The 5 best Forex Brokers in Hong Kong – Comparisons and reviews

Table of Contents

Hong Kong is among the world’s leading Capitalist economies despite its ties to China. It is also an active financial markets trading and investment hub.

See the list of the best Forex Brokers in Hong Kong:

Forex Broker: | Review: | REgulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. Capital.com  | CySEC, FCA, ASIC | Starting 0.0 pips variable & no commissions | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. RoboForex  | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) | |

5. IQ Option  | CySEC | Starting 0.1 pips variable & no commission | 500+ (25+ currency pairs) | + Easy to use + Binary Trading + Support 24/7 + Min. Deposit 10$ + Lowest spreads on main trading hours | Live-account from $ 10(Risk warning: Your capital might be at risk.) |

If you are in Hong Kong and looking to change your forex broker or start trading anew, our recommendations are for you.

5 best forex brokers in Hong Kong

- Capital.com

- BlackBull Markets

- RoboForex

- Pepperstone

- IQ Option

Here’s an introduction to each of the brokers:

1. Capital.com

Summary:

- Minimum deposit – $20

- Regulated by – CySEC, ASIC, FCA.

- Platforms – MT4, Capital.com app.

- Support – 24 hours, available on weekdays.

- Free demo – Yes.

- Payment methods – Credit card, debit card, PayPal, and bank transfers.

Capital.com is a reputable online forex broker offering AI-powered trading platforms. The company was established in the United Kingdom in 2016 and is licensed by the UK’s Financial Conduct Authority FCA.

Capital.com has operating centers in Cyprus, Belarus, and Gibraltar. The company also holds licenses from these regions, including CySEC and Australia’s ASIC license. The broker provides easy-to-use trading platforms with plenty of valuable tools suitable for novice and skilled traders.

Hong Kongers can access more than 3000 markets, which include 130+ forex pairs, hundreds of CFDs, stocks, and equities. The trading costs are low, with spreads from 0.8 pips and zero commission fees. A free demo is available, and mobile trading is fully supported.

Capital.com drawback

The broker does not offer the MetaTrader 5.

(Risk warning: 78.1% of retail CFD accounts lose money)

2. BlackBull Markets

Summary:

- Minimum deposit – $200

- Regulated by – FMA, FSA.

- Platforms – MT4, MT5, Mobile app.

- Support – 24 hours support from Mondays to Saturdays.

- Free demo – Yes.

- Payment methods – Bank wire, Unionpay, Skrill, MasterCard, Neteller, and Visa.

BlackBull Markets is an online ECN broker based in New Zealand and regulated by the Financial Markets Authority FMA. The company also operates within Africa with Seychelles’ Financial Service Authority FSA license.

BlackBull Markets offers superfast ECN order executions on all account types, and trading costs on its raw ECN accounts are comparably low. The broker offers quality support services through third-party social trading platforms and helpful educational content.

Blackbull Markets disadvantage:

The broker’s minimum deposit is relatively high, and traders seeking to test its platform with a micro account might get discouraged.

(Risk Warning: Your capital can be at risk)

3. RoboForex

Summary:

- Minimum deposit – $10

- Regulated by – IFSC.

- Platforms – MT4, MT5, cTrader, RTrader

- Support – 24 hours support from Mondays to Fridays.

- Free demo – Yes.

- Payment methods – Bank wire, Perfect Money, Visa, MasterCard, AstroPay, AdvCash.

RoboForex is great for traders who look for a wide range of choices and low trading fees. The broker is based in Belize and regulated by Belize’s IFSC (International Financial Service Commission).

Traders can access more than 12000 instruments, including stocks, thousands of ETFs, 100+ commodities, 25+ cryptocurrencies, 40 forex pairs, and a few indices. Its several account types, platforms, and bonus offers make it a top choice for traders of any level.

RoboForex drawback:

The broker charges withdrawal fees, unlike its competitors.

(Risk Warning: Your capital can be at risk)

4. Pepperstone

Overview:

- Minimum deposit – $0 ($200 recommended)

- Regulated by – CySEC, ASIC, FCA, DFSA, BaFIN.

- Platforms – MT4, MT5, cTrader.

