The 5 best Forex Brokers and platforms in Congo – Comparison and reviews

Table of Contents

If you are new to forex trading, proceed with caution. Forex products are complex and dangerous. Thus they are not appropriate for everyone. You may quickly lose all of your money. If you’re not sure how forex trading works, this is the ideal guide for you. We have put together a list of top brokers operating in Congo as well as other trading tips to help you get started.

See the list of the best Forex Brokers in Congo:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

1. Capital.com

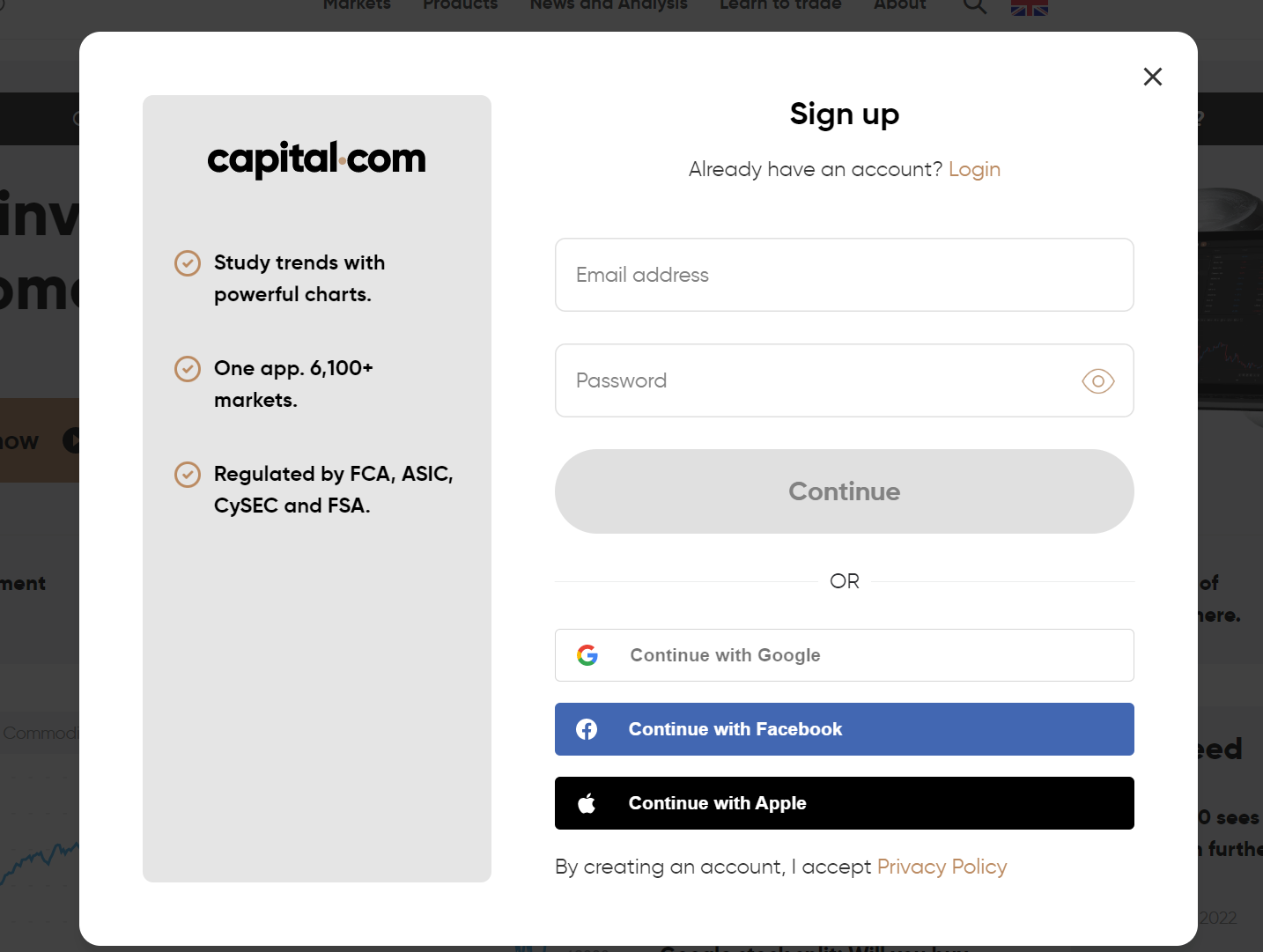

Capital.com was founded in 2016 and had over 500,000 registered clients. Regulated by the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, the Australia Securities and Investment Commission (ASIC) in Australia, and the National Bank of Belarus in Belarus.

