The 5 best Forex Brokers and platforms in Chad – Comparison and reviews

Table of Contents

See the list of the best Forex Brokers in Chad:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Foreign exchange, or forex, refers to the process of converting one currency into another. This procedure can be carried out for several reasons, notably commercial, tourism, and international trade.

To get started, it helps to familiarize yourself with our list of the five best brokers in the country, which includes:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

In 2016, Capital.com made its debut in the United Kingdom. The platform was created by a mix of software developers and bankers. This broker utilizes a different transaction processing system that increases market efficiency and allows them to provide commissions and free trading.

Capital.com is backed by prominent investors and licensed by the Financial Conduct Authority in the United Kingdom and several other regulatory authorities worldwide.Capital.com; allows you to purchase and trade cryptocurrencies such as Bitcoin, Ethereum, etc. Dogecoin and hundreds of other coins.

Capital.com provides traders with cutting-edge trading tools, Digital trade analysis, a payment pricing environment, and a diverse asset selection. All traders at Capital.com have access to the same CFD trade account type.

Eligible traders can migrate to a professional account, and British clients can choose a tax-free equities account. A share trading option is also available for long-term strategies that do not require leverage.

Capital.com offers free sample accounts. MT4 provides more versatility and is ideal for experimenting with EAs and different trading methods.

Advantages of Capital.com

- Its separate financial regulators, CySEC, ASIC, and FCA, oversee the company’s operations.

- Separated accounts are used to hold customer funds.

- Traders will be compensated financially in the event of unexpected occurrences.

- The TLS encryption protocol ensures that clients’ personal information is kept safe.

Disadvantages of Capital.com

- On the Capital.com website, no documents validate the broker’s registration.

- Many overseas clients have limited deposit and withdrawal options.

- It does not have a banking license.

(Risk warning: 78.1% of retail CFD accounts lose money)

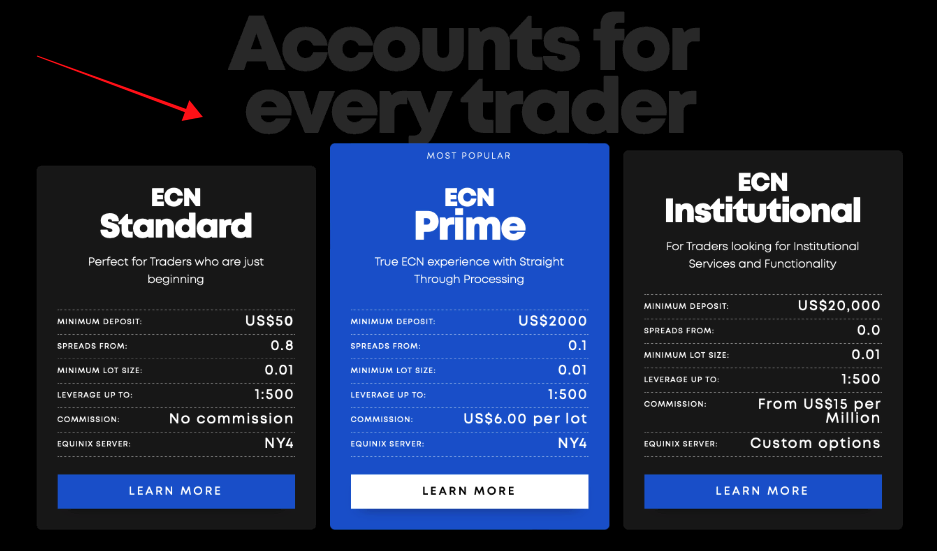

2. BlackBull Markets

BlackBull Markets is a real ECN, Zero Trading Desk broker that offers Forex, CFDs, metals, and blockchain solutions to traders worldwide. BlackBull Markets was formed in Auckland, New Zealand’s technology-driven financial hub.

The founders of BlackBull Markets decided to collaborate in the stocks retail industry in 2014 to give the most significant trading experience to their customers. BlackBull Market is linked to the ZuluTrade and Myfxbook copy-trading sites and the Trading view website.

BlackBull Markets provides MetaTrader’s MT4 and MT5 platforms and WebTrader, Personal computer, and mobile apps. Over Seventy currency futures and derivatives for gold, silver, oil, and stock indexes are among Blackbull’s trading instruments.

