3 best Forex Brokers and platforms in the Czech Republic – Comparison and reviews

Table of Contents

Trading forex is nothing new. It is nothing new in the Czech Republic today. Many Czech Republican traders trade forex on international forex brokerage company platforms. Opening an account with a broker is easy.

You are on this site because you want to know where to begin forex trading. To begin forex trading, you need to have a broker platform that trades Forex. This article will show you how to start Forex and make a profit.

See the list of the best 3 Forex Brokers in the Czech Republic:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC, SCB | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Userfreindly platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

The four best 4 forex brokerage companies are below.

- Capital.com

- BlackBull Markets

- Pepperstone

1. Capital.com

Capital.com is known as one of the technologically advanced brokers that started in 2016. The broker is well-known in Europe and has traders across the globe. Capital.com has licenses from FCA in the United Kingdom, CySEC in Cyprus, SCB in the Bahamas, and ASIC. These licenses make the company a trusted one for traders.

Capital.com makes available tutorials, videos, articles, and tests that traders use to strengthen their knowledge about forex trading. The broker educates its traders through videos and tutorials and then tests their knowledge of what they have learned so far through the test. The educational material gives room for the improvement and development of the traders.

Capital.com has a MetaTrader platform. The platform is available on computers and smartphones. Trading on these devices provides the same trading experience. It is easy to open an account on the MetaTrader 4 platform.

After registration, traders can use either the demo account or the live accounts provided on the platform. There are two live accounts available for use on Capital.com’s platform. The standard account and the Plus account.

Capital.com is a commission-free account that offers no commission to traders on either of the two accounts. The standard account has an initial deposit of $20 by credit card. Traders of both accounts can trade with different assets provided on the platform, from CFDs, Crypto, and ETFs.

Pros of Capital.com

- No commission percent on its platform

- Capital.com has low trading fees

- Capitil.com offers its traders a demo account that they can use for a long time.

- Traders can enjoy no deposit fee

Cons of Capital.com

- No clients from the US

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a famous forex brokerage company. One of the reasons for this is that it offers quick market transactions. It offers tradable instruments from ETFs and CFDs.The company started in 2014 with its headquarters in New Zealand. It is under the license of FMA and FSA.

There is the provision of reliable market resources with the platform. BlackBull Markets does not provide clients with educational resources, but its market resource is very quality. Traders can trust it to know how price competition is on the brokers’ platform.

The account types available for trade are the ECN standard account, the Prime account, and the ECN institutional account. The standard account owners can start trading with the initial amount of $200, the Prime account from $2000, and the institutional account owner from $20000. All the different accounts operate on other spreads and have different commission percentages.

The standard account has zero commission, the Prime account has a $6 commission, and the institutional account has a negotiable commission amount.

