The 5 best Forex Brokers & platforms in the Dominican Republic – Comparison & reviews

Table of Contents

The Dominican Republic is the home to numerous professional and beginner forex traders. The number of traders continues to grow each day. If you are looking to get into the forex trading business, thoroughly read this article to get an idea of which broker best suits you.

See the list of the best Forex Brokers in the Dominican Republic:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the 5 best forex brokers in the Dominican Republic:

1. Capital.com

This firm was founded in England in 2016 but only began operating in 2017. Additional offices are located in Gibraltar, the Seychelles, Cyprus, and Australia. Their inexpensive costs and excellent customer service are very popular in the forex trading market.

The Cyprus Securities and Exchange Commission, the National Bank of the Republic of Belarus, and the Australian Securities and Investments Commission regulate this corporation.

Capital.com only has one kind of account. It’s known as the Standard Account. The account opening process with this broker takes less than five minutes. You just need to provide some basic information about yourself and a valid ID to authenticate your account.

To be able to start trading live with Capital.com users must first make a $20 deposit. When using a bank to add funds, clients must invest $250. You can choose from five different base exchange rates: PLN, USD, USD, EUR, or GBP.

On the broker’s website, new Forex traders will find many training programs and tutorials. Everyone has access to a trial version account. Customers may utilize the demo account to get to know the trading system and learn about the wide range of tools and the forex market’s activities.

Capital.com’s trading desk is compatible with mobile tablets or phones for traders who wish to trade while they’re out and about. Customers have the option to trade using their smartphones or tablets. The trading desk is available in over 20 languages, including Finnish, English, Chinese, Russian, Arabic, Thai, and Polish.

Customer care is available 24 hours a day, seven days a week. You can get assistance via phone, email, or live chat.

Summary:

- A payment of $20 is needed to open a live account.

- There are no additional costs to pay.

- The NBRB, FCA, and CySEC have all approved the brokerage.

- The spread begins at 0.6 points.

- The broker accepts payment options are bank transfers, WebMoney, iDeal, Qiwi, MasterCard, Visa, Skrill, and Neteller.

Disadvantages of trading with Capital.com

- Consumers may only choose from five different account currencies, which is one downside of trading with Capital.com.

- Another factor to consider is that, although the verification procedure is not difficult, it must be completed within fifteen days. If you do not send them a valid ID in the time range specified, Capital.com has the power to delete your account.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

Since its inception in 2014, BlackBull Markets has established itself as a leading foreign currency trading organization. In addition to its main office in NZ, the business maintains offices in the UK, Malaysia, NY, and also Indonesia.

The Financial Services Authority of Seychelles and the Financial Markets Authority of New Zealand both regulate this broker.

