The 5 best Forex Brokers & platforms in Haiti – Comparison & reviews

Table of Contents

There is a common misconception that trading forex is very sketchy. This is not true as long as you partner up with a reputable and regulated broker by well-known associations. This review will talk about five of the best forex broker in Haiti that you can fully trust.

See the list of the best Forex Brokers in Haiti:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

5 best Forex Brokers in Haiti:

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

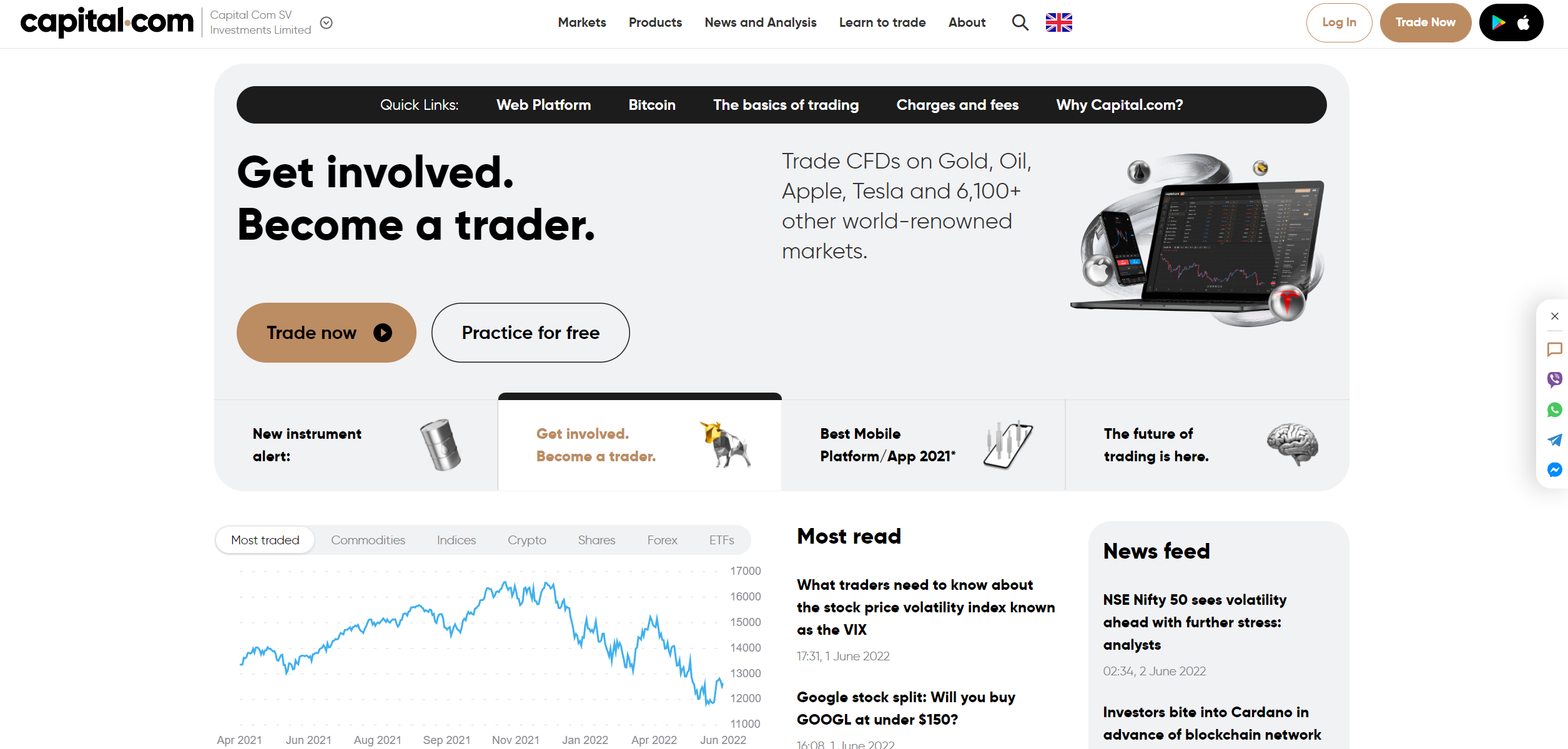

1. Capital.com

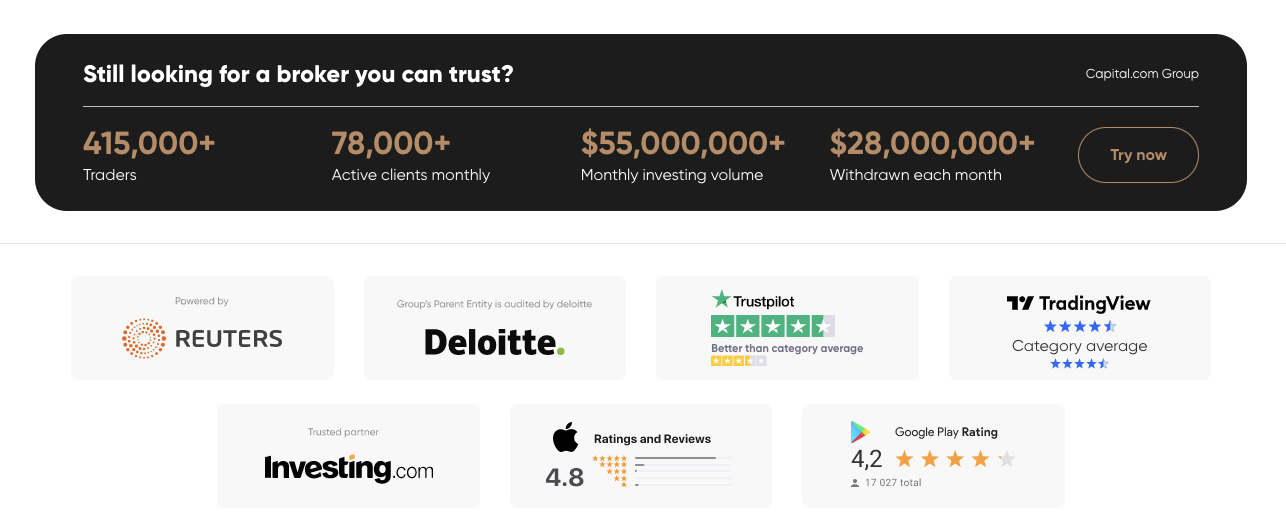

Capital.com was founded in 2016, with its headquarters in England. There are further offices in Gibraltar, Seychelles, Cyprus, and Australia. They are widely regarded for having very low fees and amazing service in the forex trading world.

This company is regulated by the Cyprus Securities and Exchange Commission, the National Bank of the Republic of Belarus, and the Australian Securities and Investments Commission,

Capital.com offers just one kind of account. This is referred to as the Standard Account. This broker’s account opening process takes less than five minutes. To verify your account, you only need to supply some basic details of yourself and produce a genuine ID.

To utilize Capital.com, you must first make a twenty-dollar deposit. Customers must deposit at least $250 when inserting funds by bank transfer. You may choose from any of the five basic base currencies: PLN, USD, USD, EUR, or GBP.

New Forex traders can discover a wealth of training programs and tutorials on the broker’s site. Furthermore, a demo version account is available to everyone. Thanks to this feature, customers may be exposed to the platform and become familiar with the market’s activity and various tools.

Capital.com’s trading platform is now available on smartphones or tablers for individuals who like to trade on the move. Clients may trade using their mobile phones or tablets. The trading site is available in over 20 languages, including Finnish, English, Chinese, Russian, Arabic, Thai, Polish, etc.

Customer service is provided 24 hours a day, seven days a week, and you can reach out to them through email, phone, or live chat on the trading platform.

Summary:

- The deposit required is $20.

- There are no fees that need to be paid.

- The brokerage is authorized by the FCA, CySEC, and NBRB.

- Spreads start at 0.6 pips.

- Payment methods accepted by the broker include bank transfer, WebMoney, iDeal, Qiwi, MasterCard, Visa, Skrill, and Neteller.

Disadvantages of trading with Capital.com

- Trading via Capital.com has a few drawbacks, one of which is that customers may only choose from five different account currencies. However, this issue may only affect some dealers.

- Another factor is that the verification procedure may not be difficult, but it must be completed within a period of fifteen days. Capital.com has the right to cancel your account if you are unable to provide a valid ID within the specified amount of time.

