The 5 best Forex Brokers in Fiji – Comparisons and reviews

Table of Contents

Are you looking to start forex trading in Fiji but do not know which broker to choose? This article introduces the best online brokers to trade with. Our major considerations are the overall trading conditions and service quality. We have reviewed numerous trading platforms to bring you the list below.

See the list of the best Forex Brokers in Fiji:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the 5 best forex brokers for Fiji traders:

An overview of the brokers:

1. Capital.com

Capital.com came into the market in 2016 and now has nearly 1 million customers worldwide. Capital.com is based in the United Kingdom, with other offices in Cyprus, Seychelles, Gibraltar, and Australia.

Capital.com is licensed by its home country’s FCA. The broker is also registered with the FSA (Seychelles), ASIC (Australia), CySEC (Cyprus), and the NBRB (Republic of Belarus).

The minimum deposit to trade with Capital.com is $20. The broker offers a free demo. Trading services are provided on the MT4 and the Capital.com app. Traders can reach support any time during trading hours (24 hours, weekdays).

Spreads start from 0.6 pips on the broker’s no-commission-fees accounts. Deposits and withdrawals are free, and dormant accounts have zero charges. Expect top-quality service with first-rate educational content and reasonable trading fees.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets joined the forex industry in 2013 and now has centers in Asia and the United Kingdom. BlackBull Markets is based in New Zealand, with offices in Japan, China, and the United States.

BlackBull Markets is registered with New Zealand’s FMA and Seychelles Financial Service Authority FSA.

The broker accepts a minimum deposit of $200. A free demo is provided. Fijians can trade with MT4, MT5, and the mobile app. Its support service is available all day and all week, except Sundays.

BlackBull Markets’ minimum spread is 0.6 pips on its standard account and 0.1 pip on the raw ECN. Zero commission is charged on the standard, but the raw ECN attracts a $3 commission per side. With this broker, Fijians can expect fast order executions and good customer support service.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex has been in operations since 2009 and has over 1 million active customers in 169 countries. RoboForex’s headquarter is in Belize, with other offices in New Zealand, Cyprus, and the United Kingdom.

RoboForex is authorized by the International Financial Service Commission of Belize.

The broker requires a $10 minimum deposit to trade on its platforms. Free demo accounts are provided for testing. RoboForex offers several platform choices, including the RTrader, MT5, MT4, and cTrader. Customer service is available 24 hours a weekday.

RoboForex’s fees are among the lowest in the industry. The lowest spread on its ECN accounts is 0.1 pip, with a $2 commission fee. The spread on its standard commission-free account starts from 0.6 pips. Traders can expect low trading costs, several bonus packages, and a conducive trading environment.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone entered the market in 2010 as an ECN forex and CFD broker. The company now has a physical presence in several regulated regions in Europe, Africa, the Caribbean, and Asia.

Pepperstone operates with several licenses, including SCB the Bahamas, CySEC, BaFIN Germany, CMA Kenya, and FCA. The broker is considered one of the safest choices for Fijians.

Any amount is allowed as a minimum deposit on Pepperstone’s platforms. Although the broker suggests $200 is an ideal amount to trade with for a start. A free demo account is available on Pepperstone’s website. Traders can use MT4, cTrader, and MT5 to access its selection of market offerings. Automated, social, and copy trading are offered through Duplitrade, Zulutrade, and MyFxbook.

The minimum spread on the broker’s razor account (raw ECN) is 0.1 pip. A $3 commission is deducted per lot traded. The starting spread on its standard account is 0.6 pips, with $0 commission charges. Fijians can expect a rich trading experience with superfast order execution and outstanding customer service.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option joined the market in 2013 as a binary options (only for professional traders and outside EAA countries) broker. Now, IQ Option offers several asset types and has offices outside its home country, Cyprus.

IQ Option operates with a CySEC license and has another regulated center in Seychelles, authorized by the FSA.

IQ Option requires a $10 minimum deposit to use its services. A free demo is offered. Trading services are available on the IQ Option app. The broker also provides social trading services on its platform through the Community Live Deal tab.

