The 5 best Forex Brokers and platforms in Gambia – Comparison and reviews

Table of Contents

The forex market is becoming popular in the Gambia. Many people have become aware of the opportunities it presents. Of course, if you’re going to get involved in the forex market, it’s crucial to choose a broker you can trust.

See the list of the best Forex Brokers in Gambia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

The forex market is the most liquid and accessible globally. Whether you’re a beginner or an experienced trader, it’s crucial to find a broker that matches your needs and provides you with the necessary tools to succeed. This article will provide you detailed information about the 5 best forex brokers in the Gambia.

The list of the 5 best forex brokers and platforms in the Gambia includes:

1. Capital.com

Capital.com is a broker that is based in London, England. Capital.com has been in business since 2011 and has become one of the leading online brokers in Europe. The company’s founders have a combined experience of over 50 years in the financial services industry.

The broker offers CFDs (contracts for difference), which are derivative products that allow traders to speculate on the price of an asset. The company provides various assets to trade, including stocks, indices, commodities, and currencies.

Capital.com is a regulated broker licensed by the Cyprus Securities and Exchange Commission (CySEC). The company is also registered with the Financial Conduct Authority (FCA) in the United Kingdom. Capital.com is a safe and secure broker that traders can trust. It is a regulated company with over 2 million customers in over 180 countries.

Besides, it is one of the fastest-growing online brokers in the world. It offers a user-friendly platform with competitive spreads.

Merits of Capital.com

- Capital.com provides its traders with quality educational materials.

- The trading platform is user-friendly.

- Capital.com offers its traders low forex CFD fees.

- Traders trade commission-free on real stocks.

Demerits of Capital.com

- MetaTrader 5 is not available on Capital.com.

- A fewer number of tradable symbols compare to other brokers that are leading in the industry

- Capital.com does not accept traders in the UK.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is a broker for binary options and one of the leading providers in this market. The company offers a wide range of products and services to retail and institutional investors, providing an intuitive and user-friendly trading platform that gives traders control over their investments.

In addition to an expansive array of assets, BlackBull Markets offers a variety of expiry times and strike prices, giving traders the ability to trade in the direction of the market.

BlackBull Markets is a broker that offers a wide range of tradable assets, including stocks, indices, commodities, and Forex. It was founded by a team of experienced traders and market analysts to provide its clients with the best possible trading experience. BlackBull Markets is based in the UK and is regulated by the Financial Conduct Authority (FCA).

The company offers a variety of account types, including a demo account for those who want to try out the platform before opening an account. BlackBull Markets also provides various trading tools and educational resources to help traders of all levels.

Pros of BlackBull Markets

- BlackBull Markets offers its traders low Forex and CFD fees.

- The platform provides adequate educational tools to its traders.

- The account opening process is fast.

Cons of BlackBull Markets

- A minimum deposit of $2,000 is required for traders with Prime Accounts.

- Blackbull Markets charge its traders a withdrawal fee.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is a company that provides online trading services and investment products. The company offers traders access to trade over 50 currency pairs, indices, commodities, and treasuries with low spreads and no commissions. RoboForex also provides access to auto-trading, social trading, and a wide range of educational resources.

Besides, RoboForex is an online trading platform that offers CFDs, metals, and cryptocurrencies on international financial markets. RoboForex is regulated by several financial authorities, including the FCA. As a regulated company, RoboForex adheres to the highest industry standards and provides its clients with quality services, advanced technologies, and convenient trading conditions. The RoboForex team is committed to providing clients with the best possible trading experience and strives to create a relaxed and comfortable trading environment.

The company has a wide range of account types and services, including STP and ECN accounts, Islamic accounts, social trading, and a wealth of educational materials.

Benefits of RoboForex

- On the RoboForex trading platform, you get your money immediately when you withdraw.

- The trading conditions on the RoboForex trading platform are favorable.

- Immediately withdrawal process.

- RoboForex gives its traders the highest afflicted payments.

Drawback of RoboForex

- Cryptocurrency tools are not available on the R trader platform.

- A minimum deposit of $10 is required when you open an account on RoboForex.

