Five best Forex Brokers and platforms in El Salvador – Comparison and reviews

Table of Contents

Introduction

If you are looking for a forex broker that accepts forex traders from El Salvador, we have a list of five forex brokers accepting EL Salvador traders. They offer low trading costs, industry-standard trading tools, and numerous trading instruments.

See the list of the best Forex Brokers in El Salvador:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

List of the five best forex brokers in El Salvador:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

1. Capital.com

It has been in the market since 2016 and has registered more than five million trading accounts. Traders access stocks, commodities, shares, cryptocurrencies, and forex. It has regulations from CySEC, ASIC, and the NBRB.

The Standard account has an initial deposit of $20, the Plus has $2000, and the Premier account offers $10,000. Forex spreads start from 0.8 pips and Capital.com is known as a no-commission forex broker since most of the trading instruments have no commission.

It has no inactivity costs, and the overnight charges vary with the open position. The deposits and withdrawals are also free. The highest leverage is 1:500, but EU clients have a limit of 1:30.

Overview

- Minimum deposit-$20

- License-FCA, ASIC, CySEC, NBRB

- Platforms-MT4, web-trader

- Spreads-from 0.8 pips on major pairs

- Support-24/5

- Free demo-yes

- Leverage-1:30

Capital.com is a forex broker that offers international standard trading features and services as multiple regulations regulate it. It also complies with investor protection rights, and its traders can access Negative balance protection when trading using this broker.

Forex traders can also open trading accounts on this forex broker. It offers a wide range of payment methods such as ApplePay, Multibanko, Sofort, GiroPay, iDeal, Trustly, bank transfers, credit/debit cards, and 2c2p.

Disadvantages of Capital.com

- It does not support MT5. Capital.com does not support the MT5 trading platform even though it has the MT4. Many traders prefer the MT5 because it has more features and traders more trading instruments than the MT4.

(Risk warning: 78.1% of retail CFD accounts lose money)