BlackBull provides traders with educational resources as well as daily market analysis. BlackBull Markets offers zero pip spreads, but the ECN Standard account typically starts at approximately 0.8 pips. EUR/USD live spreads begin at 0.2 pips. BlackBull Markets offers zero pip spreads, but the ECN Standard account typically starts at 0.8 pips. EUR/USD live spreads start at 0.2 pips.

Merits of BlackBull Markets

- There is a presence of regulation from standard regulatory bodies

- Deposits and withdrawals can be processed under twenty-four hours

- The customer care and support group operates round the clock

- There is access to trade across the various platforms the broker has without losing your business or being hacked

Demerits of BlackBull Markets

- Cryptocurrencies and stocks are not available.

- There is no protection against negative balance.

- For research, there are just a few analytic tools available.

(Risk Warning: Your capital can be at risk)

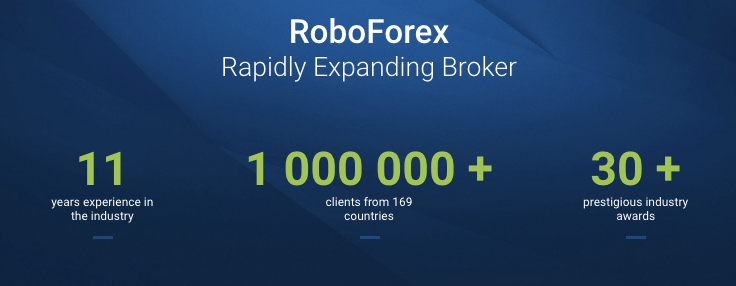

3. RoboForex

RoboForex has been in business since 2009 and is licensed by the International Financial Services Commission (IFSC) under license number 000138/210. It provides its clients with exclusive trading platforms and technologies with over twelve thousand trading instruments. There are now eight asset kinds to choose from.

RoboForex offers a broad range of live trading accounts to pick from and quick order execution, and optimal trading circumstances. The RoboForex Prime account provides excellent trading opportunities for currency and non-currency markets.

RoboForex is a multi-asset trading platform that offers over one hundred tradable assets. Forex and Derivatives are among the assets available on RoboForex. This broker also provides renowned analysts’ research-backed analysis of financial markets and investments.

RoboForex provides a user-friendly trading platform with tools for both new and experienced traders. RoboForex offers a vast range of deposit and withdrawal options, and clients may simply choose the one that best suits their needs.

RoboForex may be used on various platforms, including Apple Mac PCs, iOS devices such as iPhones and iPads, and online via an Internet browser.

RoboForex protects its clients’ personal information with SSL encryption on its PC and mobile platforms. This broker also advises its clients to seek the SSL security sign on their browser while using RoboForex via its online platform.

Pros of RoboForex

- Orders are processed quickly.

- Tight spreads start at zero pips.

- This broker offers five different currencies on your account (EUR, USD, CNY, RUB, GOLD)

- There are eight different asset classes available on this platform.

Cons of RoboForex

- The FCA does not regulate this broker.

- Accept no clients from the United States, Canada, Australia, or Japan.

- Charges are different for each trading platform.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Based on trading experience, cheap cost structure, and customer service levels, Pepperstone is the best-rated forex broker. There are two types of accounts available at Pepperstone. A Standard version with no commissions and a Razor account with tight spreads.

This broker has sixty-two currency pairs, three currency indices, nine virtual currencies, and three crypto indices. Spreads start at 0.6 pips on the Pepperstone standard account, ideal for new traders.

There are no commission-associated costs of the spread when you use the regular account pricing. This account supports only MetaTrader 4 and MetaTrader 5 trading platforms.

The analysis area contains top-notch written market insights, and trade ideas, and is concisely explained by videos. Besides, it provides information about trading. The FCA, ASIC, CySEC, BaFIN, SCB (Bahamas), CMA (Kenya), and DFSA regulate this brand.

New traders have access to many publications, webcasts, and two trading courses. It provides new traders with a thorough introduction to the financial markets.

Benefits of Pepperstone

- Pepperstone only offers negative balance protection to its clients in the United Kingdom.

- Account creation is quick, simple, and completely digital.

- Customer support responds quickly and accurately.

- The deposit and withdrawal procedures are simple and, in most instances, free.

Drawbacks of Pepperstone

- Demo accounts are only valid for 30 days.

