The 5 best Forex Brokers and platforms in Guinea – Comparison and reviews

Table of Contents

The global foreign exchange market is the largest and most liquid financial market globally, with a daily average turnover of $5 trillion. To participate in this market, forex traders need to select a trusted broker who will offer a reliable trading platform and competitive spreads. While it’s possible to trade forex through several different platforms, not all brokers are created equal.

See the list of the best Forex Brokers in Guinea:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

There are many brokers to choose from, and it can be challenging to determine which is the best for you.

We have compiled a list of Guinea’s five best forex brokers and platforms:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

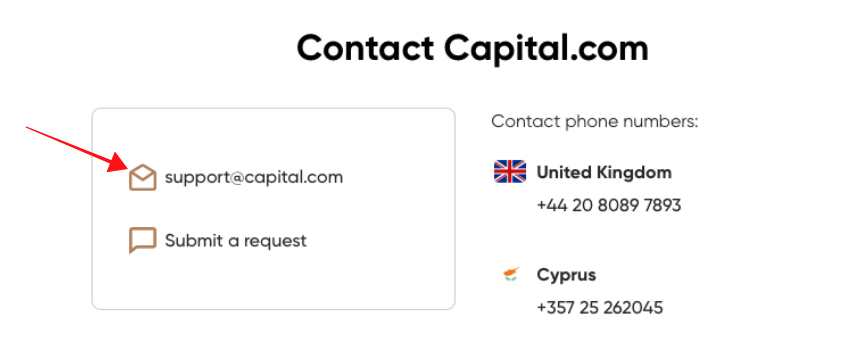

1. Capital.com

Capital.com is a Forex and CFD broker that offers traders access to markets, trading instruments, and account types. The Capital.com trading platform is web-based and easy to use, making it a good choice for novice traders. The company offers customer support in 16 languages, which is available 24 hours a day, five days a week, while its trading services are accessible in over 190 countries worldwide, including Guinea.

Capital.com is authorized and regulated by the Financial Conduct Authority (FCA) in the UK, and it is also registered with the CySEC in Cyprus. The company has various products that traders can use for their investments. These include forex, stocks, indices, commodities, and ETFs. Capital.com also offers several features that traders can improve their trading experience.

You can open a demo account for training purposes on the platform. The website is easy to use and navigate. The site is available in English, Spanish, Italian, German, French, Russian, Turkish, and Arabic.

Benefits of Capital.com

- The forex platform supports cryptocurrency trading

- commission-free pricing system available for all users

- trading platform with practical features that assist the traders in making more gain

- quality educational resources tailored to help all users

Drawbacks of using Capital.com

- The deposit withdrawal method is quite limited for some international users on the platform.

- Some clients cannot access the Capital.com trading platform.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

Are you looking for a new forex broker? If so, you may be wondering if Blackbull Markets is the right choice for you. In this short review, we highlight the overview of Blackbull Markets and provide you with some of the necessary information to make an informed decision.

BlackBull Markets is a brokerage company that was founded in 2014. The company is headquartered in the UK and is registered with the Financial Conduct Authority (FCA). BlackBull Markets offers a wide range of products and access to competitive spreads trading conditions; forex products provide quality customer service, CFDs, commodities, and many more.

The company has a wide variety of account types, including standard, premium, Islamic, and joint accounts. BlackBull Markets also offers a demo account that can be used to test out its products and services. As a new user, you might want to explore the website’s educational section to learn how to trade on the platform effectively.

BlackBull Markets is a well-established broker that offers a wide range of products and services. They have a solid reputation and are one of the most popular brokers.

Advantages of BlackBull Markets

- Deposits are free for all users.

- Well regulated; the platform doesn’t support payment for the third party.

- All withdrawals from the platform must be directed to the account owner’s bank details with corresponding details and information.

- Available to users from New Zealand

Disadvantages BlackBull Markets

- The company isn’t publicly traded.

