The 5 best Forex Brokers and platforms in Colombia – Comparison and reviews

Table of Contents

The world’s largest and most liquid financial market for buying and selling currencies is a foreign exchange or Forex. When you trade forex, you’re speculating on the price of money in the future.

You might be wondering how to get started if you’ve looked into forex trading as a Colombian and believe there’s a chance to benefit here are the top five brokers in Colombia that can help guide you as you begin your trade;

See the list of the best Forex Brokers in Colombia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 75% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

1. Capital.com

Capital.com is the most suitable alternative for newcomers. To obtain a better knowledge of the platform, novice traders can make use of learning and trading classes. In actuality, the company offers its consumers a “learning mode.”

Aside from attending live webinars and taking courses, there are many other ways to learn. Alternatively, investors can read extensive manuals, watch instructive films, or even download an investment education app.

Capital.com is a licensed broker-dealer. It’s one of the few brokers with licenses in three nations. The Financial Conduct Authority of the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), and the National Bank of Belarus are part of the regulatory bodies (NBRB).

Capital.com is the ideal trading platform for traders who want to take advantage of technology. This leverage has the potential to considerably raise their earnings. This is a recommended option for investors and those searching for a good time.

Capital.com provides traders with a wide range of assets from which to choose, allowing them to make well-informed judgments. Among the options are stocks, indices, cryptocurrency, commodities, and forex. Capital.com’s customers are well-protected by legislation, making it a well-regulated and popular trading platform.

Capital.com is one of the best brokers because of its technology platform. Traders can utilize the firm’s customized trading platform to make wise investment decisions because it delivers critical data.

Capital.com offers CFDs and Forex trading at a low cost. The procedure for creating a new account is simple. However, as compared to other brokers, the minimum deposit is high, at $3000. The company provides excellent customer support, but it also provides detailed responses.

Capital.com also has a smartphone app driven by artificial intelligence. The platform also incorporates artificial intelligence, which enhances the trade experience. The broker is one of the few that employs technology to assist its clients.

On Capital.com, traders can choose from a large variety of assets, allowing them to make well-informed judgments. Stocks, indices, cryptocurrencies, commodities, and foreign exchange are some of the choices. Capital.com customers are well-protected by law, which makes it a popular and well-regulated trading platform.

Merits of Capital.com

- There is a free Demo account that never expires.

- The market’s most competitive spreads

- All of the training materials, instructional apps, online courses, and trade regulations are of the highest quality.

Demerits of Capital.com

- The company does not accept customers based in the United States of America

- MetaTrader 5 is now unavailable.

(Risk warning: 75% of retail CFD accounts lose money)

2. BlackBull Markets

The Financial Services Provider (FSP403326) regulates Black Bull Group Limited and typically holds a Financial Markets Authority Derivative Issuer License.

BlackBull Markets is the ideal platform for traders that prefer to trade with little assets. If you wish to trade indices, commodities, or crucial currency pairs, you must choose a broker.

A group of fintech developers, FX traders, and data security professionals founded BlackBull Markets in 2014. This platform is without a doubt an excellent place to begin trading metals, commodities, indices, energy, and CFDs.

With a No-Dealing Desk (NDD) and Straight-Through Processing (STP) methodology, they are a reliable Electronic Communication Network (ECN) broker (STP). Global Partners ‘ premier liquidity providers offer deeper poo liquidity and greater market depth.

This broker offers various distinguishing features, the most notable of which is API. It connects algorithmic traders with sophisticated trading platforms. This broker also provides a free VPS hosting option for ECN Prime accounts with a trading volume of more than 20 lots.

When using BlackBull Markets for the first time, you’ll notice that the broker has a low pricing structure and good trade execution. It also offers free virtual private servers (VPS) and API trading. Using a larger asset selection allows a trader to execute profitable trading without pain or regret. BlackBull Markets is a top broker for experienced traders, with a reliable and risk-free trading platform.

The MT4 platform from BlackBull Markets connects to the Equinix NY4 server on Wall Street. It can efficiently perform trades in 2-5 milliseconds. A trader can use this server to trade directly in markets with various liquidity providers who offer competitive bid/ask prices, little slippage, and tight spreads.