- Non-UK/EU clients have limited account protection.

- Only forex and Financial derivatives are available for trading.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

Binary options, cryptocurrency, and Forex trading are available through IQ Option, a renowned online broker. (Note: Binary Options are only available for professional traders and outside EAA countries) New and seasoned traders alike will be interested in IQ Option if they wish to try out a newly established trading pattern or approach.

IQ Option offers a variety of graphs and an accessible binary options demo trading mode. Candlestick charts and various valuable indicators are among the tools available to assist you in assessing how effective your tactics are.

IQ Option Europe Ltd. is a Cyprus-based company licensed by the CySEC. IQ Option LLC is a company based in St. Vincent and the Grenadines that is not regulated. These two businesses share the same trademark, yet they serve clientele from other nations.

The number of markets is pretty extensive, and IQ Option, in our experience, is constantly bringing new markets to its platform. You can utilize a variety of financial products to trade these markets.

The IQ Option trading platform is one of the most well-designed trading platforms available. This platform can be used on any device, such as a personal computer or a smartphone. IQ Option provides its traders with a one-of-a-kind and professional trading platform.

Pros of IQ Option

- Top-notch trading platforms

- CySec-registered broker

- Full access to cryptocurrency markets such as bitcoin is available.

- Withdrawals made quickly

Cons of IQ Option

- There is a smaller range of markets on forex and CFDs than some competitors.

- The self-build robot and auto-trading features have been eliminated.

- There is no MT4 integration.

(Risk warning: Your capital might be at risk.)

Is it legal to trade Forex in Chad?

Forex trade in Chad is very legal and shared among the growing population. Chadians have come to realize the amount of profit that can be made and the ease and comfort from which it can be made.

Forex trading allows Chadians to participate in the world’s most liquid market. If you can control your mental and financial anxiety levels, investing in Forex in Chad is simple.

The principal thing you’ll need to be aware of is currency pairs. A pair of currencies, such as the Canadian Dollar and the Euro, is referred to as a pair. Understanding the link between each team is critical in Chad to fully comprehend the spread and difference between the two works.

Forex trade makes it easy for economies and individuals to carry out business seamlessly. The importance of import and export exchange can not be over-emphasized hence the acceptance of forex trade.

Chadians, both students, workers, unemployed and employed, can all venture into forex trade and continue their daily activities while still trading from wherever they are situated. They need to get a regulated broker and embark on the trading journey.

(Risk warning: 78.1% of retail CFD accounts lose money)

What are the financial regulations in Chad?

In Chad, most of the transactions done are cash-based and this equally defines the economy in general. You will find that in most cases, credit card payments are not accepted just as a company, and personal checks do not work with these payment methods.

Chad citizens make use of more traditional financial payment methods such as collections, fund transfers, and letters of credit. This is the case when transacting with foreign banks. When it comes to commercial banks, the financing options available include short-term financing, medium-term financing, and long-term financing.

Generally, there are no laid restrictions when making transfers of funds into Chad. However, if you are making transfers greater than $1000 outside Chad, you will be required to provide certain documentation regarding the source of the funds and the purpose of the transfer.

When the transaction is greater than $10,000 for individuals or $50,000 and above for companies, the COBAC is notified automatically. Also, when transferring funds above $800,000 outside Chad, there are additional requirements for these types of transactions.

Security for traders from Chad

The Chadian forex is regulated, but it doesn’t mean there can’t be scams and theft involved. As a trader, it is up to you to build on the already laid regulations and secure your trade account from there. Choosing a trustworthy broker would go a long way in helping your security.

Create a unique password with at least eight characters. Change it frequently and never use the same password twice. Keep it safe if your online broker provides you with a security token. Keep a watch on your account details, such as your phone number, email address, or login password, for any unauthorized changes.

Keep a close eye on any papers related to the transaction. Log into your online account regularly or if you receive an alert from your broker to quickly review all transactions. Use a trustworthy and secure Laptop or desktop device for online trading. Always log out of the website or system after completing your trade.

Do not log in to your online account if an unexpected pop-up screen or window opens, if your computer reacts slowly, or if unusual activities or information are asked. Check if your operating system, apps, software, and browser are all current.