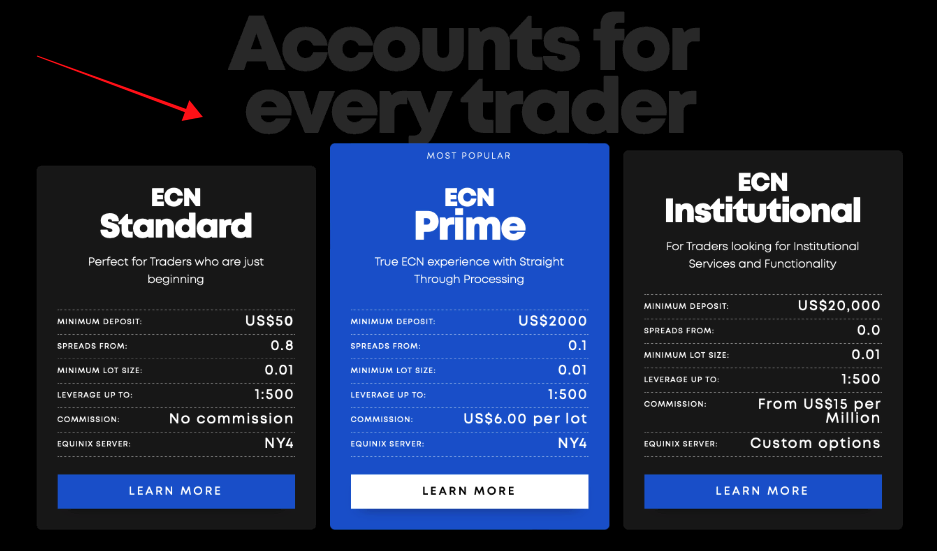

Customers who want to do business with BlackBull Markets can open a Standard or Prime Account, depending on the scope of their trading activities. When you compare these two accounts, you will see that the spreads, the amount of the needed minimum deposit, and the commission rate are all different.

When you create a Standard Account, you will be asked to deposit at least $200 to proceed. Prime Accounts need to deposit $2,000 in their wallet. Spreads start at 0.01 for Prime Accounts but can be as low as 0.8 for Standard Accounts. When it comes to price and execution, Prime Accounts are given first consideration. Standard Account customers will not be charged any extra fees. Customers who have Prime Accounts must pay a $6 exchange fee for each transaction.

You may pick from nine different base currencies. Euros, US dollars, GBP, AUD, CAD, ZAR, and JPY are all available. When you take your funds out from your BlackBull Markets account, you will be charged a $5 fee. However, the cost of utilizing a foreign banking institution climbs to $20.

The internet has a vast array of training programs and literature. Video tutorials are present to help you learn how to use the trading platform. The brokerage firm funds a free sample account with simulated money before making it accessible for trade.

Traders may now trade from any part of the world thanks to the mobile version of the web-based trading system. Serbian, English, Spanish, Chinese, and Uzbek are the most widely spoken languages.

You may contact customer care by sending an email or sending them a message through the chat box found on the website. You also have the option of phoning them. They are, however, only open 24 hours a day for five days.

Summary:

- There is a need for a deposit of $200.

- Standard Account clients are not charged.

- Broker licenses have been issued by both FMA and FSA.

- Spreads are 0.8 pips.

- Paying the broker is possible through debit cards, credit cards, China Union Pay, FasaPay, Neteller, Skrill, and bank transfers.

Disadvantages of trading with BlackBull Markets

- The broker’s minimum investment requirement is very high if you compare it to other forex brokers.

(Risk Warning: Your capital can be at risk)

3. RoboForex

This company is among the most renowned firms currently operating in the forex trading sector. The company’s headquarters have been in Belize since its creation in 2009.

The International Financial Services Centers Authority is the regulatory agency in charge of overseeing and monitoring this broker’s activity.

