The 5 best Forex Brokers and platforms in Gabon – Comparison and reviews

Table of Contents

Forex trading anywhere in the world is now possible. It involves the exchange of currencies and commodities. Forex is also how the world economies are improving.

For forex trading, individuals need to have a Forex broker that they are using to trade. This article has the best five forex brokers in Gabon. You will learn your security in trading forex and the strategies you need as a trader on any broker platform.

See the list of the best Forex Brokers in Gabon:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

Below is the list of the five best Forex brokers in Gabon:

1. Capital.com

Capital.com started in 2016 as a broker platform that allows assets such as Commodities, Metals, CDFs, and Cryptos for traders to trade with. The platform is also technologically improved, which is no wonder why it has traders from around the globe that use the platform.

Organizations from around the globe regulate Capital.com well; this means that the broker platform is a safe trading space for its traders. Capital.com regulations protect traders from fraud, price manipulations, and financial abuse, the regulators are mainly from Europe.

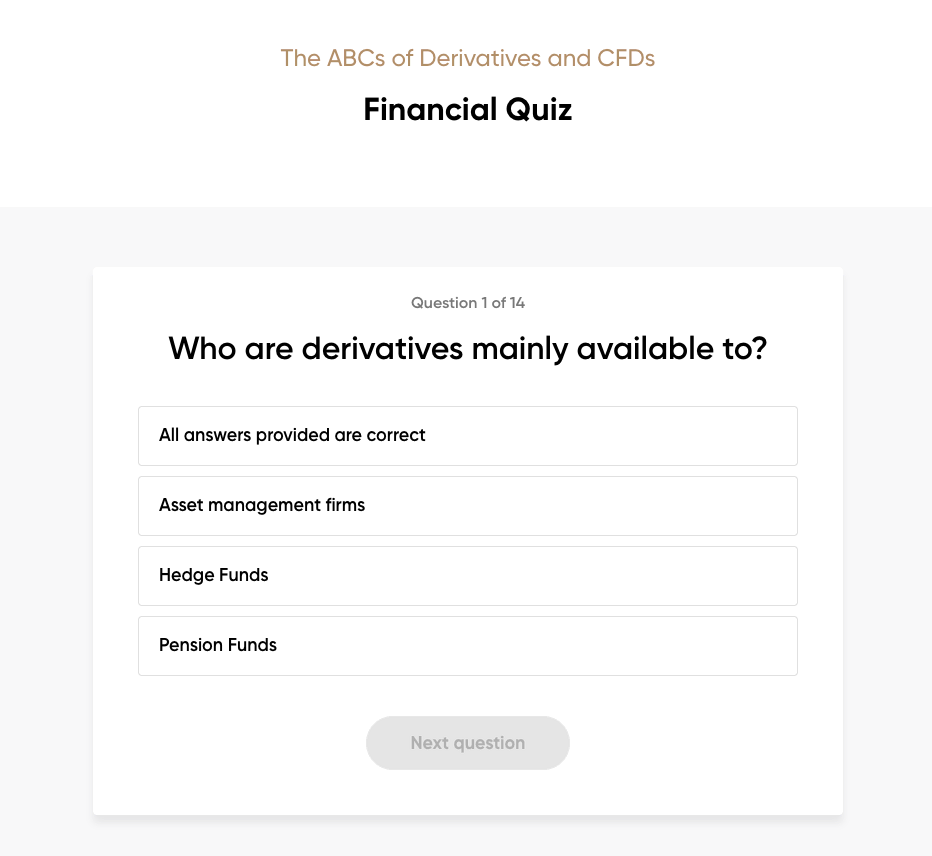

The broker platform offers traders functional materials that educate them on forex trading. This allows their clients to be well acquainted with how the forex market is operated. It also gives them strategies that they can use to become better traders on the platform. Quizzes are also taken by traders if they which after the courses have been read or watched to make sure that the resources are understood by their traders.

Traders are provided with a demo account that they can use. The demo account does not expire and can always be used whenever the Trader wishes to make use of it. Trading with your real account, you will need to make a minimum deposit of 3000 USD into the account.

Capital.com is also available on both web and mobile. Traders enjoy a flexible trading experience, plus there are available market resources given to the traders by Capital.com.

Pros of Capital.com

- Available market resources from within

- Education about Forex is provided to traders through articles and videos that they can watch.

- Readily available demo account that does not expire

- It has a reasonable spread.