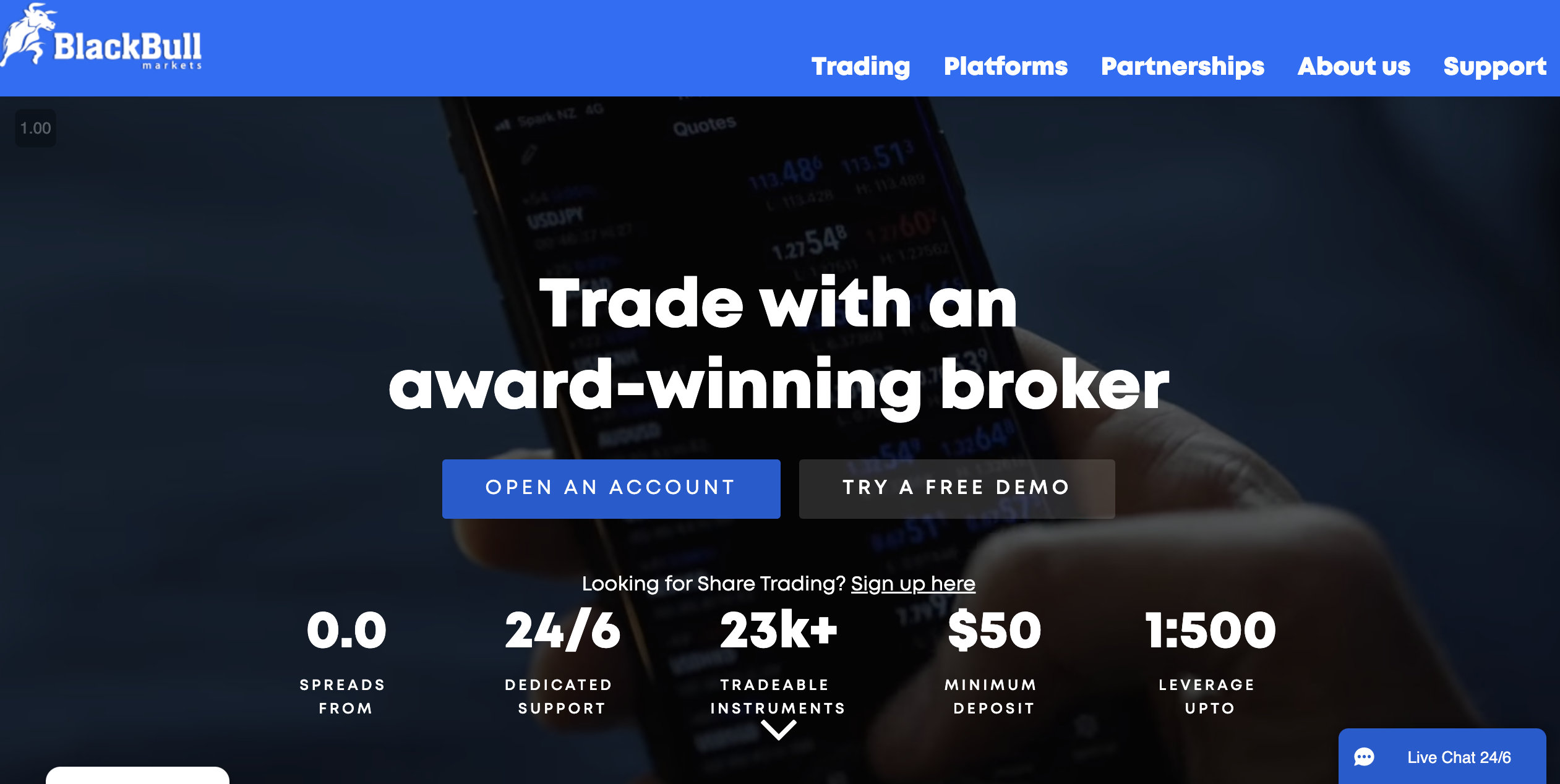

2. BlackBull Markets

It has been in the market since 2014 and has thousands of forex traders who have opened trading accounts since then. It supports commodities, energies, shares, indexes, metals, forex, and CFDs.The Financial Services Authority also regulates it in Seychelles.

Its forex traders can open one of the three types of trading accounts, ECN standard account has a minimum deposit of $200, ECN Prime with $2000, and ECN Institutional with a minimum of $20,000.Forex spreads vary with the account type, where the ECN Standard has forex spreads from 0.8 pips, the ECN Prime has 0.1 pips, and the ECN Institutional offers 0.0 pips.

Overview

- Minimum deposit-$200

- License-FSA

- Platforms-MT4, MT5

- Spreads-0.0 pips

- Support-24/5

- Free demo-yes

- Leverage-1:30

The commissions are based on the account, and the ECN Institutional has varying commissions; the ECN Standard has no commissions, while the ECN prime charges $6 for every $100,000 traded. The overnight charges apply with the size of the trading position. It has no inactivity fees and the deposits/ withdrawals are free.

Traders can open a trading account with this broker because one advantage that it has is that it uses ECN accounts which means the order processing rates are fast. It also has low trading costs and offers one of the leading trading platforms in the industry.

Disadvantages of BalckBull Markets

BlackBull Markets has limited learning resources. It has limited resources for learning how to trade forex on the different trading strategies a trader can use. Learning resources are vital, especially for a new trader.

(Risk Warning: Your capital can be at risk)