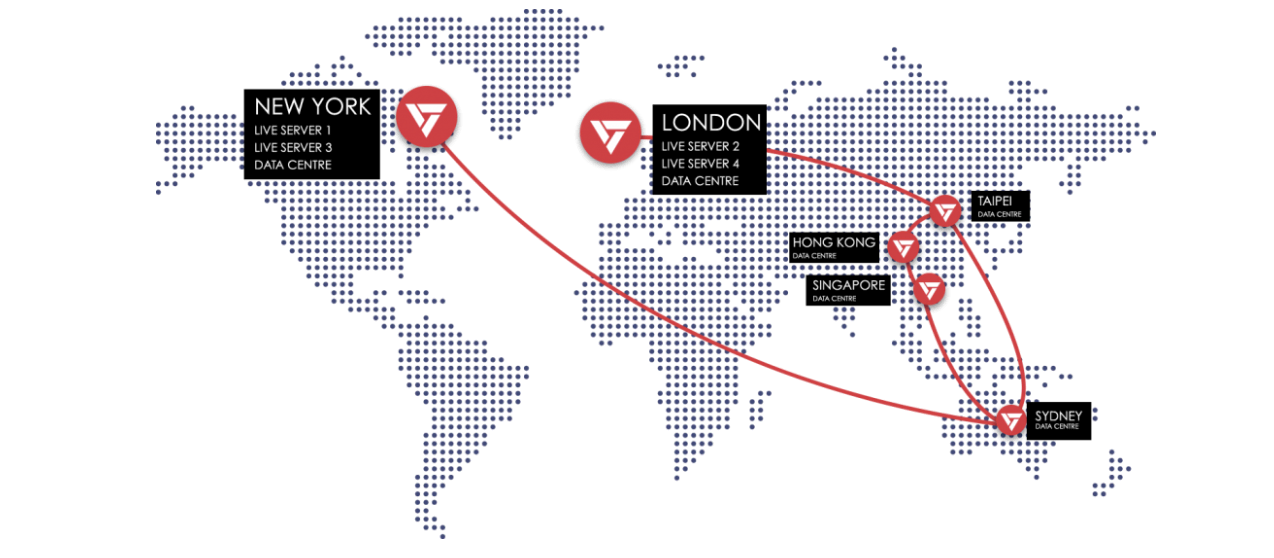

BlackBull Markets server is connected to one on Wall Street. Traders can carry out transactions in a matter of milliseconds. The transaction speed makes trading on the platform to be swift for traders.

The mobile app and desktop web versions are available for download. Traders enjoy the same trading experience on both devices. BlackBull Markets has MetaTrader platforms and WebTrader platforms.

Benefits of BlackBull Markets

- BlackBull’s market resource is trustworthy.

- Quick transactions thanks to its server connections

- There are MetaTrader platforms

Detriments of BlackBull Markets

- Educational resources are not offered on the platform

- Customer support works only six days a week.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone started in 2010 with the HQ in Australia. It is a popular forex broker used by many forex traders worldwide. The regulators ensure that the broker offers favorable trading conditions to its clients.

Currently, the company is under the regulation of:

Pepperstone tradable assets include Commodities, currency pairs, and stocks. Clients on the brokers’ platform can trade these assets with low tradable fees.