(Risk warning: 78.1% of retail CFD accounts lose money)

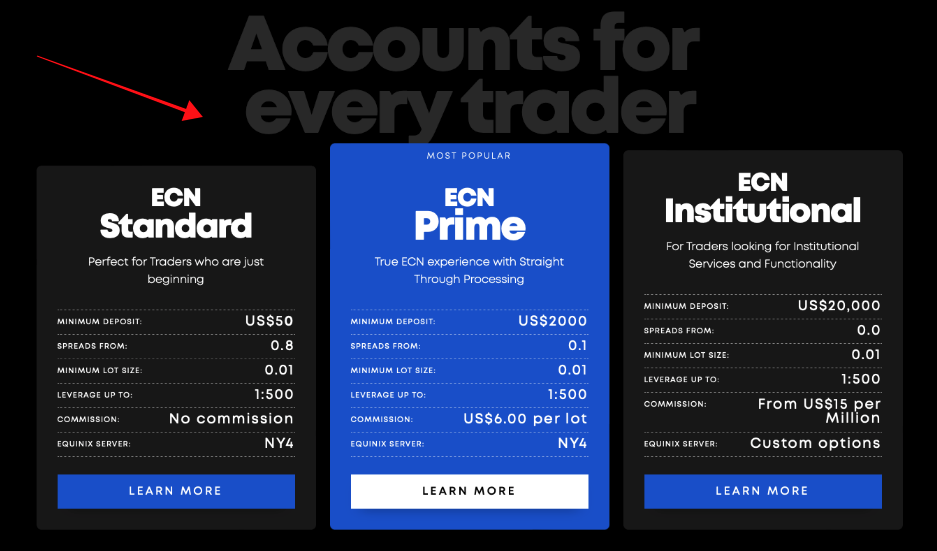

2. BlackBull Markets

The foreign exchange trading community is familiar with the name BlackBull Markets, which launched its business in 2014. Even though the company’s headquarters are situated in New Zealand, BlackBull Markets also has branches in New York City, Malaysia, the UK, and Indonesia.

The Financial Markets Authority of New Zealand and The Financial Services Authority of Seychelles are both in charge of regulating this broker. Many brokerage firms choose BlackBull because its prices are competitive, and its trading system is easy to use.

Customers of BlackBull Markets may choose between a Standard Account or a Prime Account, depending on their trading needs. There is a variation in the spreads, the minimum deposit required, and the commission rate between these two accounts.

For the Standard Account, you will need to deposit at least $200. On the other hand, to open a Prime Account, the amount required is $2,000. The spreads on the other account start at 0.01. On Standard Accounts, it is 0.8. Prime Accounts get priority when it comes to pricing and execution. Customers who have Standard Accounts are never charged any additional costs. Customers who create Prime Accounts are subject to a cost of $6 for each trade they make.

There are a total of nine different base currencies that you may pick from. The following currencies are included in this list: EUR, USD, AUD, GBP, NZD, SGD, CAD, ZAR, and JPY. A $5 will be charged by BlackBull Market whenever you withdraw your cash. On the other hand, if you make your withdrawal via a foreign financial institution, the cost is increased to $20.

The website offers a significant quantity of instructional programs in addition to a variety of books. You will also have access to a video tutorial for the platform. This will serve as your guide through the various pages of the website. Using a demo account does not incur any fees whatsoever. The firm will load your account with fictitious funds before making it available for use.

The mobile edition of the internet trading platform allows traders to open trades from anywhere using their mobile devices. The platform supports a wide range of languages, including Serbian, English, Chinese, Uzbek, and more languages.

You may contact the customer service professionals by emailing them or engaging in live chat. You may also call them using your phone. However, they are not available 24/7.

Summary:

- A deposit of $200 is needed.

- Standard Account customers do not have to pay a service charge.

- The FMA and FSA have granted the broker licenses.

- Spreads begin at 0.8 pips and go up from there.

- Payments may be made by debit card, credit card, China Union Pay, FasaPay, Neteller, Skrill, and bank transfer to the broker.

Disadvantages of trading with BlackBull Market:

$200 as an initial deposit is too high compared to other brokers.