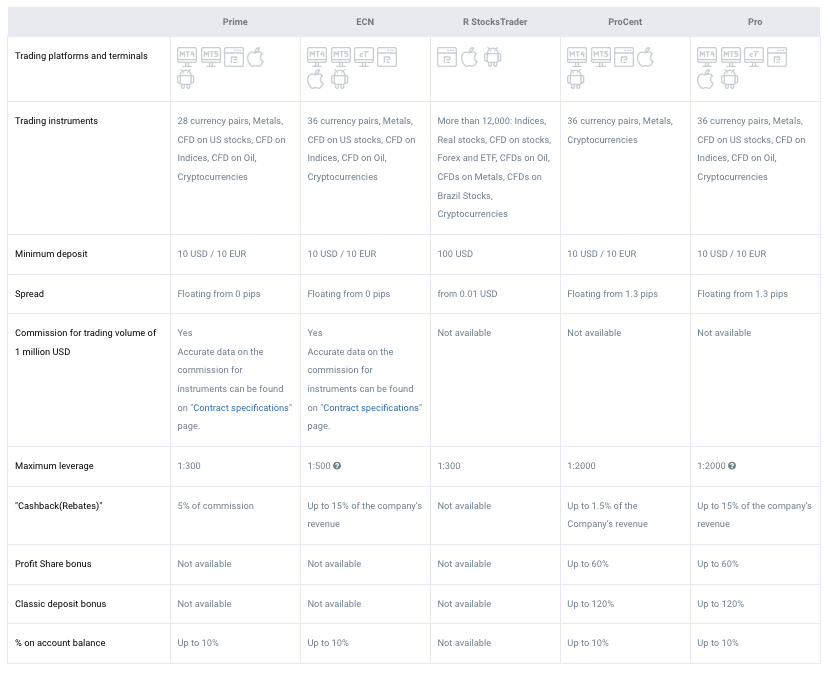

The six accounts available are Pro-Standard, Prime, Pro-Cent, ECN-Pro, and R Trader. A Pro Cent version account is great for newbies because it’s a micro account. A micro account is ideal for new traders who wish to learn how to trade with real cash.

At the broker, both withdrawals and deposits are free of charge. However, they charge inactive users an inactivity fee. There are six distinct base currency options available. BTC, Gold, CNY, RUB, EUR, and USD are among them.

Various articles, videos, and books on the website give step-by-step instructions for beginners. The broker provides a demo account and runs monthly and weekly tournaments to entice traders to adopt this account type.

There is a web-based trading desk that can be accessed from both mobile and desktop PCs. It also includes copy trading. This allows you to see how more experienced traders execute their deals.

The customer service representatives are fluent in over nine languages. They are available via phone, email, and live chat on the website or platform 24 hours every day.

Summary:

- The first investment is $10.

- The IFSC is granted the brokerage licenses.

- The brokerage charges a service fee of $2.

- Spreads are 1.3 pips

- You can deposit funds using bank transfer, debit card, Skrill, credit card, Neteller, Perfect Money, and Advcash.

Disadvantages of trading with RoboForex

- You can only trade 36 currency pairs that this broker offers.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone, an Australian company, opened its doors for the first time in 2010. To be able to serve European merchants, they extended their operation in 2015, so they could include a number of facilities in and around London.

The Financial Conduct Authority and the Australian Securities and Investments Commission maintain a close check on Pepperstone to verify that it is following the rules and norms relevant to their respective countries.

Pepperstone customers only have one live account option. On the other hand, no certain quantity of money must be raised. The brokerage also does not impose an inactivity and withdrawal fee for accounts that have been dormant for an extended period of time. If you are not up for trading with your hard-earned cash yet, you may use the risk-free practice or demo account.

You can use any kind of device to access the trading website. Users who do not wish to install the software on their workstations may instead utilize the web-based platform.

When clients have an issue that requires them to contact the customer care department of the organization, the only two channels of communication that are accessible to them are real-time chat and phone calls. These channels are open twenty-four hours every day.

Summary:

- There is no minimum payment required.

- The firm is authorized and regulated by both the ASIC and the FCA.

- The broker charges a commission fee of $3.

- The spread is originally set at 0.0 pip.

- The broker accepts Union Pay, Neteller, Skrill, Bpay, Poli, credit card, debit card, PayPal, and bank transfers.

Disadvantages of Trading with Pepperstone

- This broker’s customer support feature can only be utilized five days a week.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

This is a firm that is established in Cyprus. Since its establishment in 2013, the company has expanded to serve customers in more than 150 countries The Cyprus Securities and Exchange Commission monitors the company’s operations.

When working with this brokerage, you can open a basic or VIP account. You only need 10 dollars to create your Standard account, and after your account has been verified, you may begin trading. You must first make a deposit into your account before applying for the VIP version. The needed minimum amount varies greatly among brokers.

The three most prevalent currencies are the US dollar, Euro, and Great British Pound. The broker will not charge you any fees if you withdraw funds from your wallet. Consider the scenario in which you want to remove funds from your account by bank transfer. If this occurs, you will have to shoulder the bank’s incredibly low processing fee.

You may explore the platform’s capabilities by utilizing the demo edition of the account. This comes with a starting amount of more than $5,000 in virtual money. This should be done before signing up for an actual account. The trading desk is accessible in over eleven languages and may be used on mobile devices as well as desktop computers.

