4 best Forex Brokers and platforms in Finland – Comparison and reviews

Table of Contents

Opening a trading account for forex trading can be overwhelming because you first have to find a regulated forex broker suitable for you. It requires you to research many forex brokers to get a credible one; here is a list of 4 of the most reliable forex brokers in Finland.

See the list of the best 4 Forex Brokers in Finland:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 3,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The list of the 4 best forex brokers in Finland:

- Capital.com

- BlackBull Markets

- Pepperstone

- IQ Option

1. Capital.com

It got established in 2016 and has over 580,000 registered on its trading platform. It offers trading instruments, stocks, shares, indices, commodities, cryptocurrencies, and shares.

It has regulations from the Cyprus Securities and Exchange Commission, the Financial Conduct Authority, and the Australian Securities Commission.

It is a forex broker known for its low trading costs, especially since it is a low-commission forex broker, and forex spreads start with 0.8 pips. It has a Standard account with an initial deposit of $20.

Overview

- Minimum deposit-$20

- License-FCA, ASIC, CySEC

- Platforms-MT4, web-trader

- Spreads- from 0.8 pips on major pairs

- Support-24/5

- Free demo-yes

- Leverage-1:30

When it comes to other trading costs, overnight charges apply based on the trading account, leverage, and trade size. Deposits and withdrawals are free of charge. It has a 1:30 leverage for EU clients on forex.

It is an award-winning forex broker and has won some prestigious awards, including the most Transparent brokerage services in Europe. Besides that, it has a user-friendly interface accessible through the mobile app, and the desktop and website versions are compatible with windows and MAC.

Disadvantages of Capital.com

- It has limited trading instruments. Capital.com only offers about six categories of trading instruments that traders can choose to trade. It is less than other forex brokers competing with it in the financial markets.

(Risk warning: 78.1% of retail CFD accounts lose money)

