The 5 best Forex Brokers and platforms Chile – Comparison and reviews

Table of Contents

The growth and explosion in population in recent years in Chile. There is now a higher number of younger people in most countries across the globe, primarily because of the CoronaVirus pandemic. As the younger populace is more than, the older, the affairs of the economy of nations are shifting to a new platform – the internet.

See the list of the best Forex Brokers in Chile:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Forex trading involves the internet. The number of people that trade online Forex Brokers continues to grow. There’s a lot of comfort and ease while making money through this method. We have written down all you need to know about Forex trade and the best brokers.

Below is a list of the five best Forex brokers in Chile:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

Capital.com is one of the leading Forex brokers that exist out there in the forex brokers business. It came about in 2016 and has been one of the best in the broker’s firm. If you’re looking to begin Forex trade both as a beginner and as a professional looking to switch platforms, this is an excellent bus stop for you to start with.

One great thing about the platform is that its in-house market research is top-notch, making it compete with other excellent platforms. So, this research carried out by them helps and provides their traders with top-quality information on how the Forex market works. Captial.com sure knows it and provides excellent educational materials for their traders. The platform is rich with helpful market educational materials.

The platform’s technology lets traders have a fantastic experience when they trade on it. It’s designed and built so that both newcomers and older timers will be able to understand.

Suppose you’re worried about the flexibility of this platform. In that case, you do not need to worry because it has both a desktop version and a mobile application version that can help you, as a trader, to trade anywhere, anytime, and anyhow. They have a demo account for traders to learn and get familiar with Forex trading.

International bodies properly regulate the body. Traders do not need to worry about their security and their funds. Capital.com ensures that traders’ funds are well protected.

Benefits of Capital.com

- It has a demo account that can be used for training yourself

- It has a variety of assets to trade with, from Stocks to metals and Forex.

- Provision of in-house market research and educational materials.

- Security for traders on their platform.

Drawbacks of Capital.com

- The minimum deposit is considered too high at $3000

- The MT5 platform is not available on Capital.com

- US clients are not allowed to trade on the platform

(Risk warning: 78.1% of retail CFD accounts lose money)

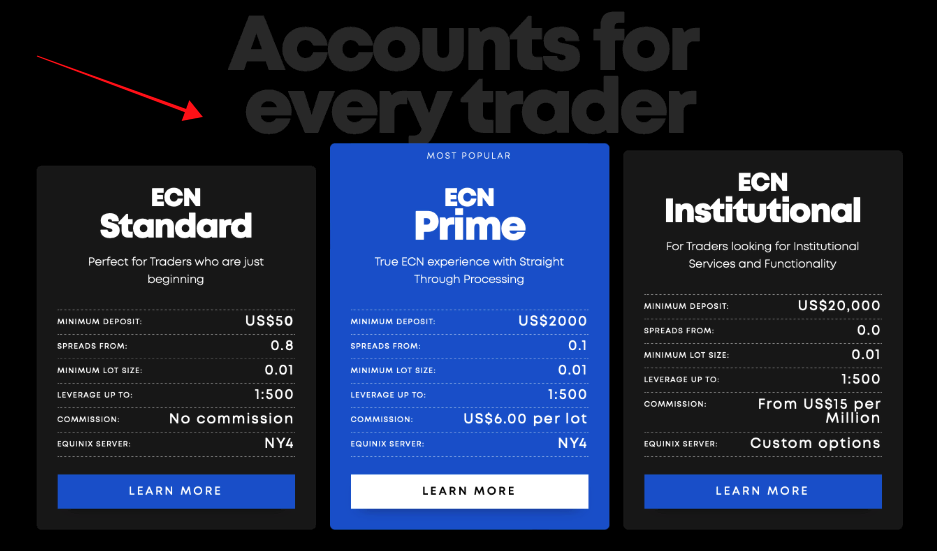

2. BlackBull Markets

Another Forex broker that is best to trade within the year 2022 is BlackBull Markets. It was established in 2014 in New Zealand by some New Zealand Forex Brokers who mainly thought they could improve the technology of business transactions with online Forex trading.

The broker is known to be one of the fastest in business transactions. This is because it has leading technology compared to some of the best Forex brokers. It has its home server connected to that on Wall Street, which permits transactions to happen within milliseconds.

Another beautiful thing about this Forex broker platform is a MetaTrader (MT4 and 5) platform. MetaTrader platforms are so good because they are well advanced in technology, and they secure the position of their traders when they bid for any Forex position. The platform also has some assets that it offers for traders to trade with. Although if you’re looking to trade crypto, BlackBull does not provide this.