Cons of Capital.com

- Clients from the US cannot trade on the Forex broker platform

- An initial deposit of $3000 has to be made before one can begin trading

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a New Zealand-based company regulated by the FSP in New Zealand. The company was founded by Forex traders and some Fintech guys in 2014. It is created to provide CDFs and other forms of assets to traders worldwide.

Known for its high server speed, traders conduct quick transactions on the broker platforms. A transaction can be carried out within a matter of milliseconds. Traders also enjoy a MetaTrader platform, MT4, which has compatibility with 3rd party trading sites.

Although BlackBull Markets does not provide its traders with educational materials and quizzes, they provide reliable market resources from within. These market resources help traders know how the market works and what position to take while trading. This makes trading and understanding the need to be easy for traders.

Traders on the platform can choose the account type of their choice. There is a standard account and ECN prime account. The standard account traders have a different spread pip from the ECN prime account traders. The minimum deposit that can be made in the standard account is 200 USD, while the ECN excellent account is 2000 USD. ECN account traders enjoy an added percentage after ending a trade.

Pros of BlackBull Markets

- Reliable market resource for their clients

- There is an MT4 platform available on BlackBull

- There is a website version and a mobile version

- Two accounts that traders can choose from.

Cons of BlackBull Markets

- When traders want to withdraw, there is an attraction of fee

- Educational materials are not provided for the traders.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex traders enjoy security from international regulatory bodies. The FCA is the body that provides regulation to RoboForex’s financial activities. The clients of RoboForex are protected from fraud and any other form of financial abuse. The broker company was founded in 2009 and has office branches that perform different functions. RoboForex offers services to traders around the globe, while RoboMarket provides services for traders only in the European Union and EEA.

RoboForex is a fast-growing broker platform and, as seen, has traders around the globe. This is contributed by the fact that the company’s customer service has many languages they speak. This offers a better means of communication between them and their customers.

RoboForex traders make an initial deposit of 10 USD. Once they make a deposit, their traders can trade from the available assets provided by the platform. Traders have access to assets like commodities, CDFs, Crypto, and Metals.

RoboForex has a MetaTrader platform for traders to use, and it also has a cTrader platform. The MetaTrader platforms include both MT4 and MT5 platforms. This is good because both platforms are technologically improved and offer traders security.

The platform provides traders with market resources.

Pros of RoboForex

- Withdrawing money does not waste time

- MT4, MT5, and cTrader platforms are all available on RoboForex

- Low trading fees

- A broad marketplace that allows multiple choice of traders.

Cons of RoboForex

- The currency set is small

- Not enough customer service respondents

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is an Australian-based forex company, and it is a regulated forex broker.

The company is regulated by:

The regulatory bodies are from countries worldwide, particularly in Europe and Africa. These bodies make Pepperstone offer favorable conditions to their clients.

The Forex broker is a MetaTrader platform-based one. The MetaTrader platform is equipped with plugins that allow traders’ trading experience easy and more advantageous. For example, the plugin comes with a bot that traders can strategize their trading position. The bot automatically helps them plan out the best place to position themselves when you open the market.

Traders can use the demo account provided by the broker to help themselves get familiar with the forex spread and how to position themselves too. The new Trader can use this demo account for a month, after which it will be deactivated, and traders can only have access to their real accounts.

Pepperstone is available on phones and desktops. This means the broker platform can be used on either of the devices.

The minimum deposit to be made depends on the account type because Pepperstone has two account types that traders can use for trading. The account type is mostly none as standard and most preferably used as the minimum deposit of 200 USD. At the same time, the other account, called the razor account, has a minimum deposit of 2000 USD. Traders can pick account types depending on the competition and spread they want.

Pros of Pepperstone

- Pepperstone has good reliable market resources.

- Pepperstone’s razor account offers commission amounts to traders and is competitive.

- The broker is a MetaTrader platform and has plugins

- Traders have social copy space available

Cons of Pepperstone

- Assets are limited on the broker platform

- The demo account expires after a month

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is an award-winning broker platform. It is based in Cyprus and under the regulatory body of the CySEC there in Cyprus. CySEC is an international regulatory body known for laying down laws for many Forex financial institutions. Traders can rest assured that they are in good hands related to security.

IQ Option provides traders with plenty of assets for trading. It began with binary options (only for professional traders and outside EAA countries), that is, binary trading. But with time, IQ Option has CFDs, Commodities, Metals, etc. It’s a platform that provides its traders with enough forex trading assets.