IQ Option offers one standard account in which the minimum spread is 0.6 pips, with a $0 commission charge. Traders can expect to trade binary options (only for professional traders and outside EAA countries) and digital options with ease alongside forex pairs. Its platform is unique and easy to use, and the trading costs are reasonable.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Fiji?

Fiji is an island country in the Pacific with a population of more than 800,000 potential forex traders. Tourism is a major part of the country’s economy, and the country is among the most developed in the Pacific regions.

The Reserve Bank of Fiji is the top financial regulator in the country. The RBF regulates the country’s money supply and ensures financial stability in Fiji. The RBF also oversees the finance industry, including currency exchanges.

Brokers seeking to operate in Fiji have to be authorized by its Reserve bank. But the bank does not restrict Fijians from trading with foreign-based brokers.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders in Fiji – Important facts

Fiji forex traders can deal with local and international brokers. Many online companies welcome traders from the country.

A single operating license from other offshore regions is considered weak because of the little consumer protection required from brokers. For instance, most offshore licenses do not require a negative balance protection and compensation scheme to issue broker licenses.

Therefore, Fijians should seek brokers with licenses from popular and top-rate jurisdictions, such as Europe, the United Kingdom, or the United States. Many reputable brokers hold licenses from these jurisdictions and other tier-two bodies.

Fijians will be safe to trade with a domestic or foreign broker that is RBF-licensed and registered with a top-tier financial body. A well-known foreign broker with a license from the aforementioned regions is also a safe option.

Is it legal to trade Forex in Fiji?

Yes, forex trading in Fiji is allowed. The Reserve Bank of Fiji does not restrict the activity. Therefore, it is legal to engage in forex trading in Fiji. Traders should use licensed brokers within or outside the country to be safe.

How to trade Forex in Fiji – A guideline for traders

Trading forex online requires these basic things:

- A smart device connected to stable internet service.

- A dependable broker.

A mobile phone, tablet, or laptop is good enough for trading since many brokers’ platforms now have mobile compatibility. The internet has to be reliable for smooth transactions. Timing is a vital consideration while trading, and you want to close or open trades at the exact time you choose. Frequent disruptions on the internet can prevent this and lead to loss of money.

A dependable broker is another basic requirement. Profitable forex trading partly depends on the broker. Quality service with favorable trading conditions gets you halfway to trading the market profitably. Therefore you want to choose your broker carefully.

Make sure the broker meets ALL these requirements:

- License

An RBF license is good, but the broker should also be registered with a reputable financial entity that mandates investor protection.

Examples of these entities are:

- A free demo

A credible broker allows site visitors and potential customers to test their platforms. A free demo account lets you do this. The broker adds enough cash and allows testing for at least 30 days. It proves that the broker has confidence in their service, and it lets you experience the broker’s offerings before committing to them.

- Reasonable trading expenses

Reputable brokers do not set their spreads and commission higher than the industry average. They do not charge unnecessary fees and keep trading expenses low. Compare trading costs among brokers to ensure your chosen one’s fees are not over the top.

- 24 hours accessible customer service

Good brokers ensure that support is readily reachable during trading hours. This means 24-hour customer service provisions via live chat, phone, email, and social media chat. Reading customers’ feedback about the broker’s support service can give you an idea of what to expect.

- Simple payment methods

Check that the payment methods provided by the broker are accessible in your country. You need to be able to deposit funds and withdraw profits without any hassle. Popular payment services in the country should be provided for this. It would be best to inquire about this before trading with the broker.

If the broker meets these requirements, you can consider signing up with them.