- No proprietary platform for the users

(Risk Warning: Your capital can be at risk)

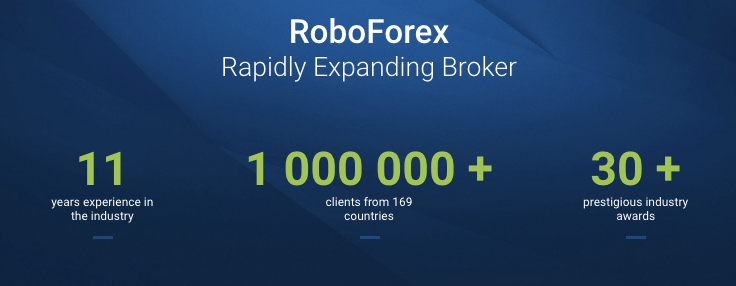

3. RoboForex

RoboForex is one of the top forex brokers out there. They are a regulated forex broker that was set up in 2010. RoboForex offers a wide range of services, providing traders access to over 250 tradable assets, including access to over 50 currency pairs, CFDs on stocks, indices, commodities, and binary options trading. Roboforex also offers a variety of account types to cater to different traders, from those just starting to experienced professionals.

The RoboForex trading platform is available in more than 20 languages, supporting manual and automated trading. RoboForex offers an impressive array of trading instruments and account types, tight spreads, fast execution, and exceptional customer service.

RoboForex has over 1,000,000 clients from more than 180 countries. The brokerage firm offers a wide range of services to its clients.

Advantage of RoboForex

- Favorable trading conditions for both new and old users

- CopyFx program accessible to the platform users

- Low deposit

- Instant withdrawal of your returns and funds

- High affiliate payment

Disadvantages of using RoboForex

- The currency pairs available are pretty small.

- Cryptocurrencies aren’t allowed on the platform.

(Risk Warning: Your capital can be at risk)

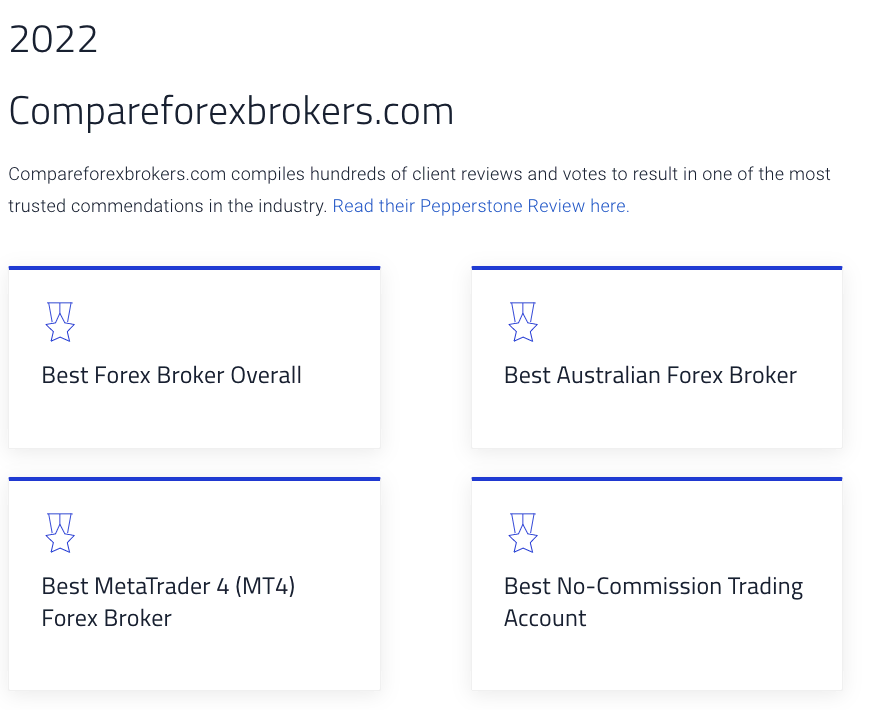

4. Pepperstone

Pepperstone is a large forex broker that has been in operation since 2010. The company is headquartered in Melbourne, Australia, and boasts of a client base spread across 180 countries. Pepperstone offers both retail and institutional clients access to streaming prices for over 55 currency pairs and metals, futures, and CFDs.

The broker offers a choice of four trading platforms that can be used on desktops, laptops, or mobile devices. Pepperstone has quickly become one of the largest Forex brokers globally, with over 150,000 clients located in over 180 countries.

The company offers traders access to the world’s largest and most liquid market, allowing for 24-hour trading on currencies, metals, and CFDs (Contracts for Difference). Pepperstone also offers MT4 (MetaTrader 4) and cTrader platforms, giving clients access to some of the most popular trading tools in the industry. They also offer a wide range of account types to suit various trading styles.

