Five best Forex Brokers and platforms in the Central African Republic – Comparison and reviews

Table of Contents

Forex brokers based in the Central Africa Republic can access the financial markets as long as they have an internet connection.

It is because forex brokers are now accepting forex brokers from this country. Here are five forex brokers that forex traders can register accounts on in the Central African Republic.

See the list of the best Forex Brokers in Central African Republic:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the five best forex brokers in the Central African Republic:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

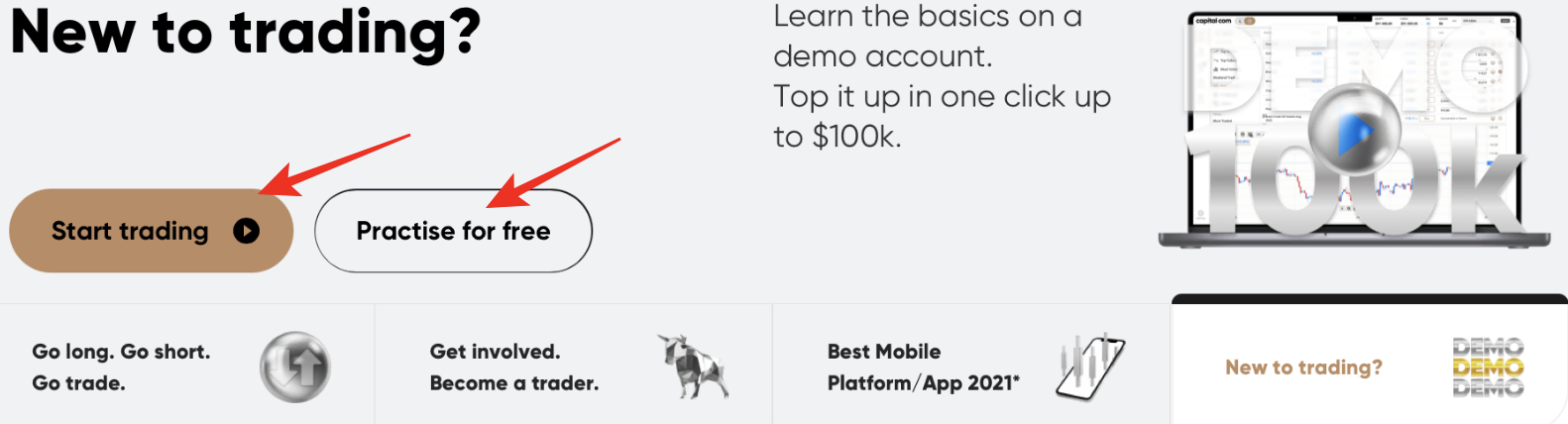

1. Capital.com

It has had 5 million registered trading accounts since it was developed in 2016. It has regulations from the Financial Conduct Authority, Cyprus Securities and Investment Commission, Australian Securities and Investment Commission, and the National Bank of the Republic of Belarus.

It has various trading instruments such as Indices, forex, commodities, cryptocurrencies, and shares. It offers three types of trading accounts; the Standard account has an initial deposit of $20, the Plus account starts from $2000, and the Premier account from $10,000.

Overview

- Minimum deposit-$20

- License-FCA, ASIC, CySEC, NBRB

- Platform-Web trader and the MT4

- Spreads –forex spreads start at 0.8 pips

- Support-24/5

- Free demo-yes

- Leverage-1:30

It is a zero commission forex broker as it has no commissions for most of its trading instruments. It follows the FCA regulations, so using its trading platform ensures security for investors. It also limits the leverage forex traders can use to 1:30for traders within the European Union.

Capital.com is available on its mobile trading app, and it has a desktop version and the website version. It offers negative balance protection, which is a feature that prevents traders from wiping out their entire account balance if the trade moves against your predictions.

Disadvantages of Capital.com

- It is a forex broker with low trading costs, but it has a high initial deposit on its Plus and the Premier account, limiting the accounts that most forex traders can access to the Standard account.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

It launched in 2014 and is a New Zealand-based forex broker with thousands of registered trading accounts. It has access to commodities, indexes, energies, metals, CFDs, shares, and energies. It has regulations from the Financial Services Authority.

