The five best Forex Brokers and platforms in Ghana – Comparison and reviews

Table of Contents

Trading forex in any country requires you first start with selecting a forex broker, and if you are new, you are likely to fall victim to numerous forex scams. If you are looking for a forex broker in Ghana, we list five recommended and regulated forex brokers.

See the list of the best Forex Brokers in Ghana:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

List of the five best Forex Brokers in Ghana:

1. Capital.com

Capital.com has been offering brokerage services since 2016 and has managed to register 5 million forex traders globally.

Trading Instruments – its users can access 6500+assets ranging from stocks, shares, commodities, forex, cryptocurrencies, and indices.

Regulation – it has a trading license from the FCA, NBA, ASIC, and CySEC.

Account types – it has three, Plus with an initial deposit of $2000, Premier with $20,000, and Standard, which is $20.

Fees – the forex spreads start from 0,8 pips.

Trading costs – The Rollover costs vary with the asset and leverage. It has no inactivity costs while commissions, deposits, and withdrawals are free.

Leverage – the highest leverage for non-EU clients is 1:500. Those within the EU have a limit of 1:30.

The demo account – Capital.com has a free demo account with $10,000 virtual funds.

Trading platforms – it offers the MT4 and we-trader.

Payment methods – range from 2c2p, GiroPay, Przelewy, Trusty, Sofort, iDeal, Multibanko, and Apple Pay.

The customer care – their support team is available 24/7 in 13 languages through live chat, SMS, and emails.

Pros

- Low trading costs

- Fast order processing speeds

- The low minimum deposit for the Standard account

- Fast withdrawals and deposits

- Negative balance protection

Cons

- Limited research tools

- High initial deposit for the Premier plus accounts.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. Pepperstone

Pepperstone started its operation in 2010 and has over 50,000 registered clients.

Financial instruments – Indices, shares, ETFs, Commodities, and forex.

Regulation – the FCA and ASIC regulate Pepperstone.

Account types – it has the Razor and Standard accounts with $200 as a minimum deposit.

Fees – forex spreads start at 0.0 pips in the Razor account and 1.3 pips on the Standard.

Trading costs – the Standard has no commissions; the Razor account charges $7 per round lot for every $100,000. It has no inactivity costs. Overnight rates apply depending on the trading position and free deposits and withdrawals.

Leverage – the maximum is 1:400.

The demo account – Pepperstone has a limited demo account of 30 days with $50,000 virtual funds.

Trading platforms – it offers MT4, MT5, and cTrader.

Payment methods – vary from Skrill, Neteller, credit/debit cards, Pay Pal, bank transfers, POLi, Bpay, and UnionPay.

The customer care – the support team works 24/5 through phone calls, email, and live chat.

Pros

- Low trading costs

- Quality educational resources

- Fast order processing speeds

- Negative balance protection

- Industry-standard trading resources

Cons

- Limited research and educational resources

- Their customer support is only available 24/5.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

3. IQ Option

IQ Option has been in the market for over nine years, offering brokerage services to thousands of clients.

Trading instruments – its users can access Cryptocurrencies, stocks, CFDs, ETFs, Options, and Forex.

Regulation – it has regulated by the Cyprus Securities and Exchange Commission.

Account types – there is the VIP with varying high initial deposits and the Standard account, which offers a $10 initial deposit.

Fees – the forex spreads vary with the trading asset and the trading conditions.

Trading costs – it has no commission except for the 2.9%, and overnight rates range from 0.1-0.5%. It also has inactivity costs of $10 for accounts inactive for three months, deposits are free, but withdrawals via bank wire attract a fee of $31.

Leverage – the highest leverage is 1:500

A demo account – it has an unlimited demo account with virtual funds of up to $10,000.

Trading platform – it has its proprietary trading platform.

Payment methods – They vary from credit cards, Neteller, Skrill, debit cards, Moneybookers, Webmoney, and bank transfers.

Customer support – customer care is available via live chat and emails.

Pros

- Low trading cost

- User-friendly interface

- Low initial deposit

- Fast order processing rates

- A Fast account registration process

- Numerous payment platforms

Cons

- Limited trading instruments

(Risk warning: Your capital might be at risk.)

4. BlackBull Markets

BlackBull Markets started its operations in 2014, and so far, it has registered thousands of forex traders.

Financial instruments – its users have indexes, energies, commodities, metals, and CFDs.