Under the FCA and CySEC, Capital.com provides minimal forex CFD costs and gives consumers commission-free actual stock transactions (typically the UK and EU clients). The account registration process is simple. Email and live chat assistance are reasonable, with prompt and detailed responses.

On the downside of the stock market index, the selection of accessible products is restricted to CFDs (equity, index, crypto – the latter not available to UK clients -commodities, FX) and actual stocks, with hefty CFD costs. In some countries, clients do not have access to real stocks. There are no minor account base currencies available.

Capital.com features a good selection of instructional materials, including articles, videos, and a thorough lesson program, making it a good pick for beginners.

This instructional program consists of 28 lectures divided into five courses, with a final test to assess your development and financial understanding.

Its Investmate app, on the other hand, is quite helpful. It has a gaming-inspired design that allows you to study at your own speed while keeping track of your progress.

Several of these guides have sub-articles that go into even more depth, explaining terms and concepts beyond what an investor glossary would cover. Overall, Capital.com’s instructional program is among the top brokers in this area.

Capital.com has three mobile trading apps: an educational app called Investmate, The Capital.com app, and the MetaTrader 4 (MT4) app, accessible on the Apple App Store and Google Play Store for iOS and Android respectively. As a result of its user-friendly design and the multitude of standard functions with MetaTrader, practically all brokers provide the MT4 mobile app. The MT4 mobile app makes seeing and maintaining positions simple, but it does not offer algorithmic trading, which requires desktop software.

Capital.com gives you access to over 6,100 of the world’s most popular markets, including stocks, indices, commodities, FX, and cryptocurrencies. They provide ultra-competitive spreads, high-speed order administration, and a minimal minimum trading size since they have access to the world’s leading financial markets.

Capital.com charges no commission and has no hidden costs. They regularly provide you with live market updates and price notifications to stay up to speed on the most recent market data and accurate prices.

Capital.com stands out for its high-quality research, comprehensive instructional content, and cutting-edge online platform, an excellent alternative for novice and seasoned traders. Capital.com has fewer regulatory licenses and a smaller variety of markets than some of the finest brokers, yet it surpasses the industry average by a wide margin.

Advantages of Capital.com

- Capital.com features excellent charting and analysis tools.

- They provide some excellent market analysis.

- Traders enjoy an easy-to-use platform

Disadvantages of Capital.com

- Lack of basic data and other analytical tools such as pattern recognition

- It doesn’t have a banking license and doesn’t publish any financial data.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets was established in 2014 as a global forex broker. The Financial Markets Authority of New Zealand (FMA) and the Financial Services Authority of Seychelles (FSA) regulate the corporation.

BlackBull Markets was established as a premier broker that also provides retail trading solutions while maintaining its translation facilities in world trading centers such as London, the United Kingdom, and Malaysia, providing worldwide exposure. There are numerous options, including various conditions and assets to trade, all of which are backed up by instructional materials and programs for active traders.

BlackBull Markets is a fully registered broker that offers excellent trading conditions. It is one of the few brokers that offer large leverage, a nice trading environment, minimal spreads based on our study, overall professional trading, and education and research. The disadvantages include the lack of 24-hour support and the possibility of limited instruments.

Merits of BlackBull Markets

- There are a variety of basic currencies from which to pick.

- BlackBull Markets provides excellent customer service by phone, email, and live chat.

- Traders have express access to the MetaTrader platform as well using Balckbull Markets.

Demerits of BlackBull Markets

- Analyses are quite restricted.