It has fast account ordering speeds and three accounts, the ECN Standard has an initial deposit of $200, the Prime with $2000, and the Institutional account with $20,000. The ECN Prime has commissions of $6 for every $100,000 and the Institutional account varies commission, and the Standard is commission-free.

Overview

- Minimum deposit-$200

- License-FSA

- Platform-MT4, mt5

- Spreads-from 0.1 pips

- Support-24/5

- Free demo-yes

- Leverage-1:30

It offers the Virtual Private Server for forex traders with account balances of more than $2000. Fore traders can also share trading strategies and ideas with other traders through the Copy trading platform Zulu trade, My-FX book AutoTrade and Hoko-Cloud.

Its trading platform is available through mobile applications, web platforms, and desktop versions. It works with the MT4 and MT5 trading platforms, offering industry-standard trading tools. It also uses the ECN accounts, allowing traders to enjoy faster execution speeds.

Disadvantages of BlackBull Markets

- It has limited educational materials. Its trading platform has very limited educational resources, which forex traders can use to learn how to trade different trading instruments, especially if they are new traders.

(Risk Warning: Your capital can be at risk)

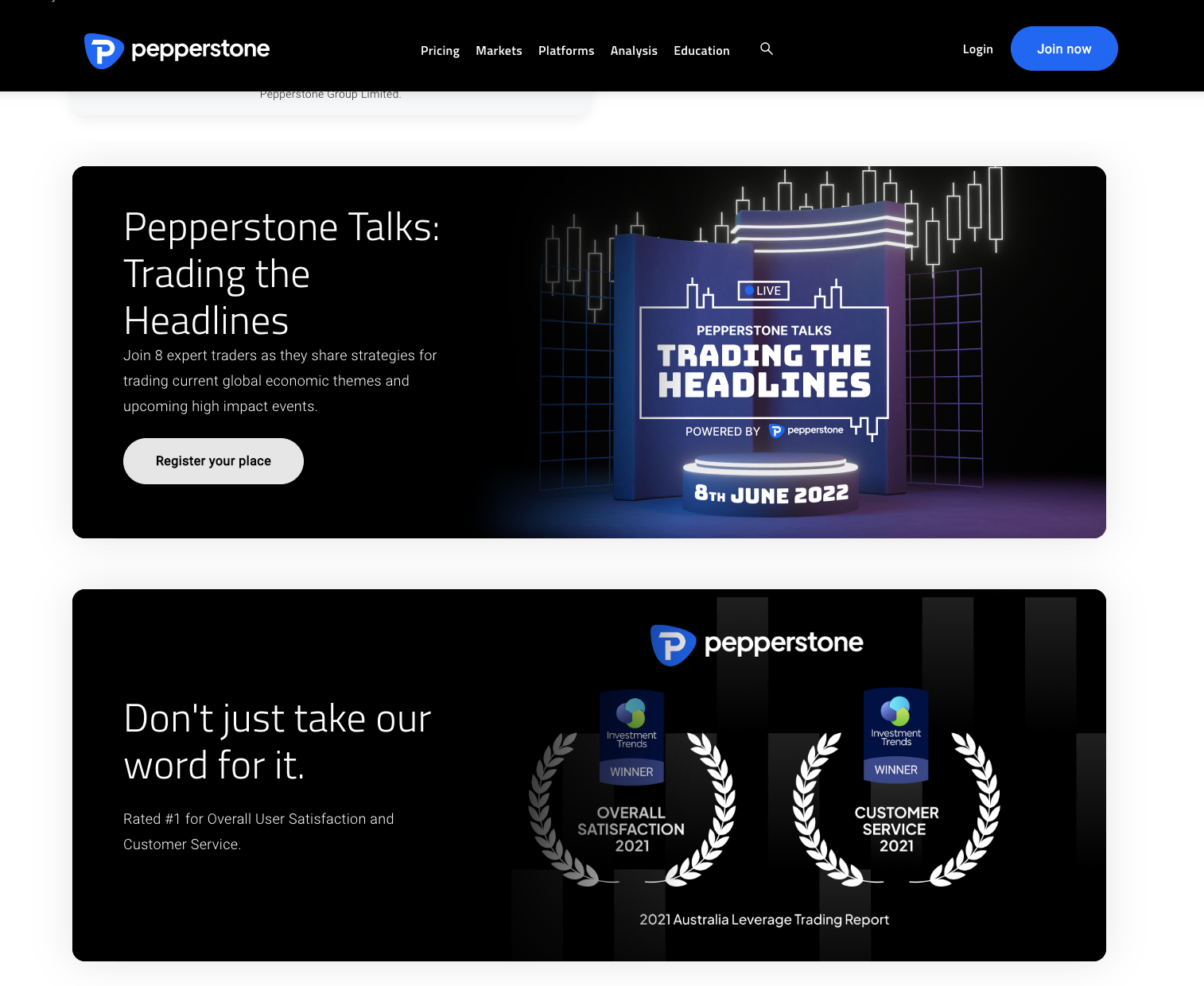

3. Pepperstone

It is a trading platform based in Australia, with thousands of forex traders trading on its platform since it started offering services in 2010. It offers shares, forex, commodities, indices, and ETFs. It has regulations from the Australian Securities and Investment Commission and the Financial Conduct Authority.

It offers two types of trading accounts, the Standard and the Razor account, with initial deposits of $200. The standard account has no commission, but the razor account charges $7 per round lot for $100,000 traded.

Overview

- Minimum deposit-$200

- License-ASIC, FCA

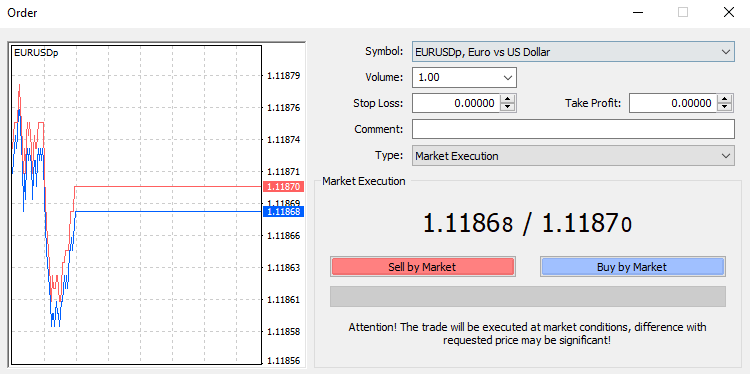

- Platform-c Trader, MT4, MT5

- Forex spreads-0.0 pips on the Razor account

- Support-24/5

