The 5 best Forex Brokers and platforms in China – Comparison and review

Table of Contents

Although licenses aren’t issued to forex brokers in China, traders are permitted to use the services of reliable offshore brokers. The Chinese Ministry of Public Security and the State Administration of Foreign Exchange permit regulated brokers of respectable foreign authorities to provide their financial services to Chinese traders.

These brokers must include the use of the Chinese language in their platforms; they must also provide the necessary local payment options and customer support for Chinese traders. This article will review the best five forex platforms for forex trading in China.

See the list of the best Forex Brokers in China:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 67% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 67% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 67% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

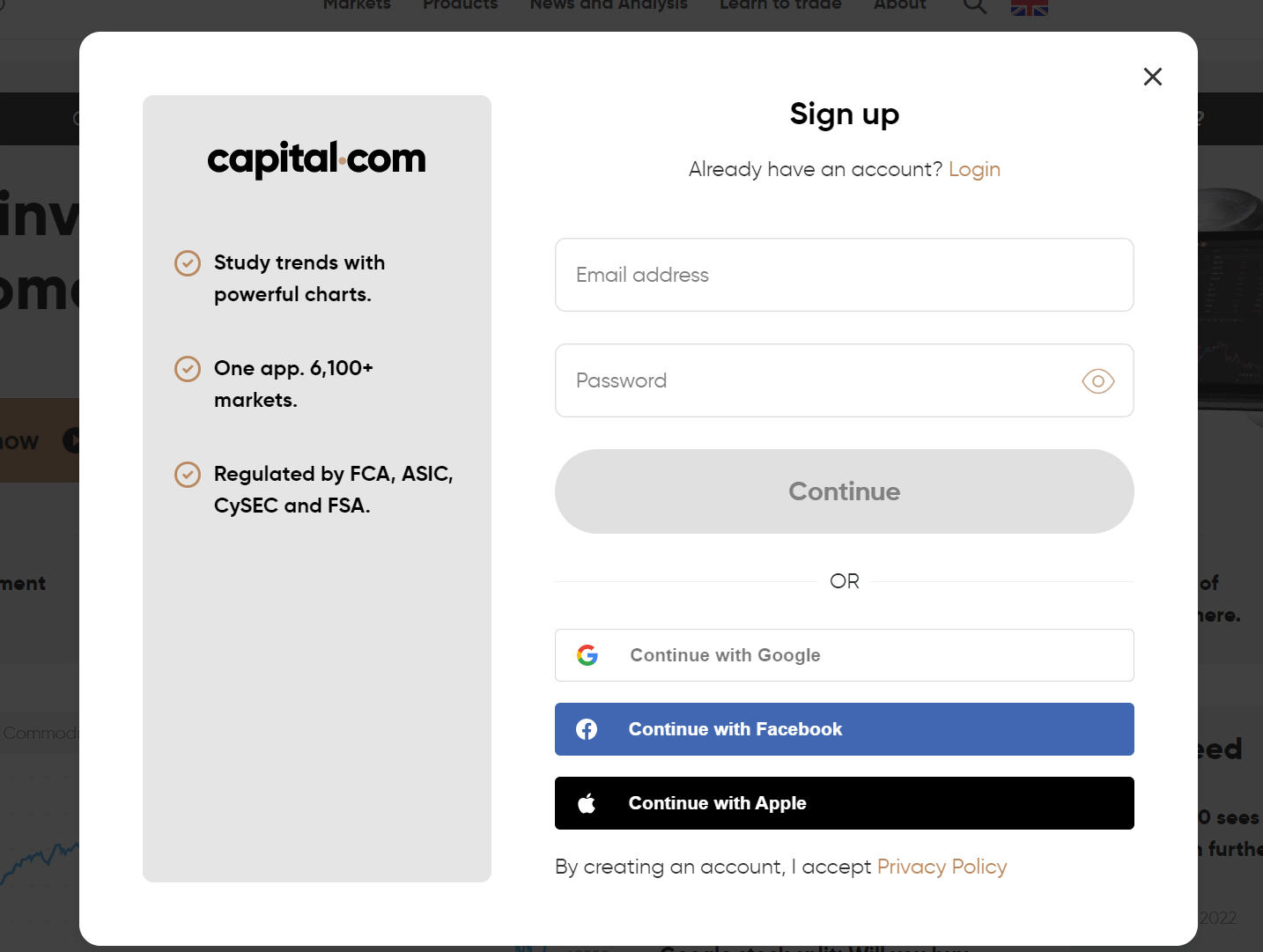

1. Capital.com

This platform was introduced in 2016 as a global CFD brokerage platform. They have offices in Cyprus, Australia, Seychelles, Gibraltar, and the United Kingdom.