- Its appearance is old, and it lacks features such as two-factor authentication and price notifications.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is a brokerage firm that began operations in 2009. It provides financial market services in 169 countries and has a user base of over 3.5 million people. In the Forex sector, RoboForex is the most well-known software developer.

The most reputable financial industry professionals see RoboForex as a trustworthy partner. Several significant accolades have been bestowed on the firm. FSC Belize has granted the RoboForex group of enterprises a worldwide license to provide services.

The broker services over eight hundred thousand traders from one hundred and seventy countries and assists in eighteen languages, emphasizing developing trading offerings through new technological solutions and a wide range of currency trading instruments.

Various regulations have been broken due to regulatory responsibilities to provide a safe and fair trade environment, which is also frequently assessed. The firm can be penalized if a violation or misleading occurs.

Additionally, RoboForex provides employer protection from negative balance, which protects your funds from being drained, and all traders’ cash is stored in distinctive accounts in significant institutions. The firm is a member of The Commission’s Compensation Fund, which offers insurance for traders, making it a safe bet.

RoboForex also developed a civil insurance policy with a capacity of 5 million EUR, which provides fraud protection that is unrivaled on the market, mistakes, carelessness, and various risks that might result in financial damages for clients.

RoboForex offers a variety of educational opportunities and the opportunity to polish your abilities and compete in trading competitions, which will help you improve your talents as well as raise your level.

There is also insight to trade and transaction records for up to a year and excellent research tools such as calculators, constructors of strategies, and the highly sophisticated capabilities found in the platforms given.

RoboForex’s review reveals a broker properly regulated with a diverse range of technology solutions that allow traders of diverse sizes and strategies to participate in trading, even if they are just getting started.

RoboForex provides instructional materials, analytical studies, and contests, demonstrating their tremendous help along with the method and resulting in earned confidence and speed development among the people they work for.

Pros of RoboForex

- Affiliate commissions begin at $5 per lot and increase from there.

- Withdrawals are made instantly

- Traders benefit from the tight spreads and pips as low as 0

Cons of RoboForex

- Each trading structure has its own price and charge structure.

- The terms and conditions may differ depending on the company and trading platform.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone Group has developed to become a top-tier participant in the online brokerage business since its inception in 2010, having built a highly competitive and feature-rich trade structure that focuses on FX, stocks, indices, metals, commodities, and even cryptocurrencies.

Pepperstone makes market access simple, allowing clients to concentrate on the more challenging challenge of making money in the markets. Pepperstone is a great option for traders looking for a small number of low-cost options, a variety of user interfaces and account types, and responsive customer care.

Pepperstone makes market access simple, allowing clients to concentrate on the more challenging challenge of making money in the markets. Pepperstone is a great option for traders looking for a small number of low-cost options, a variety of user interfaces and account types, and responsive customer care.

Advantages of Pepperstone

- Pepperstone provides access to trade ideas, market reports, and technological tools

- Withdrawals and deposits are both straightforward and free.

- Traders’ funds are kept in tier-one banks for better security.

- It is a good choice for copy traders as well as algorithmic traders because of the dual provision of cTrader and MetaTrader

Drawbacks of Pepperstone

- The platform’s interface is antique.

- They don’t have a two-step login process or price alerts.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a well-regarded forex trade platform, offering a simple and easy user interface designed to suit the demands of discerning traders. Clients may trade more than 500 assets on the IQ Option platform, including currencies, indices, commodities, and stocks.

IQ Option is an award-winning trade platform that has been lauded and recognized by the industry’s most respected specialists. It comes with a customizable platform that allows you to tailor it to your specific requirements, from chart type to color scheme.

Merits of IQ Option

- The IQ Option platform, unlike other brokers, is accessible in thirteen various languages.

- The platform at IQ Option allows you to trade a wide range of financial instruments and assets.

- It is a good choice for new traders because of the user-friendly interface

- Withdrawals can be made instantly using a variety of payment methods.

- A team of specialists that speak your native language is always available to assist you.

Demerits of IQ Option

- CFDs and Options are the only instruments accessible for trading.

- There are no binary options available to residents outside of the European Economic Area (only for professional traders and outside EEA countries).

(Risk warning: Your capital might be at risk.)

