The 3 best Forex Brokers in Israel – Comparisons and reviews

Table of Contents

Israel is one of the middle eastern countries where forex trading is well accepted and popular among citizens. Some forex brokers are based in this region, and its authorities properly manage the sector.

See the list of the best Forex Brokers in Israel:

Forex Broker: | Review: | Regulation: | Spreads: | Assets: | Advantages: | Open account: |

|---|---|---|---|---|---|---|

1. RoboForex | IFSC | Starting 0.0 pips & $ 4.0 commission per 1 lot traded | 9,000+ (50+ currency pairs) | + Huge variety + Micro accounts + Free bonus program + Leverage up to 1:2000 + ECN accounts + MT4/MT5/cTrader | Live-account from $ 10(Risk warning: 78.1% of retail CFD accounts lose money) | |

2. BlackBull Markets  | FSPR, FSCL | Starting 0.0 pips & negotiable commission per 1 lot | 500+ (64+ currency pairs) | + ECN Broker + Deep pool execution + High liquidity + Best execution + Leverage 1:500 + MT4/MT5 | Live-account from $ 200(Risk warning: 78.1% of retail CFD accounts lose money) | |

3. Pepperstone  | FCA, ASIC, DSFA, SCB | Starting 0.0 pips & $ 3.5 commission per 1 lot | 1,000+ (40+ currency pairs) | + Fast execution + Large FX Broker + Good service + MT4/MT5/cTrader + TradingView Charts | Live-account from $ 200(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs) |

Israelis and Israeli-based investors looking to start forex trading can choose from any of these global brokers:

- RoboForex

- BlackBull Markets

- Pepperstone

An overview of the brokers’ services:

1. RoboForex

RoboForex is an online broker established in 2009 with a head office in Belize. RoboForex provides trading services in various markets, including CFDs, commodities, forex, stocks, and indices. Traders enjoy several choices of account types, platforms, and assets with this broker. The trading costs are competitive, and customers receive quality support to trade profitably.

RoboForex’s service summary:

- Regulator: IFSC

- Minimum deposit: $20

- Trading platforms: cTrader, MT4, MT5, RTrader, CopyFx.

- Spreads and fees: Standard account – 0.6pip minimum, with $0 commission. ECN – 0.1 pip minimum plus a $2 commission charge.

- Free demo: Available

- Support: Available 24 hours, Monday to Friday.

(Risk Warning: Your capital can be at risk)

2. BlackBull Markets

BlackBull Markets is based in New Zealand and was established in 2013. BlackBull Markets offer direct market access trading services to several markets, including CFDs, forex, energies, metals, and commodities. Traders enjoy fast execution, competitive costs, and outstanding support services.

Below is the broker’s summary:

- Regulator: FMA, FSA

- Minimum deposit: $200

- Trading platform: MT4, MT5, mobile app, Zulutrade, MyFxbook.

- Spreads and fees: STP account – 0.6 pips minimum, with $0 commission. ECN – 0.1 pip minimum plus a $3 commission charge.

- Free demo: Available

- Support: 24-hour support, Monday to Saturday.

(Risk Warning: Your capital can be at risk)

3. Pepperstone

Pepperstone is an international online broker headquartered in Australia and founded in 2010. Pepperstone offers ECN access to a range of market assets, such as CFDs, indices, forex, commodities, and metals. Israelis can expect top-quality trading services, superfast order executions, and excellent traders’ support through educational resources and award-winning customer service. Pepperstone’s service summary:

- Regulator: ASIC, CySEC, DFSA, FCA, CMA, BaFIN, SCB.

- Minimum deposit: $200 (recommended).

- Trading platform: cTrader, MT4, MT5, Duplitrade, Zulutrade, MyFxbook.

- Spreads and fees: Standard account – 0.6 pips minimum, with $0 commission. ECN – 0.1 pip minimum plus a $3 commission charge.

- Free demo: Available

- Support: 24-hour customer service, Mon to Fri.

(Risk warning: 74-89 % of retail investor accounts lose money when trading CFDs)

Security for traders in Israel – Good to know

The ISA website is accessible to all citizens. Before proceeding, traders seeking to use local brokers should check this website to confirm their chosen broker’s license.