Advantages of BlackBull Markets

- Deposits at BlackBull Markets are free of charge.

- There are a variety of base currencies to pick from and a variety of ways to transfer money.

- The MetaTrader web trading platform used by BlackBull Markets is extremely customizable and includes a thorough fee report.

Disadvantages of BlackBull Markets

- The scope of the analyses is relatively limited.

- There is a cost for withdrawing money.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex has around 800,000 customers from 170 countries. The language barrier is significantly decreased thanks to the broker’s support in 18 languages. RoboForex has made every effort to break down any boundaries that may exist between clients, whether they are from outside or inside the country, new to trading, or have years of experience.

RoboForex and Robomarkets Ltd made comprised the RoboForex Group, which was created in 2009. The former offers services all over the world, whilst the latter was designed just for clients in the EU and EEA. The IFSC manages this organization.

There’s access to up to a year’s worth of transaction and trading history and superb research tools like a news feed, calculators, a strategy builder, trading ideas, and the platforms’ very intricate capabilities.

RoboForex provides a number of educational options and the chance to hone your skills and compete in trading competitions, all of which will help you improve your level and talents. In the Members section, members get access to market analysis, technical analysis, expert trading analytics, and a variety of trading tools.

The availability of minimum deposits varies by location, but RoboForex also offers a variety of options to help traders better understand the concept of RoboForex trading.

RoboForex offers trading platforms like MT4, MT5, and cTrader. Millions of traders use MT4 every year since it is a well-known, multi-functional trading platform. MT5 is less common than MT4 despite its better features. Both platforms offer top-notch trading capabilities. The cTrader is still the most used ECN platform.

RoboForex’s MT5 platform lacks backward compatibility and does not allow for hedging, which is why it is less popular than MT4. This platform has been significantly updated with a number of new features. It is, however, still inferior to the MT4 platform.

Pros of RoboForex

- The platforms come in a variety of languages.

- Every type of trader can find software to suit his or her needs.

- Negative balance protection is a method of preventing losses on your savings.

Cons of RoboForex

- Each trading platform has its own set of fees and charges.

- The terms and conditions may vary depending on the company and trading platform.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone has developed to become a top-tier player in the brokerage market since its inception in 2010, having built a top competitive and full-featured trading platform that focuses on forex, stocks, indices, securities, and even cryptocurrencies.

Pepperstone provides easy market access, allowing clients to focus on the more challenging process of successfully carrying out trades in the market. The broker is a fantastic alternative for traders in search of a small number of low-cost options, various types of user interfaces and account types, and swift customer service.

With its lightning-fast execution methods, several account kinds, competitive pricing, and multiple platforms, the broker beats the vast majority of global forex brokers (MT4 and MT5 and comprehensive cTrader functionality).

Pepperstone has some of the lowest commissions in the brokerage market. New clients can choose between the “Standard” account, which has minimum FX spreads starting at one pip, but no commission, and the “Razor” account, which has minimum FX spreads starting at zero pips but commission.

The spreads on Pepperstone‘s other instruments are either straight or a mix of spread and commission.

The broker is regulated by the FCA, ASIC, CMA, BaFin, and SCB. Pepperstone’s market data and insights are up to date with industry standards, and they help traders connect with the market as well as augment educational materials.

Pros of Pepperstone

- Both the withdrawal and deposit processes are quick and painless.

- Traders benefit from their excellent customer service.

- providing access to market research, trade concepts, and technical tools

Cons of Pepperstone

- In most cases, CFDs are the options provided to traders

- The Pepperstone interface lacks a two-step login requirement as well as price alerts.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

Despite being a newcomer to the binary options industry, IQ Option has a reputation for constantly seeking out new binary options technology to improve. To assist investors in evaluating markets and profiting from them, the platform provides both a desktop solution and a mobile app. It takes pride in its user-friendliness, which makes binary options trading a breeze (only for professional traders and outside EEA countries).

Industry leaders have applauded and recognized IQ Option, a multi-award-winning trading platform. It provides a versatile platform that allows you to customize anything from the chart type to the color scheme to meet your unique needs.