What are the financial regulations in the Democratic Republic of Congo?

Consumers are protected by financial regulation. A lack of broker regulation might result in subpar services and even financial loss. To prevent fraud, Congo brokers are regulated.

The operating capital of the agency and the account funded by the customers must be kept separate. If customer funds are used to do business, this is considered fraud. To prevent this from happening, legislation is essential.

As a new broker in the forex market, these financial regulations are set by the government to help ensure that your money and valuables are protected and secure and that there is room for transparency, freedom of choice to select the broker to enter business with, and also to know the dos and don’ts of the financial market.

Is it legal to trade Forex in Congo?

There is a common misperception that trading Forex on the Congolese financial market is risky. This is not true. Congolese forex traders are pretty active.

Congo allows forex trading because it is necessary to exchange currency to do business. Import and export and foreign investment all need and use forex.

While trading Forex, the essential thing to remember is to choose a licensed, safe, and reputed broker. Congo Forex trading is not prohibited, and several foreign online brokers provide favorable trading circumstances.

Security for traders – What you need to know

To invest in the Congolese currency market, you’ll need to find a reputable forex broker. Although the Congolese Forex market is not illegal, it is regulated. Therefore, you should use caution when entrusting your money to others.

Keep a watch on your online account and keep a tight eye on any transaction paperwork. To review all transactions swiftly, log into your online account on a regular basis or when you receive an e-statement alert from your broker. Be wary of any transactions that appear to be suspicious or unapproved.

Create a strong password that has at least 8 alphanumeric characters. Change it frequently, and don’t reuse the same password. Keep your security token in a safe place if your online broker gives you one.

Keep an eye out for unauthorized changes to your account information, such as your phone number, email address, or login password.

Type the website address (URL) or use a bookmark to access your broker’s website. Avoid visiting the website via a link in an email, a search engine, or a suspicious pop-up window.

For online trading, use a reputable and secure PC or mobile device. After you’ve finished your trade, always log out of the website or system.

Activate the auto-lock feature on your computer or mobile device to secure it; install reliable anti-virus, anti-spyware, and anti-malware programs and keep them up to date as new versions are released; configure a personal firewall.

Make sure your operating system, apps, software, and browser are all up to date. Ensure that your software is up to date.

Disable any wireless network functions such as Wi-Fi and Bluetooth that are not used for network services. When using Wi-Fi, use encrypted networks and disable any superfluous Wi-Fi connection settings.

When downloading and installing software and programs onto your computer or mobile device, always keep data security and privacy in mind.

When an unexpected pop-up screen or window appears, when your computer responds slowly, or when unexpected actions or information are requested, don’t log in to your online account.

These steps guide and secure traders from scams and loss of money.

How to trade Forex in Congo – A comprehensive tutorial

Open an account for Congo Traders

You can open a new account on the forex broker’s website. Some forex brokers need a minimum deposit in order to open an account. These brokers also provide a variety of account kinds, each with its own minimum deposit and spread width requirements. Choose the one that applies to you the most.

Open a spread betting or contract for difference (CFD) trading account. To trade the price fluctuations of currency pairs, you may establish a real or demo account.

(Risk warning: 78.1% of retail CFD accounts lose money)

