4 best Forex Brokers and platforms in Croatia – Comparison and reviews

Table of Contents

Croatia is a small country on the Adriatic Sea that offers diverse landscapes and a thriving economy. As the world becomes increasingly globalized, many people are interested in trading currencies to take advantage of exchange rate fluctuations. The foreign exchange (forex) market is estimated to be worth trillions of dollars.

See the list of the best 4 Forex Brokers in Croatia:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC, SCB | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Userfriendly platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

There are different brokers to choose from, each with advantages and disadvantages. When it comes to choosing a forex broker, there are many factors that you need to consider. It would be best to find a broker that offers the products and services you are interested in trading. A broker that has a good reputation and is regulated.

Here is a list of 4of the best forex brokers and platforms in Croatia:

- Capital.com

- BlackBull Markets

- Pepperstone

- IQ Option

1. Capital.com

Capital.com is a user-friendly, easy-to-use app that allows traders to buy and sell stocks, commodities, currencies, etc. Capital.com has an intuitive design and powerful tools. Besides, Capital.com makes online trading simple and fun.

The app also offers many features, including margin trading, short selling, and over 3,000 CFDs on popular assets. In addition, Capital.com provides a wealth of educational materials to help traders learn about the markets and make informed investment decisions.

Advantages of Capital.com

- Educational materials are available to traders on the Capital.com trading platform.

- The platform is user-friendly

- Trading of Capital.com is Commission free.

Disadvantages of Capital.com

- Few symbols are available to traders to trade.

- United Kingdom traders are not accepted on Capital.com.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a CFD and Forex broker that offers clients access to global markets. With over 16 years of experience, BlackBull Markets is one of the world’s leading brokers. BlackBull Markets offers its clients a wide range of products, including indices, commodities, shares, and Forex.

BlackBull Markets is licensed and regulated by the Financial Conduct Authority (FCA). The FCA ensures that the company operates in a safe and secure environment.

Pros of Blackbull Markets

- Traders are offered low forex and CFD fees on the Capital.com trading platform.

- Educational materials are provided to traders.

- The account opening process is easy and fast.

- BlackBull traders have access to MetaTrader suite trading platforms.

Cons of Blackbull Markets

- Customer support is not available on weekends.

- Traders are charged withdrawal fees at every withdrawal.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone is an Australian online forex broker. It was founded in 2010 by two traders, Owen Perks and Russell Barbara. Pepperstone has several awards, including being named the fastest-growing company in Australia in 2016 by the BRW Fast 100.

Pepperstone offers over 60 currency pairs and CFDs on stocks, indices, precious metals, and energy traders. It is one of the few brokers that offer Bitcoin trading. The company is regulated by the Australian Securities and Investments Commission and is a member of the Australian Financial Services (AFS) and the International Financial Services Commission (IFSC).

Merits of Pepperstone

- The company offers MT4 and MT5 platforms and also a mobile app.

- Pepperstone provides 24/5 customer support to traders.

- The pepperstone trading platform is user-friendly.

- Pepperstone is a safe trading platform because it is regulated.

Demerits of Pepperstone

- Pepperstone customer service department is closed on weekends.

- The educational materials provided by Pepperstone do not have an assessment to monitor traders’ progress.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option is a binary option (only for professional traders and outside EAA countries) broker well known for being user-friendly. It has been operating since 2013 and has a license from the CySEC regulator. The company is based in Cyprus and is regulated by the CySEC. This authority is known as one of the most respected and strictest regulators in the world.

Also, the platform offers a wide range of tradable assets, including stocks, commodities, currencies, and indices. The minimum deposit amount is $10. The company has more than 10 million registered users from all over the world

Advantages of IQ Option

- IQ Option provides you with the necessary tools and resources to trade successfully.

- IQ Option offers its traders personal support and assistance.

- It provides a wide range of options for traders to trade from, thus giving you more fantastic choices and flexibility.

- It also provides opportunities for hedging, which can reduce your risk exposure.

Disadvantages of IQ Options

- MetaTrader5 and MetaTrader 4 trading platforms are not available on IQ Option.