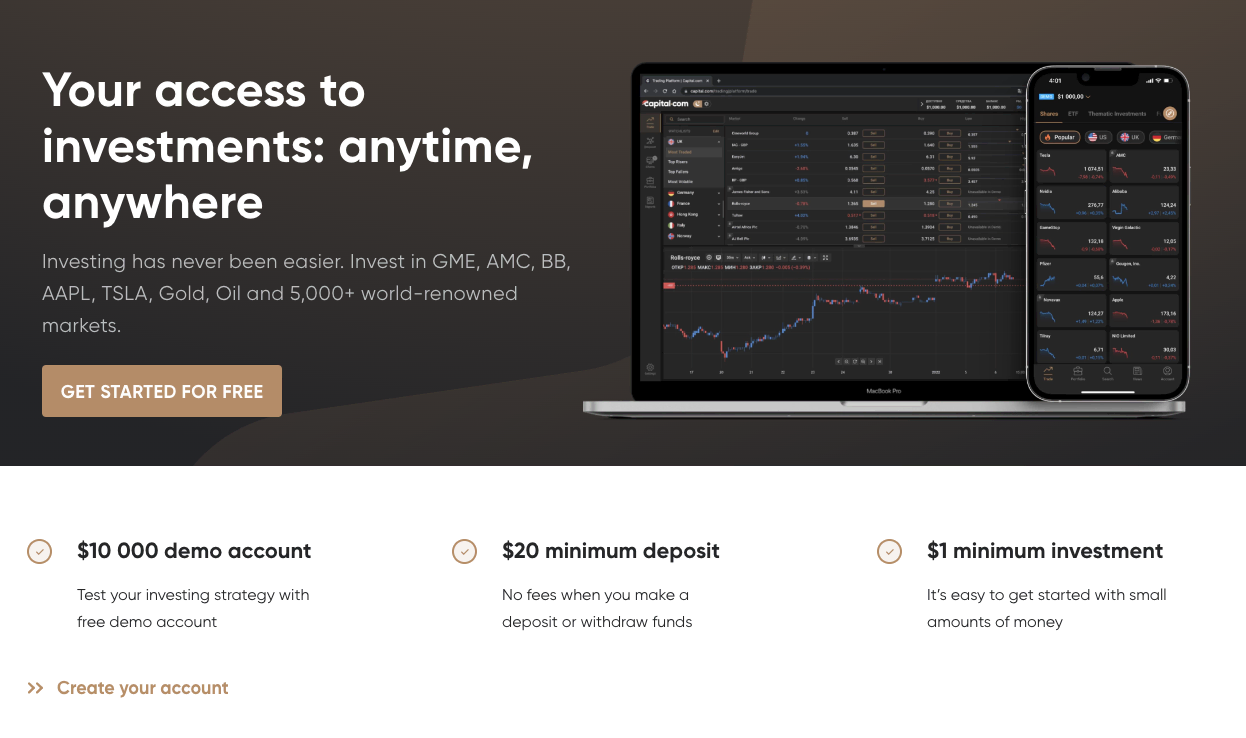

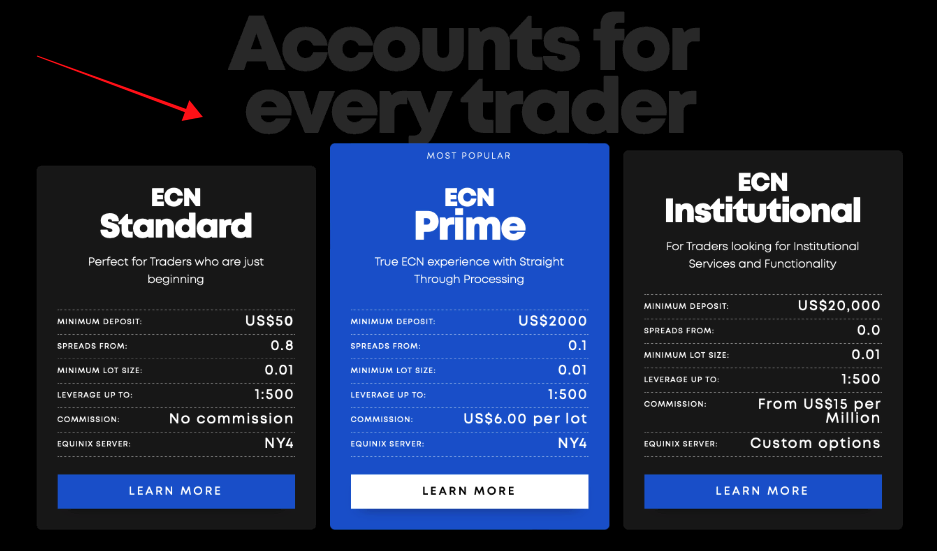

2. BlackBull Markets

It has operated since 2014 and has thousands of forex traders registered. Users can access commodities, energies, metals, CFDs, indexes, and shares. It has regulations by the Financial Services Authority.

Its forex traders can open the ECN Standard account with a $200 initial deposit, the ECN Prime offers $2000, or the ECN Institutional has a $20,000 deposit requirement. Forex spreads in the ECN Institutional account start from 0.0 pips, the ECN Prime from 0.1 pips, and the ECN Standard at 0.0 pips.

Overview

- Minimum deposit-$200

- License-FSA

- Platforms-MT4, MT5

- Spreads-0.0 pips

- Support-24/5

- Free demo-yes

- Leverage-1:30

A forex broker offers both the MT5 and MT4 trading platforms that most forex brokers prefer. It also has multiple Copy trading platforms like the ZuluTrade or MyFXbook. Apart from these, it has one of the fastest execution speeds due to the ECN order executions.

Commissions vary with the account type, and the ECN Standard is commission-free; the ECN Institutional has varying commissions, while the ECN Prime has commissions of $6 per $100,000.

Ita traders can deposit or withdraw funds through Bank transfer, credit/debit cards, UnionPay, Skrill, FasaPay, and Neteller. Customer care is present 24/6 through live chat, telephone, and email.

Disadvantages of BlackBull Markets

BlackBull Markets has limited educational materials. It has limited educational resources for traders to increase their knowledge of trading different trading assets and strategies.

