The 5 best Forex Brokers and platforms in Georgia – Comparison and reviews

Table of Contents

Trade through time has moved from just common goods and services into various relevant things that can be bought and sold. An example of this is currency. Trade has also moved from the physical world into the virtual world. This makes the process easy, accessible, and readily available to those that want to trade.

Forex trading is one of the virtual methods through which trading is done. If you want to go into Forex trading, there are some things you need to know. This article has written about some things you need to know. The five best forex platforms you can begin trading on are below.

See the list of the best Forex Brokers in Georgia:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

1. Capital.com

Capital.com is a forex platform that started in 2016. The platform has a high number of users and is still growing in its users to date. The platform is a well-secured platform for traders because it is under regulation by international bodies. The international bodies ensure that the platform is safe and secure for its traders.

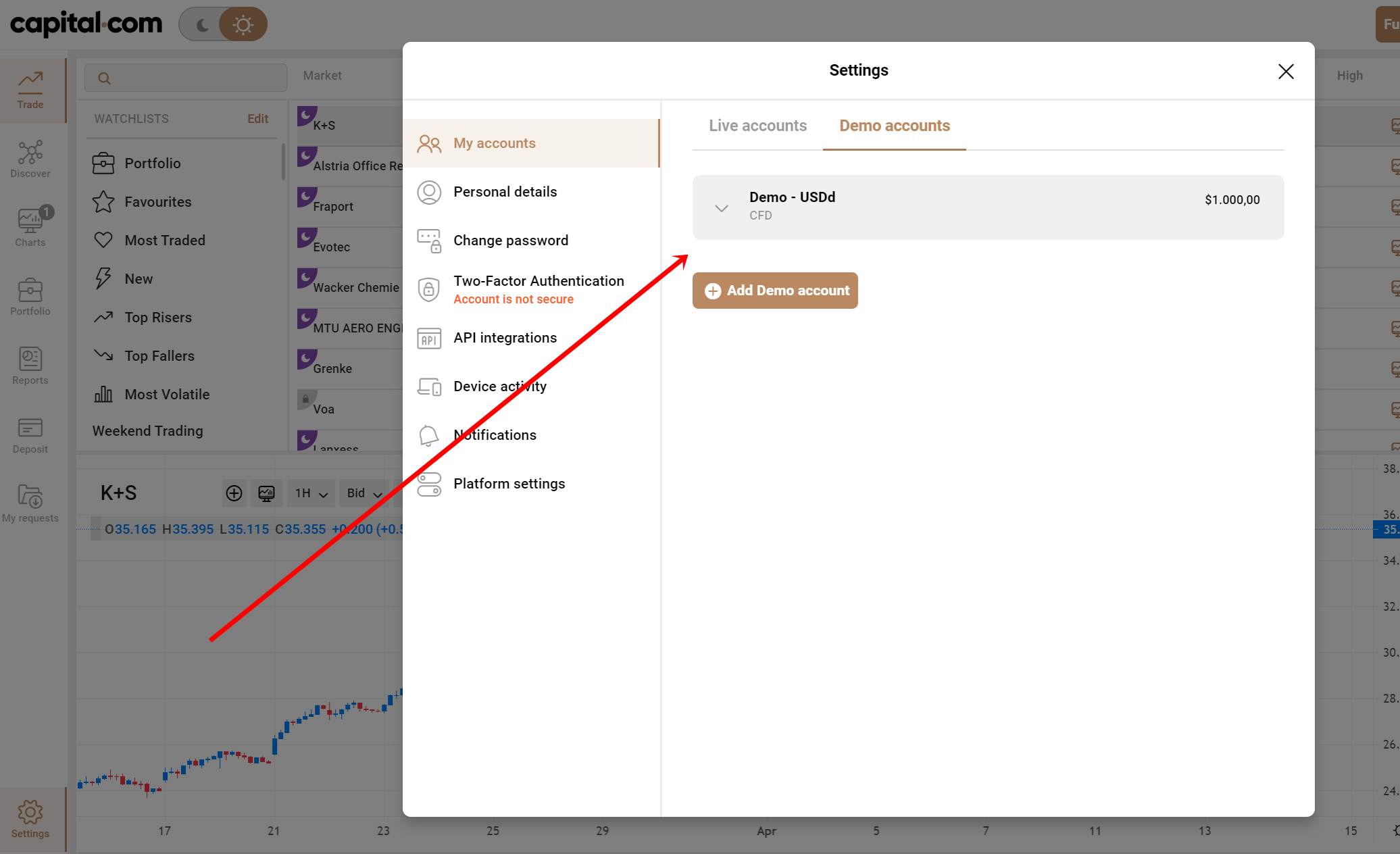

Trading on Capital.com with your real account starts with a deposit of $20. The platform has a demo account that users can practice trading before starting with their real account. The demo account does not finish or gets unavailable after some time.