(Risk Warning: Your capital can be at risk)

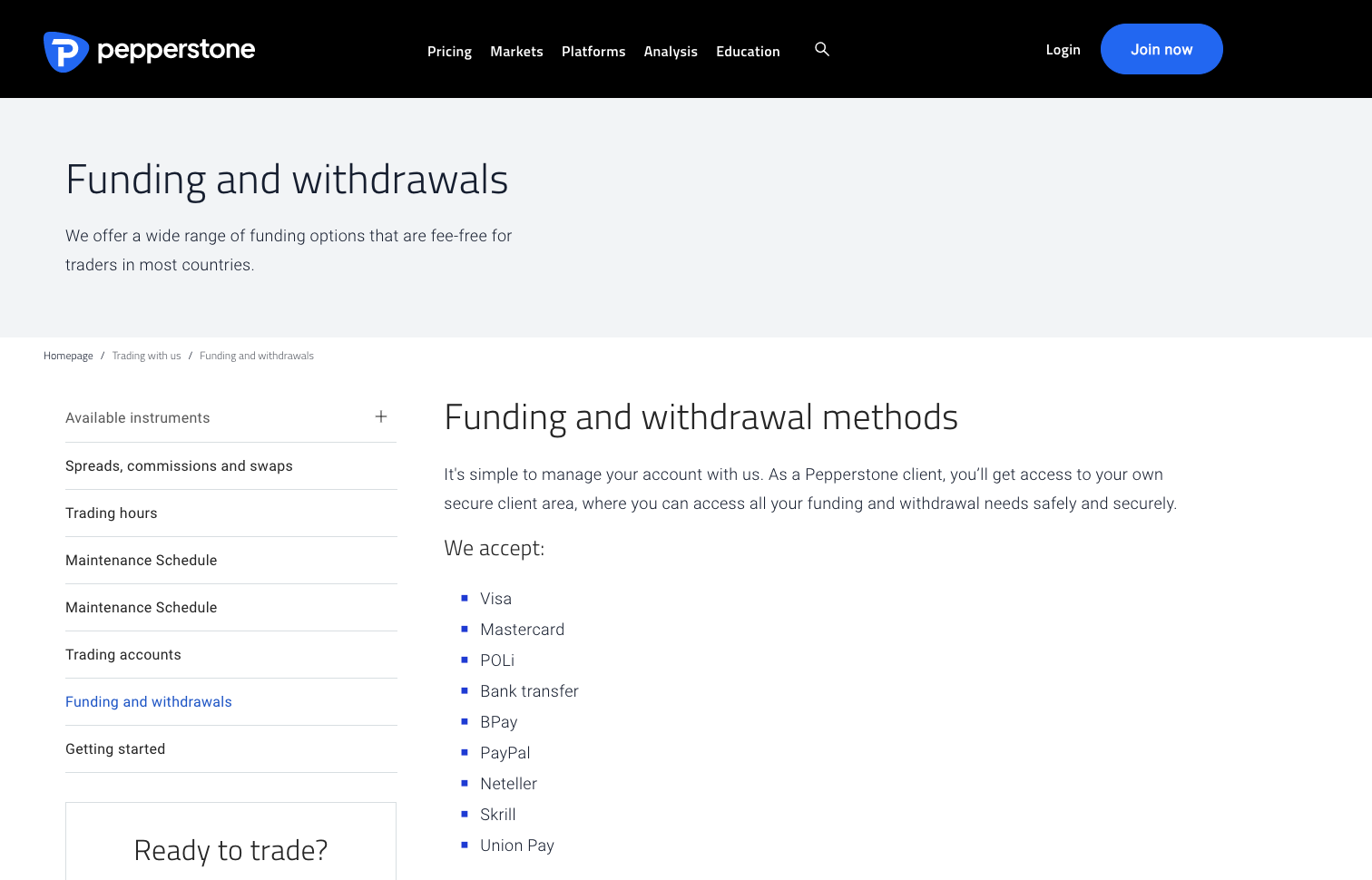

4. Pepperstone

Pepperstone is an Australian online Forex broker, providing traders access to the global currency markets. Pepperstone is a Forex broker founded in Melbourne, Australia, in 2010. The company’s founders have experienced Forex traders who saw an opportunity to create a better online trading experience by offering innovative technology and outstanding customer service.

Pepperstone has offices in Melbourne, Sydney, London, and Shanghai. Pepperstone provides traders with access to competitive spreads and cutting-edge technology with no intermediary.

Pepperstone has over 200,000 clients from more than 180 countries. The company provides access to global markets for retail and institutional investors. It also offers MT4 and MT5 trading platforms.

The company has won several awards, including Best Forex Broker Australia 2017 and Most Innovative Forex Broker 2016. Pepperstone is registered with the Australian Securities and Investments Commission (ASIC) and holds an AFS license.

Pepperstone has over 150,000 active clients and a monthly trading volume above $20 billion. The company offers clients access to over 70 currency pairs, and CFDs on commodities, indices, and cryptocurrencies.

Advantages of Pepperstone

- Pepperstone is safe for traders because it is registered in two tier-1 jurisdictions.