- Free Demo-no

- Leverage-1:400

Pepperstone offers fast order processing rates, and its platform is available as a mobile app. It has a desktop version and web version for traders to access their trades from wherever they are. It also has an expert team that analyses the financial markets and offers trading signals, daily news, articles, and trading guides.

Its users can access international standard trading features such as the stop loss tools traders use during trading. Traders can also use its guaranteed stop-loss feature to exit a losing trade at a specific price without losing to lagging.

Disadvantages of Pepperstone

- Limited learning resources. Pepperstone has a limited number of educational materials for learning how to trade forex.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

It has been a forex broker operating since 2013 and has registered over 40 million forex brokers since it started its operations. It has a trading license from Cyprus Securities and Exchange Commission and offers FX Options, commodities, stocks, binary options (only for professional traders and outside EAA countries), forex, and digital options.

IQ Option offers two account types, the Standard account with an initial deposit of $10 and the VIP account that requires a $1900 account balance to open this trading account. It is a low-cost forex broker since most of the trading instruments offered have no commissions, but cryptocurrencies have 2.9%.

Overview

- Minimum deposit-$10

- License-CySEC

- Platform-IQ Option trading platform

- Spreads-from 0.8 pips

- Support-24/7

- Free demo-yes

- Leverage-1:500

It is a forex broker that offers Options trading, and it has Binary, Digital, and has also introduced forex Options for trading. Its IQ option Trading platform offers international standard trading instruments and fast execution speeds when trading options.

Forex traders can deposit or withdraw funds from their trading accounts using bank transfers, credit/debit cards, and digital wallets such as Neteller, Skrill, and MoneyBookers.

