The 5 best Forex Brokers and platforms in Ethiopia – Comparison and reviews

Table of Contents

Over 109 million intending forex traders are streaming toward the Ethiopian market. Though, in its developing phase in the forex market, the record of growth in its forex markets is impressive.

There are many controversies saying forex trading in Ethiopia is illegitimate. This isn’t true. Notwithstanding that Ethiopia has no local forex regulatory agency, it still has legal backing from international regulatory bodies. Thus, making it legitimate.

See the list of the best Forex Brokers in Ethiopia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 75% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 75% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 75% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Top 5 Forex Brokers and platforms in Ethiopia

After a series of deep research and analysis, the following forex brokers emerged as the 5 best in Ethiopia

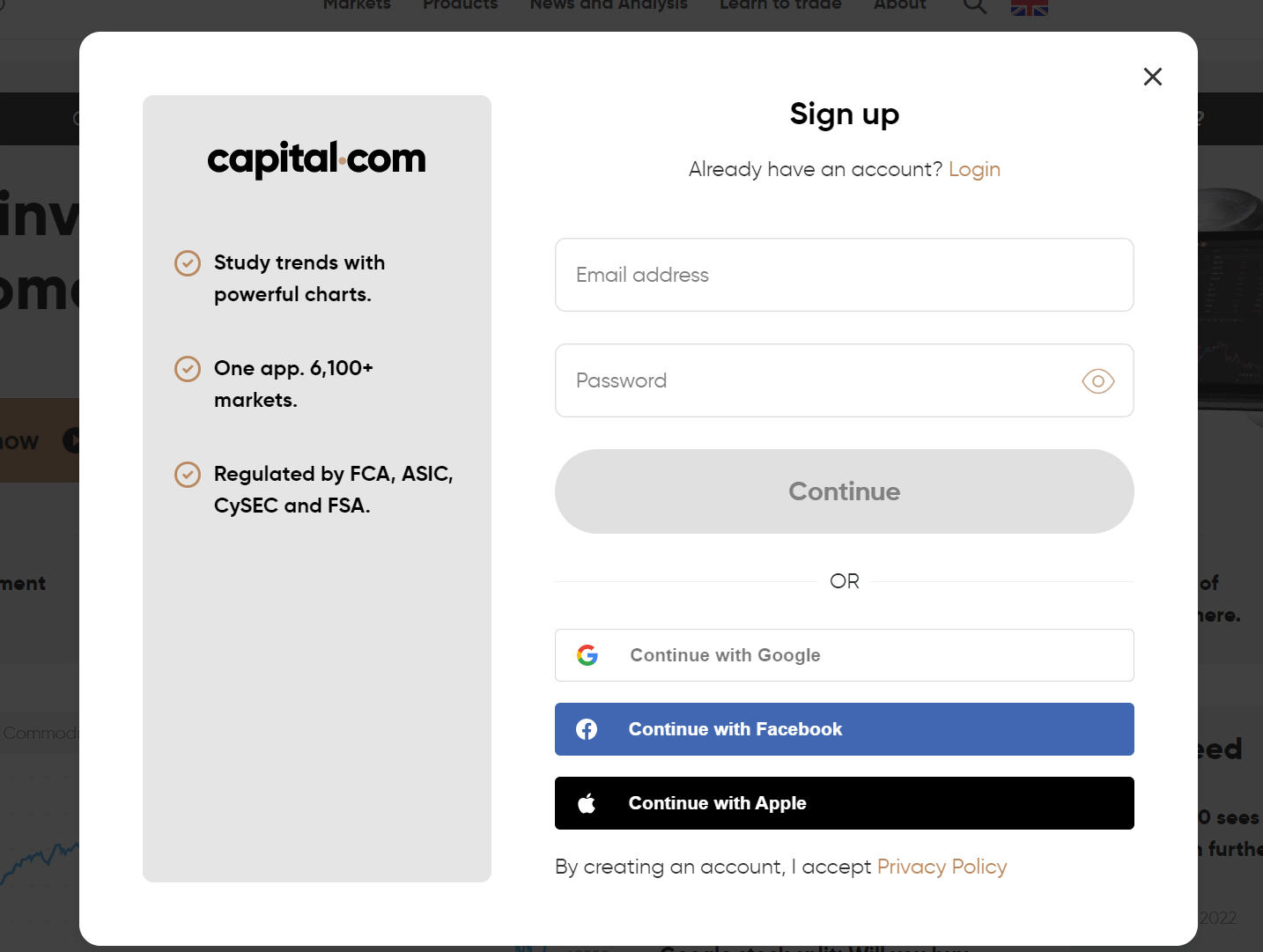

1. Capital.com

As an award-winning and authorized forex platform, Capital.com is perceived for its demonstrated quality, forex insight, extraordinary client assistance group, and genuineness in its exercises. Capital.com was established in 2016, and there is a report of 27% growth in 2022.