ISA-licensed brokers within and outside Israel are the safest choices for an Israeli-based trader. International brokers are equally safe if they hold a license from a well-known entity, especially one with similar regulations to the ISA’s.

ISA’s framework is similar to FCA’s regulations. The latter also offers a high level of consumer protection in its regulations. Therefore, an FCA-licensed broker is safe for the Israeli trader.

Other reputable financial entities with similar regulations are:

Is Forex trading legal in Israel?

Absolutely! Forex trading is legal, safe, and widespread in Israel. Regulations exist that keep traders safe from fraud. Many regulated home-based and international brokers are available to choose from.

How to trade Forex in Israel – Quick tutorial

There are a few basic requirements for trading forex anywhere.

They are:

- Smart device connected to a solid internet service.

- A qualified and trusted broker.

Fortunately, internet service in Israel is stable and fast enough. The internet is your gateway to the international online market. It is essential to stay connected when trading to monitor and manage positions properly. An unstable service makes this difficult and causes you to lose money.

The broker is your intermediary to the various liquidity providers, as traders can not deal directly with these market players. The broker connects you to these market participants, paying them for the service. Trading services and conditions vary. Traders seek a good trading environment with a qualified and trusted broker.

Here’s how to choose a qualified broker:

- Confirm the broker’s license

A local broker must be approved by ISA and have the license proving this. A qualified foreign broker should hold a license from the bodies listed above. Brokers’ regulatory information is normally displayed below their webpage. The trader can confirm the license by visiting the regulator’s website or contacting them.

- Check the trading costs

Compare fees among brokers to determine the average market rate for the service. The spread is the difference between the BUY and SELL price and represents a standard fee for each transaction. Some brokers take higher spreads than others. Many brokers lower the spreads and charge a commission for each trade, depending on the account type. Consider these costs and compare them among several brokers to avoid choosing an overpriced platform.

- A free demo

A qualified and trustworthy broker provides a demo account to allow site visitors and potential customers to test their service beforehand. The demo account access should last at least 30 days, and there should be enough credits to test the platform’s features.

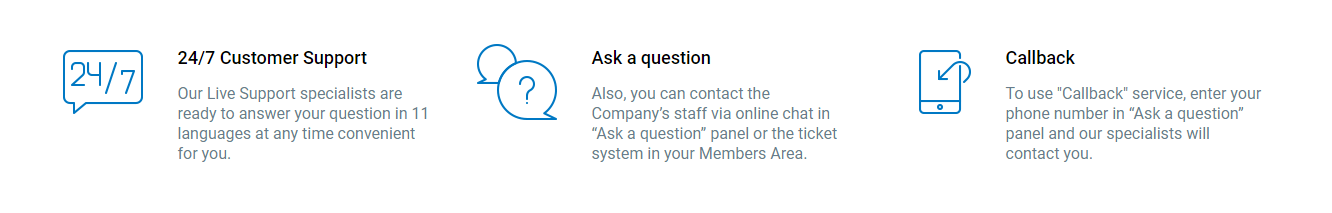

- Round-the-clock Support service

Reputable brokers provide 24-hour customer service to resolve any problems that may arise during trading. Many brokers offer multiple-language support, which usually includes Hebrew.

- Straightforward deposit and withdrawal process

Good brokers ensure that moving funds in and out of the brokerage is straightforward and fast. They provide famous payment methods in the region to make sure of this. The trader should confirm the available payment methods before signing up. Complications with deposits, especially withdrawals, can be frustrating and hinder smooth trading.

These are basic requirements that the broker must meet before they are considered trustworthy and worth trading with.

Follow these steps to trade forex:

1. Open an account for traders in Israel

Checking the requirements above will help you choose the right broker. Brokers accepting traders from different parts of the world often design websites to show the services specific to each country. So when you visit the broker’s website, you get redirected to the site containing the services for your region. Many brokers support multiple languages on their sites, so the page should load in Hebrew.

The create account tab will be displayed at the top and most visible part of the page. Click on that tab to begin the signup process. Type in the requested details, which is an email address and, likely, your full name. Once you click on submit or ok, the broker sends a confirmation message to the email address you gave.