Disadvantages of IQ Option

- IQ Option has limited educational and research materials, as there are not as many contents, announcements, analysis, and trading resources for trading as with some other brokers.

(Risk warning: Your capital might be at risk.)

5. RoboForex

It is a trading broker that started its operations in 2009 and has registered over a million forex traders. Its users can trade stocks, commodities, cryptocurrencies, CFDs, metals, forex, and energies. It has a trading license from the Financial Service Commission in Belize.

RoboForex is known as a trading broker that has low trading costs. It has five trading accounts, and four of them are the Pro, Prime, Pro-cent, and ECN accounts which have an initial deposit of $10. The R-stocks trader account is for traders who prefer trading stocks as it has the features that enable efficient trading and has an initial deposit of $100.

Overview

- Minimum deposit-$10

- License-FSC

- Platform-R-stocks trader, c Trader, MT4 and MT5

- Spreads-0.0 pips

- Support-24/7

- Free demo-yes

- Leverage-1:2000

RoboForex has low trading costs, and the Pro and Pro-cent account have no commissions, but the ECN and the Prime account have low commissions of $2 per 100,000 and $1.5 for $100,000. At the same time, the R-stocks trader starts at $1.5.

Traders can enjoy its numerous account types and fast order processing speeds offered by the MT5 and MT4, C trader, and the R-stocks trader platforms. It also accepts a variety of transfer methods.

Disadvantages of RoboForex

- RoboForex only has regulation from the Financial Service Commission, which some traders feel is insufficient to regulate certain regions.

(Risk Warning: Your capital can be at risk)

What are the forex regulations in the Central African Republic?

The forex industry of the Central Africa Republic is still in its development stages. Its economy is still growing and has an estimated GDP of 2.3 billion. It is largely dependent on agriculture, and its financial system is still growing.

The Forex industry in the Central African Republic is not as active but has been improving as its regulation started in 2019 when CEMAC established the forex regulations. Central African Republic is among other member states like Chad, Equatorial Guinea, Gabon, Congo, and Cameroon that form the CEMAC.

CEMAC stands for Central African Economic Monetary Community, which consists of six countries in Central Africa, and it is an organization that works towards enhancing financial development for its members. CEMAC has also regulated the forex exchange sector within these six countries since 2019.

It regulates the financial markets through the Bank of Central African States (BEAC). The bank got established in 1972 to supervise the financial policies of its members. It uses the Central African Franc (CFA) as its currency.

The securities and exchange industry in the Central African Republic consists of companies and members of the stock exchange of Central African States (BVMAC). CEMAC regulations cover the six-member states. Its regulations are implemented by the BEAC in charge of the execution of regulations in the banks of CEMAC.

The regulations mean It has the power to regulate financial providers that want to operate within the members of CEMAC. It can authorize foreign currency exchange by banks and other financial intermediaries. It regulates advertising and purchasing foreign securities worth more than 50 million CFA Francs.

It monitors the compliance of forex dealers and financial intermediaries such as banks and forex brokers. It also supervises and monitors the operations and transactions taking place within the countries of CEMAC.

Security for traders from Central Africa

The Central bank’s ministry of finance of the member states of CEMAC and CEMAC are tasked with acting on reports made by forex traders and investors about illegal activities carried out. They also have the authority to investigate and penalize the financial intermediary involved.

CEMAC and the Central banks have set up methods for forex traders to submit complaints and reports on illegal activities. CEMAC, COBAC, and the finance ministry of the countries involved have set anti-money laundering regulations and laws to mitigate funding terrorism.

CEMAC regulations also ensure the safety of forex traders in the Central Africa Republic by ensuring that they comply with regulations by inspections and audits. The regulations forbid using illegal and fraudulent methods to obtain funds from investors and forex traders.

Can I legally trade forex in the Central African Republic?

Forex traders within the Central African Republic can open trading accounts with local financial providers or from offshore forex brokers. Although financial regulation by the finance ministry is not strict, forex traders can rely on regulations from other jurisdictions.