- Support – 24 hours support, Mondays to Fridays.

- Free demo – Yes.

- Payment methods – Skrill, BPay, PayPal, Neteller, bank transfer, MasterCard, and Visa.

Pepperstone is an internationally renowned ECN broker founded in 2010 and based in Australia. The company is considered the safest broker and offers the fastest trade execution on its world-class trading platforms.

Global traders choose Pepperstone for its top-quality service at competitive trading costs. Its platforms provide traders with full support for profitable trading. Automated trading is available, and social and copy trading are provided through several third-party platforms like Zulutrade, Duplitrade, MyFxbook, and Tradingview.

Pepperstone drawback

The broker’s demo is only accessible for 30 days. The access is retrieved after this period.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

5. IQ Option

Summary:

- Minimum deposit – $10

- Regulated by – CySEC

- Platforms – IQ Option app

- Support – 24 hours support, Mondays to Fridays.

- Free demo – Yes.

- Payment methods – Neteller, bank wire, credit and debit card, Skrill, Bitcoins, Perfect Money.

IQ Option is considered a leading online broker for binary options (only for professional traders and outside EAA countries). Its great trading conditions, unique platform, and low minimum deposit make the broker an attractive choice for beginners and experienced traders.

IQ Option has its roots in Cyprus and operates with a license from the country’s regulatory body, CySEC. The broker was created as a binary options broker but metamorphosed to include other market assets in its offerings. Traders can access forex pairs, indices, ETFs, and commodities, apart from binary and digital options.

The broker provides unique social trading services through its social platform called the Community Live Deal. Full support is available to traders, and video tutorials are provided to help beginners learn fast.

IQ Option disadvantage

The broker does not provide the MetaTrader 4 and 4 for trading. The MetaTrader suites are considered the best trading platforms with valuable tools for the traders’ profitability.

(Risk warning: Your capital might be at risk.)

What are the financial regulations in Hong Kong?

Hong Kong is a notable finance hub in Asia. The country’s economy competes with top Asian economic powerhouses, such as Shanghai, Singapore, and Tokyo.

Many local forex brokers can be found in the city, but these tend to be overpriced and require high amounts to trade with them.

The country’s wealth and free economic system have attracted several international brokers who have now set up shop within its borders.

Hong Kong has two regulatory bodies overseeing its finance industry. The Hong Kong Securities and Futures Commission HKSFC and the Hong Kong Monetary Authority.

The HK Monetary Authority serves as the Central Bank and is responsible for its currency stability and the banking sector.

The HKSFC is in charge of its financial market operations, including online forex and CFD trading. The body issues licenses to investment companies operating within the country. They are also responsible for providing investment education to citizens. The education services are provided through its Investor education center.

Forex brokers willing to operate within Hong Kong must obtain their approval and license. They must meet the body’s requirements, including customer protection, quality service, and top-class trading platforms.

(Risk warning: 78.1% of retail CFD accounts lose money)

Security for Hong Kong traders – Good to know

Hong Kong is a free and thriving economy that encourages its people to invest and grow their wealth. There are no laws restricting trades or investments.

Hong Kongers can trade the forex market with whomever they choose. But within the country, they must use ONLY HKSFC- regulated brokers.

They can trade with offshore companies if they wish. However, they must be safety-conscious and deal with ONLY well-regulated brokerages.

Before signing up with them, traders should confirm their chosen broker’s license and find out what others say about the company.

Is it legal to trade Forex in Hong Kong?

Yes, forex trading is a legal venture in Hong Kong. The trader should take precautions and choose only reputable and licensed brokers within or outside the country’s borders.

How to trade Forex in Hong Kong – Tutorial

Online forex and CFD trading are popular activities in Hong Kong. Many can access stable internet connections and a smart device, making it easy to get into the market. There are a lot of brokers, local and international, that welcome Hong Kong traders of all levels. The tough part is choosing the right one.

The market’s competitive nature makes it possible to find a good brokerage company without looking too hard. But still, we advise caution. The broker is a crucial determiner of your success in this venture.