The broker is simple to understand, and traders can easily open an account with them on either their web on a desktop or the mobile application on their phones. The broker platform has a beautiful interface that traders can interact with. The chart, for example, can be changed to suit traders’ experience.

IQ Option traders can start trading on the platform with a VIP or standard account. The VIP account enables traders to make an initial deposit of 1900 USD, but it gives traders a 3% commission on every return. The standard account traders can make an initial deposit amount of 10 USD, but no commission for the traders. If you like, you may also trade with the demo account available.

The platform is even a community-based platform in the sense that there are available forums and webinars organized for traders on their platform. IQ Option traders can enjoy tips from other traders in those forums.

Pros of IQ Option

- $10 Initial deposit in the standard account

- Educational and market resources are provided for their traders

- VIP account users enjoy a commission of 3%

- Cryptocurrency is available on the platform.

Cons of IQ Option

- It takes a whole day before your account can be activated

- Withdrawal into your bank account can be time-wasting because it does not reflect at once

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Gabon?

Gabon is one of the countries under the Bank of Central Africa (BEAC), its headquarters in Cameroon. The BEAC is a bank founded by French-speaking countries in Central Africa. The BEAC has a body that regulates the financial institutions in the countries that form it. The Banking Commission of Central African States (COBAC) is responsible for regulating the financial institutions of the different countries of which Gabon is a part.

The BEAC is responsible for issuing currency and control of liquidity in those member states. The overall authority in charge of Gabon’s exchange is the Ministry of Budget. Gabon has a development bank (BGD) and five commercial banks in the country.

Commercial banks are the ones that provide corporate banking services to the people in the country. And the commercial banks have what is called transferred excess liquidity to banks outside Gabon.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Gabon

Trading forex is seen by so many as a dangerous means of trading. This is major because forex trading is done online, and there are many ways to lose money through online platforms. There are a lot of online monetary platforms that existed in the past, but due to one or two reasons like fraud, the company does not exist anymore.

As a trader, you should only trade with verified broker platforms. Trading with licensed brokers is the only security for you. Brokers’ regulations by international bodies give the brokers better protection for their clients. The laws keep the brokers under strict watch. Regulatory bodies can even punish the broker company if they fail to adhere to the rules.

Is it legal to trade Forex in Gabon?

Yes, it is legal for Gabonese traders to trade Forex in the country. Gabon does not have a specific framework that stipulates forex trading in the country because not so many people know about Forex in it. There is no particular regulation that guides how forex trade is operated in the country.

Gabonese traders, however, can trade with brokers that are recognized internationally. This is because they are legal and are regulated by different international financial organizations. The traders of such brokers even enjoy favorable trading conditions.

Licensed forex brokers are reputable. These international regulatory bodies have specific laws that guide and direct their existence. Gabonese traders can enjoy forex trading as long as they are sure that the broker is properly regulated.

How to trade Forex in Gabon – Tutorial

Open account for Gabonese trader

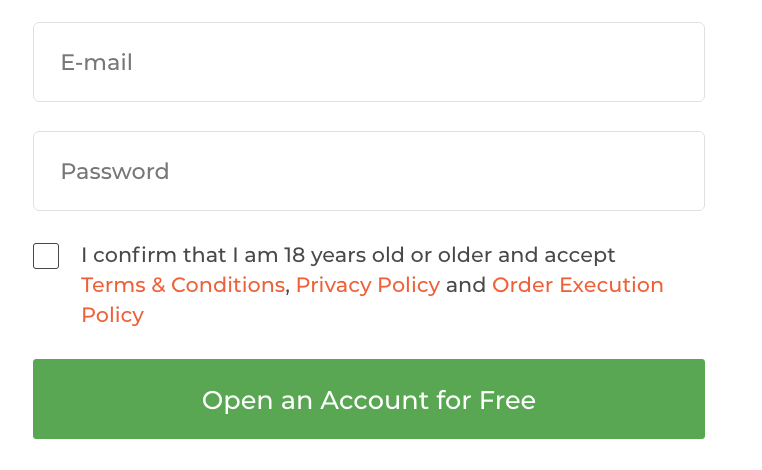

Start forex trading today by registering yourself as a trader from Gabon on the Forex broker platform you have picked. Once you have downloaded the app on your phone or gone to the website on your desktop, you will need to register as a new trader. The forex broker will need certain documents to verify your account as a trader on their platform. The verification steps are straightforward, and you need to follow them carefully.