(Risk Warning: Your capital can be at risk)

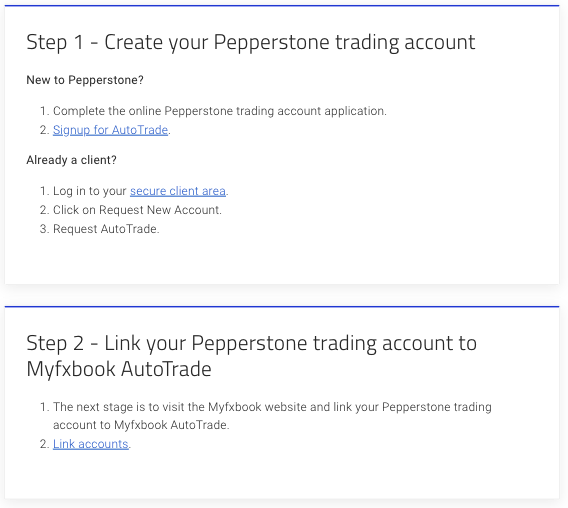

3. Pepperstone

It is a forex broker based in Australia but has trading accounts in various continents and access to thousands of traders since 2010. It offers forex, indices, ETFs, commodities, and indices. Pepperstone has a trading license from the FCA and the ASIC.

Forex traders who want to start trading can access the Standard and Razor accounts with minimum deposits of $200. The Razor account has forex spreads from 0.0 pips, while the standard account has forex spreads from 1.3 pips.

Overview

- Minimum deposit-$200

- License-ASIC, FCA

- Platform-MT4, MT5,c Trader

- Spreads-0.0 pips on the Razor account

- Support-24/5

- Free Demo-yes

- Leverage-1:400

It is a forex broker that has been trading forex for a decade and has many forex traders because it offers standard trading resources and low trading costs. It has multiple trading platforms, copies trading or social trading using MirrorTrader, MyFXbook, and RoboX platforms.

The Standard account is commission-free for commissions, but the Razor account has a commission of $7 for $100,000 traded. It also has low trading costs, overnight fees varying with the trading instruments, no inactivity costs, and deposits/ withdrawals have no charges.

Disadvantages of Pepperstone

- Although these resources are limited, it has quality learning resources for its traders. They are not as comprehensive compared to other leading forex brokers offering educational content.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

IQ Option has been in the market since 2013 and has registered over 80 million traders since its inception. It offers ETFs, CFDs, stocks, forex, commodities, binary options (only for professional traders and outside EAA countries), digital options, and cryptocurrencies.

The Cyprus Securities and Exchange Commission regulates it. The Standard account has initial deposits of $10, while the VIP account has varying initial deposits. Forex spreads are based on liquidity and the trading instrument, but their average starts at 0.8 pips for its major pairs.

Overview

- Minimum deposit-$10

- License-CySEC

- Platform-IQ Option trading platform

- Spreads-from 0.8 pips

- Support-24/7

- Free demo-yes

- Leverage-1:500

It has no commission for most trading instruments, while cryptocurrency has a rate of 2.9%. IQ options offer a user-friendly platform with different charts, a free demo account with $10,000 virtual funds, historical charts, technical analysis, multiple order types, etc.

Its platform is available as a mobile application, and it also has a desktop version and the website version. Traders can deposit on their trading accounts using various methods such as Bank transfer, Moneybookers, Skrill, Neteller, Cash U, WebMoney, and credit/debit cards.

Disadvantages of IQ Option

- Limited trading instruments. It is mainly known for trading binary options (only for professional traders and outside EAA countries), and most traders on its platform trade options. But when it comes to other trading instruments, the options it offers are limited to a few varieties, which can restrict forex traders that want to diversify their trades.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Finland?

The forex industry of Finland has a high volume of traders and is under the finance ministry of Finland. It has legislation known as the Securities markets Act that ensures the forex trading industry is safe for market participants. These laws cover listing securities and the obligations of market participants.

The FSA has to ensure that financial issuers comply with the legislation created. It also ensures that forex brokers offer relevant information to investors. The forex industry in Finland is developed, and one of the factors is its fast economic growth and trade relationships with other countries.

Forex traders in Finland require opening a trading account with a forex broker authorized to trade in Finland and start trading. Since Finland is an EU member state, it allows forex brokers to be regulated by any of the jurisdictions in the EU.