Regulation – it has a trading license from Financial Services Authority.

Account types – it offers ECN Institutional a minimum of $20,000, ECN Prime with initial deposits of $2000, and ECN Standard with $200.

Fees – the ECN standard has forex spreads from 0,8 pips, Prime from 0.1 pips, and the Institutional with 0.0 pips.

Trading cost – the commission starts at $6 for $100,000, ECN Institutions with variable commissions, and the Standard with no commission. It has no inactivity costs, and the overnight rates are applicable. Deposits and withdrawals are also free.

Leverage – the maximum leverage is 1:500.

Trading platforms – it supports MT4 and MT5.

Payment methods – it accepts FasaPay, Neteller, Skrill, Union Pay, bank transfers, and credit and debit cards.

The customer care – the support team is present 24/6 via live chat emails and telephone.

Pros

- Fast order execution speeds

- Low trading costs

- High leverage

- Fast account registration

- Fast deposits and withdrawals

Cons

- Limited research and educational resources

- Customer support is only available 24/6

(Risk Warning: Your capital can be at risk)

5. RoboForex

RoboForex started operating in 2009 and registered more than 1 million traders.

Trading Instruments – traders can access CFDs, ETFs, Metals, indices, energies, stocks, forex, and commodities.

Regulation – it has registration from the Financial Services Commission.

Account types – traders can select from Pro-Cent, Pro, ECN, and Prime account with an initial deposit of $10 and the R-stocks trader with $100.

Fees – the ECN and Prime have forex spreads from 0.0 pips the Pro and Pro-cent with 1.3 pips, and the R-stocks trader from 0.01 USD.

Trading costs – Overnight chargers apply; it has an inactivity cost of $10 for dormant accounts of over ten months. Deposits and withdrawals are free, and it charges low commissions for the ECN, R-stocks trader, and Prime accounts.

Leverage – the Prime and R-stocks trader offer 1:300, the RCN has 1:500, while the Pro and Pro-Cent have 1:2000.

Demo account – it has an unlimited demo account.

Trading platforms – it supports the c trader, MT5, MT4, and R-stocks trader.

Payment methods – it accepts AstroPay, credit cards, debit cards, Skrill, Neteller, NNganLuong wallet, bank transfers, and AdvCash.

Customer support – customer care is available 24/7 through live chat, emails, and telephone and supports 24 languages.

Pros

- Low trading costs

- Negative balance protection

- Low initial deposits

- Fast execution speeds

- High leverage rates

- Industry-standard trading resources.

Cons

- It has limited trading instruments

- It is not available in some regions.

(Risk Warning: Your capital can be at risk)

Forex trading in Ghana – What you need to know

The capital markets of Ghana started operating in 1990, with the stock exchange of Ghana. It became one of the leading stock markets in 2004 due to the adjustment program that aimed to change the financial system, including the capital markets.

It has continued to grow gradually, and by 2012 it had listed more than 34 companies. The exchange markets in Ghana have grown with the forex market even though there have been reports of low liquidity from the local traders in Ghana.

Ghana has worked on growing the financial sector, especially the capital markets because it contributes to the general improvement of the economy of Ghana. Ghana’s Securities and Exchange Commission is under the ministry of finance and is regulated by the Securities and Exchange Commission SEC and the Bank of Ghana.

Is it legal to trade Forex in Ghana?

It is legal to trade securities and stocks in Ghana. They have a commission that helps regulate the financial sector thanks to the Bank of Ghana. Forex traders in Ghana can register trading accounts to buy and sell securities.

A few forex brokers are based in Ghana, which means forex traders look for forex brokers from outside Ghana to trade. Therefore, they must choose a regulated forex broker to operate in Ghana or an offshore broker with regulation from the industry-leading forex regulators.

What are the financial regulations in Ghana?

The Securities and Exchange Commission regulates forex in Ghana, established in 1993 to implement the securities industry law of 1993 and 2000 and the legislative instruments and securities act of 2006.

The SEC was originally known as the Securities and Regulatory Commission before it changed in 2000. It also works with the Bank of Ghana to license market participants and regulate the financial markets.

Some regulations placed include:

- Financial issuers and forex brokers must register accounts using the Anti Money Laundering laws that require them to collect sufficient relevant data about a client to help mitigate money laundering and funding terrorism.

- Financial regulators have to submit accounts that have to get audited, and the auditor general has to report on the audits.