The brokers must meet the requirements below before considering them:

- Regulation

The HKSFC is the country’s forex regulator. Therefore, your choice of local broker should hold its license. If you choose an international broker, it should be a well-established broker with a top-tier license. Investigating the particular regulator and the broker’s license number would help.

- Competitive spreads and commission

The broker’s fees should not be above the market average. Trading costs are a vital consideration, so you should compare fees before choosing.

- Free demo account

The broker must provide a free demo account for at least 30 days. So that potential clients can test its platforms and trading environment.

- Round-the-clock customer service

The broker must provide 24 hours support from Monday to Friday, at least. Customer service should be reachable ANYTIME you choose to trade, except on non-market days. Multiple language support is even better, especially if it includes Cantonese and Mandarin.

- Easy payment options

The payment methods that the broker provides must be functional in your location. Deposits and withdrawals must be easy to do on the broker’s platform.

If the broker possesses all these points, they might be right for you.

Follow the steps below to start trading:

1. Open account for Hong Kong traders

Visit the broker’s internet site to begin. The create account tab will be among the boldest ones. Click on that and fill out the form.

At this stage, only your email and perhaps your name and phone number will be required. Click on signup or create an account once you enter the details.

The system automatically sends a verification link to the email you provided. Click on the link in your mailbox to verify the registration and complete the form.

You might be required to upload a government-issued ID and proof of address to complete the signup.

