4 best Forex Brokers in Estonia – Comparisons and reviews

Table of Contents

If you are in Estonia and looking for a reputable forex broker to deal with, you have visited the right page. We have tested several trading platforms and reviewed trading conditions. This article introduces the best ones in the industry to help narrow your options.

See the list of the best 4 Forex Brokers in Estonia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the 4 best forex brokers for Estonians:

- Capital.com

- BlackBull Markets

- Pepperstone

- IQ Option

Here’s a summary of their services:

1. Capital.com

- Minimum deposit – $20

- License – FCA, CySEC, ASIC, NBRB.

- Fees and commission – 0.8 pip average spread on majors. $0 commission fee.

- Free demo – Yes.

- Platforms – MT4, Capital.com app, Tradingview.

- Support – 24 hours, Mon – Fri.

Capital.com is an online CFD broker based in the United Kingdom. Capital.com has offices around Europe and operates with licenses in these regions. Founded in 2016, the broker is relatively new but has established a strong reputation as one of the best.

Capital.com special features:

- A special Invest account that allows EU customers to trade stocks at zero commission fees.

- The Investmate app is a dedicated education app that teaches beginners all about forex trading.

Capital.com disadvantage

Meta trader 5 is not provided.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

- Minimum deposit – $200

- License – FMA, FSA.

- Fees and commission – raw account: 0.4 pips average spread on majors, with a $3 commission fee. Standard account: 0.8 pips average spread with zero commission fees.

- Free demo – Yes.

- Platforms – MT4, MT5, BlackBull Markets app, MyFxbook, Zulutrade.

- Support – 24 hours, Monday – Saturday.

BlackBull Markets is an online forex and CFD broker offering ECN trading since 2014. BlackBull Markets is based in New Zealand and has offices in the United Kingdom, Japan, and Seychelles. The broker provides direct market access to traders in different parts of the world.

BlackBull Markets special features:

- A true ECN broker that offers fast execution and a zero spreads account.

Blackbull Markets disadvantage:

No European license.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

- Minimum deposit – $200

- License – CySEC, BaFIN, FCA, ASIC, SCB.

- Fees and commission – ECN account: 0.4 pips average spread on majors, with a $3 commission fee. Standard account: 0.8 pips average spread with zero commission fees.

- Free demo – Yes.

- Platforms – MT4, MT5, cTrader, Duplitrader, Zulutrade, MyFxbook.

- Support – 24 hours support, Monday – Friday.

Pepperstone is a famous international broker providing ECN trading since 2010. Pepperstone is based in Australia and has regulated head offices in the United Kingdom, Germany, Cyprus, the Bahamas, and Kenya. With Pepperstone, you will enjoy fast execution and award-winning support services.

Pepperstone’s unique features:

- The broker offers full support for automated trading.

- Order executions are superfast, and traders get the best prices on the ECN accounts.

- Active traders programs reward volume traders with many exciting benefits.

Pepperstone disadvantage

The free demo lasts only 30 days.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

- Minimum deposit – $10

- License – CySEC.

- Fees and commission – 0.8 pips average spread with zero commission fees.

- Free demo – Yes.

- Platforms – IQ Option app

- Support – 24 hours on weekdays.

IQ Option is among the famous binary options and forex brokers in Europe. IQ Option’s headquarters is in Cyprus, and the company began operations in 2013. Its other offices are in the United Kingdom and Seychelles.

IQ Option special features:

- The broker offers European traders a unique market instrument called the FX option.

- The broker provides its own social trading services through its platform’s Community Live Deal feature.

IQ Option disadvantage:

No meta trader platforms are available.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Estonia?

Estonia is a member of the European Union. Although forex trading is not as common here as in other European countries, it is well regulated by the country’s financial body.

The Estonia Financial Supervision Authority is the country’s financial markets regulator. Its policies are according to Europe’s MiFID framework. The EFSA is responsible for financial market operations and investor protection.

Like other EU nations following MiFID guidelines, Estonians cannot access more than 1:30 leverage. Binary options trading is not allowed, and brokers cannot offer bonuses. However, active traders’ rewards are permitted.

Brokers operating within Estonia must have a license from the EFSA. Domestic brokers must also be on the country’s financial register called the MajandusTegevuse Register MTR. This is a public register created by the country’s Ministry of Economic Affairs and Communications. All licensed financial institutions must be listed in this register, and the public can access it online.

Security for traders in Estonia – Good to know

Fortunately, forex trading is properly regulated by the EFSA, and Estonian traders enjoy a good level of investor protection. As long as they trade with regulated brokers, Estonians are safe.