How to trade Forex in Chad – A guideline for traders

Open account for Forex trading

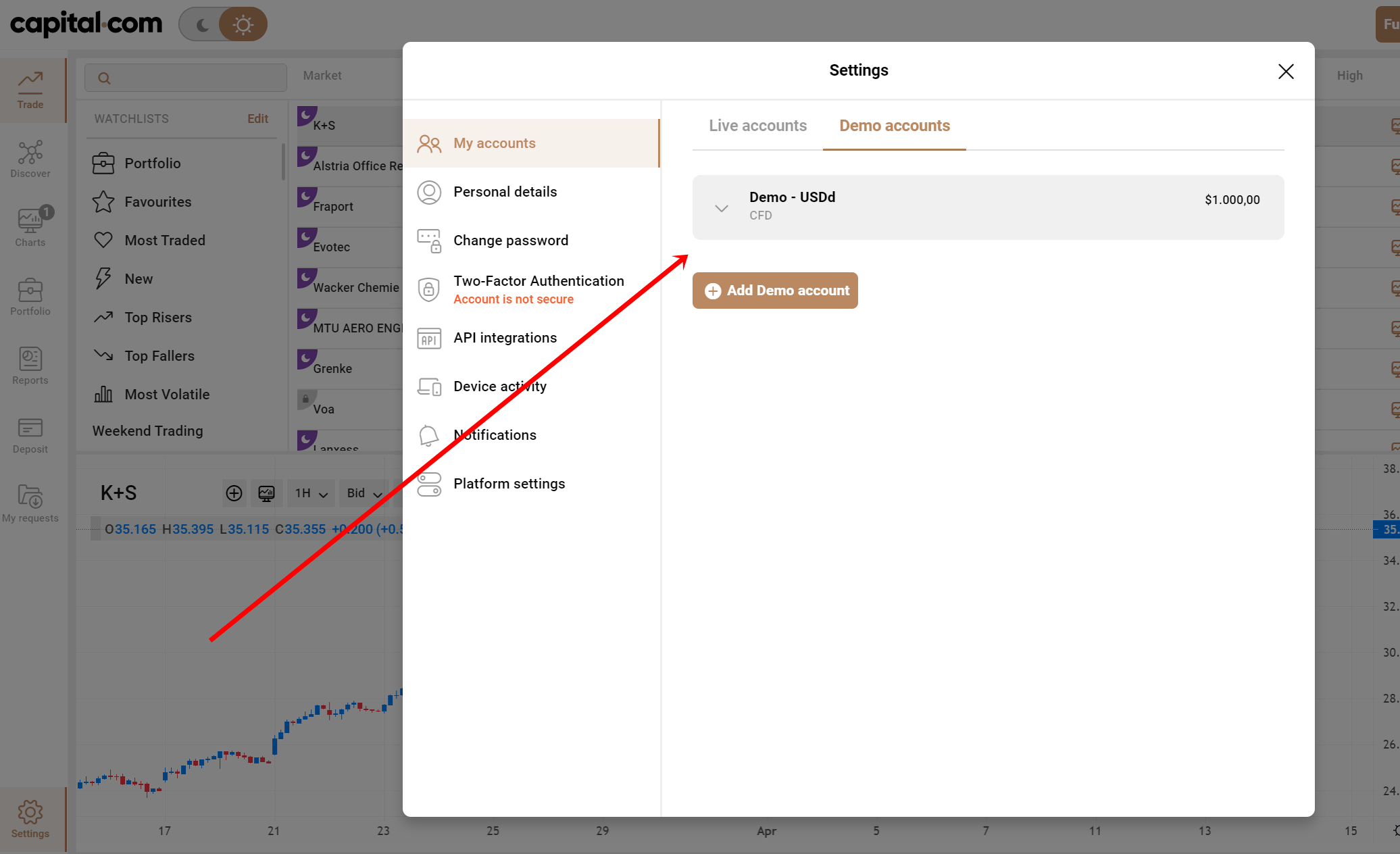

You can use a demo account, regular, or VIP account. You can switch between the demo and actual accounts on the trading platform with just two clicks.

You will receive both an actual and a demo account for free. You must be an active trader with a large trading volume to qualify for VIP account status.

Start with a demo account or real account

Traders can use a demo account to practice in a real-world trading environment without risking their own money. It will allow traders to try free online trading before depositing real money.

The demo account allows you to privilege to test run and see what the actual market trade feels like, and also it enlightens you on the risks to take when you eventually set up a real account.