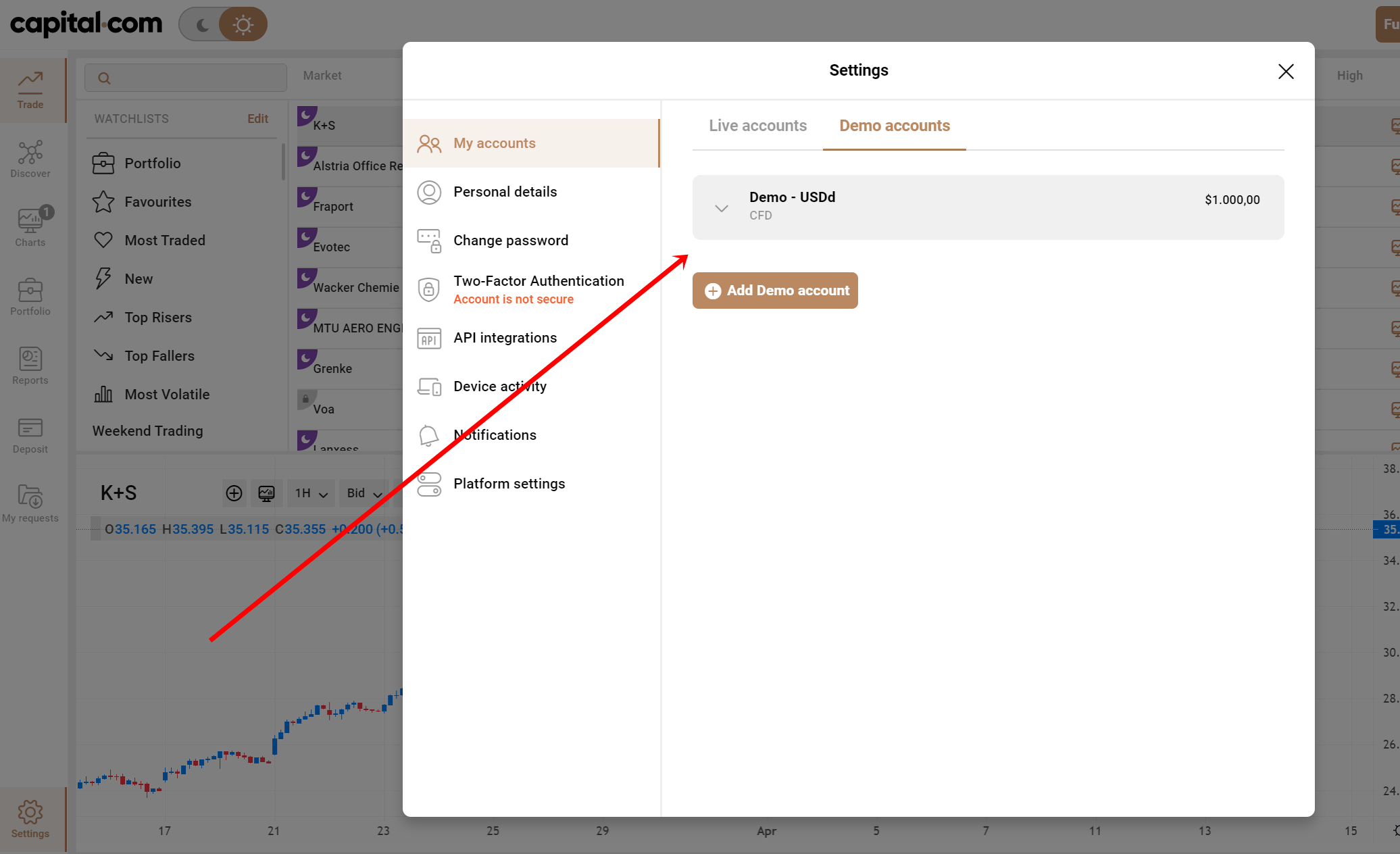

2. Start with a demo or real account

The next step is testing or practicing the free demo that the broker provides. This demo account comes with virtual money to conduct several test transactions.

New traders should take advantage of the demo to see what the forex market is like before entering the real environment.

The demo is also an opportunity for the traders to get to know a broker better before fully joining their platform. Some traders use it to check that a broker accepts their trading style.

3. Deposit money

Once you’re satisfied with the demo tests, the next is to deposit money in the live account for trading.

Brokers often assign a support rep to newly signed up customers. Part of the assistance rendered will be funding the account and perhaps placing the first trade.

However, this stage is straightforward if the broker provides easy payment options, as we mentioned. Popular payment methods in Hong Kong include MasterCard, Unionpay, Visa, bank wire, Neteller, and Skrill.

The FUNDS tab on the platform will include the deposit option. Clicking on this option brings up the available payment method. Select your choice and follow the payment instructions.

Notice:

The payment methods are depending on your country of residence. Forex Brokers are offering all kinds of methods separately for each country.

4. Use analysis and strategies

Market analysis and a functional trading strategy are equally essential to forex trading. Successful traders combine both to trade the market every time.

The market analysis tells you a lot about the currency pair you’re interested in. It gives you valuable knowledge about the past and current price movements. This helps you make great predictions about the asset’s price. Online forex trading is about speculating, and great predictions mean profitable trades.

Forex’s important market analyses include:

- Fundamental analysis

- Technical analysis

- Market sentiments

Fundamental analysis in forex trading involves looking into the economic factors that directly affect the currency pair’s price. These economic elements are the country’s interest rate, inflation rate, gross domestic product (GDP), surplus or deficit, etc.

These factors make you understand the currency pair’s price movement and help you make the right trading decision.