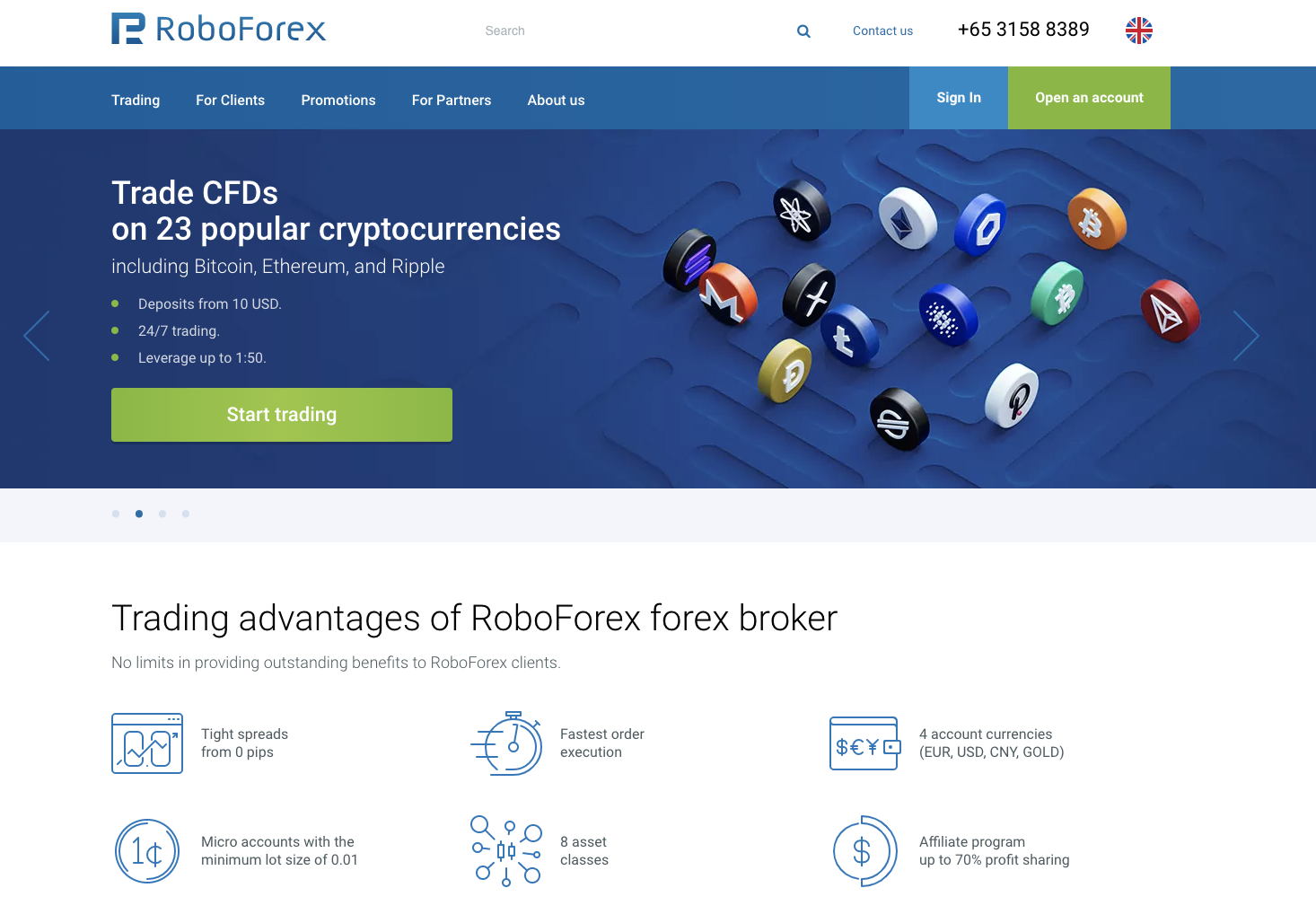

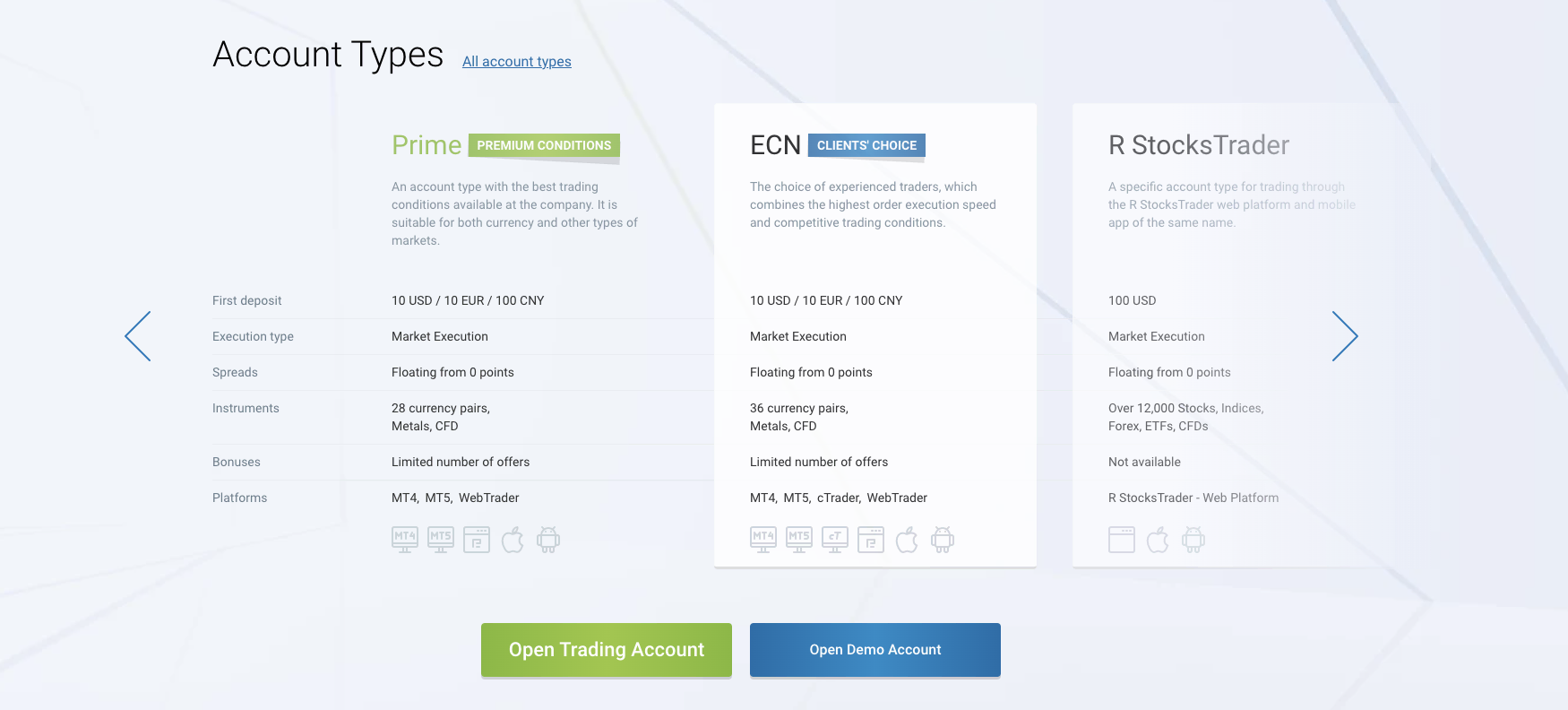

3. RoboForex

Established in 2009, it has been in the market for more than a decade and has over one million traders registered on its platform. Its users can trade ETFs, stocks, cryptocurrency, CFDs, forex, metals, and indices.