The financial regulation in Finland is made by the FSA and ESMA rules. Forex brokers that comply with ESMA and MiFID II laws can also operate in Finland. Some of the functions that these regulatory institutions have in Finland include;

Establishing the conditions investor service providers such as forex brokers follow to get a trading license from ESMA and FSA. It monitors the efficiency and Standard of the Services provided by the financial services providers such as forex brokers and exchange dealers when operating in Finland.

The investment firms regulated to operate in Finland have to ensure they follow the Anti-money laundering regulations, including the registration process, and monitor suspicious accounts to report to the relevant authorities.

According to the MiFID II regulations, the firm offering investment services has to conduct trading with the staff.

Is it legal to trade Forex in Finland?

Forex traders in Finland can access the Securities and Exchange markets in Finland; It has regulations from the (FSA) Financial Supervisory Authority of Finland and the European Securities and Markets Authority that regulates securities markets in the EU.

It means that the securities markets in Finland have strict guidelines. The securities markets in most countries in the European Union play a major role in the Economies of these countries.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders in Finland

Traders are assured of safety through the guidelines such as Negative balance protection for investors. It means that forex brokers have to put the available measures to ensure that the account balance of their investors is not wiped out in case of a losing trade.

Forex brokers also have to register the traders according to the ESMA regulations to prevent money laundering and funding of terrorism. Due to the Know Your Client (KYC) policy, forex traders must know the clients registered on their trading platform.

The staff of financial dealers has to be professional and competent in their qualifications to serve the clients. Forex brokers also need to train their staff on investor protection, handling the investors and ensuring an efficient process in their institutions.

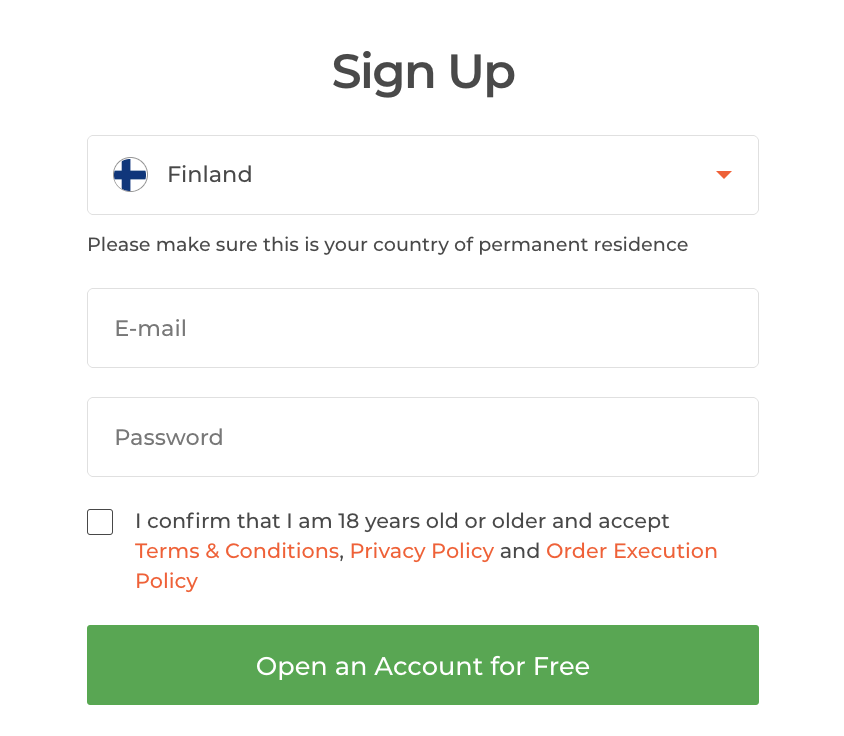

How to open a trading account in Finland – Tutorial

Open account for Finnish traders

Despite the financial markets having strict regulations, it does not rule out the possibility of finding forex scams. Forex traders must be cautious when registering a trading account and ensure that they research the forex broker first.

Find a forex broker suitable to your trading plans and offers trading features according to your preference. For example, many retail forex traders opt for a broker with low trading costs, fast order processing rates, automatic trading, and a wide range of trading instruments and payment methods.