Customers may contact the firm for assistance with their transactions by live chat, email, and phone.

Summary:

- This company or firm has a $10 minimum deposit.

- The CySEC oversees this company.

- Each trade costs the customer $3.

- The spread starts at 0.6 points.

- The broker takes deposits made through wire transfer, credit card, Skrill, debit card, Neteller, Web Money, Maestro, Cash U, and Moneybookers.

Disadvantages of trading with IQ Option

- Instead of the more common MT4 platform, customers of IQ Option are required to trade utilizing the company’s platform.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in the Dominican Republic?

In the Dominican Republic, the SB, or The Superintendency of Banks, supervises and implements the laws for financial regulation. The company regulates financial firms. The SB is also responsible for ensuring that these firms can be trusted.

Security for traders from the Dominican Republic

Whenever you’re looking for a new broker to partner with, you must proceed with extreme caution so that your financial assets and your personal information may remain safe.

To guarantee that you’re dealing with a reliable broker, the firm has to be licensed by reputable regulatory agencies. In addition, investigate if they provide insurance or other protective services that might defend you from any dangers and unwelcome financial losses.

Additionally, ensure that your cash is kept in a different or segregated account. In this manner, the company cannot profit from your money. This also aids in the protection of your cash from internet hackers.

Is it legal to trade Forex in the Dominican Republic?

Yes. Trading forex in the Dominican Republic is legal.

(Risk warning: 78.1% of retail CFD accounts lose money)