The company has created a tool called IQ Option trading patterns to guide investors on their journey to financial success. This tool, which you can access on the service’s website, has the potential to have a significant impact on your investment’s outcome.

Instant withdrawals are possible using a variety of payment methods. You’ll also have access to a team of fluent specialists in your original tongue at all times.

Advantages of IQ Option

- Interactive webinars are available for more receptive reactions.’

- They have a big customer service team that is available 24 hours a day, seven days a week, and replies in a variety of languages.

- The Real Account has a low minimum deposit requirement.

Disadvantages of IQ Option

- There is no verbal connection with customer service.

- It takes a long time to withdraw money via bank transfer.

(Risk warning: Your capital might be at risk.)

Is it legal to trade Forex in Colombia?

The idea that trading Forex on the Colombian financial market is dangerous is widely held. This is far from the case. The Colombian forex market is quite active. Because it is important to exchange money in order to conduct business, Colombia authorizes forex trading.

Forex is required for import and export, as well as international investment. When trading Forex, it’s critical to find a regulated, secure, and well-known broker. In Colombia, forex trading is legal, and various international online brokers provide attractive trading conditions.

You should be aware of the concept of leverage when trading. Colombian brokers who deal in high-leverage trades could make a lot of money. This, however, has the potential to result in substantial losses. Certain Colombian brokers offer two types of protection: negative balance protection and stop-loss accounts.

Colombia authorizes forex trading because it is vital to make business and exchange money. Forex is required for import and export, as well as international investment. When trading Forex, it’s critical to find a regulated, secure, and well-known broker.

What are the financial regulations in Colombia?

The Colombian government agency Superintendencia Financiera de Colombia (SFC) manages financial regulation and market mechanisms. It maintains stability, security, and confidence and promotes, organizes, and grows the securities market.

These Financial Regulations are intended to provide guidance to individuals in charge of the Authority’s finances, including permission, approval, receipts, custody, and payments, whether revenue or capital.

The Bank of Colombia regulates and supervises banks, financial institutions, finance lease institutions, credit reference bureaus, and bureau de change.

These financial rules were designed by the government to assist keep your money and assets safe and secure. As a new broker in the forex market, there is the potential for transparency, freedom of choice when selecting a broker, and knowledge of the financial industry’s dos and don’ts.

Financial regulation safeguards consumers. Inadequate broker regulation results in substandard service and the risk of financial loss. Iran’s brokers are regulated to prevent fraud.

The agency’s working capital and the account funded by customers must be kept separate. Fraud occurs when customer funds are utilized to do business. Legislation is required to prevent this from happening.

The Bank’s laws and regulations are types of government regulations that order banks to specific standards, limits, and rules, among other things, to ensure transparency between banking establishments and the people and businesses that they do business with.