Steps to trading forex in Fiji:

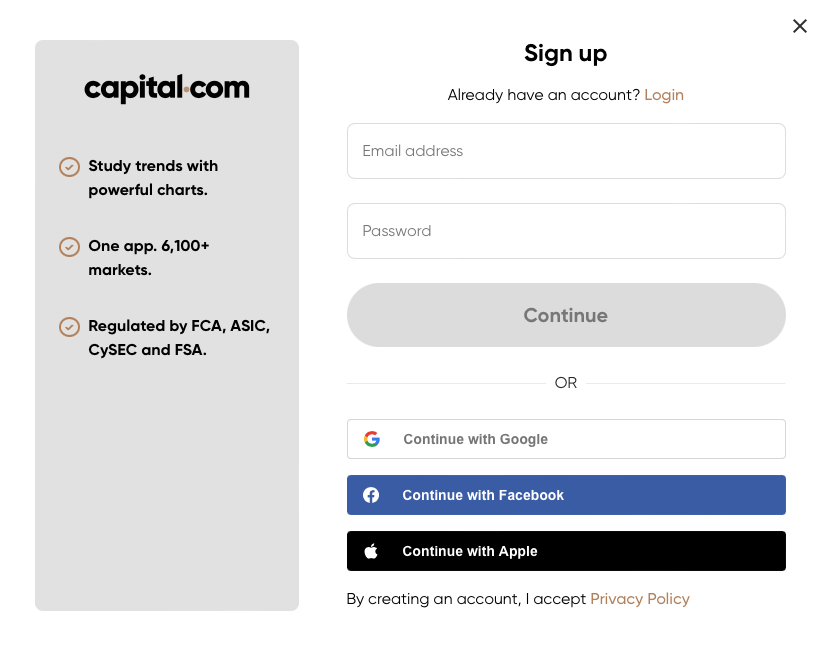

1. Open account for Fiji traders

Go to the broker’s website for Fiji traders to begin the registration. Clicking on the website link takes you to this page where the services are specific for Fijians.

The create account tab will be the most visible on the broker’s landing page. Click on that tab and type in the required details, including your email address and maybe a full name.

Click on OK after entering the information. The system sends an authentication link to the email you gave. Open the message and click on the link. It authenticates the details you provided and loads the complete signup form for you to fill out.

If applicable, be ready to scan and send some KYC documents, such as a national ID and utility bill.

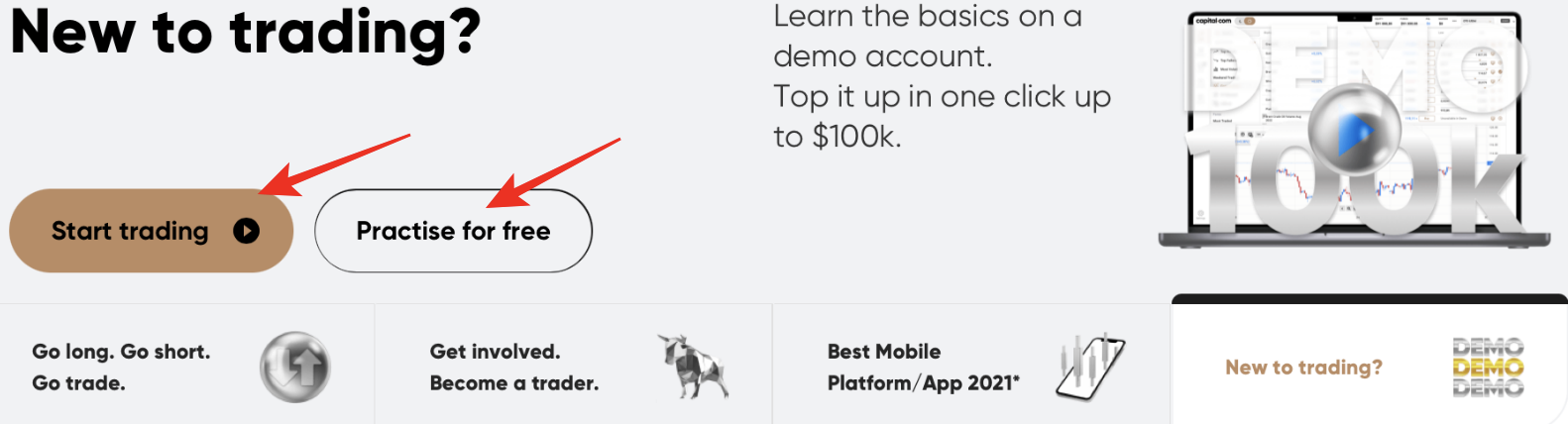

2. Start with a demo or real account

After the registration, you should test the broker’s service with the free demo account. The account comes with sufficient fake cash to conduct many tests. New traders can practice and get familiar with the forex trading environment before real trading.