They are modulated by the following across different regions:

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySec)

- Financial Conduct Authority (FCA)

- Financial Services Authority, Seychelles

This platform permits users from 15 countries to open accounts and trade using their local languages. These countries include Canada, Australia, Hong Kong, and China.

They only require a means of identity and proof of residency to open an account with them. Traders can make deposits in dollars or euros. They can also convert the money into their local currency with no extra fee. Forex traders can deposit funds through bank transfers, credit cards, or debit cards.

On Capital.com, traders can choose from many assets, allowing them to make well-informed judgments. Stocks, indices, cryptocurrencies, commodities, and foreign exchange are some choices. Capital.com customers are well-protected by law, making it a popular and well-regulated trading platform.

Other merits of trading with Capital.com

- Training materials, instructional apps, online courses, and trade guidelines are all excellent.

- Non-expiring Demo account is available for free.

- Spreads that are the best on the market

Demerits of trading with Capital.com

- A respectable number of tradable symbols, but still far fewer than the industry giants.

- There are no smaller account currencies available.

(Risk warning: 67% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a Forex broker and FinTech firm based in New Zealand. It takes pride in its speed and accuracy, offering traders ECN/NDD execution with deep liquidity via the MT4/MT5 trading platforms. One benefit traders experience is that their promised ECN, deep liquidity and price aggregation, and institution-level pricing for retail traders live up to the expectations.

BlackBull Markets is an essential MetaTrader broker with an expanding product lineup and compatibility for a few third-party social copy trading sites. BlackBull Markets, on the other hand, is failing to compete with the finest forex brokers due to its lack of teaching and research materials.

BlackBull Markets provides 281 tradable symbols and also provides clients access to various investment products.

BlackBull Markets publishes a daily series of technical and fundamental analyses for specific trading symbols. The trade-in 60 Seconds series, for example, consists of one-minute recordings that focus on a particular trading symbol, such as a specific currency pair or CFD.

Both the Market Reviews articles and the video selection produced by BlackBull Markets’ in-house staff are of excellent quality and provide depth in terms of technical and fundamental analysis.

Additional benefits of trading with BlackBull Markets

- The account opening process is simple, quick, and completely digital.

- Low forex and CFD costs are available at BlackBull Markets.

- Webtrader does not need to be installed.

Drawbacks of trading with BlackBull Markets

- There is a charge for withdrawals.

- There is no round-the-clock assistance.

(Risk Warning: Your capital can be at risk)

3. RoboForex

This platform was founded in 2009 with its head office at 2118 Guava Street, Belama Phase 1 in Belize City. They offer eight different asset types, including Stocks, Indices, ETFs, Commodities, Energy, Metals, Crypto, and Forex.

They are fine-tuned by the Financial Services Commission (FSC) with license no. 000138/210. This regulatory body resolves disputes between brokers and clients. They are also moduled by the International Finance Services Commission (IFSC). This regulatory agency only issues its license to reliable brokers in Belize and beyond.

They have eight liquidity providers offering over 1,200 trade instruments. They also provide access to other forex trading platforms. Some of these platforms include MT4, cTrader, and R Mobile Trader.

They offer customer care support that works using 11 different languages. The RoboForex customer service team is available all day long.

RoboForex provides trading platforms such as MT4, MT5, and cTrader. Millions of traders use MT4 every year since it is a well-known, multi-functional trading platform. MT5 is less popular than MT4 despite its improved features. Both platforms offer superior trading capabilities. cTrader is still the most popular ECN platform.

Benefits of trading with RoboForex

- Trading conditions that are favorable and a low minimum deposit

- Money can be withdrawn right away.