- It is an excellent fit for copy traders because of its dual trading platform.

- Pepperstone offers competitive prices to its traders.

- The platform offers its traders multiple social copy trading platforms.

Disadvantages of Pepperstone

- Pepperstone’s educational materials are rated average.

- The educational materials provided to traders do not have an assessment section to help them track their understanding.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a regulated broker with years of experience in the binary options market. They offer a wide range of assets and trading options, including binary options, Forex, stocks, and commodities. The company offers a high payout percentage of up to 95%, which is one of the highest in the industry, and its customer service is excellent.

IQ Option, a regulated binary options broker, has just announced the launch of its new cryptocurrency trading platform. The new platform will allow traders to speculate on the price of 14 different cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

This announcement is no surprise to industry insiders, as IQ Option has been hinting at a move into the cryptocurrency space for some time now. In February of this year, the company released a white paper that outlined its plans to develop a comprehensive cryptocurrency trading platform.

IQ Option is a regulated binary options broker, with its head office located in Cyprus. It has more than 10 million registered users from around the world.

Advantages of IQ Options

- The account opening method on IQ Options is easy.

- A wide range of trading tools is available to traders.

- The deposit fee is not required on the IQ Options trading platform.

- You are not charged a withdrawal fee when you withdraw your money.

Disadvantages of IQ Option

- IQ Options does not offer service to traders in the US and some other countries.

- IQ Options does not have an MT5 and MT4 trading platform.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in the Gambia?

The Gambia has a mixed economy based on agriculture, fishing, and tourism. Gambia has a for each person a GDP of $1,380. The Gambia’s primary export is peanuts.

The Republic of the Gambia, a small country in West Africa, is currently developing a financial regulatory framework. The government recognizes the vital role that the financial sector can play in contributing to economic growth and has put measures to foster a conducive environment for financial institutions.

The Gambian financial sector is highly regulated. The Central Bank of The Gambia (CBG) is the apex banking regulator and supervisor. The CBG issues licenses to commercial banks, merchant banks, discount houses, microfinance institutions (MFIs), insurance companies, and other financial institutions. It also oversees the activities of these licensed entities to ensure that they comply with the provisions of the Banking Act, 2001 (as amended) and other relevant legislation.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders in the Gambia

The Gambia is a small, sub-Saharan country that is primarily agricultural. The Gambian Dalai is the currency of The Gambia. The Gambia is a popular tourist destination in Africa, and its capital, Banjul, is home to a large market where traders buy and sell a variety of goods. Security is a primary concern for traders in Banjul. The country also has a few small trading companies, but the traders lack security and are vulnerable to theft.

The traders need a way to protect their merchandise and themselves. They could use a security guard or a security system, but that would be expensive.

A possible solution is to create a trade association. The association would provide security for the traders and work to improve the trading environment in the Gambia.

Following the inauguration of a new president in the Gambia, there is a lot of uncertainty in the air. Many people are unsure what this may mean for their safety and security. Most traders, who are predominantly women, have voiced concerns about the future and how they will be able to trade safely. The government has assured them that security will be available, but many traders are still afraid.

The security of traders in the Gambia is Paramount to the growth of the country’s economy. For businesses to flourish and for people to be able to sell and trade without fear of violence or theft, a secure environment is essential. There are several ways that the government can work to ensure the safety of traders, from providing more security patrols to cracking down on smuggling rings. It is also essential for the government to create an environment that supports business growth by reducing taxes and red tape.

As a forex trader in the Gambia, the theft rate is very high. Before trading with any broker, ensure that the broker is recognized outside of Gambia. If the broker does not have any form of recognition outside the Gambia, you shouldn’t trade with such a broker.

After that, take a look at the brokers’ historical spreads. The commission you pay to a broker is referred to as a spread. Trade with the broker that has the smallest spread.

Also, look out for reviews from traders that have traded with them or still trading with them. Ensure they have excellent customer care support.

Is it legal to trade Forex in Gambia?

Many people engage in forex trading without knowing whether it is legal to do so. In most cases, it is perfectly legal to trade currencies, except for a few countries that have placed restrictions on such activities.

Forex trading is a legal activity in the Gambia. The Central Bank of the Gambia issues licenses to qualified and regulated forex brokers, who must adhere to the rules and regulations prescribed by the bank. These rules include requirements for capital adequacy, risk management, and consumer protection.

Forex trading can be lucrative for traders, but it is essential to remember that risks are involved in all forms of trading.

Forex trading is legal in the Gambia. The Central Bank of Gambia has issued a statement saying that it is legal for Gambian citizens to trade Forex. There are some restrictions on how much currency can be imported and exported, but forex trading is legal.