It has regulations from the International Financial Services Commission. Traders that register on its platform can open one of the five trading accounts it offers, the Pro, Pro-cent, Prime, and the ECN account have an initial deposit of $10; the R-stocks trader has $100.

Overview

- Minimum deposit-$10

- License-FSC

- Platform-R-stocks trader, c Trader, MT4 and MT5

- Spreads-0.0 pips

- Support-24/7

- Free demo-yes

- Leverage-1:2000

RoboForex is a low-cost forex broker because most of its operational costs are lower than the other trading brokers. For example, the forex spreads on the Pro and Pro-cent start from 1.3 pips, the ECN and Prime start at 0.0pips, while the R-stocks trader starts from $0.01.

It also has low commissions for trading most of the assets. The Pro and Pro-cent have no commission, the Prime has $15 for every $1 million traded, the ECN has $20 for every 1million traded, and the R-stocks trader with commissions from $1.5.

Trading costs-it has an inactivity cost of $10 for ten months of inactivity. It also has overnight costs varying with the size of the trade and leverage used. It has no deposit and withdrawal costs.

Disadvantages of RoboForex

- RoboForex has limited educational resources. Its users have limited educational materials, which are useful when traders want to learn how to trade forex.

(Risk Warning: Your capital can be at risk)

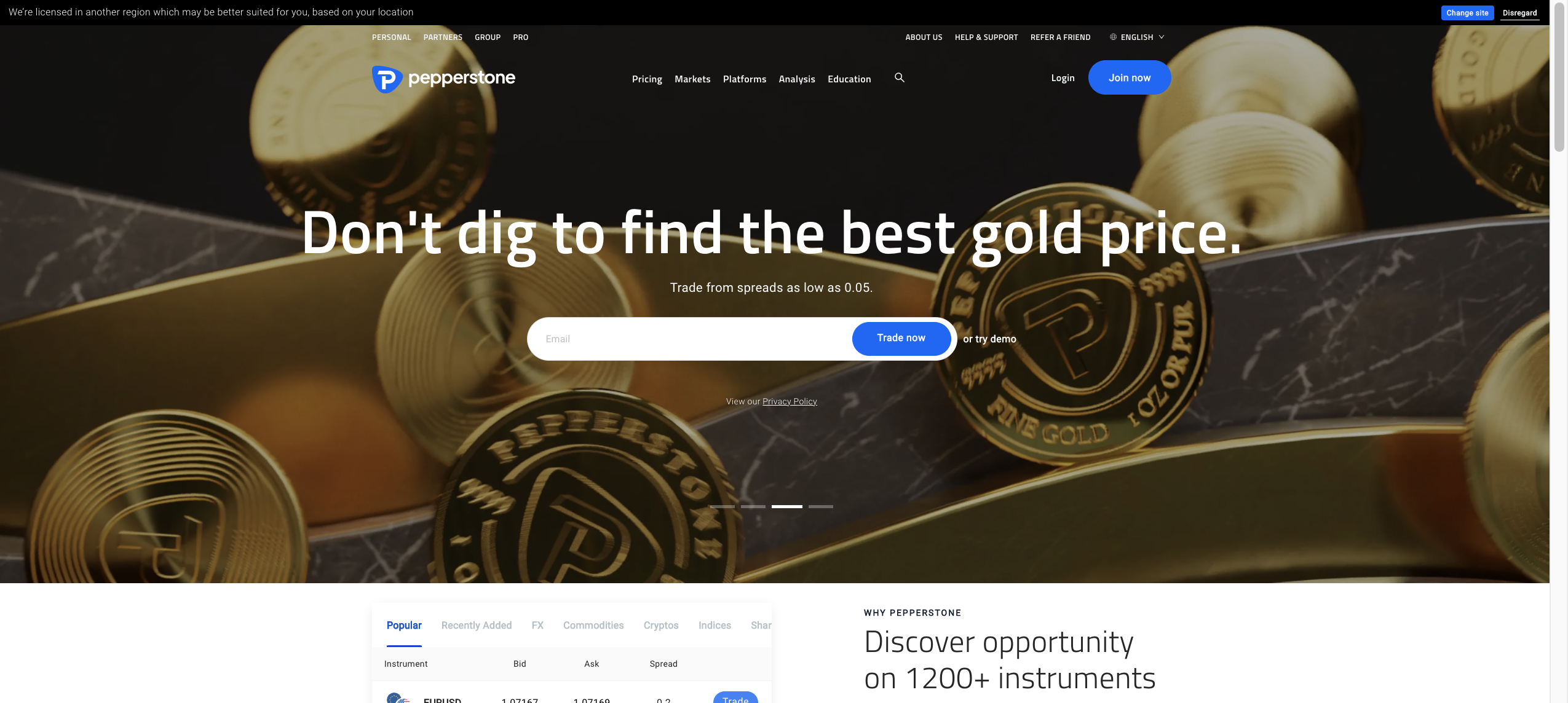

4. Pepperstone

It has offered trading services since 2010 and has registered thousands of trading accounts on its trading platform. It has access to indices, CFDs, forex, shares, commodities, and ETFs. It s regulated by the Dubai Financial Services Authority, Financial Conduct Authority, and Australian Securities and Investment Commission.

Its traders can open two types of counts, the Standard or Razor account, which have an initial deposit of $200. The Razor account has forex spreads from 0.0 pips and no commissions, and the Standard account starts at 1.3 pips with commissions of $7.

Overview

- Minimum deposit-$200

- License-ASIC, FCA

- Platform-MT4, MT5,c Trader

- Spreads-0.0 pips on the Razor account

- Support-24/5

- Free Demo-yes

- Leverage-1:400

This forex broker offers quality trading resources that traders can use to access the financial markets. Its traders can use the guaranteed stop loss, stop-loss, and take profit. Besides that, it also has low trading costs for most operations.

It has commissions based on the account types; the Standard account has no commissions, but the Razor account has $7 for every $100,000. It has no inactivity costs; the deposits and withdrawals are free. The overnight charges apply depending on the leverage and size of the trading position.

Disadvantages of Pepperstone

- Pepperstone has limited research tools that traders use to look at the market conditions when they want to trade.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