- Affiliate fees start at $5 per lot and go up from there.

Drawbacks of trading with RoboForex

- There aren’t enough cryptocurrency tools when trading on the R Trader platform.

- Stock CFD trading fees are higher than those charged by other brokers.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone provides a growing list of tradable markets, high-quality research, and support for various social copy trading platforms.

It provides MetaTrader and cTrader (finished Best in Class for MetaTrader brokers in 2022), and its extensive library of third-party tools and plugins complements its already impressive platform lineup.

Pepperstone Limited began operations in the United Kingdom in 2015 and has since expanded its services to meet the demands of the UK and European clients via local access. Overall, the group has offices in Melbourne, Dubai, Limassol, Nassau, Nairobi, Dusseldorf, and London, among other important financial centers.

Pepperstone is a reputable and licensed broker. In addition, Pepperstone has the necessary permits in each region where it operates. As a result, Pepperstone Limited, a licensed UK firm authorized by the Financial Conduct Authority, processes the data of UK and EEA citizens.

Pepperstone makes market access simple, letting clients focus on the more difficult task of profitably trading the markets. Pepperstone is an excellent choice for traders who want a limited number of low-cost alternatives, various user interfaces and account kinds, and quick customer service.

Pros of Pepperstone

- Pepperstone offers a variety of platform add-ons to improve the MetaTrader experience.

- On Pepperstone’s Razor accounts, pricing is competitive for active traders, however trading fees for retail traders are just ordinary.

- There are a variety of social copy trading platforms to choose from.

Cons of Pepperstone

- Pepperstone’s educational products are comparable to industry standards but not as good as category leaders.

- Interactive courses, progress tracking, and instructional quizzes are not available.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

This platform was introduced in 2013 as a part of the parent company IQ Option Ltd. They provide access to various financial instruments. It is one of the most trusted and reliable brokers in the world. Although it started as a binary trading platform, it now offers CFDs trade. This trade is made mainly on popular financial instruments such as stocks, commodities, ETFs, and Forex.

The organization has developed an IQ Option trading patterns tool to assist investors on their path to financial success. This tool, which can be found on the service’s website, can make a significant difference in the outcome of your investment.

IQ Option trading patterns provide video lessons for almost every trade pattern available. It will teach you everything you need to know about using such strategies in a short amount of time. Because it is so close to the trading platform, the gadget is easy to notice.

It is designated as one of the Cypriot Investment Firms with its headquarters in Cyprus and controlled by Cyprus Securities and Exchange Commission with license number #247/14.

They offer their platforms to traders all over the globe. They also offer two types of accounts; the standard version and the VIP trade account. They offer a demo account for practice. Traders can open a real account after much practice on the demo account.

Advantages of IQ Option

- Opening an account is a simple and quick process.

- A large number of trading instruments are available.

Disadvantages of IQ Option

- MT4 and MT5 trading platforms are not available.

- This service is not available for traders in the United States, Canada, Australia, Japan, and other countries.

(Risk warning: Your capital might be at risk.)

Is it legal to trade Forex in China?

The objectionable business environment in China has made it nearly impossible for western companies to gain access to the Chinese market. This includes the forex brokers and their companies. Although there are still several restrictions placed on offshore forex brokers, China is slowly opening its gates to the world of international forex markets. These restrictions are due to the closed-capital policy maintained by China.

Foreign brokerage platforms in China are slowly gaining a foothold in the Chinese foreign exchange market. They do this by partnering with local forex representatives in China. The local representatives aim to act as brokers and build a trustworthy network with Chinese clients. The best way to build a business network in China is by gaining trust. This is because business relationships based on faith in China are prevalent.

The Chinese Yuan is traded in the forex market in huge volumes. Very few banks in China conduct forex trading and few brokerage platforms. The Yuan offers competitive rates and a good service standard. Some websites operating in China offer information about the Chinese foreign exchange market.

The foreign brokers partner with these local representatives independently. This is because joint partnerships or ventures are considered illegal in China. The Chinese Government and The China Banking Regulatory Commission regard the foreign exchange market as a very high leveraged market.

The forex market does not get many investments from China or Chinese clients. Brokers regulated by respected foreign agencies are accepted to provide financial services to clients in China. Some of these brokers have offices in mainland China.