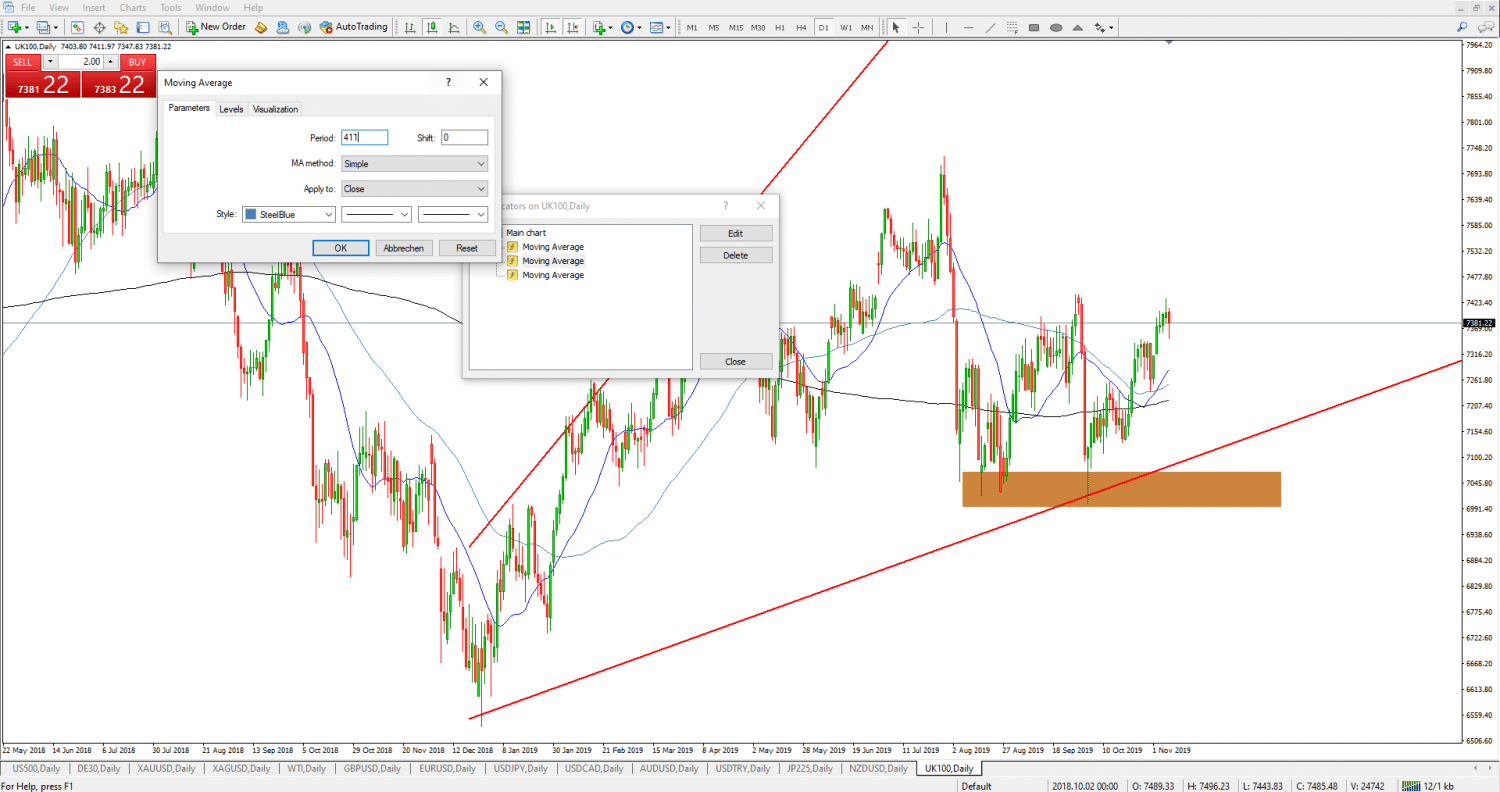

Technical analysis in forex means examining the price chart to find patterns that contain trading opportunities. These patterns emerge from price movements and can indicate the price’s next direction. Trading platforms have AI indicators and other tools that interpret these patterns and provide trade signals. The trader should learn to use these indicators for a successful technical analysis.

Market sentiment analysis examines the forex market participants’ expectations about the currency pair. Several indicators are available that help with this. The RSI (Relative Strength Index) is a popular tool that helps the trader determine market sentiment.

These analyses are important for successful forex trading. With them, you can choose the right trading strategy for your chosen asset and make a profit.

Popular forex trading strategies:

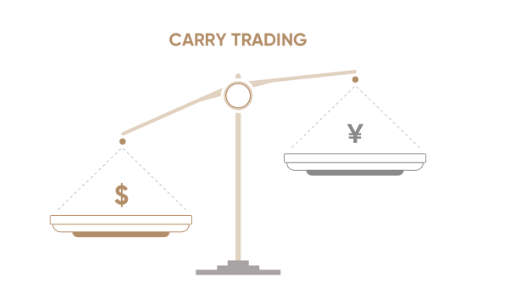

- Carry trading

Many Hong Kongers like to speculate on their national currency (HKD). Paired with a major currency like the EUR, USD, GBP, or JPY, there’s an opportunity to profit from the carry trading strategy here.

Carry trade involves buying a currency of a higher interest rate while borrowing its pair so that you earn on the interest rate difference. The approach can be positive carry or negative carry trade. The traders believe the higher interest rate will not drop in the positive carry. So they enter a buy trade to make a profit. In the negative carry strategy, the trader expects the lower interest rate to rise, so they enter a SELL trade.