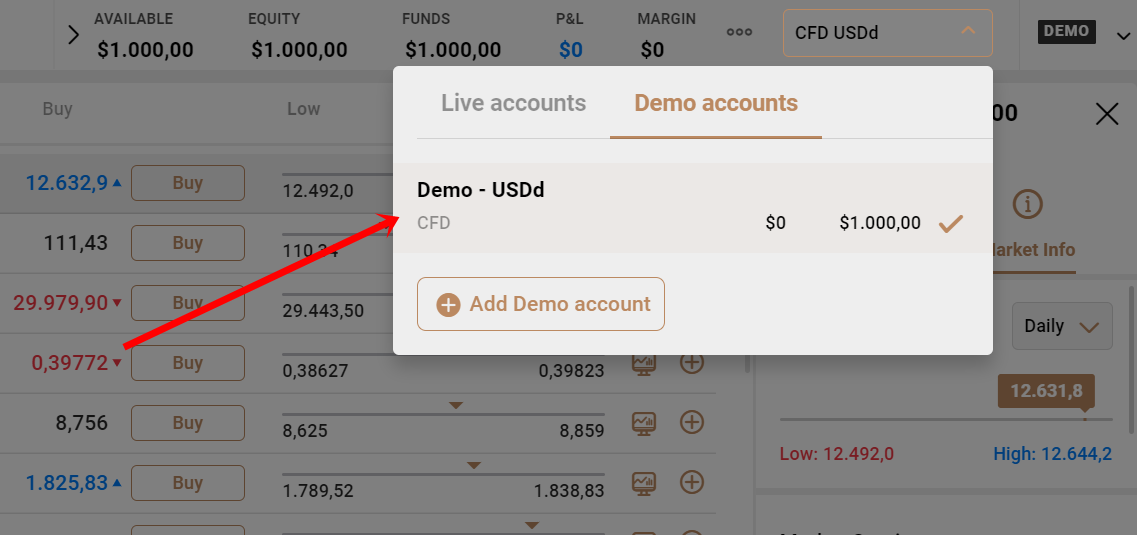

Start with a demo account or real account

Traders can utilize a trial account to simulate a real-world trading environment without risking their own money. It will let traders get started with free online trading and practice before they deposit real money.

You can open a new account on the forex broker’s website. Some forex brokers need a minimum deposit in order to open an account. These brokers also provide a variety of account kinds, each with its own minimum deposit and spread width requirements. Choose the one that applies to you the most.