- The employees of companies and professional financial advisors regulated by the SEC require trading experience in the capital markets from finance institutions.

- Forex dealers or brokers have to avail of 5 million Ghanaian Cedi as the capital when registering for regulation from the SEC.

- Financial issuers that operate in Ghana without a trading license will have to pay a penalty fine depending on the services they sell, from 12cedi to 30 million cedis.

- Forex dealers and brokers have to ensure they have segregated accounts that client deposits unless with the consent of the forex trader.

- Forex brokers must ensure their employees comply with the security laws when selling and buying securities in Ghana.

- Forex brokers must ensure they disclose information that can affect the performance of a security.

- The brokers have the authority to conduct inspections and audit the transactions and other activities in the financial markets.

- Forex brokers and other market participants are prohibited from illegal activities such as market manipulation, rigging, or insider trading.

- It has the authority to supervise the arbitration of disputes between financial issuers and clients that can get settled outside the court.

- It has the mandate to set the conditions for listing, cancellation of the listing, and how to deal in securities and investments.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Ghana

The SEC ensures that the forex market is secure through internal and external audits of the forex brokers to ensure compliance with international trading standards. Segregated accounts for investors and company funds to avoid mixing funds.

Ensuring that financial issuers disclose information about an investment that has the potential of leading to losses. It has also ensured it investigates and enforces penalties on forex brokers found engaging in market manipulation and other illegal trading activities.

Strategies and analysis to use when trading in Ghana

Analysis

When trading forex, you have to start with analyzing to prepare you for how to enter and start trading. Based on the type of trading strategy, you can use both fundamental and technical analysis or do only one type.

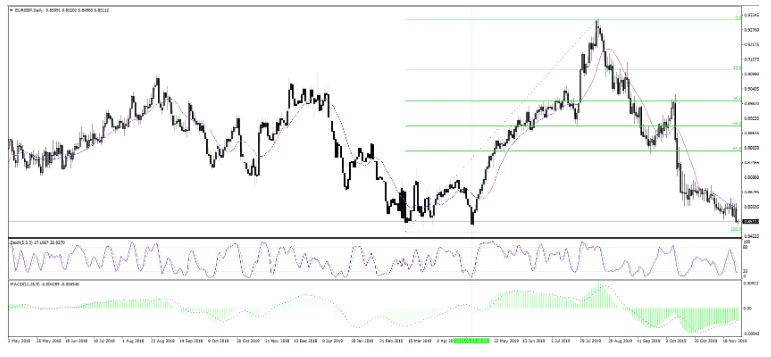

Technical analysis involves using technical tools to analyze the price direction, volatility, and liquidity. These factors help you know the best time to open a trading position, such as when you expect the market to change. You can also incorporate chart patterns or candlestick patterns when trading.

Fundamental analysis means monitoring financial events that influence price actions, such as major news releases from central banks, changes in trading contracts, political and economic factors, prices of commodities such as oils and gases, etc. These factors contribute to volatility in the prices of currencies and other related assets.

Trading strategies

You can apply different trading strategies when trading in forex, some include;

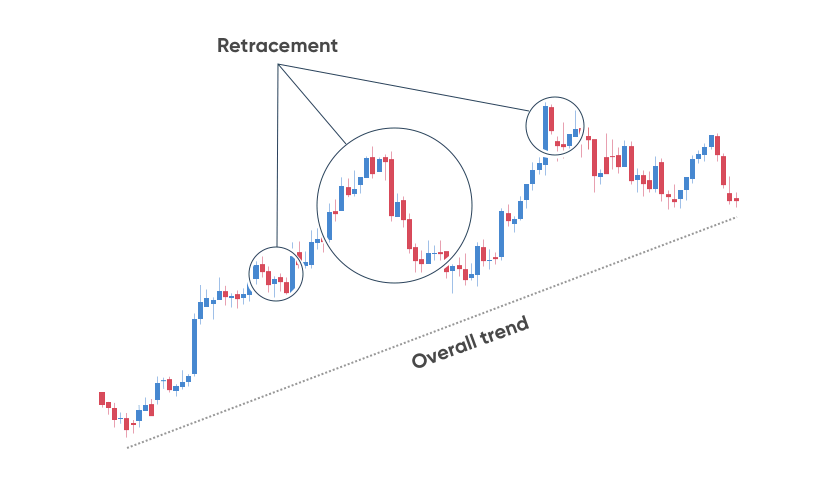

Trading pullbacks– these are points on the price action when the price action breaks from the direction of the trend and reverses before moving back. A pullback is often an opportunity to enter the market as long as you know how to predict it’s a pullback and not a reversal accurately.