Pro of Pepperstone

- The platform’s sole aim is to provide international forex

- Presence of advanced trading tools

- Professional traders often use the platform

- You have access to social trading

Cons of Pepperstone

- There is little to no analytics dashboard for users

- The CFD financing rate is very high

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

IQ Option is a brokerage firm that has been in operation since 2013. The company is headquartered in Cyprus and is regulated by the CySEC, providing investors with a level of security and peace of mind. In addition to forex, IQ Option also allows traders to invest in stocks, commodities, and indices through its web-based trading platform. The company has won numerous awards for its innovative platform and user-friendly interface.

The company’s team consists of financial experts and IT professionals. IQ Option offers its clients a unique trading platform with a wide range of assets, high payouts, and convenient payment methods.

Pros of IQ Option

- The interface is easy to use

- Both withdrawals are easy

- There are more than 500 currencies and commodities on the platform

- The platform is trustworthy and works with binary options

- Available on different OS platforms

Cons of IQ Option

- The possibility of losing money is high for new beginners

- Very cumbersome user-friendly interface

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Guinea?

In Guinea, the activities of banks are regulated by Act L/213/060/CNT of August 12, 2013. Under this Act, banks are regarded as corporate organizations that have been licensed to run business by receiving deposits from clients, giving loans, and offering clients payments tools.

Banks also offer the following service to their clients on behalf of a third party; trading in foreign currency, selling or buying gold, selling health insurance to customers, and investing in financial products. Banks also serve as the middleman for transferring electronic funds and assist clients in the process of acquiring assets.

If you want to establish a bank in Guinea, a bank that will be able to carry out all the listed functions listed, then ensure you obtain the following authorizations.

For a bank to be recognized as a registered bank, an institution must be a significant shareholder of 20% in the bank. Then you can submit your license application to the Central Bank of Guinea.

Traders are required to get the license application registered under the bank category. You should do it in five different copies, which are made up of: copies of Guinea’s bylaws as well as the minutes of the Constituent General Meeting and the list of the shareholders in the bank, which should be sealed with a notary public seal.

Also, the full name, address, and nationality of the people appointed as directed, and managers should be provided as well, as your certificate of incorporation into the register of economic activities, a short write-up talking about the economic and financial aim, and the technical and financial resources available to your bank regarding Article 12 of Act L/2005/010/AN of July 4, 2005.

The licensing committee reviews the license application, ensuring that the bank organization ticks all the requirements stated in the Banking Regulations.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Guinea – Good to know

Guinea is a country in West Africa. The official language is French, and the currency is the Guinean franc (GNF).

Forex trading online has now become very popular. The main reason this happened very fast was the need for people to get alternative sources of income because of the economic uncertainty in Guinea.

Technologies are now available that allow investors to with brokers online without taking a trip down to them to take the business.

As a trader in Guinea, make sure you know what your options are with Guinea trading platforms. The first thing is to make sure that the trading platform you intend to trade on is recognized internationally and reputable bodies regulate it. Once you notice a broker or trading platform does not have any form of recognition outside Guinea, it is best you don’t trade with such a broker, to avoid losing your money.

It is advisable to look at the historical spreads the broker offers to their clients. Spread refers to the amount you pay as a commission to the broker whenever you trade. Ensure you trade with the trading platform that has the lowest spreads.

Forex traders in Guinea need to take precautions to protect their money and their personal information.

Here are some security tips:

- Make sure your computer has up-to-date antivirus software and a firewall.

- Never open attachments or click links in emails from people you don’t know.

- Create strong passwords, and don’t use the same password for multiple accounts.

- Keep your financial information confidential, and don’t share it with anyone except

Always look out for Bucket retailers also. Bucket retailers are brokers that are not regulated by any repeatable body. They request to trade on your behalf and offer you a fixed price. But they wait for the price of the trade to increase to have more money to keep to themselves.

How to trade Forex in Guinea – Tutorial

Trading forex requires access to a great internet connection, one that doesn’t fluctuate, and a personal computer because you can not trade forex on a public computer.

