4 best Forex Brokers in France – Comparison and reviews

Table of Contents

France was the third largest European economy in 2018, with a gross domestic output of €2.3 trillion, trailing only the United Kingdom and Germany. France has a long history of involvement in European and worldwide financial markets, with French residents benefiting from several possibilities due to the European Union’s membership (EU).

To successfully trade forex in France, proper knowledge of how the foreign exchange market operates is vital. Here is some critical information you need on the 4 best forex traders in France.

See the list of the best 4 Forex Brokers in France:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC, SCB. SCA | Starting 0.3 pips variable & no commissions (*other fees can apply) | 3,000+ (70+ currency pairs) | + Userfriendly platform + TradingView charts + MT4 + Best education + Personal support | Live-account from $ 20(Risk warning: 76% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 76% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

4. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

See the comparison of the best 4 Forex Brokers in France:

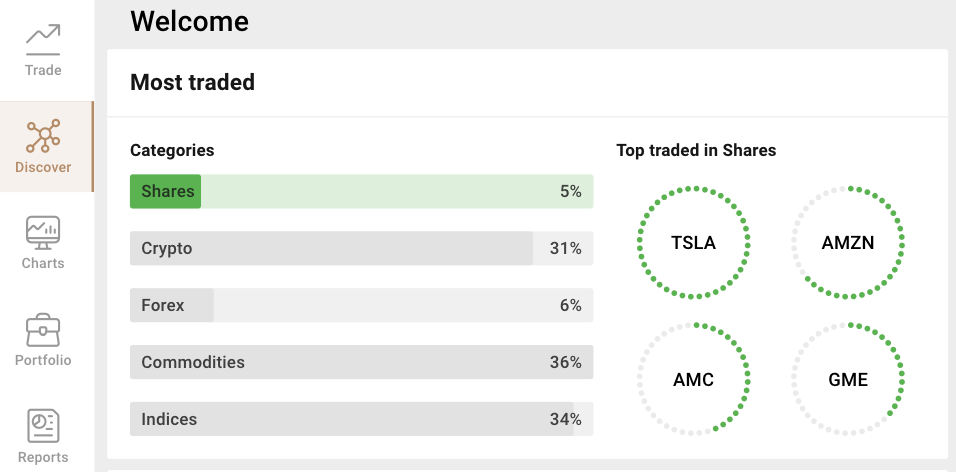

1. Capital.com

Novice traders can use learning and trading classes on Capital.com to understand the platform better. In reality, the corporation provides a “learning mode” to its customers.

There are numerous additional learning methods besides watching live webinars and completing courses. Investors may also read comprehensive manuals, view educational films, or even download an investment education app.

Capital.com is one of the few brokers holding licenses in three different countries. Regulatory authorities include the Financial Conduct Authority (FCA) of the United Kingdom, ASIC of Australia, SCA in the UAE, SCB of Bahamas and the Cyprus Securities and Exchange Commission (CySEC).

For traders who wish to take advantage of technology, Capital.com is the best trading platform.

Because of its technological platform, Capital.com is one of the finest brokers. It provides crucial data, and traders may use its bespoke trading platform to make informed investment decisions.

Capital.com provides low-cost CFD and Forex trading. The process of establishing a new account is straightforward. The business gives exceptional customer service, but it also responds promptly.

Capital.com also offers an artificial intelligence-powered smartphone app. Artificial intelligence is also included in the platform, which improves the trading experience. The broker is one of the few that uses technology to help its customers.

Advantages of Capital.com

- The mobile trading interface at Capital.com is simple to use.

- Capital.com’s instructional publications and courses are of high quality.

- For the market analysis, there is a good selection of video information.

Disadvantages of Capital.com

- MetaTrader 5 isn’t available right now.

- There are just four main currencies (USD, GBP, EUR) and one minor currency (PLN) available.

(Risk warning: 76% of retail CFD accounts lose money)

2. BlackBull Markets

A group of fintech developers, FX traders, and data security professionals founded BlackBull Markets in 2014. This platform is, without a doubt, an excellent location to begin trading metals, commodities, indices, energy, and CFDs.