Capital.com is recommended for amateurs and expert traders alike. It has a smaller range of markets yet outshines more significantly than other Forex platforms. Capital.com doesn’t trade publicly. It reports a trust score of 77 with an average risk.

The innovations used by its financial institutions are superb. Note that Capital.com keeps clients’ money in segregated bank accounts to comply with the rules as stated by international forex bodies.

Capital.com is under the rigid direction of the accompanying commissions:

- UK’s Financial Conduct Authority;

- Australian Securities and Investments Commission; and

- Cyprus Securities and Exchange Commission.

Currency pairs of Capital.com include EUR/USD, USD/JPY, GBP/USD, AUD/USD, EUR/JPY, GBP/JPY, USD/CAD, EUR/GBP, AUD/JPY, USD/CHF, EUR/AUD, NZD/USD, EUR/CAD, GBP/AUD, CAD/JPY, GBP/CHF, AUD/CHF, and more.

Merits of Capital.com

- User-friendly educational materials;

- An accessible account opening process;

- A free withdrawal that requires one day;

- Available deposits through electronic wallets and debit cards;

- The average spread of 0.8 pips

- Great customer support team.

Demerits of Capital.com

- Its platform cannot be customized to clients’ needs; and

- A poor referral program is operated.

(Risk warning: 75% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a licensed Forex broker proven for its high-quality services. It was created in 2014, and it has its headquarters in Auckland, New Zealand.

The method of making a withdrawal must correspond with the deposit method. The demo simulator provided is 30 days with virtual funds of $100,000. BlackBull Markets founded a YouTube educational channel called the Whiteboard Wizards Playlist.

To create an account with BlackBull Markets, fill out a brief application form online, verify your ID, confirm your email address and hold on for permission. A demo account is created by filling out an application form online and setting your account parameters.

Advantages of BlackBull Markets

- The average cost of trading

- Spread for Standard accounts is 1.25 pips;

- Traders can make deposits using nine currencies, including EUR, USD, and GBP.

- Excellent trading academy;

- Encrypted data;

- It permits traders from Ethiopia, the UK, South Africa, Italy, UAE, and other countries.

- ZuluTrade trading; and

- Assets selection is available as there are widespread assets in BlackBull Markets.

Disadvantages of BlackBull Markets

- US traders are not accepted;

- Minimum deposit of $2,000 for forex Prime accounts holders; and

- It has a withdrawal fee.

(Risk Warning: Your capital can be at risk)

3. RoboForex

The International Business Magazine Awards recognized RoboForex as the Most Trusted Broker in 2021. It has been operating since 2009. For every newly registered person that signs up, RoboForex provides a bonus of $30 in initial funds.

RoboForex is known for its recognized trading experience, significant technological provisions, and quality customer support. Five currencies are approved: USD, EUR, RUB, GOLD, and CNY. RoboForex has eight classes of assets.

To open a RoboForex account, sign up, fill out the application form, and make the first deposit. Before creating a real account, traders can use the RoboForex demo account to verify the conditions offered.

Merits of RoboForex

- Immediate fund withdrawal

- Minimum deposit of $10 with a spread starting from 0 pips

- RoboForex platform supports 18 languages

- Applies the rule of negative balance protection

- Provision of excellent assistance with educational tools, customer support, and analytical research throughout the process.

Demerits of RoboForex

- Clients from Japan, Canada, the US, and Australia are not permitted; and

- Spread accounts are not fixed.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is known for its quality research and multiple platforms for copy trading. It was founded in the year 2010. It has low risk with a total Trust score of 93 over 99. Pepperstone started operating in Ethiopia after getting its license from international regulatory bodies.

Pepperstone provides two types of accounts: standard account and razor account. The razor account is recommended for traders who want lower fees.

Pepperstone account opening involves:

- Registration of email and password;

- Confirmation of email; and

- Transfer to the secured area for clients.

The four platforms for trade offered by Pepperstone include:

- MT4;

- MT5;

- cTrader; and

- TradingView.