(Risk Warning: Your capital can be at risk)

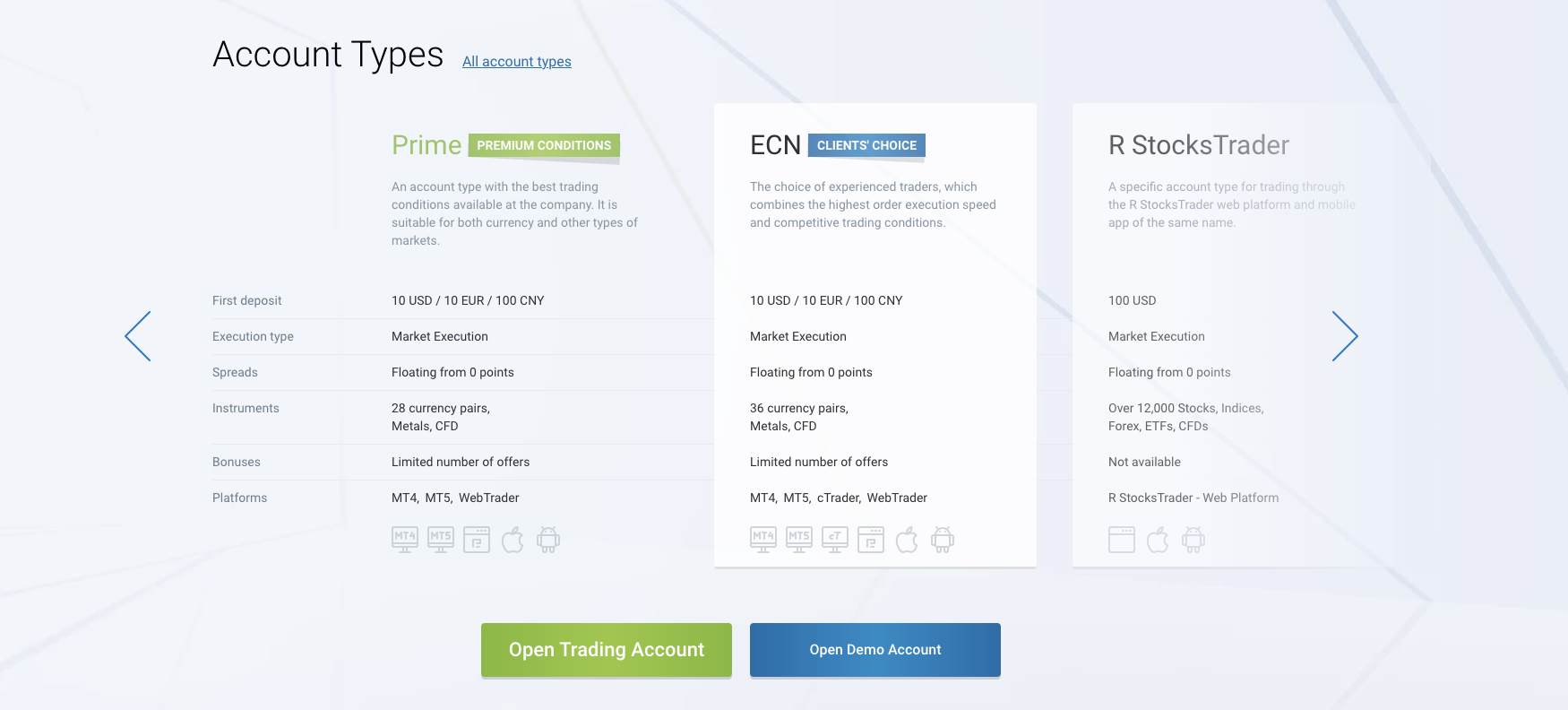

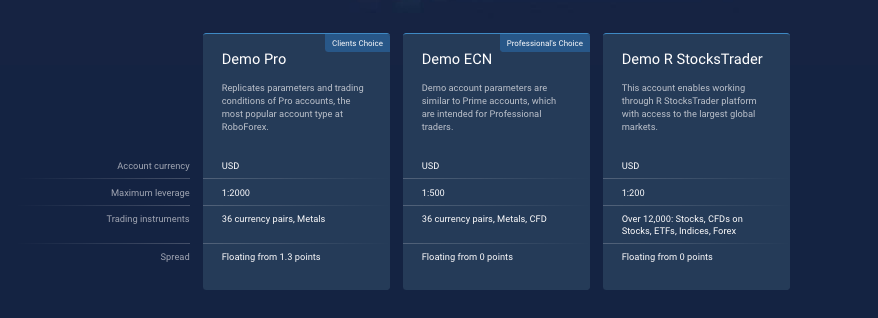

3. RoboForex

This firm is among the forex market’s most renowned firms. It began operations in 2009, and its main office is in Belize.