- IQ Option does not offer its services to traders in the United States.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Croatia?

Croatia’s accession to the European Union on July 1, 2013, brought with it a series of significant regulatory changes for the country’s financial sector. The most significant change was the adoption of the EU’s Directives on Financial Services, which harmonized the regulation of Croatia’s banking, securities, and insurance sectors with that of the rest of the EU.

The banking sector in Croatia is undergoing a period of profound transformation. In response to the global financial crisis, a range of new financial regulatory measures have been introduced in Croatia to enhance the stability of the Croatian banking system.

Three principal regulators cover Croatia’s financial institutions. They are:

- The Croatian National Bank

- The Croatian Financial Services Supervisory Agency

- The Croatian Agency for Deposit Insurance

Tasked with regulating, overseeing, and resolving problems in the Croatia Banking sector, the Croatian National Bank is Croatia’s main banking primary regulator. This body is also responsible for managing applications and implementing the Croatian Credit Institutions Act. The primary aim of CNB is to keep prices stable and keep the overall Croatian financial system stable.

The Croatian Agency for Deposit Insurance is a financial institution tasked primarily with the following functions: managing the nation’s deposit insurance system, managing the Rehabilitation Fund, and the Deposit Insurance Fund. The agency is also responsible for handling the compulsory liquidation procedures applied to credit institutions in line with applicable regulations.

The Croatian financial sector is also regulated by the Croatian Financial Services Supervisory Agency (CFSSA). The CFSSA is a government agency responsible for regulating the financial services industry in Croatia. The CFSSA was established in 2001 and is a member of the European Union’s Single Supervisory Mechanism (SSM).

The CFSSA is responsible for the following:

- Regulating the financial services industry in Croatia

- Monitoring and supervising financial institutions and intermediaries in Croatia

- Promoting financial stability and consumer protection in Croatia

The Croatian kuna is the official currency of Croatia. The international abbreviation for the Croatian kuna is HRK.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders in Croatia – Important facts

Since 1994, securities trading has gradually increased since the introduction of the Croatian kuna. In 2002, the Zagreb Stock Exchange (ZSE) started functioning as an organized securities market, and over time it has become one of the most liquid markets in Central and Eastern Europe. The ZSE offers a well-developed system for trading fixed-income securities, warrants, and structured products. The infrastructure is secure and efficient, with tightening regulations providing better protection for traders and investors.

Croatia is a beautiful country in the heart of Europe, and it is also a popular destination for forex traders. Unfortunately, Croatia is also a prime target for online criminals. Because forex traders often have large sums of money at their disposal, they are a target for cybercriminals.

There are a few things that Croatian forex traders can do to protect themselves from online crime:

- You must get your computer and use strong passwords to keep them secret.

- Secondly, it is advisable to use a good antivirus program and keep your software updated. Finally, it would be best to do adequate research on the forex trading platform you want to trade on. Ensure the broker is recognized outside Croatia and the broker is regulated by reputable bodies.

Is it legal to trade Forex in Croatia?

Croatia is a part of the European Union, and forex trading is legal. The Croatia National Bank (CNB) oversees all forex activity in the country and is responsible for regulating financial institutions and reporting any suspicious or illegal behavior. Forex brokers in Croatia must be registered with the CNB and are subject to periodic inspections to comply with regulatory requirements.

You can trade Forex through a broker or a trading platform. Several reputable brokers operate in Croatia, and traders can start by demo trading to get comfortable with the process.

Forex trading is legal in Croatia. There are a few restrictions, however. Forex brokers in Croatia cannot offer services to Croatian citizens unless they have a license from the Croatian National Bank (CNB). Furthermore, forex traders in Croatia cannot use leverage exceeding 50:1.

How to trade Forex in Croatia – A guideline for traders

Forex trading is buying and selling currencies to make a profit. It is one of the most popular forms of trading and can be done through various platforms, including online brokers and exchanges.