The minimum deposit fee is quite affordable for some people, starting at $200. However, this $200 deposit is only available to those using the standard account on BlackBull Markets. If you open an ECN premium account, the deposit fee is $2000 but has a commission of 3 dollars attached to it.

Benefits of BlackBull Markets

- It offers two accounts for traders to choose from.

- A considerable minimum deposit fee of $200

- Quick and fast experience of traders on the platform thanks to its server connections

- The spread is at 1.25 pips, making it one of the best spreads.

Drawbacks of BlackBull Markets

- No available educational materials for its traders

- The regulatory licenses on the platform are not so much and can cause fear because the trader’s protection doesn’t seem all covered.

(Risk Warning: Your capital can be at risk)

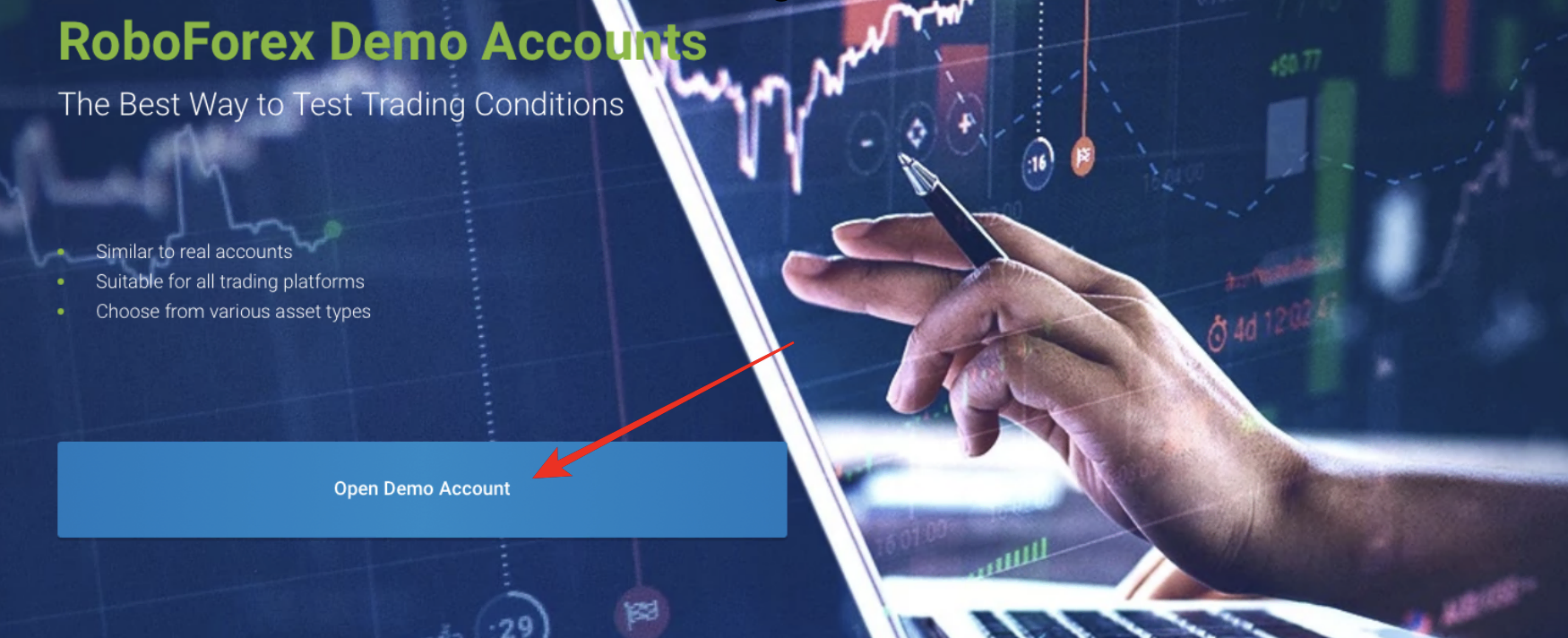

3. RoboForex

RoboForex is a MetaTrader platform-based broker platform. It is well established in more than 120 countries worldwide and keeps growing. It was founded in the year 2009, with well over 1 million traders worldwide.

A customer support system that offers more than 12 languages. It is no wonder it has good customer relations with its clients worldwide. RoboForex is considered one of the best technologically developed Forex platforms that exist. They have enough educational materials from which users can learn a lot about forex trading. Aside from that, they also provide them with tests that enable them to note and trace their growth in Forex trading.

RoboForex is also known to be a winner of numerous awards. It is well under the regulatory license of the IFSC. This body provides the protection rights of the traders on their platform. With one of the lowest deposits in the forex market of $10, you can start trading.