The International Financial Services Centers Authority regulates this broker’s activity.

Five different types of accounts are available: ECN-Pro, R Trader, Pro-Standard, Prime, and Pro-Cent. The broker does not charge a withdrawal and deposit fee. They do, however, impose an inactivity fee. There are six different base currencies to choose from. BTC, Gold, CNY, RUB, EUR, and USD are among them.

RoboForex’s website features a wealth of articles, videos, and instructional publications that provide all the necessary knowledge for novices. The broker also offers a demo account, and it hosts monthly and weekly competitions to encourage traders to practice this account type.

Both mobile and desktop devices may use the web-based trading platform. It also has copy trading. This feature allows you to see how other skilled traders execute their transactions.

More than ten languages are offered for customer service. They are available via phone, email, and chat support on the site or platform 24 hours a day, seven days every week.

Summary:

- The minimum investment required is $10.

- The brokerage received licenses from the IFSC.

- A $2 service fee is charged by the broker.

- 1.3 pips spread.

- Neteller, Skrill, Advcash, Perfect Money, credit card, bank transfer, and debit card are supported.

Disadvantages of trading with RoboForex

- Currently, this broker only has 36 tradeable forex pairs.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Pepperstone is an Australian-based company that was established in 2010. In 2015, they extended their business to include a location throughout London to better serve traders in Europe.

Both the Financial Conduct Authority and the Australian Securities and Investments Commission will be keeping an eye on Pepperstone to ensure that it complies with its rules and regulations.

Pepperstone only offers one account type for its customers who want to trade live. There is not, however, a mandatory minimum amount of investment. Additionally, you don’t have to pay a withdrawal fee. There is also no inactivity fee. If you do not believe that you are prepared to trade with real money just yet, you are more than welcome to use the demo account that is available to anyone.

The platform may be accessed from desktop computers as well as mobile devices. Access to it is also made possible in a range of different languages for the convenience of the company’s clients.

Only via the use of the telephone and real-time chat can consumers get in touch with the company’s customer service department 24 hours a day for each day of the week. The broker also guarantees that their customer service department will provide prompt and efficient responses to all questions in a matter of minutes.

Summary:

- The necessary minimum payment is $0.

- The ASIC and the FCA license the broker.

- The broker charges a commission fee of $3.

- Spreads begin at 0.0 pip.

- Union Pay, Neteller, Skrill, Bpay, Poli, PayPal, debit card, bank transfer, and a credit card are all accepted.

Disadvantages of Trading with Pepperstone

- Pepperstone’s customer support service is available 24/5 only.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

The brokerage firm is headquartered in Cyprus and began operating in 2013 and today serves customers in over 150 countries across the globe. The Cyprus Securities and Exchange Commission oversees the company’s activities.

When dealing with this brokerage, you may pick either a standard or VIP account. You only need to deposit $10 to establish a Standard account, and you can start trading once your account has been verified. Before you may apply for a VIP account, you must first deposit a certain amount of money. The minimum funds required vary greatly among brokers.

The three basic currencies are EUR, GBP, and USD. Withdrawals are not subject to any fees from the broker. Let’s say you want to withdraw money from the account through a bank transfer. You will be expected to settle the bank’s modest processing charge in such an event.

You may try out the platform’s capabilities before you sign up for a real account by utilizing the free demo account, which comes with a starting balance of $10,000 in virtual money. The trading platform is available in more than ten languages and can be used on both desktop computers and mobile devices.

Customers who have questions about their purchases may get in touch with the firm by sending an email, using the live chat feature on the website or platform, or calling the business. Because there are presently more than 80 individuals present, any problem or query will be resolved in a couple of minutes.

Summary:

- This brokerage requires a minimum investment of $10.

- CySEC regulates this brokerage.

- The customer is required to pay $3 for each transaction.

- The spread starts at 0.6 pip.

- Payment methods accepted by the broker include wire transfer, Cash U, debit card, Skrill, credit card, Neteller, Web Money, Maestro, and Moneybookers.

Disadvantages of trading with IQ Option

- Instead of the standard MT4 platform, clients can only trade using IQ Option’s proprietary platform.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Haiti?