Open an account for Forex traders

To be able to trade in Guinea, you have to open an account with a broker of your choice. To open an account, you are expected to provide the broker with your proof of residency (your bank statement or any utility bill) and your valid identity card (either your voter’s card or driver’s license)

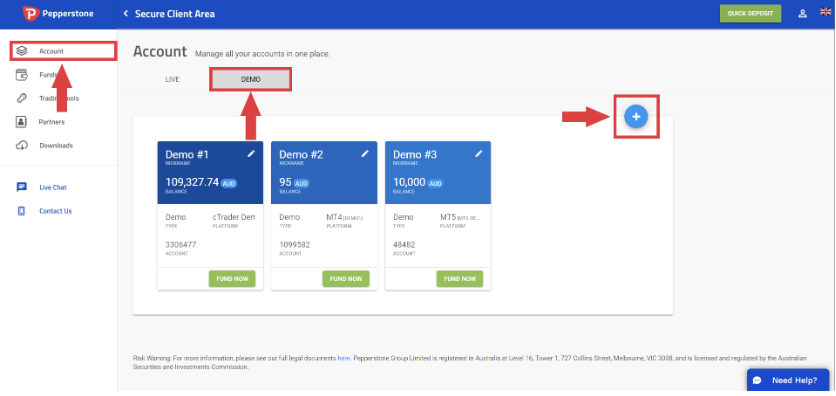

Start with a demo account or real account

As a new trader in the forex market, you should start trading with a demo account first before you trade with real money. A demo account is an account that looks just like a real account. You can use a demo account to trade forex without losing money.

Using a demo account to trade before trading with real money helps you get familiar with the trading platform. You can also use a demo account to practice the forex strategies and know which one you are most comfortable using to trade and make a profit.