Traders can use a domestic broker, but they should confirm their license by checking the MajandusTegevuse Register online. A genuine Estonia-based broker must appear in this public register.

ESMA policies allow all EU-licensed brokers to offer services to any EU citizen. Therefore Estonians can also use any Europe-based broker having a license from any well-known financial body in the EU zones.

Brokers licensed by bodies such as:

All follow the MiFID business structure. So, they are safe for Estonian traders. Checking these bodies’ websites can help confirm the broker’s license validity.

(Risk warning: 78.1% of retail CFD accounts lose money)

Is it legal to trade Forex in Estonia?

Yes, forex trading is legal. Regulations exist that protect investors and ensure the environment is safe for the activity. The trader must use only regulated brokers within the country and the European Union zones.

How to trade Forex in Estonia – Guideline

The basic tool required for online forex trading is a smart device connected to reliable and fast internet. A credible broker is among the basic requirements too.

The smart device can be a mobile phone, tablet, or computer. The internet connection should be stable without frequent interruptions, which can lead to losing trades.

Profitable forex trading partly depends on the broker you choose. A bad broker offers poor service and charges unreasonable fees. A scammer also falls in this category. It is tough to identify an unsuitable broker through an internet campaign.

So we will share how to spot a suitable broker instead:

- Regulations

Check the broker’s license and ensure it is valid. If the broker is based in Estonia, confirm their license by checking the MTR online. If they are a foreign broker, check the regulator’s brokers list on their website. The broker’s name should be on this list.

- Reasonable trading fees

The spreads are the differences between the ask and bid prices of the forex pairs. It is the broker’s fee for each transaction. Compare this fee, commission, and other non-trading charges among brokers to obtain the industry average. A reputable broker’s fees should not be above the average.

- Free demo

Credible brokers offer potential customers and site visitors the opportunity to test their services. The free demo account is available for this purpose. The demo access should last at least 30 days.

- Customer support service

24 hours customer service is the standard among reputable brokers. Traders must be able to reach support any time of the day on weekdays. The service must be easily accessible via live chat, phone, and email. Some offer social media chat support services.

- Simple deposit and withdrawal process

Credible brokers ensure deposits and withdrawals are hassle-free on their platforms. They provide popular payment methods to guarantee this. Common payment methods in Estonia are MasterCard, bank transfer, Visa, and Paypal.

If the broker meets these requirements, they are genuine and worth dealing with.

Follow the steps below to start trading:

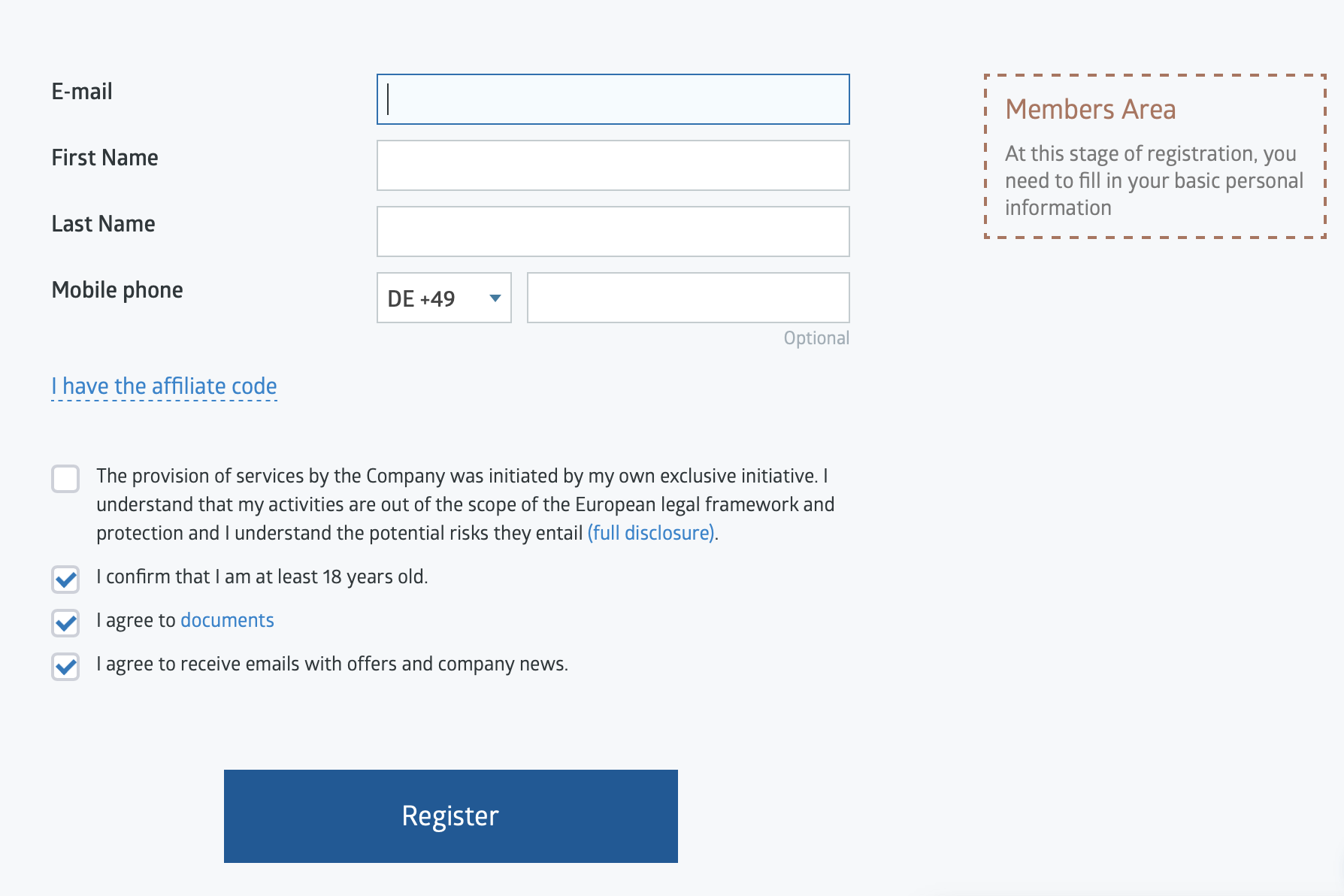

1. Open account for Estonia traders

Visit the broker’s website to get a trading account. You should be redirected to the broker’s webpage for your country. If the site supports multiple languages, the page should load in English, and you will be able to switch between Finnish, Russian, and English.

Click on the create account button visible at the top of the page or the center. Enter the requested information in the pop-up box. This should be your email address and maybe, your full name.

Once you click on create an account, the system forwards a message to the email you entered. The message will contain a verification link, which you need to click to confirm the signup and continue the registration.

The broker may request some identification documents as part of ESMA KYC requirements. You will need to scan and upload these. A government-issued ID and utility bill are often required. They may only request your ID code and ask a few questions to confirm your identity. The registration will be complete and the account ready in two days or less once you provide the necessary details.

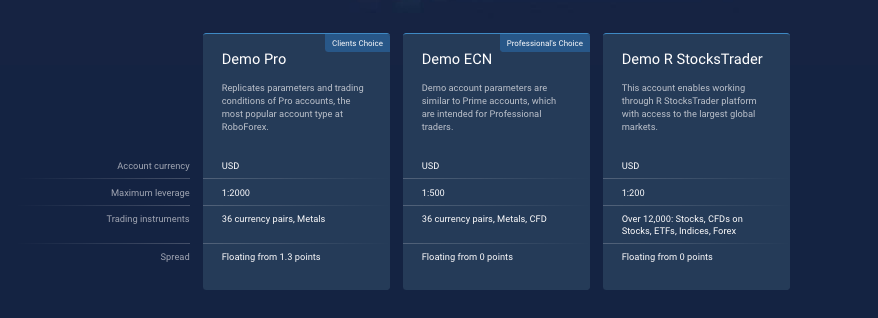

2. Start with a demo or real account

The next step is the demo stage. If you’re new to forex trading, this is the stage where you practice trading in a forex market. The broker ensures there is enough virtual cash in the demo account. This lets you conduct several trades while practicing. You should be acquainted with the forex environment before trading live.

The demo is useful for inexperienced and experienced traders. They can test strategies on this account without risking money to do so. It also helps the trader see the broker’s offerings before depositing money to trade.

Some prefer testing and practicing on real accounts for a complete market experience. We recommend a micro or cent account for this to minimize the financial risk.

3. Deposit money

Next is trading on the live account. You will need to deposit money for this. It should be easy if the broker provides popular payment methods.

Click on the funds tab on the trading platform. On the menu, select the appropriate option for money transfers into the account.

The available payment options will appear. Select the one you prefer and fill out the instruction form. The money should appear in the account within minutes, or at most, within the hour.

Deposits are mostly free on the broker’s side. But the payment company may charge a small amount. This fee is usually separate from the actual funds, so the money should reflect in full in your brokerage account balance.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

Before you trade, a market analysis of the currencies is required to succeed. Conduct market analyses, which give you valuable knowledge and insights about the price movements.