With a No-Dealing Desk (NDD) and Straight-Through Processing (STP) methodology, they are a reputable Electronic Communication Network (ECN) broker (STP). For deeper poo liquidity and greater market depth, global partners have superior liquidity providers.

The Financial Services Provider regulates Black Bull Group Limited and typically holds a Financial Markets Authority Derivative Issuer License. BlackBull Markets is the ideal platform for traders that like to trade with few assets. If you wish to trade indices, commodities, or crucial currency pairings, you must pick a broker.

The MT4 platform from BlackBull Markets connects to the Equinix NY4 server on Wall Street. It can efficiently perform transactions in 2-5 milliseconds. A trader can use this server to trade directly in markets with various liquidity providers who offer competitive bid/ask prices, little slippage, and tight spreads.

A more extensive asset selection allows a trader to execute lucrative trading without pain or regret. BlackBull Markets is a top broker for experienced traders, with a reliable and highly risk-free trading platform.

Pros of BlackBull Markets

- There are several base currencies to choose from and numerous ways to move your money.

- Blackbull Markets’ web trading platform provided by MetaTrader is highly customizable and includes a detailed fee report.

- The web trading platform at BlackBull Markets is extremely customizable. The size and position of the tabs can be readily changed.

Cons of BlackBull Markets

- There are no two-factor authentication or price notifications, and the design is outdated.

- Traders using the prime account are required to pay a minimum deposit of $2000

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone Group has developed to become a top-tier player in the online brokerage market since its inception in 2010, having built a full-featured trading and highly competitive platform that focuses on forex, indices, stocks, metals, cryptocurrencies, and commodities.

Pepperstone provides simple and easy market access, allowing users to focus on the more challenging process of executing successful trading strategies. Pepperstone is a fantastic alternative for traders searching for a provider that combines low-cost, various user interfaces, different account types, and prompt customer service.

The broker is regulated by the FCA, ASIC, CMA, BaFin, and SCB. Pepperstone’s market data and insights are up to date with industry standards, and they help traders connect with the market and augment instructional resources.

Pepperstone has some of the lowest commissions in the online brokerage market. New clients can choose between the “Standard” account, which has minimum forex spreads starting at one pip, but no commission, and the “Razor” account, which has minimum forex spreads starting at zero pips but commission.

The spreads on Pepperstone’s other instruments are either straight or a mix of spread and commission.

Advantages of Pepperstone

- Pepperstone features excellent educational resources. Demo accounts are available, as well as webinars and educational videos.

- There are no fees for withdrawals or deposits for traders.

- The process of creating an account is simple and entirely digital.

Disadvantages of Pepperstone

- Traders do not have the option of directly purchasing mutual funds or stock bonds.

- Hasn’t been granted a banking license.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

4. IQ Option

Industry leaders have applauded and acknowledged IQ Option, a multi-award-winning trading platform. It provides a versatile platform to customize anything from the chart type to the color scheme to meet your unique needs.

Despite being a newcomer to the binary options industry, IQ Option has a reputation for always seeking out new binary options technology to improve.

To assist investors in assessing markets and profiting from them, the platform provides a desktop solution and a mobile app. It takes pride in its user-friendliness, making binary options trading a breeze (only for professional traders and outside EEA countries).

The firm has created a tool called IQ Option trading patterns to guide investors on their journey to financial success. This tool, which you may access on the service’s website, has the potential to have a significant impact on your investment result.

IQ Option trading patterns offer video instruction for practically every available trade pattern. It will teach you all you need to know about applying such tactics in a short period. The gadget is simple to spot because it is adjacent to the trading platform.

Pros of IQ Option

- Requests are processed promptly using e-wallets.

- The minimum withdrawal amount is relatively modest.

- To ensure the protection of the first deposit, verification is required.