Trading news – this is a trading strategy where the forex trader waits for a major news announcement before opening a trading position to trade the impact of the news on an asset. It also requires the trader to know how to predict the market reaction or wait for a confirmation of the trend direction before trading.

Trading a trend – it is one of the simplest trading strategies that new forex traders can start with. It involves identifying a trend and opening a trading position. If t is an uptrend, you can profit from going long; if it is a downtrend, you go short. This trading strategy works on most trading instruments.

How to trade Forex in Ghana

Find a regulated Forex trader

Look for a regulated trading broker, and ensure you verify the regulation by checking the license number on the website of the regulatory body it states. Besides that, you can also choose a forex broker based on other trading features such as the trading costs, trading tools, payment methods, and customer support.

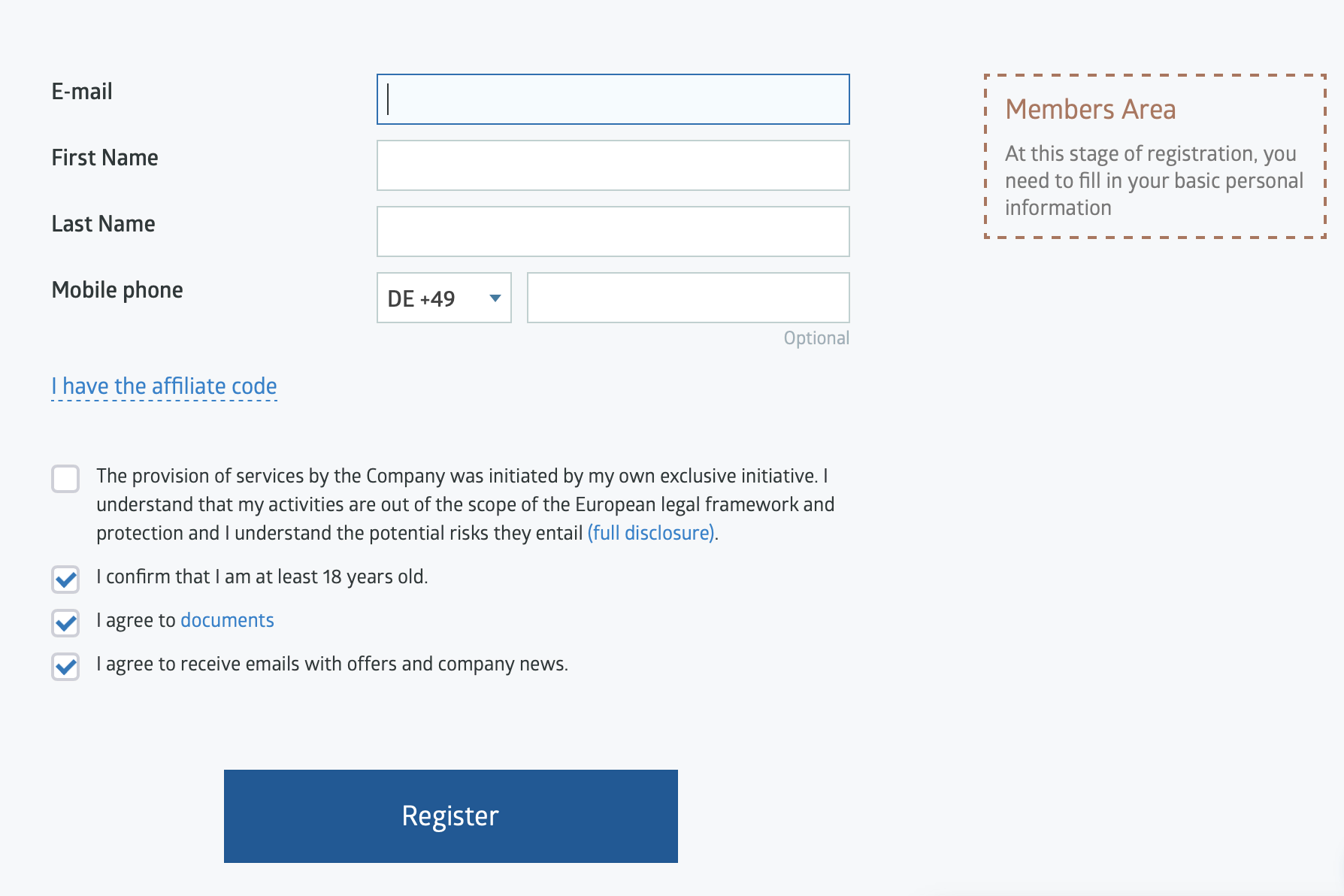

Register a trading account

Once you have found a reliable and credible broker register a trading account with the online registration form available. The registration process is fast and simple and requires you to give some details like your name, email, address, telephone number, account type, and password.

Due to the AML regulations in Ghana, you have to also verify these details by sending a copy of your trading ID and utility statements.

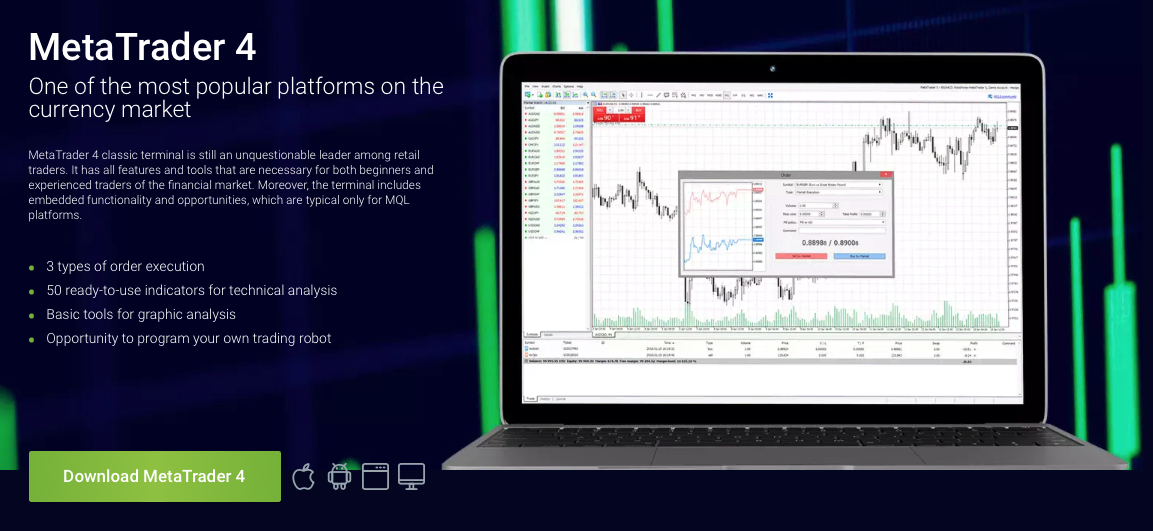

Download a trading platform

After opening a trading account, you need to download a trading platform compatible with your trading broker to access the trading instruments in the market. Forex brokers have trading platforms they incorporate with their trading accounts for trading.