There are several benefits to Forex trading. Forex trading is a very liquid market, meaning that you can buy and sell currencies 24 hours a day, five days a week. There are many strategies that you can use when trading Forex.

Croatia offers several ways for residents and visitors to trade Forex. You can open a live trading account with just a few hundred dollars or try out a demo account. The leading platforms used in Croatia are MetaTrader 4 and cTrader, desktop applications. Most brokers also offer mobile apps so that you can trade on the go.

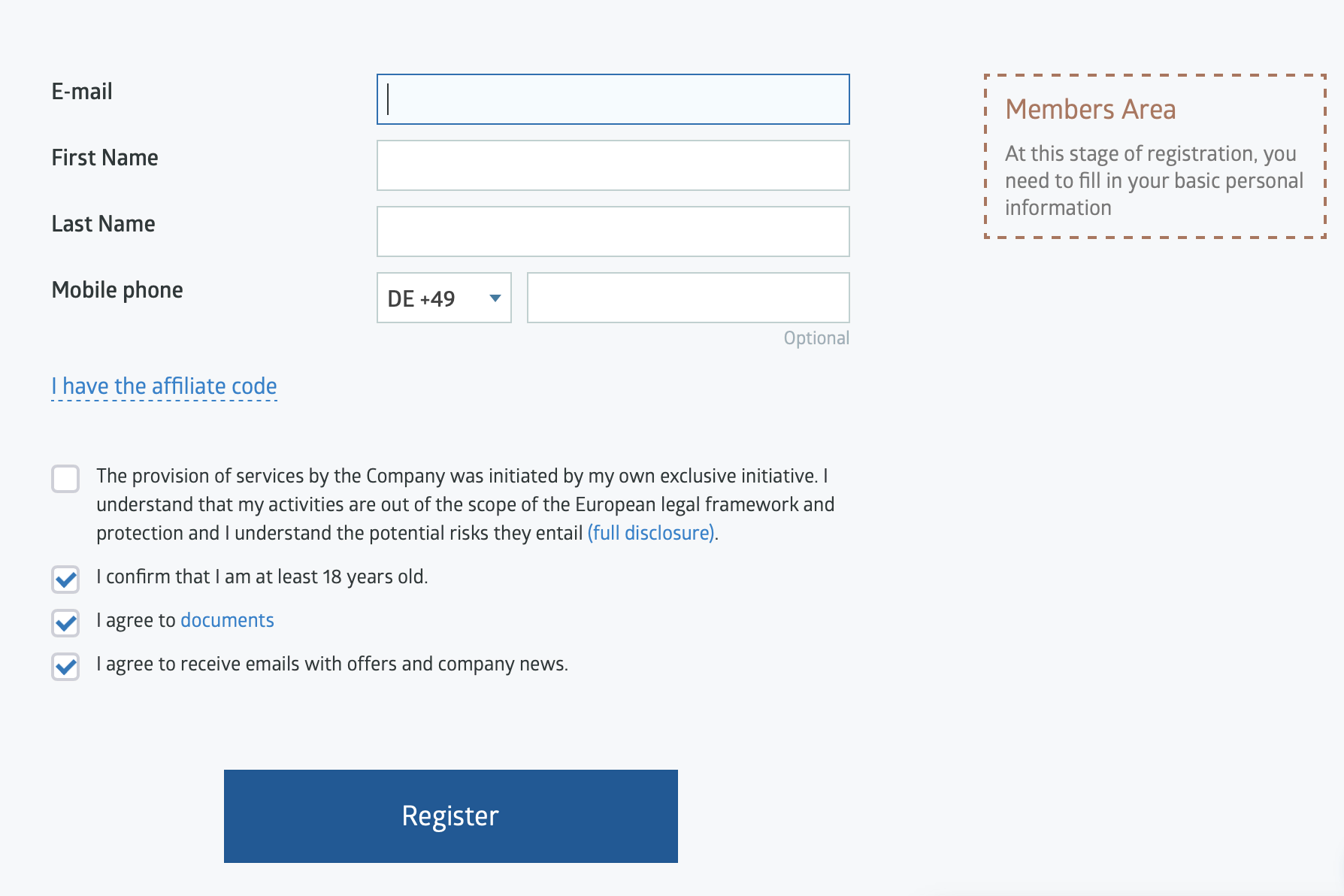

Open an account for Croatian traders

If you want to trade in the Croatian market, you need to open an account with a Croatian broker. The process of opening an account is relatively simple, and most brokers offer a variety of account types to suit your needs.