How to trade Forex in the Dominican Republic – Tutorial

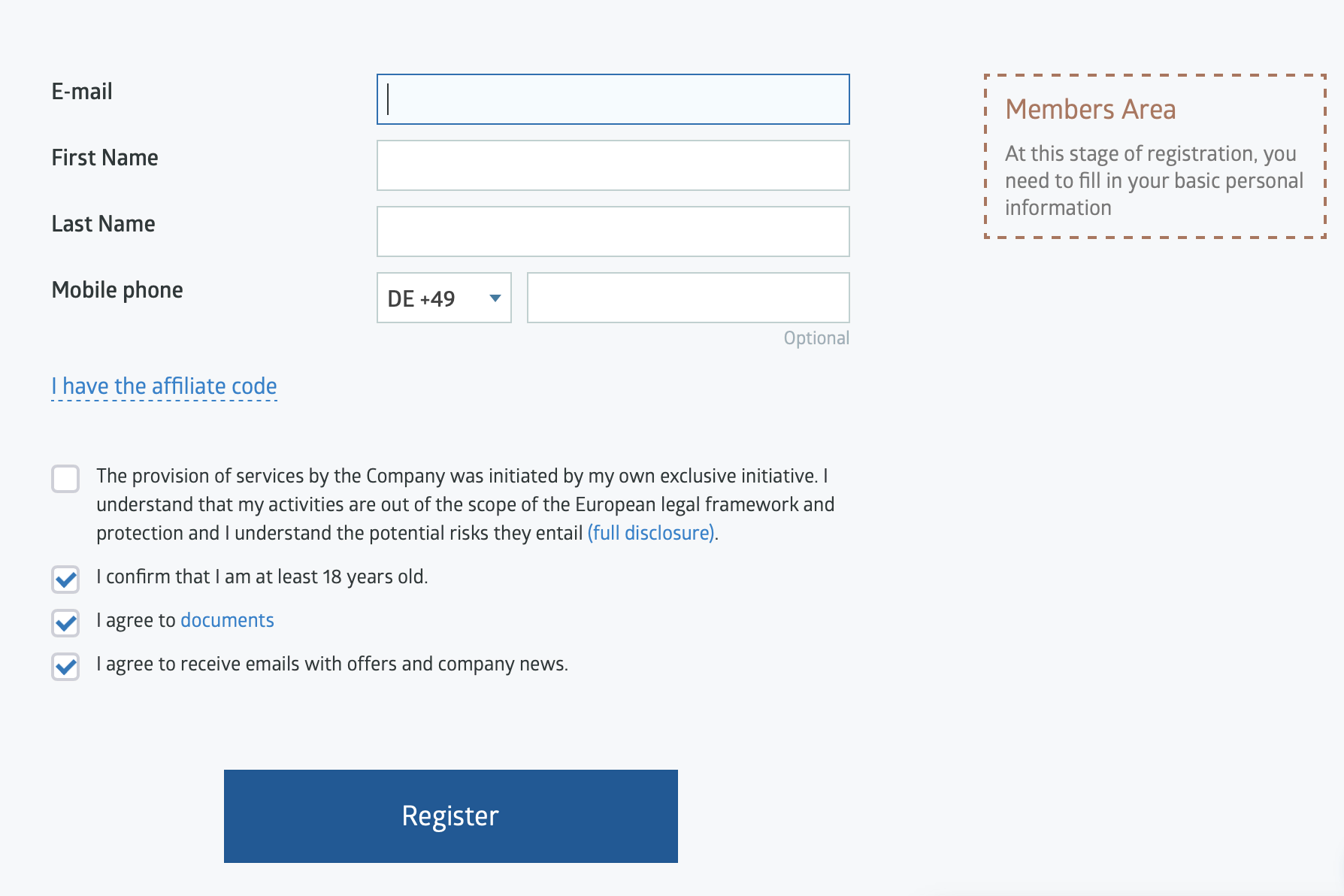

1. Open account for Dominican Republic traders

Creating an account is as simple as filling out an application form and providing your broker with your personal information. After obtaining this information, they will be able to set up your account. Most of the time, the form will ask for your name, the city and state where you live now, your cell phone number, and a few other pieces of information.

Other brokers need a copy of any kind of government-issued identification to verify your account. They might also call you on your mobile phone or email you with a verification link or code to be able to finish setting up your genuine account. Either way, it will take a few moments.