Open the message in your mailbox and click on the link in the message body. This verifies the email and loads the full signup page to continue the registration. The broker may request a scanned copy of your ID and utility bill carrying your house address. In some cases, you only need to offer your ID number and answer a few questions to confirm the number belongs to you.

2. Start with a demo or real account

After completing the signup, we recommend using a demo account first before the real one. The demo lets you see the trading environment and test the broker’s platform.

If you are a novice trader, the demo allows you to get fully familiar with the forex environment. You can test the different features and conduct several trades using the virtual funds in the account. Many brokers allow users to request more virtual cash on the demo once they exhaust the balance.

The demo is also useful for testing trading strategies before applying them to live transactions. However, some traders prefer using a real account for these purposes. Brokers offer micro or cent accounts that allow trading with a very small amount. We also recommend these account types to lower the financial risk if you wish to skip the demo.

3. Deposit money

Using a real account to trade requires actual fiat money. So after testing with a demo, you need to deposit money in the trading account. The process will be non-complex if the broker provides common payment methods in the region.

Click on the funding tab to select the deposit option to access these methods. Choose the payment option you prefer from the list and follow the instructions. Once you complete the form and click on ok, the payment service provider processes the request and credits the trading account. The account usually receives the funds within a few minutes to an hour.

Notice:

The payment methods depend on your country of residence. Forex Brokers offer all kinds of methods separately for each country.

4. Use analysis and strategies

The account might be ready for trading, but you should understand the assets before trading. Market analyses are required for successful transactions. Therefore, you should properly analyze the currency pairs before placing trades.

The market analysis will give you the required knowledge about price movements, which will help you make good trading decisions. Many factors influence price directions and cause the market to behave differently. Market analyses give traders valuable insights into these factors, helping them identify trading opportunities.

The two important market analyses in forex are:

- Technical analysis

- Fundamental analysis

Technical analysis in forex has to do with studying past prices using the forex chart. Traders can then see patterns in price movements that indicate the best buy and sell opportunities. Forex trading platforms include many tools for this analysis. Some brokers also add beginner trading tutorials to their platforms that help users learn to use these tools. Understanding these tools and correctly interpreting the patterns is key to a good technical analysis.

Fundamental analysis has to do with examining the economies behind the currencies. A currency’s exchange rate depends on the nation’s economy. Therefore, it is a basic element directly affecting price movements. That is why these factors are referred to as forex fundamentals. The trader examines them to anticipate the price direction and make better judgments about the price’s future moves. These forex fundamentals include the country’s interest rate, inflation rate, GDP, employment rate, surplus or deficit, etc.

Both analyses are vital to forex trading and boost the trader’s skills for making a profit in the foreign exchange market. All forex strategies stem from market analyses.

Common trading strategies in forex:

- Price action strategy

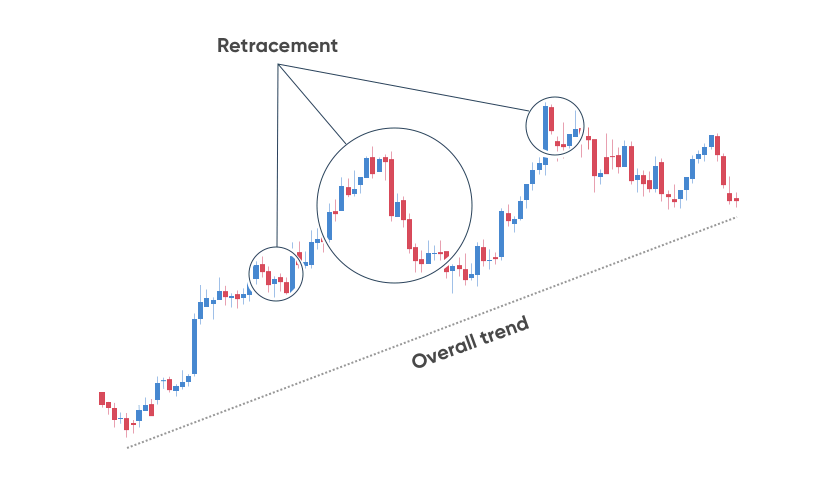

Price action trading is a less complex strategy that requires little technical analysis. The trader only has to study the naked price chart to determine how to enter and exit the market. The details to note are the price highs, lows, opening, and closing. The trader studies the candlesticks in the price chart to see these pieces of information. It allows the trader correctly predict the next price action and enter the appropriate position.