Capital.com provides resources for its traders. These resources include educational articles, videos, and courses that a trader will find very useful in developing their forex trading skills. Capital.com has tests that its traders can take within the platform to help them elevate their skills.

The brokers’ platform is advanced in its technology. This makes their clients’ trading experience enjoyable. Capital.com has desktop and mobile versions readily available for traders. Traders can choose to experience their trading from any of the devices. This makes their trading experience flexible.

Suppose you are looking to trade on a MetaTrader platform. Capital.com does not have the MT5 platform available on it. The customer service is also excellent and readily available.

Advantages of Capital.com

- The platform has excellent technology, which improves the Trader’s experience.

- Capital.com’s demo account can always be accessible

- Provides market and educational resources for their clients

- It has a good number of varieties to trade from

Disadvantages of Capital.com

- There is no MT5 platform on Capital.com

- Its smallest amount of deposit is $20 before traders can trade.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

BlackBull Markets is well known around the world. It started in New Zealand in 2014 and has formed more offices in Europe. The broker is essentially a Fintech and Forex-related company. Traders can trade assets like CFDs, indices, and Commodities.

BlackBull Markets’ traders enjoy fast-speed transactions on the platform. This is possible because of the server on Wall Street that its server is connected to. The broker provides its traders with MT4 and MT5 platforms (MetaTrader) suitable for Forex dealing. The MetaTrader platform allows for better security and a more enjoyable trading experience.

The platform is under the regulation of the FSA. This body makes sure that the organization is under proper control and provides the necessary protection for its traders. FSA is an international regulatory body in charge of how BlackBull runs its affairs.

BlackBull Markets has two account types that its traders can choose – the standard and the ECN prime accounts. The standard account traders have to deposit $200 before trading with the account. Having a standard account also means you operate with a spread of 1.1 pip and no commission.

ECN Prime account is different from the standard account. Traders using this account must first deposit up to $2000 before trading with the ECN prime account. They also trade on a spread of 0 pip.

Advantages of BlackBull Markets

- There is a demo account available for traders.

- Reliable Market resources that traders need are provided

- It is connected to a server that allows quick transaction

- MetaTrader platforms are available

Disadvantages of BlackBull Markets

- There are no educational courses, articles, or videos.

- US clients are not accepted on the platform.

(Risk Warning: Your capital can be at risk)

3. RoboForex

RoboForex is under the regulation of the IFSC. An international regulatory system. This makes this broker platform to be trustworthy for traders to deal with. RoboForex’s traders are accessible with assets to trade. These assets include Groceries, Gold, and Metals. This gives traders on their platform a range of choices to make.

RoboForex has offices in countries worldwide, and its customer service has more than 18 languages they speak. This allows for smooth communication with their clients from around the world. The platform has a user range that numbers more than 1 million users.

RoboForex offers three platforms from which the traders can pick. MetaTrader platform has both the MT4 and MT5; then, the cTrader platform is available on the broker. MetaTrader platforms are good because they provide security and better technology for the traders. cTrader is also excellent because it has a better interface than the MetaTrader platforms.

The broker platform allows traders to make a minimum amount of $10. It also provides more than one payment method for traders to deposit money into their accounts. RoboForex also has an account that allows people to deposit $100 before they can trade on the account – R Stock Trader account.

It is available on both mobile and desktop. Trading can be done on either of the views or devices. It also gives the same experience on the devices.

Advantages of RoboForex

- Traders can withdraw money, and no fee is attracted to it.

- MetaTrader platforms are available for traders

- There is a demo account open for traders

- Minimum deposit of $10

Disadvantages of RoboForex

- The customer service is sluggish

- The Forex spread is not constant.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Licensing bodies around the globe regulate Pepperstone. The Financial Conduct Authority (FCA), Australian Securities and Investment Commission (ASIC), Competition and Market Authority (CMA), BaFin, SCB, and DFSA. These international bodies make sure that Pepperstone is under careful and watchful eyes.