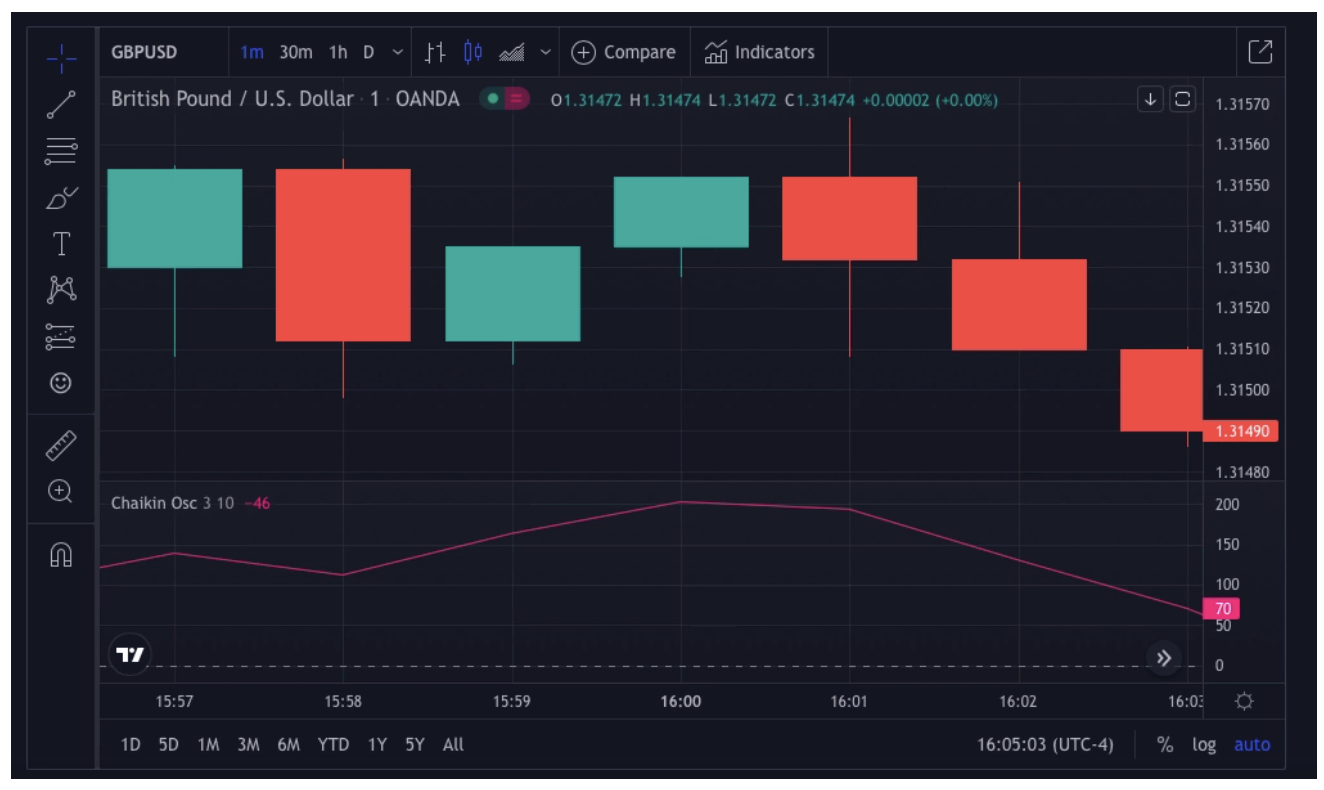

The brokerage company offers four different platforms to traders. A Trading View platform provides a good trading experience to traders. There are MetaTrader 4 and MT5 platforms available. MetaTrader platforms are good because traders can perform multiple functions on them. Lastly, a cTrader platform is even better than an MT platform.

Pepperstone has a demo account that traders can use. Although it expires after a month, traders can use it before its expiration date. Pepperstone has two account types that traders can pick.

It has a standard account with a minimum deposit of $200 and a spread that begins at 1.1. However, traders with a standard account do not get any commission, unlike the razor account users. Its Razor account starts with a minimum deposit of $2000, a commission on every trade, and a spread that begins from 0. Professional traders usually use the razor account.

Pepperstone rewards old traders who refer people to become traders on their platform.

Pros of Pepperstone

- Traders can withdraw with ease

- The razor price spread is very competitive

- Plugin for the MetaTrader platform

- Readily available customer support

Cons of Pepperstone

- The demo account expires

- There are no tests that clients can use to test themselves.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

What are the financial regulations in the Czech Republic?

The financial regulator in the Czech Republic is the Czech National Bank. The law that holds its existence and duties is Act 6 of 1993 Coll. The CNB is responsible for regulating the financial market in the country.

It supervises financial institutions in the country too. These financial institutions include commercial banks, capital markets, mortgage banks, pension institutions, and payment system institutions. There is no existing financial institution that the CNB does not license.

The CNB regulates forex brokers in the country. There is a provision for an office in the Ministry of Finance. This office regulates local brokers in the Czech Republic. Local brokers that the Czech National Bank does not restrict are not to be trusted.

Security for traders from the Czech Republic

The Czech Republican trader can give security to themselves by trading with local forex brokers with regulations with the Czech National Bank. Such broker platforms are under the supervision of the CNB. Such a broker platform will have better trading conditions for traders.

If you want to trade Forex locally, do not with forex brokers that do not have a marketing license from the CNB. It is advisable not to do so because the broker platform cannot be responsible for any ill-treatment its traders face on it. There is no external body that supervises it.

The same goes for trading on international forex brokers. If they are not under any supervision of any international monetary organization, do not trade on it. Global financial regulators include CySEC, FCA, and BaFin. These organizations ensure that the brokerage company gives fair trading rates to traders.

(Risk warning: 78.1% of retail CFD accounts lose money)

Is it legal to trade Forex in the Czech Republic?