- Trend trading strategy

Price movements follow market conditions called a trend. The condition can be a downtrend, uptrend, or a ranging market. Opportune exists in all these markets. But the trader has to identify the market trend correctly. The trader then enters a position in the same direction as the market condition. Technical analysis tools help confirm the trend for a successful trade. When the market is in a downtrend, the opportunity available is a SELL trade. If in an uptrend, a BUY position will be the profitable trade. In a ranging market, the trader has to identify support and resistance levels to trade profitably.

- Trading news release strategy

News release trading strategy involves entering trades based on economic reports. The trader conducts the proper fundamental analysis and keeps watch on the news to place trades. Market participants react to economic reports by pushing prices in a certain direction. The trader must understand the market behavior and anticipate price direction through the news. Trading experience and knowledge of market operations are required to use this strategy successfully.

Other profitable strategies are:

- Breakout trading

- Engulfing pattern strategy

- Fibonacci retracement strategy

- Etc.

Risk management is an important part of every trading strategy. Accurately applying them to trades makes the strategies effective. Therefore, the trader must choose a strategy that they fully understand.

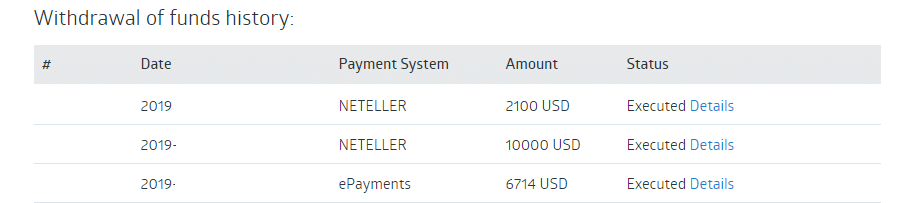

5. Make a profit

Place trades after conducting the necessary market analyses. The most suitable strategy for the forex pair you trade will cause you to make a profit. We recommend attempting a withdrawal soon enough at the initial stage of trading. It helps you further understand the platform and the broker’s service quality.

Therefore, withdraw the initial profit soon enough. If the broker is trustworthy, withdrawals should be as easy as deposits. Although, processing time takes longer. The average time is two days. Bank transfers usually take much longer than this. Online payment and debit or credit card services take less time. Some brokers, too, take longer to process withdrawals.

To request a withdrawal, follow the same steps as a deposit by clicking on the funding tab. Select the withdraw option and click on your preferred payment option. We advise using the same method when you deposit funds in the account. It prevents complications and avoidable delays. Fill out the withdrawal request form and submit it. Then wait for the funds to settle in your receiving account. The broker’s support rep will be available to assist with any problems with this service.

Final thoughts: The best Forex Brokers are available in Israel

As an Israeli trader, you have a range of choices of brokers since many welcome traders from your region. Choosing the most suitable regulated broker should be easy if you follow the guide in this article. Remember that the forex market is risky, and minimize your exposure by using all the risk measures available.

FAQ – The most asked questions about Forex Broker Israel :

What should a trader know while choosing a forex broker in Israel?

A trader should know a few things while choosing a forex broker in Israel. For instance, information such as whether a broker is regulated is important. Besides, traders must also ensure that their broker offers them a seamless trading platform. Its user interface should be easy so that a trader understands things well. In addition, it should have all features a trader would need for trading forex.

Which payment method can a trader use while funding his trading account with a forex broker in Israel?

A trader can use the following payment methods while funding his trading account with a forex broker in Israel.

Bank transfer

Cryptocurrency

Electronic wallet

Debit and credit cards

Which forex broker in Israel can a trader trust?

If you wish to trade forex, you must use a trading platform you can trust. The best forex broker in Israel belongs to the following list.

RoboForex

BlackBull Markets

Pepperstone

Since these five brokers are regulated, traders can trust them without any doubt. They have great services, which makes them the number one choice of traders in Israel. Their efficient customer support and the educational resources they offer traders enhance any trader’s experience.

Last Updated on October 20, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)