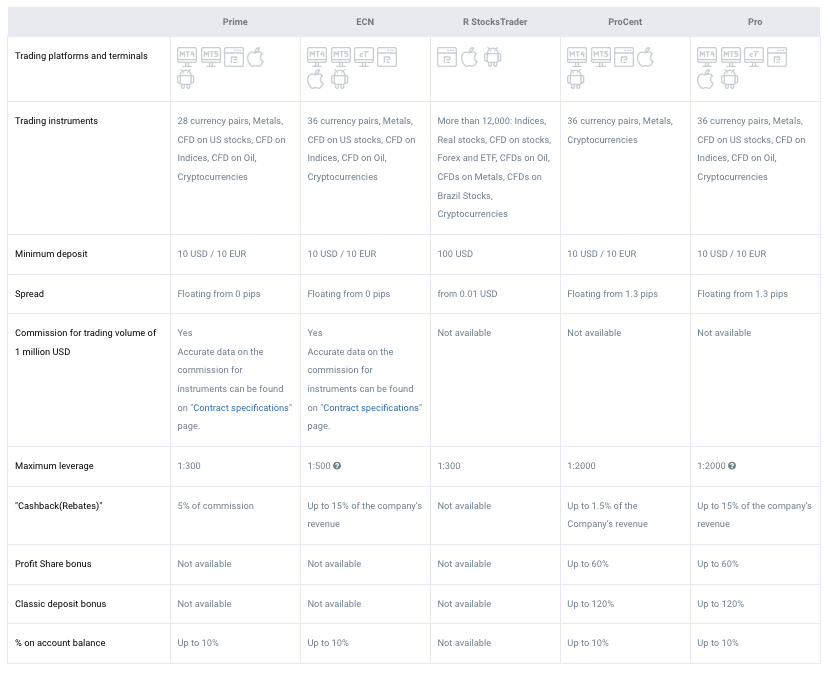

No matter their level or trading style, traders have several accounts to choose from. These are:

- Pro Standard

- Pro Cent

- Prime

- ECN

- RStocksTrader

Customers can open any one of these accounts and access over 12000 CFD assets, including forex, stocks, indices, ETFs, and commodities. Trading costs are highly competitive, with spreads starting from 0.4 pips on the ECN account. However, traders should be aware that withdrawal fees may apply on most days of the month.

Deposits attract zero fees on all the payment methods provided, such as PerfectMoney, AdvCash, Neteller, Bank Wire, Skrill, etc.

RoboForex also provides several trading platforms for these accounts. These include MT4, MT5, cTrader, and RTrader. Many useful trading tools are embedded, and the platforms are compatible with IOS and Android.

Brazil traders can also gain from the broker’s bonus and rebate programs. A free demo account is available for newly signed-up customers who wish to check out the platform’s features before they trade.

Customer support is reachable 24 hours a day, from Monday to Friday. Available on live chat, phone, or email.

(Risk Warning: Your capital can be at risk)

2. Capital.com

Capital.com is a globally known CFD and forex brokerage company. The firm is headquartered in the UK and has offices in Cyprus, Australia, and Gibraltar.

Capital.com is licensed by two internationally acclaimed bodies in the United Kingdom:

The broker offers four account types: Standard, Plus, Premier, and Invest. These are zero-commission accounts, and the spreads start from 0.6 pips. The minimum deposit to trade with Capital.com is $20 by credit card.

Traders gain access to a wide selection of financial instruments, including forex and thousands of CFDs.

Brazilian traders who wish to invest in stocks can also get an Invest account. Capital.com newly created this Invest account to allow customers to trade stocks at zero to extremely low fees.

The company offers a free demo to test its trading environment before beginning. There are no charges on deposit and withdrawal. Unlike other reputable brokers, Capital.com does not charge inactivity fees.

Traders can choose to transact on the Capital.com app or the MT4. Access your account at your fingertips with mobile trading, with all the necessary indicators, economic updates, and education content.

The broker also offers 24-hour customer service from Monday to Friday. Support is available by phone, live chat on its website, or email.

Deposits and withdrawals are straightforward and take little time. Popular payment methods are offered to ease the process. These methods include bank wire, MasterCard, Visa, Worldpay, Skrill, WebMoney, Astropay, and Neteller. Transfers to the trading wallet appear within a few minutes to an hour. Withdrawals often take longer to reflect, between 1 and 48 hours.