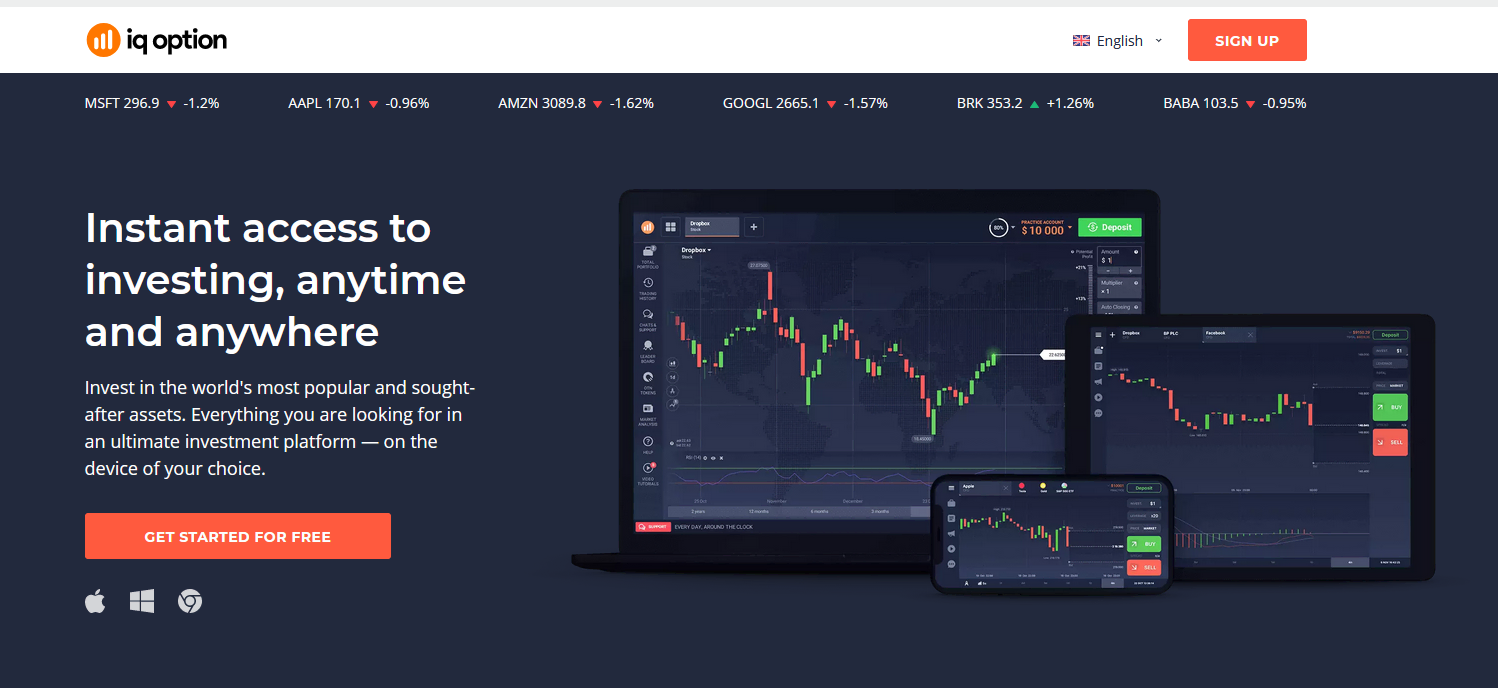

5. IQ Option

It has registered over 40 million trading accounts since 2013. Trading instruments offered include CFDs, Options, commodities, ETFs, forex, and cryptocurrencies. It has a trading license from Cyprus Securities Exchange Commission.

By opening either of the two accounts, traders can state that the VIP account has a high initial deposit of $1900 and the Standard account of $10. Forex spreads vary with the liquidity of the asset and the type of asset, but it starts with 0.8 pips.

Overview

- Minimum deposit-$10

- License-CySEC

- Platform-IQ Option trading platform

- Spreads-from 0.8 pips

- Support-24/7

- Free demo-yes

- Leverage-1:500

Most assets are free of the commission, but cryptocurrency has 2.9%. Overnight rates range between 0.1 to 0.5%; it also has inactivity costs of $10 charged on inactivity for more than three months. Deposits and withdrawals are free, although withdrawals through bank transfers attract a $31 fee.

Traders can deposit or withdraw using Payment methods such as WebMoney, Neteller, Skrill, WebMoney, Cash U, credit/ debit cards, and bank transfers.

Disadvantages of IQ Option

- It does not use MT4 and MT5. The IQ Option trading platform offers a variety of trading features, but most forex traders prefer the MT4 and MT5 trading platforms.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in El Salvador?

The capital markets in EL Salvador started with the Salvadorian Stock exchange in 1992; it started with a volume of only $600 million and has advanced to over $6 billion. The securities market is still growing at a gradual rate, as with the Economy of El Salvador.

The securities and exchange markets in El Salvador are still small and have a very limited effect on the development of the economy of El Salvador. Because of the regulations implemented by the Central bank and the Superintendencia del Sistema Financiero (SSF), which is El Salvador’s financial and insurance regulatory body.

The SSF is a regulatory authority independent of the Government and works with the Central Bank of El Salvador to authorize and supervise financial institutions operating in El Salvador.

The SSF registers and records all information of financial issuers and market participants operating in El Salvador on the electronic Registry. The securities dealers and stock exchange operators who wish to register in EL Salvador have to ensure they meet the required conditions and their accounts have to be authorized.

The negotiations and settlement of disputes, including compensation, should be sent to the superintendent’s office for observations and approval before they are executed. The Superintendence can establish provisions that ensure supervision of operations in the securities and exchange markets to prevent fraudulent and manipulative activities from market participants.

The brokers or dealers operating under forex brokers or stock exchange houses must work according to the regulations and maintain ethical standards. The registration of forex traders or investors has to adhere to the registration laws and regulations required by the Superintendence.

The external auditors have to comply with their regulations as required by the Superintendence and provide the report on any violations of the regulatory guidelines from the market participants they have audited without prejudice or bias.

The financial issuers have to rate the risk of the securities according to the risk classifications and categories they offer as required by the Superintendence. The broker house or companies involved in securities and stock exchange have to keep a record of their employees, including newly registered agents.

Security for traders from El Salvador

Traders have a secure trading environment based on the financial regulators’ legislation in El Salvador. The regulations ensure that financial dealers comply with industry standards and protect investor rights.

They have also ensured that forex traders have registered trading accounts with forex brokers that are regulated to reduce the cases of losing their funds to forex scams.

(Risk warning: 78.1% of retail CFD accounts lose money)

Is Forex trading legal in El Salvador?

Forex trading is available in El Salvador, and forex traders can register a trading account from local or international forex brokers. The Capital markets of El Salvador are regulated by the SSF, which a superintendent heads.

The SSF enforces the finance laws on market participants such as securities issuers, stockbrokers, companies involved in trading securities and stocks, auditors, and stockbroker houses.

How to trade Forex in El Salvador – A guideline

Open account for El Salvador traders

Many forex brokers emerge and claim to offer trading software that can make you rich. It is why forex traders are required to look for regulated forex brokers. These are forex brokers with trading licenses from the top regulatory agencies such as the:

If you get a forex broker you find reliable, open a trading account by filling in your details on the online registration form available on their website. You have to give details such as your name, age, nationality, email, and password.

Some forex brokers will also require you to give out your financial information before you start trading to access your risk tolerance. After registering, you have to download a trading platform to access the financial markets.