Benefits of Pepperstone

- Quality customer support service;

- Low cost of commission;

- Low spreads;

- It trades over 72 currencies;

- Security provided to its customers by segregating customers’ funds from their corporate funds;

- Withdrawal of funds in pepper stones takes up to 1-3 business days, with various withdrawal options; and

- Stress-free access to the markets.

Limitations of Pepperstone

- The minimum deposit for Pepperstone is $200; and

- Traders from the US are not granted access to trade.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option was established in 2013, with a minimum deposit of $10. IQ Option has a user-friendly platform.

IQ Option provides competitive spreads and currency pairs, including EUR/USD, USD/JPY, GBP/USD, USD/CAD, AUD/USD, NZD/USD, and USD/CHF. Recently, the IQ option has 25 Forex pairs on its platform.

IQ Option provides a free demo account with virtual money of $10,000. Forex traders can use their demo accounts as long as possible to assess trading strategies and become familiarized with the platform before depositing real money.

An IQ Option client doesn’t have to fill in any information to use the demo account. Nevertheless, some other brokers require you to fill in certain information to access their demo account.

Benefits of IQ Option

- No processing fees are charged for funds deposits;

- Withdrawal on IQ Option takes three days to verify the client’s identity. The option of withdrawal must correspond with the deposit or payment option;

- Spreads in the IQ Option depend on volatility, time, and liquidity; and

- Countries such as Ethiopia, Qatar, Kuwait, Italy, Thailand, UAE, Luxembourg, etcetera are accepted.

Drawbacks of IQ Option

- Only derivatives are traded; and

- High level of risk involved.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Ethiopia?

Approved forex offices and banks are the only places where foreign currency is changed to Birr in Ethiopia. When you want to demand Birr’s reconversion into other foreign currencies of more than USD 3000, you are expected to deliver original receipts given by banks.

Capital inflows from Forex investors have to be enlisted and authorized by the Ethiopian Investment Commission at the initial investment stage. This includes partnership agreements with an independent establishment.

The initial capital investment ought to be deposited in one of the commercial banks in Ethiopia. Upon a show of an endorsement (certificate) of deposit, can a branch or subsidiary company be enlisted by the

Forex traders are guaranteed to make gains from Ethiopia in convertible foreign currency at the current exchange rate.

These gains may include; profits and dividends accruing from investment; principal and interest payments of external loans. Also, other gains included are payments related to technology transfer agreements; proceeds from the sale or liquidation of an enterprise. The final gains here are proceeds from the transfer of shares or partial ownership of an enterprise to a domestic investor and compensation paid to an investor under the investment laws.

Ethiopian forex brokers getting loans from any foreign individual or platform are subject to the endorsement of the NBE. Certain circumstances and necessities must be met.

It is permitted to make payment of interest on foreign loans and the principal loan provided that the NBE endorses the foreign loan first. Reimbursement of a foreign loan may be denied where there is an inability and delay to meet specific requirements. In order to provide a Forex loan, the NBE directive provides that the debt-to-equity proportion should not surpass 60:40 of the foreign capital.

All foreign payments require permission from the NBE. Forex transactions must be done through ADs.

Locally sourced inputs are strategies used by private sectors to solve the forex shortage issue.

The Forex regulatory body in Ethiopia has directed all banks to share a minimum of 50pc of foreign currency.

Security for traders in Ethiopia

The recently established National Reform Committee (NRC) will coordinate a few measures to support economic development and increase foreign investment in Ethiopia to a great extent in the state-controlled economy, even though policy implementation will likely only result piecemeal.

The NRC involves the:

- Ministry of Finance agents;

- Ethiopian Investment Commission (EIC);

- National Bank of Ethiopia (NBE); and

- Central bank.

Generally speaking, the NRC is tasked with sustaining economic growth. The NRC should address the progress of the piecemeal made on economic changes by overlapping committees that have been created inside the state leader’s office. This was since the new government was set up in April 2018. State head Abiy Ahmed’s ‘New Horizon of Hope’ system, which supports the public authority’s financial technique, is only one-page long.

The strongest encryption technique of data is the SSL 128-bit. It guarantees total protection of payment details and debit cards.

Forex traders and brokers are urged to use strong and complex passwords, most importantly, when managing money. It is discouraged to repeat passwords for all sites.

When researching a brokerage company, do well to visit the review page to have an exhaustive examination of their service provider—this aids in making informed decisions.