Register a trading account on its website using the online registration form. It is a simple and fast process to register a trading account remotely. The forex broker will require your name, email, nationality, date of birth, account type, and password.

Some forex brokers also require you to offer your financial status and trading experience to gauge your risk tolerance. This registration process is according to ESMA regulations that help traders and regulatory authorities to deal with money laundering issues.

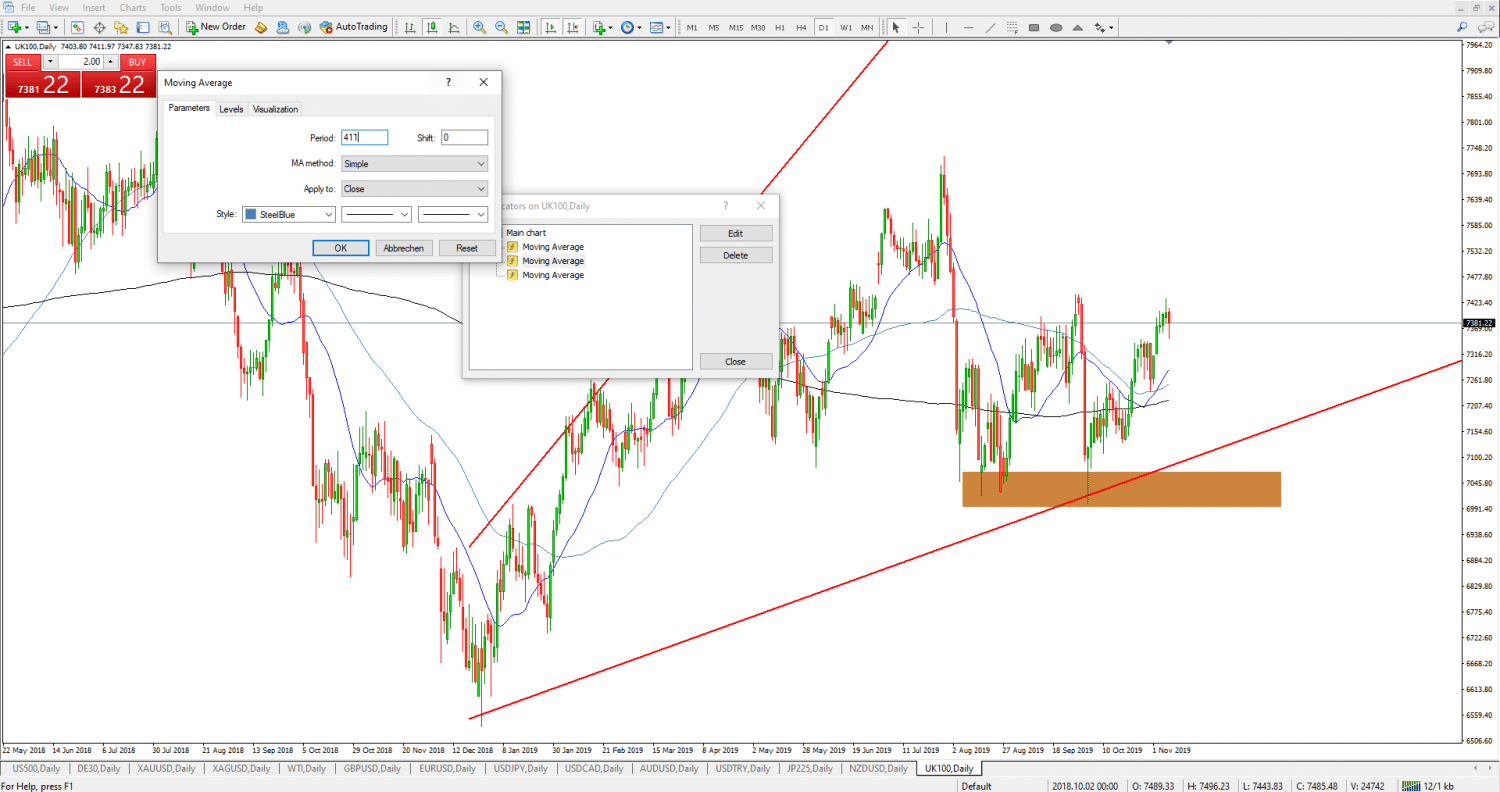

Download a trading platform compatible with the forex broker and trading account. Forex brokers offer a variety of trading platforms that offer different trading features. The trading platforms allow traders to access the financial markets when trading.