The free demo also lets you test your trading styles and strategies on the broker’s platform without risking any money. So, it is very useful, and you shouldn’t proceed to a real account until you’re comfortable with the demo.

However, some traders prefer these tests on real accounts. The live market experience gives the trader proper exposure and a complete feel of the broker’s services. We recommend using a cent account for such trading to lower the financial risks.

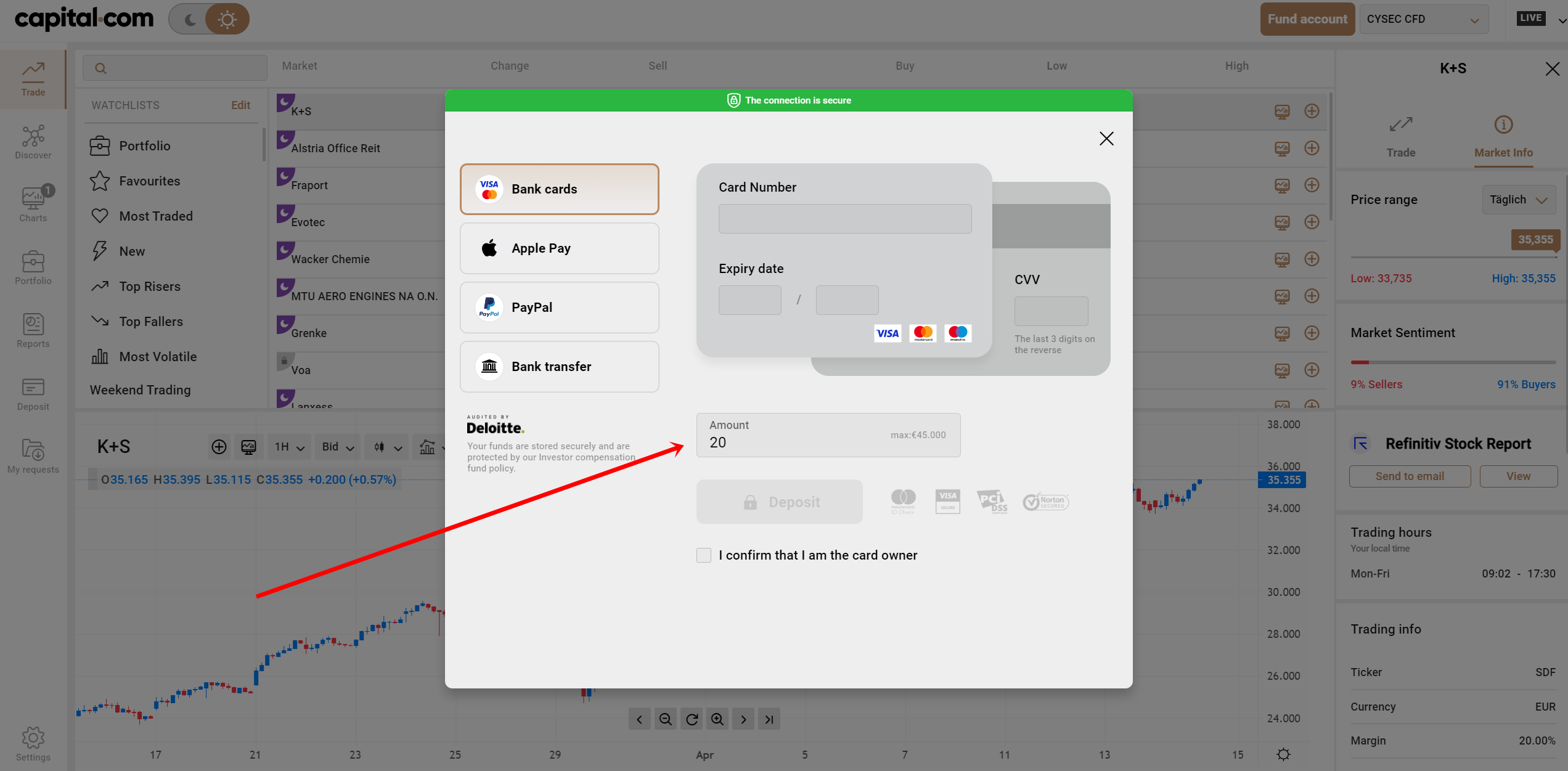

3. Deposit money

Using the real account to trade requires actual funds. You need to deposit money into the account. It should be simple and quick if the broker provides the right payment methods.

Click on the fund manager tab and select the deposit option on the menu. The available payment options will appear. Choose the best one for you and follow the instructions.

The money should appear in the trading account within a few minutes or an hour. It depends on the payment option used. The broker often assigns support reps to new customers. So if you encounter any issues with this, help will not be far away.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

Don’t just start trading once the money hits your account. First, conduct a market analysis on the forex pairs you wish to trade. Understanding the asset is key to profitable trading.

Market analyses show you the historical prices and the asset’s past behaviors, which gives you a clear idea of where the price might move next.

You can devise the best trading strategy for the forex pair through market analyses. That is how you trade the market successfully.

Here are the crucial market analyses in forex:

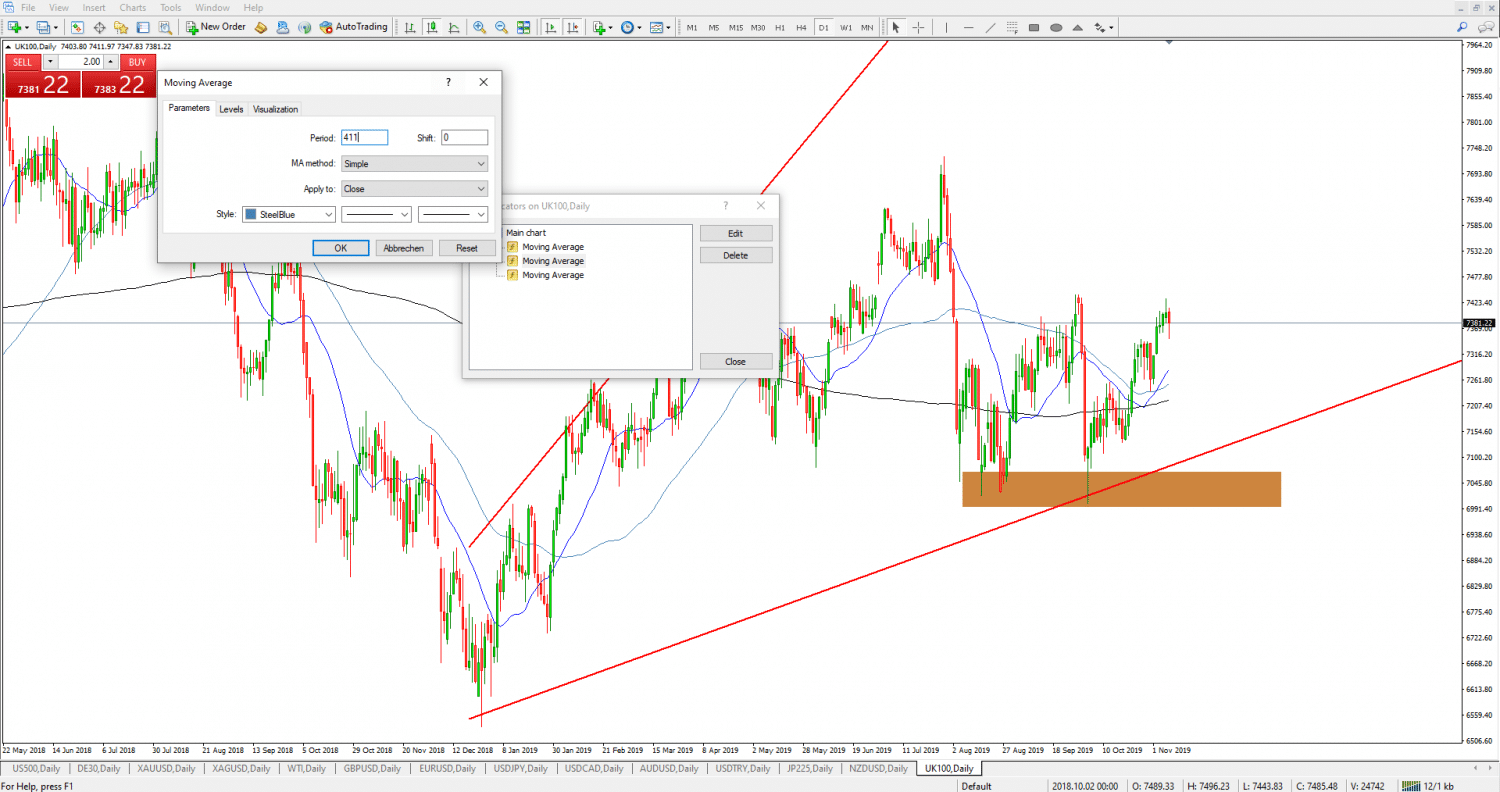

- Technical analysis

- Fundamental analysis

- Sentiment analysis

Technical analysis in forex means examining the past prices in the forex chart to look for patterns that indicate the best buy and sell opportunities. This analysis is common among forex traders, and there is a wealth of information about it on the internet. Brokers’ platforms come with a wide range of tools for technical analysis. Learning to use these tools and correctly interpreting the price patterns are crucial to a successful technical analysis.

Fundamental analysis means looking into the economies that propel the currencies. A vibrant economy translates to a strong national currency. The currency’s value increases in the foreign exchange market as the country continues to thrive. Therefore, traders examine factors like the GDP, deficits or surplus, interest rates, inflation, etc., to gain proper insight for currency speculation. Brokers’ trading platforms also come with various tools helping traders analyze forex fundamentals. The analysis is popularly used and equally vital to profitable trades.