The platform is created with various instruments that traders can trade, ranging from Metals, gold, commodities, Groceries, etc. Also, a plus on its side, unlike some forex brokers out in business, RoboForex doesn’t waste time in allowing traders to withdraw funds through bank transfer. It is quick and doesn’t take a rigorous process.

Advantages of RoboForex

- Allows for immediate withdrawal of funds

- The platform has MetaTrader available

- Improved and sound technological system

- The platform has a sound trading system and one of the lowest deposit amounts.

Disadvantages of RoboForex

- There is no crypto available if you’re using the R Trader

- Slow customer service response.

- A small number of currency sets.

(Risk Warning: Your capital can be at risk)

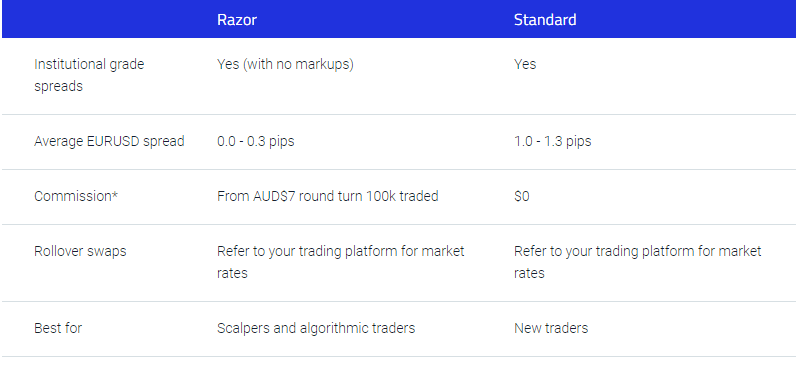

4. Pepperstone

Starting with a minimum deposit of $200, this platform is also one of the best brokers platforms today. The platform is known to have won the award for best MetaTrader platform for 2022. This means that it is a perfect MetaTrader platform (MT4 and MT5), plus it also has cTrader. cTrader is known to be one of the best and improved MetaTrader platforms. They offer better security and technology than the MT4 and MT5 platforms.

Pepperstone has a lot of regulatory licenses available to enable the security of its traders. All these licenses can be very tedious to read through when you want to begin trading with them.

These licenses include:

- FCA, a UK-based license

- ASIC, Australian-based

- SBC

- CMA, Kenyan-based

- CySEC from Cyprus

- BaFin, German-based

- and DFSA, Dubai.

Pepperstone is an Australian-based company founded in the year 2009. It has since grown to be one of the best CFDs and Forex platforms globally. It is well known for its beautiful customer service response time and support. The customer service works 24/7 and is always available to their clients.

The platform provides a demo account that traders can use to practice and get familiar with the spread and the market system. It also offers adequate market research from which the traders can have or build market insight. Provision of educational material is also made. Users can help themselves by going through them. This allows them to be familiar with market terms and market strategies.

There are also two accounts from which users can pick. That is the standard account which is the classical one. Beginners usually use it, and it offers no commission to the users of this account. While professionals mostly use the Razor accounts. The Razor account has a more competitive market structure and has a commission of $3.5 attached. The spread of this is from 0 pip.

Pros of Pepperstone

- More than one social copy space

- It has growing tradable markets that are good.

- Offers plug-ins for its trader’s unique experience

- Availability of MetaTrader platforms

Cons of Pepperstone

- The demo account is only available for a month

- Limited amount of assets available for trade

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

This is available on mobile, but it is also available on the web or desktop. This broker platform allows for the flexibility of its users. As you can trade not only on your desktop, you can also use your mobile device, which makes trading more straightforward and more flexible for everyone. It was founded in 2013 as primarily a binary options (only for professional traders and outside EAA countries) platform, but more instruments were introduced later on. These instruments include crypto, stocks, commodities, energy, and others.

The platform provides a demo account that does not expire. It is always available, and the virtual money deposited there is present for traders to practice. Traders are required to deposit a minimum of $10 to start trading. You can customize the charts to suit what you want. The chart can be changed to candles or histogram. This enables an outstanding customer experience and understanding.

The platform is available with educational materials for its traders. This helps them know a lot about Forex trading and how to avoid mistakes while trading. Also, it is a community-based platform as there are usually regular webinars and available chat forums, which help traders connect and discuss a lot about the market structures.

Pros of IQ Option

- The minimum deposit is from 10 dollars

- No attraction of deposit fee

- It has a beautiful interface that allows traders to change the chart type

Cons of IQ Option

- The withdrawal method can be time-wasting if done through a bank transfer

- MetaTrader is not available on the IQ option

- The platform is not available to clients from the United States.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Chile?