After downloading a trading platform, you can familiarize yourself with its trading interface and select the trading instrument or the currency pair you want to trade. You can also customize the trading features to enable you to trade efficiently.

Start with the demo or real account

You can start trading using the demo account if you are new to trading, if you are trading using a new trading strategy, or if you are trading on a new trading platform. The demo account offers forex traders the opportunity to practice trading without risking their real investments.

It offers virtual funds, and traders can access the financial markets and apply different trading features when practicing trading. It is a crucial tool for new traders to use when learning how to trade, as they can apply trading ideas and strategies as they learn how to trade.

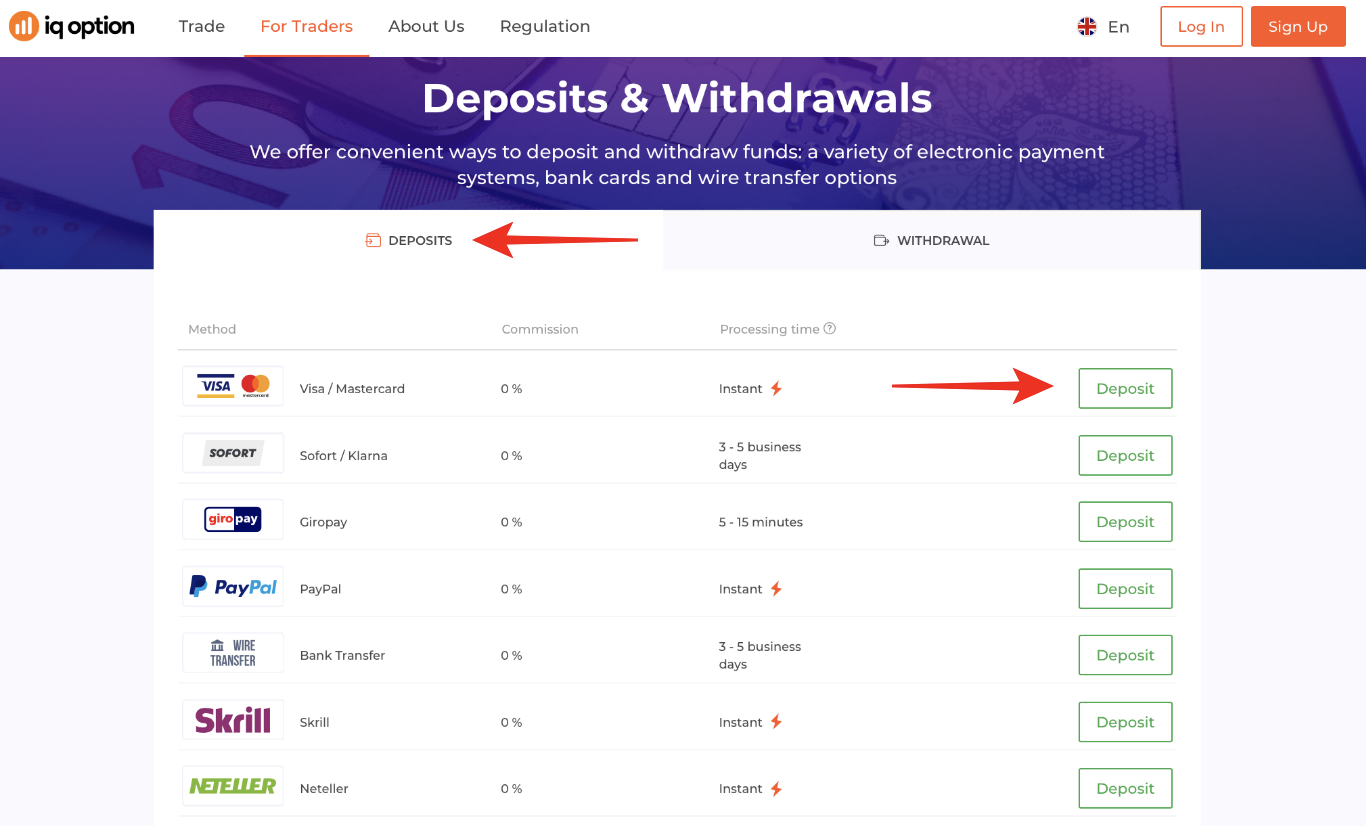

Deposit and start trading

Deposit your trading capital into your trading account and start trading. Forex brokers have a variety of payment methods they support that forex traders from many regions can use. Select a deposit method and link it with your trading account, then deposit the required amount you can start with.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

Use analysis and strategies

Analysis

As a trader, it is imperative to know how to analyze the trading instrument they want to trade. It is to help them to know which trading instrument is profitable and how they can open and exit a trading position to profit.

Technical analysis is imperative, especially for short-term traders, since it helps them find enough information to open and close a trading position. It involves evaluating the price action using technical indicators, price patterns, candlestick patterns, and previous price charts of the trading instrument.

Fundamental analysis is also crucial for long-term traders. It allows traders to anticipate the price movement in a particular direction based on news releases from central banks, interest rate adjustments, countries’ political and economic climates relating to the asset, and current financial events.

Strategies

Forex traders also need to apply trading strategies when they want to start trading, as it acts as a guide on how to open a trading position. Here are some trading strategies traders use;

Trend trading – is a simple trading strategy that even new traders can learn and apply during trading. Trend trading requires the trader to analyze the market trend before opening a trading position. The trend will determine how you will trade and go short or long on a trend.

Day trading – this trading strategy requires the trader to be fast. It is used by professional traders or traders that take forex trading as their primary income method. It requires traders to open numerous trading positions and close them within the day. Furthermore, it also needs the trader to have a good trading strategy and proper timing, as one lost trade could overshadow the profits made on an entire day.