Forex brokers support various trading platforms that traders select and download; others have a proprietary trading platform that offers various trading features. Customize it according to your trading strategy and trading plan.

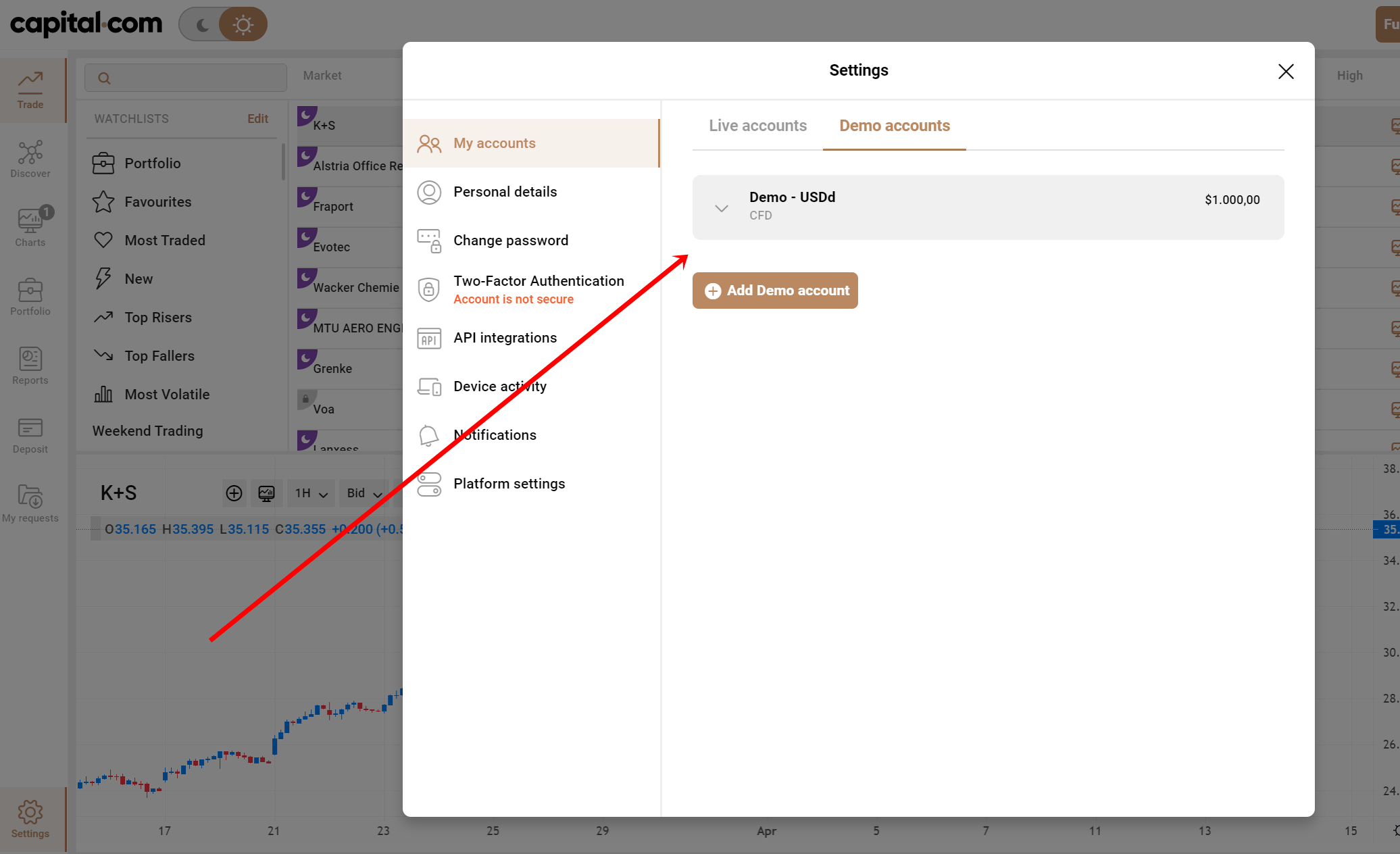

Start with the demo account

The demo account allows you to trade forex without risking your funds by using virtual funds. It enables traders to practice their trading strategies and how to trade other trading assets. It also allows traders to practice their trades and reduce their trading mistakes.

The demo account is crucial for new traders as they learn to trade. Experienced traders can use it to test out the trading platform, but they can start trading after registering a trading account.

Deposit funds and start trading

If you have practiced trading and are ready to start trading, you can deposit funds using the forex broker’s payment methods. Local and international forex brokers support a variety of trading platforms, including bank transfers, credit and debit cards, or digital wallets that traders from many regions can use, such as PayPal or Skrill.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Analysis

Analyze the market conditions to know when to enter or exit the market. The analysis also helps you to know the trading strategy to apply to a price market. Traders can conduct either fundamental or technical analyses.