Deposit money

After you’ve opened an account, you’ll need to transfer money to begin trading forex. Depending on the broker you choose, you can select your currency and fund your account in various ways.

Traders have the option of using electronic or traditional payment methods. Electronic wallets allow some deposits to be made instantly.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Analysis and strategies are techniques that renowned traders employ to help them forecast market moves and enter live positions. Some of them are;

Scalp trade

In this strategy, positions are only kept for a few seconds or minutes at most, and profit amounts are limited in terms of pips. Trades are cumulative, which means that little earnings from each business add up to a tidy sum at the end of the day or period.

Day trade

In this strategy, positions are held and liquidated on the same day in short-term transactions. The time frame for the day trade can vary from hours or minutes. Day traders need technical analysis abilities and awareness of crucial technical indicators to enhance their financial gains.

Position trade

In this positioning strategy, the trader keeps the currency for an extended period, sometimes months or even years. Because it gives a rational basis for the transaction, this form of trading necessitates more extraordinary fundamental analysis skills.

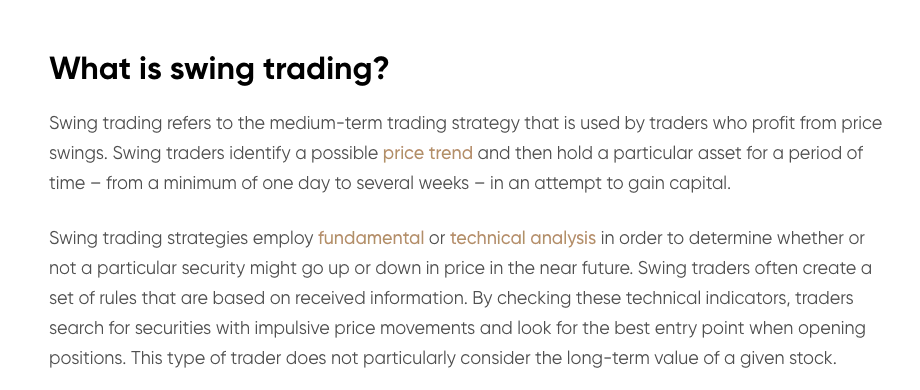

Swing trade

In this strategy, the trader retains the position for more than a day; for example, they may hold it for days or weeks. Swing trades can be beneficial during important government statements or periods of economic turmoil.

Make profit

With the help of a broker, make a foreign exchange contract. Use specified entry and exit points to execute forex transactions following your plan. When trading, remember to use risk management measures such as a take-profit or stop-loss order.

Make sure you don’t have any open positions that need to be filled out and that you have enough money in your account to trade in the future.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Chad

New forex traders may benefit from an emphasis on understanding the macroeconomic variables that influence currency values and technical analysis knowledge.

Day trading or swing trading in small quantities in the currency market is more straightforward than in other markets for traders, especially those with minimal capital.

The bottom line for beginners in the forex market is that making a profit starts with the right choice of broker, the right amount of investment, and utter understanding and application of the trade strategies.

Forex is a two-edged sword. As much as you can make from it, you can also be ripped off, scammed, or at a loss. As long as you’re not greedy and have sufficient knowledge of the trade, the odds of making a profit are in your favor.

FAQ – The most asked questions about Forex Broker Chad :

Can you suggest some regulated forex brokers in Chad?

Many regulated forex brokers in Chad excel in offering you the best trading services. For instance, brokers such as Pepperstone, RoboForex, IQ Option, Capital.com, and BlackBull Markets are a few leading names in the field of forex brokers. They are regulated and have an innovative trading platform that any trader would love. The features of these trading platforms make them number one for traders in Chad.

Are there any rules against forex trading and the operation of forex brokers in Chad?

No, there are no rules against forex trading or the operating of forex brokers in Chad. The rules and regulations in this African country allow traders to trade forex with full spirits. So, any trader can sign up for a trading account with the available forex brokers. If traders wonder which forex brokers in Chad offer the best services, you can pick one of these five.

What formalities does a trader need to finish when signing up for a trading account with forex brokers in Chad?

There are a couple of account opening formalities that a trader must complete when signing up for a trading account with forex brokers in Chad. Usually, it pertains to verifying the email address, bank account, and residence. When a trader fulfills these formalities, he can successfully trade forex.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)