Market analyses show you the factors that influence the exchange rates and how they are influenced. It improves your trading decisions by much. In fact, analyses are an indispensable ingredient in trading if you wish to make a profit.

There are two important forex market analyses:

- Fundamental analysis

- Technical analysis

Fundamental analysis in forex trading looks at the economic elements affecting the currencies’ values. Every national currency is powered by its country’s economy. So the trader studies crucial economic factors, such as interest rate, inflation, exports, imports, gross domestic product (GDP), etc. These factors provide insights into the exchange rates and help the trader make the best predictions about price movements.

Technical analysis is more commonly used and equally important to forex trading. Fortunately, trading platforms come with various tools for it, including indicators, trade signals, charts, etc. These tools help the trader examine past price movements. The aim is to spot patterns that indicate the best buy and sell opportunities in the market. Learning the trading tools used and how to interpret patterns is key to conducting technical analysis successfully.

Both analyses are essential to profitably trading the forex market. The trader can determine the best forex strategy for the asset after analyzing the market.

Famous forex trading strategies:

- Momentum trading

The momentum trading strategy involves identifying the prevailing trend and entering a trade to join the momentum. The trader must have conducted the proper analyses, indicating that the trend will continue for a specified period. Many indicators are provided in platforms for this. MACD is a famous momentum indicator used for this strategy.

- Breakout strategy

Breakout in forex trading refers to the asset’s price moving past the current support or resistant points. Trading breakouts involve placing trades at expected price break points. The trader needs first to identify the current price direction. Then find the expected breakout or breakdown points using the relevant indicators. The RSI indicator is a popular tool used for confirming breakouts.

- Price action trading

Price action strategy is a rather simple approach requiring less complex tools. The trader studies the forex chart and places a trade based on the information presented. The price movements are shown through the candlesticks in the chart. By observing the candlesticks and noting the asset’s opening, closing, highs, and lows, the trader can place profitable trades.

- Economic news trading

Many traders base their decisions on economic news reports. This is called trading the news. The user should be conversant with forex fundamentals and market participants’ behaviors. Based on the report, the market responds to news releases by pushing the price in a certain direction. The trader using this strategy must expect the correct market reaction to the news. That way, they can place the winning trade using the appropriate risk management tools.

Many other forex strategies are available. The key thing is the proper understanding of whatever strategy you choose. Its effectiveness and profitability often depend on correctly applying it to trades.

5. Make a profit

Place the trades using the most suitable strategy after proper analyses. It would be best if you started to make profits soon.

Withdrawing profits should be as uncomplicated as deposits if the broker provides the appropriate payment methods.

Click on the funds’ tab and select the withdrawal option. Choose the same payment method you used for depositing funds.

Complete the request form and click on submit. The broker receives your request and processes the transfer.

Withdrawals often take longer to hit the receiving account. But the average time length is two days. Depending on the broker and payment method, it can take longer than this or less time.

(Risk warning: 78.1% of retail CFD accounts lose money)

Final thoughts: The best Forex Brokers are available in Estonia

Estonians have a range of options for forex brokers in Europe. The recommendations in the article should help you narrow the choices. Ensure the broker you settle with holds a valid operating license within Estonia or Europe. Good luck and happy trading!

FAQ – The most asked questions about Forex Broker Estonia :

Is forex trading legal with forex brokers in Estonia?

Yes, forex trading is legal with forex brokers in Estonia. Traders in Estonia can indulge in forex trading with their favorite forex brokers. They can enjoy all the features that forex traders in other nations can. Besides, Estonia’s highly volatile trading market extends plenty of opportunities to traders. So, any trader desirous of making money with trading can sign up with the best forex brokers in Estonia.

What features do the best forex broker in Estonia offer traders?

Traders can trade forex in Estonia and signup with one of the five forex brokers in Estonia.

BlackBull Markets

Pepperstone

IQ Option

Capital.com

You will find all the leading tools and technical indicators on these platforms. Besides, they also promote a customized trading experience by letting you access trading platforms such as MT4 and MT5. So, a trader in Estonia should sign up with forex brokers that offer them many features.

How much minimum deposit does a trader need to sign up with forex brokers in Estonia?

Traders can sign up with any broker in Estonia with an amount beginning at $10. Forex brokers in Estonia, such as Roboforex, will let you sign up for a trading account for only $10. However, it also depends upon the kind of trading account you choose with the broker.

Last Updated on June 1, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)