How to trade Forex in Colombia – A quick tutorial

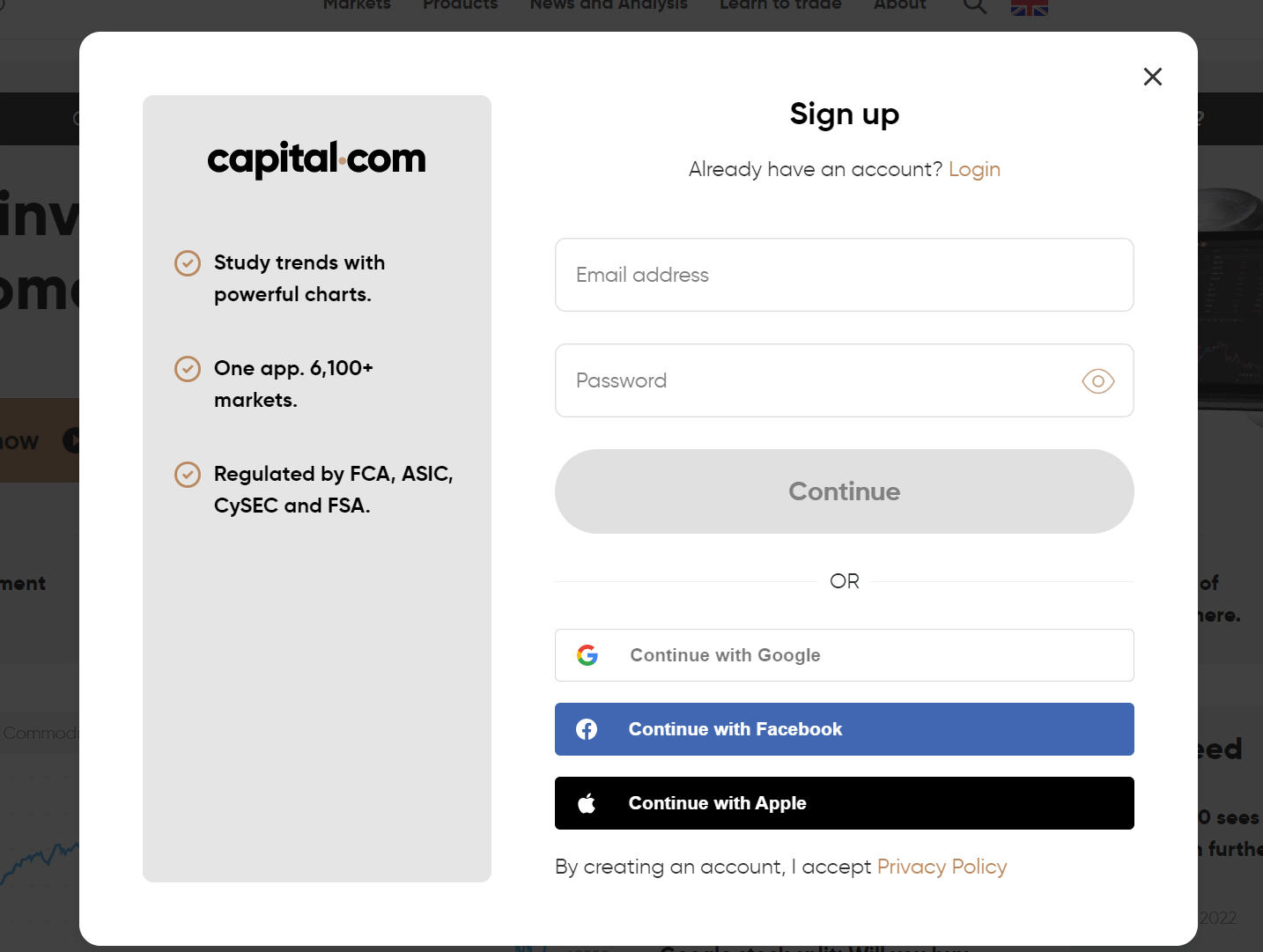

Open account for Forex traders

You can open a new account on the forex broker’s website. Some forex brokers require a minimum deposit to start an account. These brokers also provide a range of account kinds, each with a different minimum deposit and spread width. Choose the most appropriate choice for you.

Open a spread betting or contract for difference (CFD) trading account. To trade the price fluctuations of currency pairs, you may establish a real or demo account.

(Risk warning: 75% of retail CFD accounts lose money)