(Risk warning: 78.1% of retail CFD accounts lose money)

3. BlackBull Markets

BlackBull Markets is an ECN CFD and forex brokerage company established in 2014. The firms headquarter in New Zealand, and they have offices in New York, the United Kingdom, Indonesia, and Malaysia.

BlackBull Markets operate with licenses from the FMA (Financial Markets Authority of New Zealand) and the FSA (Financial Service Authority of Seychelles).

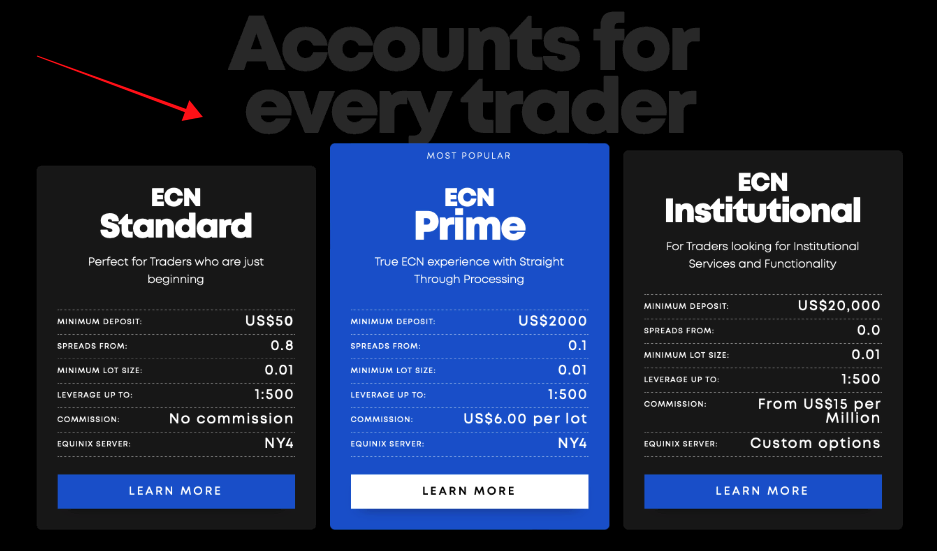

Brazil forex traders have three options of account type. These include the Standard ECN, Prime ECN, and Institutional ECN accounts. Traders access the ECN liquidity pool through any of these accounts. That means you get the best price and the tightest spreads on the asset. Orders are executed at breakneck speed, leaving no room for slippage. Although commissions apply for all trades, the fee is competitive, and the broker’s service is world-class.

BlackBull Markets offer the MT4 and its app to trade with. These platforms are accessible on mobile phones, so traders can conveniently log into their accounts. The mobile versions come with all the charts, indicators, and news updates to enhance the user’s experience.

Traders in Brazil can access various markets, including forex, precious metals, energy, indices, oil, and gas.

With popular payment methods, such as MasterCard, Visa, bank wire, Fasapay, Neteller, and Skrill, trading is easy.

BlackBull Markets support service is available via email, phone, or live chat. Traders can reach them anytime during the weekdays (24-5).

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is an online broker based in Melbourne with offices in the United Kingdom, Kenya, the Bahamas, Cyprus, Dubai, and Germany. The broker is authorized and licensed by several prestigious financial bodies, including the FCA, ASIC, CySEC, and FSCA.

Pepperstone also holds licenses from other tier-2 regulatory bodies. The brokerage company is one of the most trusted and globally accepted ones in the industry.

Brazilian forex traders can choose either its Standard or Razor account and trade on zero commission or raw spreads, depending on their choice. Trading costs are among the lowest, with an average spread of 0.3 pips on its Razor account.

A Pepperstone active trader program also rewards volume traders with many discounts. But this is only applicable to the razor account holders.

The broker provides services on the MT4, MT5, and the cTrader, supporting mobile trading. Several valuable charts and indicators are available, including algorithm trading support. Social and copy trading is also accessible here.

Pepperstone provides a free demo account that allows users to practice trading on its environment before going live. Traders can also access useful education and research content to help them place more profitable trades.

The account registration process is quick and easy. Fund transfers are straightforward with several popular payment methods, including Mastercard, Visa, PayPal, Bank Wire, Neteller, Skrill, etc.