Cons of IQ Option

- The basic currencies aren’t varied

- For traders who prefer the binary option, the contracts available on IQ Option are limited. (only for professional traders and outside EEA countries)

(Risk warning: Your capital might be at risk.)

Is it legal to trade Forex in France?

Trading currencies against each other on the Forex markets are now permitted on French land. The brokers providing the services have secured authorization from the AMF, the local regulator. The Foreign Exchange Market is regulated by the Financial Securities Act of 2003, whose implementation resulted in the formation of the AMF.

All brokerage companies that want to conduct business with French people must guarantee to stop losses on their clients’ holdings. Traders must always place a stop loss for a position before opening it.

Once the order has been executed, it is impossible to increase the stop-loss threshold. This allows French consumers to lose less money than they had anticipated for the given position.

Another requirement imposed by the French regulator is that authorized brokerages provide their clients with negative balance protection.

This policy protects consumers from losing more than their available trading account balance, which is especially important when dealing with leveraged derivatives.

While on the subject of derivatives, purchasing contracts for difference (CFDs) is permitted in the country, although there are certain limits owing to the high degree of risk involved in trading such volatile assets. The limitations become effective at the start of August 2019.

Another requirement imposed by the French regulator is that authorized brokerages provide their clients with negative balance protection. This policy protects consumers from losing more than their available trading account balance, which is especially important when dealing with leveraged derivatives.

Brokers that break French regulatory restrictions and target consumers from the Hexagon nation without the local regulator’s permission are often blocklisted. Their websites are restricted to prevent French people from accessing them.

The same goes for those who, notwithstanding the restriction, continue to provide illegal binary options trading. 138 illicit binary options and foreign exchange websites were shut down by the local authority over three years as of May 2018. As new illegal brokers are added to the list, it is updated regularly.

What are the financial regulations in France?

The Autorité des Marchés Financiers, or AMF, is the principal authority overseeing the foreign currency market in the Hexagon country. This autonomous institution was created following the enactment of the Financial Security Act, which went into effect in early August 2003.

The AMF’s duty includes regulating and safeguarding investments in various financial products and several other goals. One of them is ensuring that investors have the appropriate information to make well-informed investment decisions. The institution is also in charge of keeping the country’s financial markets balanced.

If they want to operate lawfully on French land, both domestic and international brokerage businesses must apply for and get licenses from the AMF. Firms must meet all of the conditions to get one of these documents.

Put another way, they must keep their client’s money in segregated accounts, provide negative balance protection, adhere to maximum leverage restrictions, refrain from giving bonuses to French citizens, and pass frequent external audits. In addition, the firms must show that they have sufficient operational capital, which is set at €750,000.

Those who conduct business unlawfully in the nation have their websites added to an ever-growing blocklist. The French regulator meets with the Paris High Court in an official meeting every two months. The two bodies will discuss measures to shut down brokerages that operate illegally in the nation during the discussions.

It’s worth noting that the AMF is covered by the Markets in Financial Instruments Directive II, which is a significant piece of law (MiFID II). It was implemented in 2018 to improve competition, transparency, and investor protection in EU member states.

This law aims to provide a set of harmonized rules for investment services offered within the EU. All brokerages operating in the EU must comply with this directive’s unified requirements.

The Autorité de Contrôle Prudentiel et de Résolution supervises the country’s financial industry (ACPR). The Banque de France, the country’s central bank, oversees this autonomous administrative agency. The ACPR is in charge of supervising the banking and insurance firms that operate on French land.

Finally, the European Securities and Markets Authority (ESMA) is headquartered in Paris, France. The primary goal of establishing this supranational institution was to create an EU-wide financial industry regulator.