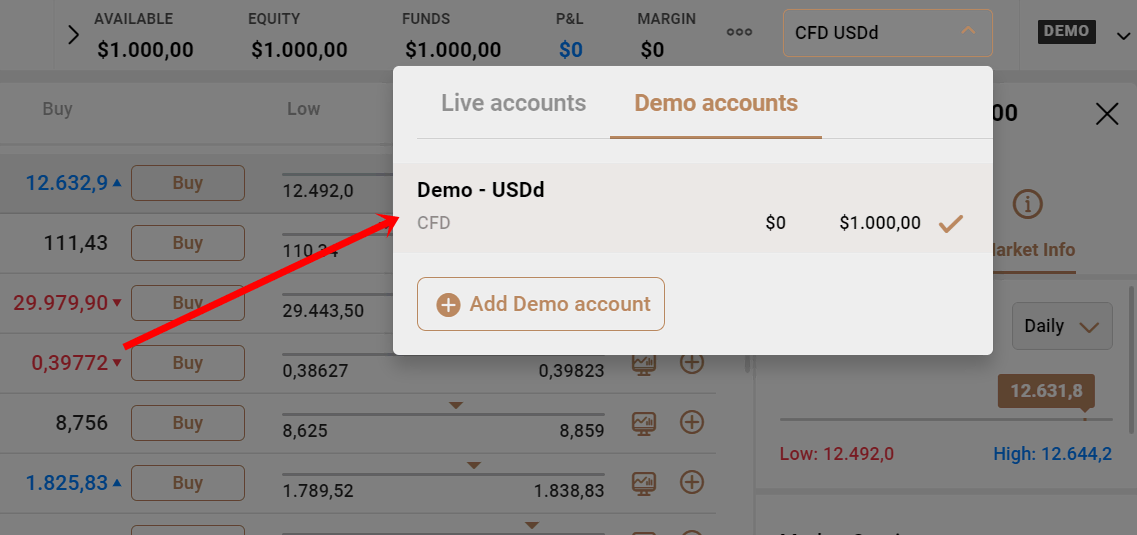

Start with a demo account or real account

Traders may simulate a real trading environment with a demo account without risking their own money. It will help traders to quickly get started with free online trading and practice before risking real money.

You can open a new account on the forex broker’s website. Some forex brokers require a minimum deposit to start an account. These brokers also provide a range of account kinds, each with a different minimum deposit and spread width. Choose the most appropriate choice for you.