Before you open an account, you will need to decide which type of account is best for you. There are two main types of accounts: cash accounts and margin accounts. A cash account allows you to trade with the money that you have deposited in your account. A margin account allows you to borrow money from the broker to deal with. Using a margin account can be risky, so be sure before you do it.

As a newbie in the forex market, you have to open an account before you can start trading. To open an account, you need to follow some basic steps. First, you need to find a reputable broker who offers services to traders in Croatia. Do your research online and read reviews from other traders to find the best broker for you.

Once you have found a broker, you will need to open an account and fund it with your chosen currency. Make sure you understand the trading terms and conditions before opening an account. When you want to open an account, you will be asked for two primary documents: your proof of residency and a valid identification card.

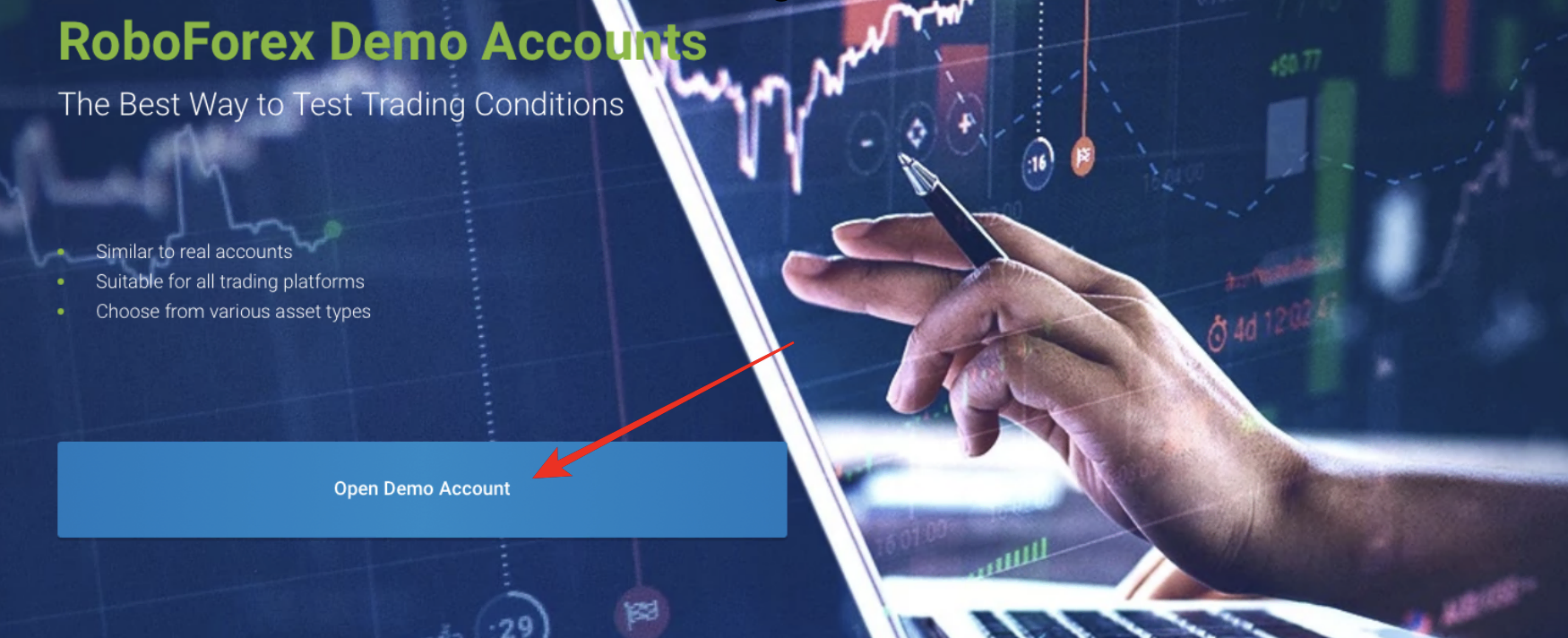

Start with a demo account or a real account

When you are ready to start trading, you should choose a platform and open an account. A demo account is an excellent way to learn how the system works without risking money. You can trade using virtual funds in a simulated environment. When you feel comfortable with the platform and how it works, you can switch to a real account and start trading with your own money.

Deposit money

After opening an account on the trading platform of your choice, the next step is to fund the forex account. There are several ways to support your account, but one of the most popular ways to deposit money into it is through bank transfers, debit cards, or payment platforms such as PayPal.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

Use analysis and strategies

Forex trading is buying and selling currencies to make a profit. Unlike stocks, forex trades can be closed at any time, making it a more flexible investment.

Forex traders use technical analysis to identify patterns in past price movements and then use those patterns to predict future trends. In this way, they can make informed decisions about when to buy or sell a currency pair. While no strategy is 100% effective, a well-rounded approach will give traders the best chance for success. These strategies include:

Position trading

Position trading is a strategy used by forex traders where the trader holds a security position for an extended period, hoping to profit from small price changes.

This trading style generally requires a more extensive account size because the trader is holding onto the stock for a more extended period and therefore faces increased risk. For this reason, position traders usually rely on technical analysis to find symbols that are likely to move in their desired direction.

Position traders often use limited orders to get the best price and protect their profits.

Scalping