The forex trading industry in the Central African Republic is still behind compared to many other countries. Still, traders based in the country trade in securities and exchange. CEMAC has established forex regulation within its members to ensure that the financial non-banking sector is secure and transparent.

(Risk warning: 78.1% of retail CFD accounts lose money)

How to trade Forex in the Central African Republic – Tutorial

Open account for Central African Republic traders

Find a forex broker that accepts Central African traders’ regulations and offers trading features compatible with your trading features. Trading features include trading costs, tools, platforms, the demo account, and a fast and responsive customer care team.

After finding a forex broker offering the trading features you prefer, ensure to verify their registration on the regulatory institution’s website which it claims to be registered under. Open a trading account if you are confident with the forex broker.

The registration form is on the forex broker’s website and requires you to fill in details such as legal name, nationality, email, phone address, and date of birth. Because of the risk tolerance factor, a forex broker might need your employment status or a trading background.

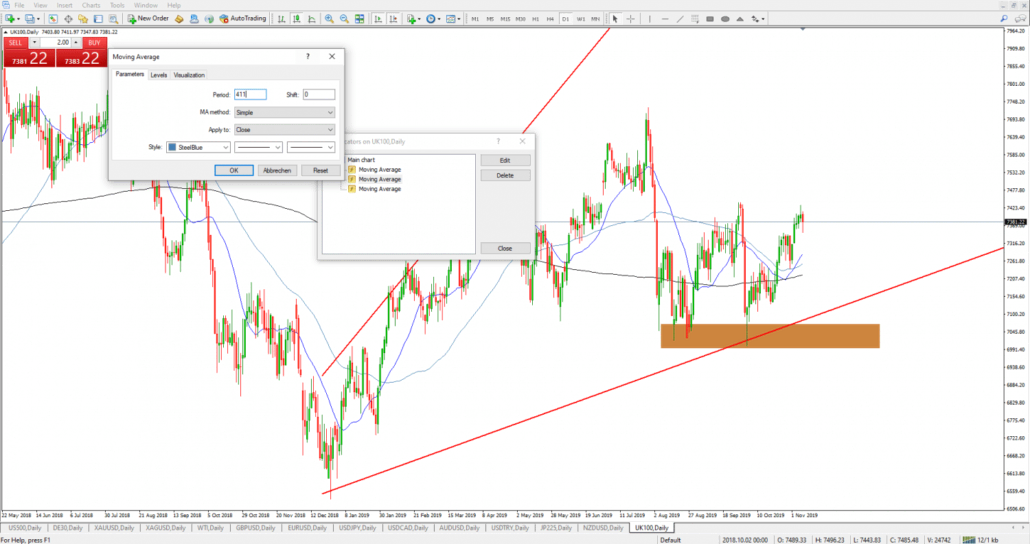

Download a trading platform that your forex broker supports. Most forex brokers support more than one trading platform, and others offer their proprietary platform. The trading platform allows traders to access the financial markets and offers trading tools to ensure efficient trading.

Once you download the platform, ensure to navigate through it to familiarise yourself with the user interface. Customize the features according to your trading objectives, such as time frame, trading asset, and the trading tools, such as the indicators.

Start with the demo or real account

Start trading on the demo account with no risk since it uses virtual funds. Traders can also use the demo account to evaluate the forex broker’s trading features. It is also a crucial tool for new traders as they can use it to practice their trading strategies.

Experience traders also use it to develop and practice their trading strategies or trade other trading instruments. After practicing on the demo account and being confident with your trading skills and strategy, you can shift to the real platform to start trading with real; funds.

Deposit money

Deposit funds on your account using the payment methods offered. Forex brokers that accept Central African Republic traders have also to support the means that the traders use. Traders can use Bank transfers, credit and debit cards, and digital wallets such as PayPal, Skrill Neteller, etc.

Link your trading account with a payment method you are comfortable using. Fund your account and start trading.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Analysis

Financial analysis is method forex traders use to prepare for trading. It enables the traders to look at the underlying conditions of financial markets before they make trading decisions. The financial markets can be unpredictable, but technical and fundamental analysis helps predict price movements.