How to trade Forex in France – A quick tutorial

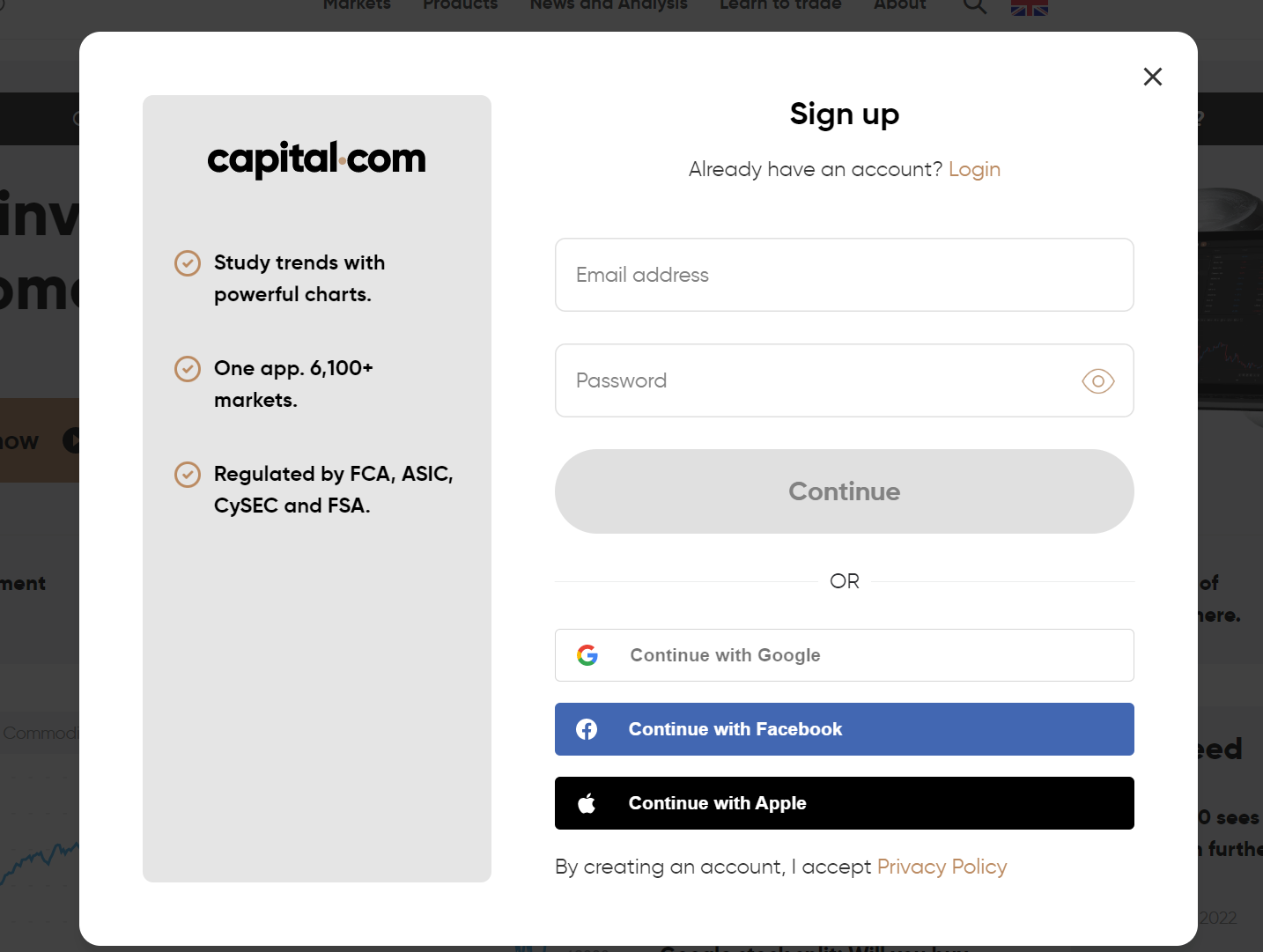

Open an account in France

On the forex broker’s website, you may create a new account. To open an account with some forex brokers, you must make a minimum deposit. These brokers also provide several different account types, each with its minimum deposit and spread width. Choose the one that is most relevant for you.

Open a trading account for spread betting or contract for difference (CFD) trading. You may open a real or demo account to trade the price variations of currency pairings.