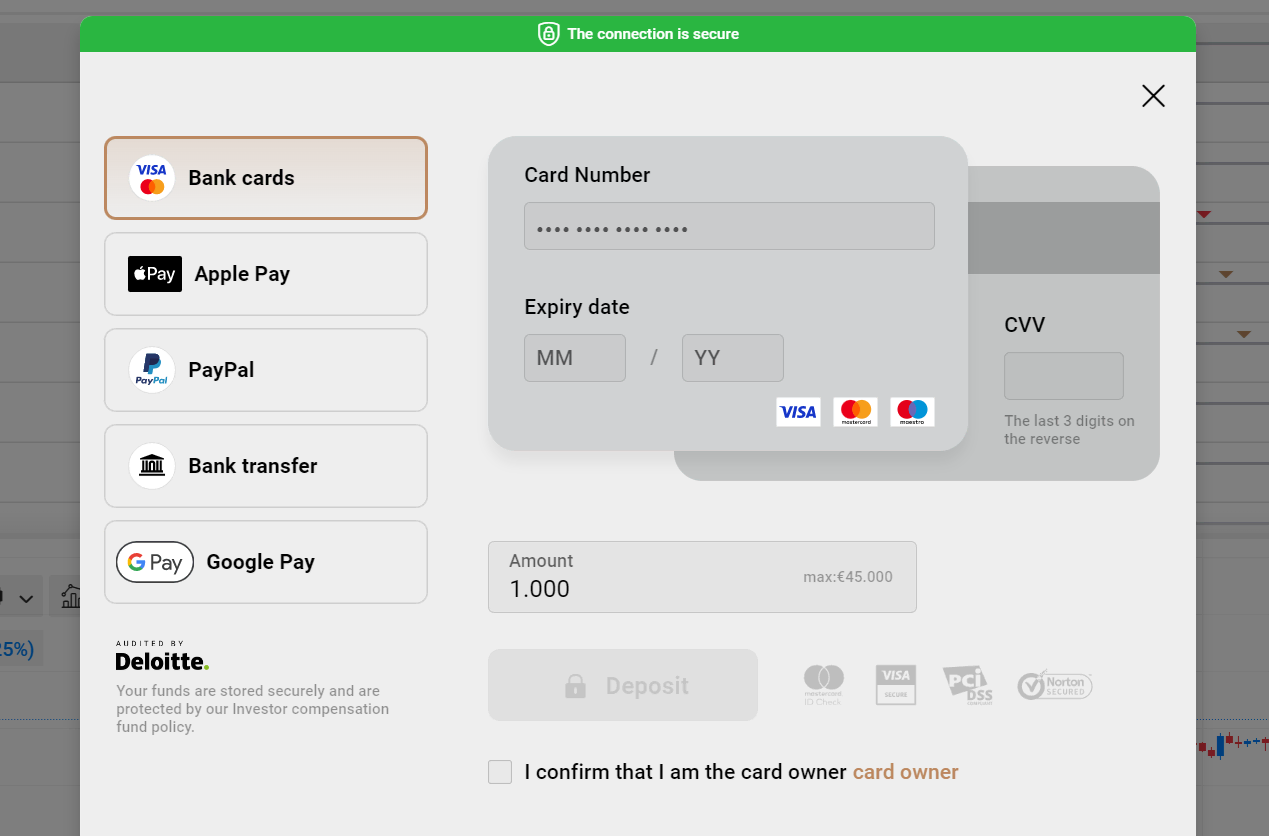

Deposit money

To start trading forex, you’ll need to transfer money after you’ve registered an account. You may choose your currency and fund your account in a variety of methods depending on the broker you choose. Wire transfers, debit cards, and electronic payment systems such as Paypal and Skrill are all common methods of funding.

Simply go into their FX accounts, add their credit card information, and the funds will be ready within one business day. Investors can also use an existing bank account, a wire transfer, or an online check to fund their trading accounts.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Retail forex day traders use forex analysis or strategies to decide whether to buy or sell currency pairs. Some strategies are;

Scalping

Scalping is a trading method in which traders buy and sell currencies on an hourly basis with the intention of making tiny profits on each transaction.

Because scalpers rely so heavily on the outcome of the spread, it’s critical to have an excellent working relationship with market makers, who set the bid and ask prices for each currency pair.

Before determining which position to take, scalpers use technical analysis and pattern recognition tools to check direction and velocity.

Day Trading

The process of swapping currencies during a single trading day is known as day trading. Day trading strategies can be utilized in any market, although they are most commonly used in the Forex market. According to this trading approach, all trades should be opened and concluded on the same day.

No position should be open overnight to lessen the danger. Day traders monitor and manage their open deals throughout the day, unlike scalpers who are only interested in remaining in markets for a few minutes.

Make profit

Make a foreign exchange contract with a broker. Place your forex trades based on your strategy, with pre-determined entry and exit points. Remember to utilize risk management conditions like a take-profit or stop-loss order while trading.

Close your business and think about it. Stick to your trading strategy and quit the market when your anticipated stops are reached. Consider how you did so that you may do better with each deal you make.

Security for traders – What you need to know

Keep a close check on any transaction documents to keep an eye on your online account. Log into your online account on a regular basis or when you receive an e-statement alert from your broker to quickly review all transactions.

Any transactions that appear suspicious or unapproved should be avoided. Don’t share the computer or mobile device you use to access your online account with others.

Conclusion: The best Forex Brokers are available in Colombia

Trust be told, you may make a good livelihood from the stock market if you practice and follow effective risk management.

However, you should proceed with prudence and ensure that you are well-versed in currency market fundamental and technical analysis. You should also have a well-thought-out and proven trading strategy. Learn as much as you can about risk management.

Forex trading is the way of the future all over the world, and there are a variety of brokers and ways to help you in Tanzania. Before entering the forex market as a beginner, it’s a good idea to research the finest brokers to deal with and extensively research the foreign exchange market.

FAQ – The most asked questions about Forex Broker Colombia :

Is forex trading profitable in Columbia?

Forex trading is profitable for traders in Columbia if they pick the right forex broker. A trader’s entire forex trading experience will depend on his chosen broker. The broker should execute fast trades and offer the best underlying assets in the market. Besides, how traders make a technical analysis is also a factor that affects their profit-earning potential. So, the ultimate possibility of earning profits lies with traders.

How can traders get into forex trading in Columbia?

Traders can get into forex trading in Columbia once they choose their desired broker. Choosing the desired broker will allow a trader to sign up for a trading account. So, opening a live trading account in Columbia becomes possible for any trader. Then, they can fund their account and place forex trades to build wealth.

How does forex trading take place in Columbia?

Several brokers operate in Columbia that allow you to place forex trades. These brokers are regulated and have full licenses to operate and offer their services in Columbia. Traders can sign up with these brokers to begin forex trading in Columbia. These brokers allow access to forex assets such as USD, GBP, EUR, etc. Also, they offer you a lot of educational content to enhance your trading decisions.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)