They work by partnering with companies owned by Chinese citizens or run based on direct ownership. These foreign brokers are being monitored closely by the Chinese government.

Although Chinese clients can invest in the forex markets, there are restrictions on the maximum amount they can invest yearly.

The Chinese regulatory agency must license all brokerage platforms that offer their services to Chinese clients. This agency is The State Administration for Forex Exchange (SAFE). This agency is responsible for monitoring brokerage platforms that provide their services to Chinese clients.

What are the financial regulations in China?

The People’s Bank of China (PBOC) has traditionally monopolized the People’s Republic of China (PRC), first as the only bank and then as the PRC’s central bank. Since 1978, when China began its economic reform and opening up, and since the early 1980s, China’s banking system has increasingly opened to include diversified ownerships and sophisticated firms.

The Chinese financial system is still changing as a result of numerous reforms. The government enabled four state-owned specialized banks to accept deposits and conduct banking activity in the early 1980s.

In 1994, China established three policy banks to provide specific financial services for construction projects, import and export enterprises, and the agricultural sector to promote construction, industrial, and agricultural development.

The China Banking and Insurance Regulatory Commission, formerly known as the China Banking Regulatory Commission (CBRC)12, supervises and regulates banking in the PRC. They are also controlled by the central bank, the PBOC, which is responsible for formulating and implementing monetary policy, among other things.

The CBIRC also oversees non-banking financial organizations such as trust businesses, financial leasing companies, foreign exchange firms, consumer finance companies, and car finance companies.

The government created these financial standards to help keep your money and assets safe and secure. There is the opportunity for transparency, freedom of choice when picking a broker, and understanding the financial industry’s dos and don’ts as a new broker in the forex market.

Consumers are protected by financial regulation—inadequate broker regulation results in poor service and the danger of financial loss. To prevent fraud, Iran’s brokers are regulated. Working capital for the agency and a customer-funded account must be kept separate. Fraud occurs when customer funds are utilized to do business. To prevent this from happening, legislation is essential.

Security for traders

Online trading is becoming increasingly popular. People, especially in these times of economic uncertainty, feel compelled to take charge of their own finances. Thanks to technological advancements, investors can now work with brokers remotely rather than visiting them in person or speaking with them on the phone.

First, ensure that internationally recognized regulatory bodies regulate them. If your broker does not have a presence outside of China, we urge you to avoid them.

Then you should examine the historical spreads provided by different brokers. The spread is the commission you pay to your broker each time you trade. The broker with the smallest spreads should be chosen. Check to see if the broker offers outstanding customer service.

Keep an eye out for Bucket retailers as well. These unregulated brokers deal on your behalf and offer a fixed price guarantee. On the other hand, they wait for the price to change before pocketing the difference.

How to trade Forex in China – A detailed guide

Open account for Chinese trader

Before a trader can open a forex trading account in China, they must provide proof of identity and residency. The evidence of identity required is either a driving license or a national identity card. The proof of residency needed is either a utility bill or a bank statement.

(Risk warning: 67% of retail CFD accounts lose money)