Pepperstone provides 24-hour customer service via phone, live chat, or email. Support is available from Monday through Friday. The support staffs are responsive and well-informed, providing quality support to traders.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is an online binary option and forex broker based in Saint Vincent and the Grenadines.

IQ Option offers a distinctive trading app for binary options, forex, and CFDs. The broker is considered the best for binary options trading. Binary options allow traders to bet on an asset’s price rise or fall and earn a fixed profit.

The broker offers one account type that requires only a $10 minimum deposit. However, an outright $2000 deposit earns you VIP status where there are many benefits, including a dedicated account manager and discounted fees.

Customers can use common and simple payment methods, such as MasterCard, Visa, Boleto, Astropay, WebMoney, Skrill, Bitcoin, and Neteller.

Video tutorials are available on its platform to help new traders find their way around the trading environment. Mobile trading is also available on IOS and Android.

IQ Option provides 24-hour multiple language support services throughout the weekday. Brazil traders can request support services in English or Spanish via phone, live chat, or email.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Brazil?

Despite popular beliefs about rampant corruption in Brazil, its financial market is properly regulated.

Retail CFD and forex trading are especially well-regulated in the country. Brazilians trade in their local currencies, and brokers accept deposits in Brazilian real.

The Banco Central do Brazil (Central bank of Brazil), BCB, is the main regulator of the country’s financial market activities.

Brazil’s citizens and forex traders must hold a Brazilian real (the national currency) account to access the forex market. Trading with a foreign currency account is only allowed on specified terms and conditions. Brazil’s central bank introduced this regulation in 2005 after lifting the tight restrictions on forex trading in the country.

The BCB issues license to approved brokers who wish to operate in the country. Brazilian traders seeking domestic brokers must deal with only such brokers. But international brokerages outside Brazil can sign up Brazilian traders without a license from this authority.

Every transaction and trading activity is recorded in the BCB’s information database system, the Sisbacen.

Security for Brazil forex traders

Brazil forex traders must deal ONLY with brokers approved by the BCB (Central bank of Brazil) if they wish to trade with a domestic company.

They can also trade with licensed international brokers outside Brazil.

The International Financial Service Commission of Belize also regulates some forex brokers accepting Brazilian traders. Its policies provide some protection for traders in this jurisdiction.

Therefore, Brazilian traders can safely deal with IFSC-licensed brokers.

High-leverage traders should also seek brokers offering negative balance protection to be safe.

Is it legal to trade forex in Brazil?

Yes, forex trading is definitely legal in Brazil. Traders must only deal with BCB-licensed brokers inside Brazil or top-tier licensed ones outside the country. Brokers with an IFSC license can also accept Brazilian traders.

(Risk warning: 78.1% of retail CFD accounts lose money)

How to trade forex in Brazil – Tutorial

Forex trading in Brazil is popular and well-regulated, as we mentioned.

Entering the market should be easy as all that is required is a stable internet connection, an internet-enabled device ( smartphone or laptop), and a licensed forex broker.

Choosing the right broker to ensure profitable trading is crucial to this venture.

Here’s what to look out for before signing up with a broker:

- Must hold a license from a reputable financial body.

- Must offer a free demo account (at least 30 days of access).

- Fees must be competitive, if not lower than the market average.

- Customer service must be available 24 hours in multiple languages.

- Must provide convenient payment methods in the country.

- Valuable education and research content to help you succeed.

These are all essential items, and the trader must ensure their chosen broker can meet these requirements. That way, peace of mind trading is guaranteed.

Follow these steps to begin forex trading:

1. Open an account for Brazil traders

Go to the broker’s website to register to trade.

Many reputable brokers accepting Brazilians will provide a website translatable to other languages. Therefore, you should be able to switch between English and Spanish or Portuguese, depending on your choice.

Once it loads, the register/create account tab should be clearly displayed on the website.

Click on this tab and input the required details. That is your name, email, and, perhaps, phone number. Within minutes, the broker sends an authentication link to the email you provided. This is meant to verify that the name and email are yours. Clicking on the link should load the full signup page, so you can continue the registration process.

Be ready to scan and upload some ID and proof of address to complete the registration.

2. Start with a demo or real account

Once you have completed the signup, you may start a live trade or test the platform with the free demo.