Start with a demo account or a real account

After your registration, you will be given a demo account to start trading with. The demo account is only meant to help you get familiar with how Forex trading works as a new trader. You can place trades with it and even profit or loss. It’s a great way to learn how the platform works before using your real account. The current account is accurate, and whatever gains or losses you make are in real-time and affect your money deposited in the account.

Deposit money

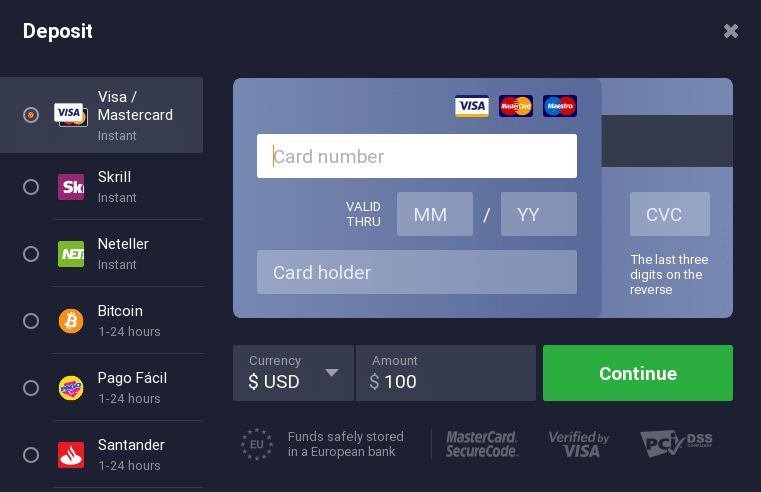

Forex trading with your real account will require you to deposit funds into it. This fund you deposit is what you will use to make a trade on the broker platform you are making use of. Every broker platform has a specific minimum amount that its traders can deposit before trading can be done.

Payment methods to deposit funds into your real account can be done differently. The common broker platforms have bank transfers, debit cards, and credit cards.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use of analysis and strategies

Strategizing and analyzing are two methods that forex traders use to monitor spread movement and market competition. A trader needs to have a strategy that they use for trading. Strategizing and analyzing can help one to have more profit while trading.

Below are common strategies that traders adopt in the FX market.

Scalping

Scalping is when a trader opens numerous markets only for a short time. The Trader aims to make small profits on all the trades opened. It has proven to be helpful to traders, especially new ones.

Day trading

Day trading is opening and closing trade on the same day. Trading does not pass a day. The Trader does that once a day is finished, they wait for the next day before opening another trade in the market.

Position trading

Position trading is like investing. The Trader ignores short-term price movements. The Trader can stay in a position for more than a week. All trades, be it buy or sell take place within the space of one week.

Make profit

Profit is the goal of every forex trader. Having a strategy is significant for traders because it helps them know how the market works and make a profit from trading easily. After you’ve made your profit, you can choose to withdraw your fund or keep trading.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Gabon

Forex online trading is a fast-growing trading method in the world today. The means of currency exchange is excellent because it is done remotely and with gadgets. You, as a trader, can easily access the marketplace from your devices any place and anywhere.

The means of online Forex has made plenty of economies improve. It also enhances the living of individuals by making them earn money from their homes. A trader needs to trade with a forex broker that is licensed. There is more assurance that your funds in the broker account are safe and secure.

FAQ – The most asked questions about Forex Broker Gabon :

Is forex trading with forex brokers in Gabon permissible?

Yes, traders can trade forex with forex brokers in Gabon. Various forex brokers operate in Gabon to enhance the trading experience of forex traders. These brokers keep in mind the trading expectations of the users. Besides, they also offer several underlying assets that further improvise your trading possibilities.

What does a trader need to know when choosing a forex broker in Gabon?

A trader must choose a forex broker in Gabon very wisely. When choosing a broker, he must consider all factors that affect his trading experience. For instance, the broker must be regulated so that a trader can enjoy a seamless trading experience. Also, the trading platform should have all the essential features for forex trading.

How much minimum deposit amount do forex brokers in Gabon stipulate for traders?

Traders can start trading with forex brokers in Gabon by funding their trading accounts with the minimum deposit stipulated by the brokers. Most brokers will allow you to initiate trading with a very low amount. For instance, IQ Option’s most basic forex trading account is available for traders with a minimum deposit of only $10.

What payment methods do forex brokers in Gabon accept?

Forex brokers in Gabon accept a couple of payment methods. You can use your bank account or electronic wallet to make payments. Besides, card payments and cryptocurrency payments are also famous.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)