Scalping – it is almost like day trading but involves making small short-term traders that could last thirty seconds to one minute trade. Scalpers trade the small market movements on the lower time frames. The profits come from the total profits from the numerous trades. Scalping requires the trader to practice fast before applying this trading strategy.

Make profit

You can make profits by ensuring you follow your trading strategy when trading. Apply the risk management strategies and conduct technical and fundamental analysis before opening a trading position for any trading instrument.

Limit the leverage if you are not experienced, and use risk management tools when trading any financial instrument. Ensure to practice your trading strategy on the demo account trading different assets.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Finland

Forex trading in Finland is advanced, and more forex traders register trading accounts compared to five years before. Forex traders should register a trading account with regulated forex brokers and evaluate the forex broker to ensure they are credible.

Traders should also ensure they prepare well before they start trading. Through analyzing the financial markets, practicing the trade on the demo account, using risk management strategies, and ensuring the trading decisions are based on facts and not emotional influence.

FAQ – The most asked questions about Forex Broker Finland :

How can I identify the top forex brokers in Finland?

While selecting the best forex brokers in Finland, we consider several factors. The selection of products, costs, and accounting are some important themes.

Costs: A trustworthy Yemeni broker will disclose their fee structure in advance. Forex brokers vary in their fees.

Account Type: There are numerous different accounts available from each forex broker. Some brokers in Yemen only provide one type of account.

Deposit and withdrawal: It should be easy to withdraw and move money. Different Yemeni brokers charge different minimum deposits.

Product Choice: It can vary depending on the broker. Various online brokers offer several currency pairs.

Trading platforms: A user-friendly trading platform is the first step to a greater trading experience. A user-friendly interface is a must when choosing a broker.

Which forex brokers in Finland have the highest reputations?

The top forex brokers in Finland are listed below for your convenience. Just look at the top forex brokers.

1. Capital.com

2. BlackBull Markets

3. Pepperstone

4. IQ Option

Capital.com is the greatest option for copy trading, education, and local assistance.

One of the greatest and most reputable forex brokers is Pepperstone.

The vantage tool is helpful for both experts and beginners.

The greatest website for online trading and instrument storage is Blackbull Markets.

Avatrade is a fantastic platform for new users access via a mobile app.

Last Updated on March 31, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)