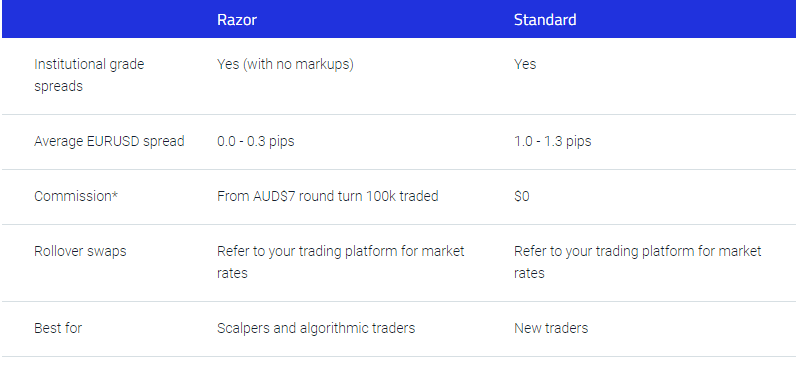

The platform also has several assets that traders can trade with. Pepperstone’s minimum deposit amount depends on the account you choose for trading. There is a standard account that has a minimum deposit of $200. The standard account also has its specific Forex spread of 1 pip. Traders that own this account do not get any form of added profit.

It has what is called a razor account. This is different from the standard account in that traders enjoy an added profit when they close a trade. Traders must make an initial minimum deposit of $2000 into the account to be able to trade with it. The spread is different from the standard account.

Pepperstone has a demo account for traders that lasts for a month. The broker platform is available on phone and desktop. Traders can enjoy flexible trading opportunities. It is a MetaTrader platform-based broker.

The brokerage’s MetaTrader platform is handy. The MT4 and MT5 platforms help traders ensure that their account is very secure. It also allows them to enjoy smooth transactions and opening and closing markets.

MetaTrader platforms have a plug-in that adds to the experience of the Trader. A plug-in can help the Trader strategize while taking trading positions on the chart. This is possible because of the bot available on the plug-in.

Advantages of Pepperstone

- Competitive spread on the razor account plus commission.

- The broker is available on mobile and desktop

- MT4 and MT5 platform based

- Good customer service

Disadvantages of Pepperstone

- There are no educational resources available

- Demo account availability is limited to only one month.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is an Arab-based forex platform. It was founded in 2013 in Cyprus to function primarily as a binary-based (only for professional traders and outside EAA countries) platform. Then when its technology improved, it started offering CFDs and commodities for traders on its platform. The Forex broker is regulated by CySEC, which stands for Cyprus Securities and Exchange Commission.

The platform is readily available on both phones and the web. Traders also get to experience the same trading experience on different devices. The ability to trade on not just a desktop makes the broker platform to be flexible for its traders.

The platform has a demo account that does not finish. To begin trading with your real account, you need to deposit $10. The platform also has two kinds of accounts that traders can choose from. A standard and VIP account that traders can pick from to begin trading on the platform.

IQ Option has a smooth and interactive interface. Traders can change the chart on the platform to favorable. They can also change the color of the chart. IQ Option is technologically improved.

It provides traders on the platform with different educational resources and market resources. There are interactive forums on IQ Option and occasional webinars. Useful market information is also shared through meetings and webinars. Through the conferences and webinars, new forex traders can learn more about the Forex market and learn different strategies from the pros.

Advantages of IQ Option

- A demo account is available

- A minimum deposit of $10 can be made for a start.

- Trading can start from as low as $1

- Valuable educational resources and interactive forum

Disadvantages of IQ Option

- USA clients can’t trade on the platform

- Direct withdrawal through bank transfer takes time.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Georgia?

The Department of Banking and Finance heads Georgia’s financial regulation. This department governs all the commercial banks and any other financial institution in the country. The department is divided into two functional bodies. These bodies share the duty of regulating financial institutions.

The depository division is the first body. This body is in charge of regulating Georgia’s state-charted banks, credit unions, and some other institutions.

The second body is the non-depository division. This body is in charge of licensing and checking mortgage brokers and lenders, payment transmitters, and other institutions. Especially those that have to deal with mortgages.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Georgia

Clients from Georgia need to be very careful with the broker they choose. Especially local ones. Most forex brokers are founded to carry out criminal activities like cyber theft. These kinds of brokers do not have any regulatory body that governs them. So the brokers are not held accountable for whatever they do.

Traders need to ensure security for themselves by trading with broker platforms that are internationally recognized and under the regulation of different international bodies. These brokers are held accountable for whatever happens to their traders or clients. These licensing bodies protect the traders from fraud and other financial crimes.

Trading forex is very with recognized brokers is the best kind of security that a trader can give him or herself.

Is it legal to trade Forex in Georgia?

Forex Trading in Georgia is legal. According to the law of Georgia in Article 23, the law provides that brokerage licensing provides a brokerage company to make transactions and other financial activities legally.

Brokerage licensed companies give them more credibility in the country. As a trader from Georgia, you need to make sure that the broker platform you picked is appropriately regulated. This is advisable because it is a form of security for you as a trader.