Technical analysis consists of using price patterns to predict the price movement, reading and interpreting candlestick and price patterns to determine the trend direction. The price action and patterns are confirmed using technical indicators that show the market prices’ direction, strength, and momentum.

Fundamental analysis evaluates the external conditions that affect price movements. For example, when you are trading a currency pair, you have to monitor the interest rates of the currencies. These financial events could influence movement, GDP growth, and trading relations between major export and export partners.

Trading strategies

It is imperative to know how to enter, apply risk management tools and exit the market. These are factors that a trading strategy consists of. Trading strategies depend on the type of trade you intend to have; if it is a long trade, you can use long-term strategies, and short trades use short-term trading strategies.

Position trading strategy is a method by which forex traders identify a currency pair or a trading instrument they speculate will increase in value within a period. They buy that asset, wait for the price increase, and sell it at a high value. It requires patience and trading discipline when the market has minor movements; you can wait for the prices to increase.

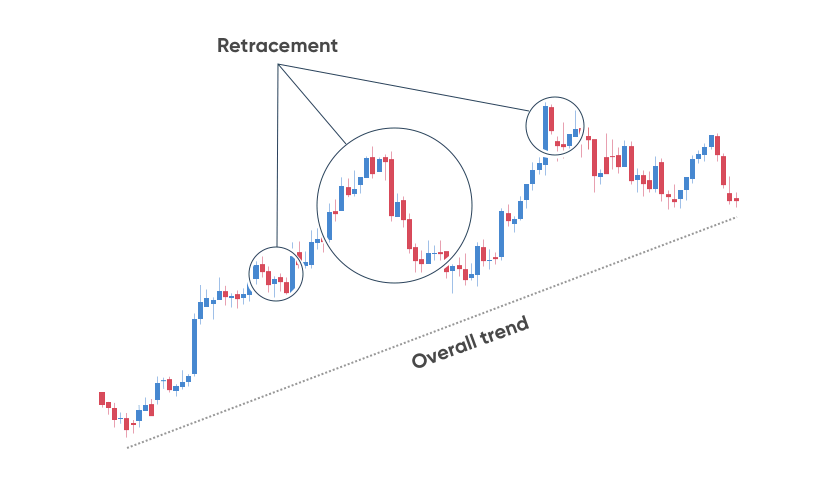

The trend trading strategy requires forex traders to identify a trend that the market is at or is almost moving to. It can be the overall trend or a minor trend in which you open a position based on the trend. If it is an uptrend, you go long; if it is a downtrend, you go short. Trend trading is usually a long-term trading strategy as it is simply that new traders can learn and apply.

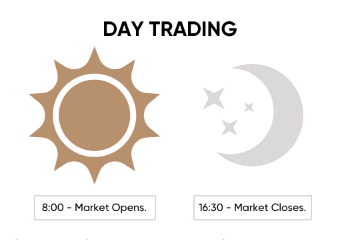

Day trading– this trading strategy consists of forex traders opening positions and closing them at the end of the day. They can be numerous trading positions in which forex traders profit from the cumulative profit from the winning trade. It is a trading strategy for traders that intend to trade professionally and can dedicate their day to trade.

Make profit

Start trading and ensure to follow the trading strategy you have chosen. Practice trading before your start trading and apply risk management strategies. Limit the leverage you use and trade without getting affected by previous trades.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in El Salvador

Forex trading in El Salvador is still growing, which means it has a higher potential to grow even as forex trading is growing popular globally. Forex traders must register trading accounts from forex brokers that are regulated.

We recommend international forex brokers that have regulation from industry-leading regulatory institutions. Besides that, forex traders need to practice trading, choose effective trading strategies and apply stop loss trading tools to increase their profits during trading.

FAQ – The most asked questions about Forex Broker El Salvador :

How can I select the finest forex broker in El Salvador?

You should look at this list while selecting the top forex brokers. Let’s examine them now.

Verify the broker’s license and rules.

Demand a demo account.

It ought to include all assets.

Allowing for mobile trading should be simple.

It should provide you with an easy and convenient deposit and withdrawal process.

Should offer you efficient and convenient client assistance.

What trading methods are accessible from El Salvador’s forex broker?

For forex brokers in El Salvador, three main types of trading methods are available.

– Day Trading – Rapid reactions and moving investments characterize day trading. You probably won’t be as concerned with political issues as a day trader. Political turmoil and economic downturns are probably much less of a concern for day traders than the bid/ask spread and daily trading volume.

– Swing Trading: Swing traders study chart patterns and follow the most recent news cycle. The news may impact the chart patterns as the swing trade evolves over a few days or weeks.

– Position Trading: A position is usually held by a forex trader for several months or even years. This time frame is meant to provide a currency with enough space to mature into a balanced condition.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)