Forex trading in the Czech Republic is legal. There is a local framework that regulates forex brokers in Czech. Suppose you are a Czech Republican forex trader; there is no need to ponder if it is appropriate to trade Forex in your country because the CNB permits forex trading. There are even local-based forex brokers existing in the country. The Czech National Bank regulates local-based forex brokers.

Trading forex internationally has no exemptions because traders can also trade Forex on international forex brokers. The country’s authority advises that citizens should trade on broker platforms under the regulation of international regulatory bodies. This is because such platforms are under supervision and have a legal framework for their existence.

How to trade Forex in the Czech Republic – A guideline

Open an account for the Czech Republic trader

Opening a Czech Republican trader’s account is the first thing to be done if you want to start Forex. Once you have decided on the brokerage company that you want to trade with, you need to open an account on their platform. It is easy to open an account on any broker platform. You will need to have ready proof of identity and residency for your account to be registered on the platform. These two documents are vital for your account to be verified.

Start with a demo account or a real account

After you are done with registration, it will take 24 hours before you can trade on the brokers’ platform. Once this has been done, you can start with either the demo account or the real account, whichever you want. But as a new trader, you should start with a demo account. The demo account will help you familiarize yourself with the chart, spread, and position on the chart.

Deposit money

Trading with a real account will require that you deposit money into your forex account. You cannot trade with an empty account. There is a minimum amount that you can deposit into your forex account as a trader. To deposit into your account, you have to select a payment method. This payment method can be by direct bank transfer, a debit card, or a credit card.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

Use of analysis and strategies

Using analysis and strategies is essential as a forex trader. Traders should have a particular tactic that they make use of during trading. Strategies can help know how the spread moves, when the best time is the open trade, and when the best time is to close a trade. Some of these analyses and strategies are below.

Scalping

Scalping is a forex strategy that involves opening more than a single trade. This is done only for a while because the trader wants to make multiple profits from the open trades. The profit made here might not be much, but it is a good strategy.

Day trading

Day trading is another strategy used by forex traders. It involves opening trade in a single day and closing it at the end of that day. The trader stays in the same position on the chart for a day. It is also a short-term strategy used by forex traders to make money.

Position trading

One can say position trading is similar to investing because it stays in the same position on the forex chart for more than a day. The trader can stay up to years in the same trading position. The trader tries to notice long-term changes in the market.

Make profit

Traders that are in the correct position when the primary market ends are the ones that make a profit in Forex. If you have a strategy, you can use it to analyze market movement and then know the best place to mark your trading position.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in the Czech Republic

With the Czech Republic having regulatory institutions that control local forex brokers, citizens can trade Forex locally in the country. The CNB controls and supervises forex brokers in the Czech. If a local broker does not have a license from the CNB, it means that it is not legally recognized, and you shouldn’t trade with the broker.

Hopefully, with the information provided in this article, if you want to trade Forex internationally, you already know where to start and how you can open a forex account with international brokers. Trading forex internationally as a Czech citizen is allowed. You can trade as long as you do so with a broker with licenses or licenses.

FAQ – The most asked questions about Forex Broker Czech Republic :

Is forex trading with a forex broker in the Czech Republic possible?

Yes, a trader can trade with a forex broker in the Czech Republic. There are a lot of forex brokers operating in the Czech Republic who offer traders the best services. However, if you want the best, you can sign up with one of the following four forex brokers.

Pepperstone

BlackBull Markets

Capital.com

What things does a forex trader need to consider when choosing a forex broker in the Czech Republic?

A trader must consider these factors when choosing a forex broker in the Czech Republic.

Services offered by the broker

Customer support

Features of the trading platform

Tools and technical indicators offered

Number of underlying assets available

Reviews of the broker

Whether the broker is regulated or not

So, a trader who picks his forex broker cautiously enjoys a great deal when trading forex to mint money.

Does a Czech Republic forex broker offers traders a demo account?

Yes, a Czech Republic forex broker offers traders a demo account. You can use a demo account on the leading trading platforms, such as the four abovementioned platforms. These platforms offer you a free demo account for 30 days. You can continue to use the demo account after 30 days, but you would need to pay fees to access it.

Last Updated on January 3, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)