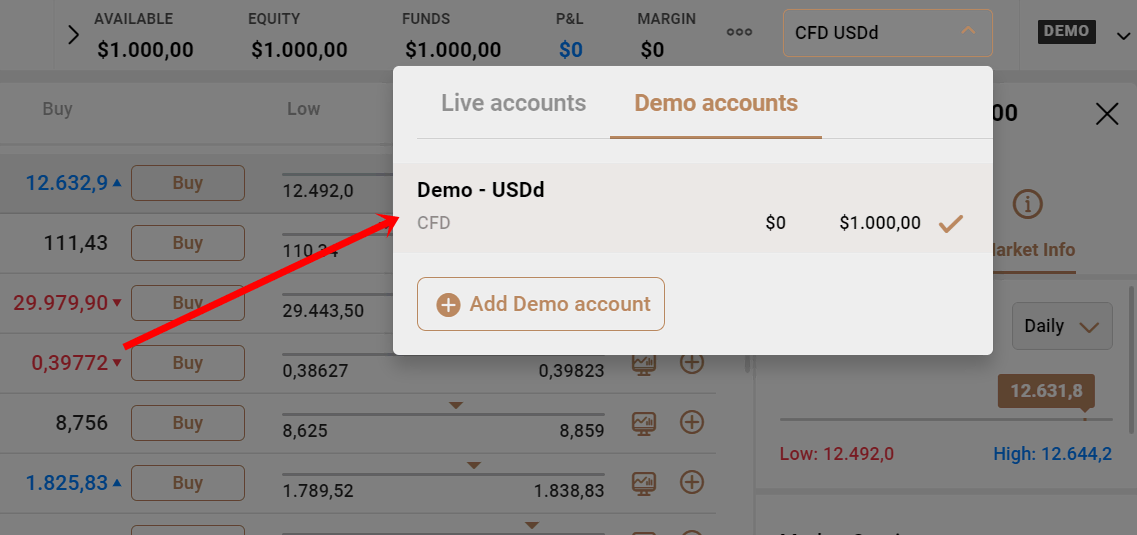

Start with a demo account or real account

If you are a beginner, never start trading on a live account because your real money will be at stake. We recommend you open a demo account with your preferred broker and then learn to trade by developing and testing a trading strategy to see what works best for you in various market situations. It would help if you only decided to deal with real money on a Live account once you are confident in your trading style and plan.