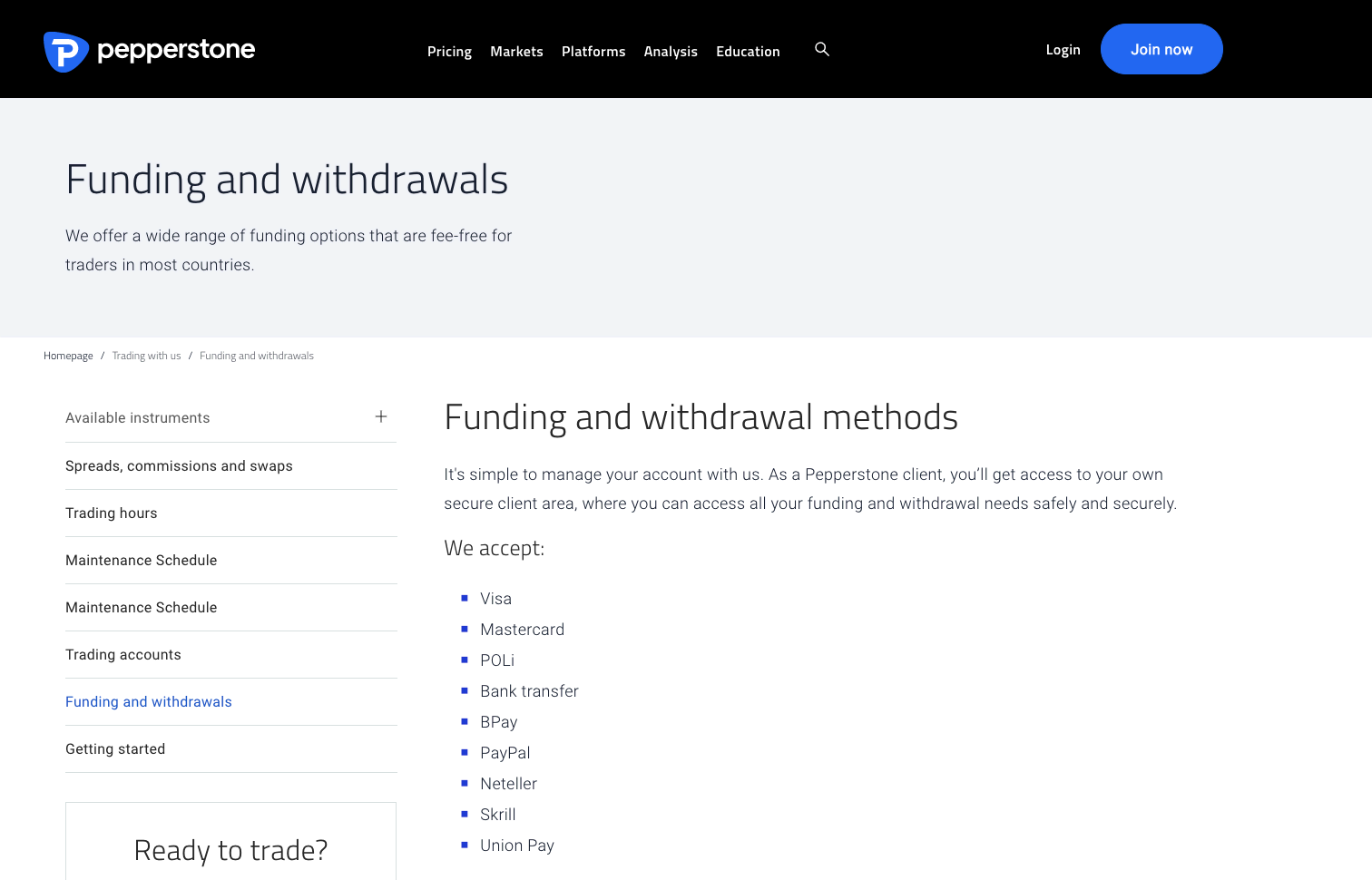

Deposit money

After you have opened an account, the next thing is to deposit money into the account. You can change it in the interbank market at real-time currency rates when you open an account.

You can deposit money into your account through bank transfers, debit cards, or payment platforms like PayPal or Skrill. The payment methods you use to fund your account will be determined by the trading platform you intend to trade on.

If you use the bank transfers method, transfer money from your bank account into your forex account. To use the debit card method, input your debit card number into the trading platform, and your account will be debited for the said amount. Using a bank transfer method to fund your account can take a bit of time. Usually, your fund will reflect in your forex account within one working day.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

Use analysis and strategies

Forex traders use Analysis and strategies to decide when to buy or sell the currency they are trading in. Analysis can be straightforward, showing why the chart software is essential.

Some forex strategies include:

Scalping

Forex traders use the scalping strategy very often. Traders that use the scaling technique have their focus on minor market changes. This strategy involves opening many trades with the sole objective of making small profits on all the trades.

Position trading

Forex position trading is a longer-term strategy designed to take advantage of market movements over days, weeks, or months. The goal is to hold onto winning trades for as long as possible and cut losses quickly to maximize profits. This approach can be used with any currency pair. This is because no trader can predict the future with 100% certainty; position trading involves much risk management to minimize losses.

Day trading

Day trading is buying and selling a financial instrument on the same day. It usually occurs in the equity markets but can also involve futures contracts, options, and currencies. The goal is to take advantage of changes in market prices and make a profit. There are a variety of day trading strategies that can be used, each with its risks and rewards.

Make profit

Making a profit through forex trading is not as difficult as one might think. To be successful, it is necessary first to understand how the forex market works and then apply a sound trading strategy. A small amount of capital can be used to trade currencies on margin, and proper risk management techniques can help protect profits during adverse market conditions. Finally, selecting the right broker is essential to obtain reasonable spreads and low commissions.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Guinea

As a trader in Guinea, trading forex is a simple process that requires you to study it diligently to make as much profit as you can on any trading platform you decide to trade on. The best forex trading platforms and brokers have been discussed extensively above, which will speed up your decision-making process.

All ensure that you follow the laydown rules and regulations in Guinea and their law concerning filing your taxes. If you follow these rules and steps judiciously, your forex trading experience in Guinea will be excellent, making lots of profits.

You need not lose hope when making losses on a forex trading platform. All you need to do is the study and practice the strategies with a demo account, apply the best one for you with a real account, and start making a profit again.

FAQ – The most asked questions about Forex Broker Guinea:

What would happen if a trader did not choose a regulated forex broker in Guinea?

A trader who does not choose a regulated forex broker would have to suffer the consequences of his actions. A regulated broker follows safe operating practices. Trading would be risky if a trader’s forex broker in Guinea is not regulated. Unregulated barkers might often indulge in scam practices that affect any trader’s investments.

How does a trader in Guinea know which forex broker to choose?

A trader should consider the factors that help him judge a forex broker. You can choose a broker that allows you to access many trading platforms according to your needs. The forex broker in Guinea should also offer many features to traders. Besides, the number of underlying assets these brokers offer should also be great.

What should a trader know about forex trading with a forex broker in Guinea?

A trader must remember to conduct a proper trading analysis when trading forex. A proper technical analysis can prevent undesirable losses to traders. Besides, traders might also make it a point to follow the news and check trends while trading forex. Remembering these things will allow a trader to trade forex with profits in Guinea.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)