The General Banking Act of 1997 governs Chile’s banking system. As of January 2019, this General Banking Act was extensively modified, bringing in innovations in supervision and aligning banks’ capital requirements and other functions with Basel III standards.

A lot of the regulatory framework for financial activities in Chile was formulated by the former Superintendence of Banks and Financial Institutions’ improved combination of Rules and the country’s Central Bank summary of Financial Regulations.

The Securities Market Act under Law No. 18,045 regulates public securities offerings, secondary markets in the country, stock exchanges, brokers, and other things. It extends to banks while serving as securities intermediates because they are authorized to do so.

The Commission for the Financials (CMF) is the banking industry’s primary regulator.

This body was established on February 23, 2017, under Law 21,000, and took over the powers of the prior financial regulator, the Superintendence of Banks and Financial Institutions, on June 1, 2019.

The principal objective of the CMF is to oversee the appropriate functioning, growth, and stability of Chile’s financial market and make sure that companies under its watch follow all relevant laws, rules, local laws, and regulations.

The Central Bank of Chile is also in charge of overseeing the flow of funds and the correct operation of markets, among other things. The fundamental goal of the Central Bank of Chile is to ensure currency stability and smooth internal and external payments.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Chile – Good to know

As a Chilean trading Forex, you will want to start trading with brokers that have international bodies as they are the best and most secure to deal with. These brokers have licenses that can be seen and read through, and every trader on their platform has their protection rights.

Forex trade is an online trading platform that carries many risks. Trading with a platform that does not have international licenses can be a dangerous risk. You can choose from these platforms with FCA, SCB, CySEC, etc.

Traders must do their proper research before trading with any broker platform. Every broker has its ups and downs, so you should always look them up on youtube, online forums about Forex trade, and others.

Is it legal to trade Forex in Chile?

Due to the whole political instability in the country, the country’s economy has also been at an all-time unstable manner. There’s been a lot of ups and downs in the currency of the country. And to this reason, Forex is not discouraged in the country because it is seen as a means to improve the economy and exchange the country’s currency.

In 2019, the government intervened in the FX market, undermining trust in the Chilean currency. The country has kept forex regulation relatively weak in light of its currency troubles. It is advised that Investors should carry out their research when in search of a broker platform. This is because Chile does not always prioritize regulation; damages resulting from dealing with an unregistered broker may be hectic to recover.

So it is advised to trade as a Chilean with a broker with registered licenses, especially when they are internationally recognized.