(Risk warning: 76% of retail CFD accounts lose money)

Start with a demo account or real account

Traders may simulate a natural trading environment with a demo account without risking their own money. It will help traders quickly get started with free online trading and practice before attempting real money.

You can open a new account on the forex broker’s website. Some forex brokers require a minimum deposit to start an account. These brokers also provide a range of account kinds, each with a different minimum deposit and spread width. Choose the most appropriate choice for you.

Deposit money

After you’ve opened an account, you’ll need to transfer money to begin trading forex. Depending on the broker you pick, you may choose your currency and fund your account in various ways. Wire transfers, debit cards, and electronic payment systems like Paypal and Skrill are popular ways to fill your account.

Enter their credit card information into their FX accounts, and the monies will be available within one working day. Investors can utilize an existing bank account, a wire transfer, or an online check to finance their trading accounts.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

Use analysis and strategies

Retail forex day traders use forex analysis and strategies to decide whether to buy or sell currency. Some of these strategies include;

Scalping

Scalping is an hourly trading strategy in which traders buy and sell currencies with the goal of making small returns on each trade.

Scalpers rely so largely on the spread, that a good working relationship with market makers, who establish the bid and ask prices for each currency pair, is essential.

Scalpers employ technical analysis and pattern recognition tools to confirm trend direction and momentum before deciding which position to take.

Trend Trading

As the name implies, this approach entails trading in the direction of the current market trend. Traders must first determine the underlying trend’s direction, duration, and intensity to trade efficiently.

An uptrend is defined as an increase in the value of a market price. When the market hits increasingly high price levels, a trader looking to profit from these fluctuations will enter a long position.

Trend trading techniques are intended to assist you in identifying trends as early as possible and exiting the market before the trend reverses.

News Trading

News trading is a practice that attempts to profit from market opportunities that exist when big economic facts and information make the news.

There is no such thing as a more essential event than another. Rather than focusing on a single element, traders look at the link between them as well as market conditions.

Make profit

With the help of a broker, make a foreign exchange contract. Make forex transactions according to your plan, with predetermined entry and exit locations. When trading, remember to use risk management conditions such as a take-profit or stop-loss order.

Close your shop and give it some thought. Stick to your trading plan and exit the market when your predetermined stops have been achieved. Think about how you performed so you may improve with each trade you make.

Conclusion: The best Forex Brokers are available in France

Despite France’s financial instability, ordinary investors still have plenty of possibilities to profit from the global economy. French investors benefit from vital regulatory agencies and easy access to the euro, which allows for efficient trading.

Forex trading is the way of the future worldwide, and there are numerous brokers and ways to help you in France. Before entering the forex market as a beginner, it’s good to research the finest brokers to deal with and extensively research the forex sector.

However, you should proceed with prudence and ensure that you are well-versed in currency market fundamental and technical analysis. You should also have a well-thought-out and proven trading strategy. Learn as much as you can about risk management.

FAQ – The most asked questions about Forex Broker France:

Which brokers in France offer traders the best technology to trade forex?

Several forex brokers are operating in France. However, the services of five forex brokers prove the best for any trader. Traders can enjoy trading on Capital.com, Pepperstone, BlackBull Markets, IQ Option, and RoboForex. These five brokers lead the race for the best forex brokers. They have all the quality features that traders would need to trade forex. Besides, they offer full customer support to traders when they encounter trouble.

Is it okay to trade forex in France?

Yes, traders can trade forex in France if they make the right trading analysis. Traders who make the best trading analysis always win while trading forex. The broker or the trading platform a trader chooses allows them to access many charts and technical indicators. Therefore, traders can use them to conduct technical analysis before placing trades.

What deposit methods are available for French traders?

Traders in France can use several deposit methods their brokers offer. However, most brokers offer traders the following deposit and withdrawal methods.

Bank transfers

Cryptocurrency

Debit cards

Credit cards

e-wallets

Traders can choose the preferred payment method that they wish to choose to deposit or withdraw their funds.

Last Updated on July 27, 2024 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)