When it comes to matters with foreign currency, the Haitian government is responsible for enforcing various laws and regulations. Because the majority of the country’s income comes from remittances, there are no regulations in place that prohibit forex trading.

Additionally, no law states that transferring or acquiring foreign funds is not allowed. This means the citizens of Haiti are allowed to have foreign currency in their bank accounts, and there is no limit to how much they can keep. However, there is a limit as to how much can be withdrawn from the bank account.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for traders from Haiti – Good to know

If you are in the market for a forex broker, you must be very cautious regarding the security of your funds and private details. There are many bogus websites that aim to dupe you into sending them a large sum of cash.

The broker you choose should be regulated and monitored by a reputable organization. Make sure your account is segregated as well. This is to ensure that you’re the only one who can access your funds and gains.

Is it legal to trade Forex in Haiti?

Trading forex in Haiti is 100% legal.

How to trade Forex in Haiti – Tutorial

1. Open account for Haiti traders

To open an account, all you have to do is fill out the signup form and give your broker the information they need. The form will often ask for your full name, where you live, your mobile number, and several other information.

There are a handful of brokers who simply send an email with a link that you need to click to verify your account. Others call you on your mobile phone to verify your identity and finish setting up your live account.

2. Start with a demo account or real account

Before you put your own money into forex, it’s good to try out the platform with a trial or demo account before you put your own money into forex. All of the above brokers give their clients a free demo account.

Take full advantage of this risk-free feature. Demo accounts are equipped with fictitious funds that may be used to practice trading or evaluate the functionality of the trading platform provided by the broker.

3. Deposit money

After making use of the demo account for free, you will be required to make a cash deposit to convert the demo account into a real one.

The majority of brokers accept bank transfers, and debit and credit card payments. They also offer e-wallets such as Neteller, Skrill, and PayPal, among other options.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

When trading foreign exchange, you can’t simply go in headfirst without first getting acquainted with the various tactics used by expert forex traders.

Trading with the direction of the trend is one of the most effective trading tactics. This type of trading is designed for the long run and involves watching the movement of the market or the trend that is currently occurring for a particular pair. This tells you to sell when there is a downward trend and buy when there is an upward trend.

Analyzing the market is also a critical part of the process of risk management. Suppose you are new to the world of forex trading. In that case, your broker will often provide you with the assistance of a staff person who is solely devoted to assisting customers like you. However, doing your own research and analysis of the industry may go a long way.

5. Make profit

Earning from forex trading can take some time. Just be patient and apply all the strategies and rules that you have set to lessen your risk.

(Risk warning: 78.1% of retail CFD accounts lose money)

Conclusion: The best Forex Brokers are available in Haiti

When it comes to foreign exchange trading, you need to exercise self-discipline, no matter how tempting it is to dive headfirst into the market. Before you go ahead and make a transaction, make sure you get as much information as possible. This helps reduce the risk that you take, which increases the likelihood that you will come out ahead.

It’s also essential for you to partner up with a broker that can be trusted. Ensure that the broker you choose is regulated by the Cyprus Securities and Exchange Commission, the Australian Securities and Investments Commission, or any other well-known regulatory bodies.

FAQ – The most asked questions about Forex Broker Haiti:

What costs does a forex broker in Haiti charge?

A forex broker in Haiti charges fees through commissions, spreads, or interest rate swaps. Additionally, they may put overnight financing, maintenance of accounts, and deposit and withdrawal fees as expenses. Overnight finance charges can be refunded (net credit) or considered a loss (net debit). The commission fees usually remain fixed based on the trading volume. In such cases, additional spreads aren’t applicable. A trading plan and an ideal trading forex account ensure you keep up a manageable amount as fees and spreads.

What policies does a regulated forex broker in Haiti follow?

A licensed and registered forex broker in Haiti has stringent rules and regulations per the directions laid by the regulatory agencies. The more strict the broker, the better discipline, safety, and enjoyable experience for the customer. Brokers must clearly state the initial funding requirements, security processes of the account, etc.

What are the prominent features of a forex broker in Haiti?

A reputed forex broker in Haiti may offer you free resources. Since the authorities have prohibited deposit bonuses, emulating more experienced traders or using free forex signals can save beginners’ research time. Limitless options are available to witness in a Haiti forex broker.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)