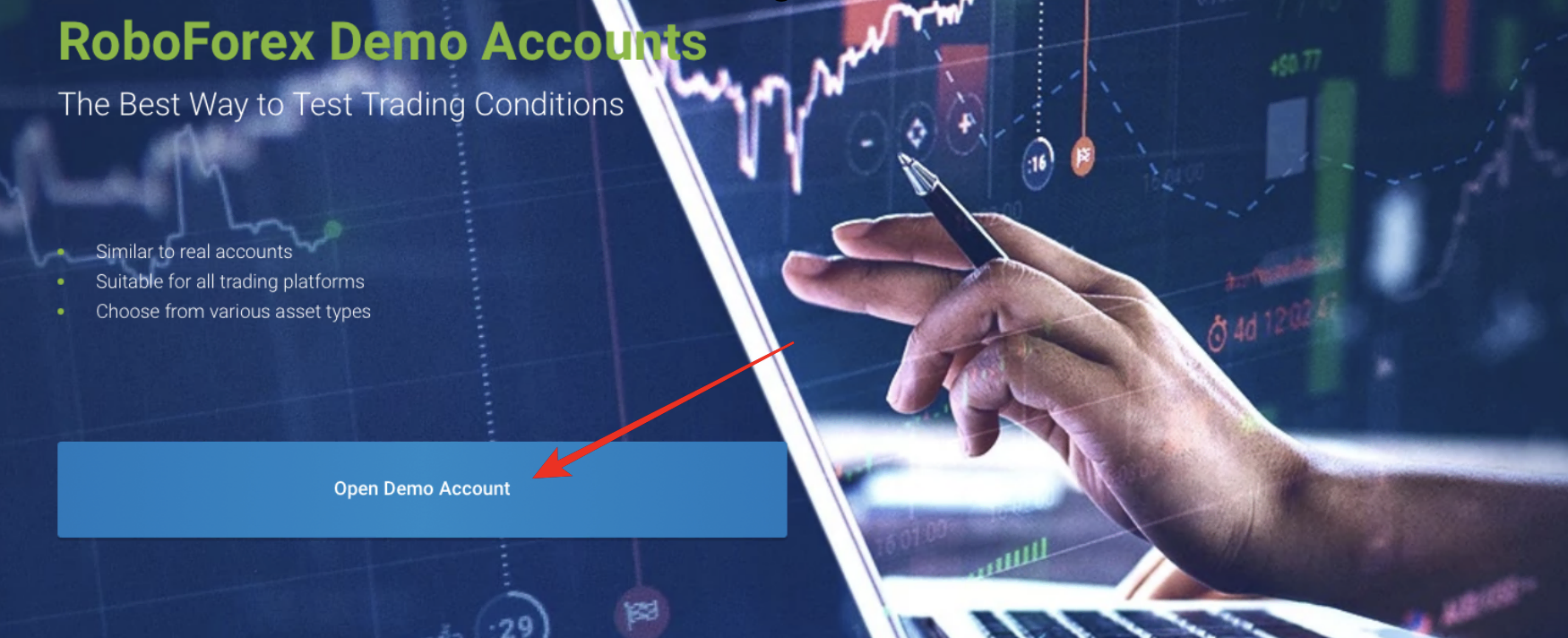

2. Start with a demo account or real account

Before placing your real funds into the foreign exchange market, it is strongly recommended that you use a practice or demo account to familiarize yourself with the interface. All of the above businesses offer free demo trading accounts to help their customers with their trading needs.

Make the most of all you have available to you and use it. Demo accounts are provided with imaginary cash that may be used to practice trading or evaluate the functionality of the trading system made accessible by the broker. Prospective traders may use demo accounts.

3. Deposit money

After using the demo account’s features for free, you’ll be requested to make a live account. The broker will require you to deposit funds into your account to do this.

Most brokers accept bank transfers, debit cards, and credit cards as payment methods. PayPal, Neteller, and Skrill are among the numerous payment options available via this organization.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