The KYC (Know Your Customer) approach is prescribed to every Forex platform to verify your potential clients’ goals and identity before rendering any services to them.

Is it legal to trade Forex in Ethiopia?

Forex trading in Ethiopia is seen as lawful but not so dynamic. The nation’s economy is generally founded on agribusiness. Although the government is attempting to advocate different fields as well, it is challenging for the country to stay aware of the affordable improvement of other nations.

As a result, there are no local Forex brokers in the country. However, the country’s citizens can still start Forex trading with international brokers that offer their services to the country’s citizens.

There are controversies that trading Forex on the financial market in Ethiopia is unsafe. However, this isn’t the case; Ethiopia is one place where forex is freely traded.

There are many scam organizations that are attempting to get to individuals and lie to them, which can wind up extremely terrible for Forex traders. In order to prevent such a situation, it is important that you constantly remain on track and trust Forex brokers that own authority licenses from one of the most trust-commendable forex regulatory bodies worldwide.

How to trade Forex in Ethiopia – A quick guide

A guide has been drafted on how to open a forex account in Ethiopia.

Open a Forex trading account

The initial step is to get enlisted with either an international broker or an Ethiopian broker. The advantage of using an international broker is to avoid currency translation risk. Likewise, the benefits of dealing with an Ethiopian broker include arranging yearly fiscal reports when filing tax returns and the experience of utilizing Ethiopian guidelines.

In this step, Forex traders are encouraged to conduct proper research on the best Forex broker and also make market analyses of the country’s economy they wish to operate in.

(Risk warning: 75% of retail CFD accounts lose money)

Start with a demo account or real account.

Clients who wish to trade Forex in Ethiopia are advised to open a demo account first. Here, virtual funds are used. Some Forex brokers don’t need any of your details for you to be able to access this account.

Novices in Forex trading are urged to gain proficiency with the rudiments and spot the best broker using this account.

A real account is then opened with proper registration and minimum deposits made. Here, real money is deposited, and real money is earned and withdrawn.

Examples of real accounts include; standard or classic, cent and, premium or professional.

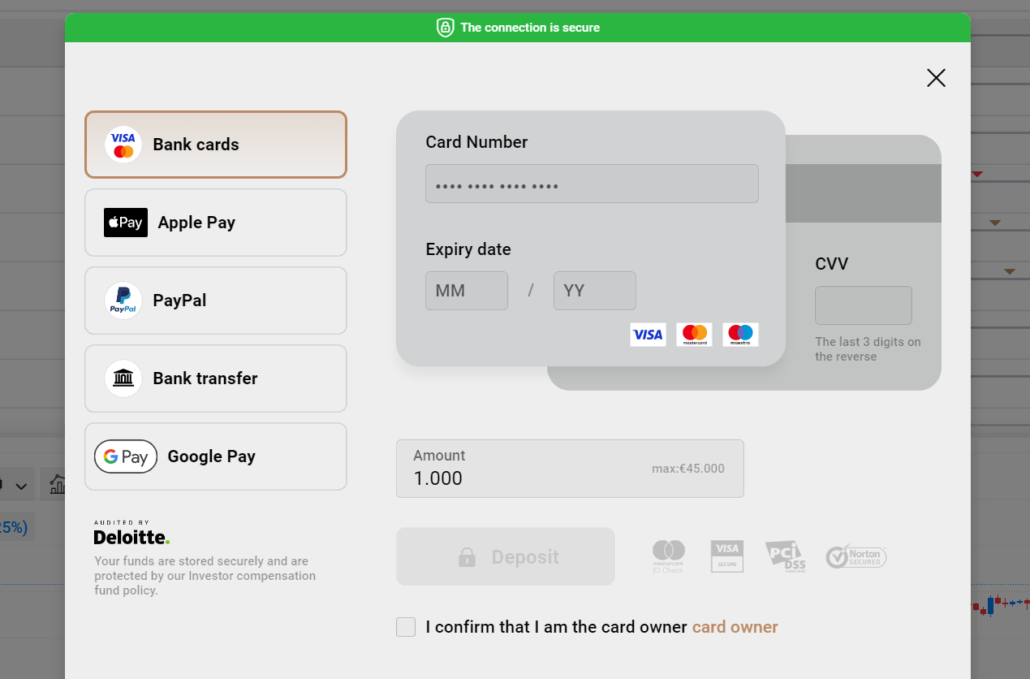

Deposit money

Different Forex brokers have their standard minimum deposit fee and commissions, which may be free or not. The initial deposit is high for some brokers, while some are low.