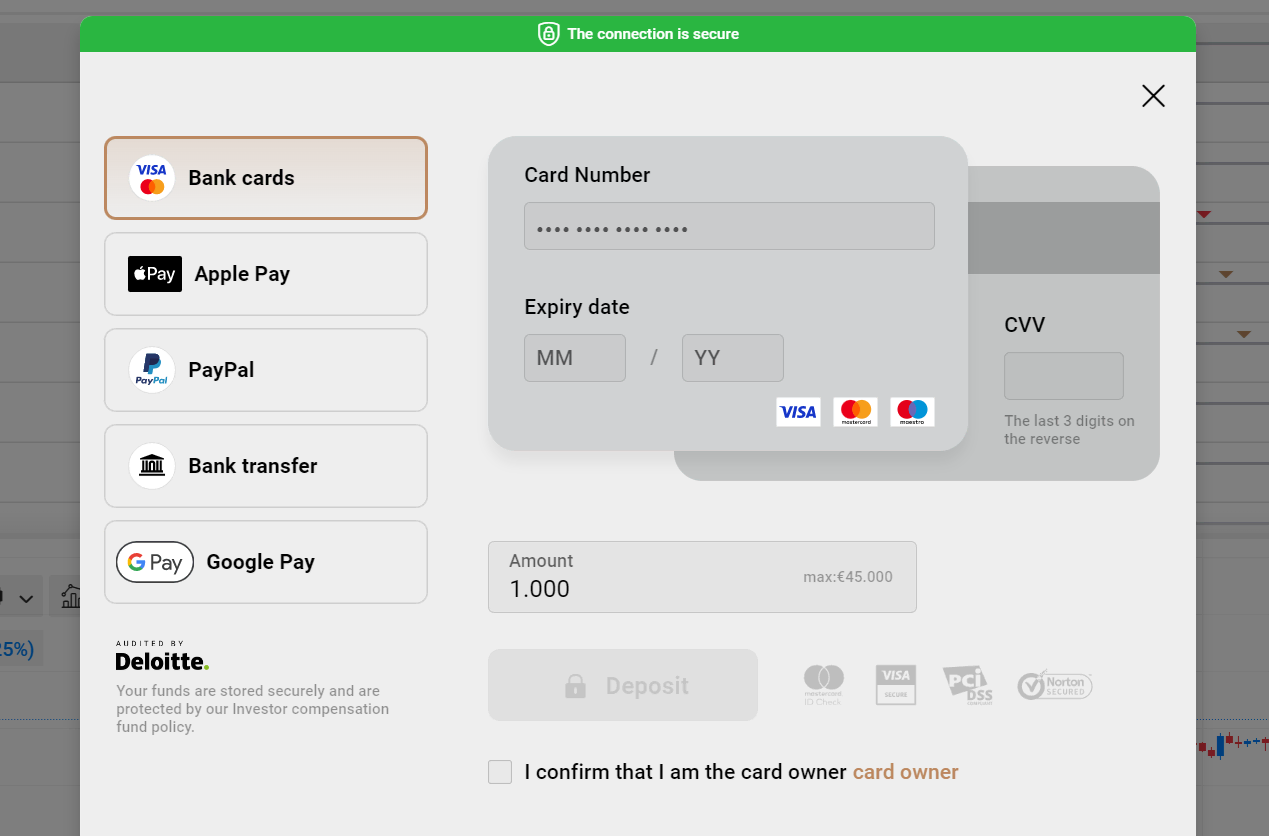

Deposit money

After you’ve decided on a Forex Broker, you may open an account with that broker to begin trading (or a demo account to learn). With this account, you’ll be able to change in the interbank market at real-time currency rates.

Accounts of Chinese clients are commonly funded through China UnionPay. This is one of the biggest issuers of debit and credit cards globally. They are higher than some known and established brands like Mastercard and Visa. The China UnionPay is an accepted payment method by the People’s Bank of China. It is swift, efficient, and reliable, so it is a prevalent method of funding Chinese forex accounts.

Another local method for Chinese clients to fund their forex accounts is the use of WeChat Pay. It supports the payment of over 650 million active users. It is trusted in China as fast, easy, and reliable.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Forex traders make use of forex analysis to determine whether to buy or sell currency. It could be straightforward, necessitating the importance of chart software. It can also be fundamental, depending on current events and economic statistics.

Some of the strategies traders use are;

Scalping

Scalping in forex is a popular trading strategy that focuses on minor market changes. This approach entails opening a huge number of trades with the aim of making tiny returns on each of them.

Day Trading

The process of exchanging currencies in a single trading day is referred to as day trading. Although day trading methods can be applied in any market, it is most commonly utilized in Forex. This trading strategy suggests that you open and close all trades on the same day.

Position Trading

Trading technique in which traders hold their positions for a long time—anywhere from a few weeks to a few years. This approach demands traders adopt a macro view of the market and tolerate smaller market changes that oppose their position as a long-term trading strategy.

Make profit

You must close the trade that you opened to realize your profit. After you conclude the deal, depending on the movement of the currency pair you were trading, you will either be profitable or lose money.

Conclusion: The best Forex Brokers are available in China

The People’s Republic of China is one of the most populated countries globally. It can also be called an economic powerhouse due to the high rate of life expectancy, literacy, and economy. It is not surprising that significant forex brokerage platforms have their eyes on China, considering all these features.

They try to spark the interest of local Chinese traders by offering them trading platforms in their local languages. These platforms also provide convenient payment options. Introducing the forex market into the Chinese business environment has not been easy. This is due to the regulations and restrictions guarding the Chinese business environment. This is also due to the close capital policy that China maintains.

Most foreign brokers penetrate the Chinese business environment by making partnerships with local Chinese foreign exchange companies. These local companies act as introductory brokers that help build trust among the locals.

Only forex brokers regulated by respectable foreign regulatory agencies are allowed access to the Chinese business environments. They are also the only brokers permitted to partner with local Chinese foreign exchange companies.

FAQ – The most asked questions about Forex Broker China :

Can Chinese trade forex?

Yes, the Chinese can trade forex like people of any other nationality can. Chinese traders are the top forex traders in the world. A lot of Chinese traders trade forex to become rich. That is why hundreds of forex brokers operate in China to offer traders the best. Traders can choose any broker that extends their services to traders.

Which forex brokers offer the best trading services in China?

Traders need a forex broker to rely on and put their faith in. After all, trading forex involves a lot of money. If you are trading forex in China, you can choose one of the five forex brokers we discussed. These brokers offer traders an intuitive trading platform that is full of features. These features make forex trading fun for any trader. So you can have a pick among these brokers after having your forex trading priorities straight.

How can traders in China trade forex with profit?

As a Chinese investor, you can make a lot of profit while trading forex online. However, it would require you to build certain trading strategies. Forex trading beginners can use copy trading or the social trading strategies these brokers offer. It will improvise your trading experience and allow you to learn from the experienced traders trading on these platforms.

Last Updated on April 14, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)