Sentiment analysis shows the trader the market participants’ expectations and behaviors. Market sentiments determine price directions. Therefore, if participants expect a rise in prices, they enter BUY positions, driving the price upwards. Trading platforms also have tools that help with this analysis, including the relative strength index (RSI) and the volatility index (VIX). Sentiment analysis is connected to forex fundamentals. The trader studies both closely for successful analyses.

These three are important to devise a winning forex trading strategy for the currency pairs you wish to trade.

Commonly used forex trading strategies:

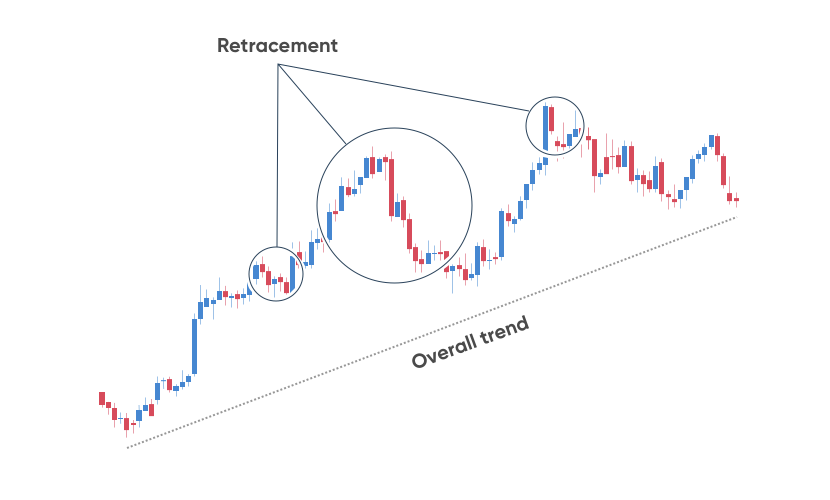

- Trend trading

Trend trading strategy is considered the mother of all forex strategies. The reason is price movements follow trends. Every market condition is a trend that the trader must first identify before taking a position. This trading strategy involves placing a trade in the same direction as the prevailing market condition.