Scalping is a strategy used by forex traders, where the goal is to earn small profits by buying and selling quickly. The idea is to buy at a lower price and then sell it a short time later at a higher price.

To scalp, you need to make quick decisions and have a firm understanding of market trends. It would help if you were also comfortable taking risks, as scalping involves trading rapidly.

Day trading

Day trading is the process of trading within the same day. It usually occurs in the forex industry and is a form of active investing.

Day traders typically buy stocks hoping that the store will go up in value and then sell the stock later in the day before it goes down in value. This strategy allows traders to profit whether the stock price goes up or down.

Make profit

Making a profit in forex trading may seem difficult at first. But if you are armed with the correct information and tools, it can be a very profitable endeavor. To make money trading currencies, you need first to understand how the forex market works and what factors influence currency prices.

You also need to develop a sound trading strategy that fits your personality and risk tolerance and diligently stick to it. When you have the appropriate information, hard work, and patience, you can make a comfortable living trading currency.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Croatia

This article profiled 4 of the best forex brokers and platforms in Croatia. Whether you are just getting started in Forex or looking for a more sophisticated platform, these five brokers will have something to offer you. Croatia is a great place to invest, and Forex is a great way to profit from the country’s economy.

FAQ – The most asked questions about Forex Broker Croatia :

Which forex broker in Croatia offers fewer fees to traders?

Out of all the brokers operating in Croatia, five do not charge hefty fees and commissions from traders. You can enjoy trading with BlackBull Markets, IQ Option, Capital.com, RoboForex, and Pepperstone, as they charge very low fees and commissions from traders.

They allow you to enjoy the maximum fruits of your investment without paying the platform much.

Why should a trader choose a regulated forex broker in Croatia?

A trader should always choose a regulated forex broker in Croatia to avoid the possibility of getting scammed. A regulated broker will always be responsible for its activities; thus, there are fewer chances of duping the investors. Thus, picking the regulated brokers will ensure the safety of the forex trader.

Here is a list of five well-regulated forex brokers.

BlackBull Markets

IQ Option

Capital.com

Pepperstone

RoboForex

How can I sign up with a forex broker in Croatia?

You can sign up with a forex broker in Croatia by logging on to the website or downloading the application. Then, you can click on the ‘signup’ option and enter your details. Clicking on submit will allow you to sign up. Once the broker confirms your identity, you can initiate trading.

Last Updated on March 31, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)