There are a wide variety of deposit options. They include; bank-wire transfer, Fasapay, bank card, Broker broker transfer, Qiwi, bitcoins, Neteller, etcetera.

The initial deposit option must tally with the withdrawal method for most brokers.

Different currencies used to make payments include:

- EUR

- USD

- RUB

- GOLD

- GBP

- JPY

- CAD

- AUD

- NZD

- CHF and

- CNY

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

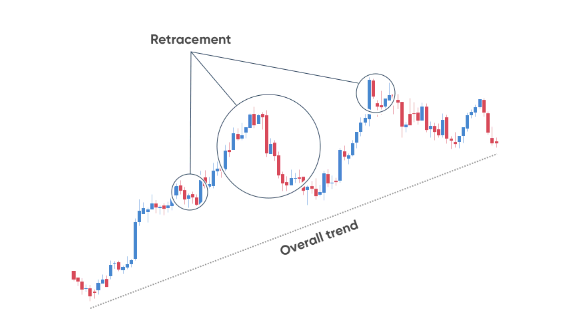

Use analysis and strategies

In Ethiopia, two major strategies are employed.

They include:

- Fundamental strategy; and

- Technical strategy.

In fundamental strategy, a country’s economic and political status is considered in-depth. The trade strength of the country under study is also analyzed. The countries with the most elevated propensity of expansion in the worth of their currencies are selected.

Balance of trade, interest rates, GDP growth, consumer confidence indexes, etcetera are all elements of this analysis method.

In technical strategy, careful observation and understudy of price data and charts are carried out. Forex clients employing this analysis give little consideration to the observed country’s political and economic stand.

Resistance levels, reversal signals, and breakout points should be considered factors under this analysis method.

Make profit

An average Forex trader in Ethiopia earns approximately $83,798. A skilled currency trader with deep pockets and the right strategies can make huge profits.

Ethiopian Forex traders enjoy certain privileges, unlike other countries’ traders. Birr is the local currency of Ethiopia and is a stable currency to trade.

Ethiopia has one of the best banking systems globally, making it even more secure against any form of loss.

Traders are provided various options when it comes to deposits and withdrawals. These options include; credit and debit cards, wired transfers, and e-wallets.

Forex traders should keep receptive outlooks as the system may be rough and not straightforward 100% all the time. With time, proper preparation, and the right broker, traders can make significant profits from trading in the foreign exchange market.

Conclusion: The best Forex Brokers are available in Ethiopia

The unfortunate digitization in Ethiopia has improved fraudulent activities amongst unlicensed forex platforms, giving them the foothold to scam clueless traders.

Much emphasis has generally been laid on the need for intending Forex traders to confirm that they are trading with a reputable broker, supervised by top regulatory bodies.

Be completely enlightened as forex trading isn’t for the oblivious. It is generally exhorted at your early phase to open a demo account. That provides you with a great deal of space to master, to an extent, the essentials and regulations of forex trading.

Forex clients need to be informed of forex scarcity and strict rules and regulations in Ethiopia. Similarly, forex traders must adhere to regulatory standards and requirements to achieve the stipulated investment objectives.

FAQ – The most asked questions about trade forex in Ethiopia :

Is it legal to trade forex in Ethiopia?

Forex trading is legitimate in Ethiopia. However, because there are so many scammers out there, traders must exercise extreme caution. You must be fully aware of which company to pick if you want to trade foreign exchange safely in Ethiopia.

What are the most popular software programs among forex traders in Ethiopia?

Most Forex firms often provide traders with MetaTrader 4, which is utilized by more than 90% of Forex brokers. You will find many additional software, such as a revamped model of MT4, MT5, and the cTrader, since the majority of FX brokers providing services to Ethiopians are worldwide businesses.

Can you use a smartphone to trade forex in Ethiopia?

Modern Forex brokers typically allow traders to do Forex transactions on their mobile devices. This is a fantastic progression, specifically for nations like Ethiopia, where the majority of the populace does not own a personal computer.

Is Ethiopia the right place to begin your forex trading?

You can begin trading in Ethiopia right now if you’re prepared to conduct a study and take every precaution to stay secure. However, this industry is unquestionably not for you if you believe that you won’t be able to put in such a lot of effort.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)