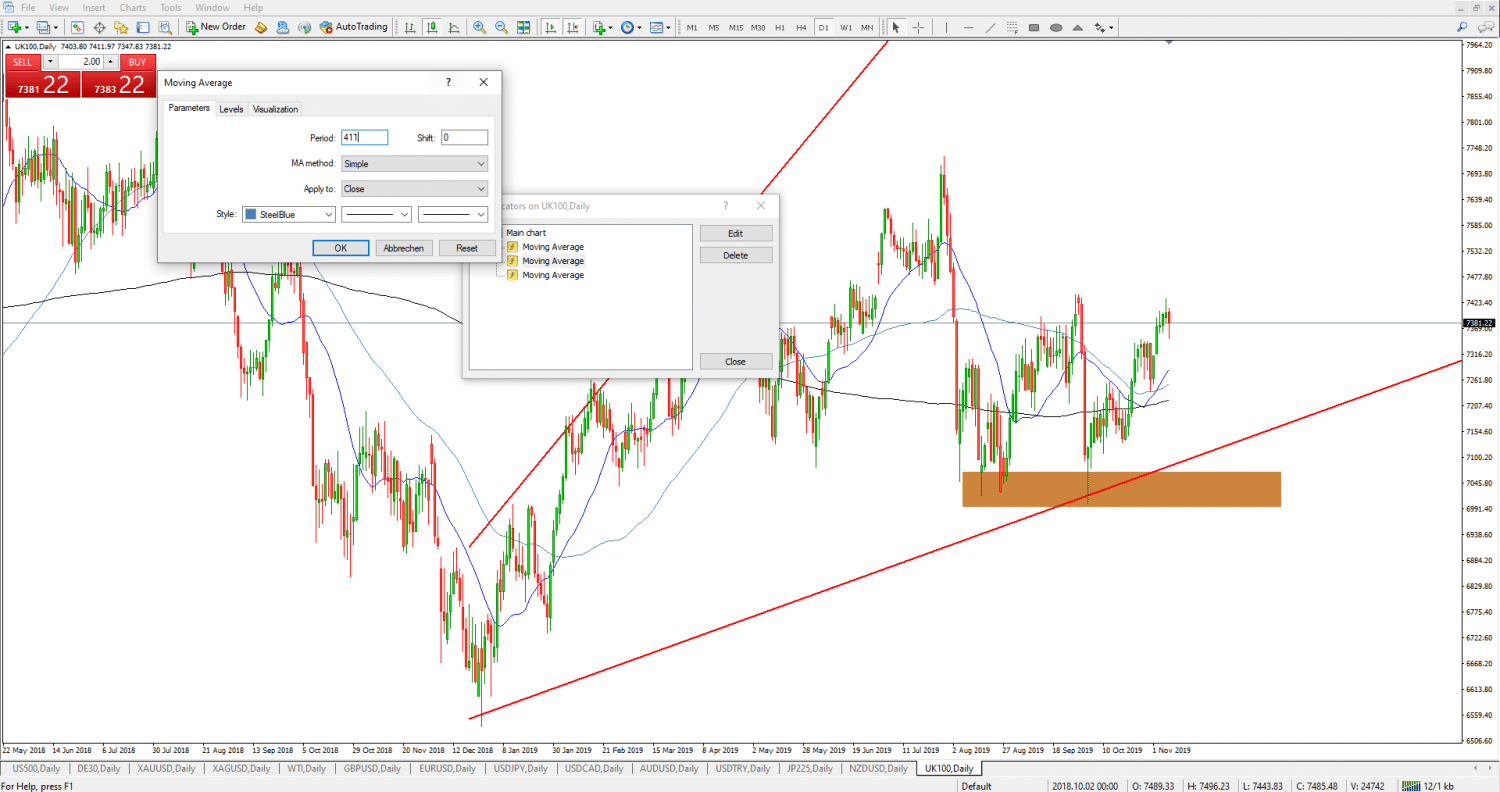

Select a trading platform, download it and navigate its interface to familiarize trading tools and features such as automated trading, technical indicators, and different charts offered.