How to trade Forex in Gambia – Tutorial

The Gambia is a small country on the west coast of Africa. Despite its small size, The Gambia has a lot of currency trading activity because it’s one of the most stable countries in Africa, with a strong economy and good infrastructure.

Forex trading is a popular way to make money in The Gambia. It involves the buying and selling of currency pairs to profit from the fluctuations in their exchange rates. If you are new to forex trading, it can be tricky to know where to start.

This article will teach you how to trade Forex in the Gambia. If you’re interested in trading forex in The Gambia or anywhere else in the world, below, you will get to read the detailed process of trading forex.

Before starting trading as a beginner, you must have a personal computer and a reliable internet connection. Also, ensure you do adequate research about the broker you intend to trade with and make sure the broker is licensed and regulated by reputable bodies.

Open account for Gambian traders

Open an account on the broker’s website of your choice. Some trading platforms require you to make a minimum deposit when opening an account. To open an account on the many forex trading platforms, you will be asked to provide two documents; your proof of identity and proof of residency.

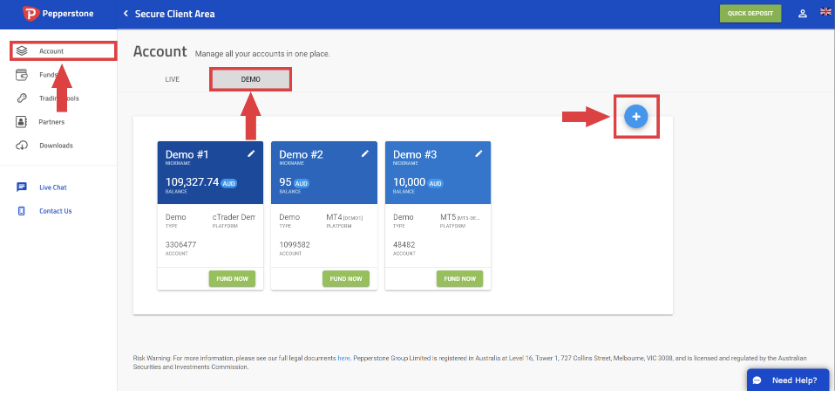

Start with a demo account or real account

Most brokers provide their traders with a demo account. When you are new to a trading platform, you should trade with a demo account first before you start trading with real money. Trading with a demo account helps you get familiar with the trading platform. It also enables you to practice the best strategies for you on the trading platform.

Deposit money

After you have opened an account on the forex trading platform of your choice, you must deposit money into your account to start trading. There are many ways to deposit money into your account. But the method you use to deposit money into your account is dependent solely on the trading platform. Some well-known methods include; bank transfers, debit cards, and electronic payment systems such as PayPal and Skrill.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