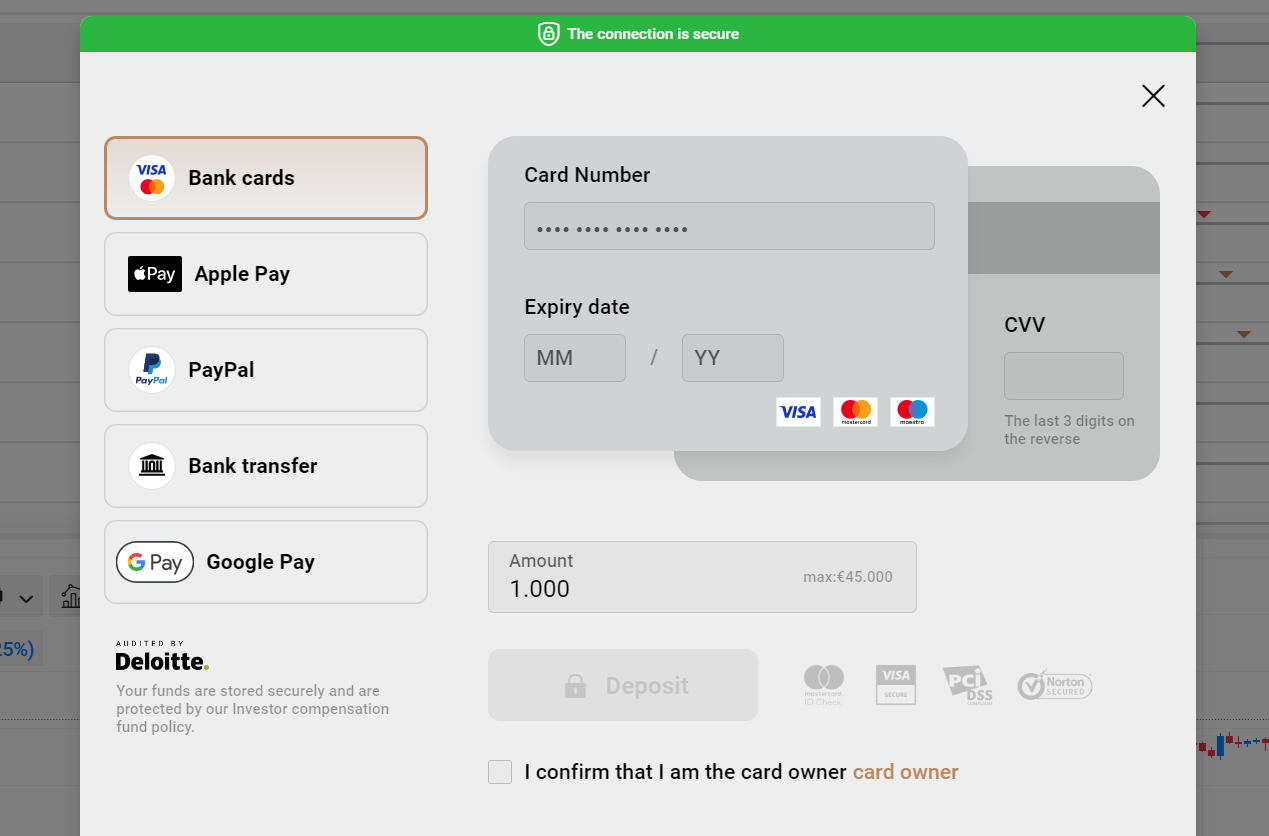

Deposit money

To start trading forex, you’ll need to transfer money after you’ve created an account. You may choose your currency and fund your account in a variety of methods depending on the broker you choose. You can use wire transfers, debit cards, and electronic payment methods like Paypal and Skrill to fund your account.

Simply said, they need to enter their credit card information into their FX accounts, and the funds will be ready within one business day. Investors can utilize an existing bank account, a wire transfer, or an online check to finance their trading accounts.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Forex traders utilize forex analysis to determine whether to trade currency pairs. It might be complicated, needing the use of charting software. It can be fundamental as well, depending on current events and economic statistics. A few strategies used in trading are;

Trend Trading

This method entails investing in the path of the present trend on the market, as the name implies. Traders are to identify the underlying direction, lifespan, and strength of the trend in order to do so in an effective manner

These indicators will indicate the strength of the present trend and the moment the market is likely to reverse. The trader doesn’t need to be aware of the precise moment or movement of the trend reversal in this strategy; all they are required to know is that quitting their existing position allows them to secure profits while minimizing losses.

While the market is on a downward trend, there will always be tiny price variations that go counter to the overall trend.

News Trading

When major economic facts and information make the news, news trading is a technique that tries to profit from market opportunities that arise.

There is no such thing as a more essential event than another. Rather than focusing on a single element, traders look at the link between them as well as market conditions.

Economic calendars and indexes such as the consumer confidence index (CCI) are used by new traders to predict when a shift will occur and in which direction the price will move.

Make profit

Make a foreign exchange contract with the aid of a broker. Make forex trades in accordance with your strategy, using predetermined entry and exit points. Remember to utilize risk management conditions like a take-profit or stop-loss order while trading.

Close your business and think about it. Stick to your trading strategy and quit the market when your planned stops are met. Consider how you did so that you may do better with each deal you make.

Conclusion: The best Forex Brokers are available in Congo

Forex trading is the way of the future worldwide, and even in the Democratic Republic of Congo, some numerous brokers and platforms can assist you. As a beginner, it is always advisable to research the best brokers to work with and thoroughly study the forex market before taking the plunge.

FAQ – The most asked questions about Forex Broker Congo:

Is forex trading possible in Congo?

Congo is keeping up with the world economies by offering traders the best investment opportunities. So, if you are a trader in Congo, you can trade forex and other underlying assets in this nation. Interestingly, several famous brokers offer the best services to traders in congo. These include Capital.com, BlackBull Markets, etc. Thus, you can choose a broker that fits your needs in Congo.

What should I remember before choosing a broker in Congo?

Before choosing a broker in Congo, you must remember to pick only a reliable one. Remember to check whether the broker is regulated or not. Besides, you should also try to test the trading platform’s features before you decide to sign up with one. Otherwise, trading might turn out unfavorable for any trader. As a result, you would make losses while trading forex in Congo and witness fewer profits.

How can I test a trading platform in Congo?

You can test a trading platform in Congo by signing up for a demo account. The brokers that operate in Congo allow traders to sign up for a demo account for free. In addition, most brokers will allow you to use the trading platform for free for 30 days. Thus, you can use all features and see whether the trading platform fits your needs.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)