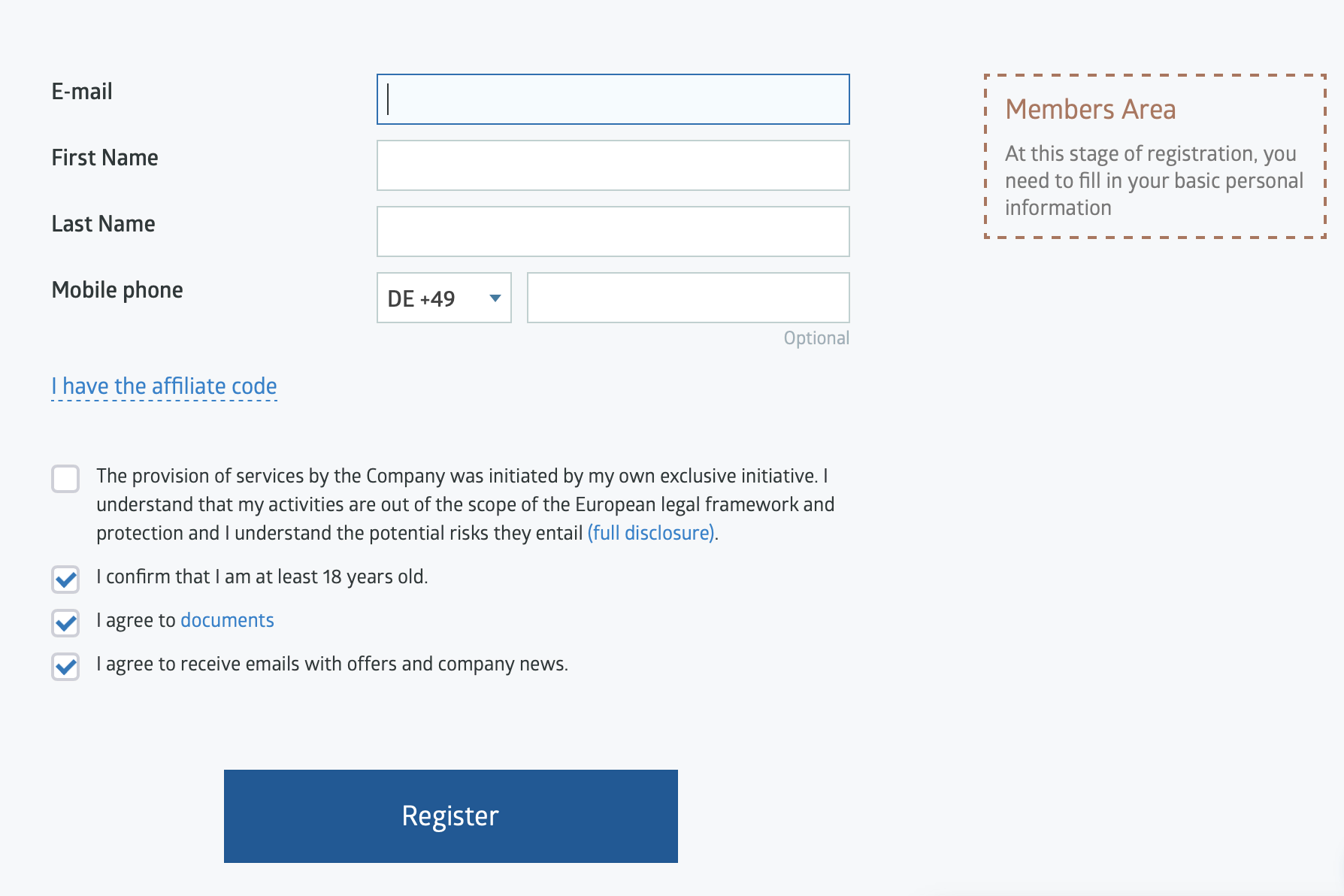

How to trade Forex in Chile – Quick overview

Open an account for Chilean trader

Opening an account is simple, whether on a desktop or mobile. In the process of opening an account, be sure to get ready some legal documents that will be asked of you to provide before you can begin trading with the platform. These documents are your national ID, national passport, phone number, and, lastly, a utility bill.

Start with a demo account or real account

After opening your account, if a demo account is available on your broker, it is usually the first account. And can use. This account is supposed to help you learn how to trade correctly and get familiar with the chart, market, and spread—no actual profit or loss with this account. But when you start with a real account, gains and losses are real.

Deposit money

This is done when you start with your real account. To deposit money into your account, you must select a payment method through with you want to fund or credit your forex account and begin trading and exchanging currencies.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use of analysis and strategies

There are various analyses and strategies which traders use to be tactical about market structure. These strategies include the following.

Scalping

This approach entails placing many transactions to make tiny profits on each one. If you like being cautious, this is an excellent method.

Day trading

As the name implies, day trading is when a trader ends a position for the entire day. When the day is done, the trader cashes in his profits and waits for the next day.

Position trading

This can be thought of as the polar opposite of day trading. A trader who uses this strategy takes the same point on the chart for a time, generally weeks, and can even take years.

Make profit

Finally, dealers must close open trades for the day before they can profit. When the entire market pauses, the motion of the currency specified determines your gain or loss.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Chile

As you can see, getting started in Forex isn’t difficult. It is pretty straightforward and quick to open an account with your broker platform. Due to technological advancements, things are becoming more detailed in the current world, and trading stocks, bitcoin, metals, and other financial instruments have never been easier. Furthermore, the fact that these activities are carried out on the internet fosters healthy market rivalry.

With the top forex brokers, trading forex is secure and straightforward. The forex market is growing in tandem with global economic growth. Forex trading is becoming increasingly popular.

FAQ – The most asked questions about Forex Broker Chile:

What special do forex brokers in Chile offer to traders?

There are many added features that Chile traders can access on the trading platforms the forex brokers offer. Besides trading your local currency, you can access several other currencies. Traders can pick a forex pair of their choice on the trading platform offered by the brokers. Besides, they can use all the technical tools and indicators the broker offers.

Are forex trading and operating of forex brokers in Chile legal?

Yes, forex brokers in Chile operate to serve the needs of the forex brokers. You can enjoy trading with forex brokers as they operate fully legally. However, not all brokers in Chile might offer legalized services. Forex traders should choose only a regulated broker if he wishes to have the best trading experience.

How can a trader choose the MT4 or MT5 platform with the forex brokers in Chile?

When a trader signs up for a trading account, their broker allows them to pick an account type. If you wish to trade forex on MT4 or MT5, you can choose this trading platform when selecting an account type during the signup process. These trading platforms require traders to fund their accounts with a more initial deposit amount.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)