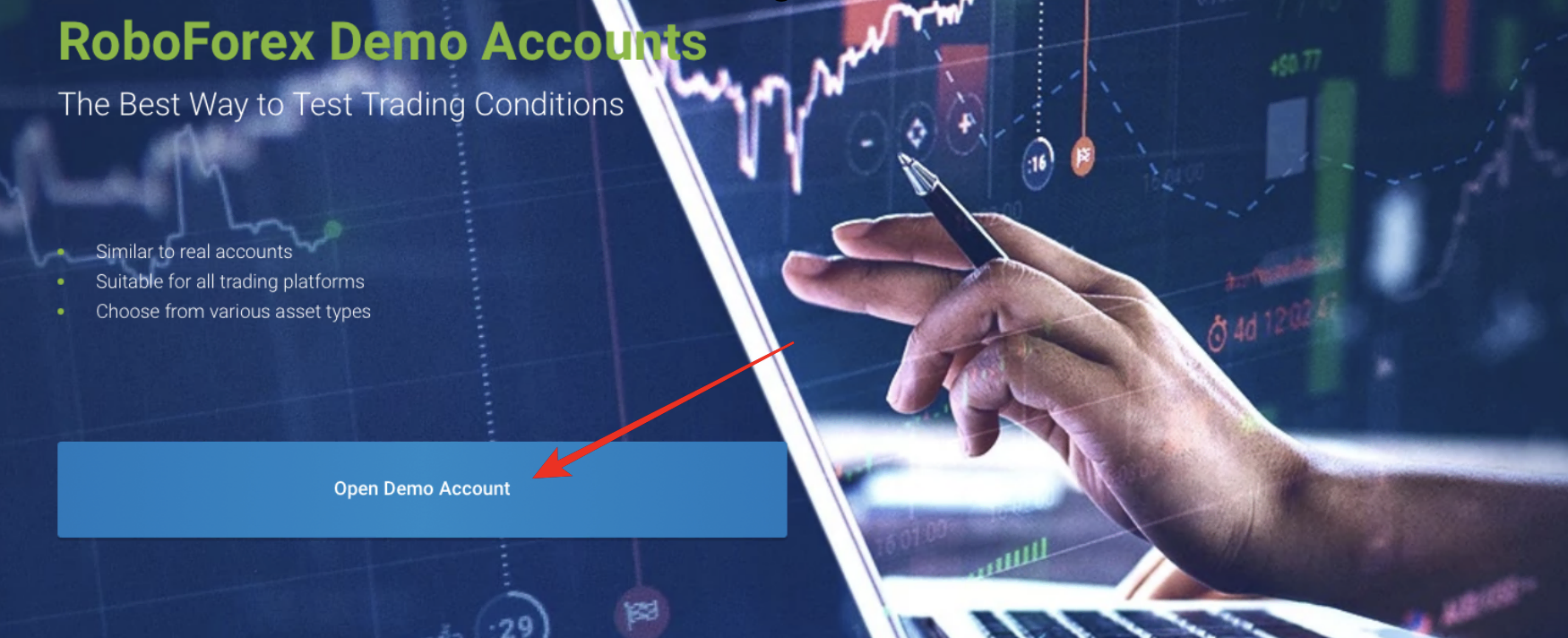

Start with a demo account

You can start with a demo or real account if you are ready to start trading. The demo account is for forex traders who wish to practice their trading strategies. It is also useful to traders who want to trade a new asset; they can practice how to trade a new currency pair.

The demo account is also crucial for new traders as they learn how to trade forex or other financial instruments. They can practice what they learn on this account before applying it with real money.

(Risk warning: 78.1% of retail CFD accounts lose money)

Deposit funds and start trading

Deposit the minimum requirement or the amount of capital you want to start with to your trading account. You can deposit funds using the payment methods the forex broker supports, such as bank transfers, credit and debit cards, and using digital wallets.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Conclusion: The best Forex Brokers are available in Ghana

Forex trading activities in Ghana and Africa have increased, and more people have joined the industry in the past five years. It has attracted foreign investors and international forex brokers who now accept forex traders from Ghana.

Unfortunately, it has also led to forex frauds to a higher population of new forex brokers looking for a way to invest in financial markets. We recommend five of the leading forex brokers from accredited regulators in the securities and exchange markets that accept forex traders from Ghana and many other African countries.

FAQ – The most asked questions about Forex Broker Ghana:

Is the Ghanaian cedi available in Forex?

Yes, it is available in forex and has the currency code GHS. Some forex brokers may not support it, but Ghanaian traders can trade it with the USD or the EUR. The USD/GHS current exchange rate is 7.5152, while the EUR/GHS is 7.9333.

How is Forex taxed in Ghana?

Ghana is trying to encourage more forex investors since the capital gains made from trading listed securities in Ghana are not liable to any taxes. It has a withholding tax of 8% for all resident and nonresident forex brokers.

What are the benefits of trading forex for any trader?

Forex trading is best because it allows traders to make more money than regular trading. All that a trader has to do to make a profit is perfect conduct research. Then, they can analyze the possibilities of making money with the change or fluctuations in currency. Currency fluctuations are inevitable. So, traders can benefit from these currency fluctuations every day.

Can traders in Ghana use a demo trading account?

Yes, most brokers that operate in Ghana allow traders to use a demo account. Demo trading is possible for traders for 30 days. After that, they can use this trading account for free. The brokers that lead in offering the best demo account services to traders include the following.

BlackBull Markets

Pepperstone

IQ Option

Capital.com

RoboForex

So, if you want to experience a demo trading platform with all features, you can choose one of these brokers.

Can traders in Ghana trade forex legally?

Yes, traders in Ghana can trade forex without any second thoughts. No rules and regulations forbid traders in Ghana from trading forex. You can trade as much forex as you like by choosing a broker. However, once you indulge in forex trading, ensure it is through a broker who offers reliable services in Ghana.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)