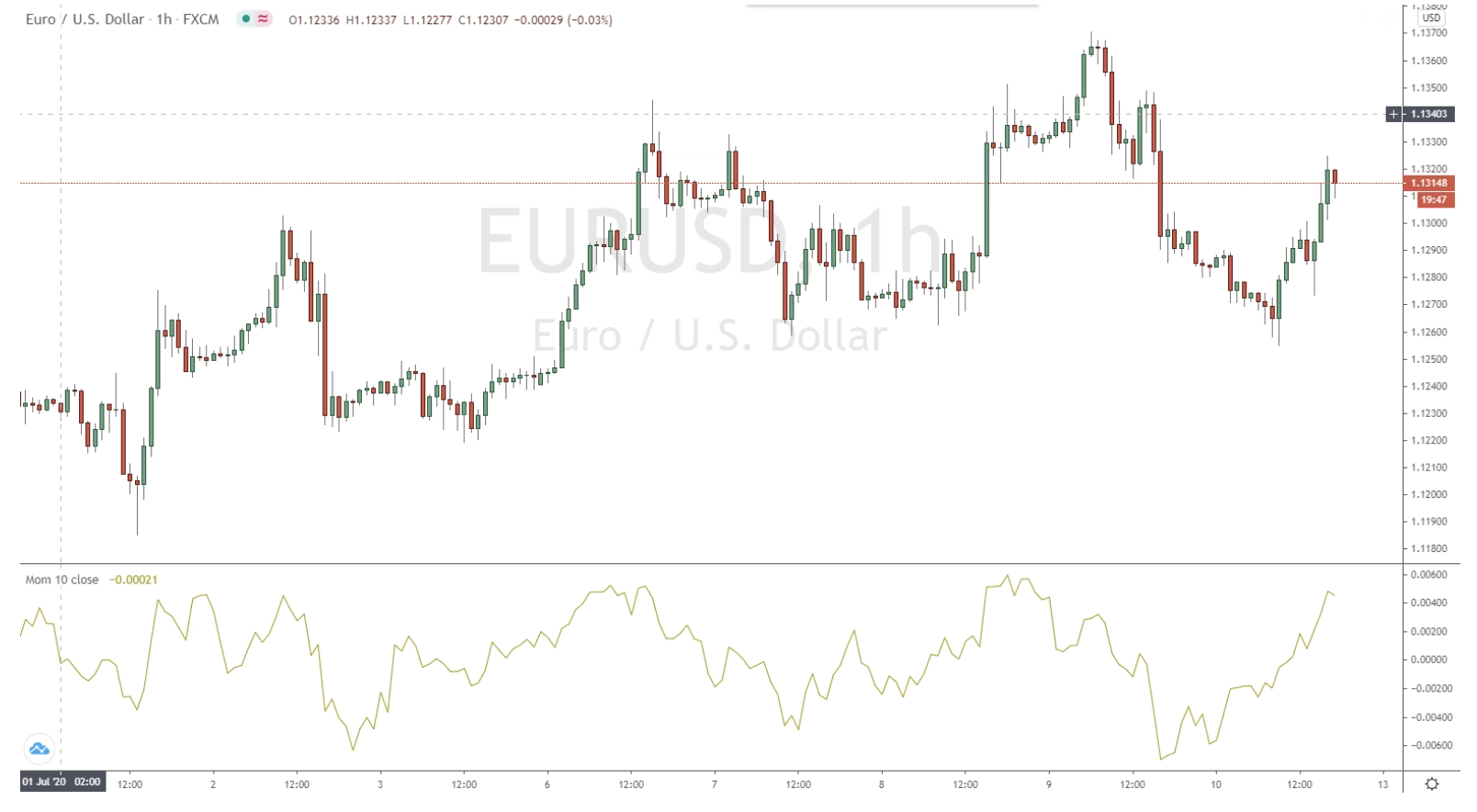

4. Use analysis and strategies

When trading, one of the best ways to make money is to trade in the same direction as the market trend. Because this kind of trading is done for the long term, one of its most important components is keeping track of the trend that is developing for a particular forex pair and the overall direction that the market is taking. This involves participating in transactional purchasing when the market is trending positively and transactional selling when the market is trending negatively.

In addition, the evaluation of the state of the market is a very significant component of the strategy for risk management. Suppose you are new to the world of trading foreign currencies. In that case, your broker will likely offer you the assistance of a staff member who is completely dedicated to supporting clients who are in the same situation as you. If this is the case, you should take advantage of this opportunity.

5. Make profit

Be patient and devote the necessary time to learning how to make profitable trades. When you trade currency pairs, earning a profit will be much simpler for you to do if you implement the right strategy. Remember to learn risk management to increase your probability of earning as well.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in the Dominican Republic

It’s important to keep the information above in mind when choosing a forex broker. In case the brokers and firms mentioned above don’t seem ideal for you, there are more to choose from. Just get all the necessary information you need before you create an account with them. Most importantly, ensure that they are regulated and monitored by trustworthy regulatory firms.

FAQ – The most asked questions about Forex Broker Dominican Republic :

Is signing up with a forex broker in the Dominican Republic easy?

Yes, signing up with a forex broker in the Dominican Republic is easy for any trader. Forex traders must visit the broker’s website and click the ‘signup’ option. Then, you can enter your details and submit them to the broker. Your trading account for forex trading will be ready within a few minutes. You can use it to trade forex and earn profits. However, the verification might involve some time.

Which is the best forex broker in the Dominican Republic?

Five forex brokers in the Dominican Republic offer traders a full-fledged trading platform. These include:

BlackBull Markets

Pepperstone

IQ Option

RoboForex

Capital.com

These brokers offer world-class trading services to traders, allowing them to trade to their full potential.

What payment methods does a forex trader in the Dominican Republic offer traders?

Traders looking forward to trading forex in the Dominican Republic can use several payment methods. These include Bank transfers, debit cards, credit cards, electronic wallets, and cryptocurrency. Thus, a trader has several payment methods, allowing him to use his preferred one.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)