This strategy requires proper analysis and should only be used with currency pairs with noticeably different interest rates.

- Scalping

The scalping strategy is very popular among people who trade forex for a living. The trader opens and closes trades within a few minutes, usually between one minute to 15 minutes. Traders use this technique to make gains from small price movements. The profits from each trade are insignificant, but the trader carries out several trades daily. The gains would accumulate to a reasonable size if the trades were successful at the end of the day.

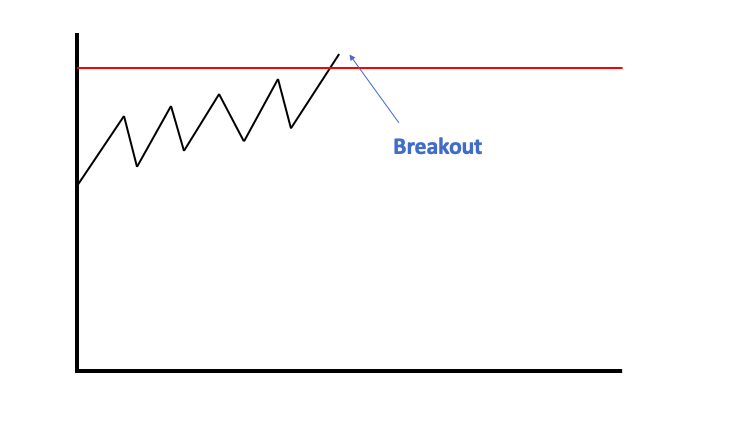

- Breakout trading strategy

Breakout trading is a famous strategy. Breakouts or break down occur in price movements when the asset’s price changes direction. It can be a change or a temporary pause in the current trend. The trader also needs to properly analyze the patterns to know how long the break would hold. They can then identify the best entry points to capitalize on this market move.

- Price action trading

The price action strategy is among the simplest because it does not involve complex technical analysis. The trader looks at the naked price chart and examines the asset’s movement to determine the best trading opportunities. The trader should understand candlesticks movement before using price action strategies.

5. Make profit

After the market analyses and choosing the best strategy, you can place trades and make a profit. Proper analyses and an effective strategy always result in gains.

You can raise your investment with the profit or move it out of the account for use. The FUNDS tab should have the appropriate option for filling out the withdrawal form. The deposit methods should also be applicable for withdrawals.

However, withdrawals tend to take longer to process. Once you fill out the request form, the broker starts to work on it, and your receiving account gets the money as soon as possible, usually within 48 hours.

(Risk warning: 78.1% of retail CFD accounts lose money)

Final remark: The best Forex Brokers are available in Hong Kong

Hong Kongers can choose the best forex brokers because there are many options for them. This article has provided the best recommendations and explained how to go about trading. Forex trading should be a piece of cake once you follow this guide. Good luck and happy trading!

FAQ – The most asked questions about Forex Broker Hong Kong :

Which forex brokers in Hong Kong offer maximum underlying assets for forex trading?

The following five forex brokers in Hong Kong offer the greatest underlying assets to traders for forex trading.

BlackBulls Markets

IQ Option

Pepperstone

Capital.com

RoboForex

Traders in Hong Kong can access as many as 50 underlying assets for trading. Besides, they also offer great trading services for other kinds of assets. These forex brokers also offer leading trading platforms such as MT4, MT5, and TradingView to traders. So, any trader who chooses these forex brokers to trade in Hong Kong gets the best.

How can a trader in Hong Kong withdraw funds from this trading account with the forex broker?

Once you choose a suitable forex broker in Hong Kong, you can sign up for a trading account and choose your underlying assets to trade. Finally, when you earn profits, you can submit the withdrawal request with your broker by clicking on the ‘withdraw funds’ option. Then, your forex broker will process your withdrawal, and you will receive your funds.

Do forex brokers in Hong Kong offer safe trading platforms?

If a trader chooses a regulated forex broker, he can trade forex safely. While choosing a forex broker in Hong Kong, remember to pick only the regulated ones.

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.8 / 5)

(4.8 / 5)