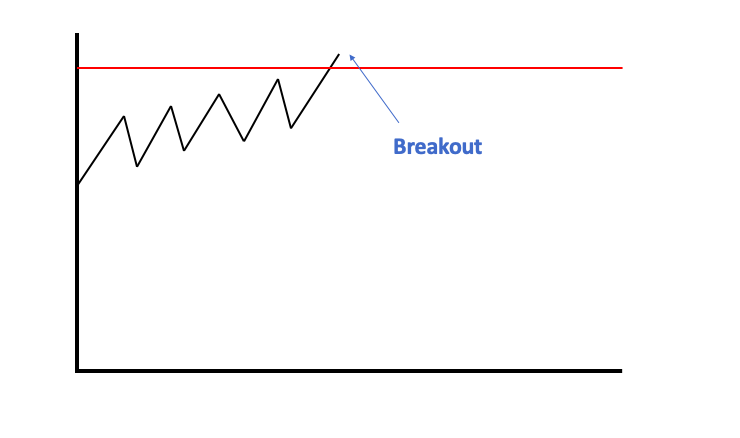

- Breakout strategy

Breakout trading is another popular forex strategy in which the trader finds opportunities where the price breaks onto a new path. The support and resistance levels are key zones to watch out for. A breakout occurs when the price cuts through any point, depending on the market condition. The trader takes a position near these zones to capitalize on the break.

There are many effective trading strategies. Understanding them is the key to using them correctly. Many combine more than one strategy to strengthen the trade signal. The technique is worth researching and studying.

5. Make a profit

Place trades using the most effective strategy for the forex pair after conducting the required market analyses. It would be best if you started to make profits soon enough.

You can move your earnings out of the trading platform or increase your capital with it. Withdrawals should be easy, although it takes longer to settle in the receiving account.

Follow the same steps for deposits by clicking on the funds’ manager tab. Click on the withdraw funds option and select your preferred payment method. Note that it is better to use the same one for deposits to avoid complications.

Fill out the withdrawal requests form and click on submit. The broker processes the request, and the money is sent to the applicable account within 48 hours or less. Sometimes it takes longer than this. It depends on the payment method used and the broker’s service speed.

(Risk warning: 78.1% of retail CFD accounts lose money)

Final thoughts: The best Forex Brokers are available in Fiji

Many brokers are accepting Fiji traders. Well-regulated brokers often provide the same basic service. But there may be small differences in the service quality and trading conditions. The brokers recommended in this article are among the market’s bests in all areas.

FAQ – The most asked questions about Forex Broker Fiji :

What can a trader expect from forex brokers in Fiji?

Traders in Fiji can expect everything from their forex brokers as traders in any other country would. The forex brokers in Fiji offer traders several features and unwavering customer support. So, trading is all fun for traders in Fiji.

Traders can also access the best trading platforms that make their trading experience fully customized. Besides, the forex brokers in Fiji offer traders a trading platform with the most innovative solutions.

Which forex brokers in Fiji are the best for trading?

There are more than one forex brokers in Fiji that are the best for trading forex. If you want to experience the best services while trading forex, you can sign up with one of the following five brokers.

BlackBull Markets

Pepperstone

IQ Option

Capital.com

RoboForex

These brokers are highly reputed. Besides, they are also regulated, and traders can trust them with closed eyes.

Can a trader trade forex with the best brokers in Fiji?

Yes, a trader can trade forex with the best brokers in Fiji. No rules or regulations in Fiji bar traders from trading forex. They can sign up with a broker of their choice.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)