How to trade Forex in Georgia – Quick tutorial

Open account for Georgian trader

Opening an account with your desired broker is the first step you must take to open a trader account in your country. Opening an account with the brokers above take easy steps to have an account with them. You will be required to provide documents for identification and proof of residency. So do make them readily available.

Start with a demo account or real account

After opening your account, after registration, you can begin trading. You can start either with the demo account provided or your real account. The profits and losses you have in your demo account do not affect the real account. As a new trader, you may want to use the demo account to practice.

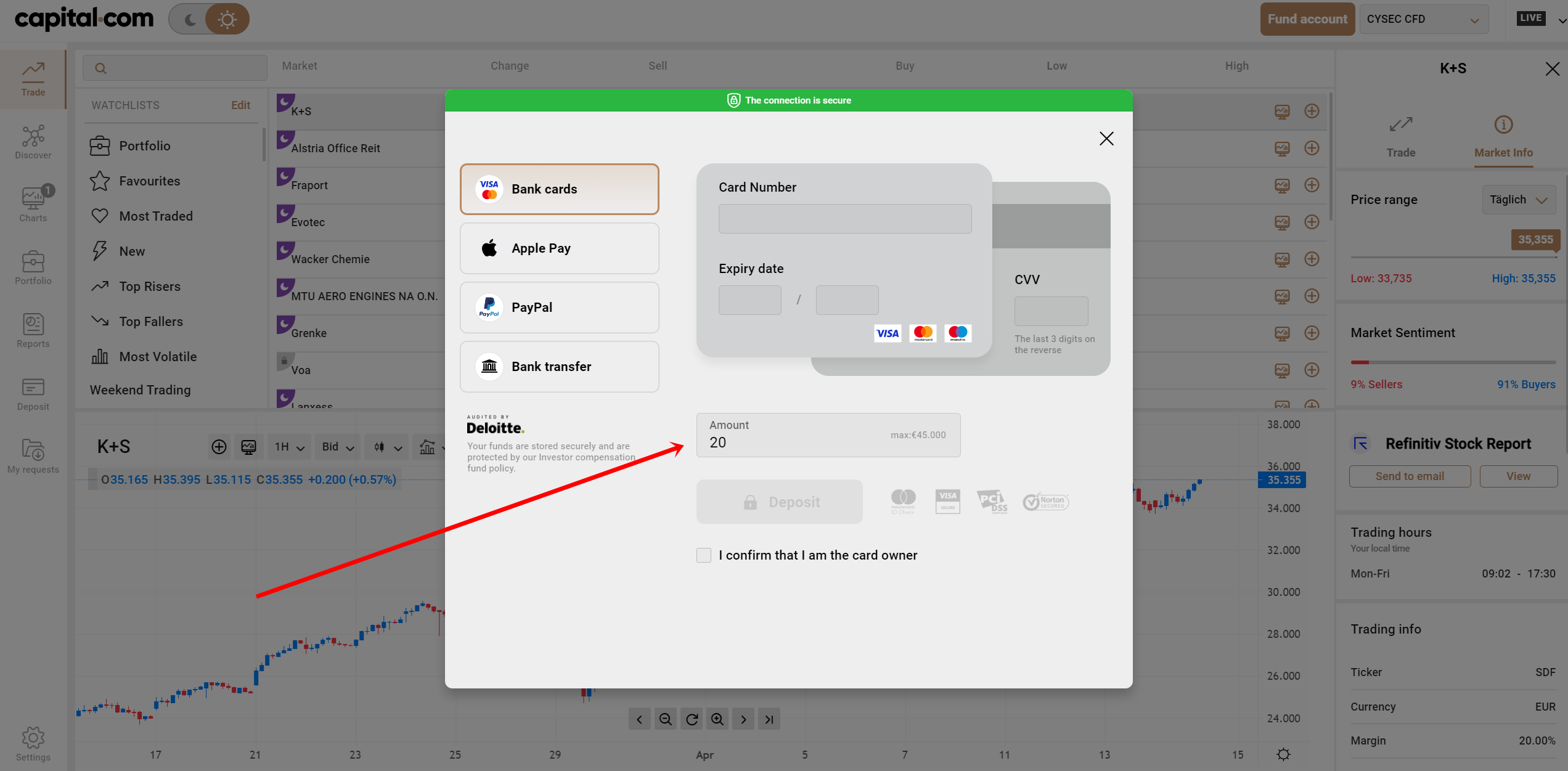

Deposit money

Trading with your real account means that you need to deposit real money into the account. The minimum deposit amount required depends on the broker you decide to use. The platform you choose also has different payment methods through which you can deposit funds into the real account. Choose the payment method that suits you.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use of analysis and strategies

Analyzing strategies can help you as a forex trader, especially a new one. Traders have different methods before they open and close the market on the chart. These strategies are helpful for planning. Some of the techniques used by traders include.