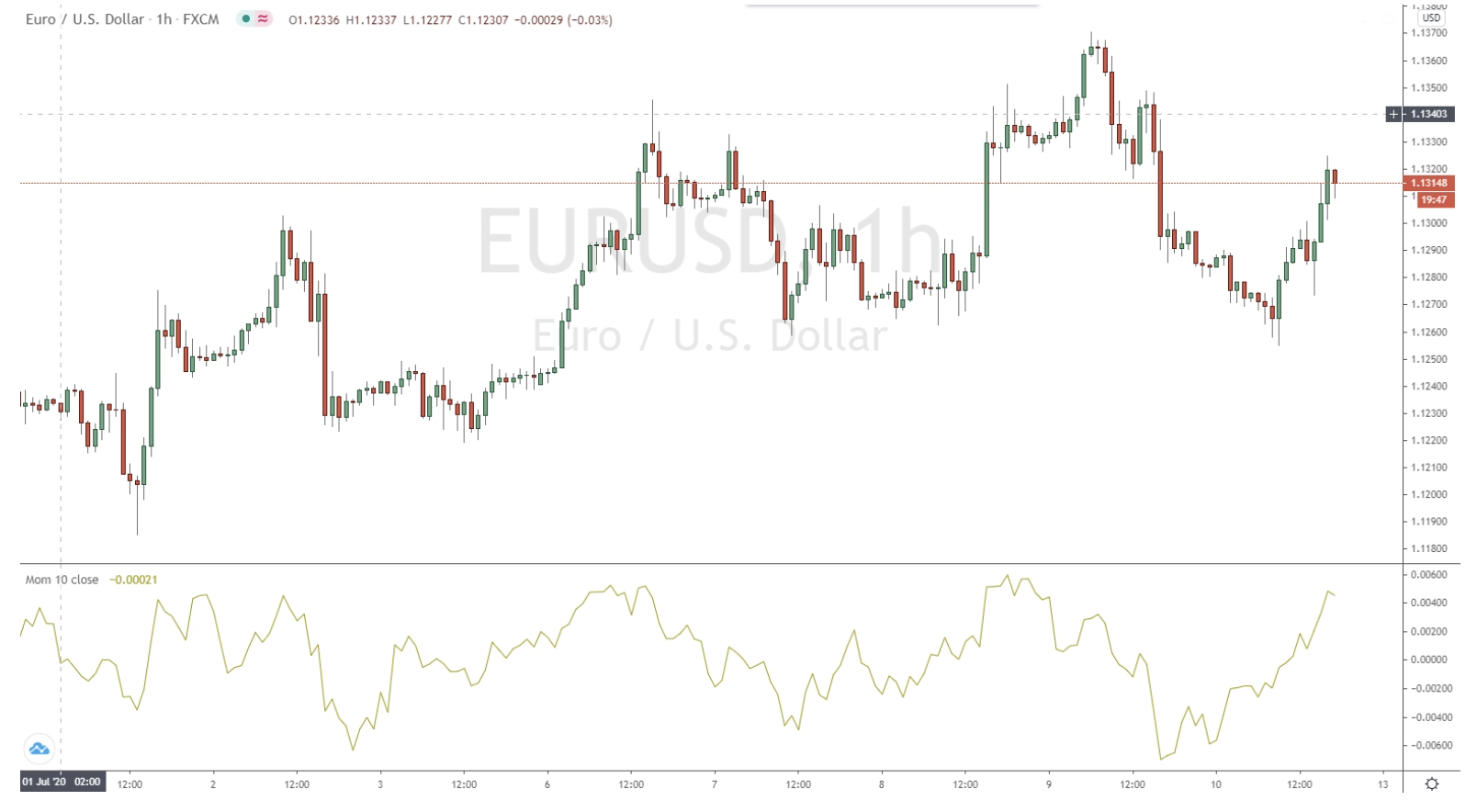

Use analysis and strategies

Forex traders use analysis and strategies to decide when to buy or sell the currency they are trading in. These strategies include;

Position trading

Position trading is a long-term trading strategy that attempts to profit from the price movements of stocks, currencies, commodities, or any other tradable asset. The trader buys an asset and holds it for a while, hoping that the price will move in a favorable direction. When the trader judges that the time is right, they sell the asset and take their profits. Position traders typically hold their positions for weeks or months, sometimes even years. By buying low and selling high, position traders can make consistent profits.

Scalping

Scalping is a trading strategy employed in most markets around the world. Scalping aims to make a small profit on each trade by buying and selling assets quickly and regularly. This approach works best in high liquidity markets with tight spreads. Traders who use this technique must have an excellent grasp of market dynamics and make quick decisions.

Day trading

Day trading is buying and selling stocks, commodities, or other financial instruments within the same trading day. The day trading strategy aims to take advantage of small price movements to make a profit. Day traders typically hold their positions for minutes or hours, sometimes even seconds. Day trading can be profitable, but it is also a risky investment strategy.

Make profit

Everyone ventures into business to make a profit at the close of every business day. But it is always a two-way thing. Either you make a profit, or you lose money. As a forex trader, the same applies to you at the close of trade; either you make a profit or a loss; this depends on the movement of the currency you are trading in.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Gambia

This article discusses the five best brokers in the Gambia. The Gambia is a country that is rebuilding, and there are many opportunities for profit, including forex trading. However, due to the high level of corruption in the country, it is essential to use a reputable broker. This article provides a list of the five best brokers in the Gambia to choose the right one for you.

FAQ – The most asked questions about Forex Broker Gambia :

How can a trader choose a good forex broker in Gambia?

A trader can choose a good forex broker in Gambia by comparing them. A comparison will allow traders to know the best services of the brokers. In addition, they can also know about the features offered by the brokers very briefly. Also, you should consider whether the broker is regulated while analyzing the broker. Trading with a regulated broker will give you peace of mind.

What features does a forex broker in Gambia offer traders?

Traders can find a lot of features with forex brokers in Gambia. The trading platforms make available whatever a trader needs to trade forex. They get all trading tools from the best forex brokers. Besides, some brokers, such as IQ Option, Pepperstone, etc., also offer you a lot of educational materials. You can also attend various trading webinars on these trading platforms.

Does a forex broker in Gambia offer traders a demo account?

A trader can sign up for a demo account with a forex broker in Gambia. You can use a demo account with the forex brokers to learn how to trade. It allows you to trade without paying the broker for thirty days.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)