Technical analysis involves using technical tools such as indicators, price charts, and patterns to look at the financial markets’ liquidity, momentum, and trend. When you combine these technical tools, you can be better positioned to know how to apply your trading strategy and know where to open a position.

The fundamental analysis method looks at the financial factors that influence the price action movement. Such factors are announcements from the central bank, a country’s economic and political status, trading relationships, and major export and import prices.

Strategies

The trading strategies that traders can use include:

Trend trading– is a trading strategy in which the trader uses fundamental and technical analysis to predict the trend direction. Traders then use the speculation to open positions depending on the trend. The trader also has to monitor the conditions for trading when using this trading strategy to ensure the price action does not change direction.

Day trading-it is a trading strategy where traders make short trades during the day and close them in the evening. Day trading strategy is based on opening numerous trades during the day and ensuring you limit the risk to make more profitable trades than losses.

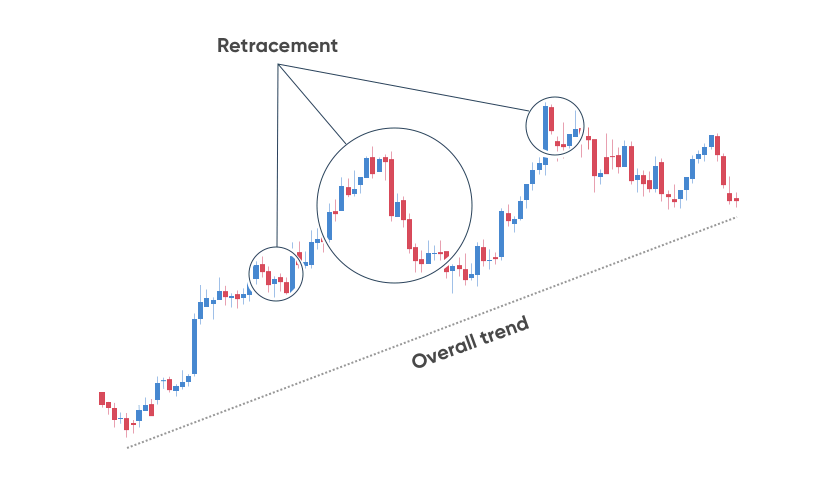

Swing trading involves identifying a trend and a point in the price action when the swing highs and swing lows are well defined. Open trading positions based on the swing you want to trade, and close the position when the price action retraces or reverses.

Make profits

Make profits by sticking to your trading strategy and practicing your trading strategy before trading. You can also increase the chances of making profits by using stop-loss and take-profit tools. Use fundamental and technical analysis to evaluate the financial market you are trading in before trading.

It is also imperative to ensure that you only risk trading with the funds you can lose. If you are a new trader, limit the leverage you use and grow the amount of leverage slowly as you get experience trading.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in the Central African Republic

Forex trading in many countries of Africa, like the Central African Republic, is still catching up with the global industry. In these countries, the regulations may not be as strict as in other regions where it is highly developed.

We recommend you open a trading account on offshore regulated brokers. If you are a trader in The Central African Republic actively looking for a forex broker, consider checking out the forex brokers we have recommended.

FAQ – The most asked questions about Forex Broker Central African Republic :

How can I trade with a forex broker in the Central African Republic?

Trading currencies is complex and risky. Despite being a fairly simple industry, forex trading is unique and necessitates specialized understanding.

Forex, also known as the foreign exchange market, is a sizable, international trading platform for fiat currencies.

Since it is the world’s largest daily trading market, forex offers a tonne of volatility and liquidity.

Understanding forex trading is essential for minimising financial loss. The following steps will assist you in beginning to trade profitably.

– Create a trading account for the Central African Republic first.

– Open a real or sample account first.

– Spend money on your account.

– Create new strategies and goals.

– Make a profit and begin withdrawal.

How can I select the Central African Republic’s top forex broker?

There are a few considerations or details you should confirm when selecting a forex broker in the Central African Republic.

– Look for a licensed and legitimate forex broker.

– The broker must give you a practice or fictional account.

– It should include several asset types.

– Should allow trading on a mobile platform.

– Should provide a simple deposit and withdrawal procedure.

– Customer service should be efficient and committed.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)