Scalping

Scalping is a strategy that involves opening more than one market on the chart. The aim is to make a small income from the different opened markets when it closes. It has proven to be very useful.

Day trading

This strategy is not only used in Forex trading. However, it is most known in forex trading. It involves staying in a particular position for a whole day. Traders close their trade when the day is over.

Position trading

Position trading is helpful for traders who like a long-term observation. Traders can assume a particular position for a long time. The time can number up to weeks, months, and even years.

Make profit

Every Trader aims to make a profit at the end of every market. Having a strategy to observe how market competition works is very useful. It higher your chance of making a profit while trading.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Georgia

In conclusion, trading Forex in Georgia is easy, to begin with, your private-owned devices such as a mobile phone or laptop. Trading forex in Georgia is also legal, so you, as a trader in Georgia, do not need to be worried about any form of sanction from your government.

If you’re going to be a Forex trader, you need to know how the market works, what strategy to take and how to implement these strategies. It would help if you also were careful about which broker you are trading with. All the brokers listed above are trusted broker platforms because internationally recognized bodies regulate them.

Except for having a particular strategy to trade, if the platform you are using for your Forex trading provides you with educational materials, it will be a plus if you take your time to go through them. Educational materials provided by Forex broker platforms help in improving traders. It is beneficial if you, as a trader, take your time to study them.

FAQ – The most asked questions about Forex Broker Georgia:

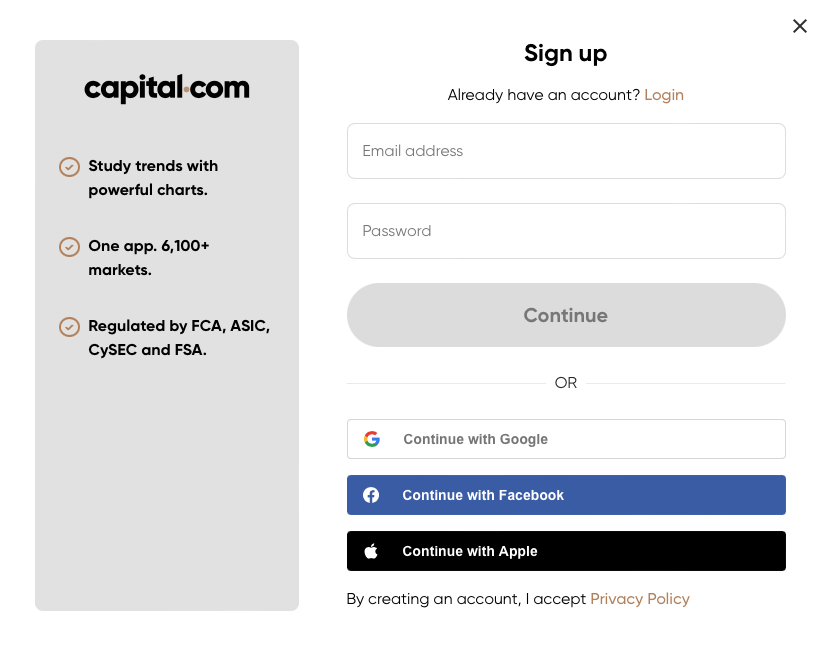

How can a trader signup for a trading account with a forex broker in Georgia?

Traders can sign up for a trading account with forex brokers in Georgia by logging on to their website. The brokers also allow traders to download their mobile applications. After opening the app or website, you can click on the ‘signup’ option. Finally, you can enter your details and begin trading by clicking on the ‘submit’ option. This way, a trader can easily trade with a forex broker in Georgia.

Is forex trading with a forex broker in Georgia easy?

It depends upon the trading experience of the broker. A trader with prior forex trading experience might find trading with a forex broker in Georgia easy. However, the brokers also offer certain features that make trading easy. For instance, forex brokers in Georgia, such as RoboForex, Pepperstone, etc., allow traders to use the feature of social trading or copy trading. With these features, traders can take help from experienced traders.

Which trading platforms are commonly offered by a forex broker in Georgia?

There are several trading platforms that forex brokers in Georgia offer traders. You can use the MT4 or MT5 trading platform. Or cTrader is also one platform that will allow you an enhanced trading experience. Almost all forex brokers in Georgia offer it.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)