We advise using the demo if you’re new to forex trading or have little experience.

Before starting, you can get fully acquainted with the market and the broker’s trading environment. You can check on the features available on the demo account and learn to use them. The broker should credit this demo account with fake money for you to conduct as many test trades as possible.

Skilled traders switching brokers may decide to skip the demo and trade on a “real” account. We recommend funding the account with only the required minimum amount since this is still a testing phase.

3. Deposit money

You need to deposit at least the minimum required sum in Brazilian real to trade live.

The broker should provide convenient payment methods for this. Most brokers also appoint staff to new customers that assist them throughout the initial trading stage.

Therefore, it should be easy enough to deposit money in the new trading account. Your funds should also appear within a few minutes, depending on the method used and the broker. There will hardly be a charge on deposits from the broker.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

4. Use analysis and strategies

Market analyses and an effective trading strategy are indispensable if you wish to profit from forex trading.

Before entering the market, the trader must gain basic insight into the assets they wish to trade. Analyses will provide the basic knowledge needed to make accurate decisions.

There are two important market analyses that the trader must not ignore. These include:

- Fundamental analysis

- Technical analysis

Fundamental analysis in forex trading refers to studies of the intricate elements that cause the price rise and fall of the currency. These elements are inherent in the country’s economy, and they include Inflation rate, interest rate, GDP, deficits/surplus, etc.

The trader must study these factors and realize how they affect the exchange rate. That way, anticipating price direction becomes possible.

Technical analysis involves studying the forex price charts to find patterns and identify BUY-SELL opportunities. Technical analysis is commonly used in forex, CFD, and stock trading. Many technical traders focus on this analysis because they believe it shows the resulting influence of the currency’s fundamental factors. Every trading platforms come with several tools for technical analysis. To succeed with this analysis, traders must take advantage of these tools and learn to interpret price patterns.

The trader should combine these analyses with an effective entry and exit approach to trade the market successfully.

Common forex trading strategies

Scalping

Scalping is a short-term trading approach in which the trader seeks to profit from tiny price moves. The trader leaves the position open for a few minutes only and earns from the minimal movements in pips. Scalpers conduct many trades within a few hours, and the small profits accumulate to a considerable amount at the end of the day. Some brokers do not allow this trading approach. So, the trader must first find out from the broker before signing up if they wish to do scalping.

Momentum

A momentum strategy is a form of trend trading. The trader must first identify the prevailing market condition. The expectation is that prices will continue to move in the current direction. Therefore, the trader enters and exits the market at strategic points to profit from the trend.

Price action

The price action strategy involves placing trades based on the current prices seen on the chart. The trader does not employ complex technical analysis for this. Trading decisions are based on the price movements in the forex chart. The trader can use this strategy in any time frame for long or short-term trades. Learning about forex chart candlesticks can help you use this strategy successfully.

(Risk warning: 78.1% of retail CFD accounts lose money)

Final remark: The best Forex Brokers are available in Brazil

There is a wide selection of online forex brokers, and Brazilians can deal with nearly all.

The most important thing to remember is to use licensed brokers offering quality service at competitive fees.

The brokers recommended in this article all meet the requirements.

1. Capital.com

2. BlackBull Markets

3. RoboForex

4. Pepperstone

5. IQ Option

FAQ – The most asked questions about Forex Broker Brazil:

Which forex broker should a trader choose for trading in Brazil?

Although there are several traders in Brazil, a trader must choose only a reliable broker. Your trading experience will be the best if you choose only the best forex broker. These five forex brokers operating in Brazil serve you with the best features. For example, you can avail of premium features for forex trading. Thus, you can expect a smooth forex trading journey.

Can traders in Brazil trade forex?

Yes, traders in Brazil can trade forex because of no rules or regulations that keep traders from trading forex. You can enjoy trading with the best forex brokers as the regulating agencies do not bar any trader or broker from forex trading. Traders in Brazil are making immense wealth by trading forex. So, if you want to trade forex, you can choose a broker.

What are the steps in forex trading in Brazil?

If you wish to trade forex in Brazil, you can begin by searching for a reliable broker. After that, you can open a trading account and deposit funds into it. Finally, the platform will allow you to search for the underlying assets that they offer. Then, you can pick an asset and place your forex trade and enjoy profit-making.

Last Updated on March 3, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)